Key Insights

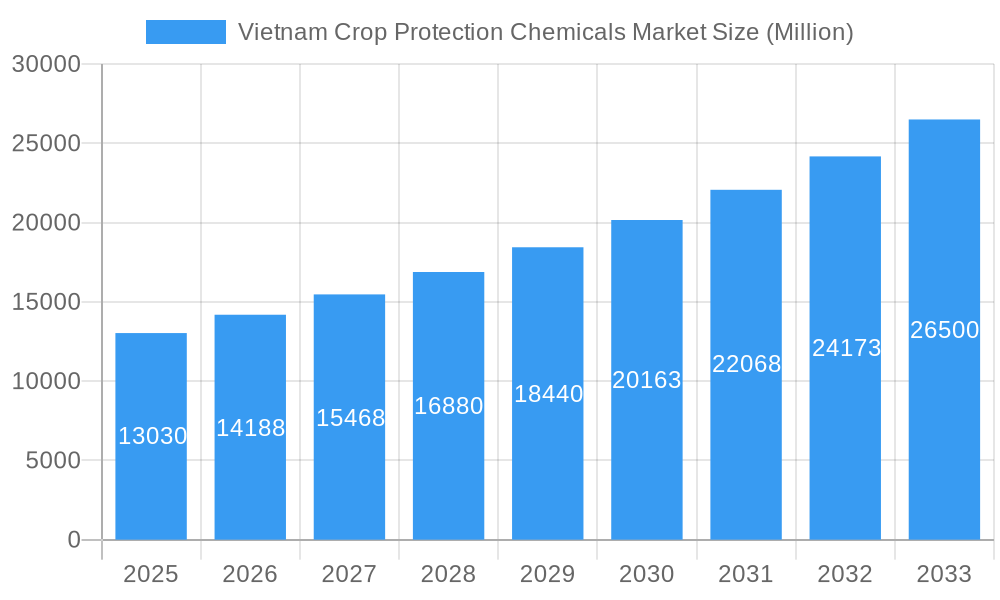

The Vietnam Crop Protection Chemicals Market is poised for robust expansion, projected to reach an estimated $13.03 billion in 2025, driven by a CAGR of 9.13% over the forecast period of 2025-2033. This growth is fueled by the increasing demand for food security, the adoption of advanced agricultural practices, and the need to combat evolving pest and disease pressures affecting Vietnam's vital agricultural sector. Key market drivers include government initiatives promoting sustainable agriculture, rising farmer incomes, and the continuous introduction of innovative and more effective crop protection solutions by leading global and local agrochemical companies. The market's expansion is further supported by the strategic importance of agriculture to Vietnam's economy, necessitating efficient and effective crop yield enhancement.

Vietnam Crop Protection Chemicals Market Market Size (In Billion)

The market segmentation reveals a diverse landscape, with Fungicides, Herbicides, and Insecticides forming the dominant functional segments. Application modes such as Foliar, Seed Treatment, and Soil Treatment are expected to witness significant uptake, reflecting a shift towards precision agriculture and integrated pest management strategies. Commercial Crops, Fruits & Vegetables, and Grains & Cereals represent the primary crop types benefiting from these advanced solutions, aligning with Vietnam's export-oriented agricultural production. While the market is dynamic, potential restraints such as stringent regulatory policies, growing concerns over environmental impact, and the adoption of organic farming practices are being addressed through the development of eco-friendly and targeted crop protection products. The presence of major global players like Bayer AG, Syngenta Group, and BASF SE, alongside strong domestic entities, indicates a competitive yet innovative market environment.

Vietnam Crop Protection Chemicals Market Company Market Share

Vietnam Crop Protection Chemicals Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

Unlock actionable insights into Vietnam's dynamic crop protection chemicals market with this in-depth report. Spanning from 2019 to 2033, with a base and estimated year of 2025, this comprehensive analysis delves into the market's growth drivers, segmentation, competitive landscape, and future trajectory. Explore the impact of fungicides, herbicides, insecticides, and more on key crop types like commercial crops, fruits & vegetables, and grains & cereals. Understand critical industry developments, strategic partnerships, and emerging opportunities that will shape the Vietnam crop protection chemicals market size, Vietnam agrochemical market, and Vietnam pesticide market. This report is your indispensable guide to navigating the complexities of Vietnam agricultural inputs, crop protection solutions Vietnam, and sustainable agriculture Vietnam.

Vietnam Crop Protection Chemicals Market Market Concentration & Innovation

The Vietnam crop protection chemicals market exhibits a moderately concentrated landscape, driven by a few dominant international players alongside an increasing number of domestic manufacturers. Innovation is a key differentiator, with companies focusing on developing advanced formulations, integrated pest management (IPM) solutions, and bio-pesticides to meet the evolving needs of Vietnamese farmers and address growing environmental concerns. Regulatory frameworks, overseen by the Ministry of Agriculture and Rural Development (MARD), play a crucial role in approving new products and ensuring their safe and effective use. The threat of product substitutes, such as biological control agents and organic farming practices, is gradually increasing, pushing chemical manufacturers to enhance the efficacy and sustainability of their offerings. End-user trends indicate a growing preference for targeted and residue-free solutions, particularly for high-value crops like fruits and vegetables. Mergers and acquisitions (M&A) activity, while not extensively documented with specific deal values, are indicative of strategic consolidation and expansion efforts by key stakeholders, aiming to strengthen their market presence and technological capabilities in Vietnam. Market share is largely held by multinational corporations, though local players are gaining traction with cost-effective solutions and localized distribution networks.

- Market Concentration: Moderate, with leading global players holding significant market share.

- Innovation Drivers: Demand for high-efficacy, eco-friendly solutions, resistance management, and IPM.

- Regulatory Frameworks: Strict approvals and usage guidelines from MARD.

- Product Substitutes: Growing adoption of biological controls and organic farming methods.

- End-User Trends: Preference for targeted, residue-free products, especially for export-oriented crops.

- M&A Activities: Strategic consolidations for market access and technological advancement.

Vietnam Crop Protection Chemicals Market Industry Trends & Insights

The Vietnam crop protection chemicals market is experiencing robust growth, propelled by several key trends and insights that are reshaping its trajectory. A primary growth driver is the increasing demand for food security to feed a growing population and cater to rising export markets, necessitating enhanced crop yields and protection against pests and diseases. The government's focus on modernizing agriculture and promoting high-tech farming practices further fuels the adoption of advanced crop protection solutions. Technological disruptions, including the development of precision agriculture, smart spraying technologies, and digital farming platforms, are influencing how crop protection chemicals are applied, leading to increased efficiency and reduced environmental impact. Consumer preferences are shifting towards safer, residue-free produce, especially for export markets, pushing manufacturers to develop and promote less toxic and more targeted chemical formulations, as well as bio-based alternatives. The competitive dynamics within the market are intensifying, with a blend of established global players and emerging local companies vying for market share. This competition fosters innovation and drives down prices, benefiting farmers. The Vietnam crop protection chemicals market CAGR is projected to be robust, reflecting these positive growth factors. Market penetration of advanced crop protection solutions is steadily increasing, driven by farmer education initiatives and the availability of government support schemes. The emphasis on sustainable agriculture and integrated pest management (IPM) is a significant trend, encouraging the development of a diverse portfolio of products that includes both conventional and biological control agents. The increasing frequency and intensity of extreme weather events due to climate change also contribute to the demand for effective crop protection to mitigate crop losses. Furthermore, the expansion of irrigation infrastructure and adoption of modern farming techniques in Vietnam are creating larger arable land areas amenable to the use of crop protection chemicals. The market is also witnessing a rise in demand for specialized products tailored to specific crop types and pest profiles, moving away from broad-spectrum applications. The regulatory environment, while evolving, is becoming more stringent regarding the registration and use of pesticides, encouraging a shift towards safer and more environmentally sound products. The economic growth of Vietnam and the increasing disposable income of farmers also contribute to their capacity to invest in advanced agricultural inputs.

- Growth Drivers: Food security needs, government modernization initiatives, export demand, and climate change impacts.

- Technological Disruptions: Precision agriculture, smart spraying, and digital farming platforms.

- Consumer Preferences: Demand for safe, residue-free, and sustainably produced food.

- Competitive Dynamics: Intense competition leading to innovation and price efficiency.

- Market Penetration: Increasing adoption of advanced crop protection solutions across various crop segments.

- Sustainable Agriculture: Growing emphasis on IPM and bio-based alternatives.

Dominant Markets & Segments in Vietnam Crop Protection Chemicals Market

The Vietnam crop protection chemicals market exhibits distinct dominance across various segments, driven by agricultural practices, economic policies, and crop cultivation patterns. The Herbicide segment consistently holds a dominant position, primarily due to the extensive cultivation of rice, the staple grain crop, which requires significant weed management. Government initiatives promoting increased rice production for both domestic consumption and export further bolster this segment. Economic policies supporting agricultural exports, particularly for rice and coffee, directly influence the demand for effective herbicides. Infrastructure development, including improved irrigation systems and better access to farmlands, also facilitates the wider application of herbicides across various crops.

Dominant Segment (Function): Herbicides lead due to extensive rice cultivation and weed management needs.

- Key Drivers: Government support for rice production, demand for increased crop yields, and efficient weed control for staple crops.

- Market Dominance Analysis: Rice farming, a cornerstone of Vietnam's agriculture, requires robust herbicide solutions to combat weed infestation, ensuring optimal grain development and harvest. The widespread use of herbicides in rice paddies significantly contributes to the segment's overall market share and value.

Dominant Application Mode: Foliar application remains the most prevalent method, offering direct and efficient delivery of crop protection chemicals to plant surfaces.

- Key Drivers: Ease of application, immediate impact on pests and diseases, and suitability for a wide range of crops and field conditions.

- Market Dominance Analysis: The traditional and most accessible application method for many Vietnamese farmers, foliar spraying, ensures that fungicides, insecticides, and herbicides are directly applied to leaves and stems, providing swift protection against various threats.

Dominant Crop Type: Grains & Cereals, with rice being the leading contributor, represents the largest segment in terms of volume and value.

- Key Drivers: Vietnam's status as a major rice producer and exporter, government focus on food security, and large-scale cultivation practices.

- Market Dominance Analysis: The sheer scale of rice cultivation across Vietnam makes Grains & Cereals the most significant end-use segment. The demand for effective crop protection is constant to ensure consistent yields and quality, driving substantial consumption of various chemical inputs.

The Insecticide segment also commands significant market share, driven by the need to protect high-value crops like fruits and vegetables from a multitude of insect pests that can cause substantial economic losses and affect export quality. Commercial crops, including rubber and coffee, also contribute to insecticide demand due to specific pest pressures. Government policies aimed at boosting agricultural exports and ensuring product quality for international markets indirectly support the use of effective insecticides.

Significant Segment (Function): Insecticides are crucial for protecting high-value crops and export commodities.

- Key Drivers: Protecting fruits, vegetables, coffee, and rubber from insect damage, meeting stringent export quality standards, and managing pest resistance.

- Market Dominance Analysis: The economic importance of fruits, vegetables, coffee, and rubber makes the insecticide segment critical. Farmers invest heavily in insecticides to prevent crop damage, minimize post-harvest losses, and meet the demanding quality specifications of global buyers.

Emerging Application Mode: Seed Treatment is gaining traction, offering a proactive approach to crop protection by safeguarding seeds and seedlings from early-stage pests and diseases.

- Key Drivers: Increased adoption of modern farming practices, demand for reduced chemical usage, and protection against soil-borne pathogens and early-season pests.

- Market Dominance Analysis: While currently a smaller segment, seed treatment is poised for significant growth as farmers recognize its benefits in ensuring healthier crop establishment and reducing the need for later-stage interventions, particularly in cereals and commercial crops.

In the Crop Type segmentation, Fruits & Vegetables represent a high-value segment with a growing demand for specialized crop protection solutions due to their susceptibility to a wide array of pests and diseases and the stringent quality requirements for both domestic and international markets.

- High-Value Segment (Crop Type): Fruits & Vegetables demand specialized and effective protection solutions.

- Key Drivers: Export market demands, consumer preference for blemish-free produce, and susceptibility to diverse pests and diseases.

- Market Dominance Analysis: The cultivation of fruits and vegetables, particularly for export to markets like Europe, Japan, and the US, necessitates the use of advanced and often more expensive crop protection chemicals to meet strict residue limits and quality standards.

Vietnam Crop Protection Chemicals Market Product Developments

Product development in the Vietnam crop protection chemicals market is characterized by a strategic focus on enhanced efficacy, reduced environmental impact, and integrated pest management solutions. Leading companies are investing in R&D to create novel formulations, such as microencapsulation and controlled-release technologies, which improve product performance and minimize off-target effects. The development of selective herbicides that target specific weeds without harming the crop, and insecticides with novel modes of action to combat resistance, are key areas of innovation. Furthermore, the increasing demand for sustainable agriculture is driving the development and commercialization of bio-pesticides and bio-stimulants, offering eco-friendly alternatives to conventional chemicals and providing competitive advantages for market leaders.

Report Scope & Segmentation Analysis

This report offers a granular analysis of the Vietnam crop protection chemicals market, segmenting it comprehensively across multiple dimensions. The Function segmentation includes Fungicides, Herbicides, Insecticides, Molluscicides, and Nematicides, providing insights into the demand drivers and market dynamics for each category. The Application Mode segmentation covers Chemigation, Foliar, Fumigation, Seed Treatment, and Soil Treatment, highlighting the evolving methods of chemical application and their adoption rates. The Crop Type segmentation includes Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, and Turf & Ornamental, detailing the specific needs and market potential within each agricultural sector. Each segment is analyzed for its market size, growth projections, and competitive landscape, offering a holistic view of the market's structure and future potential.

- Function Segmentation: Fungicides, Herbicides, Insecticides, Molluscicides, Nematicides. Each function's market size and growth projections are analyzed, considering pest and disease prevalence specific to Vietnam's agricultural landscape.

- Application Mode Segmentation: Chemigation, Foliar, Fumigation, Seed Treatment, Soil Treatment. The adoption trends and efficacy of each application mode are explored, with a focus on emerging technologies like precision application.

- Crop Type Segmentation: Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, Turf & Ornamental. The unique crop protection needs and market potential for each crop type are assessed, considering their economic significance and cultivation practices in Vietnam.

Key Drivers of Vietnam Crop Protection Chemicals Market Growth

The Vietnam crop protection chemicals market is propelled by a confluence of robust growth drivers. The escalating demand for food security, driven by a growing population and increasing export opportunities, necessitates higher agricultural productivity, which in turn relies on effective crop protection. Government support for agricultural modernization and the promotion of high-tech farming practices further catalyze market expansion. Technological advancements in agrochemicals, leading to more efficient and targeted solutions, are also key drivers. Furthermore, the increasing prevalence of pests and diseases, exacerbated by climate change and the introduction of invasive species, creates a continuous need for chemical interventions. The growing awareness among farmers regarding the economic benefits of using crop protection chemicals to minimize crop losses and improve yield quality also significantly contributes to market growth.

Challenges in the Vietnam Crop Protection Chemicals Market Sector

Despite its growth potential, the Vietnam crop protection chemicals market faces several significant challenges. Stringent and evolving regulatory frameworks for the registration and use of pesticides can create hurdles for market entry and product approval, demanding significant investment in research and development. Concerns over the environmental impact and potential health risks associated with certain chemicals are leading to increasing public scrutiny and demand for safer alternatives. Issues within the supply chain, including logistical complexities and the availability of raw materials, can impact product availability and cost. Moreover, the increasing incidence of pest resistance to existing chemical formulations necessitates continuous innovation and the development of new products, which can be costly and time-consuming. Fierce competition from both international and domestic players can also put pressure on profit margins.

Emerging Opportunities in Vietnam Crop Protection Chemicals Market

The Vietnam crop protection chemicals market presents several exciting emerging opportunities. The growing trend towards sustainable agriculture and organic farming is fostering a significant demand for bio-pesticides, bio-stimulants, and integrated pest management (IPM) solutions, opening new avenues for market players. The increasing adoption of digital agriculture and precision farming technologies presents opportunities for smart application systems and data-driven crop protection strategies. Furthermore, the demand for specialized crop protection products tailored for high-value crops, particularly those destined for export markets with stringent quality standards, is on the rise. The continuous need to address pest resistance through the development of novel active ingredients and combination products also represents a significant opportunity for innovation and market differentiation.

Leading Players in the Vietnam Crop Protection Chemicals Market Market

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Wynca Group

- Syngenta Group

- BASF SE

- FMC Corporation

- UPL limited

- Corteva Agriscience

- Nufarm Ltd

Key Developments in Vietnam Crop Protection Chemicals Market Industry

- January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

- August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.

- May 2022: UPL partnered with Bayer for Spirotetramat insecticide to develop new pest management solutions. Through this long-term global data access and supply agreement with Bayer, specifically for addressing farmer demands regarding resistance management and difficult-to-control sucking pests, UPL will develop, register, and distribute new unique solutions, including Spirotetramat, using its experience in insecticides and worldwide research and development network.

Strategic Outlook for Vietnam Crop Protection Chemicals Market Market

The strategic outlook for the Vietnam crop protection chemicals market is overwhelmingly positive, driven by ongoing agricultural modernization and the imperative for food security. Future growth will be shaped by the increasing adoption of sustainable agricultural practices, including the integration of bio-based solutions alongside conventional chemicals. Companies that invest in research and development for novel active ingredients, resistance management strategies, and precision application technologies will be well-positioned for success. The rising demand for high-quality produce for export markets will continue to fuel the need for advanced crop protection solutions that meet stringent international standards. Collaboration and strategic partnerships, as evidenced by recent industry developments, will be crucial for expanding market reach, sharing technological expertise, and navigating the evolving regulatory landscape, ensuring a robust and dynamic future for the market.

Vietnam Crop Protection Chemicals Market Segmentation

-

1. Function

- 1.1. Fungicide

- 1.2. Herbicide

- 1.3. Insecticide

- 1.4. Molluscicide

- 1.5. Nematicide

-

2. Application Mode

- 2.1. Chemigation

- 2.2. Foliar

- 2.3. Fumigation

- 2.4. Seed Treatment

- 2.5. Soil Treatment

-

3. Crop Type

- 3.1. Commercial Crops

- 3.2. Fruits & Vegetables

- 3.3. Grains & Cereals

- 3.4. Pulses & Oilseeds

- 3.5. Turf & Ornamental

-

4. Function

- 4.1. Fungicide

- 4.2. Herbicide

- 4.3. Insecticide

- 4.4. Molluscicide

- 4.5. Nematicide

-

5. Application Mode

- 5.1. Chemigation

- 5.2. Foliar

- 5.3. Fumigation

- 5.4. Seed Treatment

- 5.5. Soil Treatment

-

6. Crop Type

- 6.1. Commercial Crops

- 6.2. Fruits & Vegetables

- 6.3. Grains & Cereals

- 6.4. Pulses & Oilseeds

- 6.5. Turf & Ornamental

Vietnam Crop Protection Chemicals Market Segmentation By Geography

- 1. Vietnam

Vietnam Crop Protection Chemicals Market Regional Market Share

Geographic Coverage of Vietnam Crop Protection Chemicals Market

Vietnam Crop Protection Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.12999999999994% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. The demand for pesticides is driven by the need for effective control of pests and diseases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Crop Protection Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Fungicide

- 5.1.2. Herbicide

- 5.1.3. Insecticide

- 5.1.4. Molluscicide

- 5.1.5. Nematicide

- 5.2. Market Analysis, Insights and Forecast - by Application Mode

- 5.2.1. Chemigation

- 5.2.2. Foliar

- 5.2.3. Fumigation

- 5.2.4. Seed Treatment

- 5.2.5. Soil Treatment

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Commercial Crops

- 5.3.2. Fruits & Vegetables

- 5.3.3. Grains & Cereals

- 5.3.4. Pulses & Oilseeds

- 5.3.5. Turf & Ornamental

- 5.4. Market Analysis, Insights and Forecast - by Function

- 5.4.1. Fungicide

- 5.4.2. Herbicide

- 5.4.3. Insecticide

- 5.4.4. Molluscicide

- 5.4.5. Nematicide

- 5.5. Market Analysis, Insights and Forecast - by Application Mode

- 5.5.1. Chemigation

- 5.5.2. Foliar

- 5.5.3. Fumigation

- 5.5.4. Seed Treatment

- 5.5.5. Soil Treatment

- 5.6. Market Analysis, Insights and Forecast - by Crop Type

- 5.6.1. Commercial Crops

- 5.6.2. Fruits & Vegetables

- 5.6.3. Grains & Cereals

- 5.6.4. Pulses & Oilseeds

- 5.6.5. Turf & Ornamental

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADAMA Agricultural Solutions Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wynca Group (Wynca Chemicals

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Syngenta Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FMC Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPL limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corteva Agriscience

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nufarm Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 ADAMA Agricultural Solutions Ltd

List of Figures

- Figure 1: Vietnam Crop Protection Chemicals Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Vietnam Crop Protection Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 2: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 3: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 4: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 5: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 6: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 7: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 9: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 10: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 11: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 12: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 13: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 14: Vietnam Crop Protection Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Crop Protection Chemicals Market?

The projected CAGR is approximately 9.12999999999994%.

2. Which companies are prominent players in the Vietnam Crop Protection Chemicals Market?

Key companies in the market include ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals, Syngenta Group, BASF SE, FMC Corporation, UPL limited, Corteva Agriscience, Nufarm Ltd.

3. What are the main segments of the Vietnam Crop Protection Chemicals Market?

The market segments include Function, Application Mode, Crop Type, Function, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

The demand for pesticides is driven by the need for effective control of pests and diseases.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.May 2022: UPL partnered with Bayer for Spirotetramat insecticide to develop new pest management solutions. Through this long-term global data access and supply agreement with Bayer, specifically for addressing farmer demands regarding resistance management and difficult-to-control sucking pests, UPL will develop, register, and distribute new unique solutions, including Spirotetramat, using its experience in insecticides and worldwide research and development network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Crop Protection Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Crop Protection Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Crop Protection Chemicals Market?

To stay informed about further developments, trends, and reports in the Vietnam Crop Protection Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence