Key Insights

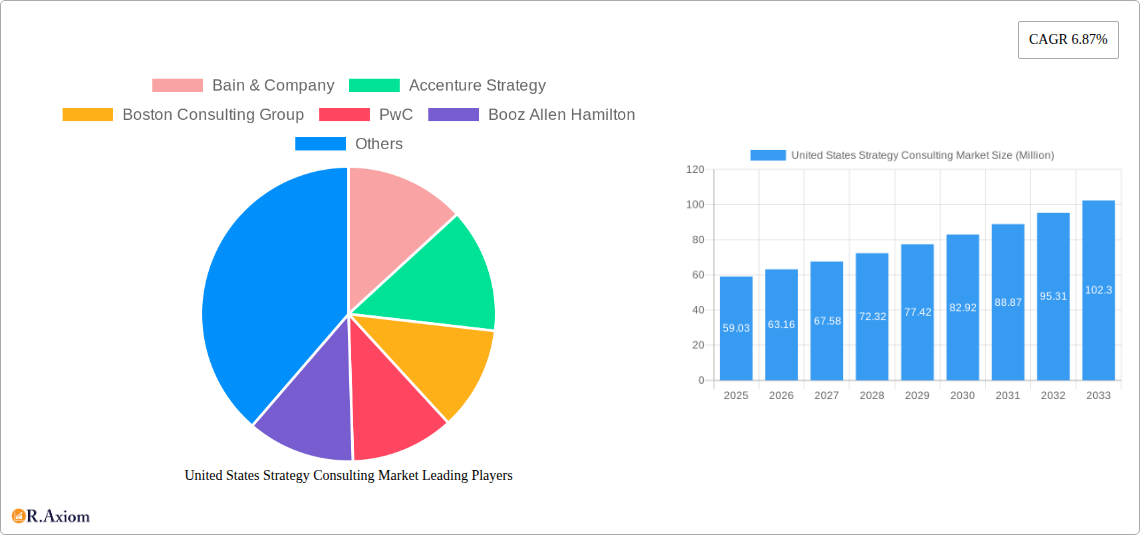

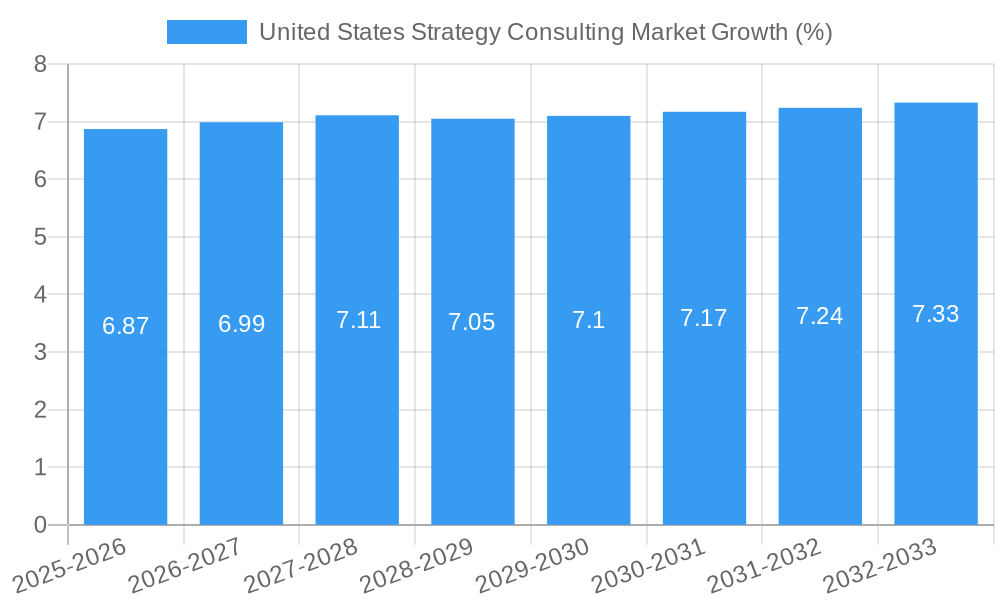

The United States strategy consulting market is poised for significant expansion, projected to reach \$59.03 million with a robust Compound Annual Growth Rate (CAGR) of 6.87% during the 2025-2033 forecast period. This growth is fueled by an increasing demand for strategic guidance across a multitude of industries, including IT & Telecommunication, Manufacturing, Energy, Healthcare, and the Public Sector. Companies are actively seeking expert advice to navigate complex market dynamics, optimize operational efficiency, and drive innovation. Key drivers such as the accelerating pace of digital transformation, the imperative for sustainable business practices, and the ongoing need for market entry and competitive positioning strategies are compelling businesses to invest heavily in specialized consulting services. The market is also witnessing a surge in demand for strategic insights related to business model innovation, organizational restructuring, and the effective integration of emerging technologies.

The competitive landscape is characterized by the presence of major global players, including Accenture Strategy, Boston Consulting Group, McKinsey, Bain & Company, Deloitte, PwC, EY, KPMG, A.T. Kearney, and Booz Allen Hamilton. These firms are instrumental in shaping market trends by offering comprehensive solutions that address intricate business challenges. While the market exhibits strong growth potential, certain restraints such as the high cost of consulting services and the potential for internal expertise development within organizations may present challenges. However, the undeniable value proposition of external strategic acumen, coupled with the growing complexity of the business environment, ensures a sustained demand for strategy consulting services, reinforcing its trajectory of growth and evolution in the coming years.

This in-depth report provides a definitive analysis of the United States Strategy Consulting Market, offering critical insights into market dynamics, segmentation, competitive landscapes, and future growth trajectories. Covering the historical period from 2019-2024, the base year of 2025, and a comprehensive forecast period of 2025-2033, this research equips industry stakeholders with actionable intelligence to navigate the evolving consulting ecosystem. The report delves into key segments including HR Consulting, Strategy Consulting, and Operations Consulting, serving diverse end-user industries such as IT & Telecommunication, Manufacturing, Energy, Healthcare, Public Sector, and Retail. With an estimated market size of over $300,000 Million in 2025, and projected growth at a Compound Annual Growth Rate (CAGR) of approximately 8.5% through 2033, understanding the nuances of this sector is paramount for sustained success.

United States Strategy Consulting Market Market Concentration & Innovation

The United States Strategy Consulting Market exhibits a dynamic blend of high concentration among major players and increasing innovation from niche firms. Leading consulting giants like McKinsey, Deloitte, Accenture Strategy, Boston Consulting Group, Bain & Company, PwC, EY, KPMG, Booz Allen Hamilton, and A.T. Kearney command a significant market share, estimated to be over 70% in 2025. Their dominance stems from extensive service portfolios, deep industry expertise, and strong client relationships. Innovation is primarily driven by the relentless pursuit of digital transformation solutions, leveraging artificial intelligence, machine learning, and data analytics to offer predictive insights and operational efficiencies. Regulatory frameworks, particularly those impacting data privacy and industry-specific compliance, indirectly shape consulting strategies, demanding greater expertise in risk management and governance. Product substitutes are evolving, with the rise of in-house consulting capabilities and specialized software solutions posing a growing challenge. End-user trends favoring agile methodologies, sustainability initiatives, and customer-centric approaches are compelling consulting firms to continuously adapt their service offerings. Mergers and acquisitions (M&A) activity, while moderate, is strategically focused on acquiring niche digital capabilities or expanding geographical reach. For instance, recent M&A deals in the digital transformation space have seen values exceeding $500 Million.

United States Strategy Consulting Market Industry Trends & Insights

The United States Strategy Consulting Market is experiencing robust growth, fueled by a confluence of technological advancements, evolving business imperatives, and a dynamic economic landscape. The market is projected to reach an estimated value of over $300,000 Million by the end of 2025, with a robust CAGR of approximately 8.5% anticipated throughout the forecast period of 2025–2033. This sustained growth trajectory is underpinned by several key trends. Digital transformation continues to be a paramount driver, as businesses across all sectors grapple with the need to integrate advanced technologies like AI, cloud computing, and the Internet of Things (IoT) into their core operations to enhance efficiency, customer experience, and competitive advantage. The increasing adoption of data analytics and big data solutions empowers organizations to derive actionable insights, leading to more informed strategic decision-making. Furthermore, the growing emphasis on environmental, social, and governance (ESG) factors is compelling companies to seek strategic guidance on sustainability initiatives, responsible sourcing, and ethical business practices, creating new avenues for specialized consulting services. The shift towards hybrid work models and the need for agile organizational structures also present significant opportunities for strategy consultants to assist clients in optimizing their workforce management and operational resilience. Geopolitical uncertainties and supply chain disruptions, particularly evident in recent years, have heightened the demand for strategic risk assessment and mitigation services, pushing consulting firms to develop more sophisticated foresight capabilities. Consumer preferences are increasingly digital-first, demanding personalized experiences and seamless interactions, which in turn drives businesses to re-evaluate their customer engagement strategies with the help of consulting expertise. The competitive dynamics within the market are intensifying, with established players facing increased competition from specialized boutique firms and technology-driven consulting platforms. Market penetration for advanced analytics and AI-driven consulting solutions is rapidly increasing, indicating a significant shift in the demand for highly specialized and data-informed strategic advice. The healthcare sector, in particular, is witnessing a surge in demand for consulting services related to digital health, patient engagement, and regulatory compliance. Similarly, the IT & Telecommunication sector continues to be a major consumer of strategy consulting, driven by rapid technological innovation and market evolution.

Dominant Markets & Segments in United States Strategy Consulting Market

The United States Strategy Consulting Market is characterized by the dominance of specific segments and end-user industries, driven by distinct economic, technological, and policy landscapes.

Dominant Type Segment: Strategy Consulting Strategy Consulting continues to be the largest and most influential segment, accounting for an estimated market share exceeding 45% in 2025. This dominance is fueled by businesses’ continuous need for high-level guidance on market entry, competitive positioning, corporate restructuring, and growth strategies in response to dynamic market conditions. Key drivers include the imperative for digital transformation, the pursuit of competitive differentiation, and the need to navigate complex economic shifts. The sophistication of strategic planning required in sectors like Finance and Technology propels this segment's growth.

Dominant End-User Industry: IT & Telecommunication The IT & Telecommunication sector stands out as the leading end-user industry, representing approximately 25% of the total market in 2025. This is attributed to the rapid pace of technological innovation, the constant evolution of digital services, and the intense competition within the industry.

- Key Drivers:

- Rapid advancements in cloud computing, AI, and 5G technologies.

- Increasing demand for cybersecurity solutions and data analytics.

- The need for strategic guidance on market expansion and digital service integration.

- Mergers and acquisitions within the tech landscape requiring strategic consolidation.

- Key Drivers:

Emerging Dominant Segments: While Strategy Consulting and IT & Telecommunication are current leaders, Operations Consulting and the Healthcare industry are demonstrating significant growth potential and increasing market share.

- Operations Consulting: Driven by the pursuit of supply chain optimization, efficiency improvements, and cost reduction in manufacturing, retail, and energy sectors. The focus on resilient supply chains post-pandemic is a significant catalyst.

- Healthcare Industry: Experiencing substantial growth due to the increasing adoption of digital health solutions, patient data management, regulatory compliance challenges (e.g., HIPAA), and the need for strategic planning in healthcare delivery models.

The Public Sector is also a growing area, with governments increasingly seeking consulting expertise for digital modernization, policy development, and public-private partnerships. The Energy sector is witnessing a surge in demand for strategy consulting related to renewable energy transitions and sustainability initiatives. Manufacturing is focused on Industry 4.0 adoption and supply chain resilience, while Retail is driven by e-commerce integration and personalized customer experiences. The interplay of these segments and industries dictates the overall market's direction, with companies like McKinsey, Deloitte, and Accenture Strategy strategically aligning their offerings to capture these evolving demands.

United States Strategy Consulting Market Product Developments

Product developments in the United States Strategy Consulting Market are characterized by the integration of advanced technologies and a focus on delivering tangible business outcomes. Firms are increasingly developing proprietary platforms and AI-powered tools to enhance service delivery, offering capabilities in predictive analytics, scenario modeling, and automated strategy formulation. Innovations are geared towards providing clients with real-time insights, actionable recommendations, and measurable ROI. Competitive advantages are derived from the ability to combine deep domain expertise with cutting-edge technological solutions, enabling clients to achieve digital transformation, optimize operations, and navigate complex market challenges effectively. The trend is towards hyper-personalized solutions tailored to specific industry needs and client objectives.

Report Scope & Segmentation Analysis

This report meticulously segments the United States Strategy Consulting Market to provide granular insights into its diverse components. The analysis encompasses three primary consulting types: HR Consulting, Strategy Consulting, and Operations Consulting. The market is further dissected by end-user industries, including IT & Telecommunication, Manufacturing, Energy, Healthcare, Public Sector, Retail, and Other End-User Industries. For HR Consulting, the segment is expected to grow at a CAGR of approximately 7.8%, driven by evolving workforce dynamics and talent management needs. Strategy Consulting, as previously noted, holds a dominant position with a projected CAGR of 8.5%. Operations Consulting is anticipated to witness a CAGR of around 8.2%, propelled by efficiency drives. In terms of end-user industries, IT & Telecommunication leads with a robust CAGR of 9.1%. Healthcare is projected to grow at 8.7%, while Manufacturing and Energy are estimated to grow at 7.9% and 8.3% respectively. The Public Sector and Retail segments are also projected for steady growth, with CAGRs of 7.5% and 7.7% respectively.

Key Drivers of United States Strategy Consulting Market Growth

The growth of the United States Strategy Consulting Market is propelled by several pivotal factors:

- Digital Transformation Imperative: The ongoing need for businesses to adopt and integrate advanced digital technologies, including AI, machine learning, and cloud computing, to remain competitive and efficient.

- Economic Volatility and Uncertainty: Geopolitical shifts, supply chain disruptions, and fluctuating economic conditions necessitate expert strategic guidance for risk mitigation, resilience building, and market adaptation.

- Sustainability and ESG Focus: Increasing pressure from investors, consumers, and regulators to adopt sustainable business practices and achieve environmental, social, and governance goals.

- Talent Management and Workforce Modernization: The evolving nature of work, including hybrid models and the demand for new skill sets, drives demand for HR and organizational strategy consulting.

- Technological Innovation: Rapid advancements across industries create opportunities for consulting firms to help clients leverage new technologies for innovation and competitive advantage.

Challenges in the United States Strategy Consulting Market Sector

Despite its robust growth, the United States Strategy Consulting Market faces several significant challenges:

- Intensifying Competition: The market is highly competitive, with a proliferation of established firms, niche specialists, and boutique consultancies vying for market share. This can lead to price pressures and the need for constant differentiation.

- Client Budgetary Constraints: Economic downturns or periods of uncertainty can lead to reduced client spending on consulting services, particularly for non-essential projects.

- Talent Acquisition and Retention: The demand for highly skilled consultants, especially in specialized areas like AI and data science, often outstrips supply, making talent acquisition and retention a persistent challenge.

- Measuring ROI and Demonstrating Value: Clients increasingly demand quantifiable returns on their consulting investments, putting pressure on firms to clearly articulate and demonstrate the tangible value of their services.

- Rapid Technological Obsolescence: The fast-paced nature of technological change requires consulting firms to continuously update their expertise and service offerings, which can be resource-intensive.

Emerging Opportunities in United States Strategy Consulting Market

The United States Strategy Consulting Market is ripe with emerging opportunities for forward-thinking firms:

- AI and Machine Learning Integration: The widespread adoption of AI presents a vast opportunity for consulting firms to guide clients in developing and implementing AI strategies, optimizing AI-driven processes, and exploring new AI applications.

- Sustainability and Green Consulting: The growing global emphasis on climate action and sustainable development creates a significant demand for consulting services focused on ESG strategies, carbon footprint reduction, and circular economy models.

- Digital Health and Healthcare Transformation: The healthcare industry's ongoing digital revolution, including telemedicine, personalized medicine, and health data analytics, offers substantial consulting opportunities.

- Supply Chain Resilience and Optimization: The recent global disruptions have highlighted the critical need for robust and agile supply chains, driving demand for consulting services in risk management, logistics optimization, and end-to-end visibility.

- Cybersecurity and Data Privacy Consulting: With increasing cyber threats and stringent data privacy regulations, businesses require expert guidance to protect their data and ensure compliance.

Leading Players in the United States Strategy Consulting Market Market

- Bain & Company

- Accenture Strategy

- Boston Consulting Group

- PwC

- Booz Allen Hamilton

- McKinsey

- KPMG

- A.T. Kearney

- EY

- Deloitte

Key Developments in United States Strategy Consulting Market Industry

- September 2023: XIX International, a trade management consulting firm based in Dubai, announced its expansion into the US market. Their objective is to assist US-based trading corporations in managing overseas trade contracts, aiming to enhance assurance and supply chain management for companies importing foreign goods. This development signifies an increasing global interest in serving the US market for specialized trade and supply chain consulting.

- April 2023: Credera, a US-based commercial and technology consulting firm, announced its entry into the German market. This move represents Credera's expansion into the European mainland, operating as a joint venture with Smart Digital, a German tech consulting company. Based in Berlin with 100 staff, this expansion, under Credera's parent company Omnicom Group, indicates strategic international growth and the pursuit of new market opportunities by established US consulting firms.

Strategic Outlook for United States Strategy Consulting Market Market

The strategic outlook for the United States Strategy Consulting Market remains exceptionally positive, driven by ongoing digital acceleration, the imperative for sustainable business practices, and the need for resilience in the face of global uncertainties. Key growth catalysts include the increasing adoption of AI and advanced analytics, which will enable consulting firms to offer more sophisticated and data-driven solutions. The growing focus on ESG compliance and the transition to a green economy will create significant demand for specialized sustainability consulting services. Furthermore, the continuous evolution of the IT & Telecommunication and Healthcare sectors will ensure sustained demand for strategic guidance. Opportunities for market expansion into new service areas and deeper engagement with existing clients will be crucial. Firms that can effectively blend deep industry expertise with cutting-edge technological capabilities and a strong commitment to client success will be best positioned to capitalize on the projected growth and shape the future of strategic advisory services in the United States.

United States Strategy Consulting Market Segmentation

-

1. Type

- 1.1. HR Consulting

- 1.2. Strategy Consulting

- 1.3. Operations Consulting

-

2. End-User Industry

- 2.1. IT & Telecommunication

- 2.2. Manufacturing

- 2.3. Energy

- 2.4. Healthcare

- 2.5. Public Sector

- 2.6. Retail

- 2.7. Other End-User Industries

United States Strategy Consulting Market Segmentation By Geography

- 1. United States

United States Strategy Consulting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption Of Advanced Data Management Strategies; Growing Investment In Analytical Solutions is Surging Companies Growth

- 3.3. Market Restrains

- 3.3.1. Project Complexities and Shift In Consulting Marketplace

- 3.4. Market Trends

- 3.4.1. Strategy Consulting Segment is Expected to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. HR Consulting

- 5.1.2. Strategy Consulting

- 5.1.3. Operations Consulting

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. IT & Telecommunication

- 5.2.2. Manufacturing

- 5.2.3. Energy

- 5.2.4. Healthcare

- 5.2.5. Public Sector

- 5.2.6. Retail

- 5.2.7. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. DACH Region United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. United Kingdom and Ireland United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. France United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Benelux United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Eastern Europe United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Scandinavia United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Rest of Europe United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Bain & Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Accenture Strategy

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Boston Consulting Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 PwC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Booz Allen Hamilton

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 McKinsey

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 KPMG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 A T Kearney

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 EY

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Deloitte

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Bain & Company

List of Figures

- Figure 1: United States Strategy Consulting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Strategy Consulting Market Share (%) by Company 2024

List of Tables

- Table 1: United States Strategy Consulting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Strategy Consulting Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Strategy Consulting Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: United States Strategy Consulting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United States Strategy Consulting Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: United States Strategy Consulting Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 21: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Strategy Consulting Market?

The projected CAGR is approximately 6.87%.

2. Which companies are prominent players in the United States Strategy Consulting Market?

Key companies in the market include Bain & Company, Accenture Strategy, Boston Consulting Group, PwC, Booz Allen Hamilton, McKinsey, KPMG, A T Kearney, EY, Deloitte.

3. What are the main segments of the United States Strategy Consulting Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption Of Advanced Data Management Strategies; Growing Investment In Analytical Solutions is Surging Companies Growth.

6. What are the notable trends driving market growth?

Strategy Consulting Segment is Expected to Drive the Market Demand.

7. Are there any restraints impacting market growth?

Project Complexities and Shift In Consulting Marketplace.

8. Can you provide examples of recent developments in the market?

In September 2023, XIX International, a consulting firm dealing with trade management, located in Dubai, announced its plans to provide services to its clients in the US for assisting customers in managing overseas trade contracts. XIX International's purpose is is to aid US-based trading corporations that import foreign goods into the US to progress excellent assurance and supply chain management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Strategy Consulting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Strategy Consulting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Strategy Consulting Market?

To stay informed about further developments, trends, and reports in the United States Strategy Consulting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence