Key Insights

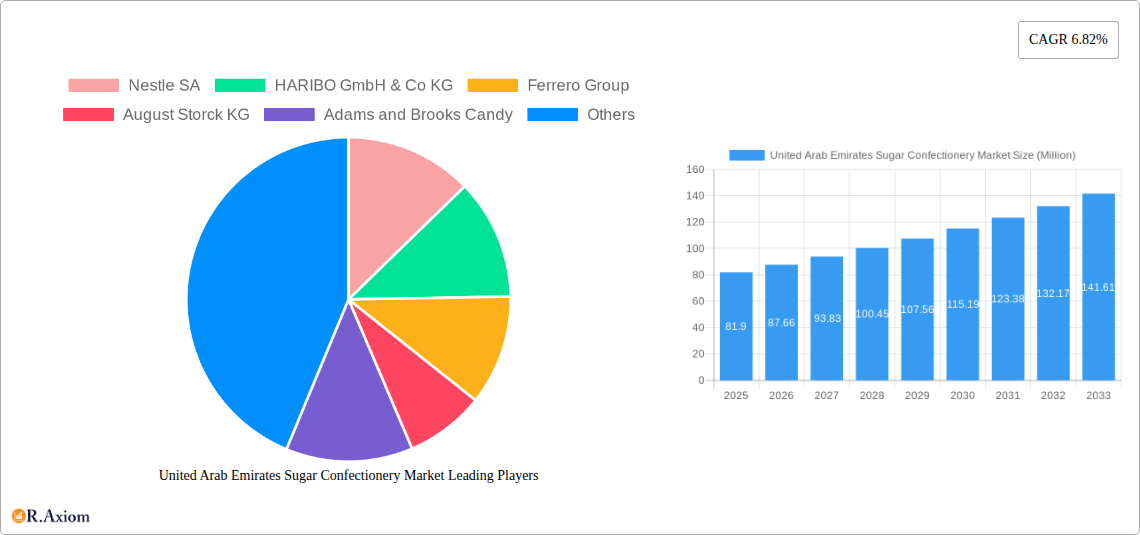

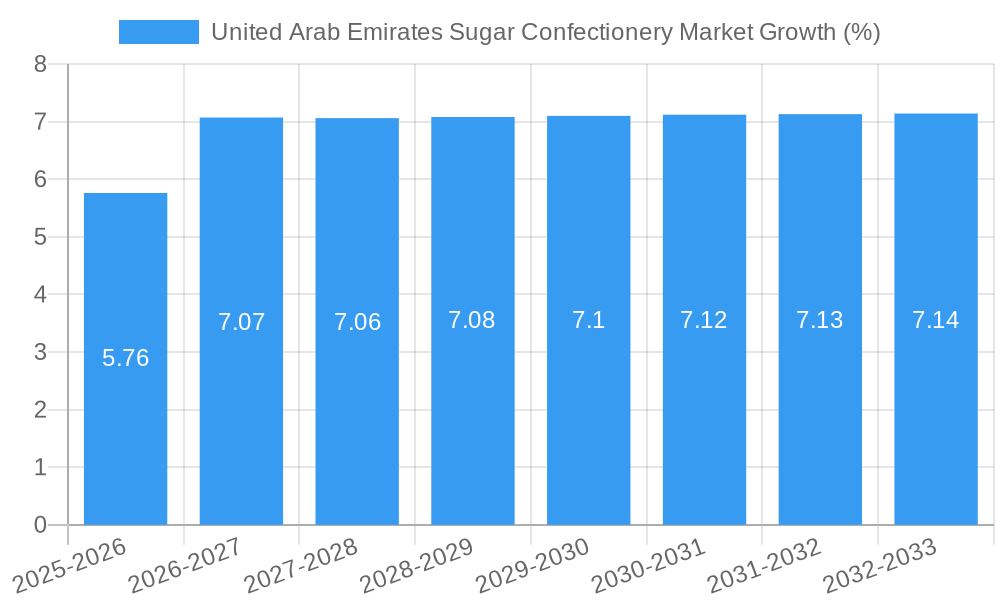

The United Arab Emirates (UAE) sugar confectionery market, valued at approximately $81.90 million in 2025, is projected to experience robust growth, driven by a rising population, increasing disposable incomes, and a growing preference for convenient and indulgent snacks. The market's Compound Annual Growth Rate (CAGR) of 6.82% from 2025 to 2033 indicates a significant expansion opportunity. Key market segments include supermarkets/hypermarkets, specialist retailers, and online retail stores, reflecting evolving consumer shopping habits. Product-wise, boiled sweets, toffees, caramels, and nougat remain popular, while pastilles, jellies, and mints are also experiencing growth, driven by health-conscious consumers seeking lower-sugar options. The presence of major international players like Nestle, Ferrero, and Mondelez, alongside local brands, ensures a competitive landscape. Challenges include fluctuating sugar prices and increasing health concerns surrounding sugar consumption, prompting manufacturers to innovate with healthier alternatives and focus on premiumization strategies. The UAE's strong tourism sector also contributes significantly to the market’s growth, as confectionery products form a prominent part of tourist purchases. Future growth will likely be fueled by strategic partnerships, product diversification, and effective marketing campaigns targeting different consumer demographics.

The UAE's confectionery market is particularly sensitive to consumer preferences and trends. The increasing popularity of online retail channels presents a compelling opportunity for growth, necessitating robust e-commerce strategies from manufacturers. Furthermore, the market's competitive landscape demands innovative product development, such as sugar-free or reduced-sugar confectionery, to address increasing health awareness. Marketing efforts that emphasize premium quality, unique flavors, and cultural relevance will be crucial for achieving sustained market share. Government regulations related to food safety and labeling standards also need to be carefully considered by market participants. Overall, the UAE's sugar confectionery market offers a promising investment prospect, provided businesses adopt agile and adaptable strategies to address dynamic consumer preferences and market challenges.

United Arab Emirates Sugar Confectionery Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the United Arab Emirates (UAE) sugar confectionery market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report explores market dynamics, segmentation, competitive landscape, and future growth prospects. The report leverages extensive primary and secondary research, incorporating quantitative data and qualitative analysis to deliver actionable strategic insights. The UAE sugar confectionery market is projected to reach xx Million by 2033.

United Arab Emirates Sugar Confectionery Market Market Concentration & Innovation

This section analyzes the competitive landscape of the UAE sugar confectionery market, focusing on market concentration, innovation drivers, and regulatory factors. Key aspects include:

Market Concentration: The UAE sugar confectionery market exhibits a moderately concentrated structure, with a few multinational players holding significant market share. Nestle SA, HARIBO GmbH & Co KG, Ferrero Group, and Mondelez International Inc. are major players, commanding a collective market share of approximately xx%. Smaller regional players like Al Seedawi Lebanese & Emirates Factory Co. also contribute significantly to the market. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

Innovation Drivers: Innovation in the UAE sugar confectionery market is driven by factors such as evolving consumer preferences (e.g., demand for healthier options, novel flavors), technological advancements in production and packaging, and the introduction of innovative product formats (e.g., gummies, innovative flavor combinations).

Regulatory Framework: UAE food safety regulations and labeling requirements significantly influence the market. Compliance with these regulations and maintaining high product quality are critical for success. Recent regulatory changes focusing on sugar content and labeling are reshaping the industry.

Product Substitutes: The market faces competition from alternative snack and sweet treat options, including fruit snacks, baked goods, and healthier confectionery alternatives. Companies are adapting by offering sugar-reduced or natural sweetener options.

End-User Trends: The UAE’s diverse population drives diverse preferences, influencing product development. Demand for premium confectionery, unique flavors catering to specific cultural tastes, and halal-certified products are crucial trends.

Mergers & Acquisitions (M&A): The UAE confectionery landscape has witnessed moderate M&A activity in the recent past. The values of these deals have ranged from xx Million to xx Million, primarily focused on expanding market reach and product portfolios.

United Arab Emirates Sugar Confectionery Market Industry Trends & Insights

This section delves into the key market trends shaping the UAE's sugar confectionery landscape. It examines market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing crucial insights into the market’s evolution.

The UAE sugar confectionery market is expected to witness a CAGR of xx% during the forecast period (2025-2033), driven by rising disposable incomes, a growing population with a preference for sweet treats, and the increasing popularity of online retail channels. Market penetration of premium confectionery brands is projected to increase from xx% in 2025 to xx% by 2033, reflecting the growing purchasing power of consumers. Technological advancements such as automated production lines and improved packaging are boosting efficiency and enhancing product quality, while e-commerce platforms are expanding market accessibility. However, changing consumer preferences toward healthier options and increasing health awareness present a significant challenge for traditional confectionery players. Intense competition among established international and regional brands is further shaping market dynamics.

Dominant Markets & Segments in United Arab Emirates Sugar Confectionery Market

This section identifies the leading segments within the UAE sugar confectionery market, considering both distribution channels and product types.

Distribution Channels:

- Supermarkets/Hypermarkets: This segment dominates the market due to wide reach and established distribution networks. Key drivers include high consumer traffic, promotional activities, and the availability of a wide range of products.

- Specialist Retailers: This segment caters to niche consumer demands, offering specialized confectionery products and creating a premium experience, driving growth.

- Convenience Stores: Convenient locations and impulsive purchase behavior drive sales in this segment, although it commands a smaller market share than supermarkets.

- Online Retail Stores: This segment is experiencing rapid growth due to the increasing popularity of e-commerce and home delivery services. Factors such as convenience, wider product selections, and competitive pricing fuel this growth.

- Other Distribution Channels: This segment includes traditional retailers, wholesalers, and direct sales, which still hold a considerable share, especially in smaller towns and regions.

Product Types:

- Boiled Sweets, Toffees, Caramels, and Nougat: This segment remains popular due to traditional preferences, though facing some decline due to health concerns.

- Pastilles and Jellies: This segment is experiencing steady growth due to its perceived "healthier" status compared to other confectionery types.

- Mints: This is a consistently strong segment due to its association with oral hygiene and refreshing qualities.

- Other Product Types: This includes chocolates, gums and other confectionery products, with growth dependent on specific product innovations and trends.

The UAE’s robust economy, sophisticated retail infrastructure, and high disposable incomes contribute significantly to the dominance of the supermarkets/hypermarkets segment in terms of distribution channels. The Boiled Sweets, Toffees, Caramels and Nougat segment remains a major contributor to overall market value, although other product segments are expanding rapidly.

United Arab Emirates Sugar Confectionery Market Product Developments

Recent product innovations include sugar-reduced options, healthier ingredients, unique flavor combinations, and sustainable packaging. Technological advancements in manufacturing, such as precision dispensing and automated packaging, enhance efficiency and product quality. These trends align with evolving consumer preferences and contribute to a dynamic market landscape.

Report Scope & Segmentation Analysis

This report comprehensively segments the UAE sugar confectionery market by distribution channels (supermarkets/hypermarkets, specialist retailers, convenience stores, online retail stores, other distribution channels) and product types (boiled sweets, toffees, caramels, and nougat; pastilles and jellies; mints; other product types). Each segment’s growth projection, market size, and competitive dynamics are detailed within the full report. The report's forecast period covers 2025-2033, with 2025 as the base year.

Key Drivers of United Arab Emirates Sugar Confectionery Market Growth

The UAE sugar confectionery market's growth is fueled by several factors: rising disposable incomes, a young and growing population with a sweet tooth, expanding tourism, and the increasing popularity of online retail. Government initiatives promoting the food processing industry also contribute positively.

Challenges in the United Arab Emirates Sugar Confectionery Market Sector

Challenges include increasing health consciousness leading to reduced sugar consumption, stringent food safety regulations, competition from healthier alternatives, and fluctuating raw material prices, impacting profitability and creating market volatility.

Emerging Opportunities in United Arab Emirates Sugar Confectionery Market

Emerging opportunities include the growing demand for premium and artisanal confectionery, the rise of sugar-free and organic options, and the potential for expansion in e-commerce and specialized retail channels. Innovation in flavors and product formats also presents significant growth opportunities.

Leading Players in the United Arab Emirates Sugar Confectionery Market Market

- Nestle SA

- HARIBO GmbH & Co KG

- Ferrero Group

- August Storck KG

- Adams and Brooks Candy

- Mondelez International Inc

- Al Seedawi Lebanese & Emirates Factory Co

- American Licorice

- Perfetti SPA

- Mars Inc

Key Developments in United Arab Emirates Sugar Confectionery Market Industry

- January 2022: Perfetti Van Melle's Chupa Chups opened its first experiential store in Dubai Mall of the Emirates, enhancing brand visibility and customer engagement.

- February 2022: Haribo launched limited-edition Goldbear gummies, capitalizing on its anniversary and boosting product innovation.

- November 2022: South Africa's 1701 launched a handcrafted nougat recipe in the GCC region, introducing a new premium product to the market.

Strategic Outlook for United Arab Emirates Sugar Confectionery Market Market

The UAE sugar confectionery market presents significant growth potential, driven by continued economic growth, evolving consumer preferences, and the rise of e-commerce. Companies can capitalize on this potential by focusing on innovation, premiumization, healthier options, and effective marketing strategies to reach the diverse consumer base.

United Arab Emirates Sugar Confectionery Market Segmentation

-

1. Product Type

- 1.1. Boiled Sweets

- 1.2. Toffees, Caramels, and Nougat

- 1.3. Pastilles and Jellies

- 1.4. Mints

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialist Retailers

- 2.3. Convenience Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

United Arab Emirates Sugar Confectionery Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Sugar Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.82% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Expenditure on Sugar Confectionery in the Country; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. Increasing Prevalance of Lifestyle Diseases

- 3.4. Market Trends

- 3.4.1. Rising Expenditure on Sugar Confectionery Products in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Boiled Sweets

- 5.1.2. Toffees, Caramels, and Nougat

- 5.1.3. Pastilles and Jellies

- 5.1.4. Mints

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialist Retailers

- 5.2.3. Convenience Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa United Arab Emirates Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia United Arab Emirates Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of Middle East and Africa United Arab Emirates Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Nestle SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 HARIBO GmbH & Co KG

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Ferrero Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 August Storck KG

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Adams and Brooks Candy

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Mondelez International Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Al Seedawi Lebanese & Emirates Factory Co

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 American Licorice

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Perfetti SPA

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Mars Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Nestle SA

List of Figures

- Figure 1: United Arab Emirates Sugar Confectionery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Sugar Confectionery Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Sugar Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Sugar Confectionery Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: United Arab Emirates Sugar Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: United Arab Emirates Sugar Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United Arab Emirates Sugar Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa United Arab Emirates Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Saudi Arabia United Arab Emirates Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of Middle East and Africa United Arab Emirates Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Arab Emirates Sugar Confectionery Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: United Arab Emirates Sugar Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 11: United Arab Emirates Sugar Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Sugar Confectionery Market?

The projected CAGR is approximately 6.82%.

2. Which companies are prominent players in the United Arab Emirates Sugar Confectionery Market?

Key companies in the market include Nestle SA, HARIBO GmbH & Co KG, Ferrero Group, August Storck KG, Adams and Brooks Candy, Mondelez International Inc, Al Seedawi Lebanese & Emirates Factory Co, American Licorice, Perfetti SPA, Mars Inc.

3. What are the main segments of the United Arab Emirates Sugar Confectionery Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 81.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Expenditure on Sugar Confectionery in the Country; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Rising Expenditure on Sugar Confectionery Products in the Country.

7. Are there any restraints impacting market growth?

Increasing Prevalance of Lifestyle Diseases.

8. Can you provide examples of recent developments in the market?

November 2022: South Africa's confectionery brand 1701 launched a handcrafted and original nougat recipe in the GCC region in partnership with Tashas Group. The recipe combines different ingredients like honey, macadamia nuts, and other ingredients as well.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Sugar Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Sugar Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Sugar Confectionery Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Sugar Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence