Key Insights

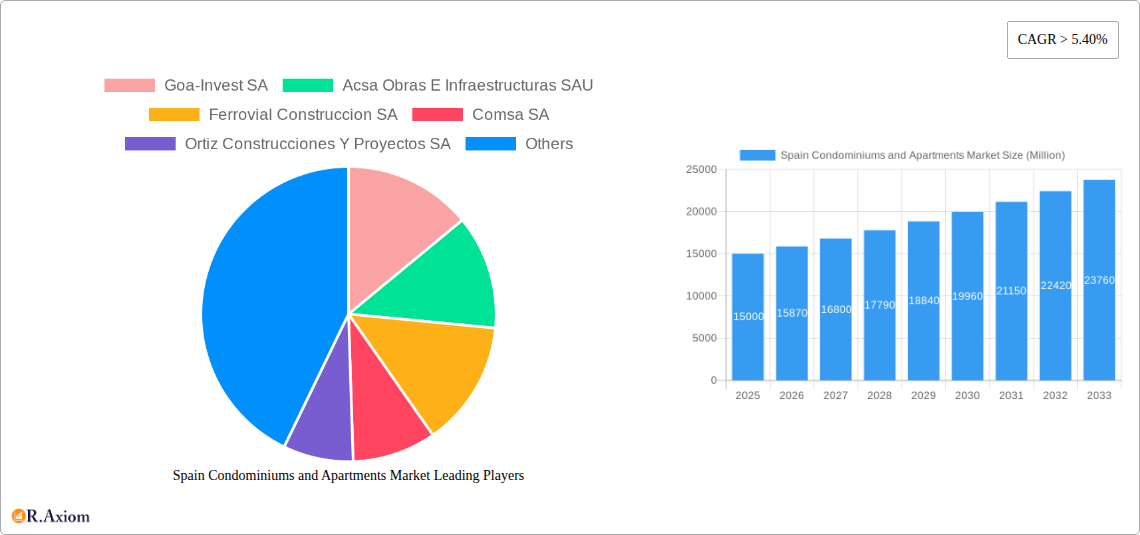

The Spain condominiums and apartments market exhibits robust growth potential, fueled by a confluence of factors. A Compound Annual Growth Rate (CAGR) exceeding 5.40% from 2019 to 2024 indicates a consistently expanding market. This growth is driven by several key factors including increasing urbanization, a rising influx of tourists boosting demand for short-term rentals, and a growing foreign investment in Spain's real estate sector, particularly in popular cities like Madrid, Barcelona, and Valencia. Furthermore, government initiatives aimed at stimulating the construction sector and improving infrastructure further contribute to market expansion. While challenges exist, such as fluctuating economic conditions and potential supply chain disruptions, the long-term outlook remains positive, with projected sustained growth through 2033. The market segmentation, featuring prominent cities like Madrid, Barcelona, and Valencia alongside other regional centers, highlights diverse investment opportunities across Spain. The presence of established construction companies such as Ferrovial Construccion SA and Comsa SA underscores the sector's maturity and capacity for continued development.

Spain Condominiums and Apartments Market Market Size (In Billion)

The market's segment-specific performance will likely vary, with prime locations like Madrid and Barcelona experiencing heightened demand and potentially higher price appreciation compared to other cities. Competition among construction firms is anticipated to remain intense, driving innovation and efficiency in the construction process. Future growth will depend on several factors including the continued strength of the Spanish economy, further infrastructural improvements, and the ongoing appeal of Spanish real estate to both domestic and international investors. The ability of developers to adapt to changing consumer preferences and leverage technological advancements will be crucial for success within this dynamic and evolving market. The market size, while not explicitly provided, can be reasonably projected based on the CAGR and the assumption of a significant base market size in 2019. Growth trajectories indicate that the market holds substantial long-term value for stakeholders.

Spain Condominiums and Apartments Market Company Market Share

This in-depth report provides a comprehensive analysis of the Spain condominiums and apartments market, covering market dynamics, key players, growth drivers, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is essential for industry stakeholders, investors, and anyone seeking to understand the complexities and opportunities within this dynamic market.

Spain Condominiums and Apartments Market Concentration & Innovation

This section analyzes the level of market concentration in Spain's condominium and apartment sector, identifying key players and their market share. We explore the drivers of innovation, including technological advancements and evolving consumer preferences. The regulatory framework impacting the market, including building codes and zoning regulations, is also examined. Furthermore, the report investigates the presence of substitute products (e.g., rental housing), prevailing end-user trends (e.g., demand for sustainable housing), and the influence of mergers and acquisitions (M&A) activity. We analyze the value and frequency of M&A deals, quantifying their impact on market consolidation and innovation. The analysis utilizes data from 2019-2024 and projects trends into 2033. Market share data for key players will be presented, alongside an assessment of the average M&A deal value (xx Million).

- Market Concentration: Analysis of market share held by top 10 players (estimated xx%).

- Innovation Drivers: Technological advancements in construction materials and techniques, smart home technologies, sustainable building practices.

- Regulatory Framework: Impact of building codes, zoning laws, and environmental regulations.

- Product Substitutes: Analysis of the impact of rental markets and alternative housing options.

- End-User Trends: Shifting preferences towards sustainable, energy-efficient, and technologically advanced housing.

- M&A Activity: Analysis of significant M&A deals (value and impact on market consolidation).

Spain Condominiums and Apartments Market Industry Trends & Insights

This section delves into the key trends shaping the Spanish condominiums and apartments market. We examine the factors driving market growth, including population growth, urbanization, and increasing disposable incomes. The impact of technological disruptions, such as the rise of PropTech and online property portals, is also analyzed. The report examines evolving consumer preferences, focusing on factors like location, amenities, and sustainability. Further, competitive dynamics including pricing strategies, brand positioning and market segmentation, are explored to determine the compound annual growth rate (CAGR) and market penetration rate for the forecast period (estimated CAGR of xx% and market penetration of xx%).

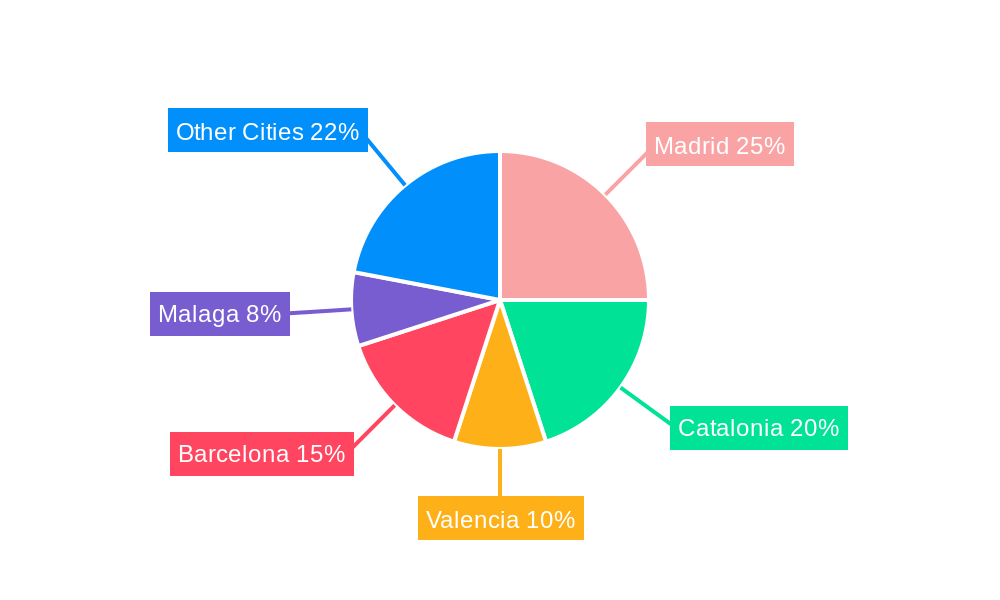

Dominant Markets & Segments in Spain Condominiums and Apartments Market

This section identifies the dominant segments within the Spanish condominiums and apartments market, focusing on a city-level analysis (Madrid, Catalonia, Valencia, Barcelona, Malaga, and Other Cities). We will determine the leading region based on factors such as housing demand, construction activity, and economic growth. For each leading city, we'll highlight key drivers and provide a detailed dominance analysis.

- Madrid: Key drivers: Strong economy, high population density, and government initiatives.

- Catalonia: Key drivers: Tourism, strong regional economy, and historical significance.

- Valencia: Key drivers: Coastal location, tourism, and relative affordability.

- Barcelona: Key drivers: Tourism, thriving cultural scene, and high demand.

- Malaga: Key drivers: Coastal location, tourism, and pleasant climate.

- Other Cities: Analysis of growth potential in other major Spanish cities.

Dominance analysis will compare these cities across key indicators such as average property prices, rental yields, transaction volumes, and construction activity.

Spain Condominiums and Apartments Market Product Developments

Recent product innovations in the Spanish condominium and apartment sector have focused on incorporating sustainable building materials, energy-efficient technologies, and smart home features. These advancements offer several competitive advantages, including reduced energy costs, improved environmental performance, and enhanced buyer appeal. The market is seeing increasing adoption of modular construction techniques which streamline the building process and enhance efficiency. This focus on eco-friendly features and smart technology directly addresses consumer demand for sustainable and technologically advanced housing solutions.

Report Scope & Segmentation Analysis

This report segments the Spanish condominiums and apartments market primarily by city: Madrid, Catalonia, Valencia, Barcelona, Malaga, and Other Cities. Each segment’s growth projections, market size (in Million), and competitive dynamics will be analyzed separately, revealing unique market opportunities and challenges within each geographical area. Market size estimates for each segment in 2025 (Million) will be presented, along with projected growth rates for the forecast period. The competitive landscape for each segment will be discussed, highlighting key players and their strategies.

Key Drivers of Spain Condominiums and Apartments Market Growth

Several factors are driving growth in the Spanish condominiums and apartments market. These include strong economic performance, increasing urbanization, and government initiatives supporting affordable housing. Technological advancements in construction and property management are enhancing efficiency and reducing costs. Furthermore, a robust tourism sector drives demand for rental properties, boosting the overall market.

Challenges in the Spain Condominiums and Apartments Market Sector

The Spanish condominiums and apartments market faces challenges including complex regulatory processes which can delay project approvals and increase costs, fluctuations in the price of construction materials impacting profitability, and intense competition among developers which can lead to price wars and reduced margins. These factors can affect the overall pace of market expansion and potentially impact the profitability of investments. The estimated impact of these challenges on market growth will be quantified.

Emerging Opportunities in Spain Condominiums and Apartments Market

Emerging opportunities lie in the growing demand for sustainable and energy-efficient housing, the rise of Build-to-Rent (BTR) developments and the increasing adoption of technology in property management and marketing. Furthermore, expansion into underserved markets and catering to specific lifestyle preferences (e.g., senior living, co-living) presents lucrative opportunities for investors and developers.

Leading Players in the Spain Condominiums and Apartments Market Market

- Goa-Invest SA

- Acsa Obras E Infraestructuras SAU

- Ferrovial Construccion SA

- Comsa SA

- Ortiz Construcciones Y Proyectos SA

- Construcciones Amenabar SA

- Avintia Proyectos Y Construcciones SL

- Altamira Santander Real Estate SA

- Arpada SA

- Constructora San Jose SA

- Norton Edificios Industriales SA

- Construcciones ACR SA

- Construcciones Rubau Sociedad Anonima

- Dragados Sociedad Anonima

Key Developments in Spain Condominiums and Apartments Market Industry

- Oct 2022: A build-to-rent (BTR) cooperation between Layetana Living and Aviva Investors launched, aiming for a EUR 500 million (USD 531.20 million) residential portfolio, starting with a 71-unit building in Barcelona.

- Sept 2022: Berkshire Hathaway HomeServices expanded into the Valencian Community, opening its fourth Spanish office.

Strategic Outlook for Spain Condominiums and Apartments Market Market

The Spanish condominiums and apartments market exhibits strong growth potential, driven by sustained economic growth, population trends, and evolving consumer preferences. Opportunities exist in sustainable development, technological integration, and expansion into new market segments. The market is expected to see significant growth over the forecast period, with continued consolidation among key players and increasing innovation.

Spain Condominiums and Apartments Market Segmentation

-

1. City

- 1.1. Madrid

- 1.2. Catalonia

- 1.3. Valencia

- 1.4. Barcelona

- 1.5. Malaga

- 1.6. Other Cities

Spain Condominiums and Apartments Market Segmentation By Geography

- 1. Spain

Spain Condominiums and Apartments Market Regional Market Share

Geographic Coverage of Spain Condominiums and Apartments Market

Spain Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High demand with signs of increased residential project developments and buyers in the market; The growing population in Bahrain is driving the luxury residential real estate sector

- 3.3. Market Restrains

- 3.3.1. The Bahrain real estate sector has been growing at a slower pace in recent years; The increased cost of credit due to higher interest rates is starting to dent demand for luxury real estate in Bahrain

- 3.4. Market Trends

- 3.4.1. Rise in International Buyers in Spain

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by City

- 5.1.1. Madrid

- 5.1.2. Catalonia

- 5.1.3. Valencia

- 5.1.4. Barcelona

- 5.1.5. Malaga

- 5.1.6. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by City

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Goa-Invest SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Acsa Obras E Infraestructuras SAU

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ferrovial Construccion SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Comsa SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ortiz Construcciones Y Proyectos SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Construcciones Amenabar SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avintia Proyectos Y Construcciones SL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Altamira Santander Real Estate SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Arpada SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Constructora San Jose SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Norton Edificios Industriales SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Construcciones ACR SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Construcciones Rubau Sociedad Anonima**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Dragados Sociedad Anonima

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Goa-Invest SA

List of Figures

- Figure 1: Spain Condominiums and Apartments Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Spain Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Condominiums and Apartments Market Revenue undefined Forecast, by City 2020 & 2033

- Table 2: Spain Condominiums and Apartments Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Spain Condominiums and Apartments Market Revenue undefined Forecast, by City 2020 & 2033

- Table 4: Spain Condominiums and Apartments Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Condominiums and Apartments Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Spain Condominiums and Apartments Market?

Key companies in the market include Goa-Invest SA, Acsa Obras E Infraestructuras SAU, Ferrovial Construccion SA, Comsa SA, Ortiz Construcciones Y Proyectos SA, Construcciones Amenabar SA, Avintia Proyectos Y Construcciones SL, Altamira Santander Real Estate SA, Arpada SA, Constructora San Jose SA, Norton Edificios Industriales SA, Construcciones ACR SA, Construcciones Rubau Sociedad Anonima**List Not Exhaustive, Dragados Sociedad Anonima.

3. What are the main segments of the Spain Condominiums and Apartments Market?

The market segments include City.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

High demand with signs of increased residential project developments and buyers in the market; The growing population in Bahrain is driving the luxury residential real estate sector.

6. What are the notable trends driving market growth?

Rise in International Buyers in Spain.

7. Are there any restraints impacting market growth?

The Bahrain real estate sector has been growing at a slower pace in recent years; The increased cost of credit due to higher interest rates is starting to dent demand for luxury real estate in Bahrain.

8. Can you provide examples of recent developments in the market?

Oct 2022: A build-to-rent (BTR) cooperation between Layetana Living and Aviva Investors was established in Spain. According to the statement, the collaboration between Aviva and the Spanish developer Layetana will construct a more than EUR 500 million (USD 531.20 million) residential portfolio, already securing its first development project. Based on the recommendation of international real estate consultancy Knight Frank, the partnership purchased a 71-unit residential building in Barcelona's Sants neighborhood. Construction is scheduled to begin at the end of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Spain Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence