Key Insights

The United States real-time payments market is poised for significant expansion, fueled by escalating consumer demand for immediate and seamless transactions, the pervasive growth of mobile banking, and the accelerated adoption of digital technologies. Projecting a Compound Annual Growth Rate (CAGR) of 10.12%, the market is expected to reach a substantial size by 2025. While precise figures for 2025 are under review, current trends indicate a market size of approximately 34.16 billion. Key growth catalysts include the widespread adoption of peer-to-peer (P2P) payment applications, the increasing integration of real-time payments by businesses (P2B) for enhanced operational efficiency, and supportive government initiatives aimed at modernizing payment infrastructure. The ongoing convergence of real-time payment capabilities within established financial systems further propels this market's growth.

United States Real Time Payments Market Market Size (In Billion)

Market segmentation highlights the dual dominance of P2P and P2B transaction volumes. P2P platforms have cultivated broad consumer engagement, while P2B solutions are gaining momentum as organizations prioritize improved cash flow management and streamlined operations. Prominent industry leaders including Visa, Mastercard, PayPal, and Fiserv are actively driving innovation and strategic alliances within this competitive landscape. Despite potential regulatory hurdles and security considerations, the market demonstrates a robust growth trajectory extending through 2033. The integration of advanced technologies like blockchain and AI is anticipated to further catalyze innovation and unlock novel opportunities within the US real-time payments sector.

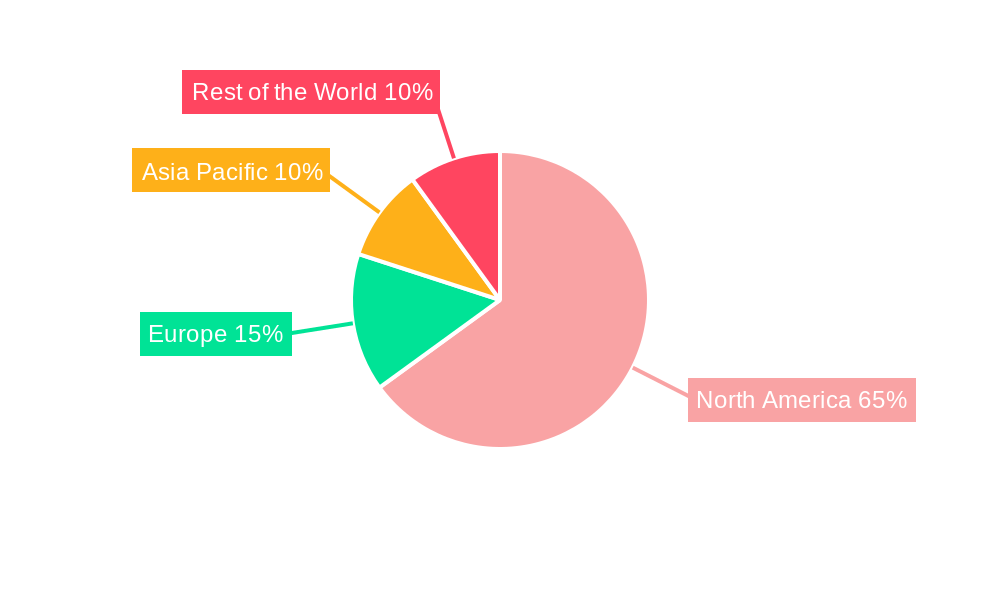

United States Real Time Payments Market Company Market Share

United States Real Time Payments Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Real Time Payments (RTP) market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving landscape. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report projects robust growth, driven by technological advancements, regulatory changes, and shifting consumer preferences. The market is segmented by payment type (P2P and P2B), providing a granular understanding of each segment's dynamics and future potential. Key players such as Visa Inc, Worldpay Inc, Fiserv Inc, and others are analyzed for their market share, strategies, and competitive advantages.

United States Real Time Payments Market Market Concentration & Innovation

The US real-time payments market exhibits moderate concentration, with several major players holding significant market share, but also fostering a competitive landscape with emerging fintech companies and established financial institutions. In 2025, the top five players are estimated to collectively hold approximately xx% of the market. However, the market is characterized by continuous innovation, driven by the demand for faster, more efficient, and secure payment solutions.

Key Innovation Drivers:

- Advancements in mobile payment technologies (e.g., Apple Pay, Google Pay).

- Increased adoption of cloud-based payment platforms.

- Development of advanced security protocols to mitigate fraud risks.

- Growing integration of AI and machine learning for enhanced fraud detection and risk management.

Regulatory Framework: The evolving regulatory landscape, including initiatives like the FedNow Service, significantly impacts market dynamics. Stringent regulations regarding data security and consumer protection are shaping market practices.

Product Substitutes: While RTPs are gaining prominence, traditional payment methods still hold a significant share. The competitive landscape includes ACH transfers, wire transfers, and checks. However, the speed and convenience of RTPs are driving market substitution.

End-User Trends: Consumers increasingly demand faster payment options for both person-to-person (P2P) and person-to-business (P2B) transactions. This shift fuels the growth of real-time payment solutions.

M&A Activities: The market has witnessed several mergers and acquisitions (M&A) activities in recent years, with deal values exceeding xx Million in 2024. These consolidations aim to enhance market share, expand product offerings, and improve technological capabilities.

United States Real Time Payments Market Industry Trends & Insights

The US real-time payments market is experiencing exponential growth, driven by several factors. The projected Compound Annual Growth Rate (CAGR) from 2025 to 2033 is estimated to be xx%, indicating a substantial increase in market size from xx Million in 2025 to xx Million by 2033. Market penetration of RTPs is steadily increasing, particularly among younger demographics who are digitally native and accustomed to instant gratification.

Technological disruptions, such as the rise of mobile wallets and advancements in blockchain technology, are reshaping the payments landscape. Consumer preferences are clearly favoring speed and convenience, pushing the adoption of real-time payment systems. Intense competitive dynamics, with both established players and innovative fintechs vying for market share, further accelerate innovation and market expansion.

Dominant Markets & Segments in United States Real Time Payments Market

The P2P segment is currently the dominant segment within the US real-time payments market, exhibiting significantly higher transaction volumes compared to the P2B segment. This is primarily driven by the widespread adoption of mobile peer-to-peer payment apps.

Key Drivers for P2P Segment Dominance:

- Increased smartphone penetration and mobile app usage.

- Growing preference for instant money transfers among individuals.

- Ease of use and accessibility of P2P payment platforms.

- Expansion of social media integration within payment apps.

Key Drivers for P2B Segment Growth (Future Projections):

- Increasing adoption of e-commerce and online businesses.

- Growing need for faster payment processing for businesses.

- Improved efficiency and reduced processing costs for businesses.

- Enhanced security features and fraud prevention measures.

The geographic dominance is spread across urban and suburban areas, reflecting the higher concentration of digitally savvy individuals and businesses in these regions.

United States Real Time Payments Market Product Developments

Recent product innovations focus on enhancing user experience, security, and integration capabilities. New features include improved fraud detection mechanisms, advanced analytics dashboards for businesses, and seamless integration with various payment platforms. Technological trends such as AI-powered fraud prevention, blockchain for enhanced security, and Open Banking APIs for seamless data exchange are driving product development. The focus is on creating user-friendly interfaces and ensuring compatibility across various devices and platforms.

Report Scope & Segmentation Analysis

This report segments the US real-time payments market primarily by payment type:

P2P (Person-to-Person): This segment encompasses payments between individuals, facilitated through mobile apps and online platforms. The projected CAGR for this segment is xx%, with a market size of xx Million in 2025, driven by the increasing adoption of mobile payment apps. Competitive dynamics are intense, with various players vying for market share through innovative features and aggressive marketing strategies.

P2B (Person-to-Business): This segment involves payments made by individuals to businesses, encompassing online purchases, bill payments, and other transactions. The growth of this segment is projected to be xx% CAGR, reaching xx Million by 2033. The increasing adoption of e-commerce and the growing preference for faster payment options drive the growth of this segment.

Key Drivers of United States Real Time Payments Market Growth

The US RTP market's growth is primarily fueled by:

- Technological advancements: The rise of mobile payments, AI, and blockchain enhances security, speed, and accessibility.

- Economic factors: E-commerce expansion necessitates faster payment processing.

- Regulatory support: Initiatives like the FedNow Service are promoting widespread adoption.

- Consumer demand: Individuals and businesses increasingly prefer instant payment capabilities.

Challenges in the United States Real Time Payments Market Sector

Several challenges hinder market growth:

- Regulatory hurdles: Maintaining compliance with evolving regulations is costly and complex.

- Security concerns: Preventing fraud and maintaining data privacy remain significant challenges.

- Interoperability issues: Lack of standardization across different platforms can limit seamless transactions.

- Integration complexities: Integrating RTP systems with existing legacy systems can be technically challenging and expensive.

Emerging Opportunities in United States Real Time Payments Market

Several opportunities are shaping the future of the market:

- Expansion into underserved markets, such as rural areas.

- Integration with other financial services, like lending and investment platforms.

- Development of new value-added services, such as personalized payment experiences and enhanced security features.

- Growing adoption of cross-border real-time payments.

Leading Players in the United States Real Time Payments Market Market

Key Developments in United States Real Time Payments Market Industry

- September 2021: FedNow Service announcement aims to bring 24/7/365 real-time payments to all US financial institutions by 2023. This significantly impacts market dynamics by creating a standardized, nationwide real-time payment infrastructure.

- February 2022: Apple's Tap to Pay on iPhone initiative enables millions of merchants to accept contactless payments without additional hardware, driving broader adoption of digital payments and potentially increasing real-time transaction volumes.

Strategic Outlook for United States Real Time Payments Market Market

The US real-time payments market is poised for sustained growth, driven by continuous technological innovation, increasing consumer demand for faster and more convenient payment options, and supportive regulatory initiatives. The expansion of e-commerce, the rise of mobile payments, and the increasing adoption of embedded finance solutions will further propel market growth. Companies focusing on enhancing security features, providing seamless integration with existing systems, and catering to specific market niches will be well-positioned for success in this dynamic and competitive landscape.

United States Real Time Payments Market Segmentation

-

1. Type

- 1.1. P2P

- 1.2. P2B

United States Real Time Payments Market Segmentation By Geography

- 1. United States

United States Real Time Payments Market Regional Market Share

Geographic Coverage of United States Real Time Payments Market

United States Real Time Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Smartphone Penetration; Falling Dependence on Traditional Banking; Ease of Convenience

- 3.3. Market Restrains

- 3.3.1. ; Sceptical View on Data Privacy

- 3.4. Market Trends

- 3.4.1. Rise in the P2B Payment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Real Time Payments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. P2P

- 5.1.2. P2B

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Visa Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Worldpay Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fiserv Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volante Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Temenos AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PayPal Holdings Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FIS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mastercard Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ACI Worldwide Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Montran Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Visa Inc

List of Figures

- Figure 1: United States Real Time Payments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Real Time Payments Market Share (%) by Company 2025

List of Tables

- Table 1: United States Real Time Payments Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: United States Real Time Payments Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: United States Real Time Payments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Real Time Payments Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: United States Real Time Payments Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: United States Real Time Payments Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: United States Real Time Payments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: United States Real Time Payments Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Real Time Payments Market?

The projected CAGR is approximately 10.12%.

2. Which companies are prominent players in the United States Real Time Payments Market?

Key companies in the market include Visa Inc, Worldpay Inc, Fiserv Inc, Volante Technologies Inc, Temenos AG, PayPal Holdings Inc, FIS, Mastercard Inc, ACI Worldwide Inc, Montran Corporation.

3. What are the main segments of the United States Real Time Payments Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.16 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Smartphone Penetration; Falling Dependence on Traditional Banking; Ease of Convenience.

6. What are the notable trends driving market growth?

Rise in the P2B Payment.

7. Are there any restraints impacting market growth?

; Sceptical View on Data Privacy.

8. Can you provide examples of recent developments in the market?

February 2022 - Apple announced plans to introduce Tap to Pay on iPhone. The new capability intends to empower millions of merchants across the US, from small businesses to large retailers, to use their iPhone seamlessly and securely to accept Apple Pay, contactless credit and debit cards, and other digital wallet payments through a simple tap to their iPhone with no additional hardware or payment terminal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Real Time Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Real Time Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Real Time Payments Market?

To stay informed about further developments, trends, and reports in the United States Real Time Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence