Key Insights

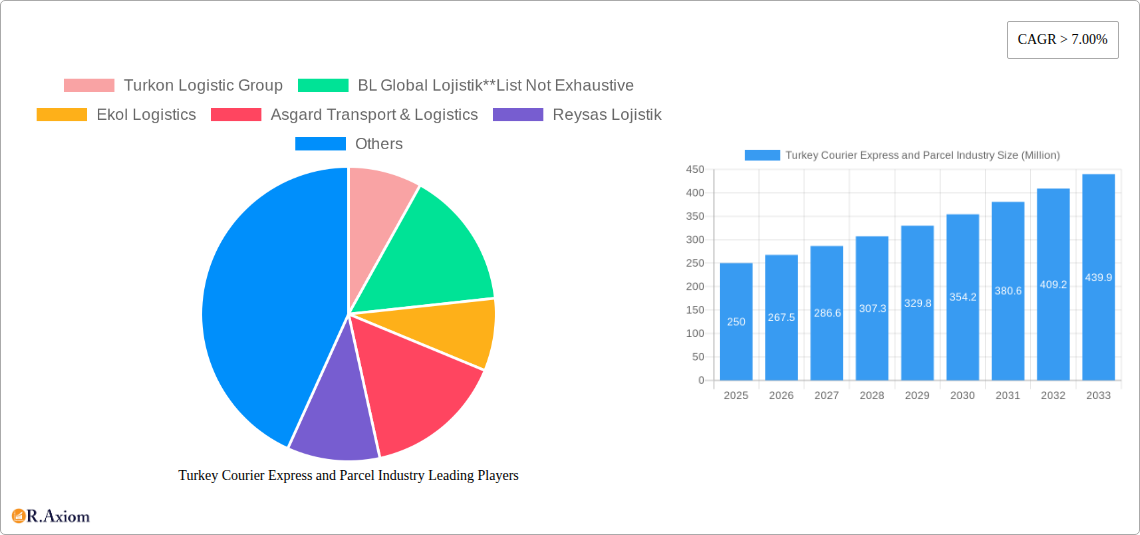

The Turkish Courier, Express, and Parcel (CEP) industry is poised for substantial expansion, driven by robust e-commerce growth, a developing logistics infrastructure, and increasing international trade. With a projected Compound Annual Growth Rate (CAGR) of 8.3% and an estimated market size of 2.3 billion in the base year 2024, the sector offers compelling investment prospects. Key growth catalysts include the surge in online retail, heightened demand for expedited and dependable delivery, and the integration of advanced logistics technologies such as automated sorting and real-time tracking. The market is segmented by destination (domestic and international), distribution channel (B2B and B2C), and end-user industries (including BFSI, e-commerce, healthcare, and manufacturing). Dominant global and local players like DHL, UPS, and Turkon Logistic Group highlight the competitive landscape, while also signaling opportunities for specialized entrants.

Turkey Courier Express and Parcel Industry Market Size (In Billion)

The forecast period (2024-2033) indicates sustained growth, supported by Turkey's improving logistics infrastructure, governmental initiatives promoting sector development, and its strategic geographic positioning. However, the industry faces challenges including currency volatility and global economic uncertainties. Rising operational costs, such as fuel prices, and intense market competition necessitate a focus on efficiency and innovation to ensure profitability. To secure market share, companies must prioritize exceptional customer service, invest in advanced technologies, and adapt to the evolving demands of an increasingly digital marketplace. Furthermore, the growing emphasis on sustainable and eco-friendly delivery solutions presents a significant avenue for competitive differentiation.

Turkey Courier Express and Parcel Industry Company Market Share

Turkey Courier Express and Parcel Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Turkish courier, express, and parcel (CEP) industry, covering market size, segmentation, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is crucial for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market. The report utilizes data measured in Millions.

Turkey Courier Express and Parcel Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Turkish CEP industry, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of multinational giants and domestic players, leading to a moderately concentrated market. While precise market share figures for each player are proprietary, we estimate that the top five players (DHL Worldwide Express, UPS Hizli Kargo, TNT International Express, Ekol Logistics, and Turkon Logistic Group) collectively hold approximately xx% of the market.

- Market Concentration: Moderate concentration with a few dominant players and numerous smaller firms.

- Innovation Drivers: E-commerce growth, technological advancements (e.g., automation, AI), and increasing demand for faster delivery services.

- Regulatory Framework: The Turkish government's policies on logistics and e-commerce significantly influence industry growth and regulations.

- Product Substitutes: Alternative delivery methods like postal services and private delivery networks exist, but their market share is relatively smaller.

- End-User Trends: A growing preference for faster, more reliable, and trackable delivery services drives market expansion.

- M&A Activities: The past five years have witnessed xx Million worth of M&A deals in the Turkish CEP sector, with several smaller acquisitions aiming to enhance market share and service capabilities. Examples include (but are not limited to) consolidations within the last-mile delivery segment.

Turkey Courier Express and Parcel Industry Industry Trends & Insights

The Turkish CEP industry exhibits strong growth potential, fueled by several key factors. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%, and the forecast for 2025-2033 indicates continued expansion, reaching a market size of xx Million by 2033. E-commerce boom and increasing consumer spending are major drivers. Technological advancements such as automated sorting facilities, real-time tracking systems, and drone delivery pilot programs are transforming the industry. Consumer preferences are shifting towards faster delivery options (same-day or next-day delivery) and enhanced transparency. Competitive dynamics remain intense, with companies focusing on price competitiveness, service quality, and technological innovation. Market penetration of express delivery services is estimated at xx% in 2025.

Dominant Markets & Segments in Turkey Courier Express and Parcel Industry

The Turkish CEP market is segmented by destination (domestic and international), channel of distribution (B2B and B2C), and end-user industry.

By Destination: The domestic segment dominates, accounting for approximately xx% of the total market revenue in 2025 due to a booming e-commerce sector and robust domestic trade. International shipments are experiencing growth due to Turkey's strategic geopolitical location.

By Channel of Distribution: B2C segment is the fastest-growing, driven by the rapid expansion of e-commerce. B2B remains significant, particularly for industrial manufacturing and wholesale trade.

By End-user Industry: Wholesale and Retail Trade (e-commerce) is the largest segment, followed by Industrial Manufacturing and BFSI. The Life Sciences/Healthcare sector is also showing promising growth due to the need for efficient and reliable delivery of medical supplies.

Key Drivers:

- Strong Economic Growth: Turkey's GDP growth directly impacts logistics and transportation demand.

- E-commerce Expansion: The rapid growth of e-commerce platforms and online shopping drives significant demand for CEP services.

- Government Infrastructure Investments: Investments in transportation infrastructure (roads, airports) facilitate efficient delivery operations.

Turkey Courier Express and Parcel Industry Product Developments

The industry is witnessing continuous product innovation, including enhanced tracking and delivery management systems, specialized handling for temperature-sensitive goods (life sciences), and the integration of Artificial Intelligence (AI) and machine learning for optimizing delivery routes and predicting demand. The focus remains on improving efficiency, speed, and reliability, enhancing the customer experience, and catering to the specific needs of various end-user industries. These innovations offer competitive advantages by improving operational efficiency and customer satisfaction.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Turkish CEP market, segmented by destination (domestic and international), distribution channel (B2B and B2C), and end-user industry (BFSI, Wholesale and Retail Trade, Life Sciences/Healthcare, Industrial Manufacturing, and Others). Each segment’s growth projections, market size, and competitive dynamics are assessed. For example, the e-commerce sector is expected to drive significant growth in the B2C segment, while the Industrial Manufacturing sector will contribute to the B2B segment's expansion. The forecast period covers 2025-2033, with a detailed breakdown of market size and growth projections for each segment.

Key Drivers of Turkey Courier Express and Parcel Industry Growth

Several factors drive the Turkish CEP industry's growth. The booming e-commerce sector fuels demand for faster delivery options. Government investments in infrastructure, such as improved road networks and logistics hubs, support efficient transportation and delivery. Technological advancements, including automated sorting systems and real-time tracking, enhance operational efficiency and customer satisfaction. Favorable economic policies and a growing middle class contribute to increased consumer spending and demand for goods and services, indirectly boosting the CEP sector's growth.

Challenges in the Turkey Courier Express and Parcel Industry Sector

The Turkish CEP industry faces various challenges, including fluctuating fuel prices impacting operational costs, increasing competition, and the need for continuous investment in technology to maintain competitiveness. Regulatory hurdles and customs procedures can sometimes delay international shipments, and infrastructure limitations in certain regions can affect delivery times. Furthermore, maintaining a skilled workforce and managing rising labor costs are persistent concerns. These factors can cumulatively decrease profit margins and impede sustainable growth if not effectively addressed.

Emerging Opportunities in Turkey Courier Express and Parcel Industry

The Turkish CEP market presents numerous opportunities. The expansion of e-commerce into smaller cities and rural areas creates demand for last-mile delivery solutions. The adoption of advanced technologies like drone delivery and autonomous vehicles can improve efficiency and reduce costs. Specialized services catering to specific industries (e.g., cold chain logistics for pharmaceuticals) offer significant growth potential. Focusing on sustainability initiatives and eco-friendly delivery options can attract environmentally conscious customers.

Leading Players in the Turkey Courier Express and Parcel Industry Market

- Turkon Logistic Group

- BL Global Lojistik

- Ekol Logistics

- Asgard Transport & Logistics

- Reysas Lojistik

- ATA Freight Line Limited

- UPS Hizli Kargo

- TNT International Express

- CEVA Logistik Limited

- ASE ASYA Afrika Hizli Kargo

- DHL Worldwide Express

- SkyNet Worldwide Express

- DSV

Key Developments in Turkey Courier Express and Parcel Industry Industry

- 2022 Q4: Ekol Logistics launched a new automated sorting facility in Istanbul, significantly increasing its processing capacity.

- 2023 Q1: DHL Worldwide Express invested in expanding its last-mile delivery network in major Turkish cities.

- 2023 Q2: A significant merger occurred between two smaller regional CEP providers, leading to increased market consolidation.

- 2024 Q1: Regulations regarding cross-border e-commerce shipments were updated, potentially influencing international delivery times and costs. (Further details require specific data points).

Strategic Outlook for Turkey Courier Express and Parcel Industry Market

The Turkish CEP industry's future is promising, driven by continued e-commerce growth, technological advancements, and government support. Companies need to focus on service innovation, operational efficiency, and sustainable practices to gain a competitive edge. Expanding into underserved regions, leveraging technology, and adapting to evolving consumer preferences will be crucial for long-term success. The market is expected to maintain healthy growth through 2033, presenting attractive opportunities for investors and businesses in the sector.

Turkey Courier Express and Parcel Industry Segmentation

-

1. Destinaion

- 1.1. Domestic

- 1.2. International

-

2. Channel of Distribution

- 2.1. B2B (Business-to-Business)

- 2.2. B2C (Business-to-Consumer)

-

3. End-user Industry

- 3.1. BFSI (Ba

- 3.2. Wholesale and Retail Trade (E-commerce)

- 3.3. Life Sciences/Healthcare

- 3.4. Industrial Manufacturing

- 3.5. Other End-user Industries

Turkey Courier Express and Parcel Industry Segmentation By Geography

- 1. Turkey

Turkey Courier Express and Parcel Industry Regional Market Share

Geographic Coverage of Turkey Courier Express and Parcel Industry

Turkey Courier Express and Parcel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Consumption of Frozen Food Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Constantly Increasing Fuel Costs

- 3.4. Market Trends

- 3.4.1. Government Initiatives to Develop Logistics Infrastructure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Courier Express and Parcel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destinaion

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. B2B (Business-to-Business)

- 5.2.2. B2C (Business-to-Consumer)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI (Ba

- 5.3.2. Wholesale and Retail Trade (E-commerce)

- 5.3.3. Life Sciences/Healthcare

- 5.3.4. Industrial Manufacturing

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Destinaion

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Turkon Logistic Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BL Global Lojistik**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ekol Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Asgard Transport & Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Reysas Lojistik

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ATA Freight Line Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPS Hizli Kargo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TNT International Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CEVA Logistik Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ASE ASYA Afrika Hizli Kargo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DHL Worldwide Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SkyNet Worldwide Express

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DSV

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Turkon Logistic Group

List of Figures

- Figure 1: Turkey Courier Express and Parcel Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Turkey Courier Express and Parcel Industry Share (%) by Company 2025

List of Tables

- Table 1: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Destinaion 2020 & 2033

- Table 2: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Channel of Distribution 2020 & 2033

- Table 3: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Destinaion 2020 & 2033

- Table 6: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Channel of Distribution 2020 & 2033

- Table 7: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Courier Express and Parcel Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Turkey Courier Express and Parcel Industry?

Key companies in the market include Turkon Logistic Group, BL Global Lojistik**List Not Exhaustive, Ekol Logistics, Asgard Transport & Logistics, Reysas Lojistik, ATA Freight Line Limited, UPS Hizli Kargo, TNT International Express, CEVA Logistik Limited, ASE ASYA Afrika Hizli Kargo, DHL Worldwide Express, SkyNet Worldwide Express, DSV.

3. What are the main segments of the Turkey Courier Express and Parcel Industry?

The market segments include Destinaion, Channel of Distribution, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Consumption of Frozen Food Driving the Market.

6. What are the notable trends driving market growth?

Government Initiatives to Develop Logistics Infrastructure.

7. Are there any restraints impacting market growth?

4.; Constantly Increasing Fuel Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Courier Express and Parcel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Courier Express and Parcel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Courier Express and Parcel Industry?

To stay informed about further developments, trends, and reports in the Turkey Courier Express and Parcel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence