Key Insights

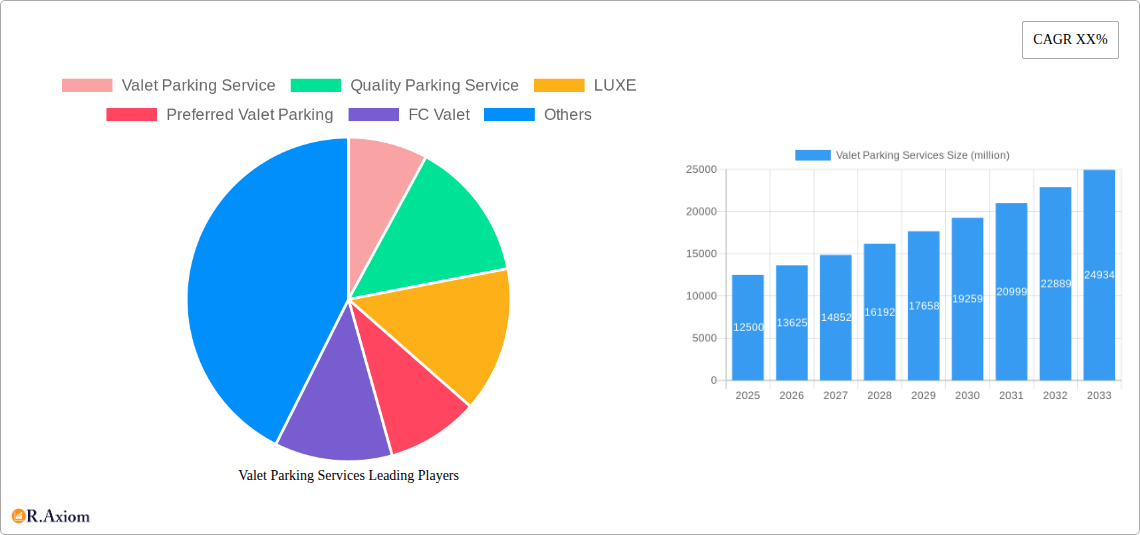

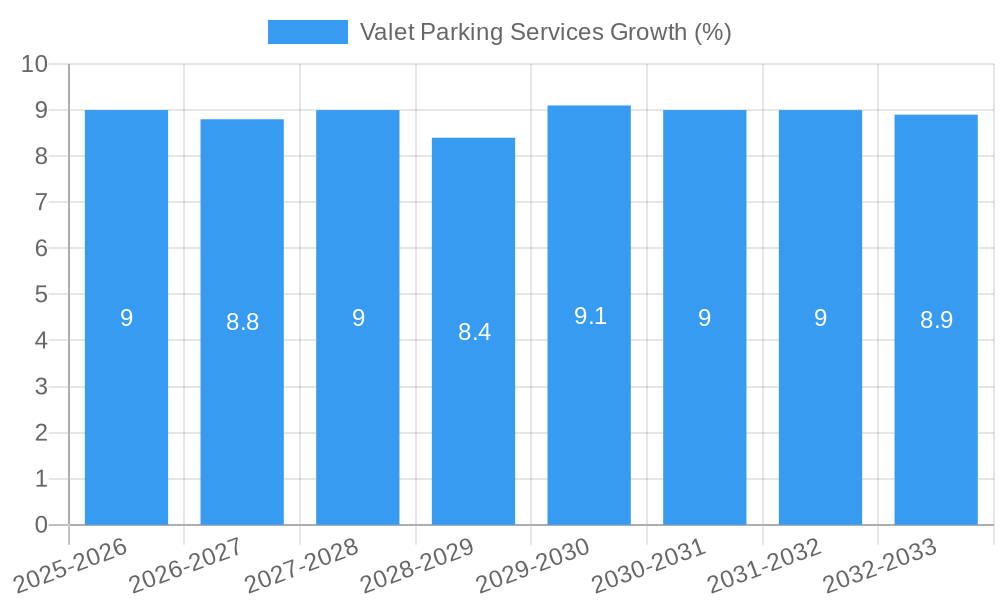

The global Valet Parking Services market is poised for robust expansion, projected to reach a substantial market size of approximately $12,500 million by the end of 2025, with a compelling Compound Annual Growth Rate (CAGR) of around 9.5% expected throughout the forecast period from 2025 to 2033. This growth is fundamentally driven by an escalating demand for convenience and enhanced customer experiences across a multitude of sectors. The hospitality industry, particularly hotels and restaurants, remains a cornerstone of this market, as businesses increasingly recognize valet parking as a critical differentiator in attracting and retaining customers. Similarly, the burgeoning retail sector, with its emphasis on seamless shopping journeys, and the dynamic office building environment, where time efficiency for professionals is paramount, are significant contributors to this upward trajectory. The increasing frequency of special events, from corporate galas to private celebrations, further bolsters the demand for these specialized services, underscoring their role in elevating event logistics and attendee satisfaction.

Emerging trends such as the integration of technology, including mobile apps for booking and payment, and the adoption of eco-friendly parking solutions are reshaping the valet parking landscape. These innovations are not only streamlining operations but also appealing to a more tech-savvy and environmentally conscious consumer base. However, the market faces certain restraints, including the initial capital investment required for technology implementation and personnel training, as well as concerns regarding liability and insurance costs. Despite these challenges, the persistent desire for time-saving solutions and a premium service offering ensures sustained market momentum. The market is segmented by application into Hotels, Restaurants, Retail Centers, Office Buildings, Residential Properties, and Special Events, with Short-Term Services and Long-Term Services representing the primary types of offerings, indicating a diverse range of customer needs and service models. Leading companies in this space are actively innovating to capture market share, focusing on service quality and technological advancements.

This in-depth report provides a comprehensive analysis of the global Valet Parking Services market, offering critical insights for stakeholders looking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape. The study covers the historical period from 2019 to 2024, with the base year set as 2025, and extends to a robust forecast period from 2025 to 2033.

Valet Parking Services Market Concentration & Innovation

The Valet Parking Services market exhibits a moderate level of concentration, with several key players vying for market share. Companies like Valet Parking Service, Quality Parking Service, LUXE, and Preferred Valet Parking are at the forefront, driving innovation and setting industry standards. Innovation in this sector is largely propelled by technological advancements aimed at enhancing efficiency, security, and customer experience. This includes the integration of mobile applications for booking and payment, smart parking sensors for optimized space utilization, and AI-powered systems for traffic flow management. Regulatory frameworks, while generally supportive of service-oriented businesses, can vary by region, impacting operational procedures and compliance costs. The emergence of sophisticated booking platforms and contactless payment solutions are key product substitutes that directly influence traditional valet operations. End-user trends are increasingly emphasizing convenience, speed, and personalized service, pushing providers to adopt more user-friendly and technologically advanced solutions. Mergers and Acquisitions (M&A) activities are anticipated to play a significant role in market consolidation, with an estimated total M&A deal value projected to reach over 500 million in the coming years. Leading companies are expected to acquire smaller players to expand their geographic reach and service offerings, thereby increasing market share.

Valet Parking Services Industry Trends & Insights

The Valet Parking Services industry is poised for substantial growth, driven by increasing urbanization, a rise in disposable incomes, and a growing preference for premium services. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period. This growth is fueled by an increasing demand for convenience and a desire to avoid the hassle of self-parking, particularly in densely populated urban areas and at high-end establishments. Technological disruptions are at the heart of current industry trends. The integration of artificial intelligence (AI) and the Internet of Things (IoT) is revolutionizing valet operations. Smart parking solutions that optimize space and reduce wait times are becoming increasingly popular. Mobile applications are transforming the customer experience, allowing for seamless booking, payment, and communication with valet attendants. Furthermore, the adoption of contactless payment systems and digital ticketing is enhancing efficiency and hygiene, aligning with evolving consumer preferences for safety and convenience.

Consumer preferences are shifting towards integrated service experiences. Patrons at hotels, restaurants, and retail centers are looking for a complete package of convenience that extends beyond just parking. This includes valet services that are efficient, reliable, and offer a personalized touch. The competitive dynamics within the market are intensifying, with established players investing heavily in technology and service innovation to differentiate themselves. New entrants are also emerging, often leveraging advanced technology to disrupt the traditional market. The market penetration of advanced valet parking solutions is expected to rise from 15% in the base year to over 35% by the end of the forecast period. This includes the adoption of automated valet parking systems and AI-driven customer management platforms, which are becoming critical for maintaining a competitive edge. The growing emphasis on sustainability is also influencing trends, with some companies exploring eco-friendly fleet management and the use of electric vehicles for valet services.

Dominant Markets & Segments in Valet Parking Services

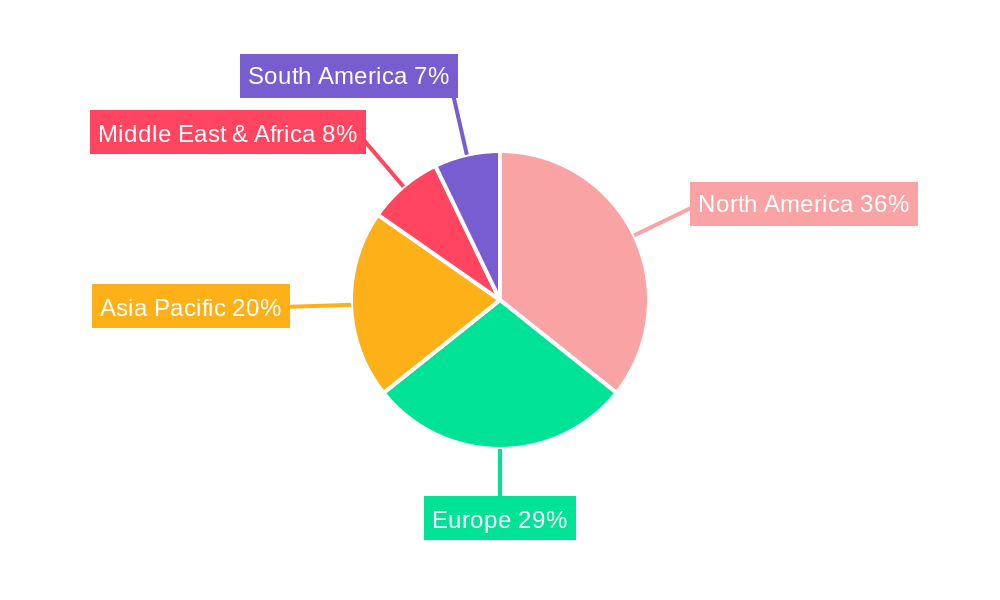

The Valet Parking Services market demonstrates significant dominance across various applications and service types, with a strong geographical concentration in North America and Europe.

Application Dominance:

- Hotels: This segment represents the largest share of the valet parking market, valued at over 2,500 million in the base year. The constant influx of travelers and business guests seeking convenience and a premium experience makes hotels a cornerstone for valet services. Factors like the presence of luxury hotels, increased tourism, and the demand for seamless guest experiences drive sustained growth in this segment.

- Restaurants: Valet parking at upscale and popular restaurants is a significant market segment, estimated at over 1,800 million. This is driven by the desire of diners to avoid parking challenges in busy city centers and to enhance their dining experience from arrival. Economic policies that support the hospitality sector and rising consumer spending on dining out contribute to its prominence.

- Retail Centers: High-end shopping malls and luxury retail destinations contribute substantially, with an estimated market value of over 1,200 million. Consumers visiting these centers often value convenience and time-saving solutions, making valet parking an attractive service, especially during peak shopping seasons. Infrastructure development that leads to the creation of larger retail complexes further boosts this segment.

- Office Buildings: Valet services for corporate clients and their visitors in commercial office buildings represent a growing segment, valued at over 900 million. This is driven by the need for professional image, employee convenience, and efficient management of parking for executive and client vehicles. Government initiatives promoting business districts and corporate infrastructure are key drivers.

- Special Events: This segment, though more sporadic, offers substantial revenue potential, estimated at over 700 million. Weddings, concerts, sporting events, and corporate functions rely heavily on valet services to manage large volumes of vehicles efficiently and provide a smooth guest experience. The increasing number of organized events globally fuels this segment.

- Residential Properties: While a smaller segment compared to commercial applications, the valet parking services for luxury apartments and condominiums are growing, valued at over 400 million. This reflects a rising demand for concierge-like services in upscale residential complexes, enhancing resident convenience and property value.

Type Dominance:

- Short-Term Services: This is the predominant type of valet service, accounting for over 70% of the market share, with a market value exceeding 6,000 million. This includes services for hotels, restaurants, retail, and events where parking is needed for a few hours to a couple of days. The high frequency of use in these applications drives its dominance.

- Long-Term Services: This segment, while smaller, is growing, valued at over 2,500 million. It encompasses services for residential properties and extended parking needs, such as airport valet. The increasing adoption of such services in residential complexes and specialized parking solutions contributes to its growth.

- Short-Term Services: This is the predominant type of valet service, accounting for over 70% of the market share, with a market value exceeding 6,000 million. This includes services for hotels, restaurants, retail, and events where parking is needed for a few hours to a couple of days. The high frequency of use in these applications drives its dominance.

- Long-Term Services: This segment, while smaller, is growing, valued at over 2,500 million. It encompasses services for residential properties and extended parking needs, such as airport valet. The increasing adoption of such services in residential complexes and specialized parking solutions contributes to its growth.

Geographically, North America leads the market due to a high concentration of high-end establishments, advanced technological adoption, and strong consumer demand for convenience. Europe follows closely, driven by its robust tourism and hospitality sectors. Emerging economies in Asia-Pacific are expected to exhibit the highest growth rates due to rapid urbanization and increasing disposable incomes.

Valet Parking Services Product Developments

Product developments in the Valet Parking Services sector are primarily focused on enhancing operational efficiency and customer convenience through technology. The integration of mobile apps for seamless booking, payment, and real-time tracking of vehicles is a key innovation. Advanced AI-powered dispatch systems are optimizing valet team allocation and minimizing wait times. Smart parking solutions that use sensors to monitor space availability and guide attendants are also gaining traction. These developments offer a competitive advantage by improving service speed, reducing errors, and providing a premium, contactless experience for users. The focus is on creating a more intuitive and integrated valet parking ecosystem.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Valet Parking Services market across all its key segments.

- Hotels: This segment, valued at over 2,500 million in the base year, encompasses valet services provided to guests of hotels, resorts, and lodging establishments. Growth is driven by the hospitality industry's emphasis on guest satisfaction and convenience.

- Restaurants: With a market value of over 1,800 million, this segment covers valet parking for dining establishments, particularly in urban and high-traffic areas. Demand is linked to the dining out culture and the need for hassle-free parking.

- Retail Centers: Valued at over 1,200 million, this segment includes valet services at shopping malls, luxury boutiques, and department stores, driven by the retail sector's focus on customer experience and convenience shopping.

- Office Buildings: This segment, worth over 900 million, caters to corporate clients and employees in commercial buildings, offering professional and efficient parking management.

- Residential Properties: Valued at over 400 million, this segment serves luxury apartment complexes and condominiums, providing residents with premium parking solutions and concierge services.

- Special Events: This segment, with a market value of over 700 million, covers temporary, high-volume parking needs for events like weddings, concerts, and conferences.

- Short-Term Services: This dominant segment, exceeding 6,000 million, includes all valet services requiring parking for a duration of a few hours to a few days, prevalent across most applications.

- Long-Term Services: Valued at over 2,500 million, this segment encompasses extended parking solutions, such as for residential properties or long-stay needs.

Key Drivers of Valet Parking Services Growth

The Valet Parking Services market is experiencing robust growth driven by several key factors. Increasing urbanization and the subsequent rise in traffic congestion in major cities make self-parking a significant challenge, thereby boosting demand for convenient valet solutions. A growing middle class with higher disposable incomes is more inclined to opt for premium services that offer convenience and a luxurious experience. Technological advancements, particularly in mobile app integration and AI-driven management systems, are enhancing operational efficiency and customer satisfaction. Furthermore, a greater focus on customer experience in the hospitality, retail, and event management sectors positions valet parking as a crucial component of a premium service offering. Government initiatives aimed at improving urban mobility and smart city development also indirectly support the expansion of such services.

Challenges in the Valet Parking Services Sector

Despite strong growth prospects, the Valet Parking Services sector faces several challenges. Stiff competition from existing players and new entrants, often with aggressive pricing strategies, can impact profitability. Regulatory hurdles and varying local ordinances regarding parking operations, licensing, and staffing can complicate expansion efforts across different regions. Labor shortages and the high cost of training and retaining skilled valet attendants are persistent issues, impacting service quality and operational efficiency. Moreover, public perception and trust can be a challenge, with concerns regarding vehicle safety and the potential for damage. The initial investment required for technology adoption and infrastructure can also be a significant barrier for smaller operators.

Emerging Opportunities in Valet Parking Services

The Valet Parking Services market is rife with emerging opportunities. The integration of sustainable practices, such as the use of electric vehicles for valet fleets and optimized routing to reduce emissions, presents a growing niche. The expansion of smart city initiatives and the demand for integrated mobility solutions offer avenues for partnerships with technology providers and urban planners. The growing events industry worldwide, particularly in emerging economies, presents a substantial opportunity for specialized event valet services. Furthermore, the increasing adoption of advanced technologies like AI-powered predictive analytics for demand forecasting and personalized customer service will redefine the market. The development of subscription-based valet services for residential properties and frequent users is another promising area.

Leading Players in the Valet Parking Services Market

- Valet Parking Service

- Quality Parking Service

- LUXE

- Preferred Valet Parking

- FC Valet

- Red Top Valet

- Best Valet

- Uboche

- Unparalleled Parking

- Y-Drive

- ParkSmart

- Valet-It

Key Developments in Valet Parking Services Industry

- 2024: Launch of AI-powered predictive analytics for demand forecasting by several leading companies.

- 2023: Increased adoption of contactless payment systems and mobile app-based booking across the industry.

- 2023: Strategic partnerships formed between valet service providers and luxury hotels to offer integrated premium experiences.

- 2022: Significant investment in electric vehicle fleets for valet services by eco-conscious operators.

- 2021: Mergers and acquisitions to consolidate market share and expand service offerings in key urban centers.

- 2020: Enhanced safety protocols and contactless service models implemented in response to the global pandemic.

- 2019: Introduction of advanced GPS tracking and in-app communication features for enhanced customer transparency.

Strategic Outlook for Valet Parking Services Market

The strategic outlook for the Valet Parking Services market is highly positive, driven by a confluence of increasing urbanization, evolving consumer expectations for convenience, and continuous technological innovation. Companies that focus on integrating advanced technologies like AI and IoT will be best positioned to optimize operations, enhance customer experience, and gain a competitive edge. Expansion into emerging markets and diversification of service offerings, including long-term residential solutions and eco-friendly options, represent significant growth catalysts. Strategic partnerships and potential consolidation through M&A will continue to shape the competitive landscape, favoring agile and forward-thinking organizations. The overarching trend is towards a more seamless, efficient, and personalized valet parking experience, making this a dynamic and opportunity-rich sector.

Valet Parking Services Segmentation

-

1. Application

- 1.1. Hotels

- 1.2. Restaurants

- 1.3. Retail Centers

- 1.4. Office Buildings

- 1.5. Residential Properties

- 1.6. Special Events

-

2. Types

- 2.1. Short-Term Services

- 2.2. Long-Term Services

Valet Parking Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Valet Parking Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Valet Parking Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hotels

- 5.1.2. Restaurants

- 5.1.3. Retail Centers

- 5.1.4. Office Buildings

- 5.1.5. Residential Properties

- 5.1.6. Special Events

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Short-Term Services

- 5.2.2. Long-Term Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Valet Parking Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hotels

- 6.1.2. Restaurants

- 6.1.3. Retail Centers

- 6.1.4. Office Buildings

- 6.1.5. Residential Properties

- 6.1.6. Special Events

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Short-Term Services

- 6.2.2. Long-Term Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Valet Parking Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hotels

- 7.1.2. Restaurants

- 7.1.3. Retail Centers

- 7.1.4. Office Buildings

- 7.1.5. Residential Properties

- 7.1.6. Special Events

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Short-Term Services

- 7.2.2. Long-Term Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Valet Parking Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hotels

- 8.1.2. Restaurants

- 8.1.3. Retail Centers

- 8.1.4. Office Buildings

- 8.1.5. Residential Properties

- 8.1.6. Special Events

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Short-Term Services

- 8.2.2. Long-Term Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Valet Parking Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hotels

- 9.1.2. Restaurants

- 9.1.3. Retail Centers

- 9.1.4. Office Buildings

- 9.1.5. Residential Properties

- 9.1.6. Special Events

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Short-Term Services

- 9.2.2. Long-Term Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Valet Parking Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hotels

- 10.1.2. Restaurants

- 10.1.3. Retail Centers

- 10.1.4. Office Buildings

- 10.1.5. Residential Properties

- 10.1.6. Special Events

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Short-Term Services

- 10.2.2. Long-Term Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Valet Parking Service

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Quality Parking Service

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LUXE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Preferred Valet Parking

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FC Valet

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Red Top Valet

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Best Valet

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Uboche

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Unparalleled Parking

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Y-Drive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ParkSmart

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Valet-It

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Valet Parking Service

List of Figures

- Figure 1: Global Valet Parking Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Valet Parking Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Valet Parking Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Valet Parking Services Revenue (million), by Types 2024 & 2032

- Figure 5: North America Valet Parking Services Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Valet Parking Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Valet Parking Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Valet Parking Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Valet Parking Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Valet Parking Services Revenue (million), by Types 2024 & 2032

- Figure 11: South America Valet Parking Services Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Valet Parking Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Valet Parking Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Valet Parking Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Valet Parking Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Valet Parking Services Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Valet Parking Services Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Valet Parking Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Valet Parking Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Valet Parking Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Valet Parking Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Valet Parking Services Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Valet Parking Services Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Valet Parking Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Valet Parking Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Valet Parking Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Valet Parking Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Valet Parking Services Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Valet Parking Services Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Valet Parking Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Valet Parking Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Valet Parking Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Valet Parking Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Valet Parking Services Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Valet Parking Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Valet Parking Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Valet Parking Services Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Valet Parking Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Valet Parking Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Valet Parking Services Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Valet Parking Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Valet Parking Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Valet Parking Services Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Valet Parking Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Valet Parking Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Valet Parking Services Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Valet Parking Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Valet Parking Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Valet Parking Services Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Valet Parking Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Valet Parking Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Valet Parking Services?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Valet Parking Services?

Key companies in the market include Valet Parking Service, Quality Parking Service, LUXE, Preferred Valet Parking, FC Valet, Red Top Valet, Best Valet, Uboche, Unparalleled Parking, Y-Drive, ParkSmart, Valet-It.

3. What are the main segments of the Valet Parking Services?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Valet Parking Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Valet Parking Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Valet Parking Services?

To stay informed about further developments, trends, and reports in the Valet Parking Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence