Key Insights

The USA plant-based yogurt market is poised for significant expansion, driven by heightened consumer health consciousness, ethical food choices, and a growing incidence of lactose intolerance and dairy allergies. The market is projected to reach $3182.6 million by 2025, with a Compound Annual Growth Rate (CAGR) of 12.7% through 2033. Key growth drivers include strong demand for diverse and innovative flavors and formulations, alongside increased availability across retail channels. A discernible shift towards dairy-free alternatives is evident, propelled by a rising vegan and flexitarian consumer base seeking sustainable and health-conscious options.

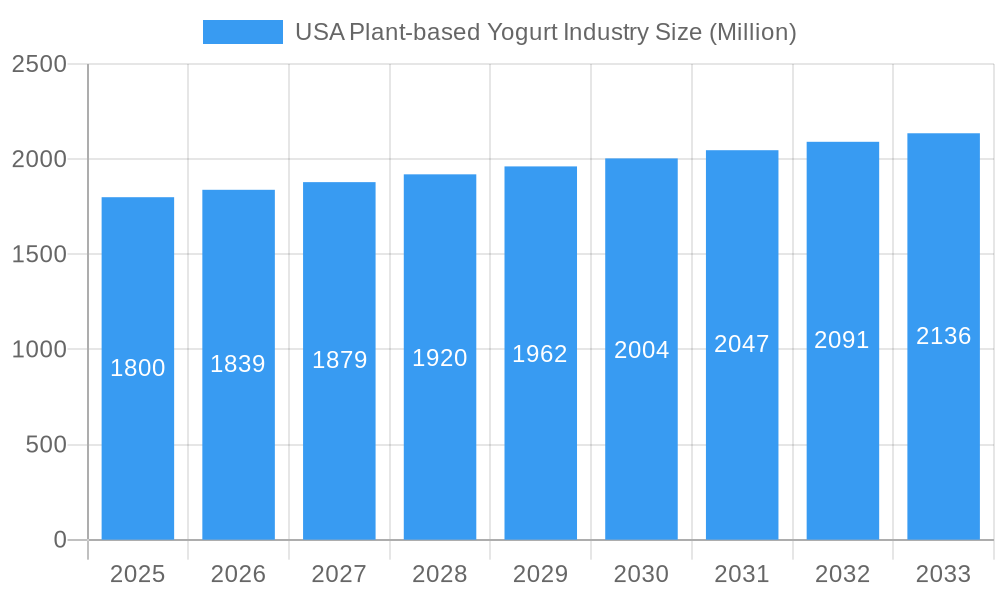

USA Plant-based Yogurt Industry Market Size (In Billion)

The competitive arena is robust, with leading companies actively investing in product innovation and market penetration. While the market encompasses both dairy-based and non-dairy yogurts, our analysis focuses on the rapidly growing plant-based segment. Flavored varieties are particularly popular, catering to evolving consumer preferences. Distribution channels are diversifying, with online retail demonstrating substantial growth potential alongside traditional supermarkets and hypermarkets. Despite a positive outlook, potential restraints include higher pricing for plant-based options and consumer education needs regarding nutritional equivalence and taste. However, ongoing product advancements and broader market acceptance are effectively addressing these challenges.

USA Plant-based Yogurt Industry Company Market Share

USA Plant-based Yogurt Industry: Market Analysis & Growth Forecast (2019-2033)

This comprehensive market research report delivers actionable insights into the USA Plant-based Yogurt Industry. Covering the period from 2019 to 2033, with a base and forecast year of 2025, this report thoroughly analyzes market dynamics, competitive landscapes, and future growth potential. It examines key industry players, product innovations, consumer trends, and distribution strategies, offering a complete market overview.

USA Plant-based Yogurt Industry Market Concentration & Innovation

The USA Plant-based Yogurt Industry exhibits a dynamic market concentration, with a blend of established dairy giants and agile plant-based innovators vying for market share. Key players like Lactalis, General Mills Inc., FAGE USA Dairy Industry Inc., Danone, Chobani LLC, and Hain Celestial Group are actively investing in expanding their plant-based portfolios, driven by burgeoning consumer demand for healthier and more sustainable alternatives. Innovation is a critical driver, with companies focusing on developing diverse plant bases beyond soy and almond, including oat, coconut, and cashew, to cater to a wider range of taste preferences and dietary needs. Regulatory frameworks primarily focus on food safety and labeling accuracy, ensuring consumer trust. Product substitutes, ranging from traditional dairy yogurt to other plant-based dairy alternatives like plant-based milk and cheese, present a competitive challenge. End-user trends are overwhelmingly leaning towards plant-based options due to perceived health benefits, ethical considerations, and environmental concerns. Mergers and acquisitions (M&A) activities, with estimated deal values in the hundreds of millions of dollars, are also shaping the market concentration, as larger companies acquire smaller, innovative startups to gain a competitive edge and expand their product offerings. For instance, the acquisition of Kite Hill by General Mills Inc. in 20XX exemplifies this trend. The market share for plant-based yogurts is steadily increasing, projected to reach over 35% of the total yogurt market by 2028.

USA Plant-based Yogurt Industry Industry Trends & Insights

The USA Plant-based Yogurt Industry is experiencing robust growth, propelled by a confluence of significant trends and evolving consumer preferences. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period. This expansion is largely fueled by a growing awareness of the health benefits associated with plant-based diets, including improved digestion, reduced risk of chronic diseases, and allergen-friendliness. Consumers are actively seeking dairy-free alternatives, leading to a substantial increase in market penetration for plant-based yogurts, which has surpassed 25% and is expected to continue its upward trajectory. Technological disruptions are playing a crucial role, with advancements in fermentation processes and the development of novel plant-based ingredients enhancing the taste, texture, and nutritional profile of plant-based yogurts, making them more comparable to their dairy counterparts. For example, the use of specific probiotics in oat-based yogurts is enhancing gut health claims. Consumer preferences are increasingly sophisticated, demanding not only a variety of plant bases but also unique flavor profiles, functional benefits (like added protein or probiotics), and clean ingredient labels. The competitive dynamics are intensifying, with both established dairy players and dedicated plant-based brands launching new products and expanding their market reach. The rise of online retail and direct-to-consumer models is also transforming distribution, allowing for greater accessibility and personalized offerings. Furthermore, sustainability concerns are a major influencing factor, with consumers prioritizing brands that demonstrate eco-friendly sourcing and packaging practices. The market penetration of plant-based yogurts in the USA is estimated to reach 30 million units by the end of 2025.

Dominant Markets & Segments in USA Plant-based Yogurt Industry

The USA Plant-based Yogurt Industry is characterized by distinct dominant markets and segments, each contributing significantly to the overall growth and evolution of the sector.

- Category: Non-dairy Yogurt: This segment is the primary engine of growth within the broader yogurt market. The escalating demand for dairy alternatives, driven by lactose intolerance, dairy allergies, veganism, and perceived health benefits, has propelled non-dairy yogurt to the forefront. Its market share is projected to reach approximately $5 Billion by 2028.

- Key Drivers: Rising health consciousness, ethical consumerism, availability of diverse plant bases (almond, soy, oat, coconut, cashew), and innovative product formulations.

- Product Type: Flavored Yogurt: While plain yogurts cater to a health-conscious base, flavored varieties are crucial for attracting a wider consumer base, including children and those seeking more indulgent options. The segment's growth is propelled by continuous innovation in unique and exotic flavor combinations.

- Key Drivers: Consumer desire for variety and taste, new product launches by key players, and seasonal flavor trends.

- Distribution Channel: Supermarkets/Hypermarkets: These channels remain the cornerstone of yogurt distribution due to their extensive reach and ability to cater to a broad demographic. Their strategic placement of both dairy and non-dairy options ensures maximum consumer accessibility.

- Key Drivers: High foot traffic, product visibility, competitive pricing strategies, and the growing presence of private label plant-based options.

- Region: North America (USA): The United States stands as the largest and most influential market for plant-based yogurts globally. Favorable consumer attitudes towards health and wellness, coupled with strong purchasing power and a sophisticated retail infrastructure, underpin its dominance.

- Key Drivers: High disposable income, established plant-based food culture, proactive food industry innovation, and supportive regulatory environments for product labeling.

USA Plant-based Yogurt Industry Product Developments

Product developments in the USA Plant-based Yogurt Industry are largely focused on enhancing taste, texture, and nutritional value to rival traditional dairy yogurts. Innovations include the use of diverse plant bases like oat, coconut, and cashew to offer a wider spectrum of flavors and mouthfeels, catering to specific dietary needs and preferences. Companies are actively developing yogurts fortified with probiotics for gut health, vitamins for immune support, and plant-based proteins for satiety. For example, Danone North America's Activia+ Multi-Benefit Probiotic Yogurt Drinks, launched in June 2022, highlight the trend of functional yogurts. Competitive advantages are being built on clean labels, sustainable sourcing, and the creation of unique flavor profiles, such as limited-edition offerings like HI-CHEWTM Rainbow Sherbet Flavor frozen yogurt in partnership with Menchie's Frozen Yogurt, and Yogurtland's summer flavors.

Report Scope & Segmentation Analysis

This report meticulously segments the USA Plant-based Yogurt Industry to provide granular insights into its diverse components. The analysis covers:

- Category: Dairy-Based Yogurt and Non-dairy Yogurt. The non-dairy segment is projected to exhibit a higher growth rate, driven by increasing consumer preference for plant-based alternatives.

- Product Type: Plain Yogurt and Flavored Yogurt. While plain yogurts appeal to the health-conscious, flavored yogurts are expected to see significant growth due to their broad consumer appeal and innovation in taste profiles.

- Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, and Online Retail. Online retail is projected to witness the fastest growth due to convenience and expanding consumer reach.

Each segment is analyzed for its market size, growth projections, and key competitive dynamics.

Key Drivers of USA Plant-based Yogurt Industry Growth

The growth of the USA Plant-based Yogurt Industry is propelled by several key drivers:

- Health and Wellness Trends: Increasing consumer awareness regarding the health benefits of plant-based diets, including improved digestion, reduced risk of chronic diseases, and suitability for individuals with lactose intolerance or dairy allergies, is a primary catalyst.

- Ethical and Environmental Concerns: A growing segment of consumers is opting for plant-based products due to ethical considerations regarding animal welfare and environmental sustainability, such as reduced carbon footprints and water usage associated with plant-based agriculture.

- Product Innovation and Variety: Continuous innovation in plant-based bases (oat, coconut, cashew, almond, soy), flavor profiles, and functional ingredients (probiotics, vitamins) is expanding the appeal and accessibility of plant-based yogurts to a wider demographic.

- Technological Advancements: Improvements in processing technologies are leading to enhanced taste, texture, and shelf-life of plant-based yogurts, making them more competitive with traditional dairy options.

Challenges in the USA Plant-based Yogurt Industry Sector

Despite robust growth, the USA Plant-based Yogurt Industry faces several challenges:

- Perception of Taste and Texture: While improving, some consumers still perceive plant-based yogurts as lacking the taste and creamy texture of traditional dairy yogurts, hindering wider adoption.

- Price Sensitivity: Plant-based yogurts often command a premium price compared to dairy counterparts, making them less accessible for budget-conscious consumers.

- Supply Chain Volatility: Sourcing consistent quality and quantity of specific plant-based ingredients can be subject to agricultural yields, weather patterns, and global supply chain disruptions, potentially impacting production costs and availability.

- Competition and Market Saturation: The rapidly growing market is attracting numerous players, leading to increased competition and potential for market saturation, requiring companies to constantly innovate and differentiate their offerings.

Emerging Opportunities in USA Plant-based Yogurt Industry

The USA Plant-based Yogurt Industry presents several emerging opportunities:

- Functional and Fortified Yogurts: There is a growing demand for yogurts with added functional benefits, such as enhanced probiotics for gut health, added vitamins and minerals for immune support, and plant-based proteins for satiety, offering a significant avenue for product development.

- Premium and Artisanal Offerings: The market is ripe for premium and artisanal plant-based yogurts that focus on unique flavor profiles, high-quality ingredients, and appealing branding, catering to discerning consumers willing to pay a premium.

- Expansion into Foodservice: Collaborations with restaurants, cafes, and frozen yogurt chains (like the HI-CHEWTM and Menchie's partnership) offer substantial opportunities to introduce plant-based yogurts to new consumers and increase trial.

- Sustainable Packaging Solutions: With a strong emphasis on sustainability, companies that adopt innovative and eco-friendly packaging solutions can gain a competitive advantage and appeal to environmentally conscious consumers.

Leading Players in the USA Plant-based Yogurt Industry Market

- Lactalis

- General Mills Inc.

- Dean Foods

- FAGE USA Dairy Industry Inc.

- Danone

- Anderson Erickson Dairy

- Dairy Farmers of America Inc.

- Chobani LLC

- Tillamook County Creamery Association

- Hain Celestial Group

Key Developments in USA Plant-based Yogurt Industry Industry

- June 2022: The chewy candy company HI-CHEW partnered with Menchie's Frozen Yogurt in North America to launch a limited edition HI-CHEWTM Rainbow Sherbet Flavor frozen yogurt, expanding the reach of plant-based-inspired frozen treats.

- June 2022: Yogurtland, a frozen yogurt company, introduced two new limited-time flavors for summer: strawberry mango sorbet and passion fruit mango tart. Yogurtland sells its Strawberry Mangonada cup exclusively online at yogurt-land.com, the Yogurtland app, and DoorDash. Online-exclusive cups and summer flavors are available at participating locations, showcasing online retail innovation.

- June 2022: Danone North America launched its latest product Activia+ Multi-Benefit Probiotic Yogurt Drinks. Activia+ is an excellent source (20% DV) of vitamins C, D, and zinc to support the immune system and is packed with billions of live and active probiotics that help support gut health, highlighting the trend towards functional and health-benefiting yogurts.

Strategic Outlook for USA Plant-based Yogurt Industry Market

The strategic outlook for the USA Plant-based Yogurt Industry remains exceptionally positive, driven by sustained consumer demand for healthier, more ethical, and environmentally conscious food options. The market is poised for continued expansion, with opportunities for significant growth in functional yogurts, premium product offerings, and strategic partnerships within the foodservice sector. Companies that prioritize innovation in taste, texture, and nutritional profiles, while also demonstrating a commitment to sustainability, will be well-positioned to capture market share. The ongoing evolution of online retail channels and the increasing acceptance of plant-based alternatives across broader consumer demographics indicate a bright and dynamic future for this industry.

USA Plant-based Yogurt Industry Segmentation

-

1. Category

- 1.1. Dairy-Based Yogurt

- 1.2. Non-dairy Yogurt

-

2. Product Type

- 2.1. Plain Yogurt

- 2.2. Flavored Yogurt

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Specialty Stores

- 3.4. Online Retail

- 3.5. Other Channels

USA Plant-based Yogurt Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Plant-based Yogurt Industry Regional Market Share

Geographic Coverage of USA Plant-based Yogurt Industry

USA Plant-based Yogurt Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood

- 3.3. Market Restrains

- 3.3.1. Rising Concern About Quality and Safety Standards of Canned Tuna

- 3.4. Market Trends

- 3.4.1. Growing Digestive Heath Concerns Heating up Demand for Probiotic Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Dairy-Based Yogurt

- 5.1.2. Non-dairy Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plain Yogurt

- 5.2.2. Flavored Yogurt

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Retail

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. North America USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Dairy-Based Yogurt

- 6.1.2. Non-dairy Yogurt

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Plain Yogurt

- 6.2.2. Flavored Yogurt

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Convenience Stores

- 6.3.3. Specialty Stores

- 6.3.4. Online Retail

- 6.3.5. Other Channels

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. South America USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Dairy-Based Yogurt

- 7.1.2. Non-dairy Yogurt

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Plain Yogurt

- 7.2.2. Flavored Yogurt

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Convenience Stores

- 7.3.3. Specialty Stores

- 7.3.4. Online Retail

- 7.3.5. Other Channels

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Europe USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Dairy-Based Yogurt

- 8.1.2. Non-dairy Yogurt

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Plain Yogurt

- 8.2.2. Flavored Yogurt

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Convenience Stores

- 8.3.3. Specialty Stores

- 8.3.4. Online Retail

- 8.3.5. Other Channels

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Middle East & Africa USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. Dairy-Based Yogurt

- 9.1.2. Non-dairy Yogurt

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Plain Yogurt

- 9.2.2. Flavored Yogurt

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Convenience Stores

- 9.3.3. Specialty Stores

- 9.3.4. Online Retail

- 9.3.5. Other Channels

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Asia Pacific USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Category

- 10.1.1. Dairy-Based Yogurt

- 10.1.2. Non-dairy Yogurt

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Plain Yogurt

- 10.2.2. Flavored Yogurt

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Convenience Stores

- 10.3.3. Specialty Stores

- 10.3.4. Online Retail

- 10.3.5. Other Channels

- 10.1. Market Analysis, Insights and Forecast - by Category

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lactalis

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Mills Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dean Foods*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FAGE USA Dairy Industry Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danone

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Anderson Erickson Dairy

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dairy Farmers of America Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chobani LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tillamook County Creamery Association

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hain Celestial Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lactalis

List of Figures

- Figure 1: Global USA Plant-based Yogurt Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America USA Plant-based Yogurt Industry Revenue (million), by Category 2025 & 2033

- Figure 3: North America USA Plant-based Yogurt Industry Revenue Share (%), by Category 2025 & 2033

- Figure 4: North America USA Plant-based Yogurt Industry Revenue (million), by Product Type 2025 & 2033

- Figure 5: North America USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America USA Plant-based Yogurt Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: North America USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America USA Plant-based Yogurt Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America USA Plant-based Yogurt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America USA Plant-based Yogurt Industry Revenue (million), by Category 2025 & 2033

- Figure 11: South America USA Plant-based Yogurt Industry Revenue Share (%), by Category 2025 & 2033

- Figure 12: South America USA Plant-based Yogurt Industry Revenue (million), by Product Type 2025 & 2033

- Figure 13: South America USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America USA Plant-based Yogurt Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 15: South America USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America USA Plant-based Yogurt Industry Revenue (million), by Country 2025 & 2033

- Figure 17: South America USA Plant-based Yogurt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe USA Plant-based Yogurt Industry Revenue (million), by Category 2025 & 2033

- Figure 19: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Category 2025 & 2033

- Figure 20: Europe USA Plant-based Yogurt Industry Revenue (million), by Product Type 2025 & 2033

- Figure 21: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe USA Plant-based Yogurt Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 23: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe USA Plant-based Yogurt Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa USA Plant-based Yogurt Industry Revenue (million), by Category 2025 & 2033

- Figure 27: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Category 2025 & 2033

- Figure 28: Middle East & Africa USA Plant-based Yogurt Industry Revenue (million), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa USA Plant-based Yogurt Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa USA Plant-based Yogurt Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific USA Plant-based Yogurt Industry Revenue (million), by Category 2025 & 2033

- Figure 35: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Category 2025 & 2033

- Figure 36: Asia Pacific USA Plant-based Yogurt Industry Revenue (million), by Product Type 2025 & 2033

- Figure 37: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific USA Plant-based Yogurt Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific USA Plant-based Yogurt Industry Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 2: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 6: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 13: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 20: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 21: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 33: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 34: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 43: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 44: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Country 2020 & 2033

- Table 46: China USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Plant-based Yogurt Industry?

The projected CAGR is approximately 12.7%.

2. Which companies are prominent players in the USA Plant-based Yogurt Industry?

Key companies in the market include Lactalis, General Mills Inc, Dean Foods*List Not Exhaustive, FAGE USA Dairy Industry Inc, Danone, Anderson Erickson Dairy, Dairy Farmers of America Inc, Chobani LLC, Tillamook County Creamery Association, Hain Celestial Group.

3. What are the main segments of the USA Plant-based Yogurt Industry?

The market segments include Category, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3182.6 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood.

6. What are the notable trends driving market growth?

Growing Digestive Heath Concerns Heating up Demand for Probiotic Products.

7. Are there any restraints impacting market growth?

Rising Concern About Quality and Safety Standards of Canned Tuna.

8. Can you provide examples of recent developments in the market?

In June 2022, The chewy candy company HI-CHEW partnered with Menchie's Frozen Yogurt in North America to launch a limited edition HI-CHEWTM Rainbow Sherbet Flavor frozen yogurt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Plant-based Yogurt Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Plant-based Yogurt Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Plant-based Yogurt Industry?

To stay informed about further developments, trends, and reports in the USA Plant-based Yogurt Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence