Key Insights

The global wood pulp market is projected for consistent, moderate growth, with an estimated market size of 166.65 billion in 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 2.7% through 2033. Key growth drivers include robust demand from the packaging sector, fueled by the e-commerce surge and increasing consumer preference for sustainable packaging. Rising disposable incomes in emerging economies are also boosting consumption of paper-based products, from tissue and hygiene items to printing and writing papers. Technological advancements in pulp production, focusing on efficiency and environmental performance, further support market expansion.

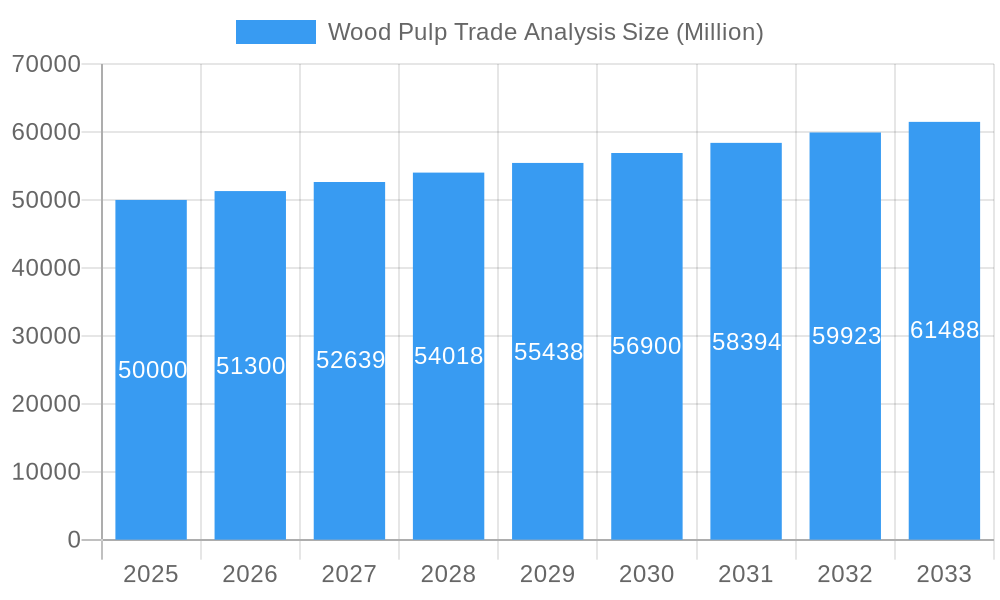

Wood Pulp Trade Analysis Market Size (In Billion)

Despite positive growth prospects, the market faces restraints such as fluctuating raw material and energy costs, geopolitical uncertainties, and evolving trade policies. While environmental regulations promote long-term sustainability, they can increase short-term compliance costs. The Asia Pacific region, particularly China and India, is anticipated to lead in both production and consumption, offering significant opportunities. The growing emphasis on circular economy principles and the development of bio-based alternatives will shape the future of the wood pulp trade.

Wood Pulp Trade Analysis Company Market Share

This comprehensive report offers a detailed analysis of the global wood pulp trade landscape from 2019 to 2033, with a base and forecast year of 2025. It examines production, consumption, trade dynamics, pricing trends, and key industry developments. Optimized with high-traffic keywords such as "wood pulp market," "pulp trade analysis," "packaging paper demand," and "fiber market," the report provides actionable intelligence on market concentration, innovation, regulations, substitutes, end-user trends, and M&A activities. Analyze the influence of key players and evolving demand across segments.

Wood Pulp Trade Analysis Market Concentration & Innovation

The wood pulp trade market exhibits a moderate to high concentration, with a few key global players dominating significant market share. Major companies like International Paper and UPM are at the forefront, holding substantial portions of global pulp production and trade volumes. Innovation within the sector is primarily driven by the pursuit of sustainable sourcing, advanced processing technologies to enhance pulp properties, and the development of specialized pulps for niche applications. Regulatory frameworks, particularly concerning environmental sustainability and forest management, play a crucial role in shaping market access and operational strategies. Product substitutes, such as recycled fiber and alternative fiber sources, are increasingly important considerations, prompting continuous innovation in wood pulp to maintain competitive advantages. End-user trends, such as the growing demand for eco-friendly packaging and hygiene products, are significant innovation drivers. Mergers and acquisitions (M&A) activity, though not consistently high, is strategic, often aimed at consolidating market share, acquiring new technologies, or expanding geographical reach. For instance, strategic acquisitions by major players in the past have significantly influenced market concentration. The focus on R&D for bio-based chemicals derived from wood pulp also represents a burgeoning area of innovation.

Wood Pulp Trade Analysis Industry Trends & Insights

The global wood pulp trade is experiencing a dynamic transformation driven by a confluence of economic, technological, and environmental factors. A key growth driver is the robust demand for packaging paper, particularly in emerging economies and fueled by the rapid expansion of e-commerce. This shift is evident in the declining demand for traditional newsprint and printing writing papers due to digitization, as highlighted by the Investment Information and Credit Rating Agency of India Limited (ICRA) regarding the Indian paper industry's paradigm shift. Conversely, the packaging paper segment is experiencing substantial growth, driven by sectors like FMCG, food and beverage, and pharmaceuticals. Technological disruptions, including advancements in pulping processes that improve yield and reduce environmental impact, are also shaping the industry. Consumer preferences are increasingly leaning towards sustainable and biodegradable materials, pushing manufacturers to invest in eco-friendly wood pulp options. Competitive dynamics are characterized by a strong emphasis on cost efficiency, supply chain optimization, and product differentiation. The average annual growth rate (CAGR) for the packaging paper segment is projected to be significant, contributing to overall market penetration of wood pulp-based products. Industry developments, such as investments in advanced packaging research laboratories, further underscore the commitment to innovation and skill development to meet evolving market demands. The growing importance of certified sustainable forestry practices also influences market access and brand perception.

Dominant Markets & Segments in Wood Pulp Trade Analysis

The wood pulp trade is dominated by regions with extensive forest resources and established pulp manufacturing capabilities, alongside significant consumer markets.

Production Analysis: North America and Europe are dominant regions in wood pulp production, owing to vast forest reserves and advanced forestry management practices. Countries like the United States, Canada, Sweden, and Finland are leading producers. Key drivers include favorable government policies supporting sustainable forestry, advanced technological infrastructure for pulp processing, and a skilled workforce. The market share of leading producers in these regions is substantial.

Consumption Analysis: Asia-Pacific, particularly China, is the largest consuming region for wood pulp. This dominance is driven by its massive manufacturing base across diverse industries, including paper and packaging, hygiene products, and textiles. E-commerce growth, a burgeoning middle class, and increasing urbanization are critical factors propelling this consumption. Economic policies supporting industrial growth and significant investments in manufacturing infrastructure have cemented its position.

Import Market Analysis (Value & Volume): China is the largest importer of wood pulp globally, both in terms of value and volume. Its insatiable demand for raw materials to feed its vast manufacturing sector makes it a critical market. Other significant import markets include other Asian nations and parts of Europe. Economic growth, industrial output, and trade agreements influence import volumes. The import market value is significantly impacted by global pulp price fluctuations.

Export Market Analysis (Value & Volume): Canada, the United States, Brazil, and Nordic countries are the leading exporters of wood pulp. Their extensive timber resources, efficient production capabilities, and strategic access to global shipping routes make them key players. Favorable export policies and strong international trade relationships are vital for maintaining export dominance. The value of exports is directly tied to the global demand and pricing of various pulp grades.

Price Trend Analysis: Price trends for wood pulp are influenced by a complex interplay of supply and demand, currency fluctuations, energy costs, and global economic conditions. Softwood pulp prices often remain higher than hardwood pulp prices due to their superior fiber strength. Major price shifts can occur due to production disruptions, changes in demand from key consuming regions like China, and inventory levels across the supply chain. The base year of 2025 is crucial for understanding current price benchmarks.

Wood Pulp Trade Analysis Product Developments

Product developments in the wood pulp trade are focused on enhancing sustainability and functionality. Innovations include high-yield pulping processes that reduce wood fiber waste and energy consumption. The development of specialized pulps, such as fluff pulp for absorbent hygiene products and chemical pulps for high-quality paper and packaging, offers competitive advantages. Advancements in creating bio-based chemicals and materials from wood pulp further expand its application spectrum, aligning with circular economy principles and increasing market fit for environmentally conscious consumers.

Wood Pulp Trade Analysis Report Scope & Segmentation Analysis

This report segmentations are based on detailed analysis of Production Analysis:, Consumption Analysis:, Import Market Analysis (Value & Volume):, Export Market Analysis (Value & Volume):, and Price Trend Analysis:. Each segment is analyzed with projections for market sizes and growth rates. The Production Analysis segment will detail regional and company-level output, while Consumption Analysis will focus on end-user industries and geographical demand. Import and Export Market Analyses will provide deep dives into trade flows, key trading partners, and their respective market shares. Price Trend Analysis will offer insights into historical price movements and future projections, crucial for strategic planning.

Key Drivers of Wood Pulp Trade Analysis Growth

The growth of the wood pulp trade is propelled by several key factors. The relentless expansion of the e-commerce sector is a major catalyst, driving unprecedented demand for packaging materials. Growing global population and rising disposable incomes, especially in emerging economies, boost demand for tissue and hygiene products, which are significant consumers of wood pulp. Technological advancements in pulping and papermaking processes are enhancing efficiency and product quality, making wood pulp more competitive. Furthermore, increasing consumer preference for sustainable and biodegradable packaging solutions is shifting the market away from plastics and towards wood fiber-based alternatives.

Challenges in the Wood Pulp Trade Analysis Sector

Despite robust growth, the wood pulp trade faces several challenges. Fluctuating raw material costs, including timber and energy prices, can significantly impact profitability. Stringent environmental regulations and the increasing demand for certified sustainable forestry practices add to operational complexities and costs. Global supply chain disruptions, as witnessed in recent years, can lead to price volatility and availability issues. Intense competition from recycled fiber and alternative materials also necessitates continuous innovation and cost management. Geopolitical risks and trade policies can further introduce uncertainty into international trade flows.

Emerging Opportunities in Wood Pulp Trade Analysis

Emerging opportunities in the wood pulp trade are multifaceted. The burgeoning demand for sustainable packaging presents a significant avenue for growth, particularly for companies committed to eco-friendly practices. The development of advanced bio-based materials and chemicals derived from wood pulp offers substantial potential for diversification beyond traditional paper and packaging applications. The increasing focus on the circular economy is driving demand for sustainably sourced and recyclable wood pulp. Furthermore, technological advancements in nanocellulose and other high-value wood-based products are opening up new markets in composites, textiles, and advanced materials.

Leading Players in the Wood Pulp Trade Analysis Market

- Kimberly-Clark

- Procter & Gamble

- Georgia-Pacific

- International Paper

- UPM

Key Developments in Wood Pulp Trade Analysis Industry

- December 2022: The Indian Institute of Technology (IIT) Roorkee, in association with Shah Paper Mills Limited, launched a new project to develop the advanced packaging research laboratory and skill development program at the Department of Paper Technology, Saharanpur Campus. This initiative aims to foster collaboration with paper industries in India, focusing on providing cutting-edge innovation research and skill development globally.

- April 2022: According to the Investment Information and Credit Rating Agency of India Limited (ICRA), the paper industry in India is undergoing a significant shift in demand. Demand for newsprint papers (NP) and printing writing papers (PWP) is declining due to digitization, while the packaging paper (PP) segment is experiencing robust growth, driven by increased demand from e-commerce, food and food products, FMCG, and the pharmaceutical sectors.

Strategic Outlook for Wood Pulp Trade Analysis Market

The strategic outlook for the wood pulp trade market is highly positive, driven by sustained demand from key end-use sectors and a global shift towards sustainable materials. The increasing adoption of wood pulp in packaging, hygiene, and specialty applications, coupled with ongoing innovation in bio-based materials, promises significant future growth. Companies that prioritize sustainable sourcing, invest in advanced technologies, and adapt to evolving consumer preferences will be well-positioned to capitalize on market opportunities. The focus on creating higher-value products from wood fiber, beyond traditional paper, represents a crucial pathway for long-term success and market expansion.

Wood Pulp Trade Analysis Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Wood Pulp Trade Analysis Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. France

- 2.5. Netherlands

- 2.6. Sweden

- 2.7. Russia

-

3. Asia Pacific

- 3.1. China

- 3.2. Australia

- 3.3. India

- 3.4. South Korea

- 3.5. Japan

- 3.6. Indonesia

-

4. South America

- 4.1. Brazil

- 4.2. Chile

-

5. Africa

- 5.1. South Africa

Wood Pulp Trade Analysis Regional Market Share

Geographic Coverage of Wood Pulp Trade Analysis

Wood Pulp Trade Analysis REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Huge Demand in Packaging and Industrial Papers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. South America

- 5.6.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. South America Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Africa Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kimberly-Clark

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Procter & Gamble

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Georgia-Pacific

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 International Paper

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UPM

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Kimberly-Clark

List of Figures

- Figure 1: Global Wood Pulp Trade Analysis Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Wood Pulp Trade Analysis Revenue (billion), by Production Analysis 2025 & 2033

- Figure 3: North America Wood Pulp Trade Analysis Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Wood Pulp Trade Analysis Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 5: North America Wood Pulp Trade Analysis Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Wood Pulp Trade Analysis Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Wood Pulp Trade Analysis Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Wood Pulp Trade Analysis Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Wood Pulp Trade Analysis Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Wood Pulp Trade Analysis Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Wood Pulp Trade Analysis Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Wood Pulp Trade Analysis Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Wood Pulp Trade Analysis Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Wood Pulp Trade Analysis Revenue (billion), by Production Analysis 2025 & 2033

- Figure 15: Europe Wood Pulp Trade Analysis Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Wood Pulp Trade Analysis Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Wood Pulp Trade Analysis Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Wood Pulp Trade Analysis Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Wood Pulp Trade Analysis Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Wood Pulp Trade Analysis Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Wood Pulp Trade Analysis Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Wood Pulp Trade Analysis Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Wood Pulp Trade Analysis Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Wood Pulp Trade Analysis Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Wood Pulp Trade Analysis Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Wood Pulp Trade Analysis Revenue (billion), by Production Analysis 2025 & 2033

- Figure 27: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Asia Pacific Wood Pulp Trade Analysis Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 29: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Asia Pacific Wood Pulp Trade Analysis Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Asia Pacific Wood Pulp Trade Analysis Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Asia Pacific Wood Pulp Trade Analysis Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 35: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Asia Pacific Wood Pulp Trade Analysis Revenue (billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Country 2025 & 2033

- Figure 38: South America Wood Pulp Trade Analysis Revenue (billion), by Production Analysis 2025 & 2033

- Figure 39: South America Wood Pulp Trade Analysis Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: South America Wood Pulp Trade Analysis Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 41: South America Wood Pulp Trade Analysis Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: South America Wood Pulp Trade Analysis Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: South America Wood Pulp Trade Analysis Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: South America Wood Pulp Trade Analysis Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: South America Wood Pulp Trade Analysis Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: South America Wood Pulp Trade Analysis Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 47: South America Wood Pulp Trade Analysis Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: South America Wood Pulp Trade Analysis Revenue (billion), by Country 2025 & 2033

- Figure 49: South America Wood Pulp Trade Analysis Revenue Share (%), by Country 2025 & 2033

- Figure 50: Africa Wood Pulp Trade Analysis Revenue (billion), by Production Analysis 2025 & 2033

- Figure 51: Africa Wood Pulp Trade Analysis Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Africa Wood Pulp Trade Analysis Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 53: Africa Wood Pulp Trade Analysis Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Africa Wood Pulp Trade Analysis Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Africa Wood Pulp Trade Analysis Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Africa Wood Pulp Trade Analysis Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Africa Wood Pulp Trade Analysis Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Africa Wood Pulp Trade Analysis Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 59: Africa Wood Pulp Trade Analysis Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Africa Wood Pulp Trade Analysis Revenue (billion), by Country 2025 & 2033

- Figure 61: Africa Wood Pulp Trade Analysis Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United States Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Mexico Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Germany Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Netherlands Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 30: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 31: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 32: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 33: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 34: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Country 2020 & 2033

- Table 35: China Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Australia Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: India Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: South Korea Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Japan Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Indonesia Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 42: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 43: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 45: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 46: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Country 2020 & 2033

- Table 47: Brazil Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Chile Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 50: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 51: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 52: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 53: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 54: Global Wood Pulp Trade Analysis Revenue billion Forecast, by Country 2020 & 2033

- Table 55: South Africa Wood Pulp Trade Analysis Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wood Pulp Trade Analysis?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Wood Pulp Trade Analysis?

Key companies in the market include Kimberly-Clark , Procter & Gamble , Georgia-Pacific, International Paper , UPM .

3. What are the main segments of the Wood Pulp Trade Analysis?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 166.65 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Huge Demand in Packaging and Industrial Papers.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

December 2022: The Indian Institute of Technology (IIT) Roorkee, in association with Shah Paper Mills Limited, launched a new project to develop the advanced packaging research laboratory and skill development program at the Department of Paper Technology, Saharanpur Campus. The institute has been fostering collaboration with paper industries from India, focusing on providing cutting-edge innovation research and skill development globally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wood Pulp Trade Analysis," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wood Pulp Trade Analysis report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wood Pulp Trade Analysis?

To stay informed about further developments, trends, and reports in the Wood Pulp Trade Analysis, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence