Key Insights

The Swedish Courier, Express, and Parcel (CEP) industry is poised for significant expansion, propelled by the surge in e-commerce, escalating international trade, and the heightened demand for agile logistics solutions across diverse sectors. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 9%, reaching a market size of 2.73 billion by 2024. This upward trend is largely attributed to the burgeoning adoption of online retail, particularly in the B2C segment, which is driving demand for last-mile delivery. The B2B sector also plays a crucial role, with enterprises leveraging efficient CEP services for optimized supply chain management and inventory control. Key industry verticals, including Life Sciences/Healthcare and Industrial Manufacturing, further contribute to this robust growth. Despite facing challenges such as volatile fuel costs and intense competition from established global carriers, the Swedish CEP market outlook remains highly favorable, underscored by continuous digitalization efforts and an unwavering need for dependable, rapid delivery services.

Sweden CEP Industry Market Size (In Billion)

The Swedish CEP market is segmented by destination (domestic and international), end-user (including BFSI, Wholesale & Retail Trade with a strong e-commerce focus, Life Sciences/Healthcare, Industrial Manufacturing, and Others), and business type (B2B and B2C). International shipments are projected to exhibit substantial growth, reflecting Sweden's active engagement in global commerce. The presence of dominant players such as DHL, UPS, and FedEx signifies a consolidated market landscape. Nevertheless, specialized niche providers like Jetpak and Bring offer competitive alternatives. Future growth trajectories will be significantly influenced by technological innovations, encompassing automated sorting and delivery systems, enhanced tracking capabilities, and the adoption of sustainable practices to address environmental concerns. Strategic expansion into rural markets and the refinement of last-mile delivery strategies will be critical for sustained success within the Swedish CEP industry.

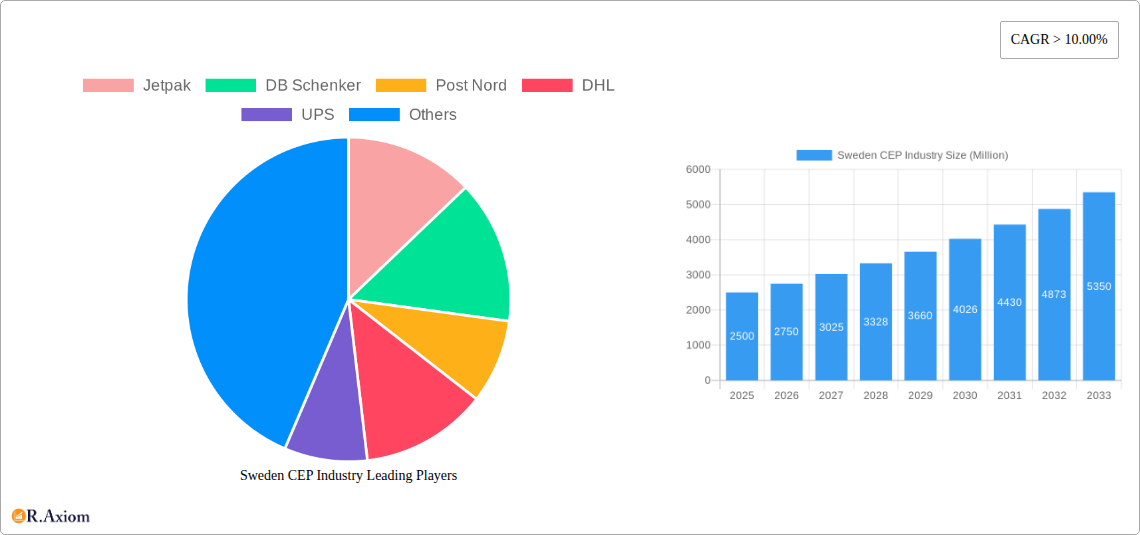

Sweden CEP Industry Company Market Share

Sweden CEP Industry: Market Analysis & Growth Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Sweden CEP (Courier, Express, and Parcel) industry, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. The report covers the period 2019-2033, with a focus on the base year 2025 and forecast period 2025-2033. Market sizing is provided in Millions.

Sweden CEP Industry Market Concentration & Innovation

The Swedish Courier, Express, and Parcel (CEP) market is characterized by a moderate level of concentration, with a dynamic interplay between established global players and agile domestic providers. Leading entities such as Jetpak, DB Schenker, PostNord, DHL, UPS, FedEx, Bring (part of Posten Norge), Bussgods, GLS Group, and DSV actively compete for market share. While specific market share percentages are proprietary, PostNord and DHL are widely recognized as holding substantial portions of the market, with other international and national operators contributing significantly. This concentration is a natural outcome of operational scale, the adoption of advanced technological capabilities, and the strategic development of extensive network infrastructure.

Innovation in the Swedish CEP sector is largely propelled by the escalating demand for delivery services that are not only faster and more efficient but also demonstrably sustainable. Technological advancements are at the forefront, with the implementation of sophisticated automated sorting systems, intelligent route optimization software, and the widespread adoption of electric vehicles (EVs) significantly reshaping operational paradigms. The regulatory landscape, particularly concerning environmental sustainability and fair driver working conditions, plays a pivotal role in shaping innovation strategies. A notable example is DB Schenker's positive reception of the EU Mobility Package, underscoring the industry's alignment with evolving regulations. Furthermore, the emergence of product substitutes, including localized delivery services and crowd-shipping platforms, presents a discernible competitive challenge, especially within the crucial last-mile delivery segment. The ongoing trend of mergers and acquisitions (M&A) is also a testament to the industry's drive for consolidation and growth, as exemplified by Jetpak's recent acquisition of BudAB AB. This strategic move, with an initial purchase price of SEK 24.8 million and a potential further SEK 10.4 million contingent on 2025 profits, highlights the industry's inclination towards inorganic growth and market expansion through strategic takeovers.

- Market Share Dynamics: PostNord and DHL are significant players, though precise market share data is confidential due to competitive considerations.

- M&A Activity: Jetpak's acquisition of BudAB AB represents a substantial deal, with a potential total value of SEK 35.2 million. This signifies a broader trend of consolidation within the sector.

- Key Innovation Drivers: The industry's innovation pipeline is fueled by technological advancements (e.g., automation, AI, route optimization, EVs), stringent sustainability mandates, and the ever-present pressure of competition.

Sweden CEP Industry Industry Trends & Insights

The Swedish CEP market is experiencing robust growth driven by the expansion of e-commerce, the increasing demand for faster deliveries, and the rising adoption of logistics technology. The CAGR for the period 2019-2024 is estimated at xx%, and projections for 2025-2033 suggest a CAGR of xx%. Market penetration of advanced logistics technologies, such as AI-powered route planning and predictive analytics, is steadily increasing, leading to improved efficiency and cost optimization. Consumer preferences are shifting towards convenient and flexible delivery options, including same-day and weekend deliveries, influencing the CEP operators to enhance their service offerings and expand their networks. The competitive dynamics are characterized by both intense rivalry among established players and the emergence of smaller, specialized service providers catering to niche segments. Furthermore, increasing pressure for sustainability and environmental responsibility is influencing the industry’s technological choices and operations.

Dominant Markets & Segments in Sweden CEP Industry

The Swedish CEP industry's largest segment is likely Domestic B2C, driven by the exponential growth of e-commerce. International B2C is also significant, particularly deliveries from global e-commerce giants. The B2B segment, particularly Wholesale and Retail Trade, contributes substantially to the industry's revenue. The Life Sciences/Healthcare segment is also of growing importance due to the increasing need for secure and timely delivery of pharmaceutical products and medical supplies.

- Key Drivers (Domestic): Strong e-commerce growth, well-developed infrastructure.

- Key Drivers (International): Globalization, increasing cross-border e-commerce.

- Key Drivers (B2B): Robust industrial manufacturing, expanding retail trade.

- Key Drivers (Life Sciences/Healthcare): stringent regulations, increased demand for temperature-sensitive products.

Sweden CEP Industry Product Developments

The Swedish CEP industry is continuously evolving its product and service offerings, with a strong emphasis on enhancing delivery speed, optimizing operational efficiency, and elevating the overall customer experience. A cornerstone of this evolution is the deeper integration of cutting-edge technologies, including Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT). These technologies enable more precise shipment tracking, sophisticated delivery route planning, and predictive analytics capabilities, allowing businesses to anticipate and mitigate potential disruptions. The adoption of these advanced tools empowers companies to offer highly customized delivery solutions, thereby improving operational workflows and providing unparalleled transparency throughout the entire delivery lifecycle. The overarching strategic imperative is the development and delivery of sustainable solutions that ensure seamless integration across all service segments, from initial pickup to final delivery.

Report Scope & Segmentation Analysis

This report comprehensively segments the Swedish CEP market by Destination (Domestic, International), End User (Services, Wholesale & Retail Trade, including E-commerce, Life Sciences/Healthcare, Industrial Manufacturing, Other), and Business (B2B, B2C). Each segment's growth projection, market size (in Millions), and competitive dynamics are analyzed in detail. For example, the domestic B2C segment shows the highest growth, while the B2B sector exhibits steady growth, driven by the needs of industrial and retail businesses. The Life Sciences/Healthcare segment experiences strong growth but requires specialized logistics solutions.

Key Drivers of Sweden CEP Industry Growth

The growth of the Swedish CEP industry is spurred by several key factors. The robust expansion of e-commerce continues to fuel demand for efficient delivery services. Technological advancements like automation, route optimization software, and real-time tracking systems enhance operational efficiency and customer satisfaction. Finally, supportive government policies promoting technological advancement and sustainable practices encourage continued growth.

Challenges in the Sweden CEP Industry Sector

The Swedish CEP industry is navigating a complex landscape of challenges. Persistent increases in fuel costs continue to exert pressure on operational expenditures, impacting profitability. The industry is also grappling with the disruptive influence of new market entrants and emerging technologies that can fundamentally alter traditional delivery models. The growing imperative for environmental sustainability necessitates significant investments in eco-friendly practices and infrastructure. Furthermore, evolving regulatory frameworks, particularly those pertaining to labour costs and operational procedures, demand agile adaptation. Addressing these multifaceted challenges requires a strategic commitment to technology adoption, the development of innovative operational models, and an unwavering focus on sustainability initiatives. The logistical intricacies of last-mile delivery, especially within densely populated urban environments, remain a persistent and significant hurdle for the sector.

Emerging Opportunities in Sweden CEP Industry

The Swedish CEP industry is brimming with promising emerging opportunities, offering fertile ground for growth and development. The intensifying global demand for sustainable delivery solutions presents a significant avenue for businesses that prioritize and excel in eco-friendly transportation methods and responsible packaging practices. The nascent but rapidly advancing adoption of technologies like drones and autonomous vehicles holds the potential to dramatically increase delivery speed and operational efficiency. Moreover, the strategic expansion into specialized niche markets and the provision of tailored services can effectively cater to the unique and evolving needs of specific customer segments and industry verticals, thereby unlocking new revenue streams and market differentiation.

Key Developments in Sweden CEP Industry Industry

- October 2023: Jetpak successfully acquired BudAB AB for a total consideration of SEK 35.2 million, significantly bolstering its market presence and operational capabilities.

- February 2022: DB Schenker expressed its endorsement of the EU Mobility Package, signaling a commitment to fostering improved working conditions and promoting sustainable practices throughout the logistics sector.

Strategic Outlook for Sweden CEP Industry Market

The Swedish CEP industry's future outlook is positive, driven by sustained e-commerce growth, technological advancements, and the increasing demand for specialized services. Continued investments in automation, sustainability, and innovative delivery solutions will be crucial for companies to maintain competitiveness and capitalize on emerging opportunities. Focusing on improving last-mile delivery, enhancing customer experience, and adapting to evolving regulatory requirements will be essential for long-term success within this dynamic market.

Sweden CEP Industry Segmentation

-

1. Business

- 1.1. B2B (Business-to-Business)

- 1.2. B2C (Business-to-Consumer)

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. End User

- 3.1. Services

- 3.2. Wholesale and Retail Trade (including E-commerce)

- 3.3. Life Sciences/ Healthcare

- 3.4. Industrial manufacturing

- 3.5. Other End Users

Sweden CEP Industry Segmentation By Geography

- 1. Sweden

Sweden CEP Industry Regional Market Share

Geographic Coverage of Sweden CEP Industry

Sweden CEP Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Growing e-commerce is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden CEP Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business

- 5.1.1. B2B (Business-to-Business)

- 5.1.2. B2C (Business-to-Consumer)

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Services

- 5.3.2. Wholesale and Retail Trade (including E-commerce)

- 5.3.3. Life Sciences/ Healthcare

- 5.3.4. Industrial manufacturing

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Business

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jetpak

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Post Nord

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bring (Part of Posten Norge)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bussgods

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GLS Group**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DSV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Jetpak

List of Figures

- Figure 1: Sweden CEP Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Sweden CEP Industry Share (%) by Company 2025

List of Tables

- Table 1: Sweden CEP Industry Revenue billion Forecast, by Business 2020 & 2033

- Table 2: Sweden CEP Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Sweden CEP Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Sweden CEP Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Sweden CEP Industry Revenue billion Forecast, by Business 2020 & 2033

- Table 6: Sweden CEP Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 7: Sweden CEP Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Sweden CEP Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden CEP Industry?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Sweden CEP Industry?

Key companies in the market include Jetpak, DB Schenker, Post Nord, DHL, UPS, FedEx, Bring (Part of Posten Norge), Bussgods, GLS Group**List Not Exhaustive, DSV.

3. What are the main segments of the Sweden CEP Industry?

The market segments include Business, Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.73 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Growing e-commerce is Driving the Market Growth.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

October 2023: Jetpak Top Holding AB (publ) has today through its subsidiary Jetpak Group AB, signed an agreement to acquire all shares in the Swedish courier and distribution company BudAB AB. Initial acquisition price amounts to SEK 24.8 million on debt-free basis. In addition, an additional conditional purchase price of a maximum of SEK 10.4 million may be paid. The conditional additional purchase price is dependent on achieved profits for the financial year 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden CEP Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden CEP Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden CEP Industry?

To stay informed about further developments, trends, and reports in the Sweden CEP Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence