Key Insights

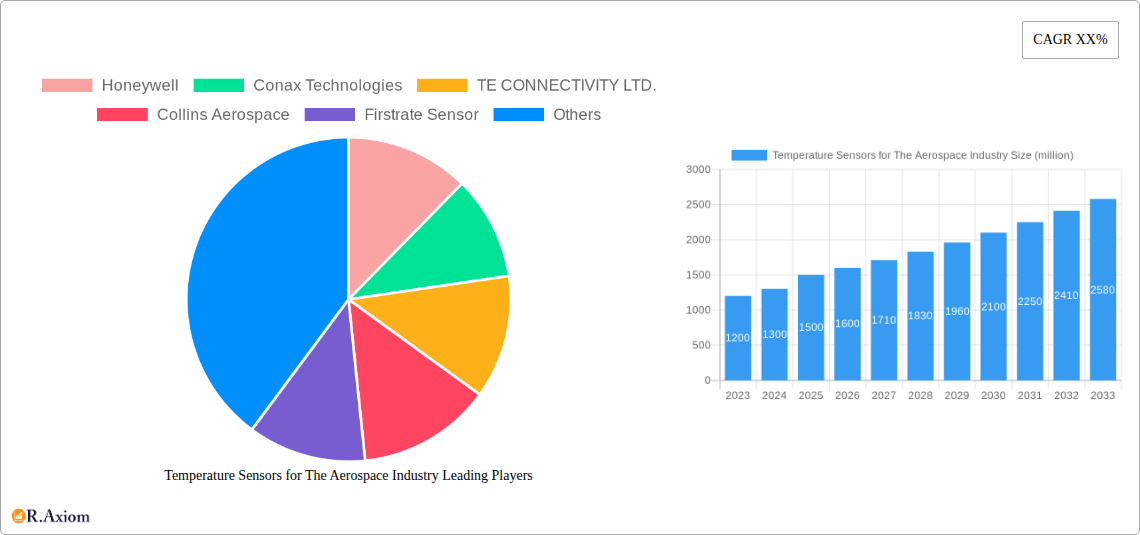

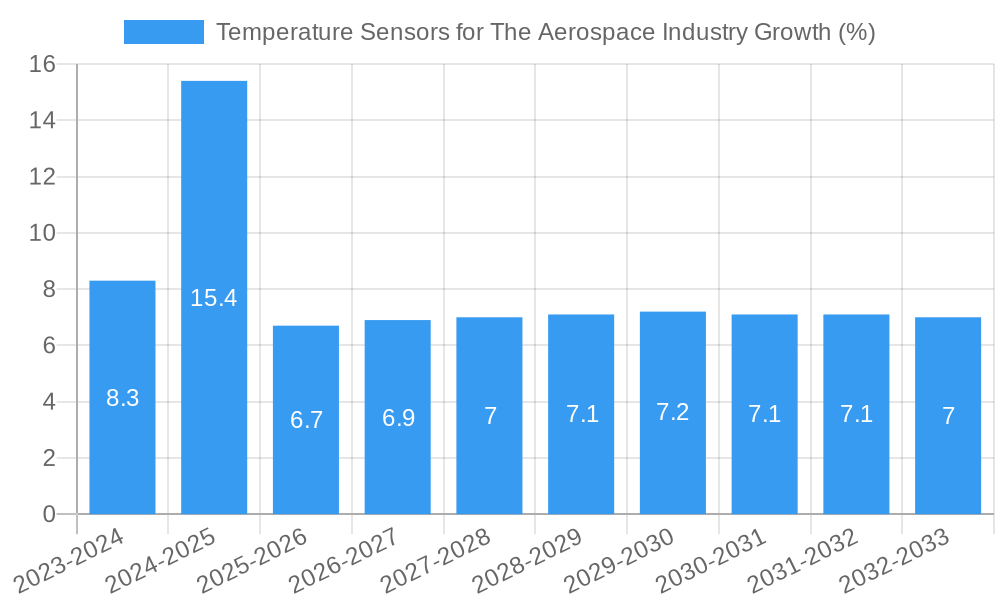

The global market for temperature sensors in the aerospace industry is poised for substantial growth, estimated to reach a valuation of approximately $1,500 million by 2025, and projected to expand at a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This robust expansion is fueled by the ever-increasing demand for advanced aircraft, both for military and civil applications, and the critical role temperature sensors play in ensuring flight safety, operational efficiency, and performance optimization. The proliferation of sophisticated avionics systems, enhanced cabin comfort features, and the development of next-generation aircraft, including drones and electric vertical take-off and landing (eVTOL) vehicles, are significant drivers. Furthermore, stringent regulatory requirements for aviation safety and the continuous need for accurate temperature monitoring in engines, airframes, and critical components necessitate the adoption of high-performance temperature sensing solutions.

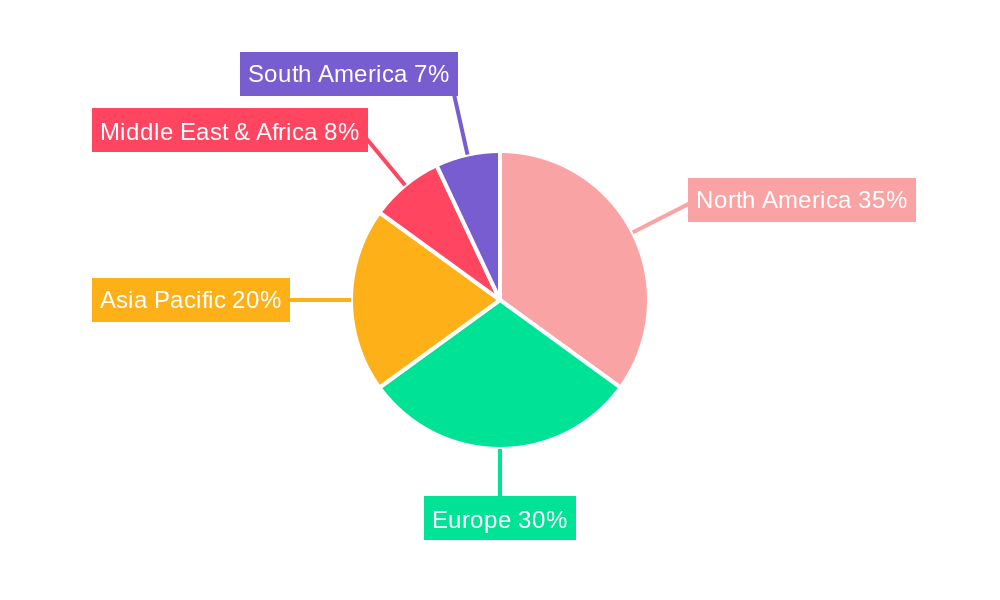

The market segmentation reveals a diverse landscape, with Thermocouple sensors holding a significant share due to their reliability and wide operating temperature range, particularly in demanding engine environments. Resistive Type sensors, including RTDs and thermistors, are gaining traction for their precision and accuracy in less extreme applications. The Infrared segment is experiencing growth driven by non-contact temperature measurement needs for specific aircraft systems and maintenance. Geographically, North America and Europe currently dominate the market, owing to the presence of major aerospace manufacturers, extensive research and development activities, and a mature aviation infrastructure. However, the Asia Pacific region is anticipated to witness the fastest growth, propelled by the expanding aerospace manufacturing capabilities in countries like China and India, and increasing investments in defense and commercial aviation. Key players like Honeywell, Collins Aerospace, and TE Connectivity are at the forefront, investing in innovation and expanding their product portfolios to cater to the evolving needs of the aerospace sector.

This comprehensive report offers an in-depth analysis of the global Temperature Sensors for The Aerospace Industry market, encompassing a detailed study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. It provides critical insights into market dynamics, segmentation, competitive landscape, and future growth trajectories.

Temperature Sensors for The Aerospace Industry Market Concentration & Innovation

The Temperature Sensors for The Aerospace Industry market exhibits a moderate to high degree of concentration, with key players like Honeywell, TE CONNECTIVITY LTD., and Collins Aerospace holding significant market share, estimated to be in the range of xx% collectively. Innovation is a primary driver, fueled by the increasing demand for enhanced aircraft safety, performance monitoring, and fuel efficiency. The aerospace industry's stringent regulatory frameworks, such as those mandated by the FAA and EASA, necessitate continuous technological advancements in sensor reliability and accuracy. Product substitutes, while present in broader industrial applications, are less prevalent within the specialized, high-performance demands of aerospace. End-user trends highlight a growing preference for lightweight, compact, and highly accurate temperature sensing solutions, particularly for next-generation aircraft and advanced drone technology. Mergers and acquisitions (M&A) activity is a notable feature, with estimated deal values in the multi-million dollar range annually, aimed at expanding product portfolios and geographical reach. Recent M&A activities have focused on acquiring specialized sensor manufacturers to integrate advanced technologies, such as non-contact infrared sensors for critical engine monitoring.

Temperature Sensors for The Aerospace Industry Industry Trends & Insights

The Temperature Sensors for The Aerospace Industry market is experiencing robust growth, driven by several key factors. The escalating demand for civil aircraft, propelled by a surge in global air travel and the expansion of airline fleets, directly translates to an increased need for sophisticated temperature sensing solutions for everything from cabin environment control to engine performance monitoring. Military aircraft modernization programs, focusing on enhanced operational capabilities and lifecycle management, also contribute significantly to market expansion. Technological disruptions are at the forefront, with a discernible shift towards more advanced sensor types, including sophisticated resistive types offering superior accuracy and stability, and infrared sensors for non-intrusive, high-temperature measurements. The integration of IoT and AI in aerospace systems is further accelerating the adoption of smart, connected temperature sensors that can provide real-time data analytics for predictive maintenance. Consumer preferences, within the context of aircraft manufacturers and operators, are evolving towards solutions that offer greater reliability, reduced weight, and lower power consumption, thereby contributing to fuel savings and extended aircraft range. Competitive dynamics are characterized by fierce innovation, strategic partnerships, and a constant drive to meet stringent aerospace certification standards. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately xx% over the forecast period, with market penetration expected to reach xx% by 2033. The increasing focus on digitalization and the "connected aircraft" concept are creating a demand for sensors that can seamlessly integrate into complex avionics systems, providing a wealth of data for performance optimization and safety.

Dominant Markets & Segments in Temperature Sensors for The Aerospace Industry

The global Temperature Sensors for The Aerospace Industry market is dominated by North America, driven by the presence of major aerospace manufacturers and significant defense spending. Within this region, the United States stands out as a key country, benefiting from a well-established aerospace ecosystem and continuous investment in both civil and military aviation advancements.

Application Dominance:

- Civil Aircraft: This segment is a major growth engine, fueled by the increasing global demand for air travel, fleet expansions by airlines, and the development of new commercial aircraft models. Economic policies supporting aviation infrastructure development and increased passenger traffic directly boost the need for advanced temperature sensors for engine health, environmental control systems, and avionics. The market size for civil aircraft applications is projected to reach xx million USD by 2033.

- Military Aircraft: While often characterized by longer product cycles, military aircraft applications represent a significant and stable market. Modernization programs, the development of next-generation fighter jets, bombers, and unmanned aerial vehicles (UAVs), and the constant need for enhanced operational readiness drive demand for high-reliability temperature sensors. Government defense budgets and geopolitical stability are key economic policies influencing this segment. The market size for military aircraft applications is projected to reach xx million USD by 2033.

Type Dominance:

- Resistive Type: This category, encompassing RTDs and thermistors, is expected to witness substantial growth due to its high accuracy, stability, and wide operating temperature range, making it ideal for critical engine and airframe monitoring. Technological advancements leading to miniaturization and improved durability are key drivers. The market size for resistive type sensors is projected to reach xx million USD by 2033.

- Thermocouple: Historically a dominant type, thermocouples continue to be crucial for high-temperature applications, particularly in engine exhaust systems and combustion chambers. Their robustness and cost-effectiveness ensure continued demand, though newer technologies are emerging to rival their performance in specific niches. The market size for thermocouple sensors is projected to reach xx million USD by 2033.

- Infrared: This segment is poised for significant expansion, driven by the increasing adoption of non-contact temperature measurement solutions for critical components and systems where direct contact is impractical or undesirable. Applications in engine diagnostics, landing gear temperature monitoring, and cargo bay climate control are growing. The market size for infrared sensors is projected to reach xx million USD by 2033.

- Other: This category includes emerging technologies and specialized sensors, which, while currently smaller in market share, represent significant future growth potential. Examples include fiber optic sensors and advanced MEMS-based temperature sensors. The market size for other sensor types is projected to reach xx million USD by 2033.

Temperature Sensors for The Aerospace Industry Product Developments

Product development in the Temperature Sensors for The Aerospace Industry is intensely focused on enhancing accuracy, reliability, and miniaturization. Innovations include advanced resistive temperature detectors (RTDs) with improved insulation resistance and faster response times, as well as infrared sensors offering higher thermal sensitivity and spectral resolution for more precise diagnostics. Companies are developing sensors with integrated diagnostics and communication capabilities, paving the way for smarter, connected aircraft systems. Competitive advantages are being gained through solutions that offer lower power consumption, extended operational life, and resistance to extreme environmental conditions such as vibration and radiation. This commitment to technological advancement ensures that temperature sensors meet the ever-increasing demands for safety and performance in modern aviation.

Report Scope & Segmentation Analysis

This report meticulously segments the Temperature Sensors for The Aerospace Industry market by Application and Type.

- Application: Military Aircraft: This segment is characterized by high-reliability requirements and extensive use in critical systems for defense purposes. Growth projections are stable, with a market size estimated at xx million USD for the historical period and projected to reach xx million USD by 2033. Competitive dynamics revolve around meeting stringent military specifications and long-term contract cycles.

- Application: Civil Aircraft: This segment is driven by the burgeoning air travel industry and fleet expansions. Growth is robust, with a market size estimated at xx million USD historically and forecast to reach xx million USD by 2033. Key competitive factors include cost-effectiveness, performance, and ease of integration into commercial avionics.

- Type: Thermocouple: This segment remains vital for high-temperature measurements, with a steady market size estimated at xx million USD historically and projected to reach xx million USD by 2033. Its dominance is maintained by its proven reliability and wide application in engine components.

- Type: Resistive Type: Exhibiting strong growth, this segment, including RTDs and thermistors, is projected to expand from xx million USD historically to xx million USD by 2033. Its precision and stability make it increasingly favored for diverse aerospace applications.

- Type: Infrared: This segment is experiencing rapid expansion due to its non-contact measurement capabilities. Forecasted to grow from xx million USD historically to xx million USD by 2033, its adoption is fueled by advanced diagnostic needs.

- Type: Other: This segment encompasses niche and emerging technologies with significant future potential. While currently smaller in market share, it is projected to grow from xx million USD historically to xx million USD by 2033, driven by ongoing research and development.

Key Drivers of Temperature Sensors for The Aerospace Industry Growth

The growth of the Temperature Sensors for The Aerospace Industry is propelled by a confluence of factors.

- Technological Advancements: The continuous drive for enhanced aircraft performance, fuel efficiency, and safety necessitates the development and adoption of more accurate, reliable, and compact temperature sensing solutions. Innovations in materials science and microelectronics are enabling sensors to withstand extreme conditions and provide real-time data.

- Increasing Air Passenger Traffic: A global resurgence in air travel fuels the demand for new aircraft and the expansion of existing fleets, directly increasing the need for comprehensive temperature monitoring systems across all aircraft types.

- Stringent Regulatory Standards: Aviation authorities worldwide impose rigorous safety and performance standards, compelling manufacturers to invest in state-of-the-art temperature sensors that ensure operational integrity and compliance.

- Military Modernization Programs: Significant investments in upgrading military aircraft fleets and developing advanced unmanned aerial vehicles (UAVs) drive the demand for highly specialized and robust temperature sensing technologies.

Challenges in the Temperature Sensors for The Aerospace Industry Sector

Despite robust growth, the Temperature Sensors for The Aerospace Industry sector faces several hurdles.

- Stringent Certification Processes: Obtaining certifications for aerospace components is a lengthy, complex, and expensive process, often involving extensive testing and validation, which can delay product introduction.

- Supply Chain Volatility: Geopolitical events, raw material shortages, and global logistics disruptions can impact the availability and cost of critical components and materials used in sensor manufacturing, leading to potential production delays.

- High Development Costs: The research, development, and rigorous testing required for aerospace-grade temperature sensors demand substantial financial investment, which can be a barrier for smaller companies.

- Intense Competition: While the market is somewhat consolidated, competition among established players and emerging innovators for contracts and market share remains fierce, putting pressure on pricing and margins.

Emerging Opportunities in Temperature Sensors for The Aerospace Industry

The Temperature Sensors for The Aerospace Industry is ripe with emerging opportunities.

- Unmanned Aerial Vehicles (UAVs): The rapid growth of the drone market, for both commercial and military applications, presents a significant opportunity for advanced, lightweight, and cost-effective temperature sensors.

- Predictive Maintenance Technologies: The increasing adoption of AI and IoT in aerospace is driving demand for sensors that can provide continuous, high-fidelity data for predictive maintenance, reducing downtime and operational costs.

- Space Exploration: As space exploration initiatives expand, the need for highly specialized temperature sensors capable of withstanding extreme space environments, including vacuum and radiation, will grow substantially.

- Sustainable Aviation Initiatives: The drive towards more fuel-efficient and environmentally friendly aircraft will spur demand for temperature sensors that can optimize engine performance and reduce emissions.

Leading Players in the Temperature Sensors for The Aerospace Industry Market

- Honeywell

- Conax Technologies

- TE CONNECTIVITY LTD.

- Collins Aerospace

- Firstrate Sensor

- TT ELECTRONICS

- San Giorgio S.E.I.N. s.r.l.

- AeroControlex Group, Inc.

- Webtec

- Pace Scientific

- PCE INSTRUMENTS UK LTD

- MINEBEAMITSUMI INC.

- Minco

- MEGGIT SENSING SYSTEMS

- THERMO EST

- UNISON INDUSTRIES

- THERMOCOAX

- Ametek Fluid management systems

- IST AG

- Crystal Instruments Corporation

- CUSTOM CONTROL SENSORS

- Kanardia d.o.o.

- Lufft

- Emerson Electric Co.

Key Developments in Temperature Sensors for The Aerospace Industry Industry

- 2023/09: Honeywell announces the development of a new generation of compact, high-accuracy temperature sensors for next-generation commercial aircraft, focusing on reduced weight and improved energy efficiency.

- 2023/05: TE CONNECTIVITY LTD. expands its aerospace sensor portfolio with the introduction of advanced resistive temperature detectors (RTDs) designed for extreme temperature environments in jet engines.

- 2023/01: Collins Aerospace introduces an integrated temperature sensing and monitoring system for regional aircraft, enhancing predictive maintenance capabilities.

- 2022/11: MEGGIT SENSING SYSTEMS acquires a specialized infrared sensor manufacturer, bolstering its non-contact temperature measurement offerings for the aerospace sector.

- 2022/07: Minco unveils a new line of miniaturized thermocouples tailored for use in unmanned aerial vehicle (UAV) systems, emphasizing ruggedness and fast response times.

Strategic Outlook for Temperature Sensors for The Aerospace Industry Market

The strategic outlook for the Temperature Sensors for The Aerospace Industry market remains exceptionally strong. Future growth will be catalyzed by the relentless pursuit of enhanced aircraft safety, efficiency, and technological advancement. The increasing integration of smart sensors into the "connected aircraft" ecosystem, facilitating real-time data analytics and predictive maintenance, presents a significant avenue for expansion. Furthermore, the growing emphasis on sustainable aviation and the burgeoning markets for unmanned aerial vehicles and space exploration will continue to drive demand for innovative and specialized temperature sensing solutions. Companies that prioritize continuous R&D, robust supply chain management, and strategic partnerships are well-positioned to capitalize on the evolving needs of this dynamic industry.

Temperature Sensors for The Aerospace Industry Segmentation

-

1. Application

- 1.1. Military Aircraft

- 1.2. Civil Aircraft

-

2. Types

- 2.1. Thermocouple

- 2.2. Resistive Type

- 2.3. Infrared

- 2.4. Other

Temperature Sensors for The Aerospace Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Temperature Sensors for The Aerospace Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Temperature Sensors for The Aerospace Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Military Aircraft

- 5.1.2. Civil Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Thermocouple

- 5.2.2. Resistive Type

- 5.2.3. Infrared

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Temperature Sensors for The Aerospace Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Military Aircraft

- 6.1.2. Civil Aircraft

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Thermocouple

- 6.2.2. Resistive Type

- 6.2.3. Infrared

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Temperature Sensors for The Aerospace Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Military Aircraft

- 7.1.2. Civil Aircraft

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Thermocouple

- 7.2.2. Resistive Type

- 7.2.3. Infrared

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Temperature Sensors for The Aerospace Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Military Aircraft

- 8.1.2. Civil Aircraft

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Thermocouple

- 8.2.2. Resistive Type

- 8.2.3. Infrared

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Temperature Sensors for The Aerospace Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Military Aircraft

- 9.1.2. Civil Aircraft

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Thermocouple

- 9.2.2. Resistive Type

- 9.2.3. Infrared

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Temperature Sensors for The Aerospace Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Military Aircraft

- 10.1.2. Civil Aircraft

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Thermocouple

- 10.2.2. Resistive Type

- 10.2.3. Infrared

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Conax Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TE CONNECTIVITY LTD.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Collins Aerospace

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Firstrate Sensor

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TT ELECTRONICS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 San Giorgio S.E.I.N. s.r.l.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AeroControlex Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inc.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Webtec

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pace Scientific

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PCE INSTRUMENTS UK LTD

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MINEBEAMITSUMI INC.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Minco

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 MEGGIT SENSING SYSTEMS

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 THERMO EST

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 UNISON INDUSTRIES

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 THERMOCOAX

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Ametek Fluid management systems

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 IST AG

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Crystal Instruments Corporation

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 CUSTOM CONTROL SENSORS

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Kanardia d.o.o.

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Lufft

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Emerson Electric Co.

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Honeywell

List of Figures

- Figure 1: Global Temperature Sensors for The Aerospace Industry Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Temperature Sensors for The Aerospace Industry Revenue (million), by Application 2024 & 2032

- Figure 3: North America Temperature Sensors for The Aerospace Industry Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Temperature Sensors for The Aerospace Industry Revenue (million), by Types 2024 & 2032

- Figure 5: North America Temperature Sensors for The Aerospace Industry Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Temperature Sensors for The Aerospace Industry Revenue (million), by Country 2024 & 2032

- Figure 7: North America Temperature Sensors for The Aerospace Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Temperature Sensors for The Aerospace Industry Revenue (million), by Application 2024 & 2032

- Figure 9: South America Temperature Sensors for The Aerospace Industry Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Temperature Sensors for The Aerospace Industry Revenue (million), by Types 2024 & 2032

- Figure 11: South America Temperature Sensors for The Aerospace Industry Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Temperature Sensors for The Aerospace Industry Revenue (million), by Country 2024 & 2032

- Figure 13: South America Temperature Sensors for The Aerospace Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Temperature Sensors for The Aerospace Industry Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Temperature Sensors for The Aerospace Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Temperature Sensors for The Aerospace Industry Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Temperature Sensors for The Aerospace Industry Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Temperature Sensors for The Aerospace Industry Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Temperature Sensors for The Aerospace Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Temperature Sensors for The Aerospace Industry Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Temperature Sensors for The Aerospace Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Temperature Sensors for The Aerospace Industry Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Temperature Sensors for The Aerospace Industry Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Temperature Sensors for The Aerospace Industry Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Temperature Sensors for The Aerospace Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Temperature Sensors for The Aerospace Industry Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Temperature Sensors for The Aerospace Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Temperature Sensors for The Aerospace Industry Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Temperature Sensors for The Aerospace Industry Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Temperature Sensors for The Aerospace Industry Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Temperature Sensors for The Aerospace Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Temperature Sensors for The Aerospace Industry Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Temperature Sensors for The Aerospace Industry Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Temperature Sensors for The Aerospace Industry?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Temperature Sensors for The Aerospace Industry?

Key companies in the market include Honeywell, Conax Technologies, TE CONNECTIVITY LTD., Collins Aerospace, Firstrate Sensor, TT ELECTRONICS, San Giorgio S.E.I.N. s.r.l., AeroControlex Group, Inc., Webtec, Pace Scientific, PCE INSTRUMENTS UK LTD, MINEBEAMITSUMI INC., Minco, MEGGIT SENSING SYSTEMS, THERMO EST, UNISON INDUSTRIES, THERMOCOAX, Ametek Fluid management systems, IST AG, Crystal Instruments Corporation, CUSTOM CONTROL SENSORS, Kanardia d.o.o., Lufft, Emerson Electric Co..

3. What are the main segments of the Temperature Sensors for The Aerospace Industry?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Temperature Sensors for The Aerospace Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Temperature Sensors for The Aerospace Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Temperature Sensors for The Aerospace Industry?

To stay informed about further developments, trends, and reports in the Temperature Sensors for The Aerospace Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence