Key Insights

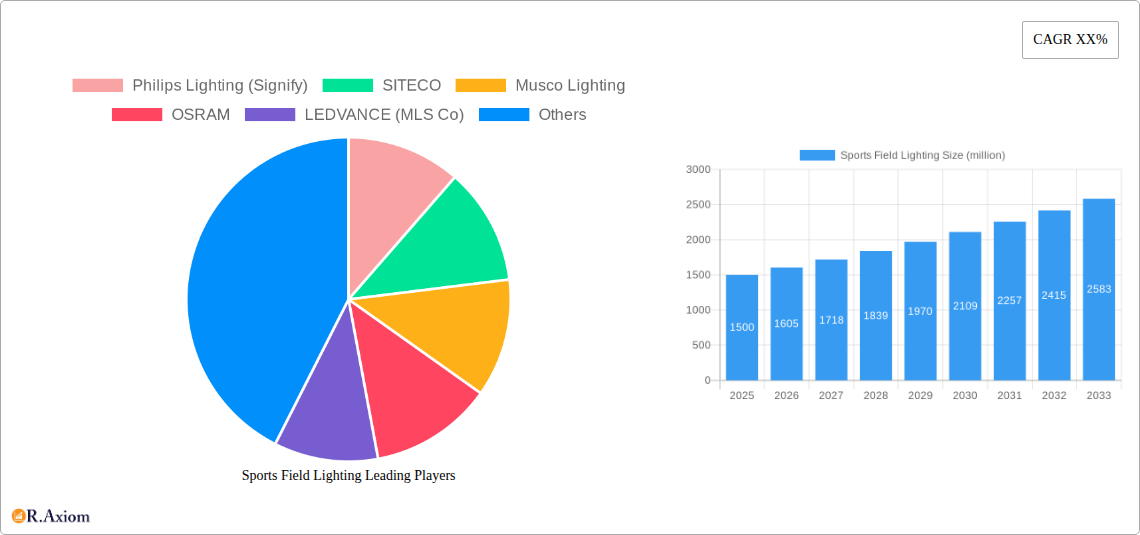

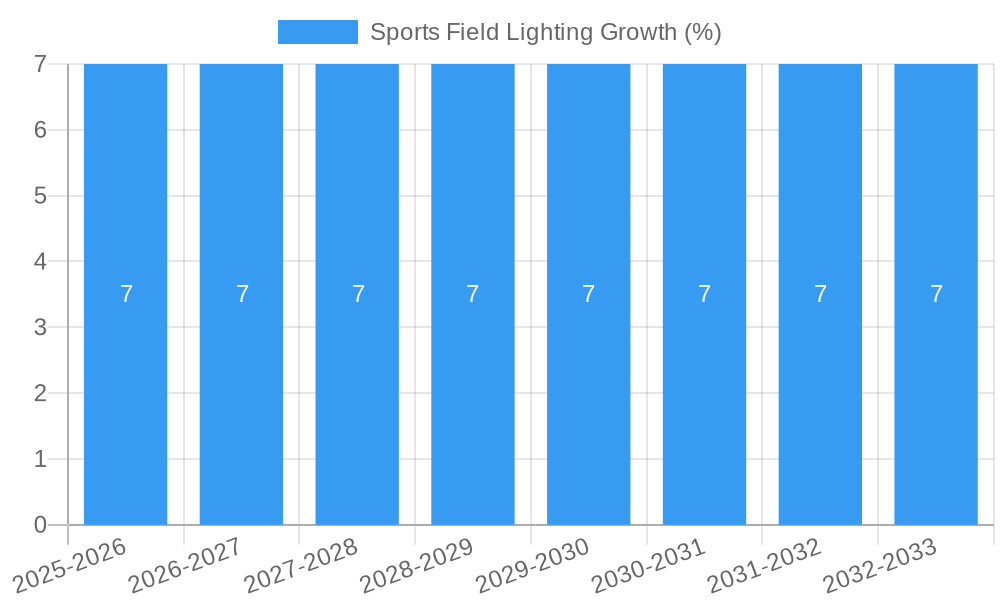

The global Sports Field Lighting market is poised for significant expansion, driven by a growing emphasis on enhanced athletic performance, increased participation in sports at all levels, and the rising demand for high-quality viewing experiences for spectators. With an estimated market size of approximately $1.5 billion in 2025, the industry is projected to grow at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033, reaching an estimated value of over $2.6 billion. This robust growth is fueled by the continuous technological advancements, particularly the widespread adoption of energy-efficient and advanced LED lighting solutions, which offer superior illumination, reduced operational costs, and longer lifespans compared to traditional HID lights. The increasing development of new sports facilities and the retrofitting of existing ones with modern lighting systems further bolster market expansion, catering to the needs of professional stadiums, community parks, universities, and even smaller recreational areas.

Key drivers propelling this market include the growing global sports tourism and the hosting of major international sporting events, necessitating state-of-the-art lighting infrastructure. Furthermore, the integration of smart lighting technologies, offering features like dimming, remote control, and integration with broadcasting systems, is becoming a significant trend. However, the market faces certain restraints, such as the high initial investment cost associated with advanced LED systems and the complexity of installation and maintenance, particularly in large-scale projects. Despite these challenges, the overwhelming benefits of improved visibility, safety, and energy savings associated with modern sports lighting solutions are expected to outweigh the initial costs, ensuring sustained market growth across diverse applications like park stadiums, racecourses, and golf courses.

This in-depth report provides a panoramic view of the global Sports Field Lighting market, projecting a market size expected to reach XX million by 2033. Analyzing the period from 2019 to 2033, with a base year of 2025, this comprehensive study offers critical insights into market dynamics, technological advancements, competitive landscapes, and future growth trajectories. We delve into the intricate details of various applications and lighting types, offering actionable intelligence for stakeholders including manufacturers, suppliers, investors, and sports facility managers. The report focuses on delivering an unvarnished analysis, free from placeholders, with all quantifiable values presented in millions for clarity and impact.

Sports Field Lighting Market Concentration & Innovation

The Sports Field Lighting market exhibits a moderate to high concentration, with key players like Signify (formerly Philips Lighting), Musco Lighting, OSRAM, and Acuity Brands holding significant market shares, estimated to be in the range of XX% to XX% for the top five companies collectively. Innovation is primarily driven by the rapid adoption of LED technology, leading to substantial energy savings, improved light quality, and enhanced control capabilities for sports venues. Regulatory frameworks, particularly those focusing on energy efficiency and sustainability, are increasingly influencing product development and market entry. The increasing demand for better playing conditions and fan experience is a major end-user trend, pushing for more sophisticated lighting solutions. Product substitutes, while historically including High-Intensity Discharge (HID) lighting, are steadily being replaced by LEDs. Mergers and acquisitions (M&A) activities, with an estimated cumulative deal value of over XX million during the historical period, reflect a trend towards consolidation and expansion of product portfolios and geographical reach among leading entities. For instance, the acquisition of Ephesus Lighting by Eaton significantly bolstered its presence in the sports lighting sector.

Sports Field Lighting Industry Trends & Insights

The global Sports Field Lighting market is poised for robust growth, driven by a confluence of factors including increasing global sports participation, the development of new sports facilities, and the imperative for energy-efficient and sustainable lighting solutions. The Compound Annual Growth Rate (CAGR) for the forecast period is estimated to be between XX% and XX%, with the market size projected to expand from approximately XX million in the base year 2025 to an impressive XX million by 2033. Technological disruptions, particularly the ongoing evolution and cost reduction of LED lighting technology, are at the forefront of this transformation. LEDs offer superior illumination quality, reduced energy consumption (often by over XX% compared to traditional HID systems), longer lifespan, and advanced control features such as dimming and programming, which are crucial for enhancing the spectator experience and operational efficiency of sports venues.

Consumer preferences are shifting towards smart lighting solutions that integrate with broader venue management systems, allowing for dynamic lighting adjustments based on event needs, time of day, and energy management policies. This includes features like glare reduction, flicker-free illumination essential for broadcast quality, and enhanced color rendering to make playing fields more vibrant and visible. Competitive dynamics are characterized by intense innovation, with companies vying to offer the most cost-effective, high-performance, and feature-rich lighting systems. The market penetration of LED lighting in sports fields is already substantial, estimated to be around XX% in the base year, and is expected to climb significantly in the coming years. This shift is further accelerated by government initiatives promoting energy efficiency and the growing awareness among sports organizations and municipalities about the long-term operational cost savings associated with LED retrofits and new installations. The demand for upgraded lighting in existing stadiums and the construction of new, state-of-the-art venues worldwide are key contributors to this sustained growth.

Dominant Markets & Segments in Sports Field Lighting

The Park Stadium segment, within the Application category, is expected to remain the dominant force in the Sports Field Lighting market, representing an estimated market share of XX% in the base year 2025. This dominance is fueled by the sheer volume of park stadiums globally, from professional arenas to local community sports grounds, all requiring reliable and high-quality illumination for training, matches, and public use. Economic policies supporting recreational infrastructure development and increased government spending on public amenities contribute significantly to this segment's growth. Furthermore, the growing emphasis on amateur and youth sports participation worldwide necessitates well-lit facilities, driving demand.

In terms of lighting Types, LED Light is unequivocally the leading segment, projected to capture over XX% of the market by 2033. The relentless advancement in LED technology, offering unparalleled energy efficiency, longevity, and superior light quality, has made it the preferred choice over traditional HID lights. The declining cost of LED fixtures and the substantial operational savings they provide make them an attractive investment for sports facilities of all sizes. Key drivers for LED dominance include stringent energy efficiency regulations, environmental sustainability initiatives, and the desire for advanced features like intelligent control systems and precise beam targeting, which LEDs excel at delivering.

The University segment also presents a significant growth opportunity, driven by the continuous need for modern sports facilities to support athletic programs, host collegiate events, and provide recreational opportunities for students. Investments in campus infrastructure, coupled with the growing importance of sports in university branding and student engagement, ensure a steady demand for upgraded lighting systems. Similarly, the Racecourse segment, while smaller in volume, demands specialized lighting solutions for safety and visibility, particularly for evening events and training. Advancements in lighting control and uniformity are crucial here. The Other applications, encompassing diverse sports venues like indoor arenas, training facilities, and multi-purpose sports complexes, collectively represent a substantial and growing market share, benefiting from the overall trend towards improved sports lighting standards.

Sports Field Lighting Product Developments

Recent product developments in the Sports Field Lighting sector are characterized by the relentless advancement of LED technology. Innovations focus on higher lumen output per watt, improved thermal management for extended fixture life, and enhanced optical precision for reduced glare and spill light, crucial for both athletes and spectators. Smart lighting systems are becoming increasingly sophisticated, integrating IoT capabilities for remote control, scheduling, and real-time performance monitoring, contributing to significant energy savings of up to XX%. The introduction of specialized fixtures designed for specific sports, such as those minimizing flicker for high-definition broadcasting, and those offering dynamic color-changing capabilities for enhanced event ambiance, are key competitive advantages. These developments cater to the growing demand for sustainable, energy-efficient, and high-performance lighting solutions that elevate the sports experience.

Report Scope & Segmentation Analysis

This report encompasses a comprehensive segmentation of the Sports Field Lighting market. In terms of Application, we analyze Park Stadium (projected CAGR of XX%, market size of XX million by 2033), Racecourse (CAGR of XX%, market size of XX million), Golf Course (CAGR of XX%, market size of XX million), University (CAGR of XX%, market size of XX million), and Other applications (CAGR of XX%, market size of XX million). Each segment is assessed based on its unique demand drivers and growth potential. For Types, the segmentation includes HID Light (declining share, CAGR of XX%), LED Light (dominant segment, CAGR of XX%, projected market share of XX% by 2033), and Other lighting technologies (niche applications, CAGR of XX%). Market sizes and growth projections are detailed for each sub-segment, offering granular insights into competitive dynamics and investment opportunities.

Key Drivers of Sports Field Lighting Growth

The Sports Field Lighting market is propelled by several key drivers. Technological advancements, particularly the rapid evolution and cost reduction of LED lighting, offer superior energy efficiency, longevity, and performance, making them the preferred choice for modern sports venues. Increasing global investment in sports infrastructure and the development of new stadiums and upgraded existing facilities worldwide are significant catalysts. Growing awareness of energy efficiency and sustainability mandates, coupled with government incentives and regulations, encourage the adoption of eco-friendly lighting solutions, with LEDs offering substantial energy savings of up to XX%. The rising popularity of various sports and the demand for enhanced viewing experiences for both live spectators and broadcast audiences necessitate high-quality, flicker-free, and precisely controlled lighting systems.

Challenges in the Sports Field Lighting Sector

Despite robust growth, the Sports Field Lighting sector faces several challenges. High initial investment costs for advanced LED systems and smart controls can be a barrier for smaller municipalities or clubs. Complex regulatory frameworks and varying regional standards for lighting intensity and uniformity can create installation complexities and delays. Supply chain disruptions and fluctuating raw material costs, particularly for components like semiconductors, can impact pricing and product availability. The need for specialized expertise in lighting design, installation, and maintenance for complex sports venues can also be a limiting factor, requiring skilled professionals. Furthermore, competition from established HID technologies, though diminishing, still exists in some budget-conscious segments.

Emerging Opportunities in Sports Field Lighting

Emerging opportunities in the Sports Field Lighting market are centered around smart and connected lighting solutions. The integration of IoT technology allows for remote monitoring, diagnostics, and dynamic control of lighting systems, optimizing energy usage and operational efficiency, with potential energy savings reaching XX%. The growing demand for sustainable and environmentally friendly lighting presents an opportunity for manufacturers to offer solutions with reduced carbon footprints and enhanced recyclability. The expansion of sports into emerging economies and the development of new sports facilities in these regions offer significant untapped market potential. Furthermore, retrofitting existing venues with energy-efficient LED lighting continues to be a substantial opportunity, providing cost savings and performance improvements for legacy infrastructure.

Leading Players in the Sports Field Lighting Market

- Signify (Philips Lighting)

- Musco Lighting

- OSRAM

- Acuity Brands

- SITECO

- LEDVANCE (MLS Co)

- NVC

- Panasonic

- Eaton (Ephesus Lighting)

- Hubbell Lighting

- Disano

- Cree Led

- Sportsbeams LED Lighting

- Nila Sports

- NAFCO International

- Pro Sports Lighting

- Sentry Sports Lighting

- Iwasaki Electric

- Abacus Lighting

- BUCK Lighting

- Simkar (Neo Lights Holdings)

- SpecGrade LED

- Kingsun

Key Developments in Sports Field Lighting Industry

- 2023 October: Signify acquires a leading smart sports lighting solutions provider, expanding its connected offerings for major stadiums.

- 2023 July: Musco Lighting launches its next-generation LED system with enhanced glare control and reduced energy consumption, targeting professional sports venues.

- 2022 December: OSRAM introduces a new series of high-performance LED floodlights optimized for broadcast quality sports illumination.

- 2022 September: Acuity Brands announces strategic partnerships to integrate its sports lighting controls with venue management platforms.

- 2021 November: Eaton (Ephesus Lighting) unveils its latest advancements in modular LED sports lighting, offering greater flexibility and cost-effectiveness.

- 2021 March: LEDVANCE (MLS Co) expands its smart lighting portfolio for sports facilities, focusing on energy efficiency and ease of installation.

Strategic Outlook for Sports Field Lighting Market

The strategic outlook for the Sports Field Lighting market remains exceptionally positive, driven by sustained demand for energy-efficient, high-performance, and technologically advanced illumination solutions. The ongoing global investment in sports infrastructure, coupled with stringent energy efficiency regulations, will continue to favor LED technology. The market is set to witness further consolidation and strategic alliances as companies aim to expand their product portfolios and geographical reach. The increasing adoption of smart lighting systems, offering integrated control and data analytics, presents a significant growth catalyst. Focusing on delivering integrated solutions that enhance the athlete and spectator experience while prioritizing sustainability and operational cost savings will be crucial for future success in this dynamic market, with opportunities estimated to reach XX million by 2033.

Sports Field Lighting Segmentation

-

1. Application

- 1.1. Park Stadium

- 1.2. Racecourse

- 1.3. Golf Course

- 1.4. University

- 1.5. Other

-

2. Types

- 2.1. HID Light

- 2.2. LED Light

- 2.3. Other

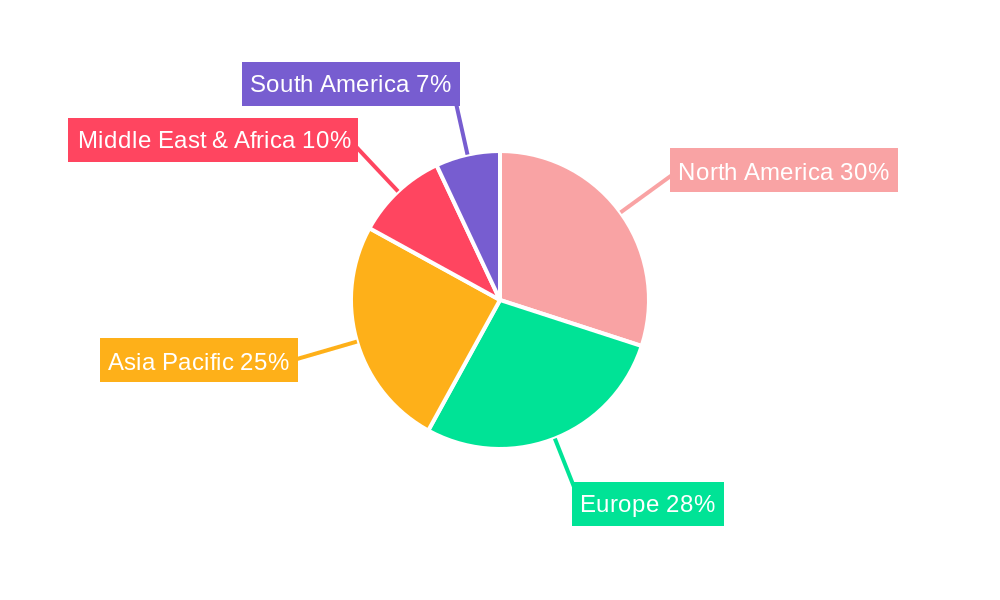

Sports Field Lighting Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sports Field Lighting REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sports Field Lighting Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Park Stadium

- 5.1.2. Racecourse

- 5.1.3. Golf Course

- 5.1.4. University

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. HID Light

- 5.2.2. LED Light

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sports Field Lighting Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Park Stadium

- 6.1.2. Racecourse

- 6.1.3. Golf Course

- 6.1.4. University

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. HID Light

- 6.2.2. LED Light

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Sports Field Lighting Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Park Stadium

- 7.1.2. Racecourse

- 7.1.3. Golf Course

- 7.1.4. University

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. HID Light

- 7.2.2. LED Light

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Sports Field Lighting Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Park Stadium

- 8.1.2. Racecourse

- 8.1.3. Golf Course

- 8.1.4. University

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. HID Light

- 8.2.2. LED Light

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Sports Field Lighting Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Park Stadium

- 9.1.2. Racecourse

- 9.1.3. Golf Course

- 9.1.4. University

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. HID Light

- 9.2.2. LED Light

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Sports Field Lighting Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Park Stadium

- 10.1.2. Racecourse

- 10.1.3. Golf Course

- 10.1.4. University

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. HID Light

- 10.2.2. LED Light

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Philips Lighting (Signify)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SITECO

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Musco Lighting

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 OSRAM

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LEDVANCE (MLS Co)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NVC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Panasonic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ephesus Lighting (Eaton)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hubbell Lighting

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Disano

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Acuity Brands

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cree Led

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sportsbeams LED Lighting

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nila Sports

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 NAFCO International

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Pro Sports Lighting

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Sentry Sports Lighting

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Iwasaki Electric

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Abacus Lighting

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 BUCK Lighting

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Simkar (Neo Lights Holdings)

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 SpecGrade LED

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Kingsun

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 Philips Lighting (Signify)

List of Figures

- Figure 1: Global Sports Field Lighting Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Sports Field Lighting Revenue (million), by Application 2024 & 2032

- Figure 3: North America Sports Field Lighting Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Sports Field Lighting Revenue (million), by Types 2024 & 2032

- Figure 5: North America Sports Field Lighting Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Sports Field Lighting Revenue (million), by Country 2024 & 2032

- Figure 7: North America Sports Field Lighting Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Sports Field Lighting Revenue (million), by Application 2024 & 2032

- Figure 9: South America Sports Field Lighting Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Sports Field Lighting Revenue (million), by Types 2024 & 2032

- Figure 11: South America Sports Field Lighting Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Sports Field Lighting Revenue (million), by Country 2024 & 2032

- Figure 13: South America Sports Field Lighting Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Sports Field Lighting Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Sports Field Lighting Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Sports Field Lighting Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Sports Field Lighting Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Sports Field Lighting Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Sports Field Lighting Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Sports Field Lighting Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Sports Field Lighting Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Sports Field Lighting Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Sports Field Lighting Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Sports Field Lighting Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Sports Field Lighting Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Sports Field Lighting Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Sports Field Lighting Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Sports Field Lighting Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Sports Field Lighting Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Sports Field Lighting Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Sports Field Lighting Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sports Field Lighting Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Sports Field Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Sports Field Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Sports Field Lighting Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Sports Field Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Sports Field Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Sports Field Lighting Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Sports Field Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Sports Field Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Sports Field Lighting Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Sports Field Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Sports Field Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Sports Field Lighting Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Sports Field Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Sports Field Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Sports Field Lighting Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Sports Field Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Sports Field Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Sports Field Lighting Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Sports Field Lighting Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sports Field Lighting?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Sports Field Lighting?

Key companies in the market include Philips Lighting (Signify), SITECO, Musco Lighting, OSRAM, LEDVANCE (MLS Co), NVC, Panasonic, Ephesus Lighting (Eaton), Hubbell Lighting, Disano, Acuity Brands, Cree Led, Sportsbeams LED Lighting, Nila Sports, NAFCO International, Pro Sports Lighting, Sentry Sports Lighting, Iwasaki Electric, Abacus Lighting, BUCK Lighting, Simkar (Neo Lights Holdings), SpecGrade LED, Kingsun.

3. What are the main segments of the Sports Field Lighting?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sports Field Lighting," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sports Field Lighting report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sports Field Lighting?

To stay informed about further developments, trends, and reports in the Sports Field Lighting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence