Key Insights

The United States Stair Lift Market is poised for substantial growth, projected to reach an estimated $1.5 billion in 2025, with a robust CAGR of 8.1% expected to drive its expansion through 2033. This upward trajectory is primarily fueled by the rapidly aging population, a demographic shift that significantly increases the demand for assistive mobility solutions to maintain independence within the home. Growing awareness of the benefits of stair lifts in preventing falls and improving the quality of life for individuals with mobility impairments is also a key driver. Furthermore, technological advancements are contributing to the market's dynamism, with manufacturers introducing more user-friendly, comfortable, and aesthetically pleasing designs. The integration of smart features and improved safety mechanisms further enhances their appeal.

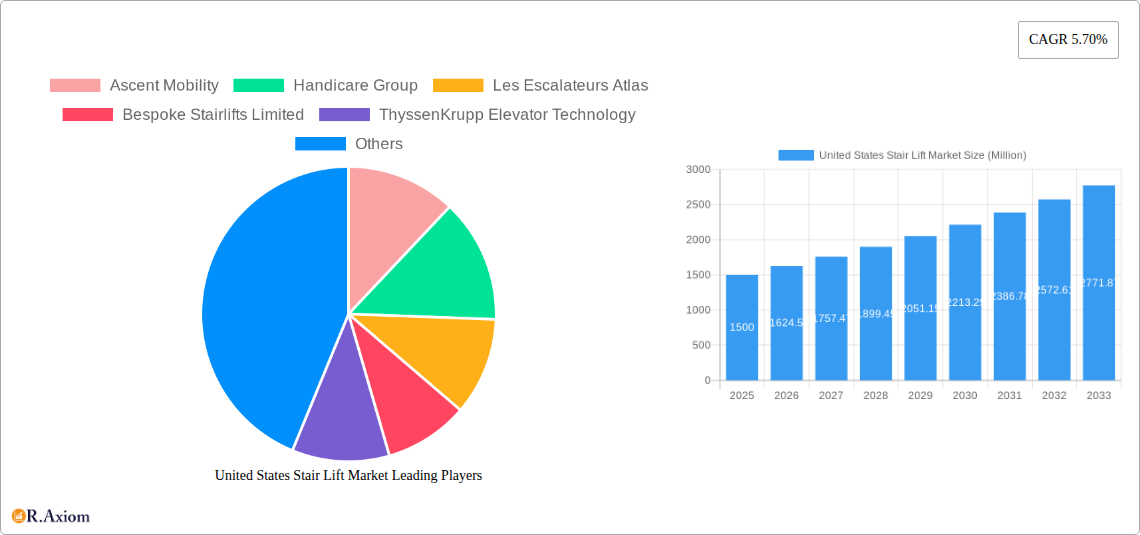

United States Stair Lift Market Market Size (In Billion)

Several factors will shape the United States Stair Lift Market landscape. The increasing prevalence of chronic health conditions, such as arthritis and cardiovascular diseases, which often lead to reduced mobility, will continue to bolster demand. Government initiatives and healthcare policies aimed at supporting home-based care and enabling seniors to age in place are also expected to positively impact market growth. The market is segmented across various rail orientations, user orientations, installation types, and applications, offering a diverse range of solutions to meet specific needs. While the market is generally strong, potential restraints could include the initial cost of installation for some consumers and the need for ongoing maintenance. However, the long-term benefits of enhanced safety, independence, and reduced healthcare costs associated with stair lifts are likely to outweigh these concerns, ensuring sustained market expansion.

United States Stair Lift Market Company Market Share

United States Stair Lift Market: A Comprehensive Market Analysis & Forecast (2019-2033)

This in-depth report offers a definitive analysis of the United States Stair Lift Market, providing critical insights into market dynamics, growth trajectories, and competitive landscapes. Covering the historical period of 2019-2024, the base year of 2025, and a detailed forecast period from 2025-2033, this report is an indispensable resource for industry stakeholders, including manufacturers, distributors, investors, and policymakers. We meticulously examine market segmentation by Rail Orientation (Straight, Curved), User Orientation (Seated, Standing, Integrated), Installation (Indoor, Outdoor), and Application (Residential, Healthcare, Others). With an estimated market size of XX billion in 2025, the US stair lift market is poised for significant expansion driven by an aging population, increasing awareness of home accessibility solutions, and advancements in assistive technology.

United States Stair Lift Market Market Concentration & Innovation

The United States stair lift market exhibits a moderate level of concentration, with a mix of established global players and niche domestic manufacturers vying for market share. Innovation is a key differentiator, driven by the persistent need for enhanced user safety, comfort, and aesthetic integration within homes. Manufacturers are investing heavily in research and development to introduce more intuitive controls, quieter operation, and customizable designs. Regulatory frameworks, particularly those pertaining to accessibility standards and safety certifications, play a crucial role in shaping product development and market entry.

- Innovation Drivers:

- Demand for enhanced user safety features (e.g., advanced sensor systems, secure seatbelts).

- Focus on ergonomic design and user comfort for prolonged use.

- Development of aesthetically pleasing and discreet stair lift models to blend with home décor.

- Integration of smart technology for remote monitoring and assistance.

- Regulatory Frameworks: Adherence to ADA (Americans with Disabilities Act) guidelines and relevant safety standards is paramount.

- Product Substitutes: While direct substitutes are limited, alternative mobility solutions like elevators and ramps are considered in broader home modification discussions.

- End-User Trends: Growing preference for in-home aging solutions and increased awareness of the benefits of stair lifts for maintaining independence.

- M&A Activities: Potential for consolidation as larger players acquire innovative startups to expand their product portfolios and market reach. Expected M&A deal values are anticipated to be in the range of XX million to XX billion over the forecast period.

United States Stair Lift Market Industry Trends & Insights

The United States stair lift market is experiencing robust growth, projected to achieve a compound annual growth rate (CAGR) of approximately XX% between 2025 and 2033. This expansion is primarily fueled by the rapidly aging demographic of the United States, with a significant segment of the population facing mobility challenges and seeking to maintain their independence at home. The increasing awareness of the benefits of stair lifts as a cost-effective and practical solution for home accessibility is further propelling market penetration. Technological advancements are also playing a pivotal role, with manufacturers continuously innovating to offer more user-friendly, comfortable, and aesthetically appealing products.

The growing emphasis on aging-in-place initiatives, supported by government policies and healthcare reforms, encourages seniors to remain in their homes for as long as possible, thereby boosting the demand for home modification products like stair lifts. Furthermore, the rising prevalence of age-related conditions such as arthritis, osteoporosis, and balance disorders directly translates into a greater need for mobility assistance.

Consumer preferences are shifting towards customized solutions that not only address functional needs but also seamlessly integrate with home interiors. This trend is driving innovation in areas such as wireless remote controls, compact designs, and a wider array of fabric and color options. The competitive landscape is dynamic, characterized by both established global brands and agile regional players. Strategic partnerships, product launches, and acquisitions are common strategies employed by companies to gain a competitive edge and expand their market presence.

The COVID-19 pandemic, while presenting initial supply chain disruptions, ultimately highlighted the critical importance of in-home safety and accessibility, leading to a renewed focus on home modification solutions. The market is also witnessing increased adoption in healthcare settings, such as assisted living facilities and rehabilitation centers, to enhance patient mobility and care. The overall market penetration is expected to reach XX% by 2033, indicating substantial room for continued growth.

Dominant Markets & Segments in United States Stair Lift Market

The Residential application segment is the dominant force within the United States stair lift market, driven by the strong societal preference for aging-in-place and the desire for continued independence. This segment consistently accounts for the largest share of the market revenue, estimated to be XX billion in 2025. The increasing number of homeowners seeking to adapt their living spaces to accommodate age-related mobility issues is a primary growth catalyst. Government initiatives promoting home accessibility and the rising awareness among individuals and their caregivers about the benefits of stair lifts further bolster this segment's dominance.

Rail Orientation: Straight vs. Curved

- Straight Stair Lifts: These represent a substantial portion of the market due to their simpler design, lower cost, and ease of installation. They are ideal for homes with standard straight staircases. Key drivers include affordability and widespread applicability in older housing stock. The market share for straight stair lifts is estimated at XX% in 2025.

- Curved Stair Lifts: While more complex and expensive, curved stair lifts are essential for homes with winding or custom-designed staircases. Their increasing adoption is linked to the growing demand for personalized home modifications. Innovations in rail manufacturing and design are making these solutions more accessible. The market share for curved stair lifts is projected to be XX% in 2025.

User Orientation: Seated, Standing, and Integrated

- Seated Stair Lifts: These are the most prevalent type, offering comfort and stability for users who can sit. Their widespread appeal is due to their inherent safety features and ergonomic design, making them the preferred choice for the majority of users. The estimated market share for seated stair lifts is XX% in 2025.

- Standing Stair Lifts: Designed for individuals who find it difficult to sit but can stand, these offer an alternative for specific mobility needs. While a niche segment, their demand is expected to grow as awareness increases.

- Integrated Stair Lifts: This emerging category encompasses solutions that are more seamlessly integrated into the home's architecture, offering a discreet and modern aesthetic. Their growth is tied to homeowner preferences for unobtrusive accessibility solutions.

Installation: Indoor vs. Outdoor

- Indoor Stair Lifts: The overwhelming majority of stair lift installations occur indoors, reflecting the primary need to navigate internal home levels. This segment benefits from the aging-in-place trend and the desire for seamless home living. The estimated market share for indoor stair lifts is XX% in 2025.

- Outdoor Stair Lifts: These are designed for external staircases, such as those leading to porches or garages. Their market is smaller but growing, driven by the need for comprehensive home accessibility.

Application: Residential, Healthcare, and Others

- Residential: As previously mentioned, this is the leading application, driven by individual homeowners.

- Healthcare: The healthcare segment, including hospitals, clinics, and assisted living facilities, is a significant and growing market. Stair lifts in these settings enhance patient mobility, care efficiency, and safety. The estimated market share for healthcare applications is XX% in 2025.

- Others: This category includes public buildings, educational institutions, and commercial spaces where accessibility is mandated or desired.

United States Stair Lift Market Product Developments

The United States stair lift market is characterized by continuous product innovation aimed at enhancing user experience, safety, and aesthetics. Recent developments focus on lighter materials for easier installation and maintenance, advanced battery backup systems for uninterrupted operation during power outages, and intuitive controls with ergonomic designs. Manufacturers are also introducing more compact and foldable models to minimize obstruction on staircases. The integration of smart features, such as remote diagnostics and app-based control, is a growing trend, catering to the tech-savvy consumer base.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the United States Stair Lift Market across key segmentation parameters.

- Rail Orientation: The market is segmented into Straight and Curved stair lifts. Straight stair lifts, favored for their cost-effectiveness and simpler installation, are expected to maintain a dominant market share. Curved stair lifts, catering to more complex staircase designs, are witnessing steady growth due to increasing demand for bespoke home modifications.

- User Orientation: This segmentation includes Seated, Standing, and Integrated user orientations. Seated stair lifts are the most prevalent due to their comfort and safety features. Standing stair lifts address specific user needs, while integrated solutions are gaining traction for their aesthetic appeal.

- Installation: The market is divided into Indoor and Outdoor installations. Indoor stair lifts are the primary focus, driven by the aging-in-place trend. Outdoor stair lifts cater to external accessibility needs, representing a growing niche.

- Application: Key applications encompass Residential, Healthcare, and Others. The residential sector is the largest, followed by healthcare facilities seeking to improve patient mobility. The "Others" category includes commercial and public spaces.

Key Drivers of United States Stair Lift Market Growth

The United States stair lift market is propelled by a confluence of powerful drivers. The most significant is the aging population, with a substantial and growing segment of seniors seeking to maintain independence and age in place. This demographic shift directly translates into increased demand for home accessibility solutions.

- Technological Advancements: Innovations in design, safety features, and user-friendliness are making stair lifts more appealing and accessible.

- Government Initiatives and Healthcare Reforms: Policies promoting aging-in-place and home-based care create a favorable environment for the market.

- Rising Awareness of Home Accessibility: Increased public discourse and media coverage on the importance of home modifications for individuals with mobility challenges.

- Increasing Prevalence of Mobility-Impairing Conditions: Age-related conditions such as arthritis and balance disorders necessitate mobility aids.

Challenges in the United States Stair Lift Market Sector

Despite the positive growth trajectory, the United States stair lift market faces several challenges. High initial purchase and installation costs can be a significant barrier for some consumers, particularly those on fixed incomes.

- High Initial Investment: The cost of purchasing and installing a stair lift can be substantial.

- Limited Awareness in Certain Demographics: Despite growing awareness, some potential users and their families may not be fully informed about available solutions.

- Complex Installation Requirements: For curved or custom staircases, installation can be intricate and time-consuming.

- Perception of Aesthetics: Some individuals may perceive stair lifts as aesthetically unappealing, influencing purchasing decisions.

- Supply Chain Disruptions: Global supply chain volatility can impact product availability and lead times.

Emerging Opportunities in United States Stair Lift Market

The United States stair lift market is ripe with emerging opportunities. The increasing adoption of smart home technology presents a significant avenue for integrating stair lifts with other connected devices, offering enhanced convenience and remote monitoring capabilities.

- Smart Home Integration: Developing stair lifts that can seamlessly connect with smart home ecosystems.

- Rental and Refurbishment Programs: Offering flexible rental options and refurbished units to cater to budget-conscious consumers.

- Targeted Marketing to Specific Conditions: Developing specialized products and marketing campaigns for individuals with specific mobility impairments.

- Expansion in Emerging Geographic Markets: Identifying and penetrating underserved regions within the US with growing senior populations.

- Partnerships with Healthcare Providers and Insurers: Collaborating to facilitate insurance coverage and streamline access for patients.

Leading Players in the United States Stair Lift Market Market

- Ascent Mobility

- Handicare Group

- Les Escalateurs Atlas

- Bespoke Stairlifts Limited

- ThyssenKrupp Elevator Technology

- Acme Home Elevator

- Acorn Stairlifts Inc

- Harmar

- Stannah Lifts Holdings Ltd

- Bruno Independent Living Aids Inc

- AmeriGlide Distributing 2019 Inc

Key Developments in United States Stair Lift Market Industry

- October 2021: Harmar Mobility's new product Vertical Platform Lift (VPL), the Highlander II, won HME Business's 2021 New Product Award competition. The New Product Award honors exceptional product development achievements by HME service providers and manufacturers.

Strategic Outlook for United States Stair Lift Market Market

The strategic outlook for the United States stair lift market remains highly positive, driven by persistent demographic trends and continuous technological innovation. The focus on aging-in-place, coupled with government support for home-based care, will continue to fuel demand. Companies that prioritize user-centric design, embrace smart technology integration, and offer flexible purchasing or rental options are poised for significant success. Strategic partnerships with healthcare providers and a focus on expanding into underserved markets will be crucial for sustained growth and market leadership. The market's trajectory indicates a strong future, with an increasing number of individuals benefiting from enhanced mobility and independence within their own homes.

United States Stair Lift Market Segmentation

-

1. Rail Orientation

- 1.1. Straight

- 1.2. Curved

-

2. User Orientation

- 2.1. Seated

- 2.2. Standing

- 2.3. Integrated

-

3. Installation

- 3.1. Indoor

- 3.2. Outdoor

-

4. Application

- 4.1. Residential

- 4.2. Healthcare

- 4.3. Others

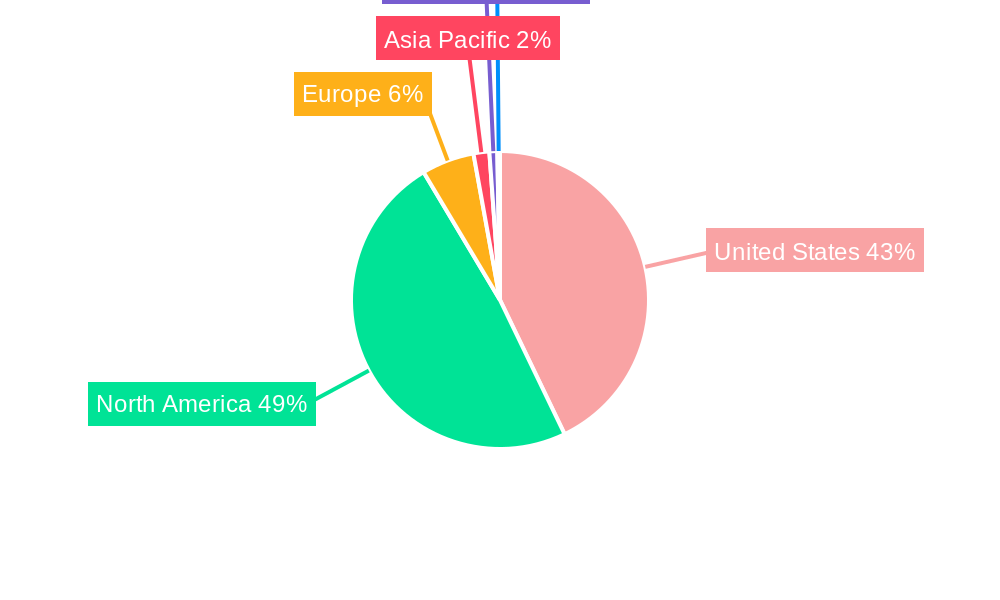

United States Stair Lift Market Segmentation By Geography

- 1. United States

United States Stair Lift Market Regional Market Share

Geographic Coverage of United States Stair Lift Market

United States Stair Lift Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Old age and disability significantly propel the demand for stair lifts

- 3.3. Market Restrains

- 3.3.1. High installation cost and post installation services

- 3.4. Market Trends

- 3.4.1. Increasing Health Issues is Driving the Stair Lift Market in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Stair Lift Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rail Orientation

- 5.1.1. Straight

- 5.1.2. Curved

- 5.2. Market Analysis, Insights and Forecast - by User Orientation

- 5.2.1. Seated

- 5.2.2. Standing

- 5.2.3. Integrated

- 5.3. Market Analysis, Insights and Forecast - by Installation

- 5.3.1. Indoor

- 5.3.2. Outdoor

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Residential

- 5.4.2. Healthcare

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Rail Orientation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ascent Mobility

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Handicare Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Les Escalateurs Atlas

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bespoke Stairlifts Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ThyssenKrupp Elevator Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Acme Home Elevator

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Acorn Stairlifts Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harmar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stannah Lifts Holdings Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bruno Independent Living Aids Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AmeriGlide Distributing 2019 Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Ascent Mobility

List of Figures

- Figure 1: United States Stair Lift Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Stair Lift Market Share (%) by Company 2025

List of Tables

- Table 1: United States Stair Lift Market Revenue undefined Forecast, by Rail Orientation 2020 & 2033

- Table 2: United States Stair Lift Market Volume K Unit Forecast, by Rail Orientation 2020 & 2033

- Table 3: United States Stair Lift Market Revenue undefined Forecast, by User Orientation 2020 & 2033

- Table 4: United States Stair Lift Market Volume K Unit Forecast, by User Orientation 2020 & 2033

- Table 5: United States Stair Lift Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 6: United States Stair Lift Market Volume K Unit Forecast, by Installation 2020 & 2033

- Table 7: United States Stair Lift Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: United States Stair Lift Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: United States Stair Lift Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: United States Stair Lift Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: United States Stair Lift Market Revenue undefined Forecast, by Rail Orientation 2020 & 2033

- Table 12: United States Stair Lift Market Volume K Unit Forecast, by Rail Orientation 2020 & 2033

- Table 13: United States Stair Lift Market Revenue undefined Forecast, by User Orientation 2020 & 2033

- Table 14: United States Stair Lift Market Volume K Unit Forecast, by User Orientation 2020 & 2033

- Table 15: United States Stair Lift Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 16: United States Stair Lift Market Volume K Unit Forecast, by Installation 2020 & 2033

- Table 17: United States Stair Lift Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: United States Stair Lift Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 19: United States Stair Lift Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United States Stair Lift Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Stair Lift Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the United States Stair Lift Market?

Key companies in the market include Ascent Mobility, Handicare Group, Les Escalateurs Atlas, Bespoke Stairlifts Limited, ThyssenKrupp Elevator Technology, Acme Home Elevator, Acorn Stairlifts Inc, Harmar, Stannah Lifts Holdings Ltd, Bruno Independent Living Aids Inc, AmeriGlide Distributing 2019 Inc.

3. What are the main segments of the United States Stair Lift Market?

The market segments include Rail Orientation, User Orientation, Installation, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Old age and disability significantly propel the demand for stair lifts.

6. What are the notable trends driving market growth?

Increasing Health Issues is Driving the Stair Lift Market in United States.

7. Are there any restraints impacting market growth?

High installation cost and post installation services.

8. Can you provide examples of recent developments in the market?

October 2021 - Harmar Mobility's new product Vertical Platform Lift (VPL), the Highlander II, won HME Business's 2021 New Product Award competition. The New Product Award honors exceptional product development achievements by HME service providers and manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Stair Lift Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Stair Lift Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Stair Lift Market?

To stay informed about further developments, trends, and reports in the United States Stair Lift Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence