Key Insights

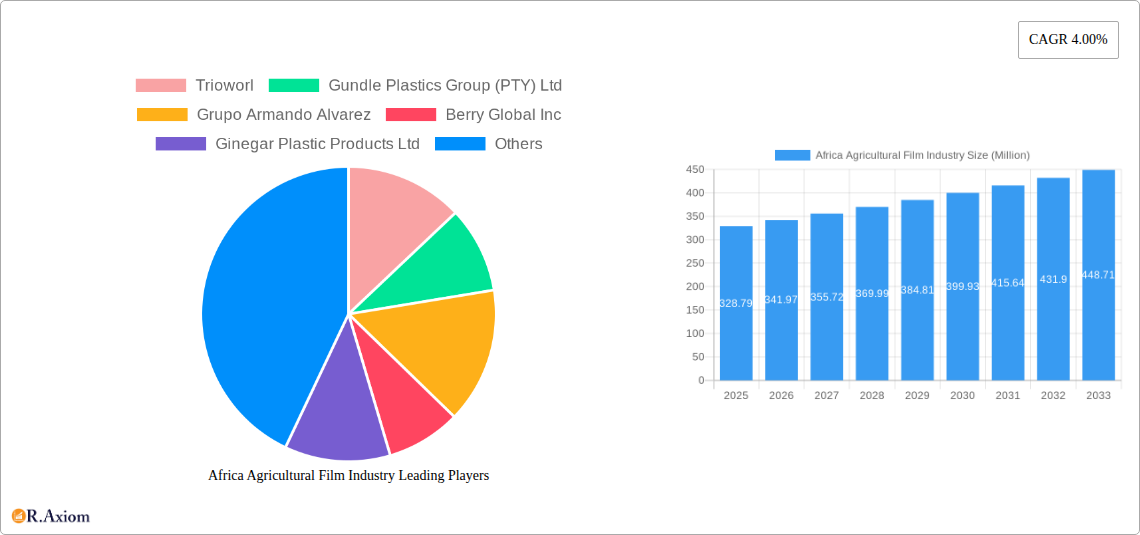

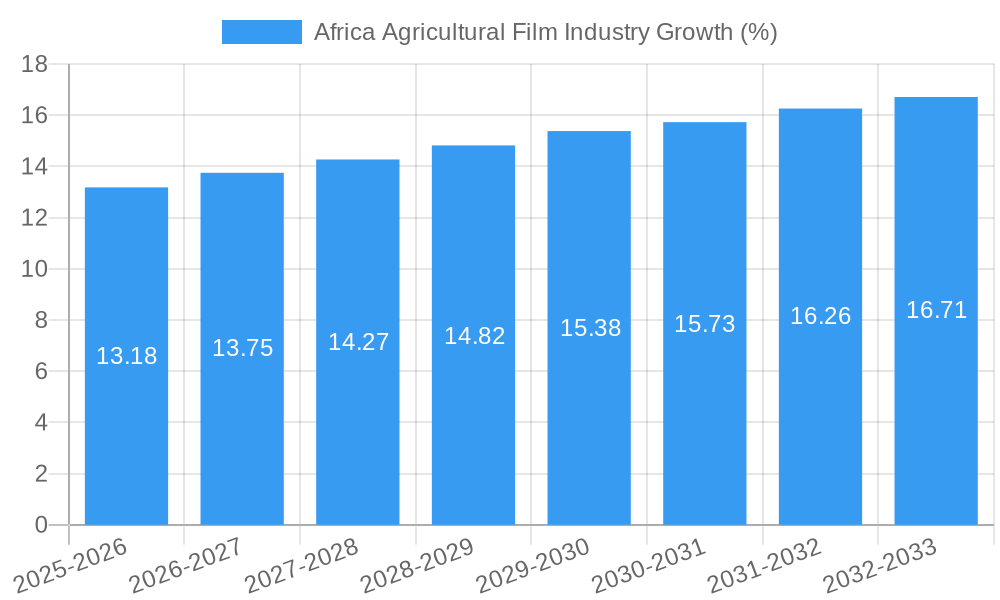

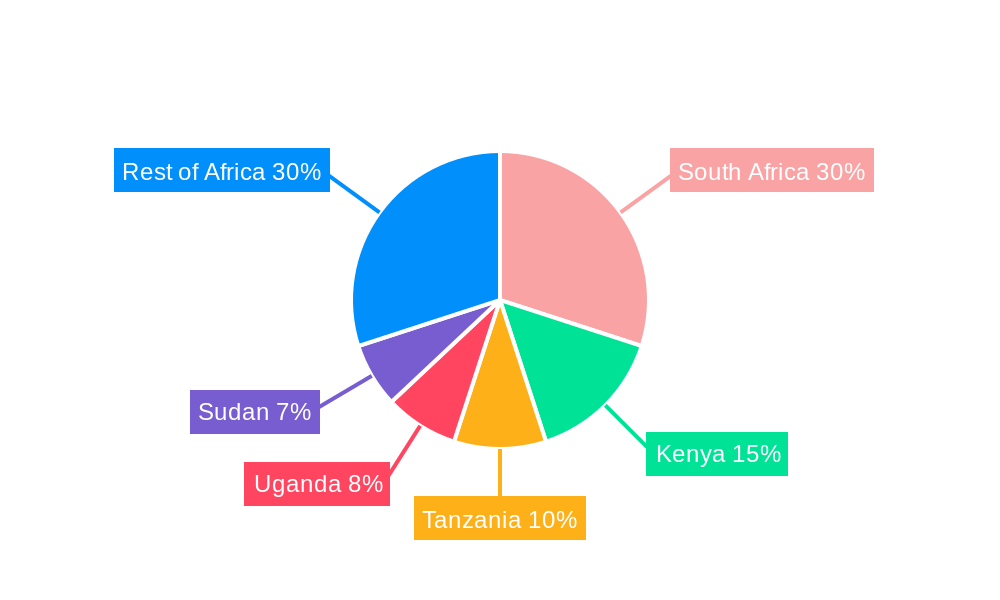

The African agricultural film market, valued at $328.79 million in 2025, is projected to experience robust growth, driven by the increasing adoption of modern farming techniques and the rising demand for efficient irrigation and crop protection solutions. The market's Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033 indicates a steady expansion, fueled by several key factors. Increased government initiatives promoting agricultural modernization, coupled with rising investments in agricultural infrastructure across various African nations, are significantly contributing to market growth. The prevalent use of polyethylene films for silage preservation, soil mulching, and greenhouse cultivation is further bolstering demand. Specific growth is observed in regions like South Africa, Kenya, and Tanzania, where the agricultural sector is relatively advanced and receptive to technological advancements. However, challenges such as inconsistent agricultural policies in certain regions and the high initial investment cost associated with adopting these films may present some restraints. The market is segmented by film type (LDPE, LLDPE, HDPE, EVA/EBA, Reclaims, Other) and application (silage, mulching, greenhouse). The polyethylene types dominate, reflecting their suitability for agricultural applications. The presence of established players like Trioworld, Gundle Plastics Group, and Berry Global indicates a competitive landscape with opportunities for both large-scale manufacturers and local suppliers.

The forecast period (2025-2033) anticipates continued expansion, with specific growth concentrated within segments demonstrating high potential for yield improvements and cost savings. Further market penetration will likely depend on successful strategies that address affordability concerns through financing options and targeted education programs, fostering broader adoption across smaller-scale farms. Regional variations in growth will be influenced by factors such as governmental support, infrastructure development, and climate conditions. This necessitates a targeted approach by market participants, emphasizing customized solutions for diverse agricultural practices and regional contexts within Africa. The market's resilience is evident in its ability to adapt to fluctuating conditions, indicating a promising future, despite certain challenges.

Africa Agricultural Film Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Africa Agricultural Film Industry, offering invaluable insights for stakeholders across the value chain. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. The report leverages extensive primary and secondary research to deliver actionable intelligence on market size, growth drivers, challenges, and future opportunities. Expected market value projections are included throughout, though specific figures for some areas may be denoted as "xx" where data is currently unavailable.

Africa Agricultural Film Industry Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, and regulatory factors influencing the African agricultural film market. Market concentration is assessed through metrics such as market share held by key players like Trioworl, Gundle Plastics Group (PTY) Ltd, Grupo Armando Alvarez, Berry Global Inc, Ginegar Plastic Products Ltd, INDEVCO (Industrial Development Company) Group, and BASF SE. The report examines the impact of mergers and acquisitions (M&A) activity, including the value of deals concluded during the study period (xx Million). Innovation drivers, such as advancements in polymer technology and sustainable film solutions, are explored, along with their impact on market growth. Regulatory frameworks related to plastic waste management and environmental sustainability are also analyzed. The influence of product substitutes, such as biodegradable films, and evolving end-user trends within the agricultural sector are examined. This section further investigates the market’s response to evolving consumer preferences for sustainable and high-performance agricultural films.

- Market Share Analysis: Detailed breakdown of market share held by key players, including those listed above.

- M&A Activity: Assessment of completed and prospective M&A deals, including their value (xx Million).

- Innovation Drivers: Analysis of technological advancements and their influence on product development and market competitiveness.

- Regulatory Landscape: Review of relevant regulations and their impact on market dynamics.

- Substitute Products: Examination of alternatives and their competitive pressure.

- End-User Trends: Analysis of shifts in demand driven by agricultural practices and technological adoption.

Africa Agricultural Film Industry Industry Trends & Insights

This section delves into the key trends shaping the African agricultural film market. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%. Market penetration rates for various film types across different agricultural applications will be analyzed. The report will also explore technological disruptions influencing film production, such as advancements in extrusion technology and the rise of automated film application systems. The section will then further assess changing consumer preferences toward specific film types based on their performance characteristics, cost-effectiveness, and environmental impact. A comprehensive analysis of the competitive dynamics, including pricing strategies and product differentiation, will also be presented. This will include factors influencing the market including macroeconomic trends and agricultural policies.

Dominant Markets & Segments in Africa Agricultural Film Industry

This section identifies the leading regions, countries, and segments within the African agricultural film market. Dominance will be analyzed across film types (Low-density Polyethylene (LDPE), Linear Low-density Polyethylene (LLDPE), High-density Polyethylene (HDPE), Ethyl Vinyl Acetate (EVA)/Ethylene Butyl Acrylate (EBA), Reclaims, Other Film Types) and applications (Silage, Mulching, Greenhouse).

- Key Drivers for Dominant Segments:

- Economic policies: Impact of government support for agriculture and investment in infrastructure.

- Infrastructure: Availability of irrigation systems and storage facilities influencing film demand.

- Agricultural practices: Adoption of modern farming techniques increasing film usage.

- Climate conditions: Regional variations impacting suitability of specific film types.

The dominance analysis provides a detailed examination of the factors contributing to the success of leading regions and segments, including market size, growth rates, and competitive intensity.

Africa Agricultural Film Industry Product Developments

This section summarizes recent product innovations, focusing on advancements in film materials, such as biodegradable and recyclable options, enhancing performance characteristics such as UV resistance and durability, and expanding applications to address specific agricultural needs. The competitive advantages offered by innovative products will be highlighted, showcasing how they are shaping market dynamics. Technological trends driving these innovations, including the use of nanomaterials and additives, will be analyzed.

Report Scope & Segmentation Analysis

This report segments the Africa Agricultural Film Industry by film type and application. Each segment's growth projections, market sizes, and competitive dynamics are detailed below. Each segment will have a dedicated paragraph analyzing its growth drivers and challenges.

- Film Type: LDPE, LLDPE, HDPE, EVA/EBA, Reclaims, Other Film Types. (Paragraphs for each detailing growth, market size, and competitive landscape).

- Application: Silage, Mulching, Greenhouse. (Paragraphs for each detailing growth, market size, and competitive landscape).

Key Drivers of Africa Agricultural Film Industry Growth

The growth of the Africa Agricultural Film Industry is driven by several key factors. Increased agricultural production to meet growing food demands is a primary driver. Government initiatives promoting modern farming techniques and investment in agricultural infrastructure further stimulate market expansion. The adoption of advanced farming technologies, which rely heavily on agricultural films, is also a crucial driver. Additionally, favorable climatic conditions in several regions of Africa contribute to heightened demand for agricultural films for diverse applications.

Challenges in the Africa Agricultural Film Industry Sector

The industry faces several challenges, including limited access to advanced technologies in some regions, high material costs due to import dependencies, and inadequate waste management infrastructure that hinders the widespread adoption of sustainable film alternatives. The lack of awareness about the benefits of using agricultural films in certain farming communities also poses a significant barrier to growth. Furthermore, intense competition among existing players and the entry of new players adds to the challenges faced by the market.

Emerging Opportunities in Africa Agricultural Film Industry

Significant opportunities exist in expanding the use of agricultural films in emerging agricultural sectors. The promotion of sustainable film solutions, such as biodegradable films, presents a promising avenue for growth. Investing in advanced recycling infrastructure to mitigate environmental concerns related to plastic waste offers substantial opportunities for industry players. Increased adoption of precision farming technologies is expected to drive demand for advanced agricultural films that offer higher performance and efficiency.

Leading Players in the Africa Agricultural Film Industry Market

- Trioworld

- Gundle Plastics Group (PTY) Ltd

- Grupo Armando Alvarez

- Berry Global Inc

- Ginegar Plastic Products Ltd

- INDEVCO (Industrial Development Company) Group

- BASF SE

Key Developments in Africa Agricultural Film Industry Industry

- [Month, Year]: Launch of a new biodegradable agricultural film by [Company Name].

- [Month, Year]: Acquisition of [Company A] by [Company B].

- [Month, Year]: Government initiative to promote sustainable agricultural practices, including the use of innovative films.

- [Month, Year]: Introduction of new technology in film production by [Company Name] resulting in xx% increase in efficiency. (Add further entries as data becomes available)

Strategic Outlook for Africa Agricultural Film Industry Market

The Africa Agricultural Film Industry is poised for significant growth over the forecast period, driven by expanding agricultural production, increasing adoption of modern farming practices, and the emergence of innovative film technologies. The market is expected to witness a shift toward sustainable and high-performance films, creating opportunities for companies that can meet the evolving needs of farmers. Strategic alliances and investments in research and development will be crucial for players seeking to capitalize on the market's growth potential.

Africa Agricultural Film Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Agricultural Film Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Agricultural Film Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Increased Food Demand and Need for Increased Agricultural Food Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Agricultural Film Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa Africa Agricultural Film Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Agricultural Film Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Agricultural Film Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Agricultural Film Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Agricultural Film Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Agricultural Film Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Trioworl

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Gundle Plastics Group (PTY) Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Grupo Armando Alvarez

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Berry Global Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Ginegar Plastic Products Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 INDEVCO (Industrial Development Company) Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 BASF SE

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 Trioworl

List of Figures

- Figure 1: Africa Agricultural Film Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Agricultural Film Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Agricultural Film Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Agricultural Film Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Africa Agricultural Film Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Africa Agricultural Film Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Africa Agricultural Film Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Africa Agricultural Film Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Africa Agricultural Film Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Africa Agricultural Film Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Africa Agricultural Film Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: Africa Agricultural Film Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: Africa Agricultural Film Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Africa Agricultural Film Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Africa Agricultural Film Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: Africa Agricultural Film Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Nigeria Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Africa Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Egypt Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Kenya Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Ethiopia Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Morocco Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Ghana Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Algeria Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Tanzania Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Ivory Coast Africa Agricultural Film Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Agricultural Film Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Africa Agricultural Film Industry?

Key companies in the market include Trioworl, Gundle Plastics Group (PTY) Ltd, Grupo Armando Alvarez, Berry Global Inc, Ginegar Plastic Products Ltd, INDEVCO (Industrial Development Company) Group, BASF SE.

3. What are the main segments of the Africa Agricultural Film Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 328.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Increased Food Demand and Need for Increased Agricultural Food Productivity.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Agricultural Film Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Agricultural Film Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Agricultural Film Industry?

To stay informed about further developments, trends, and reports in the Africa Agricultural Film Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence