Key Insights

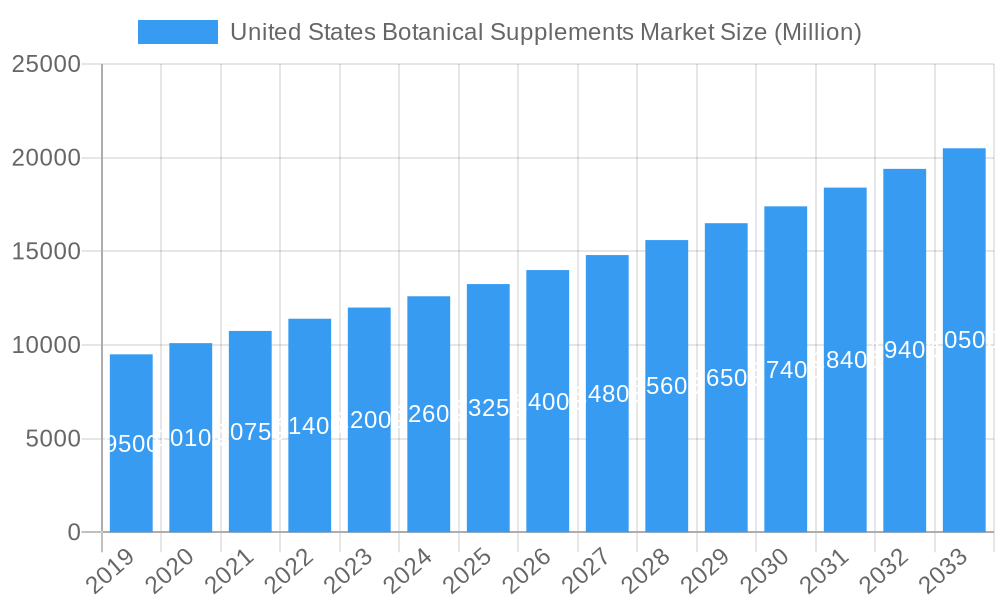

The United States botanical supplements market is anticipated for significant growth, propelled by heightened consumer interest in natural health and wellness solutions. With an estimated market size of $7.7 billion in 2025, the sector is projected to expand at a compound annual growth rate (CAGR) of 8.7% through 2033. This sustained expansion is attributed to increased awareness of the benefits of plant-based ingredients for managing chronic conditions, boosting immunity, and promoting overall well-being. Consumers are increasingly seeking natural alternatives to synthetic pharmaceuticals, driving demand for herbal remedies and botanical extracts. Key product segments with strong adoption include versatile powdered supplements and convenient capsule and tablet forms. The market also sees a notable shift towards online retail, reflecting evolving consumer purchasing habits and the convenience of e-commerce for discovering and acquiring botanical products.

United States Botanical Supplements Market Market Size (In Billion)

Market dynamics are further influenced by trends such as the growing popularity of adaptogens for stress management and the demand for scientifically validated botanical products. Emerging trends also indicate rising interest in personalized nutrition and the integration of botanical supplements into daily wellness routines. However, the market faces challenges including stringent regulatory frameworks and the need for enhanced consumer education to distinguish between efficacious and less potent botanical options. Despite these restraints, continuous product formulation innovation and strategic marketing by leading companies are expected to drive market advancement. Supermarkets and hypermarkets remain crucial distribution channels, alongside pharmacies and drug stores, though online retail is rapidly gaining traction. The United States holds a dominant position in the global botanical supplements market.

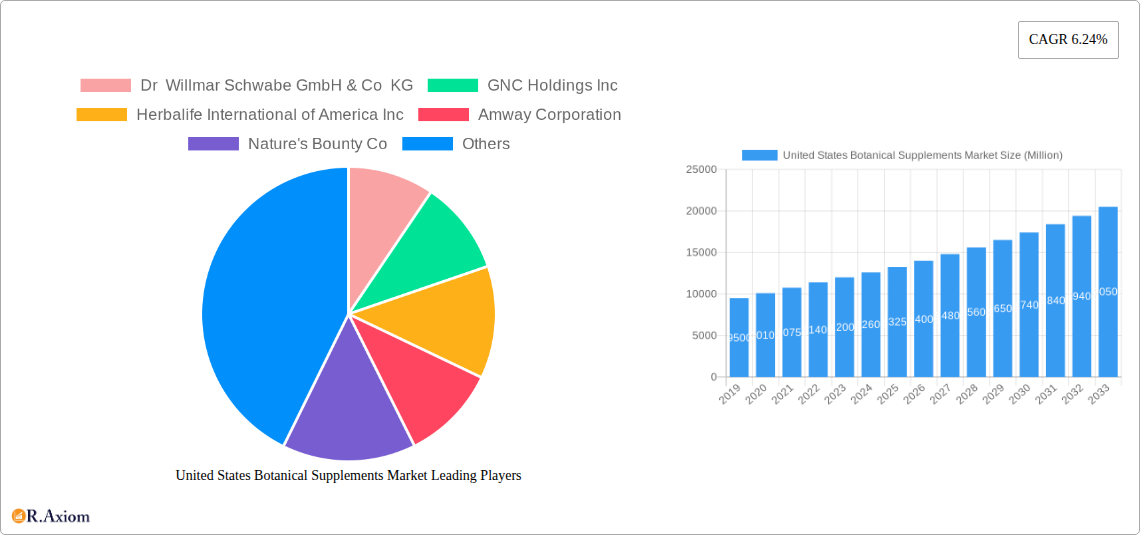

United States Botanical Supplements Market Company Market Share

This comprehensive market research report offers an in-depth analysis of the United States Botanical Supplements Market, providing critical insights for industry stakeholders, investors, and businesses. The study covers a historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033. We examine market concentration, innovation, regulatory landscapes, consumer trends, and competitive forces. Our analysis encompasses key market segments, including various forms of botanical supplements and their distribution channels, delivering actionable intelligence for strategic decision-making.

United States Botanical Supplements Market Market Concentration & Innovation

The United States Botanical Supplements Market exhibits moderate to high market concentration, with a mix of established global players and emerging specialized brands. Innovation is a key differentiator, driven by consumer demand for scientifically validated efficacy, novel delivery systems, and sustainable sourcing. Regulatory frameworks, primarily overseen by the FDA, play a crucial role in product safety and labeling, influencing product development and market entry strategies. Substitutes for botanical supplements range from synthetic alternatives to lifestyle interventions, presenting a competitive landscape that necessitates continuous product differentiation. End-user trends are increasingly focused on preventative health, wellness, and specific therapeutic benefits, such as immune support, stress management, and cognitive enhancement. Mergers and Acquisitions (M&A) activities are present, with significant deals valued in the hundreds of millions of dollars, indicating consolidation and strategic expansion by key market participants. For example, strategic acquisitions often focus on companies with unique botanical formulations or robust distribution networks. The market share of leading players is actively tracked to understand competitive dynamics.

United States Botanical Supplements Market Industry Trends & Insights

The United States Botanical Supplements Market is poised for significant growth, driven by a confluence of powerful trends and evolving consumer behaviors. The projected Compound Annual Growth Rate (CAGR) for the forecast period is robust, estimated to be between 7.5% and 9.0%, reflecting sustained consumer interest and expanding applications for botanical ingredients. Market penetration continues to deepen as awareness of the health benefits associated with natural products escalates. Key growth drivers include a heightened consumer focus on preventative healthcare, a growing preference for natural and organic products, and an increasing demand for supplements that address specific health concerns like stress, sleep disorders, and immune function. The aging population in the U.S. also contributes significantly, as older demographics often seek natural solutions to manage age-related health issues. Technological disruptions are transforming the industry, from advanced extraction and formulation techniques that enhance bioavailability and efficacy to sophisticated supply chain management systems that ensure product traceability and quality. Digitalization and e-commerce have revolutionized distribution, making a wide array of botanical supplements more accessible than ever before. Consumer preferences are increasingly sophisticated, with a demand for transparency regarding ingredient sourcing, manufacturing processes, and scientific backing for product claims. This has led to a rise in premium and specialized botanical products. The competitive dynamics are intensifying, with established brands investing heavily in research and development to introduce innovative products and expand their market reach, while smaller, agile companies are carving out niches by focusing on specific botanical ingredients or target health conditions. The overall market size is projected to exceed $40,000 million by 2033, underscoring the immense potential within this sector.

Dominant Markets & Segments in United States Botanical Supplements Market

The United States Botanical Supplements Market is characterized by the dominance of certain segments and distribution channels, reflecting current consumer purchasing habits and accessibility.

Form:

- Capsules and Tablets: This form consistently holds the largest market share, estimated at over 55% of the total market value. Their dominance is attributed to convenience, ease of consumption, precise dosage control, and consumer familiarity. The established manufacturing infrastructure for these forms further solidifies their position.

- Powdered Supplements: This segment is experiencing significant growth, with an estimated market share of approximately 30%. Its popularity is driven by versatility, allowing consumers to incorporate them into various beverages and foods, and often offering cost-effectiveness. Innovations in flavorings and blendability are enhancing their appeal.

- Other Forms: This includes liquid extracts, gummies, and topicals, collectively holding around 15% of the market. The growth in this segment is largely propelled by the rising popularity of gummies, especially among younger demographics, and the demand for specialized liquid formulations for faster absorption.

Distribution Channel:

- Online Retail Stores: This channel has emerged as the leading distribution route, capturing an estimated 40% of the market. Factors driving this dominance include vast product selection, competitive pricing, convenience of home delivery, and the ability for consumers to research and compare products extensively. The growth of direct-to-consumer (DTC) models further fuels this segment.

- Pharmacies/Drug Stores: This channel represents a significant portion of the market, accounting for approximately 30%. Their strength lies in consumer trust, accessibility in local communities, and the perceived credibility associated with healthcare environments. Pharmacist recommendations also play a crucial role.

- Supermarket/Hypermarket: These outlets hold an estimated 20% market share. Their advantage is widespread reach and impulse purchasing opportunities. However, the selection of specialized botanical supplements can be more limited compared to dedicated channels.

- Other Distribution Channels: This encompasses health and wellness stores, direct sales, and professional practitioner channels, contributing around 10% to the market. These channels often cater to niche markets and consumers seeking specialized advice or products.

United States Botanical Supplements Market Product Developments

Recent product developments in the United States Botanical Supplements Market are characterized by a strong emphasis on targeted health solutions and enhanced bioavailability. Innovations include the introduction of novel botanical blends designed for specific wellness goals, such as stress reduction, cognitive support, and enhanced athletic performance. Advanced extraction methods and nano-encapsulation technologies are being employed to improve the absorption and efficacy of active compounds. Furthermore, there's a growing trend towards clean-label products, free from artificial additives, and a focus on ethically sourced and sustainable ingredients. These developments aim to meet the evolving demands of health-conscious consumers and differentiate brands in a competitive marketplace.

Report Scope & Segmentation Analysis

This report meticulously analyzes the United States Botanical Supplements Market, segmenting it by Form and Distribution Channel to provide granular insights.

- Form: The market is segmented into Powdered Supplements, Capsules and Tablets, and Other Forms (including liquids, gummies, and topicals). The Capsules and Tablets segment is projected to hold the largest market share throughout the forecast period, estimated at over $20,000 million by 2033, due to its convenience and established consumer acceptance. Powdered Supplements are expected to witness robust growth, driven by their versatility and an estimated market value of around $13,000 million by 2033. Other Forms are anticipated to grow significantly, especially the gummy segment, reaching an estimated $7,000 million by 2033.

- Distribution Channel: Key channels analyzed include Supermarket/Hypermarket, Pharmacies/Drug Stores, Online Retail Stores, and Other Distribution Channels. Online Retail Stores are projected to dominate, with an estimated market size of over $18,000 million by 2033, fueled by e-commerce expansion. Pharmacies/Drug Stores represent a significant, stable channel, estimated at around $13,000 million by 2033, benefiting from consumer trust. Supermarkets/Hypermarkets are expected to reach approximately $8,000 million by 2033, while Other Distribution Channels will collectively contribute an estimated $4,000 million.

Key Drivers of United States Botanical Supplements Market Growth

The growth of the United States Botanical Supplements Market is propelled by several interconnected factors. A primary driver is the escalating consumer awareness and demand for natural health solutions, fueled by a proactive approach to wellness and a desire to avoid synthetic alternatives. The increasing prevalence of chronic diseases and lifestyle-related health issues further stimulates the market as consumers seek preventative and complementary therapies. Technological advancements in extraction, purification, and formulation are enhancing the efficacy and bioavailability of botanical ingredients, making them more attractive to consumers. Additionally, supportive regulatory frameworks for dietary supplements, coupled with growing investments in research and development by key players, contribute to product innovation and market expansion. Economic factors, such as rising disposable incomes, also enable greater consumer spending on health and wellness products.

Challenges in the United States Botanical Supplements Market Sector

Despite its robust growth trajectory, the United States Botanical Supplements Market faces several challenges. Stringent and evolving regulatory oversight by agencies like the FDA, particularly concerning product claims and manufacturing standards, can pose compliance hurdles for manufacturers. Supply chain disruptions, including ingredient sourcing issues, quality control inconsistencies, and geopolitical factors, can impact product availability and cost. Intense market competition from both established brands and new entrants necessitates significant investment in marketing and product differentiation. Furthermore, consumer skepticism regarding the efficacy and safety of some botanical supplements, coupled with instances of misinformation, can hinder market adoption. The cost of raw materials and the R&D investment required for clinical validation also present financial challenges.

Emerging Opportunities in United States Botanical Supplements Market

Emerging opportunities within the United States Botanical Supplements Market are vast and diverse. The growing consumer interest in personalized nutrition and functional foods presents a significant avenue for growth, with demand for tailor-made botanical formulations increasing. Advancements in scientific research are uncovering new therapeutic applications for underutilized botanical species, opening up novel product development possibilities. The expansion of e-commerce and direct-to-consumer models provides direct access to a wider customer base and allows for targeted marketing strategies. Furthermore, the increasing global emphasis on sustainable sourcing and ethical production practices creates opportunities for brands that prioritize these values, appealing to environmentally conscious consumers. The integration of botanical supplements with wearable technology and digital health platforms also offers promising future growth prospects.

Leading Players in the United States Botanical Supplements Market Market

- Dr Willmar Schwabe GmbH & Co KG

- GNC Holdings Inc

- Herbalife International of America Inc

- Amway Corporation

- Nature's Bounty Co

- NOW Foods

- Gaia Herbs LLC

Key Developments in United States Botanical Supplements Market Industry

- 2024: Launch of a new line of adaptogenic mushroom-based supplements targeting stress and cognitive function by Gaia Herbs LLC, emphasizing organic sourcing and third-party testing.

- 2023: GNC Holdings Inc. announced a strategic partnership with an e-commerce giant to expand its online market reach and offer exclusive product bundles.

- 2023: Nature's Bounty Co. invested in advanced extraction technology to enhance the bioavailability of key botanical compounds in its flagship product lines.

- 2022: Amway Corporation expanded its global supply chain for certain high-demand botanicals to ensure consistent quality and availability.

- 2021: NOW Foods introduced innovative plant-based capsule formulations to cater to a growing vegan and vegetarian consumer base.

Strategic Outlook for United States Botanical Supplements Market Market

The strategic outlook for the United States Botanical Supplements Market remains highly positive, driven by sustained consumer demand for natural health solutions and ongoing product innovation. Key growth catalysts include the increasing integration of botanical ingredients into daily wellness routines, the continuous unveiling of new scientific evidence supporting their efficacy, and the expansion of online distribution channels making products more accessible. Companies that focus on transparency, scientific validation, sustainable sourcing, and personalized consumer experiences will be best positioned for success. Strategic investments in research and development, coupled with agile adaptation to evolving consumer preferences and regulatory landscapes, will be crucial for maintaining a competitive edge and capitalizing on the substantial market potential projected over the coming decade.

United States Botanical Supplements Market Segmentation

-

1. Form

- 1.1. Powdered Supplements

- 1.2. Capsules and Tablets

- 1.3. Other Forms

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Pharmacies/ Drug Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

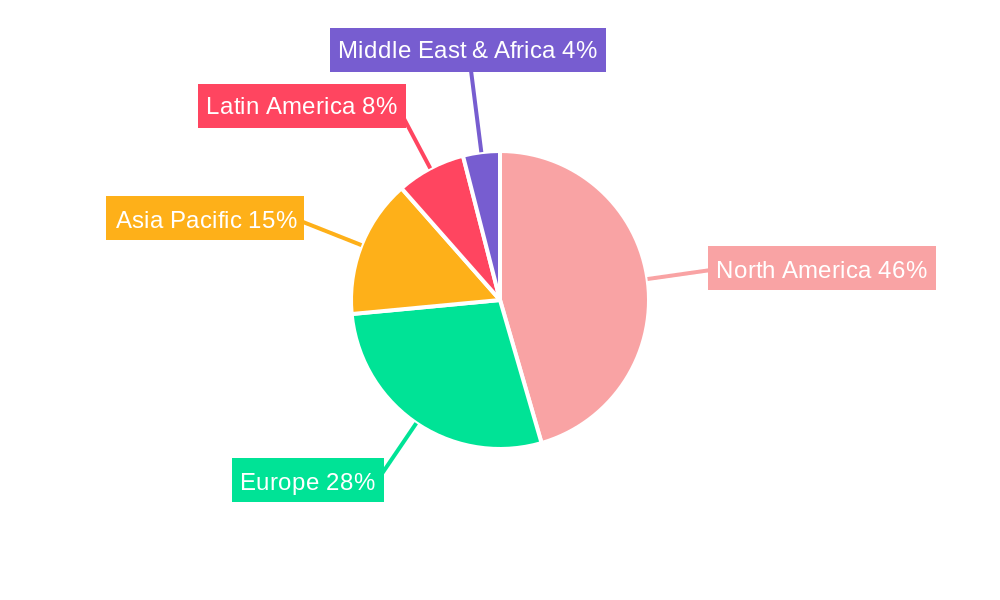

United States Botanical Supplements Market Segmentation By Geography

- 1. United States

United States Botanical Supplements Market Regional Market Share

Geographic Coverage of United States Botanical Supplements Market

United States Botanical Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Proces Affecting Production Costs

- 3.4. Market Trends

- 3.4.1. The Growing Popularity of Plant Sourced Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Powdered Supplements

- 5.1.2. Capsules and Tablets

- 5.1.3. Other Forms

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Pharmacies/ Drug Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dr Willmar Schwabe GmbH & Co KG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GNC Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Herbalife International of America Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nature's Bounty Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NOW Foods

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gaia Herbs LLC*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Dr Willmar Schwabe GmbH & Co KG

List of Figures

- Figure 1: United States Botanical Supplements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Botanical Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: United States Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: United States Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: United States Botanical Supplements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 5: United States Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Botanical Supplements Market?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the United States Botanical Supplements Market?

Key companies in the market include Dr Willmar Schwabe GmbH & Co KG, GNC Holdings Inc, Herbalife International of America Inc, Amway Corporation, Nature's Bounty Co, NOW Foods, Gaia Herbs LLC*List Not Exhaustive.

3. What are the main segments of the United States Botanical Supplements Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes.

6. What are the notable trends driving market growth?

The Growing Popularity of Plant Sourced Products.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Proces Affecting Production Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Botanical Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Botanical Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Botanical Supplements Market?

To stay informed about further developments, trends, and reports in the United States Botanical Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence