Key Insights

The global Wet Glue Labeling Machine market is poised for robust growth, with a current market size of $12.1 billion in 2025 and an anticipated Compound Annual Growth Rate (CAGR) of 3.3% from 2019 to 2033. This steady expansion is primarily fueled by the increasing demand for efficiently labeled products across a wide spectrum of consumer-facing industries. The food and beverage sector, a consistent driver of packaging innovation, continues to rely heavily on wet glue labeling for its cost-effectiveness and suitability for various container types, particularly glass bottles. Similarly, the pharmaceutical industry's stringent labeling requirements for product identification and regulatory compliance further bolster the market. The cosmetics and household goods segments also contribute significantly, driven by the constant introduction of new products and the need for appealing, durable labels. Emerging economies, with their burgeoning middle class and expanding manufacturing bases, present significant growth opportunities as adoption of automated labeling solutions increases.

Wet Glue Labeling Machine Industry Market Size (In Billion)

Key trends shaping the Wet Glue Labeling Machine market include advancements in machine precision and speed, enabling higher throughput and reduced operational costs. Manufacturers are also focusing on developing machines that can handle a wider range of label materials, including paper, plastic, and metallized films, catering to diverse product aesthetics and functional needs. The market is segmented by glue type, with hot melt adhesives and water-based adhesives dominating applications, each offering distinct advantages in terms of adhesion strength and drying times. The increasing emphasis on sustainable packaging is also influencing the development of machines capable of working with eco-friendly adhesives and recyclable label materials. While the market benefits from consistent demand, potential restraints could arise from the initial capital investment required for advanced labeling machinery and the growing competition from alternative labeling technologies like self-adhesive labeling, particularly in niche applications. However, the inherent cost-effectiveness and reliability of wet glue labeling are expected to maintain its strong market position.

Wet Glue Labeling Machine Industry Company Market Share

Wet Glue Labeling Machine Industry Market Concentration & Innovation

The global Wet Glue Labeling Machine Industry exhibits a moderate to high market concentration, with a few dominant players accounting for a significant market share estimated at over 70 billion. Key companies like Denmark Machine Tools, Shree Bhagwati Machtech (India) Pvt Ltd, Brothers Pharmamach (India) Pvt Ltd, Shenzhen Penglai Industrial Corporation Limited, Langguth GmbH - Etikettiermaschinen, Maruti Machines Pvt Ltd, Qingdao Senmei Packaging Machinery Co Ltd, Gernep GmbH, Ace Technologies Pvt Ltd, Packwell India Machinery, Zhangjiagang Alps Machine Co Ltd, are driving innovation and market expansion. Innovation in this sector is primarily fueled by the demand for increased efficiency, reduced operational costs, and enhanced labeling accuracy across various end-user industries. Technological advancements focusing on speed, precision, and versatility in handling different label materials and container shapes are crucial. Regulatory frameworks, particularly in the pharmaceutical and food sectors, play a vital role in dictating labeling standards, thereby influencing machine design and capabilities. Product substitutes, such as self-adhesive labeling machines, present a competitive challenge, though wet glue labeling machines continue to hold a strong position due to their cost-effectiveness for high-volume production. End-user trends, such as the growing demand for eye-catching packaging and the need for tamper-evident labeling, are spurring further innovation. Mergers and acquisitions (M&A) activities, though not extensively documented in publicly available figures, are observed as a strategy for market consolidation and technological integration, with estimated deal values reaching hundreds of millions.

Wet Glue Labeling Machine Industry Industry Trends & Insights

The Wet Glue Labeling Machine Industry is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.2% during the forecast period of 2025–2033. This expansion is propelled by a confluence of factors, including the escalating global demand for packaged goods, particularly in the food and beverage and pharmaceutical sectors. The continuous evolution of packaging aesthetics and brand differentiation strategies necessitates efficient and reliable labeling solutions, which wet glue labeling machines provide at a competitive cost for high-volume applications. Technological disruptions are a significant trend, with manufacturers investing in research and development to enhance machine capabilities. Innovations include the integration of advanced robotics for greater precision, the development of more energy-efficient systems to reduce operational costs for end-users, and the implementation of smart technologies for real-time monitoring and data analytics. These advancements aim to improve labeling speed, reduce adhesive consumption, and minimize downtime. Consumer preferences are also subtly influencing the market; while the focus is on product safety and information clarity, visually appealing labels that enhance brand recall are increasingly sought after, driving the demand for machines capable of applying intricate and precisely positioned labels. The competitive dynamics within the industry are characterized by a blend of established global players and emerging regional manufacturers, particularly from Asia, who are offering cost-effective solutions. This competition fosters a drive towards continuous improvement in product quality and service delivery. The market penetration of wet glue labeling machines remains high in traditional markets, while emerging economies present significant untapped potential due to industrialization and growing consumer markets. The industry is also witnessing a trend towards the development of specialized machines catering to specific product types or container materials, further segmenting the market and driving niche innovation. The increasing emphasis on sustainable packaging is also influencing the design of labeling machines, encouraging the use of eco-friendly adhesives and minimizing waste. The overall market size is projected to surpass 150 billion by the end of the forecast period.

Dominant Markets & Segments in Wet Glue Labeling Machine Industry

The Food and Beverage segment stands out as the dominant end-user for wet glue labeling machines, commanding an estimated market share exceeding 40 billion. This dominance is attributed to the sheer volume of packaged food and beverage products globally, requiring high-speed, cost-effective labeling solutions for mass production.

Glue Type Dominance:

- Water Based Adhesive: This glue type holds a significant share, estimated at over 60 billion, due to its broad applicability across various container materials and its environmental friendliness, aligning with growing sustainability concerns. Its cost-effectiveness for high-volume production further solidifies its position.

- Hot Melt Adhesive: While generally used for more specialized applications or faster drying times, hot melt adhesives represent a substantial segment, estimated around 30 billion, particularly where rapid processing or strong adhesion to challenging surfaces is required.

Material Type Dominance:

- Paper: Paper labels, being the most cost-effective and widely available, represent the largest material type segment, with a market value estimated at over 80 billion. Their versatility and ease of application with wet glue adhesives make them a staple in many industries.

- Plastic: Plastic and metallized film labels are gaining traction due to their enhanced durability, aesthetic appeal, and barrier properties. This segment is estimated to be worth over 40 billion, driven by premium product packaging needs.

End-User Dominance:

- Food: The food industry is the primary consumer, with its vast product range and high production volumes contributing an estimated 50 billion to the wet glue labeling machine market.

- Beverage: Closely following, the beverage sector, encompassing alcoholic and non-alcoholic drinks, also represents a massive market, estimated at over 45 billion, with similar demands for high-speed, efficient labeling.

- Pharmaceutical: While not the largest in volume, the pharmaceutical segment is a critical market with stringent regulatory requirements for labeling accuracy and tamper-evidence. This niche segment is valued at over 20 billion and is characterized by high-value, precision-oriented machines.

- Cosmetics & Household: This segment, estimated at over 25 billion, benefits from wet glue labeling for its cost-effectiveness in applying decorative and informative labels to a wide array of products.

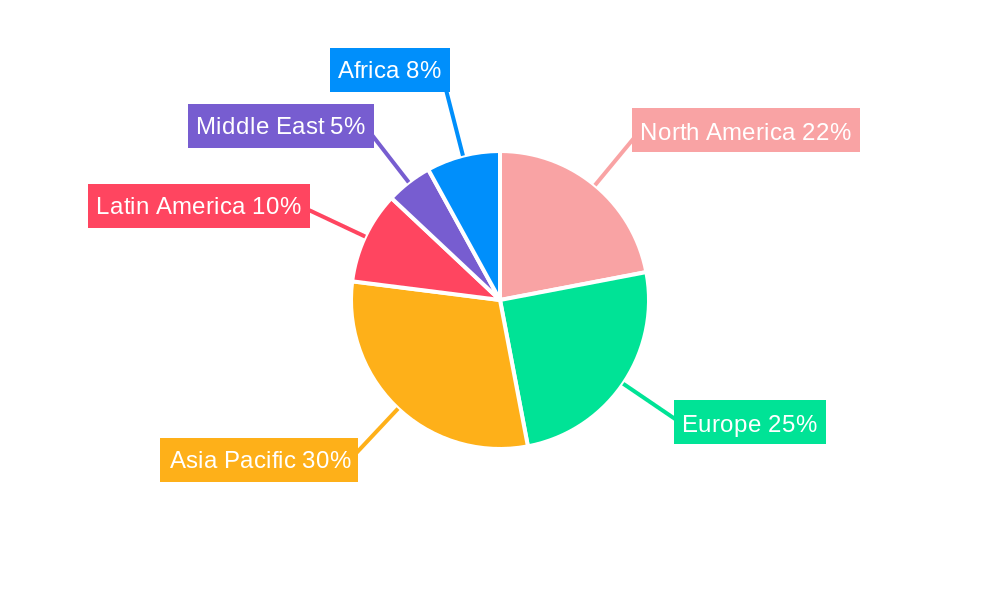

The Asia-Pacific region, particularly countries like China and India, represents the dominant geographical market, with an estimated market size exceeding 60 billion. This dominance is fueled by a rapidly expanding manufacturing base, a growing middle class driving consumer demand, and government initiatives promoting industrial automation and localized production. Economic policies supporting manufacturing growth, coupled with significant investments in packaging infrastructure, are key drivers.

Wet Glue Labeling Machine Industry Product Developments

Product developments in the Wet Glue Labeling Machine Industry are focused on enhancing efficiency, precision, and adaptability. Manufacturers are introducing machines with higher labeling speeds, capable of applying over 200 labels per minute, and improved accuracy to within +/- 1mm tolerance. Innovations include the integration of advanced sensor technologies for seamless operation with varying container types and the development of modular designs allowing for quick changeovers between different product formats. The use of servo-driven systems ensures precise label placement and reduced adhesive waste. Furthermore, advancements in software and automation are enabling real-time performance monitoring and remote diagnostics, enhancing machine reliability and minimizing downtime, thus providing significant competitive advantages to adopters.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Wet Glue Labeling Machine Industry across several key segments. The Hot Melt Adhesive segment, estimated at over 30 billion, is characterized by its specialized applications where rapid setting times are crucial. The Water Based Adhesive segment, valued at over 60 billion, dominates due to its cost-effectiveness and wide applicability, representing a core focus for many manufacturers. In terms of material types, the Paper segment, projected to grow at a CAGR of 4.8% and valued at over 80 billion, remains the largest due to its economic advantages. The Plastic and Metallized Film segments, collectively valued at over 40 billion, are experiencing robust growth driven by premium packaging trends and an estimated CAGR of 5.5%. The Food and Beverage end-user segments, holding substantial market shares of over 50 billion and 45 billion respectively, are expected to continue their strong growth trajectory, driven by global consumption patterns. The Pharmaceutical segment, though smaller at over 20 billion, is critical due to its high-value applications and strict regulatory demands, with an estimated CAGR of 5.0%. The Cosmetics & Household segment, valued at over 25 billion, benefits from the need for visually appealing and informative labeling, while Other End-Users represent a diverse and growing market.

Key Drivers of Wet Glue Labeling Machine Industry Growth

The growth of the Wet Glue Labeling Machine Industry is primarily driven by several key factors. Economically, the burgeoning global demand for packaged goods, particularly in emerging economies, fuels the need for efficient and high-volume labeling solutions. Technologically, advancements in machine design, leading to increased speed, accuracy, and reduced operational costs, are compelling end-users to upgrade their labeling capabilities. The development of more versatile machines that can handle a wider range of container shapes and label materials also contributes significantly. Regulatory frameworks, especially in the pharmaceutical and food sectors, which mandate clear and compliant labeling, create a consistent demand for reliable labeling equipment. Furthermore, the increasing focus on brand differentiation and the need for aesthetically pleasing packaging are pushing manufacturers to invest in sophisticated labeling machines.

Challenges in the Wet Glue Labeling Machine Industry Sector

Despite its growth, the Wet Glue Labeling Machine Industry faces several challenges. The primary challenge is the intense competition from alternative labeling technologies, particularly self-adhesive labeling machines, which offer ease of application and speed in certain scenarios, impacting market share in some niches. Fluctuations in the cost of raw materials, including adhesives and labeling materials, can impact profit margins for both manufacturers and end-users, creating cost pressures. Stringent and evolving regulatory landscapes, especially concerning food safety and pharmaceutical labeling, necessitate continuous adaptation and investment in compliance, which can be a significant barrier for smaller players. Supply chain disruptions, as witnessed in recent global events, can lead to delays in component availability and increased manufacturing costs. Additionally, the initial capital investment required for advanced wet glue labeling machines can be a deterrent for small and medium-sized enterprises (SMEs), limiting market penetration in certain segments.

Emerging Opportunities in Wet Glue Labeling Machine Industry

The Wet Glue Labeling Machine Industry is poised to capitalize on several emerging opportunities. The increasing demand for sustainable packaging presents an opportunity for manufacturers to develop machines optimized for eco-friendly adhesives and recyclable label materials, aligning with global environmental trends. The growing e-commerce sector necessitates efficient and robust labeling for a wider variety of packaging types, creating a new avenue for growth. Furthermore, the expansion of the food and beverage and pharmaceutical industries in developing nations offers substantial untapped market potential. The integration of Industry 4.0 technologies, such as AI-powered diagnostics, predictive maintenance, and smart automation, presents an opportunity to enhance machine performance, offer value-added services, and create a competitive edge. The development of specialized labeling machines for niche applications, such as craft beverages or personalized pharmaceutical products, also represents a growing segment.

Leading Players in the Wet Glue Labeling Machine Industry Market

- Denmark Machine Tools

- Shree Bhagwati Machtech (India) Pvt Ltd

- Brothers Pharmamach (India) Pvt Ltd

- Shenzhen Penglai Industrial Corporation Limited

- Langguth GmbH - Etikettiermaschinen

- Maruti Machines Pvt Ltd

- Qingdao Senmei Packaging Machinery Co Ltd

- Gernep GmbH

- Ace Technologies Pvt Ltd

- Packwell India Machinery

- Zhangjiagang Alps Machine Co Ltd

Key Developments in Wet Glue Labeling Machine Industry Industry

- 2023: Launch of high-speed, modular wet glue labeling machines with enhanced automation for the food and beverage industry by Langguth GmbH, improving throughput by 15%.

- 2023: Shree Bhagwati Machtech (India) Pvt Ltd introduces a new range of cost-effective wet glue labeling machines catering to SMEs in emerging markets, featuring simplified operation and maintenance.

- 2022: Shenzhen Penglai Industrial Corporation Limited focuses on integrating advanced sensor technology for greater precision in label application, reducing adhesive consumption by 10%.

- 2022: Brothers Pharmamach (India) Pvt Ltd showcases compact wet glue labeling machines designed for pharmaceutical packaging lines, ensuring compliance with strict regulatory standards.

- 2021: Gernep GmbH announces the development of energy-efficient labeling machines, reducing power consumption by up to 20% through optimized motor and control systems.

Strategic Outlook for Wet Glue Labeling Machine Industry Market

The strategic outlook for the Wet Glue Labeling Machine Industry is promising, driven by sustained demand from core sectors like food, beverage, and pharmaceuticals. The industry is expected to witness continued innovation, with a strong emphasis on automation, digitalization, and sustainability. Key growth catalysts include the expansion of manufacturing capabilities in emerging economies, the increasing adoption of advanced packaging solutions, and the ongoing need for cost-effective, high-volume labeling. Companies that invest in R&D to offer smarter, more efficient, and environmentally friendly labeling machines, while also focusing on strong customer support and service, will be well-positioned for success. The strategic focus on market segmentation and developing tailored solutions for specific end-user needs will also be crucial for capturing market share and driving future revenue streams, with the market projected to reach over 150 billion by 2033.

Wet Glue Labeling Machine Industry Segmentation

-

1. Glue Type

- 1.1. Hot Melt Adhesive

- 1.2. Water Based Adhesive

-

2. Material Type

- 2.1. Paper

- 2.2. Plastic

- 2.3. Metallized Film

-

3. End-User

- 3.1. Food

- 3.2. Beverage

- 3.3. Pharmaceutical

- 3.4. Cosmetics & Household

- 3.5. Other End-Users

Wet Glue Labeling Machine Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Wet Glue Labeling Machine Industry Regional Market Share

Geographic Coverage of Wet Glue Labeling Machine Industry

Wet Glue Labeling Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Deliver Accuracy In Terms Of Label Pasting Along With Reducing The Cost Of The Operations; Higher Adoption Of Automatic Wet Glue Labelling Machine To Increase Productivity

- 3.3. Market Restrains

- 3.3.1. ; Adoption of Self-Adhesive Labelling

- 3.4. Market Trends

- 3.4.1. Wine and Beer in Beverage Account for Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wet Glue Labeling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Glue Type

- 5.1.1. Hot Melt Adhesive

- 5.1.2. Water Based Adhesive

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Paper

- 5.2.2. Plastic

- 5.2.3. Metallized Film

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Pharmaceutical

- 5.3.4. Cosmetics & Household

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Glue Type

- 6. North America Wet Glue Labeling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Glue Type

- 6.1.1. Hot Melt Adhesive

- 6.1.2. Water Based Adhesive

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Paper

- 6.2.2. Plastic

- 6.2.3. Metallized Film

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Pharmaceutical

- 6.3.4. Cosmetics & Household

- 6.3.5. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Glue Type

- 7. Europe Wet Glue Labeling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Glue Type

- 7.1.1. Hot Melt Adhesive

- 7.1.2. Water Based Adhesive

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Paper

- 7.2.2. Plastic

- 7.2.3. Metallized Film

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Pharmaceutical

- 7.3.4. Cosmetics & Household

- 7.3.5. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Glue Type

- 8. Asia Pacific Wet Glue Labeling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Glue Type

- 8.1.1. Hot Melt Adhesive

- 8.1.2. Water Based Adhesive

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Paper

- 8.2.2. Plastic

- 8.2.3. Metallized Film

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Pharmaceutical

- 8.3.4. Cosmetics & Household

- 8.3.5. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Glue Type

- 9. Latin America Wet Glue Labeling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Glue Type

- 9.1.1. Hot Melt Adhesive

- 9.1.2. Water Based Adhesive

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Paper

- 9.2.2. Plastic

- 9.2.3. Metallized Film

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Pharmaceutical

- 9.3.4. Cosmetics & Household

- 9.3.5. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Glue Type

- 10. Middle East Wet Glue Labeling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Glue Type

- 10.1.1. Hot Melt Adhesive

- 10.1.2. Water Based Adhesive

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Paper

- 10.2.2. Plastic

- 10.2.3. Metallized Film

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Pharmaceutical

- 10.3.4. Cosmetics & Household

- 10.3.5. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Glue Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Denmark Machine Tools

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shree Bhagwati Machtech (India) Pvt Ltd*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Brothers Pharmamach (India) Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shenzhen Penglai Industrial Corporation Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Langguth GmbH - Etikettiermaschinen

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Maruti Machines Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qingdao Senmei Packaging Machinery Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gernep GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ace Technologies Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Packwell India Machinery

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zhangjiagang Alps Machine Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Denmark Machine Tools

List of Figures

- Figure 1: Global Wet Glue Labeling Machine Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Wet Glue Labeling Machine Industry Revenue (undefined), by Glue Type 2025 & 2033

- Figure 3: North America Wet Glue Labeling Machine Industry Revenue Share (%), by Glue Type 2025 & 2033

- Figure 4: North America Wet Glue Labeling Machine Industry Revenue (undefined), by Material Type 2025 & 2033

- Figure 5: North America Wet Glue Labeling Machine Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Wet Glue Labeling Machine Industry Revenue (undefined), by End-User 2025 & 2033

- Figure 7: North America Wet Glue Labeling Machine Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Wet Glue Labeling Machine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Wet Glue Labeling Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Wet Glue Labeling Machine Industry Revenue (undefined), by Glue Type 2025 & 2033

- Figure 11: Europe Wet Glue Labeling Machine Industry Revenue Share (%), by Glue Type 2025 & 2033

- Figure 12: Europe Wet Glue Labeling Machine Industry Revenue (undefined), by Material Type 2025 & 2033

- Figure 13: Europe Wet Glue Labeling Machine Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 14: Europe Wet Glue Labeling Machine Industry Revenue (undefined), by End-User 2025 & 2033

- Figure 15: Europe Wet Glue Labeling Machine Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Wet Glue Labeling Machine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Wet Glue Labeling Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Wet Glue Labeling Machine Industry Revenue (undefined), by Glue Type 2025 & 2033

- Figure 19: Asia Pacific Wet Glue Labeling Machine Industry Revenue Share (%), by Glue Type 2025 & 2033

- Figure 20: Asia Pacific Wet Glue Labeling Machine Industry Revenue (undefined), by Material Type 2025 & 2033

- Figure 21: Asia Pacific Wet Glue Labeling Machine Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Asia Pacific Wet Glue Labeling Machine Industry Revenue (undefined), by End-User 2025 & 2033

- Figure 23: Asia Pacific Wet Glue Labeling Machine Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Wet Glue Labeling Machine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Wet Glue Labeling Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Wet Glue Labeling Machine Industry Revenue (undefined), by Glue Type 2025 & 2033

- Figure 27: Latin America Wet Glue Labeling Machine Industry Revenue Share (%), by Glue Type 2025 & 2033

- Figure 28: Latin America Wet Glue Labeling Machine Industry Revenue (undefined), by Material Type 2025 & 2033

- Figure 29: Latin America Wet Glue Labeling Machine Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Latin America Wet Glue Labeling Machine Industry Revenue (undefined), by End-User 2025 & 2033

- Figure 31: Latin America Wet Glue Labeling Machine Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Latin America Wet Glue Labeling Machine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Wet Glue Labeling Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Wet Glue Labeling Machine Industry Revenue (undefined), by Glue Type 2025 & 2033

- Figure 35: Middle East Wet Glue Labeling Machine Industry Revenue Share (%), by Glue Type 2025 & 2033

- Figure 36: Middle East Wet Glue Labeling Machine Industry Revenue (undefined), by Material Type 2025 & 2033

- Figure 37: Middle East Wet Glue Labeling Machine Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 38: Middle East Wet Glue Labeling Machine Industry Revenue (undefined), by End-User 2025 & 2033

- Figure 39: Middle East Wet Glue Labeling Machine Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East Wet Glue Labeling Machine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East Wet Glue Labeling Machine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Glue Type 2020 & 2033

- Table 2: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 3: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 4: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Glue Type 2020 & 2033

- Table 6: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 7: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 8: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Glue Type 2020 & 2033

- Table 10: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 11: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 12: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Glue Type 2020 & 2033

- Table 14: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 15: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 16: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Glue Type 2020 & 2033

- Table 18: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 19: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 20: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Glue Type 2020 & 2033

- Table 22: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 23: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 24: Global Wet Glue Labeling Machine Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wet Glue Labeling Machine Industry?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Wet Glue Labeling Machine Industry?

Key companies in the market include Denmark Machine Tools, Shree Bhagwati Machtech (India) Pvt Ltd*List Not Exhaustive, Brothers Pharmamach (India) Pvt Ltd, Shenzhen Penglai Industrial Corporation Limited, Langguth GmbH - Etikettiermaschinen, Maruti Machines Pvt Ltd, Qingdao Senmei Packaging Machinery Co Ltd, Gernep GmbH, Ace Technologies Pvt Ltd, Packwell India Machinery, Zhangjiagang Alps Machine Co Ltd.

3. What are the main segments of the Wet Glue Labeling Machine Industry?

The market segments include Glue Type, Material Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Deliver Accuracy In Terms Of Label Pasting Along With Reducing The Cost Of The Operations; Higher Adoption Of Automatic Wet Glue Labelling Machine To Increase Productivity.

6. What are the notable trends driving market growth?

Wine and Beer in Beverage Account for Significant Market Share.

7. Are there any restraints impacting market growth?

; Adoption of Self-Adhesive Labelling.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wet Glue Labeling Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wet Glue Labeling Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wet Glue Labeling Machine Industry?

To stay informed about further developments, trends, and reports in the Wet Glue Labeling Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence