Key Insights

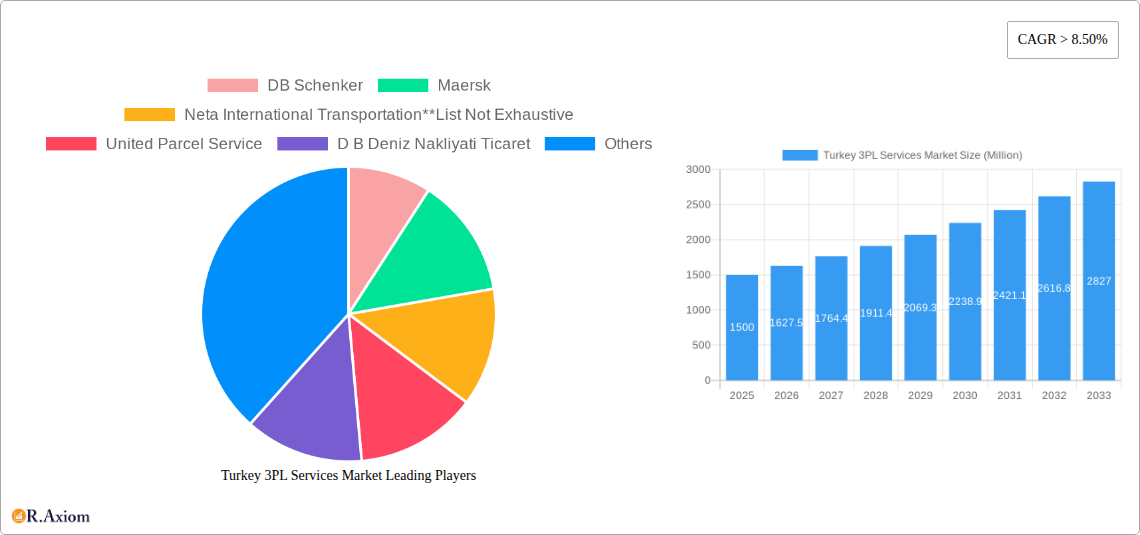

The Turkish 3PL (Third-Party Logistics) services market exhibits robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8.5% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector in Turkey significantly boosts demand for efficient warehousing, distribution, and last-mile delivery solutions. Simultaneously, the growth of manufacturing and automotive industries within the country necessitates sophisticated supply chain management, further driving the adoption of 3PL services. Furthermore, the increasing focus on cost optimization and supply chain resilience among businesses across various sectors, including oil, gas, chemicals, pharmaceuticals, and construction, contributes to market growth. The rising adoption of advanced technologies, such as warehouse management systems (WMS) and transportation management systems (TMS), enhances operational efficiency and transparency, attracting more businesses towards 3PL providers. While potential regulatory changes and economic fluctuations could pose minor restraints, the overall outlook for the Turkish 3PL market remains positive. The market segmentation reveals a strong presence across various end-user industries, with manufacturing, automotive, and e-commerce being prominent contributors. The services segment is dominated by domestic transportation management, complemented by the growing demand for international transportation and value-added warehousing services. Key players like DB Schenker, Maersk, and DHL Supply Chain actively compete in this dynamic market, continually innovating to cater to evolving customer needs.

Turkey 3PL Services Market Market Size (In Billion)

The competitive landscape is characterized by both established international players and local Turkish logistics providers. The presence of numerous smaller regional providers suggests a highly fragmented market, but consolidation is likely to occur as larger players seek to expand their market share. Further growth will be fueled by Turkey’s strategic geographical location, facilitating trade between Europe and Asia. The increasing focus on sustainability within the logistics industry will also present opportunities for 3PL providers offering eco-friendly solutions. The market's growth trajectory signifies significant opportunities for investment and expansion within the Turkish 3PL sector, making it an attractive proposition for both domestic and international businesses. The continued expansion of e-commerce, industrial growth, and technological advancements are expected to ensure sustained high growth in the coming years.

Turkey 3PL Services Market Company Market Share

Turkey 3PL Services Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Turkey 3PL (Third-Party Logistics) services market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with 2025 as the base year, this report offers a deep dive into market dynamics, competitive landscapes, and future growth projections. The report leverages extensive primary and secondary research to deliver actionable intelligence, focusing on key segments, leading players, and emerging trends shaping the Turkish 3PL landscape.

Turkey 3PL Services Market Concentration & Innovation

This section analyzes the competitive intensity, innovation drivers, and regulatory influences within the Turkish 3PL market. We examine market concentration through metrics such as market share held by key players like DB Schenker, Maersk, and DHL Supply Chain, alongside assessing the impact of mergers and acquisitions (M&A) activity. The report explores the role of technological advancements, such as AI-powered logistics solutions and blockchain technology, in driving innovation. Regulatory frameworks, including customs regulations and transportation laws, are evaluated for their impact on market dynamics. The report also considers the influence of substitute products and services and emerging end-user trends on market competition.

- Market Share Analysis: The report will detail market share percentages for major players, revealing the degree of market concentration. For example, DB Schenker may hold xx% market share, while Maersk holds yy%. These figures will be supported by detailed analysis and methodology.

- M&A Activity: The report will assess the impact of recent M&A activity on market consolidation, including deal values (e.g., a recent acquisition valued at approximately $xx Million) and the resulting changes in competitive dynamics.

- Innovation Drivers: The role of technological advancements (e.g., the adoption of IoT and automation) in enhancing efficiency and driving innovation will be analyzed. Government initiatives and investments in infrastructure will also be assessed.

- Regulatory Landscape: This section will assess the effects of Turkish regulations on the 3PL market, noting any significant compliance challenges or opportunities.

Turkey 3PL Services Market Industry Trends & Insights

This section delves into the overarching trends shaping the Turkish 3PL services market. We examine market growth drivers, including factors such as increasing e-commerce adoption, the expansion of manufacturing and industrial sectors, and government initiatives to improve logistics infrastructure. The report analyzes the impact of technological disruptions, encompassing automation, big data analytics, and the Internet of Things (IoT), on efficiency and operational optimization within the 3PL sector. We explore evolving consumer preferences, such as faster delivery expectations and increased demand for transparency in the supply chain, and their implications for 3PL service providers. The competitive dynamics, including pricing strategies and service differentiation, are thoroughly examined using metrics such as CAGR (Compound Annual Growth Rate) and market penetration rates. The section will also include forecasts and analyses of macroeconomic factors and global trade influencing the Turkish market. We will project a CAGR of xx% for the forecast period (2025-2033), driven by factors such as the growth of e-commerce and increasing foreign direct investment. Market penetration is expected to reach yy% by 2033.

Dominant Markets & Segments in Turkey 3PL Services Market

This section identifies the leading segments within the Turkish 3PL market, both by end-user and service type. We analyze the dominance of specific regions or sectors, examining the underlying factors driving their success.

By End-User:

- Manufacturing & Automotive: This segment's dominance is attributed to factors such as [detailed analysis of economic drivers, infrastructure, and government policies impacting the automotive sector in Turkey]. The growth projection for this segment is xx Million by 2033.

- Oil, Gas & Chemicals: [Detailed analysis of the factors influencing the Oil, Gas & Chemicals segment, its size, and projected growth. Growth projection for this segment is estimated to be yy Million by 2033.]

- Distributive Trade (Wholesale and Retail trade including e-commerce): The rapid growth of e-commerce is a significant driver, alongside [detailed analysis of other relevant factors]. Projected value: zz Million by 2033.

- Pharma & Healthcare: [Analysis of factors driving growth including regulatory requirements, cold chain logistics etc. Growth projection for this segment is xx Million by 2033].

- Construction: [Analysis of the Construction segment and growth drivers. Growth projection is estimated at yy Million by 2033].

- Other End Users: [Analysis and projection].

By Services:

- Domestic Transportation Management: [Analysis and growth projection].

- International Transportation Management: [Analysis and growth projection].

- Value-added Warehousing and Distribution: [Analysis and growth projection].

Turkey 3PL Services Market Product Developments

The Turkish 3PL market is witnessing significant product innovation, driven primarily by technological advancements. The integration of advanced technologies such as AI, machine learning, and blockchain is leading to the development of intelligent logistics solutions, enhancing efficiency, transparency, and traceability throughout the supply chain. These innovations offer significant competitive advantages, allowing 3PL providers to optimize operations, reduce costs, and enhance customer service. The market is seeing a growing adoption of specialized warehousing solutions, tailored to the specific needs of different industry verticals, such as temperature-controlled storage for pharmaceuticals.

Report Scope & Segmentation Analysis

This report comprehensively segments the Turkey 3PL services market by end-user (Manufacturing & Automotive, Oil, Gas & Chemicals, Distributive Trade, Pharma & Healthcare, Construction, Other End Users) and by services (Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. For instance, the Manufacturing & Automotive segment is projected to experience significant growth due to increasing investments in the automotive industry. Similarly, the e-commerce boom drives growth within the Distributive Trade segment. International Transportation Management will benefit from increasing global trade.

Key Drivers of Turkey 3PL Services Market Growth

Several key factors drive the growth of the Turkey 3PL services market. Firstly, the burgeoning e-commerce sector fuels demand for efficient logistics and delivery solutions. Secondly, increased foreign direct investment and industrial expansion stimulate demand for 3PL services. Thirdly, government initiatives aimed at improving infrastructure and streamlining logistics processes create a positive environment for growth. Finally, the adoption of advanced technologies, such as automation and data analytics, further enhances efficiency and cost-effectiveness, boosting market expansion.

Challenges in the Turkey 3PL Services Market Sector

The Turkey 3PL market faces various challenges. Fluctuations in global fuel prices significantly impact transportation costs. Geopolitical instability and regional conflicts can disrupt supply chains. Furthermore, intense competition among 3PL providers necessitates continuous innovation and operational efficiency to maintain market share. Stringent regulatory compliance requirements also add to the operational complexity and cost burden for 3PL businesses.

Emerging Opportunities in Turkey 3PL Services Market

The Turkish 3PL market presents several lucrative opportunities. The growth of e-commerce creates significant demand for last-mile delivery solutions and specialized warehousing capabilities. The increasing adoption of sustainable logistics practices presents opportunities for 3PL providers to offer environmentally friendly services. Moreover, the expansion of the manufacturing sector and growing focus on supply chain resilience create a favorable environment for 3PL growth.

Leading Players in the Turkey 3PL Services Market Market

- DB Schenker

- Maersk

- Neta International Transportation

- United Parcel Service

- D B Deniz Nakliyati Ticaret

- GEFCO

- CEVA

- Istanbul Express

- GAC Turkey

- DHL Supply Chain

- DSV Panalpina

Key Developments in Turkey 3PL Services Market Industry

- 2022 Q4: DHL Supply Chain announced a significant investment in automated warehousing technology in Turkey.

- 2023 Q1: DB Schenker expanded its domestic transportation network, adding new routes and facilities.

- 2023 Q2: Maersk partnered with a local Turkish company to enhance its cold chain logistics capabilities.

- [Add further developments with year/month and impact]

Strategic Outlook for Turkey 3PL Services Market Market

The Turkish 3PL market exhibits strong growth potential, driven by robust economic growth, expanding e-commerce, and increased investments in infrastructure. The ongoing adoption of advanced technologies and the focus on improving supply chain resilience create favorable conditions for market expansion. Strategic partnerships and acquisitions are likely to play a key role in shaping the competitive landscape, further consolidating the market. The forecast period (2025-2033) promises substantial growth opportunities for 3PL providers who can adapt to evolving market demands and adopt innovative technologies.

Turkey 3PL Services Market Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Manufacturing & Automotive

- 2.2. Oil, Gas & Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End Users

Turkey 3PL Services Market Segmentation By Geography

- 1. Turkey

Turkey 3PL Services Market Regional Market Share

Geographic Coverage of Turkey 3PL Services Market

Turkey 3PL Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade

- 3.3. Market Restrains

- 3.3.1. Nature of Supply Chain Business

- 3.4. Market Trends

- 3.4.1. Development in Railways Connectivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey 3PL Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil, Gas & Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maersk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Neta International Transportation**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 United Parcel Service

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 D B Deniz Nakliyati Ticaret

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GEFCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Istanbul Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GAC Turkey

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DHL Supply Chain

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DSV Panalpina

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Turkey 3PL Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Turkey 3PL Services Market Share (%) by Company 2025

List of Tables

- Table 1: Turkey 3PL Services Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Turkey 3PL Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Turkey 3PL Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Turkey 3PL Services Market Revenue Million Forecast, by Services 2020 & 2033

- Table 5: Turkey 3PL Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Turkey 3PL Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey 3PL Services Market?

The projected CAGR is approximately > 8.50%.

2. Which companies are prominent players in the Turkey 3PL Services Market?

Key companies in the market include DB Schenker, Maersk, Neta International Transportation**List Not Exhaustive, United Parcel Service, D B Deniz Nakliyati Ticaret, GEFCO, CEVA, Istanbul Express, GAC Turkey, DHL Supply Chain, DSV Panalpina.

3. What are the main segments of the Turkey 3PL Services Market?

The market segments include Services, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade.

6. What are the notable trends driving market growth?

Development in Railways Connectivity.

7. Are there any restraints impacting market growth?

Nature of Supply Chain Business.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey 3PL Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey 3PL Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey 3PL Services Market?

To stay informed about further developments, trends, and reports in the Turkey 3PL Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence