Key Insights

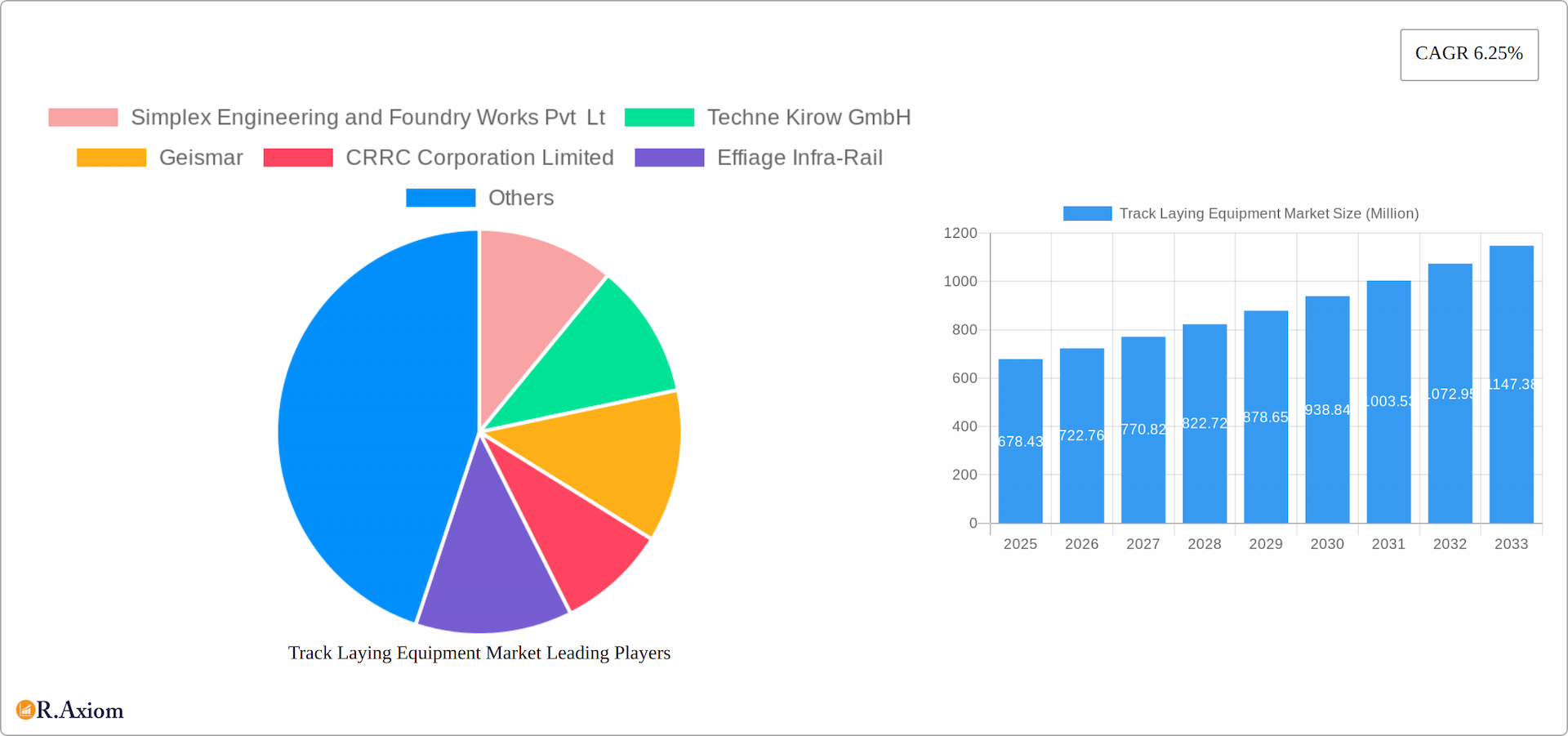

The global track laying equipment market, valued at $678.43 million in 2025, is projected to experience robust growth, driven by increasing investments in railway infrastructure modernization and expansion globally. Significant drivers include the rising demand for high-speed rail networks, the need for efficient track maintenance to ensure operational safety and reduce downtime, and government initiatives promoting sustainable transportation solutions. The market is segmented by equipment type (new construction and renewal), application (heavy and urban rail), and lifting capacity (up to 9 tonnes, 9-12 tonnes, and more than 12 tonnes). Growth is anticipated to be particularly strong in the Asia-Pacific region, fueled by rapid urbanization and substantial infrastructure development projects in countries like China and India. The market's competitive landscape comprises both established international players and regional manufacturers, leading to a dynamic interplay between technological innovation and cost-effectiveness. Renewal equipment is expected to witness higher demand compared to new construction equipment due to the need for regular maintenance and upgrades of existing rail networks.

Track Laying Equipment Market Market Size (In Million)

The 6.25% CAGR projected for the forecast period (2025-2033) suggests a consistent upward trajectory. However, certain restraints, such as fluctuating raw material prices, stringent regulatory compliance requirements, and the cyclical nature of infrastructure spending, could pose challenges. Technological advancements, including the integration of automation and digital technologies in track laying equipment, are expected to reshape the market dynamics, enhancing efficiency and precision. Companies are likely to focus on developing innovative solutions that address these challenges and capitalize on emerging opportunities, particularly in the areas of sustainable and smart rail infrastructure development. This will involve strategic collaborations, mergers and acquisitions, and significant investments in R&D to maintain a competitive edge in a rapidly evolving market.

Track Laying Equipment Market Company Market Share

Track Laying Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Track Laying Equipment market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, growth drivers, competitive landscape, and future trends, enabling stakeholders to make informed strategic decisions. The report utilizes data from the historical period (2019-2024), with 2025 serving as the base and estimated year, and forecasts extending to 2033. The total market size is predicted to reach xx Million by 2033.

Track Laying Equipment Market Concentration & Innovation

The global track laying equipment market exhibits a moderately consolidated structure, with a few major players holding significant market share. Precise market share figures for individual companies are not publicly available and require further dedicated research. However, based on industry knowledge, companies like Plasser & Theurer, Vossloh AG, and Matisa Matariel Industriel SA are considered key players, possibly commanding a combined xx% of the market. The market's competitive intensity is driven by continuous innovation, technological advancements, and mergers & acquisitions (M&A) activities.

- Innovation Drivers: The increasing demand for high-speed rail networks and improved track maintenance efficiency drives innovation in areas like automation, remote operation, and enhanced lifting capacities.

- Regulatory Frameworks: Stringent safety regulations and environmental concerns influence product design and manufacturing processes, creating opportunities for compliant and sustainable solutions.

- Product Substitutes: While no direct substitutes exist, advancements in track construction methods could indirectly impact market demand.

- End-User Trends: The growing focus on infrastructure development, particularly in emerging economies, fuels significant demand for track laying equipment.

- M&A Activities: The industry has witnessed several M&A deals in recent years, with deal values ranging from xx Million to xx Million. These activities reflect the industry's drive for consolidation and expansion into new markets.

Track Laying Equipment Market Industry Trends & Insights

The global track laying equipment market is experiencing robust growth, driven by a combination of factors. The increasing investments in railway infrastructure globally, especially in high-speed rail projects and urban rail transit systems, is a primary growth catalyst. This is further augmented by the need for regular track maintenance and renewal to ensure the safety and efficiency of rail operations. The market's CAGR during the forecast period (2025-2033) is estimated at xx%.

Technological advancements, including automation and digitalization, are significantly impacting market dynamics. The adoption of advanced track laying machines with improved precision and efficiency is increasing. Market penetration of automated track laying systems is projected to reach xx% by 2033. Consumer preferences are shifting towards more sustainable and environmentally friendly solutions, prompting manufacturers to develop eco-conscious equipment. Competitive dynamics are characterized by intense rivalry among established players and emerging entrants, leading to innovation and price competition.

Dominant Markets & Segments in Track Laying Equipment Market

The Asia-Pacific region is currently the dominant market for track laying equipment, driven by extensive infrastructure development initiatives, particularly in countries like China and India. Europe and North America also represent significant markets.

- By Type:

- New Construction Equipment: This segment is expected to maintain a larger market share due to ongoing railway expansion projects.

- Renewal Equipment: This segment is driven by the need for regular track maintenance and upgrades.

- By Application:

- Heavy Rail: This segment dominates due to the extensive lengths of heavy rail networks.

- Urban Rail: Rapid urbanization fuels the growth of urban rail networks, boosting demand in this segment.

- By Lifting Capacity:

- Up to 9 Tonnes: This segment holds a larger market share due to its suitability for a wide range of applications.

- 9-12 Tonnes & More than 12 Tonnes: These segments cater to specialized needs and are expected to experience moderate growth.

Key drivers for market dominance include favorable government policies, significant investments in railway infrastructure, and rapid urbanization. The Asia-Pacific region benefits from large-scale infrastructure projects, while Europe and North America are driven by modernization and renewal efforts.

Track Laying Equipment Market Product Developments

The track laying equipment market is experiencing significant advancements driven by the need for increased efficiency, precision, and automation in rail infrastructure projects. Manufacturers are incorporating cutting-edge technologies such as GPS, laser guidance systems, and sophisticated remote control functionalities to enhance track laying accuracy and minimize downtime. This focus on technological integration leads to improved operational efficiency and reduced project completion times. Furthermore, new designs prioritize modularity and simplified maintenance procedures, resulting in lower operational costs and extended equipment lifespan. These innovations directly address the growing demand for high-speed rail lines and contribute to the overall enhancement of global rail infrastructure development.

Report Scope & Segmentation Analysis

This comprehensive report meticulously analyzes the track laying equipment market across key segments, providing detailed insights into market size, growth projections, and competitive dynamics. The segmentation encompasses:

By Type: A thorough examination of New Construction Equipment and Renewal Equipment, including individual market size estimations, growth forecasts, and competitive landscape analysis for each segment.

By Application: A detailed exploration of the Heavy Rail and Urban Rail segments, highlighting the unique market drivers and growth opportunities within each application area.

By Lifting Capacity: A comprehensive analysis of the Up to 9 Tonnes, 9-12 Tonnes, and More than 12 Tonnes segments, providing market share breakdowns and future growth projections based on capacity requirements.

Each segment's analysis incorporates detailed growth forecasts, precise market size estimations, and insightful assessments of the competitive landscape, providing a complete understanding of the market's structure and dynamics.

Key Drivers of Track Laying Equipment Market Growth

Several factors fuel the growth of the track laying equipment market:

- Rising Investments in Rail Infrastructure: Governments worldwide are heavily investing in rail networks to improve transportation and logistics.

- Technological Advancements: Innovations in automation, precision, and efficiency drive demand for advanced equipment.

- Demand for High-Speed Rail: The increasing popularity of high-speed rail necessitates sophisticated track laying technology.

- Urbanization and Growing Commuter Traffic: Expanding urban rail systems require significant track laying equipment.

Challenges in the Track Laying Equipment Market Sector

Despite significant growth, the track laying equipment market faces several challenges that impact market expansion and profitability:

- High Initial Investment Costs: The advanced technology integrated into modern track laying equipment necessitates substantial upfront investments, potentially creating a barrier to entry for smaller companies and limiting market participation.

- Supply Chain Disruptions: Global supply chain vulnerabilities, including material shortages and logistical bottlenecks, can significantly impact equipment availability, pricing, and project timelines.

- Stringent Safety Regulations: Compliance with increasingly stringent international safety regulations adds complexity and cost to both manufacturing processes and operational procedures, impacting profitability and competitiveness.

- Technological Advancements: The rapid pace of technological advancement necessitates continuous investment in research and development to maintain competitiveness and meet evolving market demands. Failure to adapt could lead to obsolescence and market share loss.

Emerging Opportunities in Track Laying Equipment Market

The market offers several emerging opportunities:

- Expanding into Developing Economies: Emerging markets with burgeoning rail infrastructure projects present growth prospects.

- Development of Sustainable Technologies: Growing environmental concerns create demand for eco-friendly equipment.

- Integration of Digital Technologies: The use of IoT, AI, and data analytics can optimize track laying operations.

Leading Players in the Track Laying Equipment Market Market

- Simplex Engineering and Foundry Works Pvt Lt

- Techne Kirow GmbH

- Geismar

- CRRC Corporation Limited

- Effiage Infra-Rail

- Salcef Group SpA

- Weihua Group

- Plasser & Theurer

- Vossloh AG

- Matisa Matariel Industriel SA

- BEML India

- Harsco Corporation (Enviri)

Key Developments in Track Laying Equipment Market Industry

- November 2023: The announcement of a high-speed railway project connecting China and Vietnam signifies a substantial increase in demand for advanced track laying equipment, driving market expansion in the Asia-Pacific region.

- January 2024: The successful implementation of the CCPG-500A track-laying machine on Malaysia's East Coast Rail Link project, demonstrating an impressive laying rate of 1.5-2 km/day, highlights the efficiency gains achieved through technological advancements.

- February 2024: Ozbir Vagon's contract win with SBB Bahninfrastruktur in Switzerland, alongside Harsco Rail, for the supply of 59 units of track equipment underscores the growing demand for high-quality and reliable track laying equipment in the European market.

Strategic Outlook for Track Laying Equipment Market Market

The track laying equipment market is poised for continued growth, fueled by global infrastructure development and technological advancements. Opportunities lie in the development of sustainable and automated solutions, expanding into new markets, and strategically leveraging partnerships to enhance market reach and product offerings. The market's future trajectory hinges on continued investment in rail infrastructure, technological innovation, and adapting to evolving environmental regulations.

Track Laying Equipment Market Segmentation

-

1. Type

- 1.1. New Construction Equipment

- 1.2. Renewal Equipment

-

2. Application

- 2.1. Heavy Rail

- 2.2. Urban Rail

-

3. Lifting Capacity

- 3.1. Up to 9 Tonnes

- 3.2. 9-12 Tonnes

- 3.3. More than 12 Tonnes

Track Laying Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Track Laying Equipment Market Regional Market Share

Geographic Coverage of Track Laying Equipment Market

Track Laying Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Investments to Expand the Railway Network is Expected to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Maintenance and Renewal Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The New Construction Equipment Segment is Dominating the Track-Laying Equipment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Track Laying Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Construction Equipment

- 5.1.2. Renewal Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Heavy Rail

- 5.2.2. Urban Rail

- 5.3. Market Analysis, Insights and Forecast - by Lifting Capacity

- 5.3.1. Up to 9 Tonnes

- 5.3.2. 9-12 Tonnes

- 5.3.3. More than 12 Tonnes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Track Laying Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. New Construction Equipment

- 6.1.2. Renewal Equipment

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Heavy Rail

- 6.2.2. Urban Rail

- 6.3. Market Analysis, Insights and Forecast - by Lifting Capacity

- 6.3.1. Up to 9 Tonnes

- 6.3.2. 9-12 Tonnes

- 6.3.3. More than 12 Tonnes

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Track Laying Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. New Construction Equipment

- 7.1.2. Renewal Equipment

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Heavy Rail

- 7.2.2. Urban Rail

- 7.3. Market Analysis, Insights and Forecast - by Lifting Capacity

- 7.3.1. Up to 9 Tonnes

- 7.3.2. 9-12 Tonnes

- 7.3.3. More than 12 Tonnes

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Track Laying Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. New Construction Equipment

- 8.1.2. Renewal Equipment

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Heavy Rail

- 8.2.2. Urban Rail

- 8.3. Market Analysis, Insights and Forecast - by Lifting Capacity

- 8.3.1. Up to 9 Tonnes

- 8.3.2. 9-12 Tonnes

- 8.3.3. More than 12 Tonnes

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Track Laying Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. New Construction Equipment

- 9.1.2. Renewal Equipment

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Heavy Rail

- 9.2.2. Urban Rail

- 9.3. Market Analysis, Insights and Forecast - by Lifting Capacity

- 9.3.1. Up to 9 Tonnes

- 9.3.2. 9-12 Tonnes

- 9.3.3. More than 12 Tonnes

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Simplex Engineering and Foundry Works Pvt Lt

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Techne Kirow GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Geismar

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 CRRC Corporation Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Effiage Infra-Rail

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Salcef Group SpA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Weihua Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Plasser & Theurer

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vossloh AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Matisa Matariel Industriel SA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BEML India

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Harsco Corporation (Enviri)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Simplex Engineering and Foundry Works Pvt Lt

List of Figures

- Figure 1: Global Track Laying Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Track Laying Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Track Laying Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Track Laying Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Track Laying Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Track Laying Equipment Market Revenue (Million), by Lifting Capacity 2025 & 2033

- Figure 7: North America Track Laying Equipment Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 8: North America Track Laying Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Track Laying Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Track Laying Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Track Laying Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Track Laying Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Track Laying Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Track Laying Equipment Market Revenue (Million), by Lifting Capacity 2025 & 2033

- Figure 15: Europe Track Laying Equipment Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 16: Europe Track Laying Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Track Laying Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Track Laying Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Track Laying Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Track Laying Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Track Laying Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Track Laying Equipment Market Revenue (Million), by Lifting Capacity 2025 & 2033

- Figure 23: Asia Pacific Track Laying Equipment Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 24: Asia Pacific Track Laying Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Track Laying Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Track Laying Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Rest of the World Track Laying Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Track Laying Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Rest of the World Track Laying Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of the World Track Laying Equipment Market Revenue (Million), by Lifting Capacity 2025 & 2033

- Figure 31: Rest of the World Track Laying Equipment Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 32: Rest of the World Track Laying Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Track Laying Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Track Laying Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Track Laying Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Track Laying Equipment Market Revenue Million Forecast, by Lifting Capacity 2020 & 2033

- Table 4: Global Track Laying Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Track Laying Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Track Laying Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Track Laying Equipment Market Revenue Million Forecast, by Lifting Capacity 2020 & 2033

- Table 8: Global Track Laying Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Track Laying Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Track Laying Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Track Laying Equipment Market Revenue Million Forecast, by Lifting Capacity 2020 & 2033

- Table 15: Global Track Laying Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Track Laying Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Track Laying Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Track Laying Equipment Market Revenue Million Forecast, by Lifting Capacity 2020 & 2033

- Table 24: Global Track Laying Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Track Laying Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Track Laying Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Track Laying Equipment Market Revenue Million Forecast, by Lifting Capacity 2020 & 2033

- Table 33: Global Track Laying Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Track Laying Equipment Market?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the Track Laying Equipment Market?

Key companies in the market include Simplex Engineering and Foundry Works Pvt Lt, Techne Kirow GmbH, Geismar, CRRC Corporation Limited, Effiage Infra-Rail, Salcef Group SpA, Weihua Group, Plasser & Theurer, Vossloh AG, Matisa Matariel Industriel SA, BEML India, Harsco Corporation (Enviri).

3. What are the main segments of the Track Laying Equipment Market?

The market segments include Type, Application, Lifting Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 678.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Investments to Expand the Railway Network is Expected to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

The New Construction Equipment Segment is Dominating the Track-Laying Equipment Market.

7. Are there any restraints impacting market growth?

High Cost of Maintenance and Renewal Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Ozbir Vagon, a Turkey-based company, unveiled its new track machines to be deployed in Switzerland as part of the project undertaken by the national operator SBB Bahninfrastruktur. The company also announced that, along with Harsco Rail, it is tasked with supplying 59 units of track equipment to SBB Bahninfrastruktur.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Track Laying Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Track Laying Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Track Laying Equipment Market?

To stay informed about further developments, trends, and reports in the Track Laying Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence