Key Insights

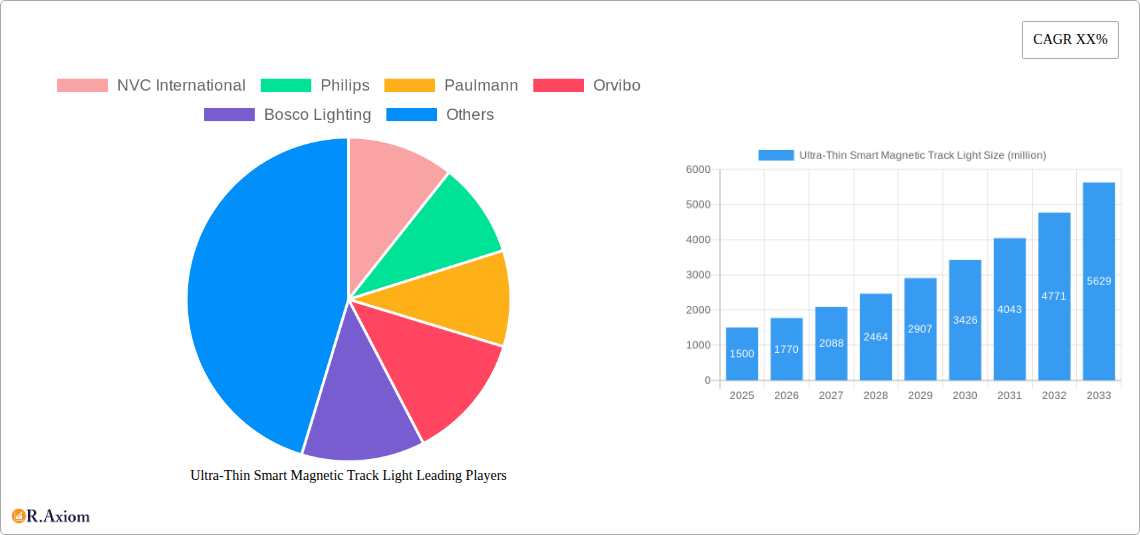

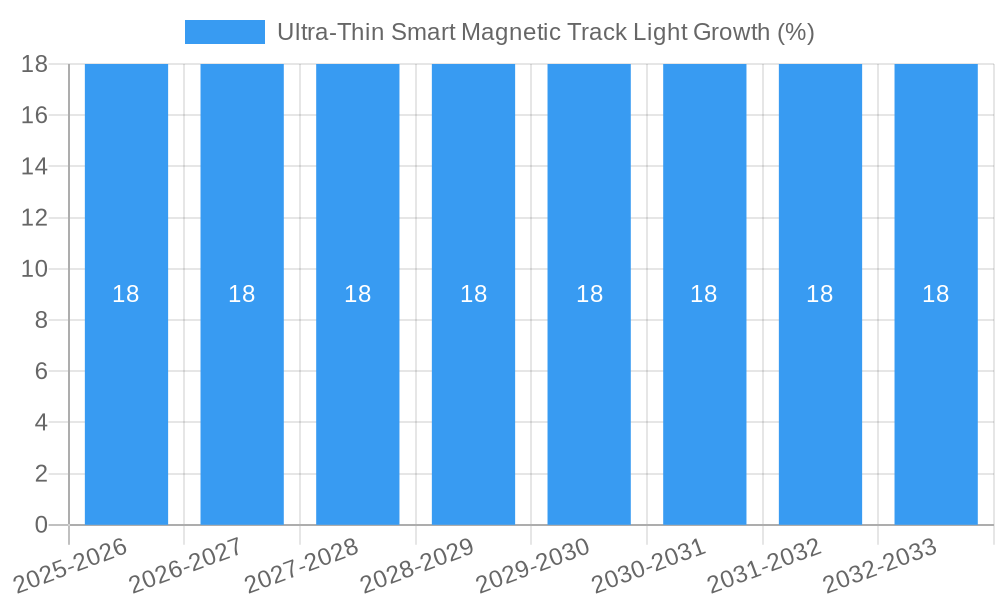

The Ultra-Thin Smart Magnetic Track Light market is poised for substantial expansion, projected to reach a robust market size of approximately $1.5 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 18% through 2033. This remarkable growth is fueled by a confluence of powerful drivers, primarily the increasing consumer demand for integrated smart home solutions and the burgeoning trend of minimalist interior design that favors discreet yet highly functional lighting. The inherent versatility of magnetic track systems, offering effortless installation and customization, aligns perfectly with modern living spaces, particularly in urban environments where space optimization is paramount. Furthermore, the growing emphasis on energy efficiency and the adoption of advanced LED technology contribute significantly to the market's upward trajectory. The market's value is predominantly denominated in millions of US dollars, reflecting the premium nature of smart and innovative lighting solutions.

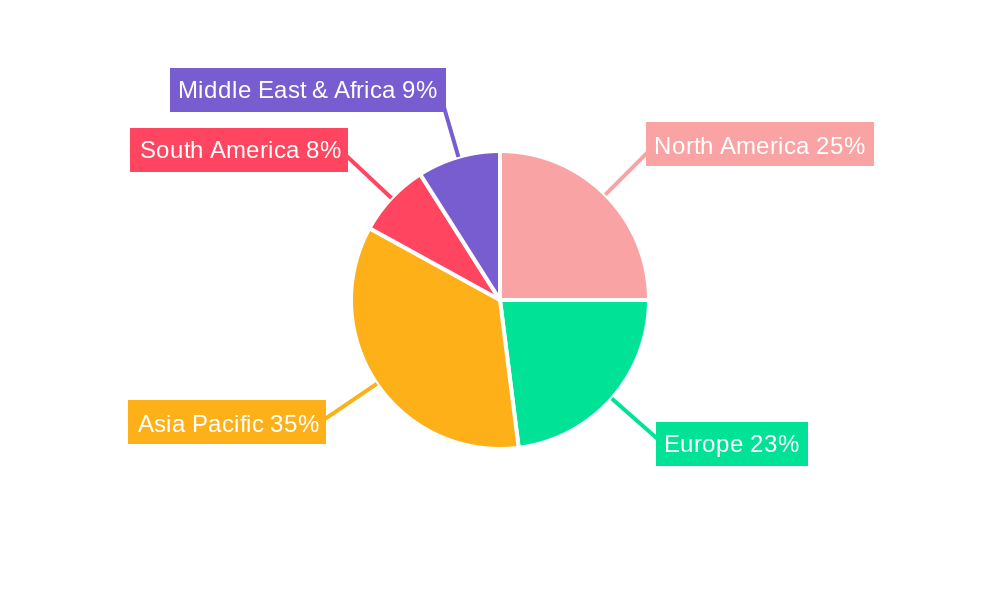

The market's evolution is characterized by a dynamic interplay of technological advancements and evolving consumer preferences. While the embedded type segment is expected to dominate in terms of adoption due to its seamless integration capabilities, the suspension type is gaining traction for its aesthetic appeal and flexibility, especially in commercial and high-end residential settings. Online sales channels are rapidly emerging as a key avenue for distribution, driven by e-commerce penetration and the convenience offered to consumers seeking specialized lighting products. However, offline sales through specialized lighting showrooms and home improvement stores continue to play a crucial role, providing tactile product experiences and expert advice. Key restraints include the initial cost of smart track lighting systems compared to conventional options and the need for greater consumer education regarding the benefits and ease of use of smart lighting technology. Geographically, Asia Pacific, led by China, is anticipated to be a frontrunner in market growth, followed by robust performance in North America and Europe, owing to their high adoption rates of smart home technologies and significant construction and renovation activities.

Here is a detailed, SEO-optimized report description for the Ultra-Thin Smart Magnetic Track Light market, designed for immediate use without modification.

Ultra-Thin Smart Magnetic Track Light Market Concentration & Innovation

The global Ultra-Thin Smart Magnetic Track Light market exhibits a moderately concentrated landscape, with key players such as Philips, NVC International, and OPPOLE holding significant market share, estimated in the billions of dollars. Innovation is a primary driver, fueled by advancements in LED technology, smart home integration (IoT), and energy efficiency demands. Regulatory frameworks, particularly concerning energy standards and safety certifications in regions like Europe and North America, are shaping product development and market entry. Product substitutes, including traditional track lighting systems and standalone smart lighting solutions, present a competitive challenge, albeit with differentiated value propositions. End-user trends are leaning towards minimalist design, ease of installation, and integrated smart home ecosystems. Merger and acquisition (M&A) activities, though not at a feverish pace, are strategically focused on acquiring technological capabilities or expanding market reach. Notable M&A deal values are anticipated to reach several hundred million dollars over the forecast period as companies seek consolidation and synergy. The market share of the top five players is projected to remain around 60-70% in the base year.

Ultra-Thin Smart Magnetic Track Light Industry Trends & Insights

The Ultra-Thin Smart Magnetic Track Light industry is poised for robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and expanding application horizons. The market is experiencing a significant upward trajectory, with a Compound Annual Growth Rate (CAGR) projected to be in the double digits, potentially ranging from 12% to 18% during the forecast period. This growth is underpinned by the increasing adoption of smart home technology, where consumers are actively seeking integrated and aesthetically pleasing lighting solutions that offer convenience, energy savings, and customization. The miniaturization of electronic components and the development of high-efficiency LEDs have enabled the creation of ultra-thin profiles, a key differentiator that appeals to modern architectural and interior design trends. Market penetration is steadily increasing, particularly in urban centers and developed economies, where disposable incomes and awareness of smart living concepts are higher. Technological disruptions, such as advancements in wireless connectivity (Wi-Fi, Bluetooth, Zigbee), voice control integration, and sophisticated lighting control systems, are creating new product categories and enhancing user experience. Furthermore, the growing emphasis on sustainability and energy conservation is pushing the demand for LED-based lighting solutions like ultra-thin smart magnetic track lights, which offer significant energy savings compared to traditional lighting methods. The competitive dynamics are intensifying, with both established lighting manufacturers and emerging tech companies vying for market share. Strategic partnerships and collaborations are becoming more common, aiming to leverage complementary expertise in lighting technology, software development, and smart home platforms. The increasing availability of diverse product options catering to various aesthetic preferences and functional requirements is also contributing to market expansion. The integration of advanced features like tunable white light, color-changing capabilities, and scene setting further enhances the appeal of these sophisticated lighting systems.

Dominant Markets & Segments in Ultra-Thin Smart Magnetic Track Light

The Ultra-Thin Smart Magnetic Track Light market's dominance is significantly influenced by regional economic strength, technological adoption rates, and infrastructure development. Asia Pacific, particularly China, is emerging as a dominant region, driven by its robust manufacturing capabilities, a rapidly growing middle class, and a strong push towards smart city initiatives and smart home adoption. Countries like China are expected to account for a substantial portion of the global market value, potentially exceeding several billion dollars in the base year.

Application: Online Sales

Online Sales represent a rapidly growing and increasingly dominant segment within the ultra-thin smart magnetic track light market. The convenience of e-commerce platforms, coupled with targeted digital marketing strategies, allows manufacturers and retailers to reach a wider consumer base globally. For instance, platforms like Amazon, Alibaba, and specialized smart home e-tailers are crucial channels. Key drivers for this segment's dominance include:

- Global Reach: Online platforms eliminate geographical barriers, enabling access to consumers in all corners of the world.

- Cost-Effectiveness: Reduced overheads compared to physical retail spaces often translate to competitive pricing for consumers.

- Consumer Convenience: Easy comparison of products, detailed specifications, and direct delivery contribute to higher sales volumes.

- Data Analytics: Online sales generate valuable consumer data, enabling personalized marketing and product development.

- Growth Projections: The online sales segment is projected to witness a CAGR of over 15% during the forecast period, reaching a market size in the billions.

Application: Offline Sales

Offline Sales, while facing increasing competition from online channels, still hold significant importance, especially in regions with established retail infrastructure and for consumers who prefer a hands-on purchasing experience. This segment encompasses traditional lighting showrooms, home improvement stores, and specialized electrical retailers. Key drivers for the continued significance of offline sales include:

- Experiential Buying: Consumers can physically see, touch, and experience the product's quality and design.

- Expert Advice: In-store consultations with lighting designers or sales associates can guide complex purchasing decisions.

- Brand Presence: Physical retail spaces build brand visibility and trust among consumers.

- Immediate Availability: For immediate project needs, offline stores offer instant product acquisition.

- Market Penetration: While online channels are growing faster, offline sales are expected to maintain a stable market share in the billions, with growth in the single to low double digits.

Types: Embedded Type

The Embedded Type of ultra-thin smart magnetic track lights is gaining considerable traction due to its seamless integration into ceilings and walls, offering a minimalist and aesthetically pleasing lighting solution. This type is particularly favored in new constructions and high-end renovations. Key drivers include:

- Aesthetic Appeal: Provides a clean, uncluttered look, blending perfectly with modern interior design.

- Space Saving: Eliminates the need for bulky fixtures, maximizing ceiling height and visual space.

- Versatility: Offers flexibility in lighting placement and adjustment, crucial for dynamic interior layouts.

- Market Size: The embedded type is anticipated to capture a substantial market share, projected to be in the billions, with a CAGR mirroring the overall market trend.

Types: Suspension Type

The Suspension Type of ultra-thin smart magnetic track lights offers a distinct design element, often used to create focal points or define zones within a space. This type is popular in both residential and commercial settings where a statement lighting piece is desired. Key drivers for this segment include:

- Design Flexibility: Allows for creative arrangements and customizable suspension heights.

- Architectural Statement: Serves as a modern design feature, enhancing the overall ambiance of a room.

- Ease of Installation: Compared to complex embedded systems, suspension systems can offer simpler installation processes.

- Market Potential: The suspension type is expected to contribute significantly to the market's growth, with its market size also projected to be in the billions, exhibiting steady growth.

Ultra-Thin Smart Magnetic Track Light Product Developments

Product developments in the ultra-thin smart magnetic track light sector are characterized by a focus on enhanced smart functionality, improved energy efficiency, and sophisticated design integration. Innovations include the incorporation of advanced wireless connectivity protocols for seamless integration with smart home ecosystems, enabling voice control via platforms like Alexa and Google Assistant. Manufacturers are also developing products with higher lumen outputs in smaller form factors, improved color rendering indices (CRIs) for more natural light, and tunable white capabilities to adjust color temperature for different moods and times of day. The competitive advantage lies in offering intuitive control interfaces, robust build quality, and energy savings that exceed current benchmarks, catering to the growing demand for sustainable and user-friendly lighting solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Ultra-Thin Smart Magnetic Track Light market, segmenting it by Application and Type.

Application: Online Sales

The Online Sales segment encompasses all transactions conducted through e-commerce platforms, direct-to-consumer websites, and other digital channels. This segment is projected for robust growth, driven by increasing internet penetration and consumer comfort with online purchasing. Market size is estimated to be in the billions. Competitive dynamics are characterized by aggressive pricing strategies and effective digital marketing.

Application: Offline Sales

The Offline Sales segment covers purchases made through physical retail stores, including lighting showrooms, home improvement centers, and electrical supply stores. While growth may be slower than online, this segment retains importance for immediate needs and tactile product evaluation. Market size is also in the billions. Competition involves in-store customer service and brand experience.

Types: Embedded Type

The Embedded Type segment focuses on track lights designed for flush mounting within ceilings or walls, offering a minimalist aesthetic. This segment is expected to grow significantly due to its design appeal and integration capabilities. Market size is anticipated to be in the billions. Key competitive factors include ease of installation and design versatility.

Types: Suspension Type

The Suspension Type segment includes track lights that are hung from the ceiling using cables or rods. This segment caters to design-forward applications and is projected to see steady growth. Market size is in the billions. Competitive advantages lie in aesthetic innovation and customizable configurations.

Key Drivers of Ultra-Thin Smart Magnetic Track Light Growth

The growth of the Ultra-Thin Smart Magnetic Track Light market is propelled by several key drivers. Technologically, advancements in LED efficiency and miniaturization enable sleeker designs and lower power consumption, aligning with global sustainability goals. The widespread adoption of smart home technology, driven by consumer demand for convenience and connected living, creates a strong market pull for integrated lighting solutions. Economic factors, such as increasing disposable incomes in emerging economies and government initiatives promoting energy-efficient buildings, further bolster market expansion. Regulatory support for energy-saving technologies also plays a crucial role.

Challenges in the Ultra-Thin Smart Magnetic Track Light Sector

Despite its promising outlook, the Ultra-Thin Smart Magnetic Track Light sector faces several challenges. High initial manufacturing costs associated with advanced smart technologies and premium materials can pose a barrier for some consumers. Intense competition from established lighting brands and new entrants, including tech giants, leads to price pressures and necessitates continuous innovation. Supply chain disruptions, particularly for specialized electronic components, can impact production volumes and lead times. Moreover, the need for robust cybersecurity measures to protect smart lighting systems from potential breaches adds another layer of complexity and cost.

Emerging Opportunities in Ultra-Thin Smart Magnetic Track Light

Emerging opportunities in the Ultra-Thin Smart Magnetic Track Light market are abundant. The growing demand for customizable lighting solutions in commercial spaces like offices, retail stores, and hospitality venues presents a significant growth avenue. The integration of AI-powered adaptive lighting, which adjusts brightness and color temperature based on ambient conditions and user behavior, is another promising frontier. Furthermore, the expansion of smart home ecosystems and the increasing interoperability between different smart devices will create new opportunities for advanced control features and bundled product offerings. The development of more sustainable and recyclable materials for track light components will also appeal to eco-conscious consumers.

Leading Players in the Ultra-Thin Smart Magnetic Track Light Market

- NVC International

- Philips

- Paulmann

- Orvibo

- Bosco Lighting

- Grnled

- Xiaomi

- OPPLE

- Foshan Electric Lighting

- Guangdong PAK Corporation

- AUX Group

- Meizu Technology

Key Developments in Ultra-Thin Smart Magnetic Track Light Industry

- 2023: Philips launches a new series of ultra-thin smart magnetic track lights with enhanced color rendering and seamless integration with major smart home platforms.

- 2023: Xiaomi introduces an AI-powered adaptive lighting feature for its magnetic track light system, further enhancing user experience.

- 2024 (Q1): Orvibo announces strategic partnerships with several smart home hub manufacturers to improve interoperability and expand its market reach.

- 2024 (Q2): Grnled focuses on developing more energy-efficient modules with extended lifespans for its ultra-thin magnetic track light solutions.

- 2024 (Q3): Guangdong PAK Corporation expands its production capacity to meet the growing global demand for its smart lighting products.

Strategic Outlook for Ultra-Thin Smart Magnetic Track Light Market

The strategic outlook for the Ultra-Thin Smart Magnetic Track Light market is overwhelmingly positive, driven by continuous technological innovation and increasing consumer demand for smart, aesthetically pleasing, and energy-efficient lighting solutions. The market is expected to witness sustained growth, fueled by the expansion of smart home ecosystems and a growing preference for minimalist interior designs. Key growth catalysts include further integration of AI for personalized lighting experiences, development of more sustainable materials and manufacturing processes, and strategic collaborations between lighting manufacturers and smart home technology providers. Companies that focus on user-friendly interfaces, robust connectivity, and differentiated design will be well-positioned to capture significant market share in the coming years.

Ultra-Thin Smart Magnetic Track Light Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Embedded Type

- 2.2. Suspension Type

Ultra-Thin Smart Magnetic Track Light Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ultra-Thin Smart Magnetic Track Light REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultra-Thin Smart Magnetic Track Light Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Embedded Type

- 5.2.2. Suspension Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ultra-Thin Smart Magnetic Track Light Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Embedded Type

- 6.2.2. Suspension Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ultra-Thin Smart Magnetic Track Light Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Embedded Type

- 7.2.2. Suspension Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ultra-Thin Smart Magnetic Track Light Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Embedded Type

- 8.2.2. Suspension Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ultra-Thin Smart Magnetic Track Light Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Embedded Type

- 9.2.2. Suspension Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ultra-Thin Smart Magnetic Track Light Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Embedded Type

- 10.2.2. Suspension Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NVC International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Philips

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Paulmann

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Orvibo

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bosco Lighting

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Grnled

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Xiaomi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 OPPLE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Foshan Electric Lighting

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Guangdong PAK Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AUX Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Meizu Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 NVC International

List of Figures

- Figure 1: Global Ultra-Thin Smart Magnetic Track Light Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Ultra-Thin Smart Magnetic Track Light Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Ultra-Thin Smart Magnetic Track Light Revenue (million), by Application 2024 & 2032

- Figure 4: North America Ultra-Thin Smart Magnetic Track Light Volume (K), by Application 2024 & 2032

- Figure 5: North America Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Ultra-Thin Smart Magnetic Track Light Revenue (million), by Types 2024 & 2032

- Figure 8: North America Ultra-Thin Smart Magnetic Track Light Volume (K), by Types 2024 & 2032

- Figure 9: North America Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Ultra-Thin Smart Magnetic Track Light Revenue (million), by Country 2024 & 2032

- Figure 12: North America Ultra-Thin Smart Magnetic Track Light Volume (K), by Country 2024 & 2032

- Figure 13: North America Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Ultra-Thin Smart Magnetic Track Light Revenue (million), by Application 2024 & 2032

- Figure 16: South America Ultra-Thin Smart Magnetic Track Light Volume (K), by Application 2024 & 2032

- Figure 17: South America Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Ultra-Thin Smart Magnetic Track Light Revenue (million), by Types 2024 & 2032

- Figure 20: South America Ultra-Thin Smart Magnetic Track Light Volume (K), by Types 2024 & 2032

- Figure 21: South America Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Ultra-Thin Smart Magnetic Track Light Revenue (million), by Country 2024 & 2032

- Figure 24: South America Ultra-Thin Smart Magnetic Track Light Volume (K), by Country 2024 & 2032

- Figure 25: South America Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Ultra-Thin Smart Magnetic Track Light Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Ultra-Thin Smart Magnetic Track Light Volume (K), by Application 2024 & 2032

- Figure 29: Europe Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Ultra-Thin Smart Magnetic Track Light Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Ultra-Thin Smart Magnetic Track Light Volume (K), by Types 2024 & 2032

- Figure 33: Europe Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Ultra-Thin Smart Magnetic Track Light Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Ultra-Thin Smart Magnetic Track Light Volume (K), by Country 2024 & 2032

- Figure 37: Europe Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Ultra-Thin Smart Magnetic Track Light Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Ultra-Thin Smart Magnetic Track Light Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Ultra-Thin Smart Magnetic Track Light Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Ultra-Thin Smart Magnetic Track Light Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Ultra-Thin Smart Magnetic Track Light Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Ultra-Thin Smart Magnetic Track Light Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Ultra-Thin Smart Magnetic Track Light Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Ultra-Thin Smart Magnetic Track Light Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Ultra-Thin Smart Magnetic Track Light Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Ultra-Thin Smart Magnetic Track Light Volume K Forecast, by Country 2019 & 2032

- Table 81: China Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Ultra-Thin Smart Magnetic Track Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Ultra-Thin Smart Magnetic Track Light Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultra-Thin Smart Magnetic Track Light?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Ultra-Thin Smart Magnetic Track Light?

Key companies in the market include NVC International, Philips, Paulmann, Orvibo, Bosco Lighting, Grnled, Xiaomi, OPPLE, Foshan Electric Lighting, Guangdong PAK Corporation, AUX Group, Meizu Technology.

3. What are the main segments of the Ultra-Thin Smart Magnetic Track Light?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultra-Thin Smart Magnetic Track Light," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultra-Thin Smart Magnetic Track Light report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultra-Thin Smart Magnetic Track Light?

To stay informed about further developments, trends, and reports in the Ultra-Thin Smart Magnetic Track Light, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence