Key Insights

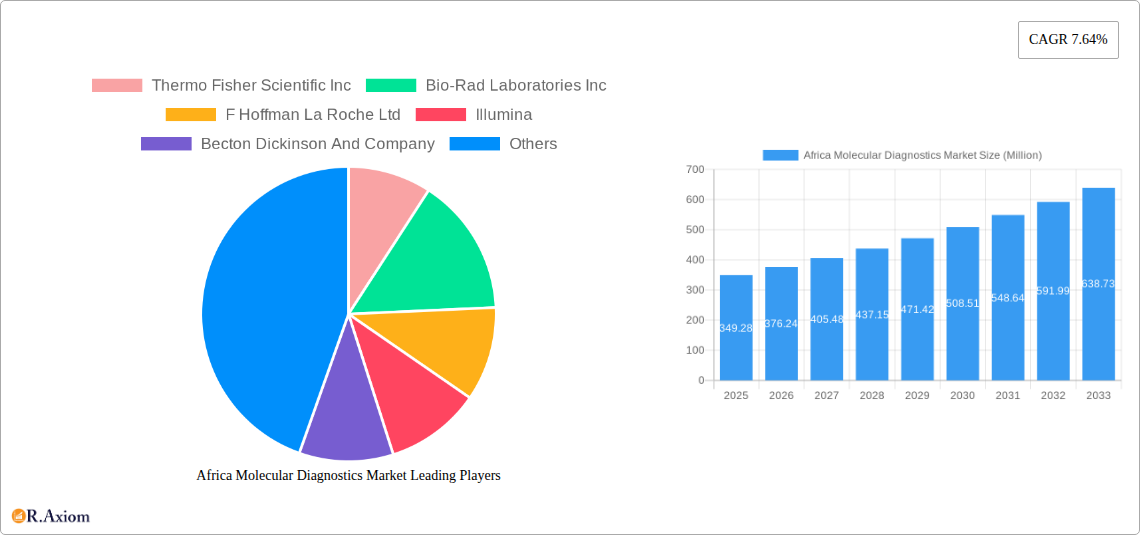

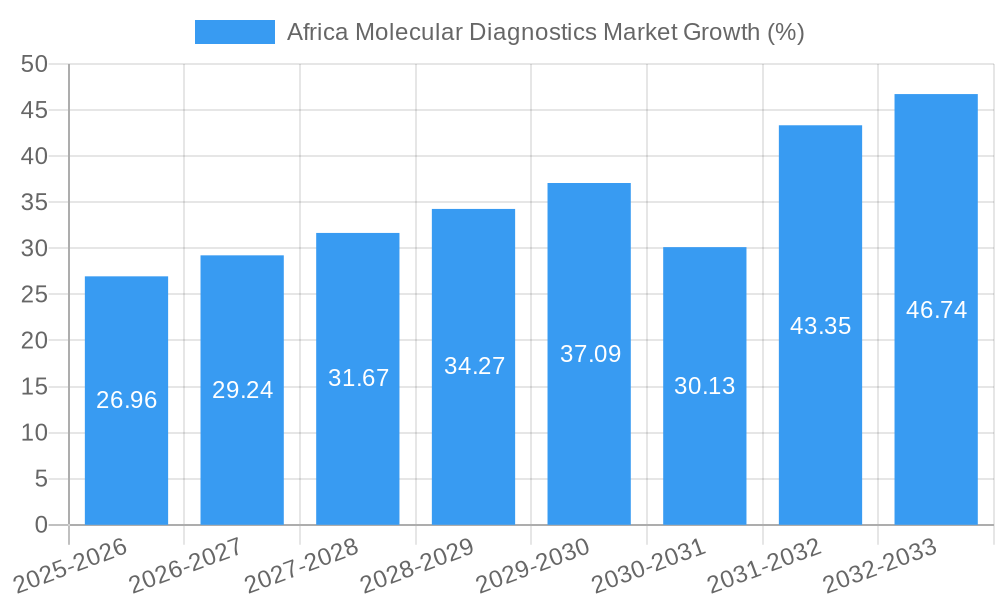

The Africa Molecular Diagnostics Market, valued at $349.28 million in 2025, is projected to experience robust growth, driven by rising infectious disease prevalence, increasing healthcare infrastructure development, and growing government initiatives promoting disease surveillance and control. The market's Compound Annual Growth Rate (CAGR) of 7.64% from 2025 to 2033 signifies substantial expansion. Key technological advancements in areas like PCR, next-generation sequencing, and mass spectrometry are fueling market expansion. The increasing adoption of point-of-care diagnostics and the growing awareness of personalized medicine are further boosting the demand for molecular diagnostic solutions across various applications, including infectious disease diagnosis, oncology, and pharmacogenomics. Significant growth is also anticipated in genetic disease screening and human leukocyte antigen typing. While challenges such as limited healthcare infrastructure in certain regions and high costs associated with advanced technologies exist, the overall market outlook remains positive due to increasing investments in healthcare infrastructure and the growing need for accurate and timely diagnosis.

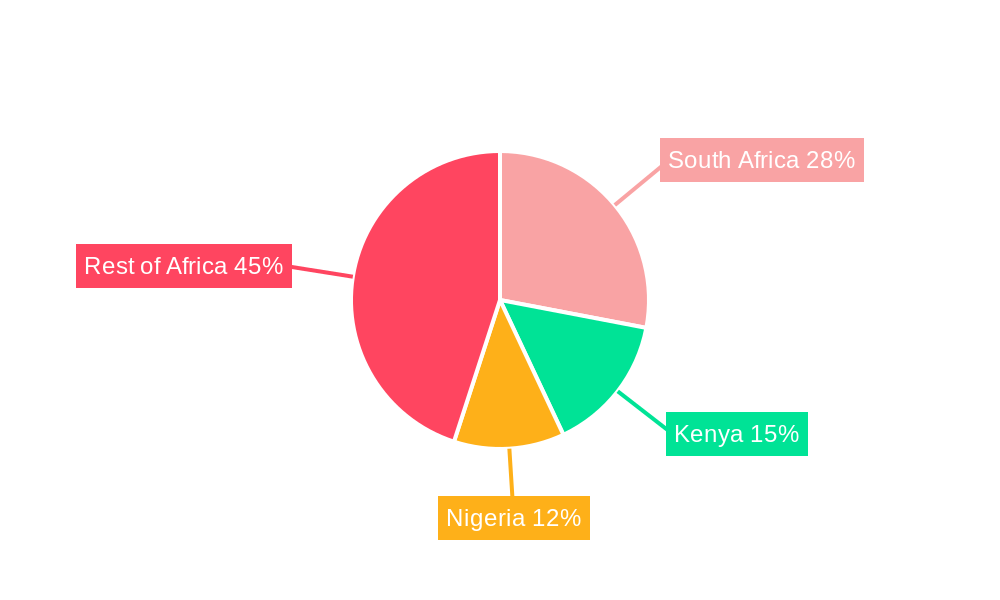

The market segmentation reveals significant opportunities across various technologies, applications, products, and end-users. The 'Instruments' segment within the product category is expected to dominate due to increasing demand for advanced diagnostic equipment. Hospitals and laboratories are the primary end-users, although the 'Other End-Users' segment is projected to grow steadily, driven by the increasing accessibility of molecular diagnostic services. Among applications, infectious diseases hold a substantial share due to the prevalence of various infectious agents, followed by oncology and pharmacogenomics. Geographically, South Africa, Kenya, and other major economies within the region are expected to exhibit robust growth, although significant potential exists in less developed areas as healthcare infrastructure improves. Competition among major players like Thermo Fisher Scientific, Bio-Rad, Roche, and Illumina is intense, leading to continuous innovation and cost optimization within the market.

Africa Molecular Diagnostics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa Molecular Diagnostics Market, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with 2025 as the base year, this report unveils the market's dynamics, growth drivers, challenges, and future prospects. The report segments the market by technology, application, product, and end-user, providing granular data and projections for informed decision-making. The total market size is projected to reach xx Million by 2033.

Africa Molecular Diagnostics Market Concentration & Innovation

The Africa Molecular Diagnostics market exhibits a moderately concentrated landscape, dominated by multinational corporations such as Thermo Fisher Scientific Inc, Bio-Rad Laboratories Inc, and Roche. These players hold a significant market share, estimated at xx% collectively in 2025, leveraging their established brand reputation, extensive product portfolios, and robust distribution networks. However, the market also presents opportunities for smaller, specialized players focusing on niche applications or innovative technologies. Innovation is driven by the rising prevalence of infectious diseases, increasing demand for personalized medicine, and advancements in genetic testing technologies. Regulatory frameworks, while varying across African nations, are increasingly aligning with international standards, fostering market growth. The market experiences significant M&A activity, with deal values exceeding xx Million in the past five years, primarily driven by strategic acquisitions aimed at expanding product offerings and market reach. Substitutes for molecular diagnostics are limited, primarily relying on traditional diagnostic methods which are less sensitive and specific. End-user trends indicate a shift towards adopting advanced molecular diagnostic techniques in hospitals and specialized laboratories.

- Market Share (2025): Top 3 players: xx%

- M&A Deal Value (2019-2024): xx Million

- Key Innovation Drivers: Rising infectious disease prevalence, demand for personalized medicine, technological advancements in genomics.

Africa Molecular Diagnostics Market Industry Trends & Insights

The Africa Molecular Diagnostics market is experiencing robust growth, driven by factors such as increasing healthcare expenditure, rising prevalence of infectious diseases (e.g., HIV, tuberculosis, malaria), expanding healthcare infrastructure, and growing awareness of the benefits of early disease detection. Technological advancements, particularly in PCR, next-generation sequencing (NGS), and microarrays, are significantly impacting the market, leading to increased testing accuracy, reduced turnaround times, and improved disease management. Consumer preferences are shifting towards non-invasive diagnostic methods and point-of-care testing solutions. Competitive dynamics are shaped by continuous product innovation, strategic partnerships, and a growing focus on providing affordable and accessible diagnostic solutions. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), with market penetration steadily increasing in both urban and rural areas. This growth is particularly evident in applications such as infectious disease diagnostics and oncology testing.

Dominant Markets & Segments in Africa Molecular Diagnostics Market

The South Africa molecular diagnostics market dominates the African landscape, driven by advanced healthcare infrastructure, higher per capita income, and strong regulatory support. Other key markets include Nigeria, Kenya, and Egypt, exhibiting significant growth potential due to rising population, increasing healthcare investments, and government initiatives to combat infectious diseases.

- Leading Region: Southern Africa

- Leading Country: South Africa

- Dominant Technology Segment: PCR technology dominates due to its relative affordability and widespread accessibility.

- Dominant Application Segment: Infectious diseases testing holds the largest market share due to the high prevalence of infectious diseases across the continent.

- Key Drivers:

- Increasing healthcare expenditure

- Growing government initiatives to improve healthcare infrastructure

- Rising prevalence of infectious diseases and chronic illnesses

- Increasing awareness among consumers regarding the benefits of early diagnosis

Dominance Analysis: South Africa's strong healthcare infrastructure and higher disposable income contribute significantly to its leading market position. However, other countries are rapidly catching up, driven by growing investments in healthcare and disease control programs.

Africa Molecular Diagnostics Market Product Developments

Recent product developments include the introduction of portable and user-friendly PCR devices, improved next-generation sequencing (NGS) platforms for faster and more accurate genetic testing, and the development of cost-effective diagnostic assays tailored to the specific needs of the African market. These innovations are enhancing diagnostic capabilities, improving accessibility, and driving market expansion. The emphasis is on developing products that are robust, adaptable to diverse environmental conditions, and affordable for resource-constrained settings.

Report Scope & Segmentation Analysis

This report segments the Africa Molecular Diagnostics market comprehensively across various parameters. The technology segment includes PCR, In Situ Hybridization, Chips and Microarrays, Mass Spectrometry (MS), Sequencing, and Other Technologies, each demonstrating distinct growth trajectories and competitive landscapes. The application segment encompasses Infectious Diseases, Oncology, Pharmacogenomics, Microbiology and Genetic Disease Screening, Human Leukocyte Antigen Typing, and Blood Screening, showcasing varying market sizes and future potential. The product segment includes Instruments, Reagents, and Other Products, with varying demand based on technology and application. Finally, the end-user segment includes Hospitals, Laboratories, and Other End Users, reflecting differences in adoption rates and purchasing patterns. Growth projections vary across segments, with PCR and infectious disease diagnostics showing the highest growth potential.

Key Drivers of Africa Molecular Diagnostics Market Growth

The African molecular diagnostics market is propelled by several factors: a surging prevalence of infectious diseases, increasing government initiatives to improve healthcare infrastructure, rising investments in healthcare technology, a growing demand for accurate and rapid diagnostic tools, and the increasing affordability of molecular diagnostic tests. These factors, combined with technological advancements, are fueling significant market expansion.

Challenges in the Africa Molecular Diagnostics Market Sector

The market faces several challenges including limited healthcare infrastructure in certain regions, high costs of advanced diagnostic technologies, a shortage of skilled professionals, and regulatory hurdles in some countries. These factors can hinder market penetration and limit access to advanced diagnostic services, particularly in rural areas. Supply chain disruptions also pose a significant risk to market stability.

Emerging Opportunities in Africa Molecular Diagnostics Market

Significant opportunities exist in expanding point-of-care testing capabilities, developing affordable and accessible diagnostic solutions for resource-constrained settings, and capitalizing on the increasing adoption of telemedicine and remote diagnostic services. The focus on tackling neglected tropical diseases also presents a significant growth opportunity for specialized diagnostic solutions.

Leading Players in the Africa Molecular Diagnostics Market Market

- Thermo Fisher Scientific Inc

- Bio-Rad Laboratories Inc

- F Hoffman La Roche Ltd

- Illumina

- Becton Dickinson And Company

- Abbott Laboratories

- Agilent Technologies Inc

- Qiagen NV

- Sysmex Corporation

- Myriad Genetics

- Hologic Corporation

- Danaher Corporation (Beckman Coulter Inc )

- Biomerieux Sa

Key Developments in Africa Molecular Diagnostics Market Industry

- 2022 Q4: Roche launches a new PCR-based assay for rapid detection of malaria in sub-Saharan Africa.

- 2023 Q1: Thermo Fisher Scientific partners with a local distributor to expand its reach in East Africa.

- 2023 Q2: Illumina announces the expansion of its NGS sequencing services in South Africa.

- 2024 Q1: A major merger between two mid-sized molecular diagnostics companies creates a stronger competitor in the region. (Further details on specific mergers and acquisitions can be added here)

Strategic Outlook for Africa Molecular Diagnostics Market Market

The Africa Molecular diagnostics market holds immense growth potential driven by sustained investment in healthcare infrastructure, growing government support for disease control programs, and the continuous advancement of molecular diagnostic technologies. The increasing prevalence of chronic diseases, coupled with growing consumer awareness about the benefits of early diagnosis and personalized medicine, presents compelling opportunities for market expansion and innovation. The market is expected to witness a period of sustained growth, characterized by increased competition, strategic alliances, and the introduction of innovative diagnostic solutions tailored to the unique needs of the African population.

Africa Molecular Diagnostics Market Segmentation

-

1. Technology

- 1.1. In Situ Hybridization

- 1.2. Chips and Microarrays

- 1.3. Mass Spectrometry (MS)

- 1.4. Sequencing

- 1.5. PCR

- 1.6. Other Technologies

-

2. Application

- 2.1. Infectious Diseases

- 2.2. Oncology

- 2.3. Pharmacogenomics

- 2.4. Microbiology and Genetic Disease Screening

- 2.5. Human Leukocyte Antigen Typing

- 2.6. Blood Screening

-

3. Product

- 3.1. Instruments

- 3.2. Reagents

- 3.3. Other Products

-

4. End User

- 4.1. Hospitals

- 4.2. Laboratories

- 4.3. Other End Users

-

5. Geography

- 5.1. South Africa

- 5.2. Nigeria

- 5.3. Rest of Africa

Africa Molecular Diagnostics Market Segmentation By Geography

- 1. South Africa

- 2. Nigeria

- 3. Rest of Africa

Africa Molecular Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Point-of-Care Diagnostics in the Region; Increasing Burden of Bacterial and Viral Diseases; Technological Advancements in Molecular Diagnostics Space

- 3.3. Market Restrains

- 3.3.1. High Cost of Disease Diagnostics; Lack of Trained Healthcare Professionals

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Witness a Strong Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. In Situ Hybridization

- 5.1.2. Chips and Microarrays

- 5.1.3. Mass Spectrometry (MS)

- 5.1.4. Sequencing

- 5.1.5. PCR

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infectious Diseases

- 5.2.2. Oncology

- 5.2.3. Pharmacogenomics

- 5.2.4. Microbiology and Genetic Disease Screening

- 5.2.5. Human Leukocyte Antigen Typing

- 5.2.6. Blood Screening

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Instruments

- 5.3.2. Reagents

- 5.3.3. Other Products

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Hospitals

- 5.4.2. Laboratories

- 5.4.3. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. South Africa

- 5.5.2. Nigeria

- 5.5.3. Rest of Africa

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.6.2. Nigeria

- 5.6.3. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. South Africa Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. In Situ Hybridization

- 6.1.2. Chips and Microarrays

- 6.1.3. Mass Spectrometry (MS)

- 6.1.4. Sequencing

- 6.1.5. PCR

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infectious Diseases

- 6.2.2. Oncology

- 6.2.3. Pharmacogenomics

- 6.2.4. Microbiology and Genetic Disease Screening

- 6.2.5. Human Leukocyte Antigen Typing

- 6.2.6. Blood Screening

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. Instruments

- 6.3.2. Reagents

- 6.3.3. Other Products

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Hospitals

- 6.4.2. Laboratories

- 6.4.3. Other End Users

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. South Africa

- 6.5.2. Nigeria

- 6.5.3. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Nigeria Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. In Situ Hybridization

- 7.1.2. Chips and Microarrays

- 7.1.3. Mass Spectrometry (MS)

- 7.1.4. Sequencing

- 7.1.5. PCR

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infectious Diseases

- 7.2.2. Oncology

- 7.2.3. Pharmacogenomics

- 7.2.4. Microbiology and Genetic Disease Screening

- 7.2.5. Human Leukocyte Antigen Typing

- 7.2.6. Blood Screening

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. Instruments

- 7.3.2. Reagents

- 7.3.3. Other Products

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Hospitals

- 7.4.2. Laboratories

- 7.4.3. Other End Users

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. South Africa

- 7.5.2. Nigeria

- 7.5.3. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Rest of Africa Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. In Situ Hybridization

- 8.1.2. Chips and Microarrays

- 8.1.3. Mass Spectrometry (MS)

- 8.1.4. Sequencing

- 8.1.5. PCR

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infectious Diseases

- 8.2.2. Oncology

- 8.2.3. Pharmacogenomics

- 8.2.4. Microbiology and Genetic Disease Screening

- 8.2.5. Human Leukocyte Antigen Typing

- 8.2.6. Blood Screening

- 8.3. Market Analysis, Insights and Forecast - by Product

- 8.3.1. Instruments

- 8.3.2. Reagents

- 8.3.3. Other Products

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Hospitals

- 8.4.2. Laboratories

- 8.4.3. Other End Users

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. South Africa

- 8.5.2. Nigeria

- 8.5.3. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South Africa Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 10. Sudan Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 11. Uganda Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 12. Tanzania Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 13. Kenya Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Africa Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Thermo Fisher Scientific Inc

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Bio-Rad Laboratories Inc

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 F Hoffman La Roche Ltd

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Illumina

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Becton Dickinson And Company

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Abbott Laboratories

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Agilent Technologies Inc

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Qiagen NV

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Sysmex Corporation

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Myriad Genetics

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Hologic Corporation

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Danaher Corporation (Beckman Coulter Inc )

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 Biomerieux Sa

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.1 Thermo Fisher Scientific Inc

List of Figures

- Figure 1: Africa Molecular Diagnostics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Molecular Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Molecular Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Molecular Diagnostics Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Africa Molecular Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Africa Molecular Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 5: Africa Molecular Diagnostics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Africa Molecular Diagnostics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 7: Africa Molecular Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Africa Molecular Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa Africa Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan Africa Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda Africa Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania Africa Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya Africa Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa Africa Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Africa Molecular Diagnostics Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Africa Molecular Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Africa Molecular Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 18: Africa Molecular Diagnostics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 19: Africa Molecular Diagnostics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Africa Molecular Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Africa Molecular Diagnostics Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: Africa Molecular Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Africa Molecular Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 24: Africa Molecular Diagnostics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 25: Africa Molecular Diagnostics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Africa Molecular Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Africa Molecular Diagnostics Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 28: Africa Molecular Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Africa Molecular Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 30: Africa Molecular Diagnostics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 31: Africa Molecular Diagnostics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Africa Molecular Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Molecular Diagnostics Market?

The projected CAGR is approximately 7.64%.

2. Which companies are prominent players in the Africa Molecular Diagnostics Market?

Key companies in the market include Thermo Fisher Scientific Inc, Bio-Rad Laboratories Inc, F Hoffman La Roche Ltd, Illumina, Becton Dickinson And Company, Abbott Laboratories, Agilent Technologies Inc, Qiagen NV, Sysmex Corporation, Myriad Genetics, Hologic Corporation, Danaher Corporation (Beckman Coulter Inc ), Biomerieux Sa.

3. What are the main segments of the Africa Molecular Diagnostics Market?

The market segments include Technology, Application, Product, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 349.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Point-of-Care Diagnostics in the Region; Increasing Burden of Bacterial and Viral Diseases; Technological Advancements in Molecular Diagnostics Space.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Witness a Strong Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Disease Diagnostics; Lack of Trained Healthcare Professionals.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Molecular Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Molecular Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Molecular Diagnostics Market?

To stay informed about further developments, trends, and reports in the Africa Molecular Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence