Key Insights

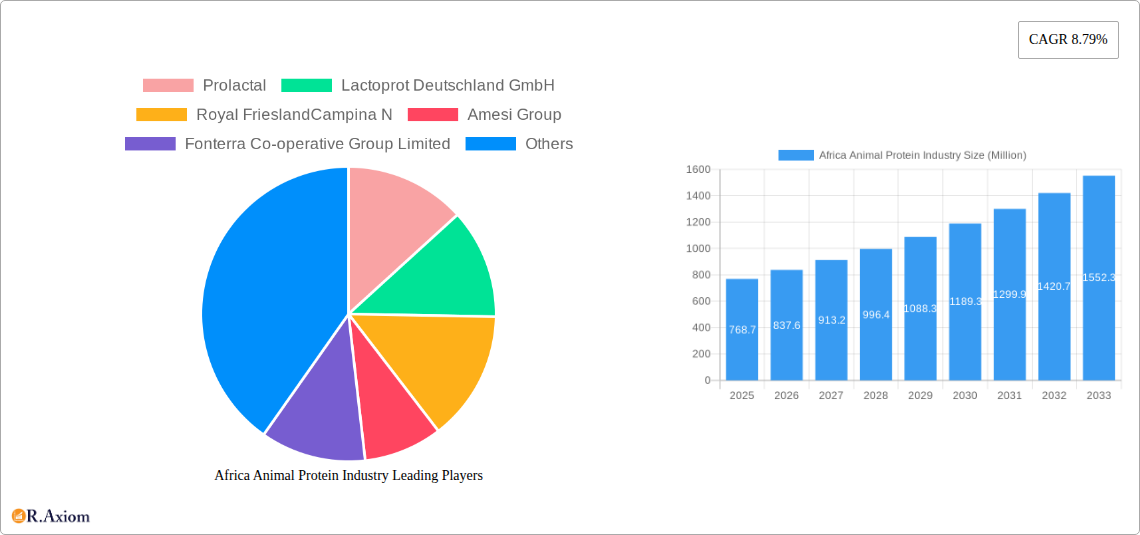

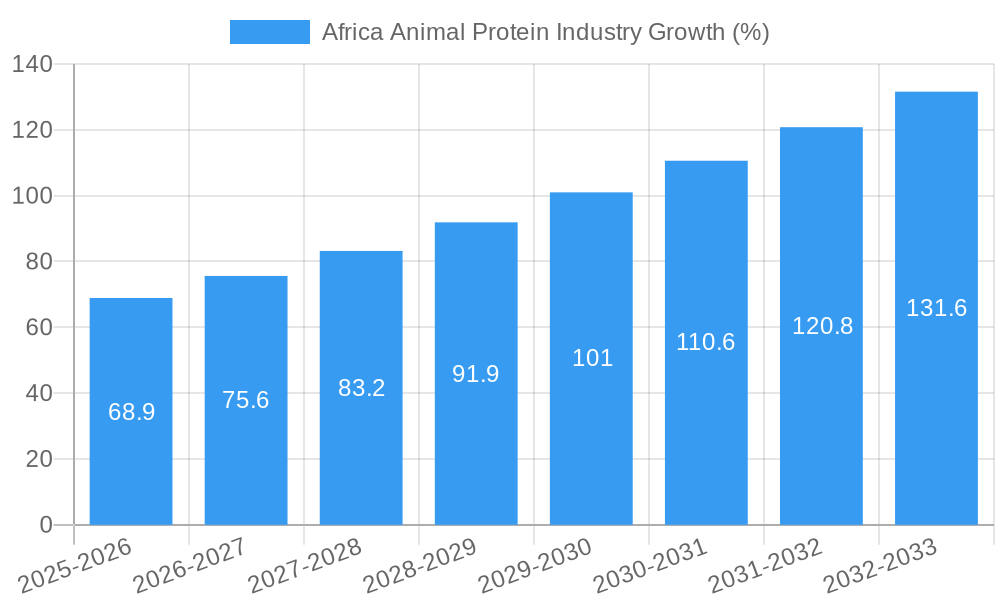

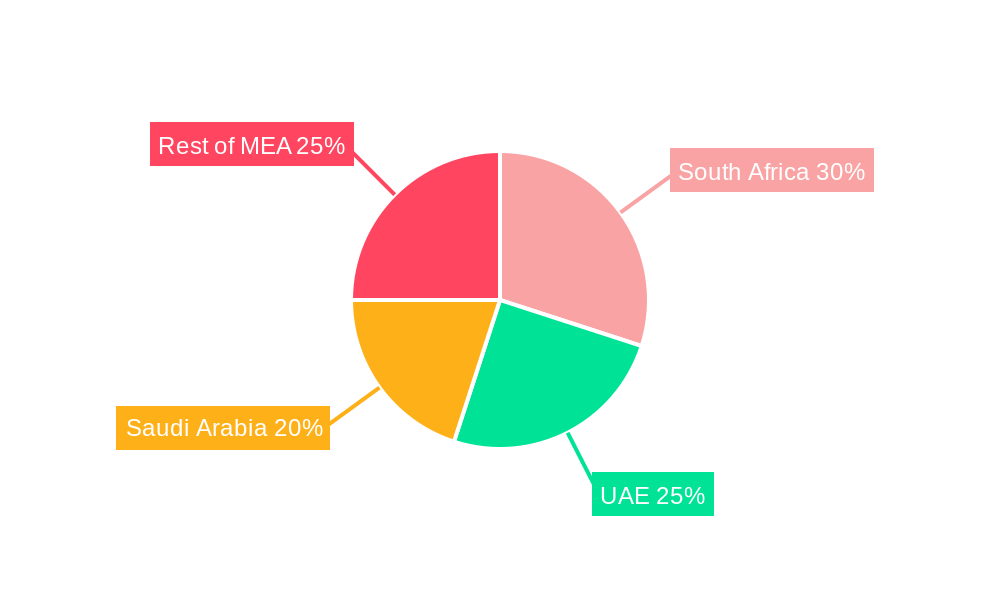

The Africa animal protein market, valued at approximately $768.7 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 8.79% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning population across the Middle East and Africa (MEA) region, particularly in countries like South Africa, UAE, and Saudi Arabia, is increasing the demand for animal-based protein sources in both food and feed applications. Secondly, the rising disposable incomes in several MEA countries are contributing to increased consumption of protein-rich foods, including meat, dairy, and eggs. Thirdly, the growth of the sports nutrition sector, coupled with increasing health awareness, is driving demand for high-quality protein supplements such as whey and casein. Finally, ongoing investments in animal feed production and advancements in animal husbandry techniques are further boosting the market. However, challenges remain, including fluctuating raw material prices, potential supply chain disruptions, and the need for sustainable and ethical sourcing practices within the animal protein industry.

Growth within specific protein types will vary. Whey protein, due to its popularity in sports nutrition, is expected to dominate the market share, followed by casein and caseinates, primarily used in dairy and food applications. Collagen and egg protein segments are also anticipated to demonstrate growth, although at a slower pace than whey. The animal feed segment will continue to be a significant end-user, driven by the expanding livestock industry in the region. While precise market segmentation data is unavailable, a logical estimation suggests a distribution favoring animal feed over food and beverage applications, mirroring global trends. Companies like Prolactal, Lactoprot Deutschland GmbH, and Fonterra are key players, and their strategies will significantly shape the market landscape in the coming years. Further research into specific market segment sizes and individual company performance will offer a more granular understanding of this dynamic industry.

Africa Animal Protein Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Africa Animal Protein Industry, covering market size, growth drivers, challenges, and future opportunities from 2019 to 2033. With a focus on key segments, leading players, and recent industry developments, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to project the forecast period (2025-2033).

Africa Animal Protein Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the African animal protein market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of large multinational corporations and smaller regional players. While precise market share data for individual companies is unavailable for this report, the market is currently moderately concentrated, with the top five players likely holding xx% of the market share. The value of M&A deals in the industry has been estimated at xx Million over the past five years.

- Innovation Drivers: Growing demand for high-protein foods, increasing health consciousness, and technological advancements in protein extraction and processing are key drivers of innovation.

- Regulatory Frameworks: Varying regulatory landscapes across African countries influence market access and product development. Harmonization of regulations could boost market growth.

- Product Substitutes: Plant-based protein alternatives are emerging as substitutes, posing a potential challenge to the animal protein industry.

- End-User Trends: Shifting consumer preferences towards convenience, health, and sustainability are shaping product development strategies.

- M&A Activities: Consolidation through mergers and acquisitions is expected to continue, driven by the need for economies of scale and access to new markets.

Africa Animal Protein Industry Industry Trends & Insights

The African animal protein market is experiencing significant growth, driven by rising disposable incomes, population growth, and urbanization. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, particularly in areas like precision fermentation and insect protein production, are expected to reshape the industry. Consumer preferences are shifting towards healthier and more sustainable protein sources. Competitive dynamics are intense, with companies vying for market share through innovation, branding, and distribution strategies. Market penetration of specific animal protein types varies significantly across regions and countries. Whey protein, for instance, displays higher penetration in urban areas compared to rural regions due to higher purchasing power and access to distribution channels.

Dominant Markets & Segments in Africa Animal Protein Industry

The report identifies key dominant markets and segments within the African animal protein industry. While data limitations preclude exact quantification, analysis suggests that South Africa, Nigeria, and Egypt represent some of the largest national markets, driven by factors like higher per capita income and established food processing industries.

Dominant Protein Types:

- Whey Protein: High demand driven by its use in sports nutrition and functional foods.

- Milk Protein: Wide application in dairy products and infant formula.

- Casein and Caseinates: Usage in cheese and other dairy products.

Dominant End-Users:

- Food and Beverages: Largest segment, driven by increasing demand for protein-rich foods and beverages.

- Animal Feed: Significant demand from the growing livestock industry.

- Sport/Performance Nutrition: Rapidly growing segment due to rising health consciousness and fitness trends.

Key Drivers:

- Economic growth and rising disposable incomes.

- Expanding urban population.

- Growing middle class with increased protein consumption.

- Government initiatives to promote food security and agricultural development.

Africa Animal Protein Industry Product Developments

Recent years have seen significant product innovation in the African animal protein industry. Companies are focusing on developing convenient, functional, and value-added protein products, such as ready-to-drink protein shakes, protein bars, and high-protein dairy products. Technological advancements in protein extraction, purification, and formulation are enabling the development of novel products with enhanced nutritional profiles and functionalities. This focus on value-added products caters to the growing demand for convenience and health-conscious options among consumers.

Report Scope & Segmentation Analysis

This report segments the Africa animal protein market by protein type (Casein and Caseinates, Collagen, Egg Protein, Gelatin, Insect Protein, Milk Protein, Whey Protein, Other Animal Protein) and end-user (Animal Feed, Food and Beverages, Sport/Performance Nutrition). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. For example, the whey protein segment is anticipated to witness robust growth due to its increasing incorporation into various applications, including sports nutrition products, while the insect protein segment, though nascent, showcases significant potential for future growth.

Key Drivers of Africa Animal Protein Industry Growth

Several factors are driving the growth of the Africa animal protein industry. Firstly, a rapidly expanding population is increasing the overall demand for protein sources. Secondly, rising urbanization and disposable incomes are increasing purchasing power, enabling consumers to afford more protein-rich products. Finally, increasing awareness of the importance of protein for health and fitness is fueling demand for specialized protein products, particularly within the sports nutrition segment.

Challenges in the Africa Animal Protein Industry Sector

The African animal protein industry faces several challenges. These include inconsistent regulatory frameworks across different countries, which hinders cross-border trade and market expansion. Supply chain inefficiencies and a lack of reliable infrastructure also pose significant obstacles. Finally, the growing prevalence of plant-based protein alternatives creates additional competitive pressure. These factors collectively restrict the industry's growth potential.

Emerging Opportunities in Africa Animal Protein Industry

The African animal protein industry presents significant opportunities. Expanding into new markets, particularly in rapidly growing urban centers, offers substantial potential. Technological advancements, such as precision fermentation and alternative protein sources, hold promise for sustainable and efficient protein production. Finally, a growing focus on health and wellness creates a strong demand for functional and value-added protein products.

Leading Players in the Africa Animal Protein Industry Market

- Prolactal

- Lactoprot Deutschland GmbH

- Royal FrieslandCampina N.V.

- Amesi Group

- Fonterra Co-operative Group Limited

- Hilmar Cheese Company Inc.

- Kerry Group plc

Key Developments in Africa Animal Protein Industry Industry

- February 2021: Prolactal introduced PRORGANIC, a flexible new line of organic milk and whey proteins for use in organic dairy products and sports drinks.

- February 2021: FrieslandCampina Ingredients partnered with Cayuga Milk Ingredients to produce Refit milk proteins, MPI 90 and MPC 85.

- April 2020: FrieslandCampina Ingredients unveiled a high-protein sports gel concept using its Nutri Whey Isolate Clear ingredient, providing a convenient high-protein option.

Strategic Outlook for Africa Animal Protein Industry Market

The African animal protein market is poised for significant growth, driven by population expansion, rising incomes, and increased health consciousness. Companies with a focus on innovation, sustainable practices, and effective distribution strategies will be best positioned to capitalize on the market's immense potential. The industry's future lies in producing high-quality, affordable, and convenient protein products to meet the needs of a growing and increasingly health-conscious population.

Africa Animal Protein Industry Segmentation

-

1. Protein Type

- 1.1. Casein and Caseinates

- 1.2. Collagen

- 1.3. Egg Protein

- 1.4. Gelatin

- 1.5. Insect Protein

- 1.6. Milk Protein

- 1.7. Whey Protein

- 1.8. Other Animal Protein

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. RTE/RTC Food Products

- 2.2.1.7. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Africa Animal Protein Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Animal Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.79% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion

- 3.3. Market Restrains

- 3.3.1. Associated Health Risks; Easy Availability of Healthy Substitutes

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Animal Protein Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Casein and Caseinates

- 5.1.2. Collagen

- 5.1.3. Egg Protein

- 5.1.4. Gelatin

- 5.1.5. Insect Protein

- 5.1.6. Milk Protein

- 5.1.7. Whey Protein

- 5.1.8. Other Animal Protein

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. RTE/RTC Food Products

- 5.2.2.1.7. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. UAE Africa Animal Protein Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Africa Animal Protein Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Africa Animal Protein Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Africa Animal Protein Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Prolactal

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lactoprot Deutschland GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Royal FrieslandCampina N

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Amesi Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fonterra Co-operative Group Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hilmar Cheese Company Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kerry Group plc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Prolactal

List of Figures

- Figure 1: Africa Animal Protein Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Animal Protein Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Animal Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Animal Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Africa Animal Protein Industry Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 4: Africa Animal Protein Industry Volume K Tons Forecast, by Protein Type 2019 & 2032

- Table 5: Africa Animal Protein Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Africa Animal Protein Industry Volume K Tons Forecast, by End User 2019 & 2032

- Table 7: Africa Animal Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Africa Animal Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Africa Animal Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Africa Animal Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: UAE Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: UAE Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: South Africa Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Saudi Arabia Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Saudi Arabia Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Rest of MEA Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of MEA Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Africa Animal Protein Industry Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 20: Africa Animal Protein Industry Volume K Tons Forecast, by Protein Type 2019 & 2032

- Table 21: Africa Animal Protein Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 22: Africa Animal Protein Industry Volume K Tons Forecast, by End User 2019 & 2032

- Table 23: Africa Animal Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Africa Animal Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 25: Nigeria Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Nigeria Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: South Africa Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: South Africa Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Egypt Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Egypt Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Kenya Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Kenya Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Ethiopia Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Ethiopia Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: Morocco Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Morocco Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Ghana Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ghana Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Algeria Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Algeria Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Tanzania Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Tanzania Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Ivory Coast Africa Animal Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Ivory Coast Africa Animal Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Animal Protein Industry?

The projected CAGR is approximately 8.79%.

2. Which companies are prominent players in the Africa Animal Protein Industry?

Key companies in the market include Prolactal, Lactoprot Deutschland GmbH, Royal FrieslandCampina N, Amesi Group, Fonterra Co-operative Group Limited, Hilmar Cheese Company Inc, Kerry Group plc.

3. What are the main segments of the Africa Animal Protein Industry?

The market segments include Protein Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 768.7 Million as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Associated Health Risks; Easy Availability of Healthy Substitutes.

8. Can you provide examples of recent developments in the market?

February 2021: Prolactal introduced PRORGANIC, which is a flexible new line of organic milk and whey proteins. Proteins of this line can be used to enrich organic dairy products, including sports drinks, Greek-style yogurt, and soft cheese.February 2021: FrieslandCampina Ingredients partnered with Cayuga Milk Ingredients for the production of its Refit milk proteins, MPI 90 and MPC 85.April 2020: FrieslandCampina Ingredients unveiled a new, concentrated high-protein sports gel concept formulated with its Nutri Whey Isolate Clear ingredient. The high-protein concept delivers protein content of up to 15% in a convenient format. As per the company, the product can provide an equivalent amount of high-quality protein as a 500 ml sports drink. The concept designed by the company aims to promote its recently launched Nutri Whey Isolate and increase awareness regarding its application among food manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Animal Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Animal Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Animal Protein Industry?

To stay informed about further developments, trends, and reports in the Africa Animal Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence