Key Insights

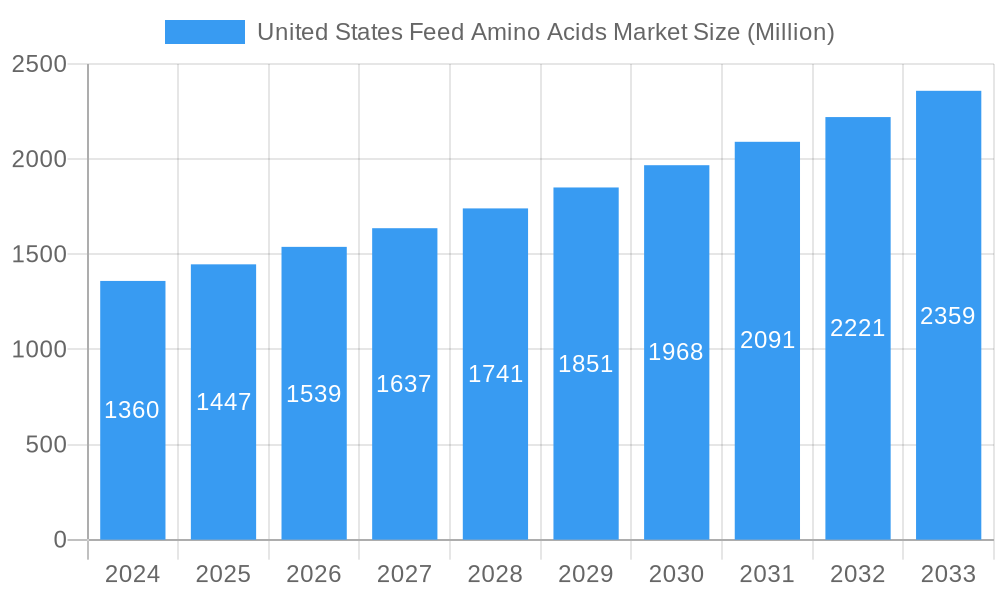

The United States feed amino acids market is poised for significant expansion, driven by the increasing demand for animal protein and the growing adoption of precision nutrition in livestock and aquaculture. With a current market valuation estimated at $1.36 billion in 2024, the sector is projected to witness robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.4% over the forecast period from 2025 to 2033. This upward trajectory is fueled by several key factors, including the need to optimize animal feed formulations for enhanced growth, improved feed conversion ratios, and reduced environmental impact. The poultry segment, particularly broilers and layers, remains a dominant consumer of feed amino acids, owing to the high volume production and specific nutritional requirements of these birds. Similarly, the swine industry's focus on efficient protein utilization further bolsters demand. Emerging growth opportunities are also evident in aquaculture, where the intensification of fish and shrimp farming necessitates specialized feed solutions for optimal health and productivity.

United States Feed Amino Acids Market Market Size (In Billion)

The market's growth is further propelled by ongoing trends such as the development of novel amino acid products with enhanced bioavailability and the increasing awareness among farmers and feed manufacturers regarding the economic and environmental benefits of using supplemental amino acids. These benefits include reducing nitrogen excretion, thereby mitigating environmental pollution, and decreasing reliance on traditional protein sources like soybean meal, which can be subject to price volatility and supply chain disruptions. While the market presents substantial opportunities, certain restraints, such as stringent regulatory frameworks for feed additives and the fluctuating raw material costs for amino acid production, could influence its pace. However, continuous innovation in production technologies and a strong focus on sustainability are expected to enable the United States feed amino acids market to overcome these challenges and continue its healthy expansion.

United States Feed Amino Acids Market Company Market Share

This in-depth report provides a comprehensive analysis of the United States feed amino acids market, offering critical insights into its current state and future trajectory. Covering the study period from 2019–2033, with a base and estimated year of 2025, and a forecast period of 2025–2033, this report delves into market dynamics, segmentation, competitive landscape, and growth catalysts. It is an indispensable resource for stakeholders seeking to understand the evolving animal nutrition sector and capitalize on emerging opportunities in poultry feed additives, swine feed supplements, and aquaculture nutrition. The report addresses key amino acids such as lysine, methionine, threonine, and tryptophan, and their application across various animal segments including broilers, layers, beef cattle, dairy cattle, shrimp, and fish. Anticipated market size in 2025 is projected to be in the hundreds of billions of dollars, with significant growth anticipated.

United States Feed Amino Acids Market Market Concentration & Innovation

The United States feed amino acids market exhibits a moderate to high market concentration, characterized by the presence of several dominant global players and a few regional specialists. Innovation remains a key differentiator, with companies actively investing in research and development to enhance the efficacy and sustainability of their feed additive offerings. Drivers of innovation include the increasing demand for cost-effective animal protein production, the growing awareness of animal welfare, and the imperative to reduce the environmental footprint of livestock farming. Regulatory frameworks, primarily governed by the FDA, play a crucial role in ensuring the safety and quality of feed ingredients. However, evolving environmental regulations and sustainability mandates are also shaping innovation pathways. Product substitutes, such as alternative protein sources and enzymes, are emerging, necessitating continuous product differentiation. End-user trends are leaning towards more specialized and functional feed additives that address specific nutritional needs and health benefits for various animal species. Mergers and acquisitions (M&A) activities are also prevalent, driven by the desire for market expansion, synergistic product portfolios, and enhanced technological capabilities. For instance, recent M&A activities like Novus International's acquisition of Agrivida indicate a strategic move towards integrating biotechnology for novel feed additive development.

United States Feed Amino Acids Market Industry Trends & Insights

The United States feed amino acids market is experiencing robust growth, driven by a confluence of factors that are reshaping the animal nutrition landscape. The escalating global demand for protein-rich food products, particularly meat, poultry, eggs, and fish, is a primary growth engine. This surge in demand necessitates increased efficiency in animal feed, where amino acids play a pivotal role in optimizing nutrient utilization, promoting animal growth, and improving feed conversion ratios. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period, underscoring its significant expansion potential. Market penetration of feed amino acids is already substantial, but opportunities remain for increased adoption in emerging animal segments and through the introduction of advanced, value-added products. Technological disruptions are continuously influencing the industry. Advancements in biotechnology, fermentation processes, and precision nutrition are leading to the development of more bioavailable and environmentally friendly amino acid formulations. Consumers’ increasing preference for ethically produced and sustainably sourced animal products is also a significant trend. This is pushing feed manufacturers to adopt ingredients that contribute to reduced environmental impact, such as lower nitrogen excretion. Competitive dynamics are intense, with established players constantly innovating and vying for market share. The focus is shifting from basic amino acid supplementation to customized solutions that address specific animal health challenges, improve gut health, and boost immune responses. The integration of digital solutions for better comprehension and reduced environmental impact, as seen in the Evonik and BASF partnership for OpteinicsTM, highlights the industry's commitment to sustainability and technological advancement.

Dominant Markets & Segments in United States Feed Amino Acids Market

The United States feed amino acids market is characterized by strong dominance in specific segments, driven by the scale of production and consumption within those categories.

Dominant Animal Segment: Poultry

- Broiler Production: The sheer volume of broiler chickens produced in the U.S. makes this segment the largest consumer of feed amino acids, particularly lysine, methionine, and threonine. The focus on rapid growth and efficient feed conversion in broiler diets directly translates to a high demand for these essential amino acids. Economic policies supporting the poultry industry and robust infrastructure for processing and distribution further bolster this dominance.

- Layer Production: Similar to broilers, the significant output of egg-laying hens also drives substantial demand for feed amino acids. Ensuring optimal egg production and shell quality relies heavily on balanced amino acid profiles in their feed.

- Other Poultry Birds: This includes turkeys and other fowl, which also contribute to the overall amino acid consumption within the poultry sector.

Dominant Sub-Additive: Lysine & Methionine

- Lysine: As the first limiting amino acid in most common feedstuffs for monogastric animals like swine and poultry, lysine is the most widely used and consequently, the largest segment by volume. Its critical role in muscle development and overall growth makes it indispensable.

- Methionine: Essential for feather development, growth, and metabolism, methionine is another high-demand amino acid, particularly crucial for poultry diets. The United States' significant poultry production directly correlates with the substantial market share of methionine. Evonik's expansion of its methyl mercaptan plant in Alabama underscores the strategic importance and demand for methionine production.

Significant Animal Segment: Swine

- The U.S. pork industry is a major consumer of feed amino acids. Lysine, threonine, and tryptophan are particularly important for optimizing growth, lean meat deposition, and reproductive performance in pigs. The economic significance of the U.S. swine sector ensures a consistent and substantial demand for these feed additives.

Growing Animal Segment: Aquaculture

- While currently smaller than poultry or swine, the aquaculture segment, encompassing fish and shrimp, is experiencing rapid growth in the United States. As aquaculture operations expand and adopt more scientifically formulated feeds, the demand for specific amino acids to enhance growth, disease resistance, and flesh quality is on the rise.

Emerging Animal Segment: Ruminants

- While ruminants can synthesize some amino acids, the supplementation of specific amino acids like methionine and lysine is gaining traction, particularly in high-producing dairy cattle and beef cattle. This aims to improve milk protein yield, reduce metabolic disorders, and enhance overall efficiency. The economic policies supporting livestock farming and the drive for increased productivity in beef and dairy sectors contribute to the increasing relevance of this segment.

United States Feed Amino Acids Market Product Developments

The United States feed amino acids market is witnessing a wave of product innovations focused on enhanced bioavailability, targeted delivery, and improved sustainability. Companies are developing novel formulations of essential amino acids like lysine, methionine, threonine, and tryptophan to optimize animal performance and reduce environmental impact. Technologies such as encapsulation and microencapsulation are being employed to protect amino acids during feed processing and ensure their efficient absorption in the animal’s digestive tract. Furthermore, advancements in biotechnology are leading to the development of amino acid blends tailored to specific animal life stages and dietary requirements, offering competitive advantages in terms of improved growth rates, feed conversion efficiency, and overall animal health.

Report Scope & Segmentation Analysis

This report meticulously segments the United States feed amino acids market by sub-additive and animal type. The sub-additive segmentation includes Lysine, Methionine, Threonine, Tryptophan, and Other Amino Acids, each contributing significantly to the overall market value and volume. The animal segmentation is comprehensive, encompassing Aquaculture (further divided into Fish, Shrimp, and Other Aquaculture Species), Poultry (including Broiler, Layer, and Other Poultry Birds), Ruminants (Beef Cattle, Dairy Cattle, and Other Ruminants), Swine, and Other Animals. Each segment's market size, growth projections, and competitive dynamics have been analyzed to provide a granular understanding of the market landscape. The growth in the aquaculture and ruminant sectors, though currently smaller, presents significant future growth potential as these industries evolve and adopt advanced feeding strategies.

Key Drivers of United States Feed Amino Acids Market Growth

The growth of the United States feed amino acids market is propelled by several key factors. The increasing global demand for animal protein, driven by population growth and rising disposable incomes, necessitates more efficient animal production. Feed amino acids are crucial in achieving this by optimizing nutrient utilization and improving feed conversion ratios. Technological advancements in fermentation and biotechnology are leading to more cost-effective and higher-quality amino acid production. Furthermore, a growing emphasis on animal health and welfare, coupled with a desire for reduced environmental impact from livestock farming (e.g., lower nitrogen excretion), encourages the use of precisely supplemented amino acid diets. Government initiatives promoting sustainable agriculture and animal husbandry also play a supporting role.

Challenges in the United States Feed Amino Acids Market Sector

Despite its strong growth trajectory, the United States feed amino acids market faces certain challenges. Volatility in raw material prices, particularly those derived from corn and soybeans, can impact production costs and profitability. Stringent regulatory requirements for feed additives, while ensuring safety, can also pose compliance hurdles and increase R&D investment needs. Fluctuations in global trade policies and tariffs can affect import and export dynamics, influencing market accessibility and pricing. Intense competition among established global players and emerging regional manufacturers can lead to price pressures and necessitate continuous innovation to maintain market share. Supply chain disruptions, as experienced in recent years, can also impact the availability and timely delivery of feed amino acids.

Emerging Opportunities in United States Feed Amino Acids Market

The United States feed amino acids market presents several exciting emerging opportunities. The rapidly expanding aquaculture sector in the U.S. offers significant growth potential as it moves towards more intensive and scientifically managed operations, requiring specialized amino acid formulations for fish and shrimp. The increasing focus on sustainable and environmentally friendly animal production is driving demand for amino acids that contribute to reduced nitrogen excretion and greenhouse gas emissions. Advancements in precision nutrition and personalized feed solutions, enabled by digital technologies and data analytics, are creating opportunities for customized amino acid supplements tailored to specific animal needs and farm conditions. The development of novel, bio-based amino acid production methods also presents a promising avenue for market expansion and differentiation.

Leading Players in the United States Feed Amino Acids Market Market

- Novus International Inc

- Kemin Industries

- Evonik Industries AG

- SHV (Nutreco NV)

- Ajinomoto Co Inc

- Land O'Lakes

- Archer Daniel Midland Co

- Alltech Inc

- IFF (Danisco Animal Nutrition)

- Adisseo

Key Developments in United States Feed Amino Acids Market Industry

- January 2023: Novus International acquired the Biotech company Agrivida to develop new feed additives, enhancing their portfolio with innovative biotechnological solutions.

- October 2022: The partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution designed to improve comprehension and reduce the environmental impact of the animal protein and feed industries.

- March 2022: Evonik extended its methyl mercaptan plant in Alabama, United States. Methyl mercaptan is a crucial intermediate obtained from outside sources and used in the production of DL-methionine, signaling an effort to bolster domestic methionine production capacity.

Strategic Outlook for United States Feed Amino Acids Market Market

The strategic outlook for the United States feed amino acids market remains highly positive, driven by persistent global demand for animal protein and ongoing advancements in animal nutrition science. Key growth catalysts include the continued expansion of the poultry and swine sectors, coupled with the burgeoning aquaculture industry's increasing adoption of specialized feed solutions. Investments in R&D, particularly in bio-based production methods and precision nutrition technologies, will be crucial for market players to maintain a competitive edge. Furthermore, the growing consumer and regulatory pressure for sustainable animal agriculture will further propel the demand for feed additives that contribute to reduced environmental impact. Strategic collaborations and M&A activities are expected to continue as companies seek to consolidate market positions and enhance their product portfolios. The market is poised for sustained growth, offering significant opportunities for innovation and expansion.

United States Feed Amino Acids Market Segmentation

-

1. Sub Additive

- 1.1. Lysine

- 1.2. Methionine

- 1.3. Threonine

- 1.4. Tryptophan

- 1.5. Other Amino Acids

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Beef Cattle

- 2.3.2. Dairy Cattle

- 2.3.3. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

United States Feed Amino Acids Market Segmentation By Geography

- 1. United States

United States Feed Amino Acids Market Regional Market Share

Geographic Coverage of United States Feed Amino Acids Market

United States Feed Amino Acids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Feed Amino Acids Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Lysine

- 5.1.2. Methionine

- 5.1.3. Threonine

- 5.1.4. Tryptophan

- 5.1.5. Other Amino Acids

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Beef Cattle

- 5.2.3.2. Dairy Cattle

- 5.2.3.3. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Novus International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kemin Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Evonik Industries AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SHV (Nutreco NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ajinomoto Co Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Land O'Lakes

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Archer Daniel Midland Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alltech Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IFF(Danisco Animal Nutrition)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adisseo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Novus International Inc

List of Figures

- Figure 1: United States Feed Amino Acids Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Feed Amino Acids Market Share (%) by Company 2025

List of Tables

- Table 1: United States Feed Amino Acids Market Revenue undefined Forecast, by Sub Additive 2020 & 2033

- Table 2: United States Feed Amino Acids Market Revenue undefined Forecast, by Animal 2020 & 2033

- Table 3: United States Feed Amino Acids Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: United States Feed Amino Acids Market Revenue undefined Forecast, by Sub Additive 2020 & 2033

- Table 5: United States Feed Amino Acids Market Revenue undefined Forecast, by Animal 2020 & 2033

- Table 6: United States Feed Amino Acids Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Feed Amino Acids Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the United States Feed Amino Acids Market?

Key companies in the market include Novus International Inc, Kemin Industries, Evonik Industries AG, SHV (Nutreco NV, Ajinomoto Co Inc, Land O'Lakes, Archer Daniel Midland Co, Alltech Inc, IFF(Danisco Animal Nutrition), Adisseo.

3. What are the main segments of the United States Feed Amino Acids Market?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

January 2023: Novus International acquired the Biotech company Agrivida to develop new feed additives.October 2022: The partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution to improve comprehension and reduce the environmental impact of the animal protein and feed industries.March 2022: Evonik extended its methyl mercaptan plant in Alabama, the United States. Methyl mercaptan is currently obtained from outside sources and used as an intermediate in the production of DL-methionine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Feed Amino Acids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Feed Amino Acids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Feed Amino Acids Market?

To stay informed about further developments, trends, and reports in the United States Feed Amino Acids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence