Key Insights

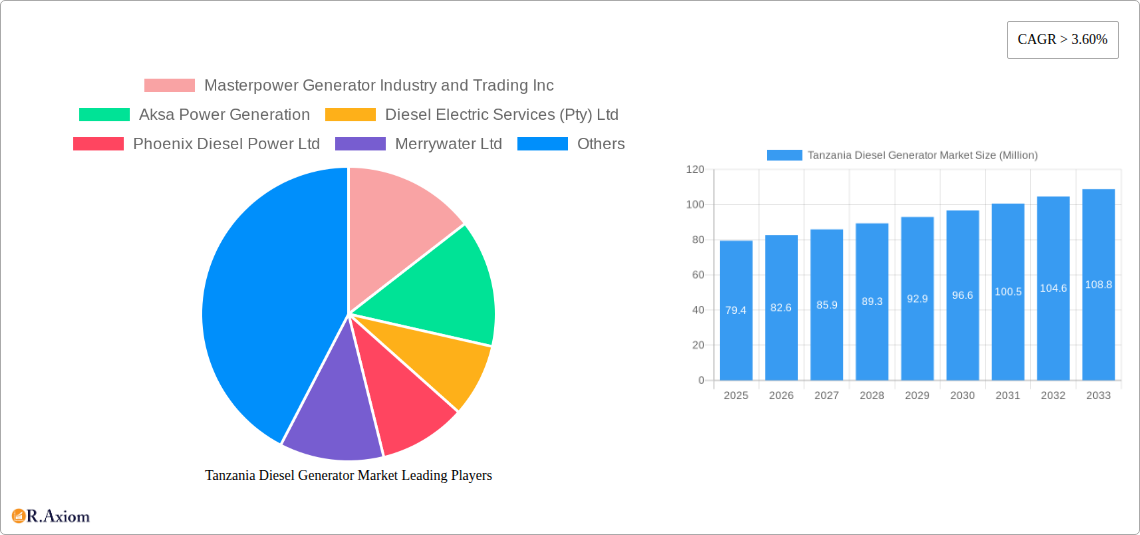

The Tanzania Diesel Generator Market is poised for substantial growth, projected to reach USD 79.4 million by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 4.01%. This expansion is driven by increasing industrialization and the ongoing demand for reliable power solutions across various sectors. While precise historical driver and restrain data is not provided, it is logical to infer that consistent power outages and the growing need for backup power in the burgeoning commercial and residential sectors are significant growth catalysts. The market is segmented by specification, with a notable demand expected for generators in the 75kVA-375kVA range, catering to the diverse power needs of businesses and larger homes. Furthermore, the 'More than 375kVA' segment is likely to witness strong traction due to large-scale industrial projects and critical infrastructure development.

Tanzania Diesel Generator Market Market Size (In Million)

The forecast period, from 2025 to 2033, will likely see a sustained upward trajectory for the Tanzania Diesel Generator Market. This growth will be fueled by increasing investments in infrastructure, mining, and manufacturing sectors, all of which heavily rely on uninterrupted power supply. The residential sector is also expected to contribute to this growth as more households seek to mitigate the impact of grid instability. Key players such as Caterpillar Inc., Aksa Power Generation, and Masterpower Generator Industry and Trading Inc. are well-positioned to capitalize on these opportunities. Emerging trends may include a focus on fuel-efficient models and the integration of smart technologies for remote monitoring and control, enhancing operational efficiency and reducing downtime for end-users across commercial, industrial, and residential applications.

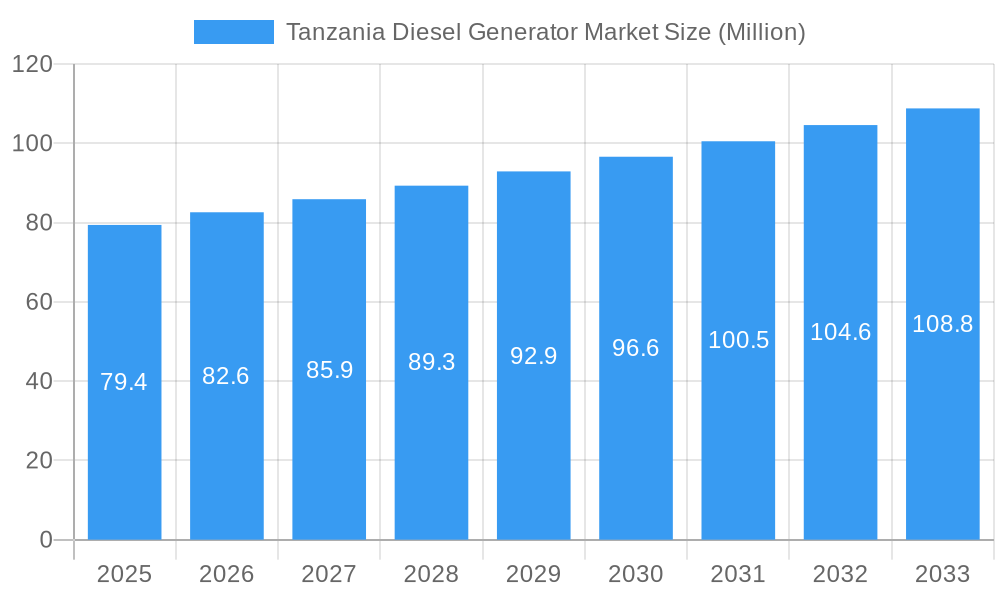

Tanzania Diesel Generator Market Company Market Share

Tanzania Diesel Generator Market - Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides an exhaustive analysis of the Tanzania Diesel Generator Market, offering critical insights and actionable intelligence for stakeholders. Covering the historical period from 2019 to 2024, a base year of 2025, and a forecast period extending to 2033, this study delves into market dynamics, growth drivers, challenges, and competitive landscapes. The report leverages high-traffic keywords such as "Tanzania diesel generator," "standby power solutions," "industrial generators," "commercial generators," "residential generators," "generator market share," and "power generation Tanzania" to ensure maximum visibility and reach for industry professionals.

Tanzania Diesel Generator Market Market Concentration & Innovation

The Tanzania Diesel Generator Market exhibits a moderate to high level of market concentration, with a few key players dominating the landscape. Innovation in this sector is primarily driven by the demand for more fuel-efficient, reliable, and technologically advanced generator sets. Regulatory frameworks are evolving, with an increasing focus on emission standards and noise pollution control, which influences product development and market entry strategies. Product substitutes, such as solar power systems and grid expansion, pose a growing challenge, particularly for long-term energy solutions. However, diesel generators remain indispensable for immediate and reliable backup power. End-user trends indicate a rising demand for generators equipped with remote monitoring capabilities, IoT integration, and automatic transfer switches for enhanced convenience and operational efficiency. Merger and acquisition activities, while not widespread, are anticipated to increase as larger players seek to consolidate market share and expand their product portfolios. Estimated M&A deal values are projected to reach tens of millions.

Tanzania Diesel Generator Market Industry Trends & Insights

The Tanzania Diesel Generator Market is poised for significant growth, driven by a confluence of economic, infrastructural, and developmental factors. The ever-increasing demand for reliable and uninterrupted power across various sectors, from burgeoning industries to essential services and a growing residential base, forms the bedrock of this market expansion. Economic diversification initiatives within Tanzania, particularly in mining, manufacturing, and agriculture, necessitate robust power infrastructure, making diesel generators a crucial component for operational continuity. The nation's ongoing infrastructural development projects, including roads, ports, and special economic zones, also require substantial and dependable power sources, often met by generator sets. Technological advancements are continually reshaping the market. Manufacturers are focusing on developing diesel generators that offer improved fuel efficiency, reduced emissions, and enhanced durability to meet evolving environmental regulations and operational cost considerations. The integration of smart technologies, such as IoT-enabled monitoring, remote diagnostics, and automated control systems, is becoming a key differentiator, allowing users to optimize performance, predict maintenance needs, and ensure maximum uptime. Consumer preferences are leaning towards generator solutions that are not only powerful and reliable but also cost-effective in the long run, factoring in fuel consumption and maintenance expenses. The competitive dynamics within the market are characterized by a mix of established global manufacturers and local distributors, each vying for market share through product innovation, competitive pricing, and comprehensive after-sales service. The market penetration of diesel generators is expected to deepen as more businesses and households recognize their critical role in mitigating power outages. The Compound Annual Growth Rate (CAGR) for the Tanzania Diesel Generator Market is projected to be in the range of 6% to 8% over the forecast period.

Dominant Markets & Segments in Tanzania Diesel Generator Market

The Industrial end-user segment stands out as a dominant force within the Tanzania Diesel Generator Market. This dominance is propelled by the nation's ambitious industrialization agenda, encompassing sectors like mining, manufacturing, agriculture processing, and construction. These industries require substantial and consistent power to operate heavy machinery and maintain production lines, making reliable backup power solutions like diesel generators indispensable. Economic policies aimed at attracting foreign investment and fostering local manufacturing further bolster the demand from this segment.

Within the Specification segmentation, the 75kVA-375kVA range is witnessing significant traction. This capacity is ideal for a broad spectrum of commercial operations, small to medium-sized manufacturing units, and large residential complexes. The versatility and adaptability of generators within this range to meet diverse power needs contribute to their widespread adoption.

The Commercial end-user segment also plays a pivotal role, driven by the growth in retail, hospitality, healthcare, and telecommunications. These sectors rely heavily on uninterrupted power to ensure customer satisfaction, operational efficiency, and service delivery. Power outages can lead to significant financial losses and reputational damage, thus making diesel generators a critical investment.

Key Drivers for Industrial Segment Dominance:

- Government initiatives promoting industrial growth and investment.

- Expansion of mining operations and related infrastructure.

- Increasing demand for reliable power in manufacturing facilities.

- Growth in the construction sector and large-scale projects.

Key Drivers for 75kVA-375kVA Specification Dominance:

- Ideal power output for a wide array of commercial and small-scale industrial applications.

- Cost-effectiveness and efficiency for mid-sized power requirements.

- Flexibility to scale power solutions for growing businesses.

Key Drivers for Commercial Segment Growth:

- Rapid urbanization and the expansion of the service sector.

- Need for continuous operation in critical service industries like healthcare.

- Demand for reliable power in retail and hospitality to maintain customer experience.

The More than 375kVA specification segment is gaining momentum, particularly with the expansion of large-scale industrial projects and critical infrastructure developments, requiring substantial power reserves. The Residential segment, while smaller, is also showing consistent growth, driven by increasing household electrification and the desire for comfort and security against grid instability.

Tanzania Diesel Generator Market Product Developments

Product developments in the Tanzania Diesel Generator Market are largely focused on enhancing efficiency, reliability, and sustainability. Manufacturers are introducing advanced engine technologies for improved fuel economy and reduced emissions, aligning with global environmental trends. The integration of digital solutions, such as remote monitoring and diagnostic systems, is a significant trend, offering users real-time performance data and predictive maintenance capabilities. These innovations provide competitive advantages by lowering operational costs and minimizing downtime for end-users.

Tanzania Diesel Generator Market Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Tanzania Diesel Generator Market, meticulously segmented by specification and end-user. The Specification segmentation includes: Less than or Equal to 75kVA, 75kVA-375kVA, and More than 375kVA. The End-User segmentation encompasses Residential, Commercial, and Industrial sectors. Each segment's growth projections, market sizes, and competitive dynamics are thoroughly examined to offer a granular understanding of market opportunities and potential.

- Less than or Equal to 75kVA: This segment, often catering to smaller commercial needs and premium residential backup, is projected to experience steady growth, driven by increasing electrification and demand for localized power solutions.

- 75kVA-375kVA: This segment is expected to be a significant growth driver, supporting a broad range of commercial enterprises and small to medium-sized industrial operations.

- More than 375kVA: This segment is anticipated to witness robust expansion due to large-scale industrial projects and critical infrastructure demands.

- Residential: Growth in this segment is driven by a rising middle class and the increasing awareness of power outage impacts on daily life.

- Commercial: This segment is poised for strong performance, fueled by the expansion of the service sector, retail, hospitality, and healthcare.

- Industrial: The industrial segment is expected to remain a dominant force, propelled by government focus on industrialization and resource extraction.

Key Drivers of Tanzania Diesel Generator Market Growth

The Tanzania Diesel Generator Market's growth is underpinned by several key drivers:

- Unreliable Grid Power: Persistent challenges with the national power grid necessitate reliable backup solutions for businesses and households to ensure operational continuity and comfort.

- Industrialization and Infrastructure Development: Government initiatives to boost industrial output and expand infrastructure across sectors like mining, manufacturing, and construction significantly increase the demand for robust power generation.

- Economic Growth and Urbanization: Tanzania's expanding economy and growing urban centers lead to increased energy consumption and a higher demand for consistent power supply.

- Technological Advancements: Innovations in fuel efficiency, emission reduction, and smart monitoring features are making diesel generators more attractive and sustainable, meeting evolving regulatory and user demands.

Challenges in the Tanzania Diesel Generator Market Sector

Despite robust growth prospects, the Tanzania Diesel Generator Market faces several challenges:

- Fluctuating Fuel Prices: The volatility of diesel prices can significantly impact operational costs for end-users, affecting the total cost of ownership and potentially influencing purchasing decisions.

- Competition from Renewable Energy: The increasing adoption of renewable energy sources, such as solar power, presents a competitive alternative, particularly for long-term energy solutions where upfront investment is a consideration.

- Import Duties and Taxes: High import duties and taxes on generator sets and spare parts can increase the overall cost for consumers, impacting market affordability.

- After-Sales Service and Maintenance: Ensuring adequate availability of qualified technicians and genuine spare parts across the country remains a challenge, impacting the long-term reliability and maintenance of generator units.

Emerging Opportunities in Tanzania Diesel Generator Market

The Tanzania Diesel Generator Market presents several emerging opportunities:

- Hybrid Power Solutions: The integration of diesel generators with renewable energy sources (like solar) offers a promising avenue for hybrid power solutions, providing enhanced reliability and cost savings.

- Smart Grid Integration: As Tanzania's grid evolves, opportunities exist for generators equipped with smart technology that can seamlessly integrate with grid management systems for optimal power distribution and load balancing.

- Remote and Off-Grid Applications: The development of remote areas and specialized off-grid applications, such as agricultural processing units and telecommunication towers, creates a sustained demand for localized power generation.

- Serviced Rental Market: A growing serviced rental market for diesel generators, offering flexible power solutions for short-term projects and events, presents a significant business opportunity.

Leading Players in the Tanzania Diesel Generator Market Market

- Masterpower Generator Industry and Trading Inc

- Aksa Power Generation

- Diesel Electric Services (Pty) Ltd

- Phoenix Diesel Power Ltd

- Merrywater Ltd

- Sincro Sitewatch Ltd

- Caterpillar Inc

- Power Providers Tanzania

- African Power Machinery(TZ) Ltd

Key Developments in Tanzania Diesel Generator Market Industry

- January 2021: Caterpillar Inc. introduced 31 new models of GC diesel generator sets for the global electrical contractor market, focusing on 50Hz and 60Hz applications. These value-engineered standby power solutions include 1100 kVA models specifically launched for Africa, Europe, Asia-Pacific, and the Middle East, enhancing the availability of reliable power solutions for the region.

- January 2022: The Tanzanian government discussed moving ahead with the Coal, Iron, and Steel mining project in Liganga, Tanzania, implemented by Tanzania China International Mineral Resource Ltd (TCIMRL). The project's resumption after a nine-year waiting period, contingent upon an agreement over incentives with the government, signifies a potential surge in demand for industrial-grade diesel generators for large-scale mining and processing operations.

Strategic Outlook for Tanzania Diesel Generator Market Market

The strategic outlook for the Tanzania Diesel Generator Market is highly positive, driven by sustained demand for reliable power in a developing economy. The market's growth will be significantly influenced by continued infrastructure development, industrial expansion, and the ongoing need for backup power to mitigate grid instability. Strategic investments in advanced, fuel-efficient, and technologically integrated generator solutions will be crucial for players to capture market share. Furthermore, exploring opportunities in hybrid power systems and the serviced rental market will provide diversified revenue streams and cater to evolving customer needs. The focus on robust after-sales service and spare parts availability will be paramount for long-term customer retention and market leadership.

Tanzania Diesel Generator Market Segmentation

-

1. Specification

- 1.1. Less than or Equal to 75kVA

- 1.2. 75kVA-375kVA

- 1.3. More than 375kVA

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

Tanzania Diesel Generator Market Segmentation By Geography

- 1. Tanzania

Tanzania Diesel Generator Market Regional Market Share

Geographic Coverage of Tanzania Diesel Generator Market

Tanzania Diesel Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Strict Regulations for Wastewater Treatment Across Residential and Industrial Sector4.; Rising Use for Recovery in the Oil and Gas and Mining Industries

- 3.3. Market Restrains

- 3.3.1. 4.; High Operation and Maintenance Costs4.; Volatility in Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Industrial Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Tanzania Diesel Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Specification

- 5.1.1. Less than or Equal to 75kVA

- 5.1.2. 75kVA-375kVA

- 5.1.3. More than 375kVA

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Tanzania

- 5.1. Market Analysis, Insights and Forecast - by Specification

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Masterpower Generator Industry and Trading Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aksa Power Generation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Diesel Electric Services (Pty) Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Phoenix Diesel Power Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Merrywater Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sincro Sitewatch Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Caterpillar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Power Providers Tanzania

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 African Power Machinery(TZ) Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Masterpower Generator Industry and Trading Inc

List of Figures

- Figure 1: Tanzania Diesel Generator Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Tanzania Diesel Generator Market Share (%) by Company 2025

List of Tables

- Table 1: Tanzania Diesel Generator Market Revenue undefined Forecast, by Specification 2020 & 2033

- Table 2: Tanzania Diesel Generator Market Volume K Unit Forecast, by Specification 2020 & 2033

- Table 3: Tanzania Diesel Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Tanzania Diesel Generator Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Tanzania Diesel Generator Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Tanzania Diesel Generator Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Tanzania Diesel Generator Market Revenue undefined Forecast, by Specification 2020 & 2033

- Table 8: Tanzania Diesel Generator Market Volume K Unit Forecast, by Specification 2020 & 2033

- Table 9: Tanzania Diesel Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Tanzania Diesel Generator Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Tanzania Diesel Generator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Tanzania Diesel Generator Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tanzania Diesel Generator Market?

The projected CAGR is approximately 4.01%.

2. Which companies are prominent players in the Tanzania Diesel Generator Market?

Key companies in the market include Masterpower Generator Industry and Trading Inc, Aksa Power Generation, Diesel Electric Services (Pty) Ltd, Phoenix Diesel Power Ltd, Merrywater Ltd, Sincro Sitewatch Ltd, Caterpillar Inc, Power Providers Tanzania, African Power Machinery(TZ) Ltd.

3. What are the main segments of the Tanzania Diesel Generator Market?

The market segments include Specification, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Strict Regulations for Wastewater Treatment Across Residential and Industrial Sector4.; Rising Use for Recovery in the Oil and Gas and Mining Industries.

6. What are the notable trends driving market growth?

Industrial Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Operation and Maintenance Costs4.; Volatility in Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

In January 2021, Caterpillar Inc. introduced 31 new models of GC diesel generator sets for the global electrical contractor market. The new models are for 50Hz and 60Hz applications. They are the company's new range of value-engineered standby power solutions, including 1100 kVA models exclusively launched for Africa, Europe, Asia-Pacific, and the Middle East.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tanzania Diesel Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tanzania Diesel Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tanzania Diesel Generator Market?

To stay informed about further developments, trends, and reports in the Tanzania Diesel Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence