Key Insights

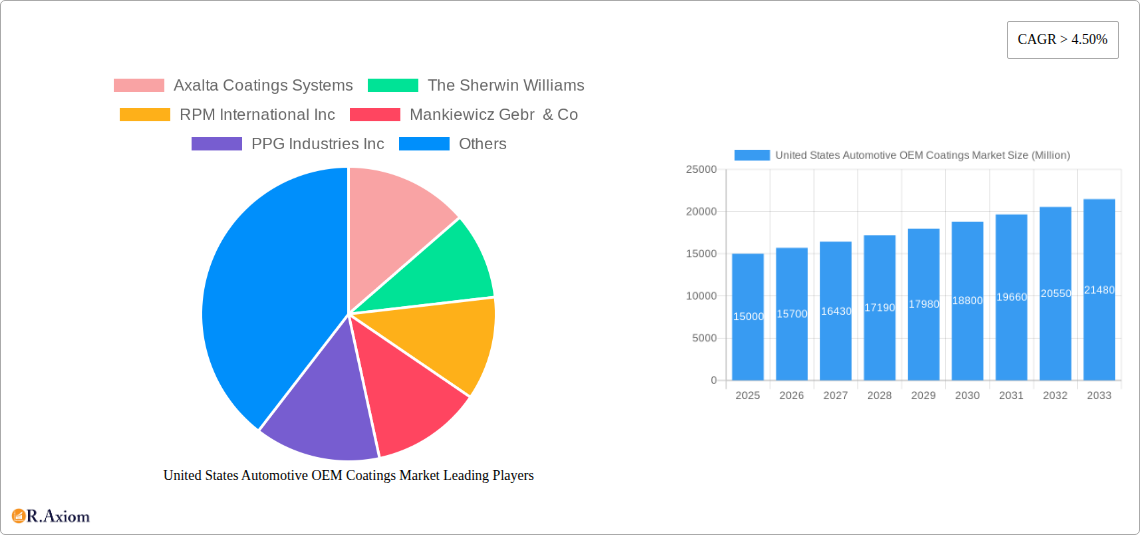

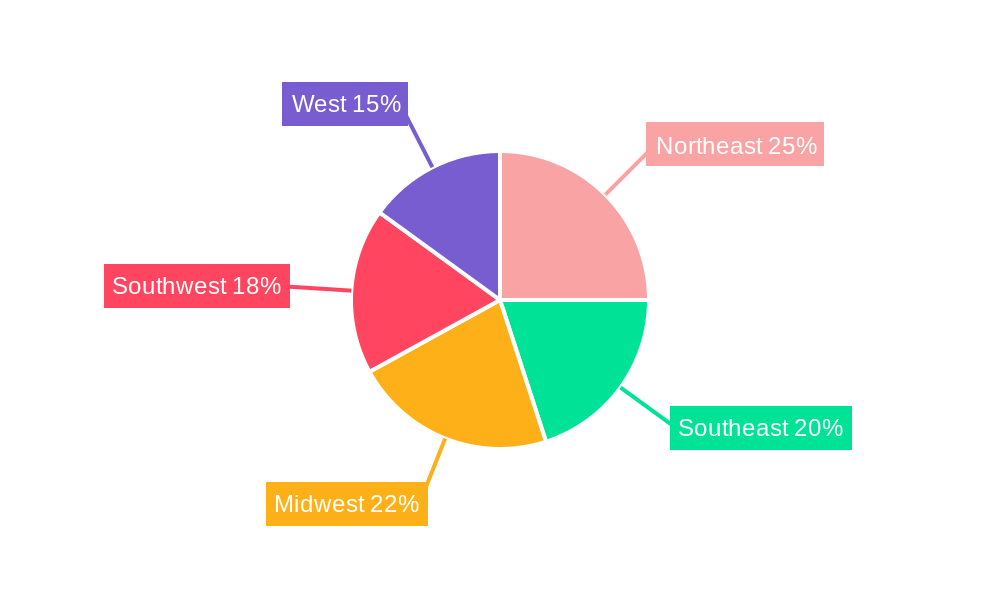

The United States Automotive OEM Coatings market is poised for significant expansion, driven by sustained demand for new vehicles and the accelerating adoption of innovative coating solutions. With a projected market size of $16.8 billion in 2025, the market is anticipated to achieve a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033. This upward trajectory is underpinned by several key drivers. The burgeoning automotive industry, encompassing passenger cars and commercial vehicles, necessitates high-quality coatings for enhanced aesthetics, durability, and corrosion resistance. Furthermore, the increasing preference for advanced technologies, including water-borne and high-performance acrylic coatings, is spurring innovation and market growth. These eco-friendly and superior-performance solutions are vital for adhering to stringent environmental regulations and meeting consumer demand for sustainable automotive products. The integration of Advanced Driver-Assistance Systems (ADAS) and the growing prevalence of Electric Vehicles (EVs) are also stimulating the market, as these segments often require specialized coatings for component protection and performance optimization. The market is segmented by resin type (epoxy, acrylic, alkyd, polyurethane, polyester, others), technology (water-borne, solvent-borne, others), and application (passenger cars, commercial vehicles, automotive components and equipment (ACE)). Despite potential challenges like fluctuating raw material costs and economic uncertainties, the long-term outlook remains robust, supported by consistent vehicle production growth and continuous technological advancements. Leading industry players, including Axalta Coatings Systems, Sherwin-Williams, and PPG Industries, are actively pursuing research and development and strategic collaborations to solidify their market positions and address evolving client needs. Significant market activity is distributed across US regions such as the Northeast, Southeast, Midwest, Southwest, and West, with regional growth rates influenced by automotive manufacturing hubs and local economic conditions.

United States Automotive OEM Coatings Market Market Size (In Billion)

The competitive arena features a blend of established global corporations and regional manufacturers, all prioritizing product differentiation, technological innovation, and strategic alliances to secure a competitive advantage. Future growth will be heavily influenced by the widespread adoption of sustainable coating technologies, the increasing demand for lightweight vehicle construction, and the continuous evolution of automotive design and functionality. Market success will depend on effectively balancing innovation, cost-effectiveness, and environmental stewardship, necessitating ongoing development of more resilient, eco-friendly, and economical coating solutions to meet future industry demands. Continued market growth is expected as the sector consistently innovates and strives to meet escalating consumer expectations for vehicle appearance, performance, and environmental responsibility.

United States Automotive OEM Coatings Market Company Market Share

United States Automotive OEM Coatings Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Automotive OEM Coatings market, offering invaluable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The report leverages extensive data analysis and expert insights to deliver actionable intelligence for informed decision-making.

Keywords: United States Automotive OEM Coatings Market, Automotive Coatings, OEM Coatings, Passenger Cars, Commercial Vehicles, Epoxy Coatings, Acrylic Coatings, Polyurethane Coatings, Water-borne Coatings, Solvent-borne Coatings, Axalta Coatings Systems, Sherwin-Williams, PPG Industries, BASF, Market Size, Market Share, Market Growth, CAGR, Industry Trends, Competitive Analysis, Future Outlook.

United States Automotive OEM Coatings Market Concentration & Innovation

The United States Automotive OEM Coatings market exhibits a moderately concentrated structure, with a few major players commanding significant market share. Axalta Coatings Systems, PPG Industries Inc, Sherwin-Williams, and BASF SE are among the dominant players, collectively holding approximately xx% of the market share in 2025. However, the market also features several smaller, specialized players catering to niche segments. Innovation within the industry is driven by the increasing demand for lightweight vehicles, stringent emission regulations, and the push towards sustainable coatings solutions. Key innovation areas include the development of water-borne coatings to reduce volatile organic compound (VOC) emissions, the utilization of advanced resin technologies (e.g., polyurethane and epoxy) for enhanced durability and performance, and the exploration of bio-based and recycled materials. Regulatory frameworks, such as those pertaining to VOC emissions and hazardous waste disposal, significantly impact the market. Product substitutes, such as powder coatings and electro-deposition coatings, are gaining traction in specific applications. End-user preferences for aesthetically pleasing, durable, and environmentally friendly coatings are driving innovation. The past five years have witnessed several mergers and acquisitions (M&A) activities, with deal values ranging from xx Million to xx Million, primarily focused on expanding product portfolios and geographic reach.

United States Automotive OEM Coatings Market Industry Trends & Insights

The United States Automotive OEM Coatings market is experiencing robust growth, driven primarily by the expanding automotive industry, particularly the passenger car segment. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The increasing demand for high-performance, durable, and aesthetically appealing coatings is a major growth driver. Technological advancements, such as the development of advanced resin technologies and innovative application methods, are also contributing to market expansion. Consumer preferences are shifting towards environmentally friendly coatings, fueling the growth of water-borne and solvent-borne technologies. The market is characterized by intense competition, with major players continuously investing in R&D to enhance their product offerings and expand their market presence. The market penetration of water-borne coatings is expected to increase significantly in the coming years, driven by stringent environmental regulations and the rising consumer demand for sustainable products. The adoption of advanced technologies such as automation and digitalization in the manufacturing process is further impacting market dynamics.

Dominant Markets & Segments in United States Automotive OEM Coatings Market

The passenger car segment dominates the United States Automotive OEM Coatings market, accounting for approximately xx% of the total market value in 2025. This dominance stems from the high volume of passenger car production in the country. Within resin types, polyurethane coatings hold the largest market share due to their superior performance characteristics such as durability and flexibility.

- Key Drivers for Passenger Car Segment Dominance:

- High volume of passenger car production.

- Strong demand for aesthetically pleasing and durable finishes.

- Increasing adoption of advanced automotive technologies.

- Key Drivers for Polyurethane Segment Dominance:

- Superior performance characteristics (durability, flexibility).

- Excellent chemical and UV resistance.

- Wide range of applications across different vehicle segments.

The water-borne technology segment is experiencing rapid growth driven by stringent environmental regulations and increasing demand for eco-friendly coatings.

- Key Drivers for Water-borne Technology Growth:

- Stringent environmental regulations reducing VOC emissions.

- Growing consumer preference for sustainable coatings.

- Technological advancements improving performance of water-borne coatings.

Geographically, the Midwest and South regions are dominant, reflecting strong automotive manufacturing hubs.

United States Automotive OEM Coatings Market Product Developments

Recent product innovations focus on enhancing performance characteristics such as durability, scratch resistance, and UV resistance. The integration of nanotechnology and other advanced materials is leading to the development of coatings with enhanced properties. Key product developments include the introduction of high-solids coatings to reduce VOC emissions and improve application efficiency. These innovations are aimed at catering to the evolving needs of automotive manufacturers, including the growing demand for lightweight and fuel-efficient vehicles. The market fit is strong due to the increasing focus on sustainability and performance optimization across the industry.

Report Scope & Segmentation Analysis

This report segments the United States Automotive OEM Coatings market based on Resin Type (Epoxy, Acrylic, Alkyd, Polyurethane, Polyester, Other Resin Type), Technology (Water-borne, Solvent-borne, Other Technologies), and Application (Passenger Cars, Commercial Vehicles, ACE). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. For instance, the polyurethane resin segment is expected to experience significant growth due to its superior performance characteristics. Similarly, the water-borne technology segment is projected to witness substantial expansion driven by environmental regulations. The passenger car application segment dominates the market, while the commercial vehicle segment is expected to witness moderate growth.

Key Drivers of United States Automotive OEM Coatings Market Growth

Several factors are driving the growth of the United States Automotive OEM Coatings market. These include the rising demand for vehicles, particularly passenger cars, leading to increased demand for coatings. Technological advancements in coating formulations, such as the development of water-borne coatings, are also contributing to market expansion. Government regulations concerning VOC emissions are pushing manufacturers to adopt more sustainable coating technologies. Furthermore, the growing emphasis on aesthetics and enhanced vehicle performance is driving demand for high-quality, durable coatings.

Challenges in the United States Automotive OEM Coatings Market Sector

The United States Automotive OEM Coatings market faces several challenges. Fluctuations in raw material prices can impact profitability. Stringent environmental regulations necessitate continuous innovation and investment in sustainable technologies. Intense competition among established players and the emergence of new entrants create pricing pressures. Supply chain disruptions can also affect the availability of raw materials and impact production schedules. These factors collectively pose challenges to the market's sustainable growth.

Emerging Opportunities in United States Automotive OEM Coatings Market

The growing demand for electric vehicles (EVs) presents significant opportunities for the automotive coatings industry. The development of specialized coatings for EV batteries and other components is a promising area. The increasing adoption of lightweight materials in automotive manufacturing opens up opportunities for coatings designed for specific material properties. Furthermore, innovations in application technologies, such as robotic spraying and automated coating systems, are creating new avenues for market growth. Finally, the focus on sustainability is opening doors for bio-based and recycled materials in coatings manufacturing.

Leading Players in the United States Automotive OEM Coatings Market Market

- Axalta Coatings Systems

- The Sherwin-Williams

- RPM International Inc

- Mankiewicz Gebr & Co

- PPG Industries Inc

- Beckers Group

- Nippon Paint Holdings Co Ltd

- BASF SE

- Valspar Automotive

- Red Spot Paint & Varnish Company Inc

- AkzoNobel NV

- KCC Corporation

Key Developments in United States Automotive OEM Coatings Market Industry

- 2023-06: Axalta Coatings Systems launched a new water-borne coating technology with enhanced durability and sustainability features.

- 2022-11: PPG Industries Inc. announced a strategic partnership to expand its presence in the electric vehicle coatings market.

- 2021-09: BASF SE invested xx Million in a new research and development facility for automotive coatings.

- Further key developments will be detailed in the full report.

Strategic Outlook for United States Automotive OEM Coatings Market Market

The future of the United States Automotive OEM Coatings market appears promising, driven by the continuing growth of the automotive industry, the increasing demand for high-performance coatings, and the growing focus on sustainability. The market is expected to witness further consolidation through mergers and acquisitions. The development and adoption of innovative coating technologies, such as those incorporating nanomaterials and bio-based materials, will continue to shape the market landscape. Companies that can effectively balance performance, cost-effectiveness, and environmental sustainability will be well-positioned for success in the years to come.

United States Automotive OEM Coatings Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Acrylic

- 1.3. Alkyd

- 1.4. Polyurethane

- 1.5. Polyester

- 1.6. Other Resin Type

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-borne

- 2.3. Other Technologies

-

3. Application

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

- 3.3. ACE

United States Automotive OEM Coatings Market Segmentation By Geography

- 1. United States

United States Automotive OEM Coatings Market Regional Market Share

Geographic Coverage of United States Automotive OEM Coatings Market

United States Automotive OEM Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Support Market Growth

- 3.3. Market Restrains

- 3.3.1. Ongoing Shortage of Semiconductors; Other Restraints

- 3.4. Market Trends

- 3.4.1. Public & Private Investments to Support Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Automotive OEM Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Acrylic

- 5.1.3. Alkyd

- 5.1.4. Polyurethane

- 5.1.5. Polyester

- 5.1.6. Other Resin Type

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-borne

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.3.3. ACE

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Axalta Coatings Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Sherwin Williams

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RPM International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mankiewicz Gebr & Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PPG Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Beckers Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nippon Paint Holdings Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Valspar Automotive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Red Spot Paint & Varnish Company Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AkzoNobel NV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 KCC Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Axalta Coatings Systems

List of Figures

- Figure 1: United States Automotive OEM Coatings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Automotive OEM Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: United States Automotive OEM Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 2: United States Automotive OEM Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 3: United States Automotive OEM Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: United States Automotive OEM Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: United States Automotive OEM Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: United States Automotive OEM Coatings Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 7: United States Automotive OEM Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: United States Automotive OEM Coatings Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: United States Automotive OEM Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 10: United States Automotive OEM Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 11: United States Automotive OEM Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: United States Automotive OEM Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 13: United States Automotive OEM Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: United States Automotive OEM Coatings Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 15: United States Automotive OEM Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United States Automotive OEM Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Automotive OEM Coatings Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the United States Automotive OEM Coatings Market?

Key companies in the market include Axalta Coatings Systems, The Sherwin Williams, RPM International Inc, Mankiewicz Gebr & Co, PPG Industries Inc, Beckers Group, Nippon Paint Holdings Co Ltd, BASF SE, Valspar Automotive, Red Spot Paint & Varnish Company Inc, AkzoNobel NV, KCC Corporation.

3. What are the main segments of the United States Automotive OEM Coatings Market?

The market segments include Resin Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Support Market Growth.

6. What are the notable trends driving market growth?

Public & Private Investments to Support Automotive Industry.

7. Are there any restraints impacting market growth?

Ongoing Shortage of Semiconductors; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Automotive OEM Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Automotive OEM Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Automotive OEM Coatings Market?

To stay informed about further developments, trends, and reports in the United States Automotive OEM Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence