Key Insights

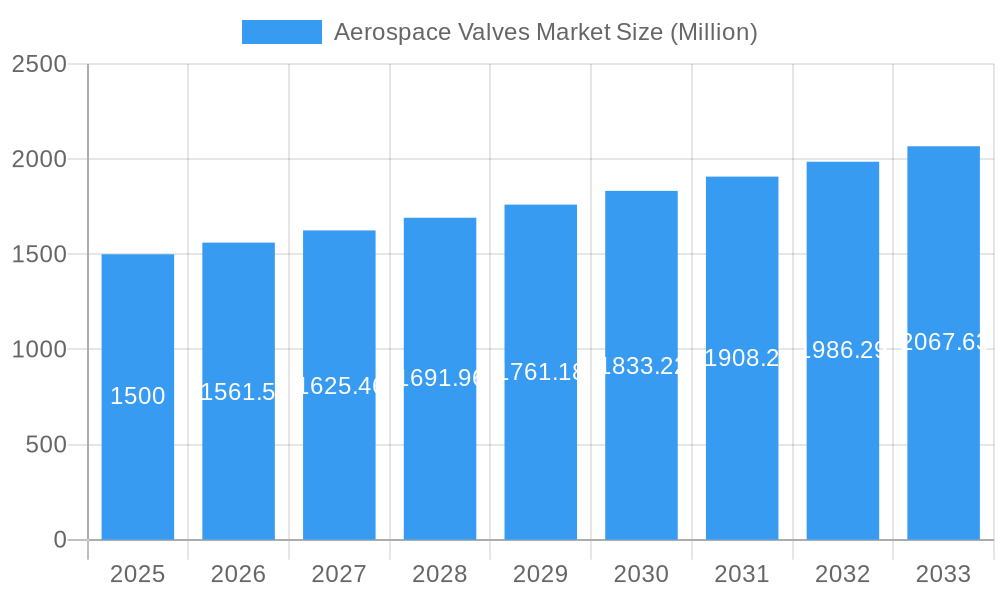

The aerospace valves market, valued at approximately 14.81 billion in 2025, is projected for substantial expansion with a CAGR of 7.4% between 2025 and 2033. This growth trajectory is underpinned by increasing commercial aircraft demand, particularly in emerging markets, and ongoing fleet modernization efforts requiring advanced valve replacements. The integration of smart sensor technology and superior materials for enhanced valve performance and reliability also fuels market expansion. Furthermore, the aviation industry's imperative for improved fuel efficiency and reduced emissions drives demand for precise and efficient valve control systems. While economic fluctuations and fuel price volatility present potential challenges, the sustained investment in aerospace technology and projected growth in air travel ensure a positive long-term outlook.

Aerospace Valves Market Market Size (In Billion)

Butterfly and ball valves are anticipated to lead market segments due to their adaptability and cost-efficiency. Commercial aircraft currently represent the largest share, followed by business and military aircraft. The general aviation segment exhibits strong growth potential, influenced by the rising trend in private and recreational aviation. Fuel system applications dominate due to the critical function of valves in fuel management. Geographically, North America and Europe maintain leadership, supported by established aerospace manufacturing and high aircraft deployment. However, the Asia-Pacific region presents significant growth prospects, driven by rapid industrialization and expanding air travel. Leading entities such as Honeywell, Safran, and Parker Hannifin are strategically enhancing their market positions through R&D, mergers, and acquisitions to leverage evolving opportunities.

Aerospace Valves Market Company Market Share

Aerospace Valves Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the global Aerospace Valves Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) and robust forecasting methodologies to present a clear picture of market dynamics and future trends. The market is segmented by valve type, aircraft type, and application, providing granular insights into various market segments. The report also profiles key players, analyzing their market share, competitive strategies, and recent developments. Expected market value in Million is used throughout the report.

Aerospace Valves Market Concentration & Innovation

The Aerospace Valves market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. Honeywell International Inc., Safran SE, and Parker Hannifin Corp. are among the key players shaping the market dynamics. However, several smaller, specialized companies also contribute significantly, particularly in niche segments. The market is driven by continuous innovation in valve design and materials, focusing on improved efficiency, weight reduction, and enhanced reliability. Stringent safety regulations and certification processes govern the industry, ensuring high product quality and performance. Substitution with alternative technologies is limited due to the critical nature of valves in aerospace applications. End-user trends towards lighter, more fuel-efficient aircraft directly impact demand for lightweight and high-performance valves. Mergers and acquisitions (M&A) activity within the sector is relatively frequent, with larger companies strategically acquiring smaller players to expand their product portfolio and market reach. Recent M&A deal values are estimated to be in the range of xx Million to xx Million annually, reflecting the consolidation trend.

Aerospace Valves Market Industry Trends & Insights

The Aerospace Valves market is experiencing robust growth, driven by factors such as the increasing demand for commercial and military aircraft, the growth of the general aviation sector, and ongoing technological advancements in aerospace engineering. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of advanced materials like lightweight alloys and composites, are significantly impacting valve design and manufacturing. Consumer preferences for enhanced safety, reliability, and fuel efficiency are fueling demand for technologically advanced valves. Competitive dynamics are marked by continuous innovation, strategic partnerships, and M&A activities. Market penetration of new technologies, like smart valves with embedded sensors and data analytics, is steadily increasing, reaching an estimated xx% in 2025.

Dominant Markets & Segments in Aerospace Valves Market

Leading Region: North America is currently the leading region in the Aerospace Valves market, driven by strong domestic aircraft manufacturing and a robust aerospace industry. Europe follows closely, while the Asia-Pacific region is experiencing rapid growth due to increased air travel and investments in aerospace infrastructure.

Dominant Segments:

- By Valve Type: Ball valves and butterfly valves currently dominate the market due to their versatility and cost-effectiveness. However, the demand for rotary valves and specialized valves is also increasing.

- By Aircraft Type: The commercial aircraft segment constitutes the largest portion of the market due to high aircraft production volumes. However, military and business aircraft segments also demonstrate substantial growth potential.

- By Application: Fuel and hydraulic systems are the primary applications of aerospace valves, followed by pneumatic systems. Demand across all these applications is closely aligned with aircraft production and maintenance cycles.

Key drivers for regional dominance include favorable economic policies promoting aerospace manufacturing, well-established supply chains, and a skilled workforce. Specific economic policies such as tax incentives for aerospace companies and government funding for R&D have a direct effect on market growth in these regions.

Aerospace Valves Market Product Developments

Recent product developments focus on enhancing valve performance, reducing weight, and improving reliability. Manufacturers are incorporating advanced materials, implementing improved sealing technologies, and integrating smart sensors for real-time monitoring and predictive maintenance. These innovations cater to the industry's growing need for lighter, more efficient, and safer aircraft systems, leading to improved market fit and competitive advantage. Technological trends like the Internet of Things (IoT) are driving the adoption of smart valves, offering remote diagnostics and predictive maintenance capabilities.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Aerospace Valves market across multiple segments:

By Valve Type: Butterfly Valve, Ball Valve, Rotary Valve, Gate Valve, Others. Each segment's growth projection, market size, and competitive landscape are analyzed.

By Aircraft Type: Commercial Aircraft, General Aviation Aircraft, Business Aircraft, Military Aircraft, Helicopters. Market size and future trends are assessed for each aircraft type.

By Application: Fuel System, Hydraulic System, Pneumatic System, Others. Specific applications and their respective market dynamics are examined.

Key Drivers of Aerospace Valves Market Growth

The Aerospace Valves market's growth is driven by several key factors: the continuous expansion of the global air travel industry, increasing demand for new aircraft, stringent safety regulations mandating reliable valves, technological advancements leading to lighter and more efficient valves, and investments in research and development aimed at improving valve performance and reliability.

Challenges in the Aerospace Valves Market Sector

The Aerospace Valves market faces challenges such as intense competition, stringent quality and safety standards that increase manufacturing costs, supply chain disruptions impacting raw material availability and delivery times, and fluctuating raw material prices impacting profitability. These factors can collectively hinder market growth.

Emerging Opportunities in Aerospace Valves Market

The Aerospace Valves market presents numerous opportunities: the growing demand for unmanned aerial vehicles (UAVs), increasing focus on lightweight materials to improve fuel efficiency, development of innovative valve technologies for next-generation aircraft, expansion of aftermarket services and maintenance, repair, and overhaul (MRO) activities.

Leading Players in the Aerospace Valves Market

- Honeywell International Inc.

- Sitec Aerospace GmbH

- Collins Aerospace

- Porvair Plc

- Liebherr

- Woodward Inc.

- Eaton Corporation PLC

- Megitt Plc

- Crissair Inc.

- Triumph Group

- Triton Valves Ltd

- Moong Inc.

- Parker Hannifin Corp

- Safran SE

- Circor International Inc.

- Marotta Controls Inc.

Key Developments in Aerospace Valves Market Industry

November 2022: Triumph Group secures a contract from Lockheed Martin to manufacture brake valve assemblies for the F-16 Fighting Falcon aircraft, strengthening its position in the military aerospace sector.

August 2022: Marsh Brothers Aviation wins a four-year deal with Aviation Fabricators for supplying aircraft seat actuator valves, highlighting the growth in the aftermarket services sector.

February 2022: ITT Aerospace Controls expands its aircraft component line with five new valves and actuators, enhancing its product portfolio and competitive edge.

Strategic Outlook for Aerospace Valves Market

The Aerospace Valves market is poised for sustained growth, driven by continued expansion of the aerospace industry and the ongoing adoption of technologically advanced valves. Opportunities exist in emerging markets, particularly in the Asia-Pacific region, and in the development of advanced valve technologies for next-generation aircraft. Strategic partnerships and M&A activities will continue to shape the market landscape. The focus on lightweighting, improved performance, and enhanced safety will remain key drivers of innovation and growth in the coming years.

Aerospace Valves Market Segmentation

-

1. Valve Type

- 1.1. Butterfly Valve

- 1.2. Ball Valve

- 1.3. Rotary Valve

- 1.4. Gate Valve

- 1.5. Others

-

2. Aircraft Type

- 2.1. Commercial Aircraft

- 2.2. General Aviation Aircraft

- 2.3. Business Aircraft

- 2.4. Military Aircraft

- 2.5. Helicopters

-

3. Application

- 3.1. Fuel System

- 3.2. Hydraulic System

- 3.3. Pneumatic System

- 3.4. Others

Aerospace Valves Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Aerospace Valves Market Regional Market Share

Geographic Coverage of Aerospace Valves Market

Aerospace Valves Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Butterfly Valve Segment Is Expected To Grow Significantly During The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerospace Valves Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Valve Type

- 5.1.1. Butterfly Valve

- 5.1.2. Ball Valve

- 5.1.3. Rotary Valve

- 5.1.4. Gate Valve

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.2.1. Commercial Aircraft

- 5.2.2. General Aviation Aircraft

- 5.2.3. Business Aircraft

- 5.2.4. Military Aircraft

- 5.2.5. Helicopters

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Fuel System

- 5.3.2. Hydraulic System

- 5.3.3. Pneumatic System

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Valve Type

- 6. North America Aerospace Valves Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Valve Type

- 6.1.1. Butterfly Valve

- 6.1.2. Ball Valve

- 6.1.3. Rotary Valve

- 6.1.4. Gate Valve

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.2.1. Commercial Aircraft

- 6.2.2. General Aviation Aircraft

- 6.2.3. Business Aircraft

- 6.2.4. Military Aircraft

- 6.2.5. Helicopters

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Fuel System

- 6.3.2. Hydraulic System

- 6.3.3. Pneumatic System

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Valve Type

- 7. Europe Aerospace Valves Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Valve Type

- 7.1.1. Butterfly Valve

- 7.1.2. Ball Valve

- 7.1.3. Rotary Valve

- 7.1.4. Gate Valve

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.2.1. Commercial Aircraft

- 7.2.2. General Aviation Aircraft

- 7.2.3. Business Aircraft

- 7.2.4. Military Aircraft

- 7.2.5. Helicopters

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Fuel System

- 7.3.2. Hydraulic System

- 7.3.3. Pneumatic System

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Valve Type

- 8. Asia Pacific Aerospace Valves Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Valve Type

- 8.1.1. Butterfly Valve

- 8.1.2. Ball Valve

- 8.1.3. Rotary Valve

- 8.1.4. Gate Valve

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.2.1. Commercial Aircraft

- 8.2.2. General Aviation Aircraft

- 8.2.3. Business Aircraft

- 8.2.4. Military Aircraft

- 8.2.5. Helicopters

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Fuel System

- 8.3.2. Hydraulic System

- 8.3.3. Pneumatic System

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Valve Type

- 9. Latin America Aerospace Valves Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Valve Type

- 9.1.1. Butterfly Valve

- 9.1.2. Ball Valve

- 9.1.3. Rotary Valve

- 9.1.4. Gate Valve

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.2.1. Commercial Aircraft

- 9.2.2. General Aviation Aircraft

- 9.2.3. Business Aircraft

- 9.2.4. Military Aircraft

- 9.2.5. Helicopters

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Fuel System

- 9.3.2. Hydraulic System

- 9.3.3. Pneumatic System

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Valve Type

- 10. Middle East and Africa Aerospace Valves Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Valve Type

- 10.1.1. Butterfly Valve

- 10.1.2. Ball Valve

- 10.1.3. Rotary Valve

- 10.1.4. Gate Valve

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.2.1. Commercial Aircraft

- 10.2.2. General Aviation Aircraft

- 10.2.3. Business Aircraft

- 10.2.4. Military Aircraft

- 10.2.5. Helicopters

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Fuel System

- 10.3.2. Hydraulic System

- 10.3.3. Pneumatic System

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Valve Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sitec Aerospace GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Collins Aerospac

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Porvair Plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Liebherr

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Woodward Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eaton Corporation PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Megitt Plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Crissair Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Triumph Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Triton Valves Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Moong Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Parker Hannifin Corp

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Safran SE

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Circor International Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Marotta Controls Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Aerospace Valves Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Aerospace Valves Market Revenue (billion), by Valve Type 2025 & 2033

- Figure 3: North America Aerospace Valves Market Revenue Share (%), by Valve Type 2025 & 2033

- Figure 4: North America Aerospace Valves Market Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 5: North America Aerospace Valves Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 6: North America Aerospace Valves Market Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Aerospace Valves Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Aerospace Valves Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Aerospace Valves Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aerospace Valves Market Revenue (billion), by Valve Type 2025 & 2033

- Figure 11: Europe Aerospace Valves Market Revenue Share (%), by Valve Type 2025 & 2033

- Figure 12: Europe Aerospace Valves Market Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 13: Europe Aerospace Valves Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 14: Europe Aerospace Valves Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Aerospace Valves Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Aerospace Valves Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Aerospace Valves Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aerospace Valves Market Revenue (billion), by Valve Type 2025 & 2033

- Figure 19: Asia Pacific Aerospace Valves Market Revenue Share (%), by Valve Type 2025 & 2033

- Figure 20: Asia Pacific Aerospace Valves Market Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 21: Asia Pacific Aerospace Valves Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 22: Asia Pacific Aerospace Valves Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Asia Pacific Aerospace Valves Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Aerospace Valves Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Aerospace Valves Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Aerospace Valves Market Revenue (billion), by Valve Type 2025 & 2033

- Figure 27: Latin America Aerospace Valves Market Revenue Share (%), by Valve Type 2025 & 2033

- Figure 28: Latin America Aerospace Valves Market Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 29: Latin America Aerospace Valves Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 30: Latin America Aerospace Valves Market Revenue (billion), by Application 2025 & 2033

- Figure 31: Latin America Aerospace Valves Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Aerospace Valves Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Aerospace Valves Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Aerospace Valves Market Revenue (billion), by Valve Type 2025 & 2033

- Figure 35: Middle East and Africa Aerospace Valves Market Revenue Share (%), by Valve Type 2025 & 2033

- Figure 36: Middle East and Africa Aerospace Valves Market Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 37: Middle East and Africa Aerospace Valves Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 38: Middle East and Africa Aerospace Valves Market Revenue (billion), by Application 2025 & 2033

- Figure 39: Middle East and Africa Aerospace Valves Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Aerospace Valves Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Aerospace Valves Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerospace Valves Market Revenue billion Forecast, by Valve Type 2020 & 2033

- Table 2: Global Aerospace Valves Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 3: Global Aerospace Valves Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Aerospace Valves Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Aerospace Valves Market Revenue billion Forecast, by Valve Type 2020 & 2033

- Table 6: Global Aerospace Valves Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 7: Global Aerospace Valves Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Aerospace Valves Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Aerospace Valves Market Revenue billion Forecast, by Valve Type 2020 & 2033

- Table 12: Global Aerospace Valves Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 13: Global Aerospace Valves Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Aerospace Valves Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Germany Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Aerospace Valves Market Revenue billion Forecast, by Valve Type 2020 & 2033

- Table 20: Global Aerospace Valves Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 21: Global Aerospace Valves Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Aerospace Valves Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Australia Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Aerospace Valves Market Revenue billion Forecast, by Valve Type 2020 & 2033

- Table 29: Global Aerospace Valves Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 30: Global Aerospace Valves Market Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Aerospace Valves Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Mexico Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Brazil Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Aerospace Valves Market Revenue billion Forecast, by Valve Type 2020 & 2033

- Table 35: Global Aerospace Valves Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 36: Global Aerospace Valves Market Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Aerospace Valves Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East and Africa Aerospace Valves Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace Valves Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Aerospace Valves Market?

Key companies in the market include Honeywell International Inc, Sitec Aerospace GmbH, Collins Aerospac, Porvair Plc, Liebherr, Woodward Inc, Eaton Corporation PLC, Megitt Plc, Crissair Inc, Triumph Group, Triton Valves Ltd, Moong Inc, Parker Hannifin Corp, Safran SE, Circor International Inc, Marotta Controls Inc.

3. What are the main segments of the Aerospace Valves Market?

The market segments include Valve Type, Aircraft Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.81 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Butterfly Valve Segment Is Expected To Grow Significantly During The Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Triumph Group announced that they had won a contract from Lockheed Martin to manufacture the brake valve assembly for the F-16 Fighting Falcon aircraft. The Triumph Group will provide production hardware and operational support for the F-16 aircraft.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerospace Valves Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerospace Valves Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerospace Valves Market?

To stay informed about further developments, trends, and reports in the Aerospace Valves Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence