Key Insights

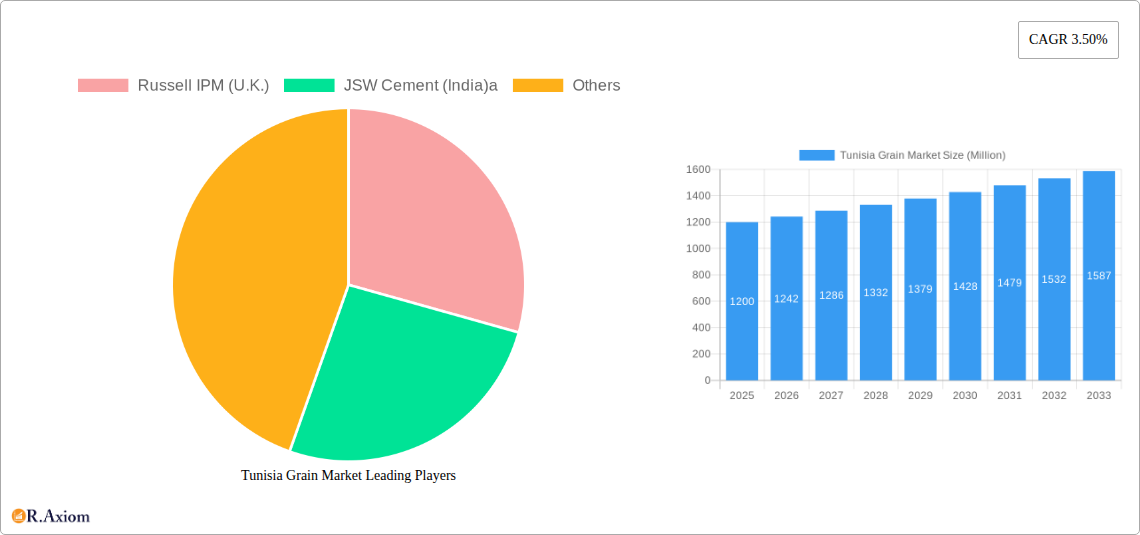

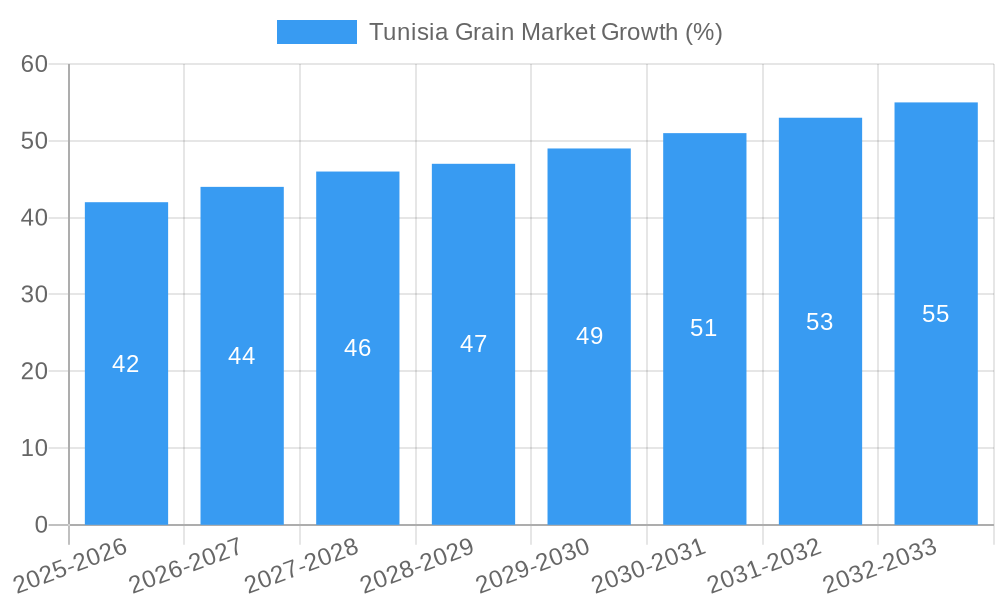

The Tunisian grain market, valued at $1.20 billion in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 3.50% from 2025 to 2033. This growth is driven by several factors. Increasing population and rising per capita income are boosting domestic consumption of cereals, pulses, and oilseeds. Furthermore, Tunisia's reliance on imports for a significant portion of its grain needs presents opportunities for increased agricultural production and trade. Government initiatives aimed at improving agricultural infrastructure and promoting sustainable farming practices will likely contribute positively to market expansion. However, challenges such as climate change impacting yields, fluctuating global grain prices, and competition from imported grains pose potential restraints to market growth. The market is segmented into cereals (wheat, barley, etc.), pulses (lentils, chickpeas, etc.), and oilseeds (sunflower, soybean, etc.), each with its own production, consumption, import/export dynamics, and price trends. Analysis of these segments reveals crucial insights into the overall market performance and identifies areas for investment and growth. For instance, understanding the import dependency in certain segments highlights opportunities for domestic production expansion. Conversely, analyzing price trends helps businesses make informed decisions regarding pricing strategies and risk mitigation. The data suggests a relatively stable market with consistent growth opportunities, albeit with challenges requiring strategic adaptation by market participants.

The Tunisian grain market's detailed segmental analysis reveals nuanced market trends. Cereal production, despite fluctuations influenced by weather patterns, shows consistent growth driven by government support for farmers. Consumption of cereals remains strong, leading to a notable import demand. Pulse production is characterized by relatively lower yields compared to cereals, contributing to a greater reliance on imports. Oilseed cultivation is steadily expanding, driven by the growing demand for vegetable oils, but still lags behind cereal and pulse consumption. Import and export analysis of each segment provides critical insights into Tunisia's position within the global grain market, illustrating the country's strengths and vulnerabilities. Price trends within each segment reveal the market's responsiveness to global supply and demand shifts, as well as the impact of domestic policies. Understanding these dynamics is critical for effective market planning and sustainable growth within the Tunisian grain sector. Competitive analysis, while limited in the provided data, indicates both local and international players influencing the market landscape.

Tunisia Grain Market: A Comprehensive Market Analysis (2019-2033)

This detailed report provides a comprehensive analysis of the Tunisia grain market, covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It offers invaluable insights for industry stakeholders, investors, and strategic decision-makers seeking to understand the dynamics and future trajectory of this crucial sector. The report meticulously examines key segments – cereals, pulses, and oilseeds – providing in-depth analysis of production, consumption, import/export volumes and values, and price trends. It also explores market concentration, innovation, industry trends, dominant markets, product developments, challenges, and emerging opportunities, along with profiles of key players like Russell IPM (U.K.) and JSW Cement (India).

Tunisia Grain Market Market Concentration & Innovation

The Tunisia grain market exhibits a moderately concentrated structure, with a few large players dominating specific segments. Market share data for 2025 reveals that xx% of the cereal market is held by the top three players, while the pulse and oilseed markets show slightly higher fragmentation. Innovation in the sector is driven by technological advancements in farming practices (e.g., precision agriculture, improved seed varieties), storage and processing technologies, and the increasing adoption of sustainable farming methods. Regulatory frameworks, while generally supportive of agricultural development, face challenges in ensuring efficient market access and promoting fair competition. Product substitutes, particularly imported grains, exert pressure on local producers, impacting prices and market dynamics. End-user trends reflect a growing demand for processed grains and value-added products, driving the market towards higher value-added segments. M&A activity remains relatively low, with recorded deal values in the xx Million range over the past five years, primarily focused on consolidation within the processing and distribution segments.

- Market Share (2025): Cereals - Top 3 players: xx%; Pulses - Top 3 players: xx%; Oilseeds - Top 3 players: xx%

- M&A Deal Value (2019-2024): Approximately xx Million

Tunisia Grain Market Industry Trends & Insights

The Tunisia grain market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by rising domestic consumption fueled by population growth and changing dietary habits. Technological disruptions, such as the increasing adoption of precision agriculture and improved irrigation techniques, are enhancing production efficiency and yields. Consumer preferences are shifting towards higher-quality, processed grains and value-added products, creating opportunities for value chain development. However, competitive dynamics are intensified by fluctuations in global grain prices and the availability of imported grains. Market penetration of improved seed varieties and modern farming techniques remains relatively low, presenting opportunities for further expansion.

Dominant Markets & Segments in Tunisia Grain Market

Within the Tunisian grain market, the cereal segment constitutes the largest share, driven by high consumption of wheat and barley. The central and eastern regions dominate cereal production due to favorable climatic conditions and arable land availability.

- Key Drivers for Cereal Dominance:

- Favorable climatic conditions in central and eastern regions.

- Government support for wheat production through subsidies and price supports.

- High domestic consumption of wheat-based products.

- Pulse Market: The pulse market displays significant growth potential driven by increasing consumer awareness of the nutritional benefits of pulses. Import dependence remains a key challenge.

- Oilseed Market: The oilseed market is relatively smaller compared to cereals and pulses, but is experiencing growth driven by increasing demand for vegetable oils.

Tunisia Grain Market Product Developments

Recent product innovations focus on developing improved seed varieties with higher yields and disease resistance. Advancements in processing technologies are enabling the production of value-added products, such as fortified flours and ready-to-eat cereals. These developments enhance the competitive advantage of local producers by catering to evolving consumer preferences and improving nutritional value.

Report Scope & Segmentation Analysis

This report segments the Tunisia grain market based on grain type (cereals, pulses, and oilseeds), production methods, processing methods, distribution channels, and geographic location. Growth projections for each segment vary based on factors like consumer demand, government policies, and technological advancements. For example, the cereal segment is expected to experience a CAGR of xx% during the forecast period, while the pulse segment is projected at xx%, and the oilseed segment at xx%. Competitive dynamics within each segment are influenced by the number of players, their market share, and their ability to innovate and adapt to market changes.

Key Drivers of Tunisia Grain Market Growth

Several factors contribute to the growth of the Tunisian grain market, including government support for agricultural development through subsidies and infrastructure investments. Increasing domestic consumption driven by population growth and changing dietary habits is another major factor. Technological advancements, such as improved farming techniques and processing technologies, enhance production efficiency and quality. Favorable climatic conditions in certain regions also play a significant role.

Challenges in the Tunisia Grain Market Sector

The Tunisian grain market faces several challenges, including climate change impacting crop yields, limited access to modern farming technologies, and high dependence on imports for certain grain types. Supply chain inefficiencies and infrastructural limitations hinder the efficient movement of grains from production areas to consumers. Price volatility in the global grain market poses another major risk to local producers.

Emerging Opportunities in Tunisia Grain Market

The Tunisia grain market presents opportunities for growth in value-added products, organic grains, and sustainable farming practices. Increasing consumer demand for healthier and more sustainable food options creates opportunities for value chain development and diversification. Investments in advanced technologies and improved infrastructure can also unlock significant growth potential.

Leading Players in the Tunisia Grain Market Market

- Russell IPM (U.K.)

- JSW Cement (India)

Key Developments in Tunisia Grain Market Industry

- 2022: Government announces new agricultural subsidies to boost grain production.

- 2023: A major grain processing facility is opened in the central region.

- 2024: Several initiatives are launched to promote the adoption of sustainable farming practices.

Strategic Outlook for Tunisia Grain Market Market

The Tunisia grain market holds substantial long-term growth potential. Strategic investments in research and development, infrastructure development, and sustainable farming practices are crucial for unlocking this potential. By addressing the challenges and capitalizing on the emerging opportunities, the Tunisian grain sector can ensure its long-term viability and contribute to the country's food security.

Tunisia Grain Market Segmentation

-

1. Cereal

- 1.1. Production Analysis

- 1.2. Consumption Analysis and Market Value

- 1.3. Import Market Analysis (Volume and Value)

- 1.4. Export Market Analysis (Volume and Value)

- 1.5. Price Trend Analysis

-

2. Pulse

- 2.1. Production Analysis

- 2.2. Consumption Analysis and Market Value

- 2.3. Import Market Analysis (Volume and Value)

- 2.4. Export Market Analysis (Volume and Value)

- 2.5. Price Trend Analysis

-

3. Oilseeds

- 3.1. Production Analysis

- 3.2. Consumption Analysis and Market Value

- 3.3. Import Market Analysis (Volume and Value)

- 3.4. Export Market Analysis (Volume and Value)

- 3.5. Price Trend Analysis

-

4. Cereal

- 4.1. Production Analysis

- 4.2. Consumption Analysis and Market Value

- 4.3. Import Market Analysis (Volume and Value)

- 4.4. Export Market Analysis (Volume and Value)

- 4.5. Price Trend Analysis

-

5. Pulse

- 5.1. Production Analysis

- 5.2. Consumption Analysis and Market Value

- 5.3. Import Market Analysis (Volume and Value)

- 5.4. Export Market Analysis (Volume and Value)

- 5.5. Price Trend Analysis

-

6. Oilseeds

- 6.1. Production Analysis

- 6.2. Consumption Analysis and Market Value

- 6.3. Import Market Analysis (Volume and Value)

- 6.4. Export Market Analysis (Volume and Value)

- 6.5. Price Trend Analysis

Tunisia Grain Market Segmentation By Geography

- 1. Tunisia

Tunisia Grain Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Adoption of High Technology Farming Practices; Government Initiatives to Increase Local Production

- 3.3. Market Restrains

- 3.3.1. ; Limited Resource Availability and Unfavorable Climatic Conditions; Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Increased Domestic Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Tunisia Grain Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cereal

- 5.1.1. Production Analysis

- 5.1.2. Consumption Analysis and Market Value

- 5.1.3. Import Market Analysis (Volume and Value)

- 5.1.4. Export Market Analysis (Volume and Value)

- 5.1.5. Price Trend Analysis

- 5.2. Market Analysis, Insights and Forecast - by Pulse

- 5.2.1. Production Analysis

- 5.2.2. Consumption Analysis and Market Value

- 5.2.3. Import Market Analysis (Volume and Value)

- 5.2.4. Export Market Analysis (Volume and Value)

- 5.2.5. Price Trend Analysis

- 5.3. Market Analysis, Insights and Forecast - by Oilseeds

- 5.3.1. Production Analysis

- 5.3.2. Consumption Analysis and Market Value

- 5.3.3. Import Market Analysis (Volume and Value)

- 5.3.4. Export Market Analysis (Volume and Value)

- 5.3.5. Price Trend Analysis

- 5.4. Market Analysis, Insights and Forecast - by Cereal

- 5.4.1. Production Analysis

- 5.4.2. Consumption Analysis and Market Value

- 5.4.3. Import Market Analysis (Volume and Value)

- 5.4.4. Export Market Analysis (Volume and Value)

- 5.4.5. Price Trend Analysis

- 5.5. Market Analysis, Insights and Forecast - by Pulse

- 5.5.1. Production Analysis

- 5.5.2. Consumption Analysis and Market Value

- 5.5.3. Import Market Analysis (Volume and Value)

- 5.5.4. Export Market Analysis (Volume and Value)

- 5.5.5. Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Oilseeds

- 5.6.1. Production Analysis

- 5.6.2. Consumption Analysis and Market Value

- 5.6.3. Import Market Analysis (Volume and Value)

- 5.6.4. Export Market Analysis (Volume and Value)

- 5.6.5. Price Trend Analysis

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Tunisia

- 5.1. Market Analysis, Insights and Forecast - by Cereal

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Russell IPM (U.K.)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JSW Cement (India)a

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.1 Russell IPM (U.K.)

List of Figures

- Figure 1: Tunisia Grain Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Tunisia Grain Market Share (%) by Company 2024

List of Tables

- Table 1: Tunisia Grain Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Tunisia Grain Market Revenue Million Forecast, by Cereal 2019 & 2032

- Table 3: Tunisia Grain Market Revenue Million Forecast, by Pulse 2019 & 2032

- Table 4: Tunisia Grain Market Revenue Million Forecast, by Oilseeds 2019 & 2032

- Table 5: Tunisia Grain Market Revenue Million Forecast, by Cereal 2019 & 2032

- Table 6: Tunisia Grain Market Revenue Million Forecast, by Pulse 2019 & 2032

- Table 7: Tunisia Grain Market Revenue Million Forecast, by Oilseeds 2019 & 2032

- Table 8: Tunisia Grain Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Tunisia Grain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Tunisia Grain Market Revenue Million Forecast, by Cereal 2019 & 2032

- Table 11: Tunisia Grain Market Revenue Million Forecast, by Pulse 2019 & 2032

- Table 12: Tunisia Grain Market Revenue Million Forecast, by Oilseeds 2019 & 2032

- Table 13: Tunisia Grain Market Revenue Million Forecast, by Cereal 2019 & 2032

- Table 14: Tunisia Grain Market Revenue Million Forecast, by Pulse 2019 & 2032

- Table 15: Tunisia Grain Market Revenue Million Forecast, by Oilseeds 2019 & 2032

- Table 16: Tunisia Grain Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tunisia Grain Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Tunisia Grain Market?

Key companies in the market include Russell IPM (U.K.), JSW Cement (India)a.

3. What are the main segments of the Tunisia Grain Market?

The market segments include Cereal, Pulse, Oilseeds, Cereal, Pulse, Oilseeds.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.20 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Adoption of High Technology Farming Practices; Government Initiatives to Increase Local Production.

6. What are the notable trends driving market growth?

Increased Domestic Production.

7. Are there any restraints impacting market growth?

; Limited Resource Availability and Unfavorable Climatic Conditions; Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tunisia Grain Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tunisia Grain Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tunisia Grain Market?

To stay informed about further developments, trends, and reports in the Tunisia Grain Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence