Key Insights

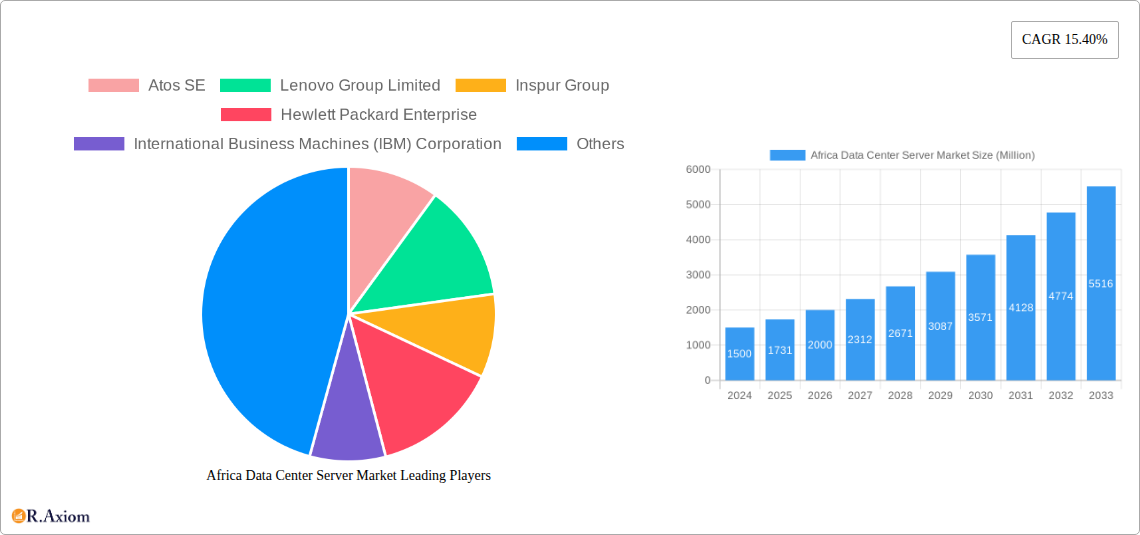

The Africa Data Center Server Market is projected for substantial growth, expected to reach a market size of $3.8 billion by 2025, expanding at a robust CAGR of 15.4%. This expansion is driven by accelerating digital transformation across the continent. Key factors include the increasing demand for cloud computing, big data analytics, and connected devices, all requiring advanced server infrastructure. The IT & Telecommunication sector leads, fueled by network expansion and 5G deployment. The BFSI sector is actively modernizing for digital banking, fintech, and enhanced data security. Government initiatives for e-governance and smart cities, alongside the media and entertainment industry's demand for streaming and content creation, further propel server adoption.

Africa Data Center Server Market Market Size (In Billion)

The adoption of hyperscale data centers and the rise of edge computing are key accelerators. Hyperscale deployments are crucial for supporting massive data processing and storage, while edge computing reduces latency for real-time IoT data analysis. Challenges include high initial investment costs and infrastructure limitations in certain regions. The market is segmented into Blade Servers, Rack Servers, and Tower Servers. South Africa and Nigeria are leading, with significant development anticipated in the "Rest of Africa" as digital adoption expands.

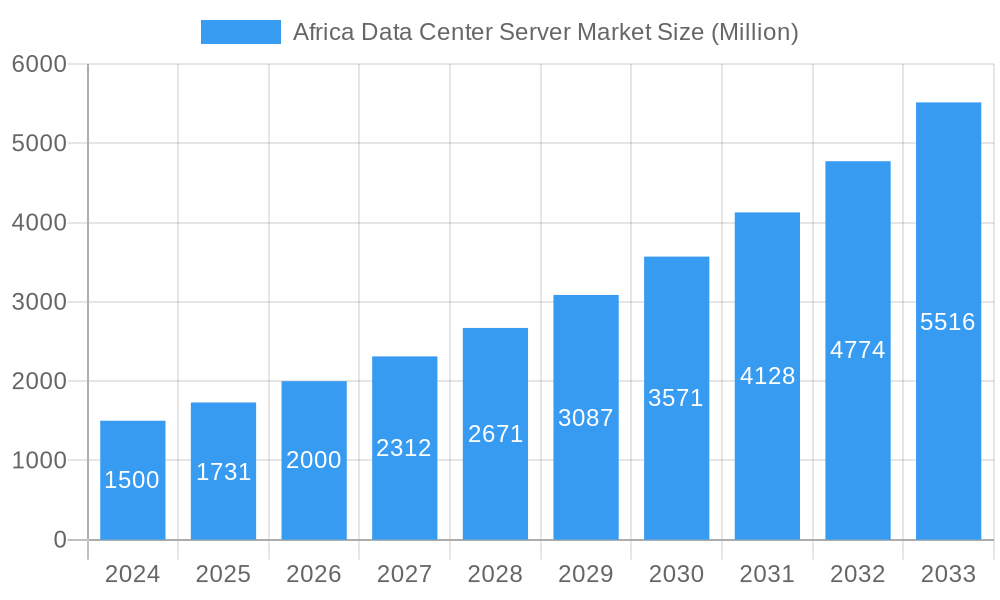

Africa Data Center Server Market Company Market Share

This report offers an in-depth analysis of the Africa Data Center Server Market, providing insights into its current state and future trajectory from 2019–2033, with a base year of 2025. It is an essential resource for stakeholders seeking to understand market dynamics, identify opportunities, and navigate the competitive landscape. The analysis covers market concentration, innovation, regulations, end-user trends, M&A activities, key growth drivers, challenges, emerging opportunities, and leading players.

Africa Data Center Server Market Market Concentration & Innovation

The Africa Data Center Server Market exhibits a moderate to high level of concentration, with key global players dominating the supply chain. Innovation is primarily driven by advancements in server hardware, including higher processing speeds, increased memory capacities, and energy-efficient designs. Regulatory frameworks across various African nations are evolving to support digital infrastructure development, though inconsistencies can pose challenges. Product substitutes are limited, with cloud-based solutions offering an alternative but not a direct replacement for on-premises server infrastructure. End-user trends are pointing towards increased demand for scalable and high-performance servers to support burgeoning data volumes from digitalization initiatives. Mergers & Acquisitions (M&A) activities are expected to witness significant growth as larger entities seek to expand their market share and technological capabilities, with M&A deal values projected to reach approximately $1,500 Million by 2030.

- Market Share Distribution: Leading players hold an estimated combined market share of over 60%.

- Innovation Focus Areas: AI/ML acceleration, edge computing capabilities, and enhanced cybersecurity features.

- Regulatory Impact: Data localization policies in select countries are influencing server deployment strategies.

- End-User Demand: Growing adoption of IoT and big data analytics is fueling server hardware requirements.

Africa Data Center Server Market Industry Trends & Insights

The Africa Data Center Server Market is poised for substantial growth, driven by a confluence of technological advancements, increasing digitalization across industries, and a burgeoning young population with high digital adoption rates. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% between 2025 and 2033. This growth is fueled by the increasing need for robust IT infrastructure to support cloud computing services, big data analytics, artificial intelligence, and the Internet of Things (IoT). Several key trends are shaping the industry: escalating demand for high-performance computing (HPC) solutions for scientific research and complex simulations; a noticeable shift towards energy-efficient servers to reduce operational costs and environmental impact; and the continuous evolution of server architectures to accommodate specialized workloads like AI/ML inference and training.

Technological disruptions, such as the adoption of next-generation processors and advanced cooling technologies, are enhancing server capabilities and enabling data centers to handle more data with greater efficiency. Consumer preferences are shifting towards vendors offering integrated solutions, including hardware, software, and support services, simplifying deployment and management for businesses of all sizes. The competitive dynamics are characterized by intense rivalry among global server manufacturers, with emerging local players gradually gaining traction.

- CAGR: Projected at 12.5% from 2025-2033.

- Market Penetration: Increasing penetration of enterprise-grade server solutions across SMEs.

- Technological Disruptions: Rise of liquid cooling and ARM-based server architectures.

- Competitive Landscape: Intensified competition leading to price optimizations and bundled service offerings.

Dominant Markets & Segments in Africa Data Center Server Market

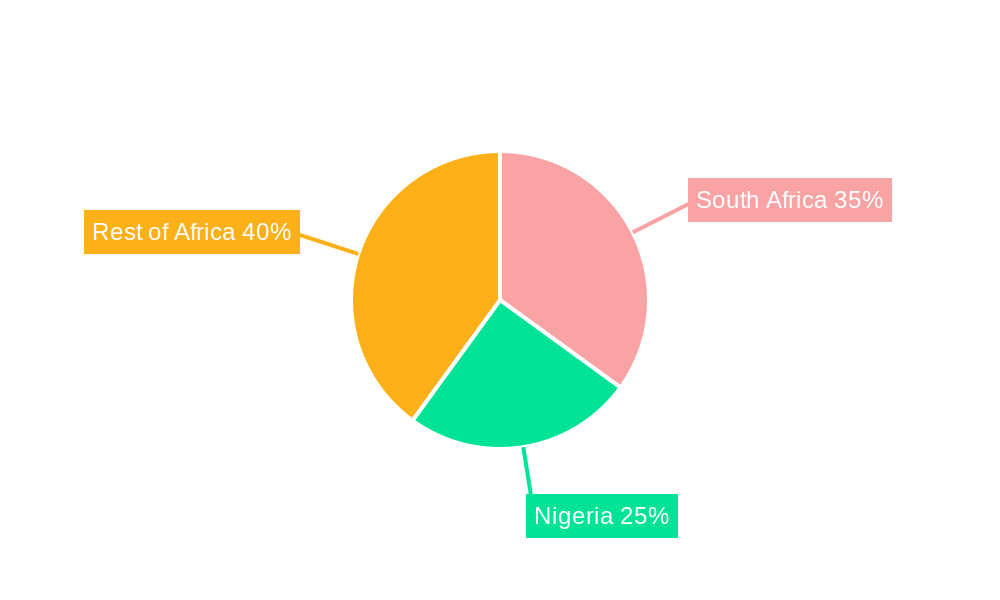

South Africa currently stands as the dominant market within the Africa Data Center Server Market, driven by its relatively developed digital infrastructure, established financial sector, and early adoption of data center technologies. Nigeria follows closely, exhibiting rapid growth due to its large population, expanding telecommunications sector, and increasing government initiatives aimed at fostering digital transformation. The Rest of Africa region, while fragmented, presents significant untapped potential, with countries like Kenya, Ghana, and Egypt showing promising signs of growth.

In terms of Form Factor, Rack Servers are anticipated to dominate the market share, accounting for approximately 55% of the total sales by 2030. This dominance is attributed to their versatility, scalability, and suitability for a wide range of applications in enterprise data centers. Blade Servers are expected to capture a significant share of around 30%, driven by their high density and efficiency, making them ideal for high-performance computing and mission-critical workloads. Tower Servers, while holding a smaller but consistent share of about 15%, will continue to cater to small and medium-sized businesses (SMBs) and edge computing deployments requiring standalone solutions.

The IT & Telecommunication sector is the leading end-user segment, projected to account for over 35% of the market by 2030. This is due to the continuous expansion of network infrastructure, cloud service providers, and the exponential growth in data traffic. The BFSI (Banking, Financial Services, and Insurance) sector is the second-largest contributor, driven by the increasing adoption of digital banking, fintech solutions, and the need for secure and reliable data processing. Government sector adoption is also on the rise, fueled by e-governance initiatives and the demand for secure data storage. The Media & Entertainment sector, alongside "Other End-Users" such as healthcare and education, will contribute a growing, albeit smaller, share to the overall market.

- Leading Region: South Africa, followed by Nigeria.

- Dominant Form Factor: Rack Servers (estimated 55% market share by 2030).

- Key End-User Segment: IT & Telecommunication (over 35% market share by 2030).

- Growth Drivers in Nigeria: Rapid internet penetration, digital economy growth, and government support for technology.

Africa Data Center Server Market Product Developments

Recent product developments in the Africa Data Center Server Market highlight a strong focus on enhancing performance, memory capacity, and energy efficiency. Kingston Technology Company, Inc.'s launch of 32 GB and 16 GB Server Premier DDR5 5600 MT/s and 5200 MT/s ECC Unbuffered DIMMs and ECC SODIMMs signifies a move towards higher memory bandwidth and improved reliability, crucial for demanding workloads. Lenovo Group Ltd.'s introduction of new servers, storage systems, and Hyperconverged Infrastructure appliances, integrating Intel Corp.'s Sapphire Rapids server processors, underscores the trend towards powerful, integrated solutions optimized for next-generation computing demands and incorporating advanced manufacturing processes. These innovations offer enhanced processing capabilities, improved power efficiency, and greater scalability, providing businesses with robust platforms for their digital transformation journeys.

Report Scope & Segmentation Analysis

This report segments the Africa Data Center Server Market by Form Factor into Blade Servers, Rack Servers, and Tower Servers. It further divides the market by End-User into IT & Telecommunication, BFSI, Government, Media & Entertainment, and Other End-Users. Geographically, the market is analyzed across South Africa, Nigeria, and the Rest of Africa. The IT & Telecommunication segment is projected to exhibit the highest growth, driven by increasing cloud adoption and data traffic, with an estimated market size of over $2,500 Million by 2030. The BFSI segment will see steady growth due to digital banking initiatives, while government adoption will be spurred by e-governance projects. The Rest of Africa represents a high-potential segment with evolving data center needs across various emerging economies.

Key Drivers of Africa Data Center Server Market Growth

The growth of the Africa Data Center Server Market is propelled by several key factors. The accelerating pace of digitalization across industries, including e-commerce, online education, and digital media, necessitates robust server infrastructure. Increased adoption of cloud computing services, both public and private, by African businesses fuels the demand for high-performance servers. Government initiatives promoting digital transformation and the development of smart cities are also significant drivers. Furthermore, the growing prevalence of emerging technologies like Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) requires powerful and scalable server solutions to process and analyze vast amounts of data.

Challenges in the Africa Data Center Server Market Sector

Despite the promising growth trajectory, the Africa Data Center Server Market faces several challenges. Inadequate and unreliable power infrastructure in some regions poses a significant hurdle, leading to increased operational costs due to backup power solutions and potential disruptions. High import duties and taxes on technology hardware can increase the overall cost of server acquisition. The limited availability of skilled IT professionals for server deployment, maintenance, and management can also hinder market growth. Furthermore, cybersecurity concerns and evolving data privacy regulations require continuous investment in robust security measures and compliance frameworks.

Emerging Opportunities in Africa Data Center Server Market

Emerging opportunities within the Africa Data Center Server Market are substantial and diverse. The expansion of 5G networks across the continent will drive the demand for edge data center servers to support low-latency applications. The burgeoning fintech sector presents a significant opportunity for specialized server solutions capable of handling high transaction volumes and ensuring data security. Growth in the healthcare sector, with the increasing adoption of telemedicine and digital health records, will also create a demand for reliable server infrastructure. The untapped potential in the Rest of Africa, particularly in East and West African nations undergoing rapid economic development, offers fertile ground for new market entrants and expansion strategies.

Leading Players in the Africa Data Center Server Market Market

- Atos SE

- Lenovo Group Limited

- Inspur Group

- Hewlett Packard Enterprise

- International Business Machines (IBM) Corporation

- Cisco Systems Inc

- Fujitsu Limited

- Dell Inc

- Kingston Technology Company Inc

- Huawei Technologies Co Ltd

Key Developments in Africa Data Center Server Market Industry

- June 2023: Kingston Technology Company, Inc., a significant provider of memory products and technology solutions, announced the launch of its 32 GB and 16 GB Server Premier DDR5 5600 MT/s and 5200 MT/s ECC Unbuffered DIMMs and ECC SODIMMs. This development aims to enhance server performance and reliability, crucial for data-intensive applications in the African market.

- September 2022: Lenovo Group Ltd. introduced dozens of new servers, storage systems, and Hyperconverged Infrastructure appliances, as well as a cloud-based hardware management service. Intel Corp. Sapphire Rapids server processors would be incorporated into some of the new systems it is rolling out. The processors, which are scheduled to launch in the market next year, use a ten-nanometer Intel 7 manufacturing process. This strategic move by Lenovo signifies a commitment to delivering cutting-edge server technology in Africa, leveraging advanced processors for improved computing power and efficiency.

Strategic Outlook for Africa Data Center Server Market Market

The strategic outlook for the Africa Data Center Server Market is overwhelmingly positive, marked by sustained growth and evolving technological adoption. The increasing demand for digital services, coupled with government support for digitalization, will continue to be a primary growth catalyst. Investment in cloud infrastructure, edge computing, and specialized servers for AI and IoT applications will shape future market dynamics. Companies focusing on providing scalable, energy-efficient, and cost-effective server solutions, while also addressing local infrastructure challenges, are well-positioned for success. Strategic partnerships and localized manufacturing or assembly capabilities could further enhance market penetration and customer support across the continent. The forecast period is expected to witness significant expansion, driven by innovation and the unwavering drive towards a digitally empowered Africa.

Africa Data Center Server Market Segmentation

-

1. Form Factor

- 1.1. Blade Server

- 1.2. Rack Server

- 1.3. Tower Server

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

-

3. Geography

- 3.1. South Africa

- 3.2. Nigeria

- 3.3. Rest of Africa

Africa Data Center Server Market Segmentation By Geography

- 1. South Africa

- 2. Nigeria

- 3. Rest of Africa

Africa Data Center Server Market Regional Market Share

Geographic Coverage of Africa Data Center Server Market

Africa Data Center Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of cloud computing services; Advent of 5G networks

- 3.3. Market Restrains

- 3.3.1. Rising CapEx for data center construction; Cybersecurity Threats and Ransomware attacks

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment Holds the Major Share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. Blade Server

- 5.1.2. Rack Server

- 5.1.3. Tower Server

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Nigeria

- 5.3.3. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Nigeria

- 5.4.3. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. South Africa Africa Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 6.1.1. Blade Server

- 6.1.2. Rack Server

- 6.1.3. Tower Server

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. IT & Telecommunication

- 6.2.2. BFSI

- 6.2.3. Government

- 6.2.4. Media & Entertainment

- 6.2.5. Other End-User

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Nigeria

- 6.3.3. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 7. Nigeria Africa Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 7.1.1. Blade Server

- 7.1.2. Rack Server

- 7.1.3. Tower Server

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. IT & Telecommunication

- 7.2.2. BFSI

- 7.2.3. Government

- 7.2.4. Media & Entertainment

- 7.2.5. Other End-User

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Nigeria

- 7.3.3. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 8. Rest of Africa Africa Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 8.1.1. Blade Server

- 8.1.2. Rack Server

- 8.1.3. Tower Server

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. IT & Telecommunication

- 8.2.2. BFSI

- 8.2.3. Government

- 8.2.4. Media & Entertainment

- 8.2.5. Other End-User

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Nigeria

- 8.3.3. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Atos SE

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Lenovo Group Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Inspur Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Hewlett Packard Enterprise

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 International Business Machines (IBM) Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cisco Systems Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Fujitsu Limited

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Dell Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Kingston Technology Company Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Huawei Technologies Co Ltd

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Atos SE

List of Figures

- Figure 1: Africa Data Center Server Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Data Center Server Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Data Center Server Market Revenue billion Forecast, by Form Factor 2020 & 2033

- Table 2: Africa Data Center Server Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Africa Data Center Server Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Africa Data Center Server Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Africa Data Center Server Market Revenue billion Forecast, by Form Factor 2020 & 2033

- Table 6: Africa Data Center Server Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 7: Africa Data Center Server Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Africa Data Center Server Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Africa Data Center Server Market Revenue billion Forecast, by Form Factor 2020 & 2033

- Table 10: Africa Data Center Server Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 11: Africa Data Center Server Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Africa Data Center Server Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Africa Data Center Server Market Revenue billion Forecast, by Form Factor 2020 & 2033

- Table 14: Africa Data Center Server Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Africa Data Center Server Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Africa Data Center Server Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Data Center Server Market?

The projected CAGR is approximately 15.4%.

2. Which companies are prominent players in the Africa Data Center Server Market?

Key companies in the market include Atos SE, Lenovo Group Limited, Inspur Group, Hewlett Packard Enterprise, International Business Machines (IBM) Corporation, Cisco Systems Inc, Fujitsu Limited, Dell Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd.

3. What are the main segments of the Africa Data Center Server Market?

The market segments include Form Factor, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Adoption of cloud computing services; Advent of 5G networks.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment Holds the Major Share..

7. Are there any restraints impacting market growth?

Rising CapEx for data center construction; Cybersecurity Threats and Ransomware attacks.

8. Can you provide examples of recent developments in the market?

June 2023: Kingston Technology Company, Inc., a significant provider of memory products and technology solutions, announced the launch of its 32 GB and 16 GB Server Premier DDR5 5600 MT/s and 5200 MT/s ECC Unbuffered DIMMs and ECC SODIMMs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Data Center Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Data Center Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Data Center Server Market?

To stay informed about further developments, trends, and reports in the Africa Data Center Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence