Key Insights

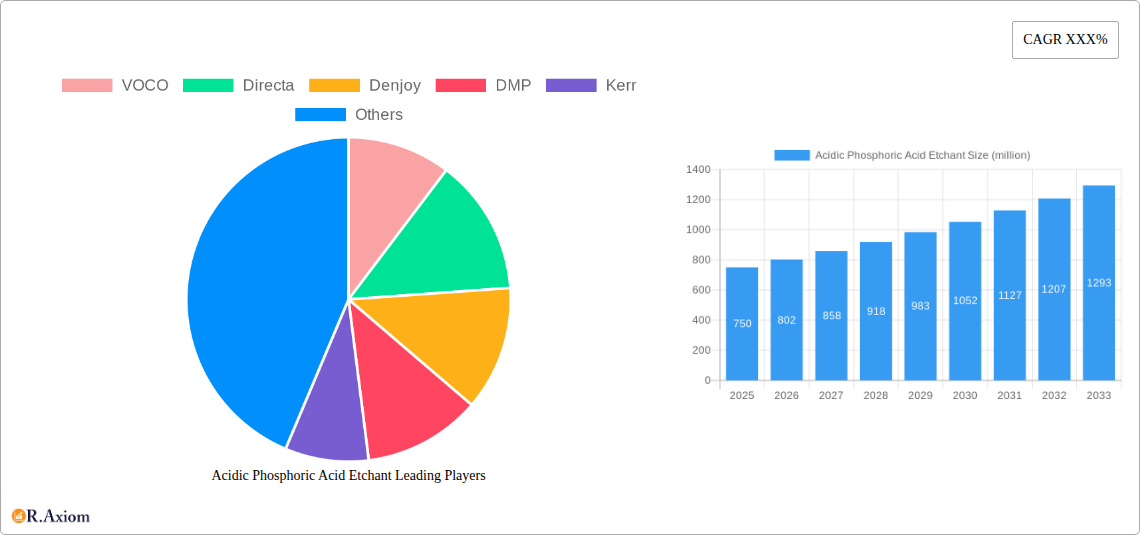

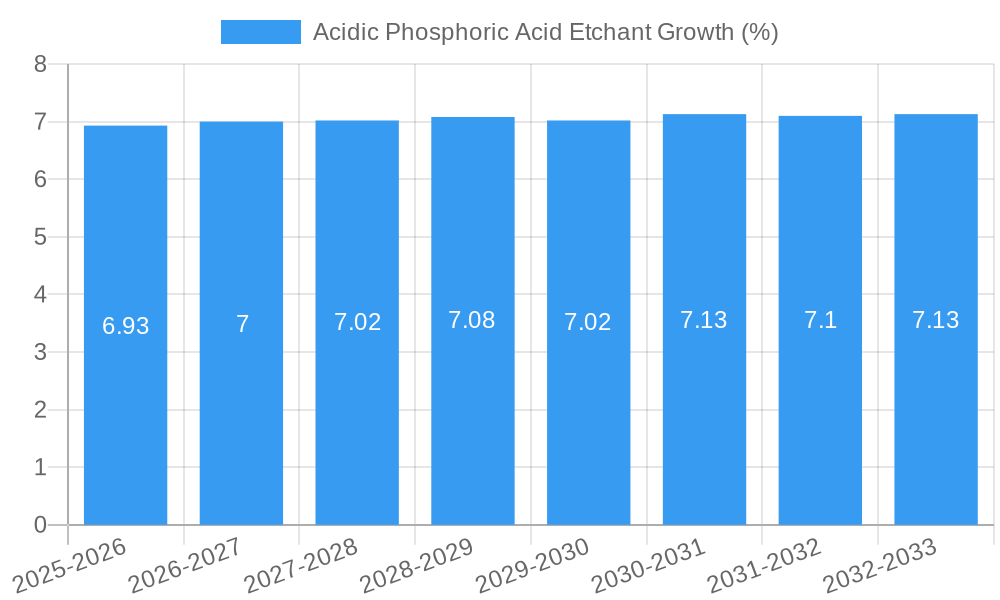

The global market for Acidic Phosphoric Acid Etchants is projected to experience robust growth, driven by increasing demand in dental procedures and a rising prevalence of dental caries and other oral health issues worldwide. The market size is estimated to be around USD 750 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 6.8% over the forecast period of 2025-2033. This upward trajectory is fueled by advancements in dental materials, growing patient awareness regarding oral hygiene, and the expanding dental tourism sector in various emerging economies. Hospitals and dental clinics represent the primary applications, accounting for a significant portion of market consumption due to routine restorative and cosmetic dental treatments. The increasing adoption of dental technologies and minimally invasive procedures further bolsters the demand for effective and reliable etchants.

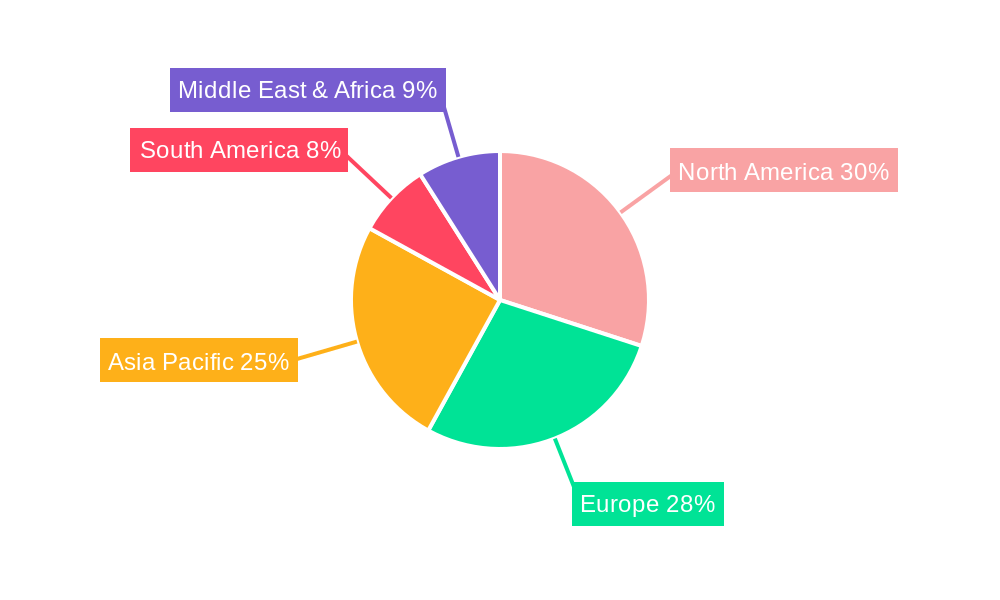

The market is segmented into Single Acidic Phosphoric Acid Etchants and Compound Acidic Phosphoric Acid Etching Agents, with Compound agents likely gaining traction due to their enhanced efficacy and reduced application time. Geographically, the Asia Pacific region is anticipated to emerge as a significant growth engine, propelled by burgeoning healthcare infrastructure, a large and growing population, and increasing disposable incomes in countries like China and India. North America and Europe are expected to maintain their dominance, supported by well-established healthcare systems and a high prevalence of dental issues. However, the market may face restraints such as the availability of alternative etching materials and stringent regulatory requirements for dental products in certain regions. Nonetheless, key players like 3M, Kerr, and VOCO are actively investing in research and development to introduce innovative products, further shaping the market landscape.

Here is a comprehensive, SEO-optimized report description for Acidic Phosphoric Acid Etchant, designed for immediate use without modification.

Acidic Phosphoric Acid Etchant Market Concentration & Innovation

The Acidic Phosphoric Acid Etchant market exhibits a moderate concentration, with key players like 3M, Kerr, and VOCO holding significant market shares estimated to be between 15% and 20% each. Innovation is primarily driven by advancements in formulation chemistry, aiming for improved bond strength, reduced post-operative sensitivity, and enhanced ease of use for dental professionals. Regulatory frameworks, such as those governed by the FDA and EMA, play a crucial role in dictating product safety and efficacy standards, impacting research and development pipelines. The threat of product substitutes, while present from alternative etching agents like polyacrylic acid, remains relatively low due to the well-established efficacy and cost-effectiveness of phosphoric acid. End-user trends indicate a growing demand for user-friendly, single-step etchants, particularly within dental clinics, driving product development. Mergers and acquisitions (M&A) are notable, with recent deals valued in the tens of millions of dollars, such as the acquisition of a smaller specialty dental materials manufacturer by a larger entity, aimed at consolidating market presence and expanding product portfolios.

Acidic Phosphoric Acid Etchant Industry Trends & Insights

The Acidic Phosphoric Acid Etchant industry is projected to experience robust growth, driven by an increasing global prevalence of dental caries and a rising demand for esthetic restorative dentistry. The market's Compound Annual Growth Rate (CAGR) is estimated to be approximately 6.5% over the forecast period of 2025–2033. Technological disruptions are centered on the development of novel formulations that offer enhanced biocompatibility and reduced etching times without compromising bond strength. Consumer preferences are shifting towards minimally invasive dental procedures, which in turn boosts the demand for reliable and predictable bonding agents that utilize acidic phosphoric acid etchants. Competitive dynamics are characterized by intense product differentiation, with companies focusing on unique delivery systems and chemical compositions. Market penetration is high in developed economies, while emerging markets present significant untapped potential due to improving healthcare infrastructure and increasing disposable incomes. The widespread adoption of CAD/CAM technology in dentistry also indirectly fuels the demand for high-quality etchants to ensure optimal bonding of restorations.

Dominant Markets & Segments in Acidic Phosphoric Acid Etchant

The Dental Clinic segment is currently the dominant market for Acidic Phosphoric Acid Etchants, accounting for an estimated 60% of the total market revenue. This dominance is fueled by the sheer volume of routine dental procedures performed daily, including cavity preparations, sealants, and bonding of orthodontic brackets. Key drivers for this segment include the widespread availability of dental practices, a growing emphasis on preventive and cosmetic dentistry, and the direct accessibility of these products to a vast number of dental professionals.

Within the Type segmentation, Single Acidic Phosphoric Acid Etchant holds a substantial market share, estimated at 55%, due to its user-friendliness and reduced chair time, aligning perfectly with the fast-paced environment of dental clinics. Compound Acidic Phosphoric Acid Etching Agent, estimated at 45%, is also significant, particularly in complex restorative procedures requiring precise control over the etching process.

Geographically, North America and Europe currently represent the leading markets, collectively holding over 70% of the global market share. This is attributed to advanced healthcare infrastructure, high patient awareness regarding oral hygiene, and substantial investment in dental research and development. Economic policies supporting healthcare access, coupled with the presence of major industry players like 3M and Kerr, further solidify their dominance.

The Hospital segment, though smaller, contributes significantly to the market, especially for complex reconstructive surgeries and trauma cases. Its growth is linked to increasing healthcare expenditure and the rising incidence of dental-related medical emergencies.

Acidic Phosphoric Acid Etchant Product Developments

Recent product developments in Acidic Phosphoric Acid Etchants focus on creating faster-acting, less technique-sensitive formulations with improved biocompatibility. Innovations include self-etching primers that combine etching and priming steps, and low-viscosity gels for enhanced penetration and control. These advancements offer competitive advantages by simplifying the bonding process, reducing the risk of procedural errors, and improving patient comfort. The market is seeing a trend towards fluoride-releasing etchants for enhanced caries prevention, a key technological trend.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Acidic Phosphoric Acid Etchant market across key segments. The Application segment is divided into Hospital, Dental Clinic, and Other, with Dental Clinic anticipated to lead with a market size of over $300 million in 2025. The Type segment comprises Single Acidic Phosphoric Acid Etchant and Compound Acidic Phosphoric Acid Etching Agent. Single-step etchants are projected to grow at a CAGR of 7.0% due to their convenience, while compound etchants are expected to maintain steady growth driven by specialized applications.

Key Drivers of Acidic Phosphoric Acid Etchant Growth

The growth of the Acidic Phosphoric Acid Etchant market is primarily driven by the increasing global incidence of dental caries and periodontal diseases, necessitating effective restorative treatments. Advancements in dental material science, leading to the development of more biocompatible and reliable etchants, further propel market expansion. The rising disposable income in emerging economies, coupled with increasing awareness about oral health, is also a significant growth catalyst. Furthermore, favorable reimbursement policies for dental procedures in several countries enhance patient access to necessary treatments.

Challenges in the Acidic Phosphoric Acid Etchant Sector

Despite its robust growth, the Acidic Phosphoric Acid Etchant sector faces several challenges. Stringent regulatory approvals for new dental materials can lead to extended product development timelines and increased costs. Fluctuations in raw material prices, particularly for key chemical components, can impact manufacturing expenses and profit margins. Intense competition among established players and the emergence of lower-cost generic alternatives can pressure pricing. Moreover, concerns regarding potential tooth sensitivity following etching procedures, although largely mitigated by modern formulations, still require careful clinical management.

Emerging Opportunities in Acidic Phosphoric Acid Etchant

Emerging opportunities in the Acidic Phosphoric Acid Etchant market lie in the development of bio-active etchants that can promote remineralization and actively fight caries. The growing demand for minimally invasive dentistry presents an opportunity for ultra-gentle yet highly effective etching solutions. Expansion into underserved emerging markets with tailored product offerings and cost-effective solutions offers significant untapped potential. Furthermore, the integration of digital dentistry workflows and the demand for predictable bonding in implantology and orthodontics create new avenues for specialized etchant formulations.

Leading Players in the Acidic Phosphoric Acid Etchant Market

- VOCO

- Directa

- Denjoy

- DMP

- Kerr

- Pentron

- Kuraray

- 3M

- BISCO

- Ho Dental Company

- Bossklein

- DMG

- Advanced Healthcare Ltd

- Pulpdent

- Prime Dental Manufacturing

- President Dental GmbH

- Sinclair Dental

- SDI Limited

Key Developments in Acidic Phosphoric Acid Etchant Industry

- 2023 Q4: 3M launches a new generation of universal etchants with enhanced viscosity control and reduced post-operative sensitivity.

- 2022: Kerr introduces a novel self-etching primer designed for faster application and improved bond durability.

- 2021: VOCO expands its product line with a fluoride-releasing phosphoric acid etchant for enhanced caries prevention.

- 2020: The market sees a rise in M&A activities, with smaller specialty dental material manufacturers being acquired to consolidate market share.

Strategic Outlook for Acidic Phosphoric Acid Etchant Market

- 2023 Q4: 3M launches a new generation of universal etchants with enhanced viscosity control and reduced post-operative sensitivity.

- 2022: Kerr introduces a novel self-etching primer designed for faster application and improved bond durability.

- 2021: VOCO expands its product line with a fluoride-releasing phosphoric acid etchant for enhanced caries prevention.

- 2020: The market sees a rise in M&A activities, with smaller specialty dental material manufacturers being acquired to consolidate market share.

Strategic Outlook for Acidic Phosphoric Acid Etchant Market

The strategic outlook for the Acidic Phosphoric Acid Etchant market remains highly positive, driven by continuous innovation and increasing global demand for advanced dental care. Companies are expected to focus on developing user-friendly, time-saving, and highly biocompatible etching solutions. Expansion into emerging markets, strategic partnerships, and a continued emphasis on research and development to address unmet clinical needs will be crucial for sustained growth. The market's trajectory indicates a strong future potential, especially with the growing integration of digital workflows in dentistry.

Acidic Phosphoric Acid Etchant Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Dental Clinic

- 1.3. Other

-

2. Type

- 2.1. Single Acidic Phosphoric Acid Etchant

- 2.2. Compound Acidic Phosphoric Acid Etching Agent

Acidic Phosphoric Acid Etchant Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Acidic Phosphoric Acid Etchant REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Acidic Phosphoric Acid Etchant Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Dental Clinic

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single Acidic Phosphoric Acid Etchant

- 5.2.2. Compound Acidic Phosphoric Acid Etching Agent

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Acidic Phosphoric Acid Etchant Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Dental Clinic

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single Acidic Phosphoric Acid Etchant

- 6.2.2. Compound Acidic Phosphoric Acid Etching Agent

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Acidic Phosphoric Acid Etchant Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Dental Clinic

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single Acidic Phosphoric Acid Etchant

- 7.2.2. Compound Acidic Phosphoric Acid Etching Agent

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Acidic Phosphoric Acid Etchant Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Dental Clinic

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single Acidic Phosphoric Acid Etchant

- 8.2.2. Compound Acidic Phosphoric Acid Etching Agent

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Acidic Phosphoric Acid Etchant Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Dental Clinic

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single Acidic Phosphoric Acid Etchant

- 9.2.2. Compound Acidic Phosphoric Acid Etching Agent

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Acidic Phosphoric Acid Etchant Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Dental Clinic

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single Acidic Phosphoric Acid Etchant

- 10.2.2. Compound Acidic Phosphoric Acid Etching Agent

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 VOCO

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Directa

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Denjoy

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DMP

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kerr

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pentron

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kuraray

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 3M

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BISCO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ho Dental Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bossklein

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DMG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Advanced Healthcare Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Pulpdent

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Prime Dental Manufacturing

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 President Dental GmbH

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Sinclair Dental

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 SDI Limited

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 VOCO

List of Figures

- Figure 1: Global Acidic Phosphoric Acid Etchant Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Acidic Phosphoric Acid Etchant Revenue (million), by Application 2024 & 2032

- Figure 3: North America Acidic Phosphoric Acid Etchant Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Acidic Phosphoric Acid Etchant Revenue (million), by Type 2024 & 2032

- Figure 5: North America Acidic Phosphoric Acid Etchant Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Acidic Phosphoric Acid Etchant Revenue (million), by Country 2024 & 2032

- Figure 7: North America Acidic Phosphoric Acid Etchant Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Acidic Phosphoric Acid Etchant Revenue (million), by Application 2024 & 2032

- Figure 9: South America Acidic Phosphoric Acid Etchant Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Acidic Phosphoric Acid Etchant Revenue (million), by Type 2024 & 2032

- Figure 11: South America Acidic Phosphoric Acid Etchant Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Acidic Phosphoric Acid Etchant Revenue (million), by Country 2024 & 2032

- Figure 13: South America Acidic Phosphoric Acid Etchant Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Acidic Phosphoric Acid Etchant Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Acidic Phosphoric Acid Etchant Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Acidic Phosphoric Acid Etchant Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Acidic Phosphoric Acid Etchant Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Acidic Phosphoric Acid Etchant Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Acidic Phosphoric Acid Etchant Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Acidic Phosphoric Acid Etchant Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Acidic Phosphoric Acid Etchant Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Acidic Phosphoric Acid Etchant Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Acidic Phosphoric Acid Etchant Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Acidic Phosphoric Acid Etchant Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Acidic Phosphoric Acid Etchant Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Acidic Phosphoric Acid Etchant Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Acidic Phosphoric Acid Etchant Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Acidic Phosphoric Acid Etchant Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Acidic Phosphoric Acid Etchant Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Acidic Phosphoric Acid Etchant Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Acidic Phosphoric Acid Etchant Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Acidic Phosphoric Acid Etchant Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Acidic Phosphoric Acid Etchant Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Acidic Phosphoric Acid Etchant?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Acidic Phosphoric Acid Etchant?

Key companies in the market include VOCO, Directa, Denjoy, DMP, Kerr, Pentron, Kuraray, 3M, BISCO, Ho Dental Company, Bossklein, DMG, Advanced Healthcare Ltd, Pulpdent, Prime Dental Manufacturing, President Dental GmbH, Sinclair Dental, SDI Limited.

3. What are the main segments of the Acidic Phosphoric Acid Etchant?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Acidic Phosphoric Acid Etchant," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Acidic Phosphoric Acid Etchant report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Acidic Phosphoric Acid Etchant?

To stay informed about further developments, trends, and reports in the Acidic Phosphoric Acid Etchant, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence