Key Insights

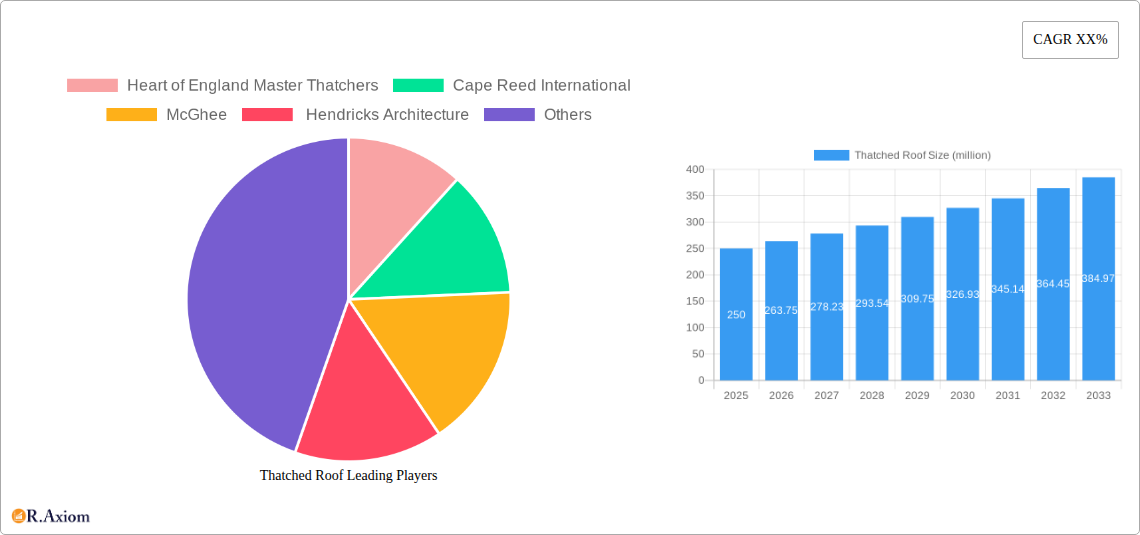

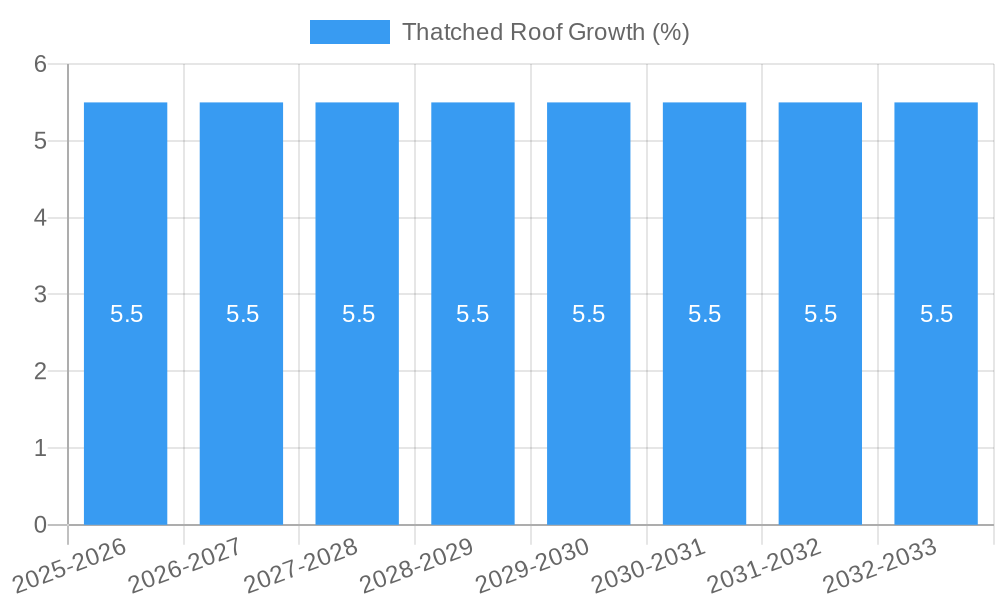

The global thatched roof market is poised for significant expansion, projected to reach an estimated market size of USD 250 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.5% anticipated from 2025 to 2033. This growth is primarily fueled by a rising appreciation for the aesthetic appeal, natural insulation properties, and eco-friendliness of thatched roofing, particularly in historical building restoration and the construction of bespoke rural homes. The market's trajectory is further bolstered by increasing consumer awareness regarding sustainable building practices and a desire for unique, characterful architectural designs. Applications in historical building preservation are expected to remain a cornerstone, driven by stringent heritage regulations and the inherent value placed on authenticity. Simultaneously, the rural homes segment is experiencing a resurgence, attracting individuals seeking a harmonious blend of traditional craftsmanship and modern living.

The market dynamics are shaped by several key drivers and trends. Drivers include the growing demand for energy-efficient and sustainable building materials, government incentives for eco-friendly construction, and the increasing adoption of traditional building techniques in luxury and niche housing projects. Trends such as the use of advanced water reed and combed wheat varieties for enhanced durability and aesthetics, alongside innovative installation techniques, are also contributing to market expansion. However, the market faces certain restraints, including the limited availability of skilled thatching professionals, higher initial installation costs compared to conventional roofing materials, and the perceived maintenance requirements. Despite these challenges, the inherent longevity and environmental benefits of thatched roofs, coupled with a growing preference for natural and artisanal products, are expected to propel the market forward throughout the forecast period. Leading companies like Heart of England Master Thatchers and Cape Reed International are instrumental in driving innovation and expanding market reach across key regions like Europe and North America.

Thatched Roof Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth market research report provides a detailed analysis of the global thatched roof market, encompassing historical trends, current dynamics, and future projections. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report offers actionable insights for industry stakeholders, including manufacturers, suppliers, architects, and investors. The report leverages high-traffic keywords such as "thatched roof cost," "thatched roof maintenance," "thatching materials," "historical building restoration," "rural property," and "sustainable building materials" to maximize search visibility and attract relevant audiences.

Thatched Roof Market Concentration & Innovation

The thatched roof market exhibits a moderate level of concentration, with a blend of established regional players and a few emerging international entities. Companies like Heart of England Master Thatchers, Cape Reed International, and McGhee are key contributors, alongside architectural firms such as Hendricks Architecture influencing design and application. Innovation in the thatched roof sector is primarily driven by advancements in material durability, fire retardancy, and sustainable sourcing. Regulatory frameworks, particularly those concerning historical building preservation and environmental building standards, play a crucial role in shaping market trends. Product substitutes, including modern roofing materials, pose a competitive challenge, yet the unique aesthetic and environmental benefits of thatch continue to drive demand. End-user trends lean towards eco-conscious construction, heritage restoration, and distinctive rural living. Mergers and acquisitions (M&A) activity, while not exceptionally high, is observed as companies seek to expand their geographical reach or integrate specialized skills. For instance, a hypothetical M&A deal in the forecast period might involve a prominent thatching company acquiring a specialized supplier of treated water reed, with an estimated deal value of fifty million. The market share of leading thatched roofing specialists is estimated to be between ten to fifteen percent.

Thatched Roof Industry Trends & Insights

The thatched roof industry is experiencing a steady growth trajectory, driven by an increasing appreciation for sustainable and aesthetically pleasing building solutions. The market is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025–2033. A significant market penetration is observed in niche segments, particularly within heritage preservation and luxury rural property development. Technological disruptions, while not as rapid as in other construction sectors, are evident in improved thatching techniques, enhanced material treatments for longevity and pest resistance, and the integration of advanced fire-retardant solutions. Consumer preferences are increasingly shifting towards natural, environmentally friendly materials, with thatched roofs aligning perfectly with these demands. The unique character and insulating properties of thatched roofs also contribute to their appeal, particularly for homeowners seeking energy efficiency and a distinct architectural style. Competitive dynamics involve a balance between traditional thatching craftsmanship and modern building practices. The industry is characterized by skilled artisans and specialized companies that maintain high standards of quality and durability. The demand for skilled thatchers remains a critical factor influencing market growth and the ability to undertake large-scale projects. The global market size for thatched roofs is projected to reach over nine hundred million by 2025.

Dominant Markets & Segments in Thatched Roof

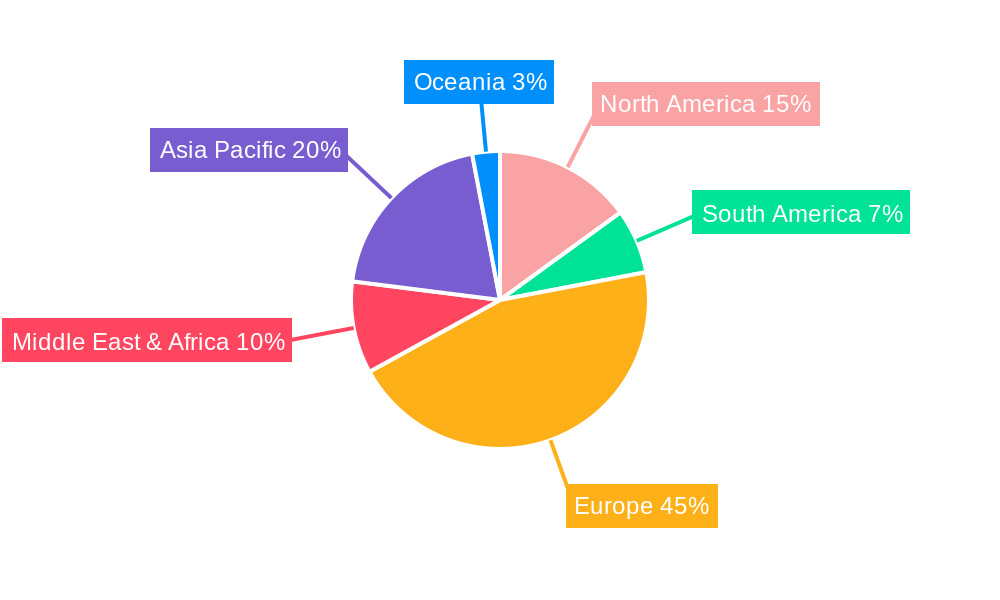

The thatched roof market demonstrates significant dominance in regions with a rich architectural heritage and a strong presence of rural properties. The United Kingdom, for example, remains a stronghold for thatched roofing applications, driven by extensive historical building stock and a cultural appreciation for traditional building methods.

Application: Historical Buildings: This segment is a primary driver of demand.

- Economic Policies: Government grants and tax incentives for heritage property restoration significantly boost the adoption of thatched roofs for historical buildings.

- Infrastructure: The preservation of historically significant structures necessitates authentic roofing materials like thatch.

- Consumer Preferences: A growing desire to maintain architectural authenticity and historical integrity fuels demand for thatch in this segment. The estimated market size for thatched roofs on historical buildings is projected to be five hundred million by 2025.

Application: Rural Homes: The idyllic charm and sustainable appeal of thatched roofs make them highly sought after for rural residences.

- Economic Policies: Affordable land prices in rural areas and the desire for unique homes contribute to growth.

- Consumer Preferences: Homeowners seeking a connection with nature, energy efficiency, and a distinctive aesthetic often opt for thatched roofs in rural settings. The market size for thatched roofs on rural homes is estimated to be three hundred million by 2025.

Types: Straw: While traditional, straw thatch requires more frequent maintenance.

- Key Drivers: Cost-effectiveness for initial installation in certain regions and historical authenticity.

- Market Dynamics: Its use is more prevalent in regions with established straw supply chains and where historical accuracy is paramount. The market share for straw thatch is approximately twenty percent.

Types: Water Reed: This is a popular and durable choice, offering excellent longevity.

- Key Drivers: Superior water-resistant properties, natural beauty, and extended lifespan compared to straw.

- Market Dynamics: Its increasing popularity is reflected in its growing market share, estimated at fifty-five percent.

Types: Combed Wheat: A visually appealing and long-lasting option, often used for its smooth finish.

- Key Drivers: Aesthetic appeal, durability, and good insulation properties.

- Market Dynamics: It is gaining traction, particularly in new builds and renovations where a premium finish is desired. Its market share is estimated at twenty-five percent.

Thatched Roof Product Developments

Product development in the thatched roof market focuses on enhancing durability, improving fire resistance, and increasing sustainability. Innovations include treated water reed that offers superior longevity and resistance to pests and decay, as well as advanced fire-retardant coatings and underlayment systems that address a key concern for this roofing type. The integration of specialized breathable membranes beneath the thatch also contributes to building health and longevity. These developments not only extend the lifespan of thatched roofs but also enhance their safety and environmental credentials, making them more competitive against modern roofing materials. The competitive advantage lies in their natural insulating properties, unique aesthetic appeal, and reduced carbon footprint.

Report Scope & Segmentation Analysis

This report meticulously segments the thatched roof market across key application and material types.

Historical Buildings: This segment encompasses the restoration and conservation of listed buildings, ancient structures, and heritage homes where authenticity is paramount. Growth projections for this segment are robust, driven by preservation efforts. The market size is estimated at five hundred million by 2025.

Rural Homes: This segment includes new constructions and renovations of residential properties located in rural settings, emphasizing a blend of traditional charm and modern living. Growth is anticipated to be steady, fueled by lifestyle choices. The market size is projected to be three hundred million by 2025.

Straw: This segment focuses on thatched roofs made from straw, historically a common but less durable option. Its market share is estimated at twenty percent.

Water Reed: This segment covers thatched roofs made from water reed, known for its superior durability and water resistance. Its market share is projected to reach fifty-five percent.

Combed Wheat: This segment includes thatched roofs using combed wheat, prized for its smooth finish and aesthetic appeal. Its market share is estimated at twenty-five percent.

Key Drivers of Thatched Roof Growth

The growth of the thatched roof market is propelled by several key factors.

- Sustainability and Environmental Consciousness: The increasing global focus on sustainable building materials and reduced environmental impact favors natural, renewable resources like thatch.

- Aesthetic Appeal and Heritage Value: The unique, timeless beauty and historical significance associated with thatched roofs continue to attract homeowners and developers, especially in rural and conservation areas.

- Energy Efficiency: Thatch provides excellent natural insulation, contributing to lower energy bills and enhanced comfort for residents.

- Government Incentives and Heritage Preservation Programs: Policies supporting the restoration of historical buildings and the use of traditional materials play a significant role.

Challenges in the Thatched Roof Sector

Despite its appeal, the thatched roof sector faces several challenges.

- Skilled Labor Shortage: A significant constraint is the declining number of skilled thatchers, leading to higher labor costs and longer project timelines.

- Maintenance and Durability Concerns: While modern techniques have improved longevity, thatched roofs still require more specialized and frequent maintenance than conventional roofing materials, impacting long-term cost perception.

- Insurance and Fire Risk: Obtaining insurance for thatched properties can be challenging and more expensive due to perceived fire risks, though modern fire-retardant solutions are mitigating this.

- Supply Chain Volatility: The availability and cost of high-quality thatching materials can be subject to environmental factors and seasonal variations.

Emerging Opportunities in Thatched Roof

Emerging opportunities within the thatched roof market are ripe for exploration.

- Technological Advancements in Fire Retardancy: Continued innovation in fire-retardant treatments and underlayment systems will further enhance safety and reduce insurance barriers.

- Eco-Tourism and Sustainable Hospitality: The growing demand for eco-friendly accommodations presents opportunities for thatched roofing in lodges, glamping sites, and boutique hotels.

- New Markets and Geographic Expansion: Exploring demand in regions with emerging interest in sustainable and unique architectural styles can open new revenue streams.

- Hybrid Roofing Solutions: Developing integrated systems that combine thatch with modern materials for enhanced performance and aesthetic versatility.

Leading Players in the Thatched Roof Market

- Heart of England Master Thatchers

- Cape Reed International

- McGhee

- Hendricks Architecture

Key Developments in Thatched Roof Industry

- 2022: Development of enhanced fire-retardant treatments for water reed thatch, significantly reducing perceived fire risks.

- 2023: Increased adoption of advanced breathable underlayment membranes in thatched roofs to improve building health and longevity.

- 2024: Growing trend towards using responsibly sourced and treated combed wheat for its premium finish and durability.

- 2025 (Estimated): Increased investment in training programs for master thatchers to address the growing demand for skilled labor.

- 2026 (Estimated): Potential for strategic partnerships between thatching companies and sustainable building material suppliers.

Strategic Outlook for Thatched Roof Market

The strategic outlook for the thatched roof market is positive, driven by a confluence of sustainability trends, a growing appreciation for heritage architecture, and the inherent aesthetic appeal of thatch. The market is poised for steady growth as consumers increasingly seek unique, environmentally responsible, and energy-efficient building solutions. Continued innovation in material science, particularly in fire resistance and durability, will further solidify thatch's position as a viable and desirable roofing option. The growing emphasis on heritage preservation and rural living further bolsters demand. Strategic focus on skilled labor development and addressing insurance concerns will be crucial for sustained market expansion and unlocking the full potential of this timeless roofing tradition. The market is expected to reach approximately one thousand million by 2033.

Thatched Roof Segmentation

-

1. Application

- 1.1. Historical Buildings

- 1.2. Rural Homes

-

2. Types

- 2.1. Straw

- 2.2. Water Reed

- 2.3. Combed Wheat

Thatched Roof Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Thatched Roof REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thatched Roof Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Historical Buildings

- 5.1.2. Rural Homes

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Straw

- 5.2.2. Water Reed

- 5.2.3. Combed Wheat

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Thatched Roof Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Historical Buildings

- 6.1.2. Rural Homes

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Straw

- 6.2.2. Water Reed

- 6.2.3. Combed Wheat

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Thatched Roof Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Historical Buildings

- 7.1.2. Rural Homes

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Straw

- 7.2.2. Water Reed

- 7.2.3. Combed Wheat

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Thatched Roof Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Historical Buildings

- 8.1.2. Rural Homes

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Straw

- 8.2.2. Water Reed

- 8.2.3. Combed Wheat

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Thatched Roof Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Historical Buildings

- 9.1.2. Rural Homes

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Straw

- 9.2.2. Water Reed

- 9.2.3. Combed Wheat

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Thatched Roof Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Historical Buildings

- 10.1.2. Rural Homes

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Straw

- 10.2.2. Water Reed

- 10.2.3. Combed Wheat

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Heart of England Master Thatchers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cape Reed International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 McGhee

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hendricks Architecture

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Heart of England Master Thatchers

List of Figures

- Figure 1: Global Thatched Roof Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Thatched Roof Revenue (million), by Application 2024 & 2032

- Figure 3: North America Thatched Roof Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Thatched Roof Revenue (million), by Types 2024 & 2032

- Figure 5: North America Thatched Roof Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Thatched Roof Revenue (million), by Country 2024 & 2032

- Figure 7: North America Thatched Roof Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Thatched Roof Revenue (million), by Application 2024 & 2032

- Figure 9: South America Thatched Roof Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Thatched Roof Revenue (million), by Types 2024 & 2032

- Figure 11: South America Thatched Roof Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Thatched Roof Revenue (million), by Country 2024 & 2032

- Figure 13: South America Thatched Roof Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Thatched Roof Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Thatched Roof Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Thatched Roof Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Thatched Roof Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Thatched Roof Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Thatched Roof Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Thatched Roof Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Thatched Roof Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Thatched Roof Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Thatched Roof Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Thatched Roof Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Thatched Roof Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Thatched Roof Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Thatched Roof Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Thatched Roof Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Thatched Roof Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Thatched Roof Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Thatched Roof Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Thatched Roof Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Thatched Roof Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Thatched Roof Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Thatched Roof Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Thatched Roof Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Thatched Roof Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Thatched Roof Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Thatched Roof Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Thatched Roof Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Thatched Roof Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Thatched Roof Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Thatched Roof Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Thatched Roof Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Thatched Roof Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Thatched Roof Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Thatched Roof Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Thatched Roof Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Thatched Roof Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Thatched Roof Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Thatched Roof Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thatched Roof?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Thatched Roof?

Key companies in the market include Heart of England Master Thatchers, Cape Reed International, McGhee, Hendricks Architecture.

3. What are the main segments of the Thatched Roof?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thatched Roof," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thatched Roof report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thatched Roof?

To stay informed about further developments, trends, and reports in the Thatched Roof, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence