Key Insights

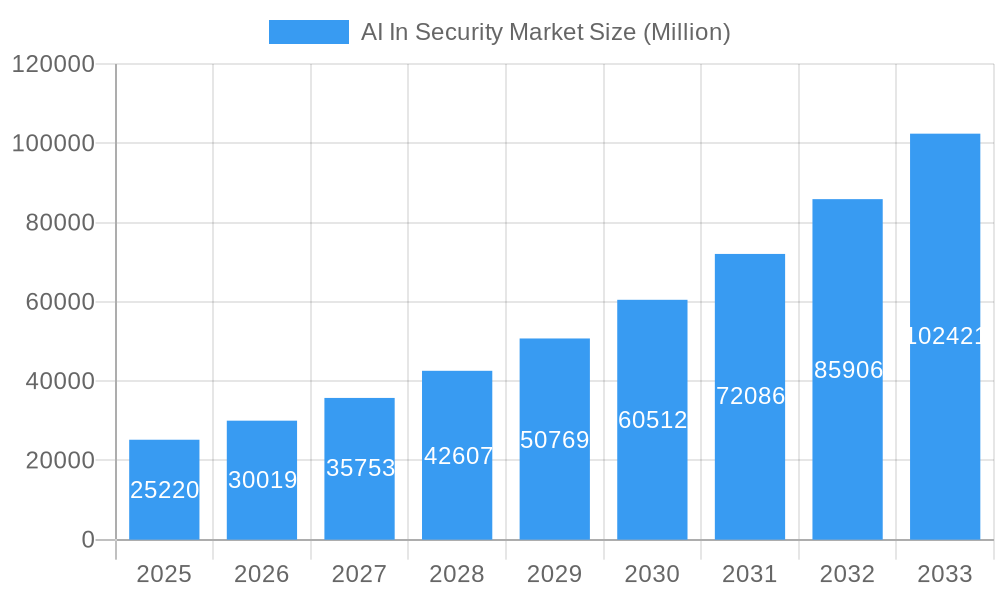

The AI in Security market is poised for substantial expansion, projected to reach $25.22 Billion by 2025 with a remarkable Compound Annual Growth Rate (CAGR) of 19.02% from 2025 to 2033. This robust growth is propelled by a confluence of factors, primarily the escalating sophistication and volume of cyber threats, necessitating advanced defense mechanisms. The increasing adoption of cloud computing and the proliferation of connected devices (IoT) create a wider attack surface, driving the demand for AI-powered security solutions that can detect, analyze, and respond to threats in real-time. Furthermore, regulatory pressures and the growing awareness among organizations about the critical need for data protection and privacy are significant catalysts for market adoption. The integration of AI in security is no longer a futuristic concept but a present-day imperative for safeguarding digital assets.

AI In Security Market Market Size (In Billion)

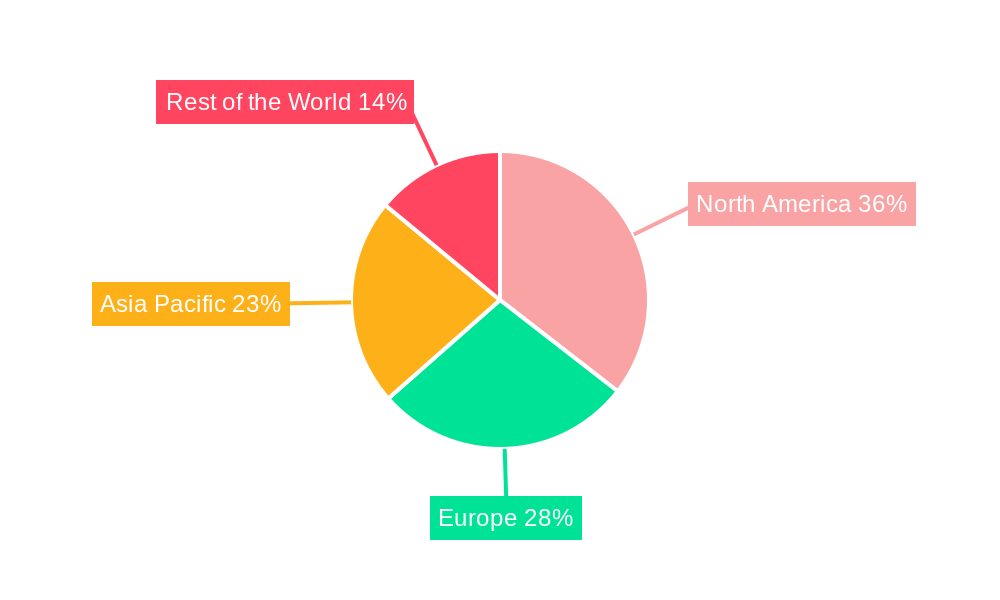

The market is witnessing significant trends, including the rise of AI-driven threat intelligence platforms, behavioral analytics for anomaly detection, and the application of machine learning in areas like malware analysis and phishing prevention. While the demand for professional and managed security services powered by AI is surging, on-premise deployments are gradually giving way to cloud-based solutions, offering greater scalability and flexibility. Key end-user industries like Government & Defense, BFSI, and Healthcare are leading the adoption due to the sensitive nature of their data. Geographically, North America and Europe are established leaders, but the Asia Pacific region is emerging as a high-growth market, fueled by rapid digital transformation and increasing cybersecurity investments. The market is characterized by intense competition, with major technology players investing heavily in AI research and development to stay ahead of evolving threats.

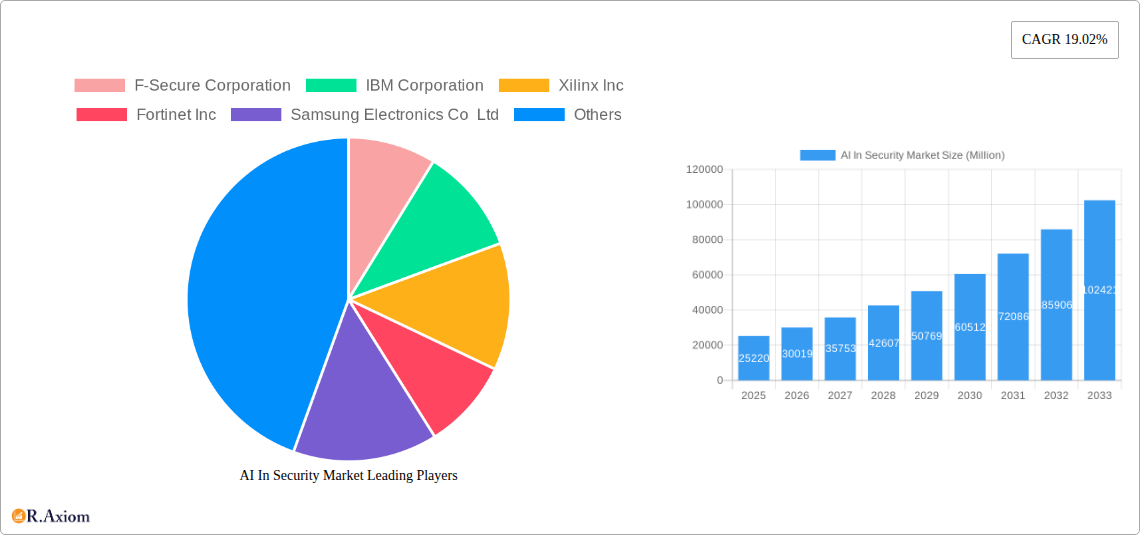

AI In Security Market Company Market Share

This in-depth market research report provides a definitive analysis of the global AI in Security Market, offering critical insights for stakeholders navigating this rapidly evolving landscape. With a study period spanning from 2019 to 2033, encompassing a historical period (2019-2024), a base year (2025), an estimated year (2025), and a robust forecast period (2025-2033), this report offers a detailed examination of market dynamics, growth drivers, challenges, and future opportunities. We delve into the intricate segmentation of the market, covering Security Type (Network Security, Application Security, Cloud Security), Service (Professional Services, Managed Services), Deployment (On-premise, Cloud), and End-user Industry (Government & Defense, Retail, BFSI, Manufacturing, Healthcare, Automotive & Transportation, Other End-user Industries).

The report highlights key industry developments, including recent strategic investments and innovative product launches aimed at combating sophisticated cyber threats and securing emerging AI technologies. Leading players such as F-Secure Corporation, IBM Corporation, Xilinx Inc, Fortinet Inc, Samsung Electronics Co Ltd, Micron Technology Inc, ThreatMetrix Inc (RELX Group), Cisco Systems Inc, Tech Mahindra Limited, Facebook Inc, Nvidia Corporation, Broadcom Inc (Symantec Corporation), and Juniper Network Inc are meticulously analyzed. This report is an essential resource for cybersecurity professionals, technology providers, investors, and policymakers seeking to understand and capitalize on the immense potential of artificial intelligence in safeguarding digital assets and infrastructure.

AI In Security Market Market Concentration & Innovation

The AI in Security Market is characterized by a dynamic interplay of established cybersecurity giants and agile AI technology innovators, leading to a moderately concentrated landscape. Innovation remains the primary catalyst, driven by the escalating sophistication of cyber threats, the proliferation of connected devices, and the growing adoption of cloud-based infrastructure. Companies are heavily investing in research and development for advanced threat detection, predictive analytics, and automated response systems, leveraging machine learning (ML) and deep learning (DL) to stay ahead of adversaries. Regulatory frameworks are also playing an increasingly significant role, with governments worldwide implementing stricter data privacy and cybersecurity mandates, encouraging the adoption of robust AI-powered security solutions. Product substitutes, while present in the form of traditional security measures, are increasingly being augmented or replaced by AI-driven alternatives due to their superior efficiency and adaptability. End-user trends demonstrate a clear preference for proactive and intelligent security solutions, particularly within high-risk sectors. Mergers and acquisitions (M&A) activities are prevalent as larger players seek to acquire specialized AI expertise and innovative technologies. For instance, the strategic investment by Microsoft in G42 for USD 1.5 Billion signifies a major consolidation and expansion of AI capabilities within the security domain. The market share of leading AI security solution providers is expected to grow significantly, with a projected collective market share of over 60% by 2030.

AI In Security Market Industry Trends & Insights

The AI in Security Market is experiencing a period of unprecedented growth, fueled by a confluence of compelling industry trends and transformative technological advancements. The escalating volume and complexity of cyber threats, ranging from ransomware and phishing attacks to sophisticated nation-state sponsored assaults, have created an urgent demand for intelligent and adaptive security solutions. AI, with its ability to analyze vast datasets, identify subtle anomalies, and predict potential threats, has emerged as a critical weapon in the cybersecurity arsenal. The Compound Annual Growth Rate (CAGR) for this market is projected to exceed 25% over the forecast period, indicating a rapid expansion driven by both necessity and opportunity.

Key market growth drivers include the widespread adoption of cloud computing, the burgeoning Internet of Things (IoT) ecosystem, and the increasing digitization of critical infrastructure across various end-user industries. As organizations migrate their data and operations to the cloud, the attack surface expands, necessitating advanced security measures that AI can provide, particularly in Cloud Security. Similarly, the proliferation of interconnected IoT devices in sectors like manufacturing and healthcare presents new vulnerabilities that AI-powered security systems are uniquely positioned to address.

Technological disruptions are at the forefront of this market's evolution. The integration of Generative AI (GenAI) into security platforms, as exemplified by Palo Alto Networks' Precision AI, is a game-changer. This allows for real-time, proactive defense against AI-generated attacks, a critical development in the ongoing cybersecurity arms race. Furthermore, advancements in Natural Language Processing (NLP) are enabling AI to better understand and respond to social engineering tactics, while advancements in explainable AI (XAI) are fostering greater trust and transparency in automated security decisions.

Consumer preferences are shifting towards solutions that offer not just reactive defense but also proactive risk mitigation and intelligent automation. Organizations are increasingly seeking Managed Services powered by AI, which offer continuous monitoring, threat hunting, and incident response without requiring extensive in-house expertise. This trend is particularly pronounced among Small and Medium-sized Enterprises (SMEs) and organizations facing a shortage of skilled cybersecurity professionals.

The competitive dynamics are intensifying, with established cybersecurity vendors rapidly integrating AI capabilities into their portfolios and new AI-native security startups emerging. Strategic partnerships and acquisitions are common as companies seek to enhance their technological prowess and market reach. For instance, the USD 1.5 Billion strategic investment by Microsoft in G42 underscores the significant capital flowing into AI-driven security initiatives. Market penetration of AI in security solutions is expected to reach over 70% across major industries by 2030, driven by the undeniable return on investment in terms of reduced breach costs and enhanced operational resilience. The AI in Security Market is thus poised for sustained and substantial growth, fundamentally reshaping the future of cybersecurity.

Dominant Markets & Segments in AI In Security Market

The AI in Security Market exhibits significant dominance across various regions and specific market segments, driven by a complex interplay of economic policies, technological infrastructure, regulatory mandates, and industry-specific risks.

Leading Region: North America, particularly the United States, currently dominates the AI in Security Market. This dominance is attributed to several factors:

- Technological Advancement: The region is a global hub for AI research and development, with a high concentration of leading technology companies and research institutions.

- High Cybersecurity Spending: Both government and private sectors in North America allocate substantial budgets towards cybersecurity, driven by a heightened awareness of cyber threats and a mature digital economy.

- Regulatory Environment: While proactive, the regulatory landscape encourages advanced security adoption to meet compliance standards.

- Strong Cloud Adoption: Widespread adoption of cloud infrastructure in the US fuels demand for sophisticated Cloud Security solutions.

Leading Security Type: Network Security commands a significant share within the AI in Security Market.

- Ubiquitous Need: Protecting networks from external and internal threats is a foundational requirement for all organizations.

- Data Volume: Networks generate massive amounts of data, making them ideal candidates for AI-driven analysis and threat detection.

- Evolving Threats: The constant evolution of network-based threats, such as advanced persistent threats (APTs) and zero-day exploits, necessitates AI's adaptive capabilities.

- Key Drivers: Increased network traffic from remote work, IoT devices, and cloud integration.

Leading Service: Managed Services are witnessing rapid growth and dominance in the AI in Security Market.

- Talent Shortage: A global shortage of skilled cybersecurity professionals makes outsourcing security operations to AI-powered managed service providers highly attractive.

- Cost-Effectiveness: Managed services often offer a more cost-effective solution compared to building and maintaining an in-house AI security team.

- 24/7 Monitoring: AI enables continuous, round-the-clock monitoring and threat response, a critical component of effective security operations.

- Key Drivers: Demand for proactive threat hunting, incident response, and compliance management.

Leading Deployment: Cloud deployment is rapidly becoming the dominant mode for AI in security solutions.

- Scalability and Flexibility: Cloud-based AI security offers unparalleled scalability and flexibility to adapt to changing organizational needs and threat landscapes.

- Accessibility: Cloud deployment reduces the upfront infrastructure costs and complexity, making advanced AI security accessible to a broader range of businesses.

- Integration: Seamless integration with other cloud services and applications.

- Key Drivers: The overall shift towards cloud computing and the agility it provides.

Leading End-user Industry: The Government & Defense sector stands out as a dominant end-user industry.

- National Security Concerns: High stakes associated with protecting critical national infrastructure, classified data, and sensitive government systems.

- Sophisticated Threats: This sector is a prime target for state-sponsored cyberattacks, necessitating the most advanced AI security measures.

- Mandatory Compliance: Stringent regulatory requirements and compliance mandates drive the adoption of cutting-edge security technologies.

- Key Drivers: Increased geopolitical tensions, evolving warfare tactics, and the need to secure sensitive data and critical infrastructure.

The BFSI (Banking, Financial Services, and Insurance) sector also represents a significant and rapidly growing market.

- Financial Assets: Protecting vast financial assets and sensitive customer data from fraud and theft is paramount.

- Regulatory Scrutiny: The BFSI sector is heavily regulated, with strict compliance requirements for data protection and cybersecurity.

- Fraud Detection: AI's capabilities in anomaly detection and behavioral analytics are crucial for combating financial fraud.

- Key Drivers: Rising online transactions, increasing financial crime sophistication, and strict regulatory compliance.

The Manufacturing sector is also a key growth area, driven by the increasing adoption of Industry 4.0 technologies, IoT devices, and operational technology (OT) security needs. The Healthcare industry is increasingly adopting AI in security to protect patient data and critical medical devices. Automotive & Transportation are also emerging as significant markets, especially with the rise of connected and autonomous vehicles.

AI In Security Market Product Developments

Product development in the AI in Security Market is characterized by a relentless pursuit of enhanced threat detection, predictive analytics, and automated response capabilities. Innovations are focused on leveraging advanced machine learning (ML) and deep learning (DL) algorithms to identify and neutralize sophisticated cyber threats in real-time. Companies are developing AI-powered solutions that can analyze vast datasets from network traffic, endpoints, and cloud environments to detect anomalies and predict potential breaches before they occur. Key advancements include the integration of Generative AI (GenAI) for more proactive defense against AI-generated attacks and the development of explainable AI (XAI) for increased transparency and trust in automated security decisions. Competitive advantages are being built on the ability of these AI solutions to offer faster response times, reduced false positives, and improved operational efficiency compared to traditional security measures.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation of the AI in Security Market, providing detailed analysis across key dimensions to understand market dynamics and growth projections.

Security Type: The market is segmented into Network Security, Application Security, and Cloud Security. Network Security is expected to maintain a leading position due to the fundamental need for network protection, while Cloud Security will witness robust growth driven by increasing cloud adoption. Application Security is crucial for safeguarding software from vulnerabilities, with AI playing a vital role in DevSecOps. Market sizes for each segment are estimated with projections for significant growth, influenced by evolving threat landscapes.

Service: The segmentation includes Professional Services and Managed Services. Managed Services are anticipated to dominate the market owing to the shortage of skilled cybersecurity professionals and the demand for continuous monitoring and response. Professional Services, including consulting and implementation, will also see steady growth as organizations seek expert guidance in deploying AI security solutions.

Deployment: The market is divided into On-premise and Cloud deployments. The Cloud segment is projected to experience higher growth rates due to its scalability, flexibility, and cost-effectiveness, aligning with the broader trend of cloud migration. On-premise solutions will remain relevant for organizations with strict data sovereignty requirements or existing on-premise infrastructure.

End-user Industry: The report analyzes segments such as Government & Defense, Retail, BFSI, Manufacturing, Healthcare, Automotive & Transportation, and Other End-user Industries. Government & Defense and BFSI are identified as dominant sectors due to high-value targets and stringent regulatory requirements. Manufacturing and Healthcare are emerging as key growth areas with increasing adoption of IoT and digital transformation initiatives.

Key Drivers of AI In Security Market Growth

The AI in Security Market is propelled by a confluence of powerful growth drivers. The escalating sophistication and volume of cyber threats, including advanced persistent threats (APTs), ransomware, and zero-day exploits, are the primary impetus. AI's ability to analyze massive datasets, identify subtle patterns, and predict potential attacks offers a crucial advantage in this evolving threat landscape. The widespread adoption of cloud computing and the burgeoning Internet of Things (IoT) ecosystem further expand the attack surface, creating a critical need for intelligent and scalable security solutions that AI can provide, particularly in Cloud Security and Network Security. Stricter regulatory frameworks and compliance mandates across various industries, such as GDPR and CCPA, compel organizations to invest in robust security measures, with AI offering efficient compliance management and data protection capabilities. Furthermore, the persistent global shortage of skilled cybersecurity professionals drives demand for AI-powered Managed Services that can automate security tasks and provide 24/7 monitoring.

Challenges in the AI In Security Market Sector

Despite its immense potential, the AI in Security Market faces several significant challenges that can impede its growth and adoption. The complexity and cost of implementation can be a barrier for smaller organizations, requiring substantial investment in infrastructure, expertise, and integration with existing systems. The lack of skilled professionals who can effectively develop, deploy, and manage AI security solutions remains a critical constraint, often necessitating extensive training or reliance on managed services. Data privacy and ethical concerns surrounding the use of AI in security, including potential biases in algorithms and the risk of misuse, require careful consideration and robust governance frameworks. The ever-evolving nature of cyber threats means that AI models must be continuously updated and retrained to remain effective, demanding ongoing investment and resources. Furthermore, interoperability issues between different AI security platforms and legacy systems can create integration challenges. Quantifiably, the cost of breaches due to inadequate AI security can range from millions to billions for large enterprises, highlighting the high stakes involved.

Emerging Opportunities in AI In Security Market

The AI in Security Market is ripe with emerging opportunities, driven by technological advancements and evolving market needs. The increasing adoption of Generative AI (GenAI) in cybersecurity presents a significant opportunity for developing more sophisticated defenses against AI-powered attacks and for automating threat intelligence gathering. The expansion of the Internet of Things (IoT), particularly in industrial settings (IIoT) and smart cities, creates a vast new attack surface demanding specialized AI-driven security solutions for device security and network integrity. The growing demand for explainable AI (XAI) in security applications offers an opportunity to build greater trust and transparency, facilitating wider adoption among risk-averse organizations. The development of AI-powered solutions for zero-trust architectures is another key area, providing continuous verification and granular access control. Furthermore, the burgeoning market for AI-driven threat hunting and proactive risk assessment presents significant growth potential as organizations shift from reactive to predictive security postures. Emerging markets in developing economies are also opening up, offering substantial opportunities for scalable and cost-effective AI security solutions.

Leading Players in the AI In Security Market Market

- F-Secure Corporation

- IBM Corporation

- Xilinx Inc

- Fortinet Inc

- Samsung Electronics Co Ltd

- Micron Technology Inc

- ThreatMetrix Inc (RELX Group)

- Cisco Systems Inc

- Tech Mahindra Limited

- Facebook Inc

- Nvidia Corporation

- Broadcom Inc (Symantec Corporation)

- Juniper Network Inc

Key Developments in AI In Security Market Industry

- May 2024: Palo Alto Networks introduced new security solutions to help enterprises thwart AI-generated attacks and effectively secure AI by design. Leveraging Precision AI, the new proprietary innovation that combines the best of machine learning (ML) and deep learning (DL) with the accessibility of generative AI (GenAI) in real time, the international cybersecurity player is expected to deliver AI-powered security that can outpace adversaries and more proactively protect networks and infrastructure. This development signifies a critical step in defending against sophisticated AI-driven threats.

- April 2024: G42, the UAE-based artificial intelligence (AI) technology holding company, and Microsoft Corp. announced a USD 1.5 Billion strategic investment by Microsoft in G42. The investment will strengthen the two companies' collaboration on bringing the latest Microsoft AI technologies and skilling initiatives to the UAE and other countries worldwide. This expanded collaboration will empower organizations of all sizes in new markets to benefit from Microsoft's AI and cloud capabilities while ensuring they adopt AI that adheres to world-leading standards and security. This partnership highlights the increasing strategic importance of AI in securing digital transformation efforts globally.

Strategic Outlook for AI In Security Market Market

The strategic outlook for the AI in Security Market is exceptionally robust, driven by the undeniable imperative to defend against increasingly sophisticated cyber threats. The continuous evolution of AI technologies, including advancements in deep learning, natural language processing, and the emerging capabilities of generative AI, will fuel the development of more intelligent and proactive security solutions. Organizations will increasingly adopt AI for automated threat detection, predictive analytics, and real-time incident response, leading to enhanced resilience and reduced breach costs. The growing emphasis on securing AI systems themselves, coupled with the need to defend against AI-powered attacks, will create significant demand for specialized AI security tools and expertise. Furthermore, the ongoing digital transformation across all industries, including the expansion of cloud computing and the Internet of Things (IoT), will continue to broaden the attack surface, making AI indispensable for comprehensive security coverage. Strategic collaborations, mergers, and acquisitions will remain prevalent as companies seek to consolidate market positions and acquire cutting-edge AI capabilities. The market is poised for sustained high growth, with AI becoming an integral component of virtually all cybersecurity strategies.

AI In Security Market Segmentation

-

1. Security Type

- 1.1. Network Security

- 1.2. Application Security

- 1.3. Cloud Security

-

2. Service

- 2.1. Professional Services

- 2.2. Managed Services

-

3. Deployment

- 3.1. On-premise

- 3.2. Cloud

-

4. End-user Industry

- 4.1. Government & Defense

- 4.2. Retail

- 4.3. BFSI

- 4.4. Manufacturing

- 4.5. Healthcare

- 4.6. Automotive & Transportation

- 4.7. Other End-user Industries

AI In Security Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

AI In Security Market Regional Market Share

Geographic Coverage of AI In Security Market

AI In Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Security Frauds and Technology Penetration; Increasing Number of Malware Attacks (Ransomware) Across Cloud Computing Ecosystem

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled AI Professionals

- 3.4. Market Trends

- 3.4.1. The Healthcare Sector is Significantly Driving Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global AI In Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Security Type

- 5.1.1. Network Security

- 5.1.2. Application Security

- 5.1.3. Cloud Security

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Professional Services

- 5.2.2. Managed Services

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. On-premise

- 5.3.2. Cloud

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Government & Defense

- 5.4.2. Retail

- 5.4.3. BFSI

- 5.4.4. Manufacturing

- 5.4.5. Healthcare

- 5.4.6. Automotive & Transportation

- 5.4.7. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Security Type

- 6. North America AI In Security Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Security Type

- 6.1.1. Network Security

- 6.1.2. Application Security

- 6.1.3. Cloud Security

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Professional Services

- 6.2.2. Managed Services

- 6.3. Market Analysis, Insights and Forecast - by Deployment

- 6.3.1. On-premise

- 6.3.2. Cloud

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Government & Defense

- 6.4.2. Retail

- 6.4.3. BFSI

- 6.4.4. Manufacturing

- 6.4.5. Healthcare

- 6.4.6. Automotive & Transportation

- 6.4.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Security Type

- 7. Europe AI In Security Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Security Type

- 7.1.1. Network Security

- 7.1.2. Application Security

- 7.1.3. Cloud Security

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Professional Services

- 7.2.2. Managed Services

- 7.3. Market Analysis, Insights and Forecast - by Deployment

- 7.3.1. On-premise

- 7.3.2. Cloud

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Government & Defense

- 7.4.2. Retail

- 7.4.3. BFSI

- 7.4.4. Manufacturing

- 7.4.5. Healthcare

- 7.4.6. Automotive & Transportation

- 7.4.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Security Type

- 8. Asia Pacific AI In Security Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Security Type

- 8.1.1. Network Security

- 8.1.2. Application Security

- 8.1.3. Cloud Security

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Professional Services

- 8.2.2. Managed Services

- 8.3. Market Analysis, Insights and Forecast - by Deployment

- 8.3.1. On-premise

- 8.3.2. Cloud

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Government & Defense

- 8.4.2. Retail

- 8.4.3. BFSI

- 8.4.4. Manufacturing

- 8.4.5. Healthcare

- 8.4.6. Automotive & Transportation

- 8.4.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Security Type

- 9. Rest of the World AI In Security Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Security Type

- 9.1.1. Network Security

- 9.1.2. Application Security

- 9.1.3. Cloud Security

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Professional Services

- 9.2.2. Managed Services

- 9.3. Market Analysis, Insights and Forecast - by Deployment

- 9.3.1. On-premise

- 9.3.2. Cloud

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Government & Defense

- 9.4.2. Retail

- 9.4.3. BFSI

- 9.4.4. Manufacturing

- 9.4.5. Healthcare

- 9.4.6. Automotive & Transportation

- 9.4.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Security Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 F-Secure Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IBM Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Xilinx Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fortinet Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Samsung Electronics Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Micron Technology Inc *List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ThreatMetrix Inc (RELX Group)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cisco Systems Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Tech Mahindra Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Facebook Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Nvidia Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Broadcom Inc (Symantec Corporation)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Juniper Network Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 F-Secure Corporation

List of Figures

- Figure 1: Global AI In Security Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America AI In Security Market Revenue (Million), by Security Type 2025 & 2033

- Figure 3: North America AI In Security Market Revenue Share (%), by Security Type 2025 & 2033

- Figure 4: North America AI In Security Market Revenue (Million), by Service 2025 & 2033

- Figure 5: North America AI In Security Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America AI In Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 7: North America AI In Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 8: North America AI In Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 9: North America AI In Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America AI In Security Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America AI In Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe AI In Security Market Revenue (Million), by Security Type 2025 & 2033

- Figure 13: Europe AI In Security Market Revenue Share (%), by Security Type 2025 & 2033

- Figure 14: Europe AI In Security Market Revenue (Million), by Service 2025 & 2033

- Figure 15: Europe AI In Security Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe AI In Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 17: Europe AI In Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 18: Europe AI In Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Europe AI In Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Europe AI In Security Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe AI In Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific AI In Security Market Revenue (Million), by Security Type 2025 & 2033

- Figure 23: Asia Pacific AI In Security Market Revenue Share (%), by Security Type 2025 & 2033

- Figure 24: Asia Pacific AI In Security Market Revenue (Million), by Service 2025 & 2033

- Figure 25: Asia Pacific AI In Security Market Revenue Share (%), by Service 2025 & 2033

- Figure 26: Asia Pacific AI In Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Asia Pacific AI In Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Asia Pacific AI In Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific AI In Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific AI In Security Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific AI In Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World AI In Security Market Revenue (Million), by Security Type 2025 & 2033

- Figure 33: Rest of the World AI In Security Market Revenue Share (%), by Security Type 2025 & 2033

- Figure 34: Rest of the World AI In Security Market Revenue (Million), by Service 2025 & 2033

- Figure 35: Rest of the World AI In Security Market Revenue Share (%), by Service 2025 & 2033

- Figure 36: Rest of the World AI In Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 37: Rest of the World AI In Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 38: Rest of the World AI In Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Rest of the World AI In Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Rest of the World AI In Security Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World AI In Security Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global AI In Security Market Revenue Million Forecast, by Security Type 2020 & 2033

- Table 2: Global AI In Security Market Revenue Million Forecast, by Service 2020 & 2033

- Table 3: Global AI In Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: Global AI In Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Global AI In Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global AI In Security Market Revenue Million Forecast, by Security Type 2020 & 2033

- Table 7: Global AI In Security Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global AI In Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 9: Global AI In Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global AI In Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global AI In Security Market Revenue Million Forecast, by Security Type 2020 & 2033

- Table 14: Global AI In Security Market Revenue Million Forecast, by Service 2020 & 2033

- Table 15: Global AI In Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 16: Global AI In Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 17: Global AI In Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United Kingdom AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Germany AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global AI In Security Market Revenue Million Forecast, by Security Type 2020 & 2033

- Table 25: Global AI In Security Market Revenue Million Forecast, by Service 2020 & 2033

- Table 26: Global AI In Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 27: Global AI In Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global AI In Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: China AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Japan AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: India AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Korea AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Asia Pacific AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global AI In Security Market Revenue Million Forecast, by Security Type 2020 & 2033

- Table 35: Global AI In Security Market Revenue Million Forecast, by Service 2020 & 2033

- Table 36: Global AI In Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 37: Global AI In Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 38: Global AI In Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Latin America AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Middle East and Africa AI In Security Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the AI In Security Market?

The projected CAGR is approximately 19.02%.

2. Which companies are prominent players in the AI In Security Market?

Key companies in the market include F-Secure Corporation, IBM Corporation, Xilinx Inc, Fortinet Inc, Samsung Electronics Co Ltd, Micron Technology Inc *List Not Exhaustive, ThreatMetrix Inc (RELX Group), Cisco Systems Inc, Tech Mahindra Limited, Facebook Inc, Nvidia Corporation, Broadcom Inc (Symantec Corporation), Juniper Network Inc.

3. What are the main segments of the AI In Security Market?

The market segments include Security Type, Service, Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Security Frauds and Technology Penetration; Increasing Number of Malware Attacks (Ransomware) Across Cloud Computing Ecosystem.

6. What are the notable trends driving market growth?

The Healthcare Sector is Significantly Driving Market Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled AI Professionals.

8. Can you provide examples of recent developments in the market?

May 2024: Palo Alto Networks introduced new security solutions to help enterprises thwart AI-generated attacks and effectively secure AI by design. Leveraging Precision AI, the new proprietary innovation that combines the best of machine learning (ML) and deep learning (DL) with the accessibility of generative AI (GenAI) in real time, the international cybersecurity player is expected to deliver AI-powered security that can outpace adversaries and more proactively protect networks and infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "AI In Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the AI In Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the AI In Security Market?

To stay informed about further developments, trends, and reports in the AI In Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence