Key Insights

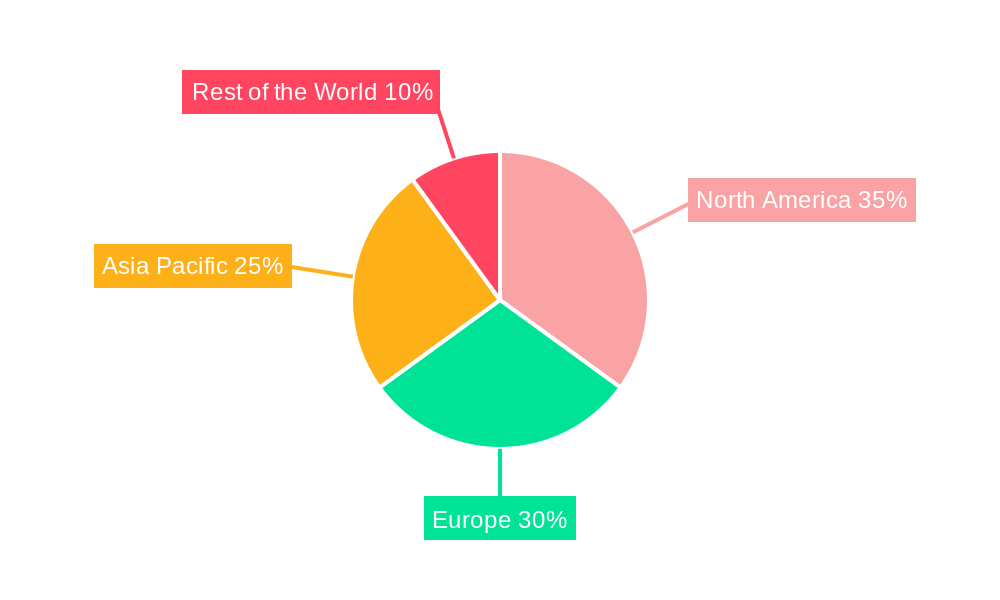

The global truck platooning technology market is experiencing robust growth, projected to reach a significant size driven by the increasing demand for fuel efficiency, enhanced safety, and reduced transportation costs. The market's Compound Annual Growth Rate (CAGR) of 22.25% from 2019 to 2024 indicates a substantial upward trajectory. This growth is fueled by several key factors: Firstly, the rising adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies is paving the way for wider implementation of truck platooning. Secondly, stringent government regulations aimed at improving road safety and reducing carbon emissions are incentivizing the adoption of this technology. Thirdly, the continuous development and refinement of vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication technologies are enhancing the reliability and safety of platooning systems. The market segmentation reveals a strong preference for Driver-Assistive Truck Platooning (DATP) currently, reflecting a gradual transition towards fully autonomous systems. Key players like Daimler, Wabco, and others are heavily investing in research and development, further bolstering market expansion. Regional analysis suggests North America and Europe currently hold significant market shares, with Asia Pacific emerging as a rapidly growing market due to increasing infrastructure development and freight transportation demands.

Truck Platooning Technology Industry Market Size (In Million)

Looking ahead to 2033, the market is poised for continued expansion, driven by ongoing technological advancements, supportive government policies, and increasing logistics demands. The shift towards autonomous truck platooning is anticipated to accelerate, significantly impacting the market’s dynamics. While challenges remain, such as high initial investment costs, the development of robust cybersecurity measures, and the need for comprehensive regulatory frameworks, the long-term prospects of truck platooning remain exceptionally positive. The continuous improvement in communication technologies, the integration of AI, and the increasing sophistication of platooning systems are expected to address these challenges and fuel further growth. The market will likely see a greater diversification of technology providers and increased competition, potentially leading to more cost-effective solutions and wider adoption across diverse geographical regions.

Truck Platooning Technology Industry Company Market Share

Truck Platooning Technology Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Truck Platooning Technology industry, encompassing market size, segmentation, growth drivers, challenges, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes data from the historical period (2019-2024) to provide accurate and insightful projections. This report is essential for industry stakeholders, investors, and researchers seeking to understand this rapidly evolving market. The global market value is projected to reach xx Million by 2033.

Truck Platooning Technology Industry Market Concentration & Innovation

The Truck Platooning Technology industry exhibits a moderately concentrated market structure, with several key players holding significant market share. Daimler Truck AG, Wabco Holdings Inc, NXP Semiconductors N V, Toyota Motor Corporation (Toyota Tsusho), ZF Friedrichshafen, Continental AG, Peloton Technology, Hyundai Motor Company, Paccar Inc (DAF Trucks), Robert Bosch GmbH, Iveco S p A, Volkswagen Group (MAN Scania), Knorr-Bremse AG, and AB Volvo are among the leading companies driving innovation and market growth.

Market share data for 2024 suggests Daimler Truck AG holds approximately xx% market share, followed by Wabco Holdings Inc with xx%, and NXP Semiconductors with xx%. The remaining market share is distributed among other significant players. Innovation in this sector is primarily driven by advancements in autonomous driving technologies, improved communication systems (V2V, V2I), and the need for enhanced fuel efficiency and safety.

Regulatory frameworks, varying significantly across regions, play a crucial role in shaping market dynamics. Stringent safety regulations are driving the development of more sophisticated safety features, while evolving infrastructure requirements are fostering the adoption of V2I technologies.

The industry is witnessing increasing M&A activity as companies strategically expand their portfolios and technological capabilities. In the past five years, the total value of M&A deals in the truck platooning technology sector has been estimated at approximately xx Million. These deals are primarily focused on acquiring smaller technology firms with specialized expertise in areas such as AI, sensor technologies, and cybersecurity. The trend of consolidation is likely to continue as companies aim to gain a competitive edge in this rapidly growing market. Product substitutes, such as advanced driver-assistance systems (ADAS) in individual trucks, pose a challenge, though the efficiency and cost benefits of platooning are compelling counterpoints. End-user trends indicate a preference for increased automation and safety features.

Truck Platooning Technology Industry Industry Trends & Insights

The Truck Platooning Technology industry is experiencing robust growth, fueled by several key trends. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. This growth is primarily driven by several factors:

- Rising demand for enhanced fuel efficiency: Platooning reduces fuel consumption by minimizing aerodynamic drag, resulting in significant cost savings for logistics companies.

- Growing adoption of autonomous driving technologies: The increasing sophistication of autonomous driving technologies is paving the way for the widespread adoption of autonomous truck platooning, further boosting market growth.

- Technological advancements: Continuous innovation in areas such as sensor technology, communication systems, and AI is leading to the development of more reliable and efficient platooning systems.

- Government initiatives and supportive regulations: Many governments are actively promoting the adoption of truck platooning technologies through supportive regulations and funding initiatives. This proactive approach is accelerating market penetration.

- Increasing focus on road safety: Platooning technologies enhance road safety by improving driver awareness and reducing the risk of accidents. This is a critical driver for market adoption.

- Addressing driver shortages: The persistent shortage of qualified truck drivers is another key factor driving the adoption of autonomous and driver-assisted platooning systems.

Market penetration for Driver-Assistive Truck Platooning (DATP) is currently higher compared to Autonomous Truck Platooning due to lower implementation cost and regulatory hurdles. However, the penetration rate of Autonomous Truck Platooning is projected to increase significantly in the coming years with technological advancements and supportive regulations. The competitive dynamics are characterized by intense competition amongst key players vying for market share through innovation, strategic partnerships, and M&A activities.

Dominant Markets & Segments in Truck Platooning Technology Industry

The North American region currently dominates the Truck Platooning Technology market, followed by Europe and Asia-Pacific. This dominance is attributed to several factors:

North America:

- Well-developed transportation infrastructure

- Strong government support and funding for autonomous vehicle technologies

- High adoption of advanced driver-assistance systems (ADAS)

- Presence of major truck manufacturers and technology companies

Europe:

- Stringent emission regulations driving demand for fuel-efficient solutions

- Significant investments in research and development of autonomous driving technologies

- Focus on improving logistics efficiency and reducing transportation costs

Asia-Pacific:

- Rapidly growing logistics sector and increasing demand for efficient transportation solutions

- High population density and traffic congestion, leading to increased interest in autonomous driving technologies

Segment Analysis:

By Platooning Type: Driver-Assistive Truck Platooning (DATP) currently holds a larger market share compared to Autonomous Truck Platooning, primarily due to lower implementation costs and less stringent regulatory requirements. However, Autonomous Truck Platooning is expected to witness significant growth in the forecast period.

By Technology Type: Adaptive Cruise Control, Forward Collision Warning, and Automated Emergency Braking are currently the most widely adopted technologies, with Active Brake Assist and Lane Keep Assist showing rapid growth. The adoption of other technologies, such as Blind Spot Warning, is also anticipated to increase significantly in the coming years.

By Infrastructure Type: Vehicle-to-Vehicle (V2V) communication is currently dominant due to its adaptability and relatively lower implementation cost. Vehicle-to-Infrastructure (V2I) and Global Positioning System (GPS) are also important aspects of the overall technology, contributing to enhanced safety and efficiency. The integration of 5G technology is expected to significantly improve the effectiveness of V2V and V2I communication in the future.

Truck Platooning Technology Industry Product Developments

Recent product innovations focus on enhancing safety, improving fuel efficiency, and increasing automation levels. Advanced sensor technologies, AI-powered algorithms, and improved communication systems are key features driving advancements. Companies are integrating various technologies to create comprehensive platooning systems that offer significant benefits over traditional trucking. The market fit is strong, particularly in long-haul trucking, where the benefits of fuel efficiency and reduced driver fatigue are most pronounced. The continuous improvement in the reliability and cost-effectiveness of these systems is further strengthening their market acceptance.

Report Scope & Segmentation Analysis

This report comprehensively segments the Truck Platooning Technology market by Platooning Type (Driver-Assistive Truck Platooning, Autonomous Truck Platooning), Technology Type (Adaptive Cruise Control, Forward Collision Warning, Automated Emergency Braking, Active Brake Assist, Lane Keep Assist, Others), and Infrastructure Type (V2V, V2I, GPS). Each segment includes detailed analysis of market size, growth projections, and competitive dynamics. For example, the Autonomous Truck Platooning segment is projected to witness a high growth rate, driven by advancements in AI and autonomous driving technologies. Similarly, the V2V communication segment is anticipated to expand rapidly due to its cost-effectiveness and scalability. The report offers detailed insights into the dynamics and growth potential of each segment, allowing for a comprehensive understanding of the market landscape.

Key Drivers of Truck Platooning Technology Industry Growth

Several factors are driving the growth of the Truck Platooning Technology industry: Firstly, the rising fuel costs and stringent emission regulations are pushing logistics companies to adopt fuel-efficient solutions like truck platooning. Secondly, the increasing adoption of autonomous driving technologies is enabling higher levels of automation, improving efficiency, and reducing the dependence on human drivers. Thirdly, government support in the form of funding and policy initiatives is creating a favorable environment for the adoption of these technologies. Finally, the growing demand for safer and more efficient transportation solutions is further propelling market growth. These factors collectively indicate a bright future for the truck platooning technology sector.

Challenges in the Truck Platooning Technology Industry Sector

The industry faces several challenges, including regulatory hurdles concerning the deployment of autonomous vehicles, the high initial investment costs associated with implementing the technology, and the complexities of integrating various technologies in a seamless manner. Supply chain disruptions and the potential for cybersecurity vulnerabilities also pose significant challenges. The intense competition among key players, with companies investing heavily in R&D, is impacting profit margins. These factors, although challenging, also serve as catalysts for innovation and improvement in the overall efficiency and safety of truck platooning technology.

Emerging Opportunities in Truck Platooning Technology Industry

Emerging opportunities include the expansion into new markets, such as the off-highway transportation sector and the adoption of 5G technology for improved communication between vehicles. The integration of advanced analytics and machine learning techniques offers opportunities to optimize operations and further improve fuel efficiency. Developing robust cybersecurity measures to protect platooning systems from cyberattacks will be crucial to ensuring market confidence. Finally, exploration of new business models and partnerships will be key to unlocking the full potential of truck platooning technology.

Leading Players in the Truck Platooning Technology Industry Market

- Daimler Truck AG

- Wabco Holdings Inc

- NXP Semiconductors N V

- Toyota Motor Corporation (Toyota Tsusho)

- ZF Friedrichshafen

- Continental AG

- Peloton Technology

- Hyundai Motor Company

- Paccar Inc (DAF Trucks)

- Robert Bosch GmbH

- Iveco S p A

- Volkswagen Group (MAN Scania)

- Knorr-Bremse AG

- AB Volvo

Key Developments in Truck Platooning Technology Industry Industry

- December 2023: Softbank and West Japan Railway Company partnered to research 5G-enabled V2V technology for BRT systems and truck platooning, aiming to improve Japan's logistics sector and address driver shortages.

- July 2023: FPInnovations collaborated with RRAI to adapt self-driving technology to the off-highway forestry sector, completing initial tests for an off-highway truck platooning project funded by Société du Plan Nord and Natural Resources Canada to address driver shortages in Canada's forestry sector.

- March 2023: Ohmio partnered with the Port Authority of New York and New Jersey to conduct a three-vehicle platooning demonstration at JFK Airport, showcasing the use of driverless passenger shuttles.

Strategic Outlook for Truck Platooning Technology Industry Market

The future of the Truck Platooning Technology industry looks promising, with strong growth anticipated due to continued technological advancements, supportive government policies, and increasing demand for efficient and safe transportation solutions. The expansion of autonomous truck platooning and the integration of 5G technology will be significant drivers of future growth. Companies focusing on innovation, strategic partnerships, and efficient supply chain management will be best positioned to capitalize on the significant market opportunities. The long-term outlook points towards widespread adoption of truck platooning technologies, transforming the logistics industry significantly.

Truck Platooning Technology Industry Segmentation

-

1. Platooning Type

- 1.1. Driver-Assistive Truck Platooning (DATP)

- 1.2. Autonomous Truck Platooning

-

2. Technology Type

- 2.1. Adaptive Cruise Control

- 2.2. Forward Collision Warning

- 2.3. Automated Emergency Braking

- 2.4. Active Brake Assist

- 2.5. Lane Keep Assist

- 2.6. Others (Blind Spot Warning, etc.)

-

3. Infrastructure Type

- 3.1. Vehicle-to-Vehicle (V2V)

- 3.2. Vehicle-to-Infrastructure (V2I)

- 3.3. Global Positioning System (GPS)

Truck Platooning Technology Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Truck Platooning Technology Industry Regional Market Share

Geographic Coverage of Truck Platooning Technology Industry

Truck Platooning Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Governments' Aggressive Push Towards Lowering Fuel Consumption and Co2 Emission of Vehicles to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Platooning Technology Deters Market Growth

- 3.4. Market Trends

- 3.4.1. Adaptive Cruise Control Segment to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platooning Type

- 5.1.1. Driver-Assistive Truck Platooning (DATP)

- 5.1.2. Autonomous Truck Platooning

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Adaptive Cruise Control

- 5.2.2. Forward Collision Warning

- 5.2.3. Automated Emergency Braking

- 5.2.4. Active Brake Assist

- 5.2.5. Lane Keep Assist

- 5.2.6. Others (Blind Spot Warning, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.3.1. Vehicle-to-Vehicle (V2V)

- 5.3.2. Vehicle-to-Infrastructure (V2I)

- 5.3.3. Global Positioning System (GPS)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Platooning Type

- 6. North America Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platooning Type

- 6.1.1. Driver-Assistive Truck Platooning (DATP)

- 6.1.2. Autonomous Truck Platooning

- 6.2. Market Analysis, Insights and Forecast - by Technology Type

- 6.2.1. Adaptive Cruise Control

- 6.2.2. Forward Collision Warning

- 6.2.3. Automated Emergency Braking

- 6.2.4. Active Brake Assist

- 6.2.5. Lane Keep Assist

- 6.2.6. Others (Blind Spot Warning, etc.)

- 6.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.3.1. Vehicle-to-Vehicle (V2V)

- 6.3.2. Vehicle-to-Infrastructure (V2I)

- 6.3.3. Global Positioning System (GPS)

- 6.1. Market Analysis, Insights and Forecast - by Platooning Type

- 7. Europe Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platooning Type

- 7.1.1. Driver-Assistive Truck Platooning (DATP)

- 7.1.2. Autonomous Truck Platooning

- 7.2. Market Analysis, Insights and Forecast - by Technology Type

- 7.2.1. Adaptive Cruise Control

- 7.2.2. Forward Collision Warning

- 7.2.3. Automated Emergency Braking

- 7.2.4. Active Brake Assist

- 7.2.5. Lane Keep Assist

- 7.2.6. Others (Blind Spot Warning, etc.)

- 7.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.3.1. Vehicle-to-Vehicle (V2V)

- 7.3.2. Vehicle-to-Infrastructure (V2I)

- 7.3.3. Global Positioning System (GPS)

- 7.1. Market Analysis, Insights and Forecast - by Platooning Type

- 8. Asia Pacific Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platooning Type

- 8.1.1. Driver-Assistive Truck Platooning (DATP)

- 8.1.2. Autonomous Truck Platooning

- 8.2. Market Analysis, Insights and Forecast - by Technology Type

- 8.2.1. Adaptive Cruise Control

- 8.2.2. Forward Collision Warning

- 8.2.3. Automated Emergency Braking

- 8.2.4. Active Brake Assist

- 8.2.5. Lane Keep Assist

- 8.2.6. Others (Blind Spot Warning, etc.)

- 8.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.3.1. Vehicle-to-Vehicle (V2V)

- 8.3.2. Vehicle-to-Infrastructure (V2I)

- 8.3.3. Global Positioning System (GPS)

- 8.1. Market Analysis, Insights and Forecast - by Platooning Type

- 9. Rest of the World Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platooning Type

- 9.1.1. Driver-Assistive Truck Platooning (DATP)

- 9.1.2. Autonomous Truck Platooning

- 9.2. Market Analysis, Insights and Forecast - by Technology Type

- 9.2.1. Adaptive Cruise Control

- 9.2.2. Forward Collision Warning

- 9.2.3. Automated Emergency Braking

- 9.2.4. Active Brake Assist

- 9.2.5. Lane Keep Assist

- 9.2.6. Others (Blind Spot Warning, etc.)

- 9.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9.3.1. Vehicle-to-Vehicle (V2V)

- 9.3.2. Vehicle-to-Infrastructure (V2I)

- 9.3.3. Global Positioning System (GPS)

- 9.1. Market Analysis, Insights and Forecast - by Platooning Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Daimler Truck AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wabco Holdings Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NXP Semiconductors N V

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toyota Motor Corporation (Toyota Tsusho)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ZF Friedrichshafen

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Peloton Technology

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hyundai Motor Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Paccar Inc (DAF Trucks)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Robert Bosch GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Iveco S p A

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Volkswagen Group (MAN Scania)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Knorr-Bremse AG

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 AB Volvo

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Daimler Truck AG

List of Figures

- Figure 1: Global Truck Platooning Technology Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 3: North America Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 4: North America Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 5: North America Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 6: North America Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 7: North America Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 8: North America Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 11: Europe Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 12: Europe Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 13: Europe Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 14: Europe Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 15: Europe Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 16: Europe Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 19: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 20: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 21: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 22: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 23: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 24: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 27: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 28: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 29: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 30: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 31: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 32: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 2: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 3: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 4: Global Truck Platooning Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 6: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 7: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 8: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 13: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 14: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 15: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 22: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 23: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 24: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 31: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 32: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 33: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Truck Platooning Technology Industry?

The projected CAGR is approximately 22.25%.

2. Which companies are prominent players in the Truck Platooning Technology Industry?

Key companies in the market include Daimler Truck AG, Wabco Holdings Inc, NXP Semiconductors N V, Toyota Motor Corporation (Toyota Tsusho), ZF Friedrichshafen, Continental AG, Peloton Technology, Hyundai Motor Company, Paccar Inc (DAF Trucks), Robert Bosch GmbH, Iveco S p A, Volkswagen Group (MAN Scania), Knorr-Bremse AG, AB Volvo.

3. What are the main segments of the Truck Platooning Technology Industry?

The market segments include Platooning Type, Technology Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Governments' Aggressive Push Towards Lowering Fuel Consumption and Co2 Emission of Vehicles to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Adaptive Cruise Control Segment to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Platooning Technology Deters Market Growth.

8. Can you provide examples of recent developments in the market?

In December 2023, Softbank announced its partnership with West Japan Railway Company to research 5G-enabled Vehicle-to-Vehicle (V2V) technology for a Bus Rapid Transit (BRT) system and truck platooning on Japanese highways. The research aims to enhance the country's logistics sector by facilitating advanced communication technology while assisting in addressing the issue of driver shortages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Truck Platooning Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Truck Platooning Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Truck Platooning Technology Industry?

To stay informed about further developments, trends, and reports in the Truck Platooning Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence