Key Insights

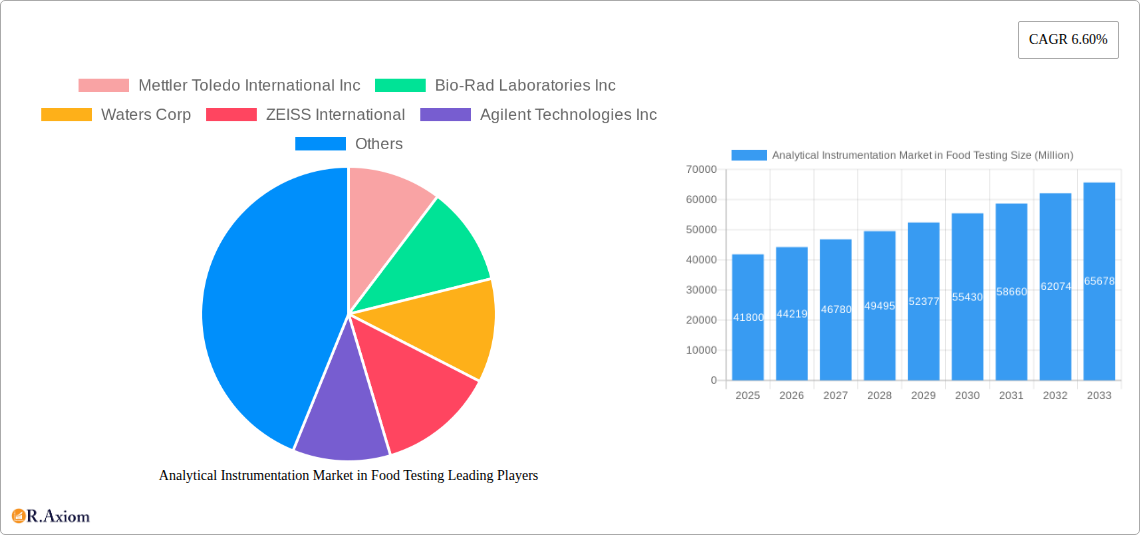

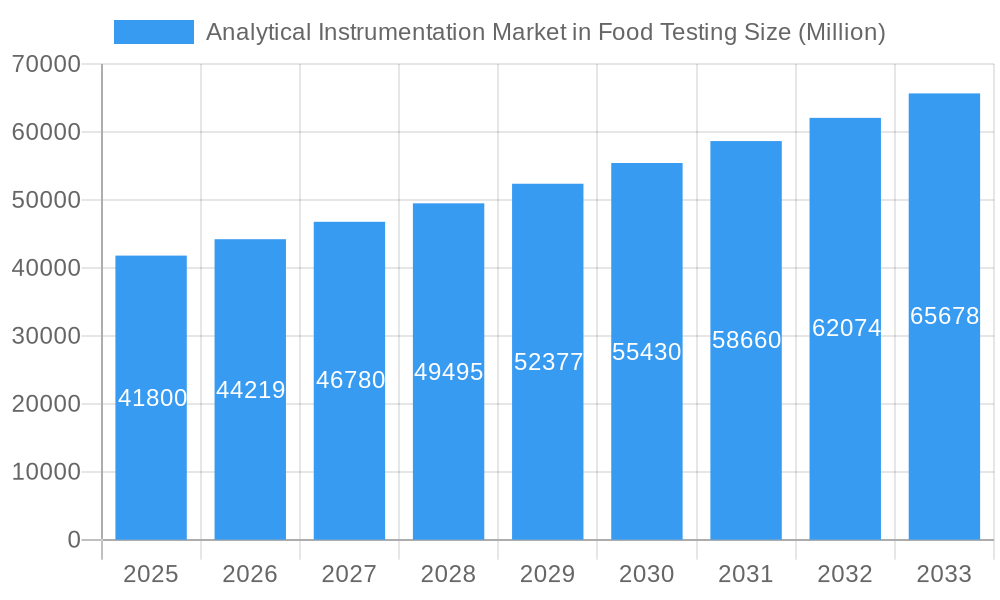

The Analytical Instrumentation Market in Food Testing is poised for robust growth, driven by an increasing global demand for safe and high-quality food products. The market size is estimated at USD 41.8 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.7% from 2025 to 2033. This expansion is fueled by a growing consumer awareness of food safety and the subsequent tightening of regulatory frameworks worldwide. Advances in analytical techniques, such as chromatography and spectroscopy, are enabling more precise and rapid detection of contaminants, allergens, and authenticity markers, further stimulating market adoption. The increasing complexity of food supply chains and the rise in global food trade also necessitate advanced testing capabilities, creating a sustained demand for sophisticated analytical instruments. Key end-users, including food and beverage manufacturers, regulatory agencies, and independent laboratories, are investing significantly in these technologies to ensure compliance and maintain consumer trust.

Analytical Instrumentation Market in Food Testing Market Size (In Billion)

Emerging trends in the Analytical Instrumentation Market for Food Testing include a heightened focus on rapid and portable testing solutions, enabling on-site analysis and reducing turnaround times. The integration of artificial intelligence and machine learning into analytical platforms is also gaining traction, promising enhanced data interpretation and predictive capabilities. Furthermore, the development of multi-analyte detection systems is allowing for more comprehensive screening of food samples. However, the market also faces certain restraints, such as the high initial cost of advanced instrumentation and the need for skilled personnel to operate and maintain them. Stringent validation protocols for new testing methods can also present a barrier to rapid market penetration. Despite these challenges, the overarching imperative for food safety and quality assurance, coupled with continuous technological innovation, is expected to propel the market forward throughout the forecast period, with significant contributions from regions like North America, Europe, and Asia-Pacific.

Analytical Instrumentation Market in Food Testing Company Market Share

This in-depth report provides a detailed analysis of the global Analytical Instrumentation Market in Food Testing, offering critical insights into market dynamics, segmentation, key players, and future trajectories. Spanning from 2019 to 2033, with a base year of 2025, this study is an essential resource for stakeholders seeking to understand the evolving landscape of food safety and quality assurance. We explore the crucial role of advanced analytical instruments in meeting stringent regulatory demands, ensuring consumer health, and enhancing product integrity across the entire food and beverage value chain.

Analytical Instrumentation Market in Food Testing Market Concentration & Innovation

The Analytical Instrumentation Market in Food Testing exhibits a moderate to high degree of concentration, driven by a few dominant global players alongside numerous specialized regional providers. Innovation is a primary catalyst, fueled by the relentless pursuit of higher sensitivity, faster analysis times, greater automation, and more portable solutions for on-site testing. Regulatory frameworks, such as those enforced by the FDA, EFSA, and national food safety authorities, mandate rigorous testing protocols, creating a consistent demand for sophisticated analytical equipment. Product substitutes are emerging, particularly in rapid screening technologies, but traditional, highly precise analytical instruments continue to hold significant market share due to their accuracy and comprehensive data output. End-user trends reveal a growing demand for integrated solutions that combine hardware, software, and consumables, simplifying workflows and reducing operational costs for food and beverage manufacturers, regulatory agencies, and independent laboratories. Mergers and acquisitions (M&A) activity is significant, with companies strategically acquiring innovative technologies or expanding their geographical reach. For instance, historical M&A deal values often range from tens of millions to several billion dollars, reflecting the strategic importance of consolidating market positions and intellectual property.

Analytical Instrumentation Market in Food Testing Industry Trends & Insights

The Analytical Instrumentation Market in Food Testing is experiencing robust growth, driven by an increasing global population, rising disposable incomes, and a heightened consumer awareness of food safety and quality. The CAGR is projected to be approximately 7.5% during the forecast period (2025–2033), pushing the market value well into the billions. Technological disruptions are at the forefront, with advancements in AI-powered data analysis, miniaturization of instruments, and the integration of IoT for real-time monitoring playing a pivotal role. Consumer preferences are leaning towards transparency, organic certifications, and allergen-free products, all of which necessitate advanced analytical capabilities to verify claims and ensure compliance. Competitive dynamics are characterized by intense R&D investment, strategic partnerships, and a focus on providing comprehensive service and support to end-users. The increasing complexity of food supply chains, coupled with the rise in food fraud and adulteration incidents, further amplifies the demand for reliable and sophisticated analytical solutions. The market penetration of advanced techniques, such as mass spectrometry and advanced spectroscopic methods, is steadily increasing as their cost-effectiveness and efficiency become more apparent to a wider range of users.

Dominant Markets & Segments in Analytical Instrumentation Market in Food Testing

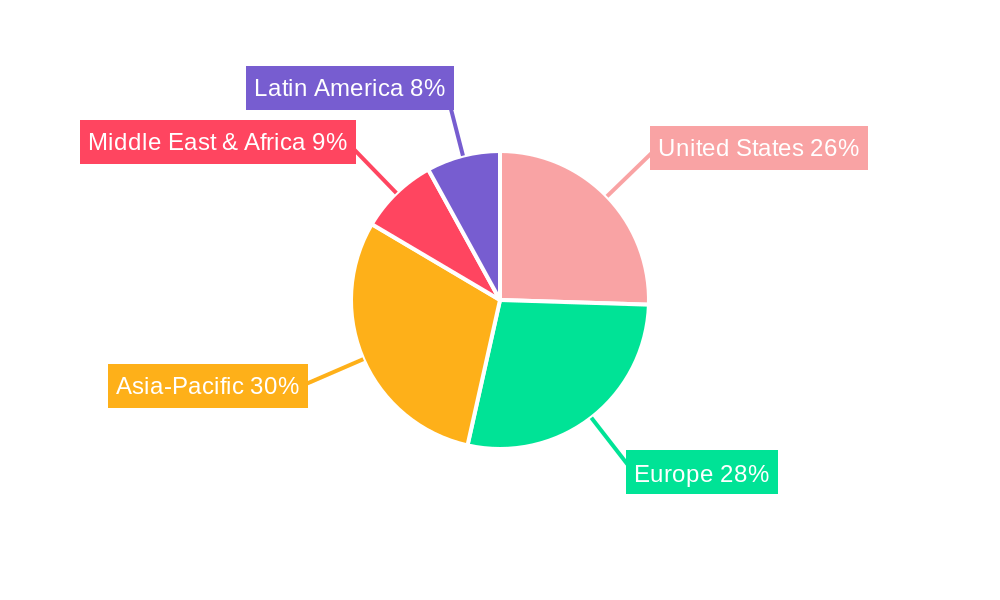

The United States is currently the dominant market for analytical instrumentation in food testing, driven by a mature food and beverage industry, stringent regulatory oversight, and substantial investment in R&D and advanced technologies. Economic policies that prioritize food safety and consumer protection, coupled with robust infrastructure supporting research and development, significantly contribute to its leading position. In terms of Technique, Chromatography, particularly High-Performance Liquid Chromatography (HPLC) and Gas Chromatography (GC), holds a dominant share due to its versatility in separating and quantifying a wide range of analytes, from pesticides and contaminants to flavor compounds. Spectroscopy, including techniques like Mass Spectrometry (MS), FT-IR, and Raman spectroscopy, is rapidly gaining traction and is projected to witness significant growth, driven by its ability to provide rapid, non-destructive analysis and molecular identification. For End-Users, Food and Beverage Manufacturers represent the largest segment, investing heavily in analytical instrumentation for quality control, product development, and compliance with regulatory standards. Laboratories, both independent and in-house, also form a substantial segment, performing outsourced testing and specialized analyses. Regulatory Agencies, while smaller in terms of direct instrument procurement, exert significant influence by setting testing standards and driving demand for validated analytical methods. Within the Region of Europe, the market is also substantial, influenced by the European Food Safety Authority (EFSA) and member state regulations that emphasize food safety and traceability. The Asia-Pacific region is emerging as a high-growth market, fueled by rapid industrialization, a growing middle class, and increasing awareness of food safety issues.

Analytical Instrumentation Market in Food Testing Product Developments

Recent product developments in the Analytical Instrumentation Market in Food Testing are characterized by a strong focus on enhancing speed, accuracy, and ease of use. Innovations are geared towards enabling real-time or near-real-time analysis, reducing sample preparation time, and increasing throughput. The development of compact, portable instruments for on-site testing is a significant trend, allowing for immediate verification of food quality and safety at various points in the supply chain. Furthermore, software advancements incorporating AI and machine learning are optimizing data interpretation and reducing the need for highly specialized operators. These developments are directly addressing the market's need for more efficient and cost-effective testing solutions, thereby strengthening competitive advantages for adopting companies.

Report Scope & Segmentation Analysis

This report segments the Analytical Instrumentation Market in Food Testing by Technique (Chromatography, Spectroscopy, Other Techniques), End-User (Food and Beverage Manufacturers, Regulatory Agencies, Laboratories), and Region (United States, Europe, Asia-Pacific, Middle East & Africa, Latin America). The Chromatography segment is expected to maintain its significant market share throughout the forecast period, driven by its established reliability and versatility in detecting a wide array of contaminants and compounds. The Spectroscopy segment, however, is projected to exhibit the highest growth rate, propelled by advancements in techniques like FT-IR and Raman spectroscopy, offering rapid, non-destructive analysis. Food and Beverage Manufacturers constitute the largest end-user segment, with ongoing investments in quality control and safety compliance. Laboratories are expected to demonstrate robust growth as outsourcing of testing services continues to rise. The United States and Europe are projected to remain dominant regions, while the Asia-Pacific region is anticipated to witness the fastest growth due to increasing food production and evolving regulatory landscapes.

Key Drivers of Analytical Instrumentation Market in Food Testing Growth

Several key drivers are propelling the growth of the Analytical Instrumentation Market in Food Testing. Firstly, the escalating demand for food safety and quality assurance, driven by consumer concerns and stringent government regulations globally, is a primary impetus. Secondly, technological advancements in analytical techniques, leading to increased sensitivity, accuracy, and speed of testing, are crucial. For instance, the development of novel detectors and sample preparation methods enhances the ability to identify trace contaminants. Thirdly, the growing complexity of global food supply chains necessitates robust testing at multiple stages to ensure traceability and prevent adulteration. Finally, the increasing incidence of foodborne illnesses and recalls underscores the critical need for advanced analytical instrumentation to safeguard public health.

Challenges in the Analytical Instrumentation Market in Food Testing Sector

Despite its growth, the Analytical Instrumentation Market in Food Testing faces several challenges. High initial investment costs for sophisticated analytical equipment can be a barrier for small and medium-sized enterprises (SMEs) and laboratories with limited budgets, impacting market penetration. Stringent and evolving regulatory requirements, while driving demand, also necessitate continuous upgrades and validation of analytical methods and instruments, adding to operational costs. The need for skilled personnel to operate and maintain complex analytical instruments poses a challenge, particularly in regions with a shortage of trained professionals. Furthermore, the development of counterfeit products and sophisticated adulteration techniques requires constant innovation in analytical methods to stay ahead, presenting an ongoing research and development challenge.

Emerging Opportunities in Analytical Instrumentation Market in Food Testing

Emerging opportunities within the Analytical Instrumentation Market in Food Testing are diverse and promising. The growing demand for testing in niche food categories, such as plant-based alternatives, functional foods, and infant nutrition, presents new avenues for specialized analytical solutions. The increasing adoption of portable and handheld analytical devices for on-site testing, offering real-time data and immediate decision-making capabilities, is a significant opportunity. Furthermore, the application of AI and machine learning in data analysis and instrument automation offers the potential to significantly enhance efficiency and reduce turnaround times. The expansion of global food trade, particularly into emerging economies with developing regulatory frameworks, also creates substantial growth potential for analytical instrumentation providers.

Leading Players in the Analytical Instrumentation Market in Food Testing Market

- Mettler Toledo International Inc

- Bio-Rad Laboratories Inc

- Waters Corp

- ZEISS International

- Agilent Technologies Inc

- PerkinElmer Inc

- Malvern Panalytical Ltd

- Thermo Fisher Scientific

- Bruker Corporation

- Shimadzu Corporation

Key Developments in Analytical Instrumentation Market in Food Testing Industry

- July 2022: GenTech Scientific and Conquer Scientific announced a partnership in analytical instrumentation and services. Through this partnership, the companies aim to provide efficient end-to-end solutions for their customers. The companies' complete solutions strategy extends across numerous areas, including cannabis, toxicology, food and beverage, and other high-growth industries. It includes building relationships with partners and leveraging expertise to provide solutions for their customers.

- March 2022: PerkinElmer launched its latest FT-IR liquid food testing platform, comprising instruments, software, and streamlined workflows. Leveraging PerkinElmer's FT-IR spectroscopy technology, the LQA300 system identifies key quality markers, including alcohol, sugar, acidity, pH, and density levels during every part of the winemaking process, from harvest to bottling.

Strategic Outlook for Analytical Instrumentation Market in Food Testing Market

The strategic outlook for the Analytical Instrumentation Market in Food Testing is overwhelmingly positive, driven by persistent global demand for safe and high-quality food. Future growth will be catalyzed by continued innovation in analytical technologies, particularly in areas like automation, miniaturization, and AI-driven data interpretation, making advanced testing more accessible and efficient. Strategic collaborations and partnerships among instrument manufacturers, software developers, and end-users will be crucial for delivering comprehensive solutions. Furthermore, the increasing focus on sustainable food production and traceability throughout the supply chain will create new opportunities for sophisticated analytical tools that can verify origin, composition, and safety claims, ensuring market expansion and sustained revenue generation for leading players.

Analytical Instrumentation Market in Food Testing Segmentation

-

1. Technique

- 1.1. Chromatography

- 1.2. Spectroscopy

- 1.3. Other Te

-

2. End-User

- 2.1. Food and Beverage Manufacturers

- 2.2. Regulatory Agencies

- 2.3. Laboratories

-

3. Region

- 3.1. United States

- 3.2. Europe

- 3.3. Asia-Pacific

- 3.4. Middle East & Africa

- 3.5. Latin America

Analytical Instrumentation Market in Food Testing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Analytical Instrumentation Market in Food Testing Regional Market Share

Geographic Coverage of Analytical Instrumentation Market in Food Testing

Analytical Instrumentation Market in Food Testing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Imposition of Stringent Regulations is Aiding the Market's Growth; Increasing Technological Advancements; Developing Consumer Interests in Food Quality

- 3.3. Market Restrains

- 3.3.1. High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. The Chromatography Segment is Expected to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Analytical Instrumentation Market in Food Testing Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technique

- 5.1.1. Chromatography

- 5.1.2. Spectroscopy

- 5.1.3. Other Te

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Food and Beverage Manufacturers

- 5.2.2. Regulatory Agencies

- 5.2.3. Laboratories

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Europe

- 5.3.3. Asia-Pacific

- 5.3.4. Middle East & Africa

- 5.3.5. Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Technique

- 6. North America Analytical Instrumentation Market in Food Testing Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technique

- 6.1.1. Chromatography

- 6.1.2. Spectroscopy

- 6.1.3. Other Te

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Food and Beverage Manufacturers

- 6.2.2. Regulatory Agencies

- 6.2.3. Laboratories

- 6.3. Market Analysis, Insights and Forecast - by Region

- 6.3.1. United States

- 6.3.2. Europe

- 6.3.3. Asia-Pacific

- 6.3.4. Middle East & Africa

- 6.3.5. Latin America

- 6.1. Market Analysis, Insights and Forecast - by Technique

- 7. South America Analytical Instrumentation Market in Food Testing Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technique

- 7.1.1. Chromatography

- 7.1.2. Spectroscopy

- 7.1.3. Other Te

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Food and Beverage Manufacturers

- 7.2.2. Regulatory Agencies

- 7.2.3. Laboratories

- 7.3. Market Analysis, Insights and Forecast - by Region

- 7.3.1. United States

- 7.3.2. Europe

- 7.3.3. Asia-Pacific

- 7.3.4. Middle East & Africa

- 7.3.5. Latin America

- 7.1. Market Analysis, Insights and Forecast - by Technique

- 8. Europe Analytical Instrumentation Market in Food Testing Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technique

- 8.1.1. Chromatography

- 8.1.2. Spectroscopy

- 8.1.3. Other Te

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Food and Beverage Manufacturers

- 8.2.2. Regulatory Agencies

- 8.2.3. Laboratories

- 8.3. Market Analysis, Insights and Forecast - by Region

- 8.3.1. United States

- 8.3.2. Europe

- 8.3.3. Asia-Pacific

- 8.3.4. Middle East & Africa

- 8.3.5. Latin America

- 8.1. Market Analysis, Insights and Forecast - by Technique

- 9. Middle East & Africa Analytical Instrumentation Market in Food Testing Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technique

- 9.1.1. Chromatography

- 9.1.2. Spectroscopy

- 9.1.3. Other Te

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Food and Beverage Manufacturers

- 9.2.2. Regulatory Agencies

- 9.2.3. Laboratories

- 9.3. Market Analysis, Insights and Forecast - by Region

- 9.3.1. United States

- 9.3.2. Europe

- 9.3.3. Asia-Pacific

- 9.3.4. Middle East & Africa

- 9.3.5. Latin America

- 9.1. Market Analysis, Insights and Forecast - by Technique

- 10. Asia Pacific Analytical Instrumentation Market in Food Testing Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technique

- 10.1.1. Chromatography

- 10.1.2. Spectroscopy

- 10.1.3. Other Te

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Food and Beverage Manufacturers

- 10.2.2. Regulatory Agencies

- 10.2.3. Laboratories

- 10.3. Market Analysis, Insights and Forecast - by Region

- 10.3.1. United States

- 10.3.2. Europe

- 10.3.3. Asia-Pacific

- 10.3.4. Middle East & Africa

- 10.3.5. Latin America

- 10.1. Market Analysis, Insights and Forecast - by Technique

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mettler Toledo International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bio-Rad Laboratories Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Waters Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ZEISS International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Agilent Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PerkinElmer Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Malvern Panalytical Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thermo Fisher Scientific

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bruker Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shimadzu Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mettler Toledo International Inc

List of Figures

- Figure 1: Global Analytical Instrumentation Market in Food Testing Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Analytical Instrumentation Market in Food Testing Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Analytical Instrumentation Market in Food Testing Revenue (undefined), by Technique 2025 & 2033

- Figure 4: North America Analytical Instrumentation Market in Food Testing Volume (K Unit), by Technique 2025 & 2033

- Figure 5: North America Analytical Instrumentation Market in Food Testing Revenue Share (%), by Technique 2025 & 2033

- Figure 6: North America Analytical Instrumentation Market in Food Testing Volume Share (%), by Technique 2025 & 2033

- Figure 7: North America Analytical Instrumentation Market in Food Testing Revenue (undefined), by End-User 2025 & 2033

- Figure 8: North America Analytical Instrumentation Market in Food Testing Volume (K Unit), by End-User 2025 & 2033

- Figure 9: North America Analytical Instrumentation Market in Food Testing Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Analytical Instrumentation Market in Food Testing Volume Share (%), by End-User 2025 & 2033

- Figure 11: North America Analytical Instrumentation Market in Food Testing Revenue (undefined), by Region 2025 & 2033

- Figure 12: North America Analytical Instrumentation Market in Food Testing Volume (K Unit), by Region 2025 & 2033

- Figure 13: North America Analytical Instrumentation Market in Food Testing Revenue Share (%), by Region 2025 & 2033

- Figure 14: North America Analytical Instrumentation Market in Food Testing Volume Share (%), by Region 2025 & 2033

- Figure 15: North America Analytical Instrumentation Market in Food Testing Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Analytical Instrumentation Market in Food Testing Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Analytical Instrumentation Market in Food Testing Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Analytical Instrumentation Market in Food Testing Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Analytical Instrumentation Market in Food Testing Revenue (undefined), by Technique 2025 & 2033

- Figure 20: South America Analytical Instrumentation Market in Food Testing Volume (K Unit), by Technique 2025 & 2033

- Figure 21: South America Analytical Instrumentation Market in Food Testing Revenue Share (%), by Technique 2025 & 2033

- Figure 22: South America Analytical Instrumentation Market in Food Testing Volume Share (%), by Technique 2025 & 2033

- Figure 23: South America Analytical Instrumentation Market in Food Testing Revenue (undefined), by End-User 2025 & 2033

- Figure 24: South America Analytical Instrumentation Market in Food Testing Volume (K Unit), by End-User 2025 & 2033

- Figure 25: South America Analytical Instrumentation Market in Food Testing Revenue Share (%), by End-User 2025 & 2033

- Figure 26: South America Analytical Instrumentation Market in Food Testing Volume Share (%), by End-User 2025 & 2033

- Figure 27: South America Analytical Instrumentation Market in Food Testing Revenue (undefined), by Region 2025 & 2033

- Figure 28: South America Analytical Instrumentation Market in Food Testing Volume (K Unit), by Region 2025 & 2033

- Figure 29: South America Analytical Instrumentation Market in Food Testing Revenue Share (%), by Region 2025 & 2033

- Figure 30: South America Analytical Instrumentation Market in Food Testing Volume Share (%), by Region 2025 & 2033

- Figure 31: South America Analytical Instrumentation Market in Food Testing Revenue (undefined), by Country 2025 & 2033

- Figure 32: South America Analytical Instrumentation Market in Food Testing Volume (K Unit), by Country 2025 & 2033

- Figure 33: South America Analytical Instrumentation Market in Food Testing Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Analytical Instrumentation Market in Food Testing Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Analytical Instrumentation Market in Food Testing Revenue (undefined), by Technique 2025 & 2033

- Figure 36: Europe Analytical Instrumentation Market in Food Testing Volume (K Unit), by Technique 2025 & 2033

- Figure 37: Europe Analytical Instrumentation Market in Food Testing Revenue Share (%), by Technique 2025 & 2033

- Figure 38: Europe Analytical Instrumentation Market in Food Testing Volume Share (%), by Technique 2025 & 2033

- Figure 39: Europe Analytical Instrumentation Market in Food Testing Revenue (undefined), by End-User 2025 & 2033

- Figure 40: Europe Analytical Instrumentation Market in Food Testing Volume (K Unit), by End-User 2025 & 2033

- Figure 41: Europe Analytical Instrumentation Market in Food Testing Revenue Share (%), by End-User 2025 & 2033

- Figure 42: Europe Analytical Instrumentation Market in Food Testing Volume Share (%), by End-User 2025 & 2033

- Figure 43: Europe Analytical Instrumentation Market in Food Testing Revenue (undefined), by Region 2025 & 2033

- Figure 44: Europe Analytical Instrumentation Market in Food Testing Volume (K Unit), by Region 2025 & 2033

- Figure 45: Europe Analytical Instrumentation Market in Food Testing Revenue Share (%), by Region 2025 & 2033

- Figure 46: Europe Analytical Instrumentation Market in Food Testing Volume Share (%), by Region 2025 & 2033

- Figure 47: Europe Analytical Instrumentation Market in Food Testing Revenue (undefined), by Country 2025 & 2033

- Figure 48: Europe Analytical Instrumentation Market in Food Testing Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe Analytical Instrumentation Market in Food Testing Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Analytical Instrumentation Market in Food Testing Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Analytical Instrumentation Market in Food Testing Revenue (undefined), by Technique 2025 & 2033

- Figure 52: Middle East & Africa Analytical Instrumentation Market in Food Testing Volume (K Unit), by Technique 2025 & 2033

- Figure 53: Middle East & Africa Analytical Instrumentation Market in Food Testing Revenue Share (%), by Technique 2025 & 2033

- Figure 54: Middle East & Africa Analytical Instrumentation Market in Food Testing Volume Share (%), by Technique 2025 & 2033

- Figure 55: Middle East & Africa Analytical Instrumentation Market in Food Testing Revenue (undefined), by End-User 2025 & 2033

- Figure 56: Middle East & Africa Analytical Instrumentation Market in Food Testing Volume (K Unit), by End-User 2025 & 2033

- Figure 57: Middle East & Africa Analytical Instrumentation Market in Food Testing Revenue Share (%), by End-User 2025 & 2033

- Figure 58: Middle East & Africa Analytical Instrumentation Market in Food Testing Volume Share (%), by End-User 2025 & 2033

- Figure 59: Middle East & Africa Analytical Instrumentation Market in Food Testing Revenue (undefined), by Region 2025 & 2033

- Figure 60: Middle East & Africa Analytical Instrumentation Market in Food Testing Volume (K Unit), by Region 2025 & 2033

- Figure 61: Middle East & Africa Analytical Instrumentation Market in Food Testing Revenue Share (%), by Region 2025 & 2033

- Figure 62: Middle East & Africa Analytical Instrumentation Market in Food Testing Volume Share (%), by Region 2025 & 2033

- Figure 63: Middle East & Africa Analytical Instrumentation Market in Food Testing Revenue (undefined), by Country 2025 & 2033

- Figure 64: Middle East & Africa Analytical Instrumentation Market in Food Testing Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East & Africa Analytical Instrumentation Market in Food Testing Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Analytical Instrumentation Market in Food Testing Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Analytical Instrumentation Market in Food Testing Revenue (undefined), by Technique 2025 & 2033

- Figure 68: Asia Pacific Analytical Instrumentation Market in Food Testing Volume (K Unit), by Technique 2025 & 2033

- Figure 69: Asia Pacific Analytical Instrumentation Market in Food Testing Revenue Share (%), by Technique 2025 & 2033

- Figure 70: Asia Pacific Analytical Instrumentation Market in Food Testing Volume Share (%), by Technique 2025 & 2033

- Figure 71: Asia Pacific Analytical Instrumentation Market in Food Testing Revenue (undefined), by End-User 2025 & 2033

- Figure 72: Asia Pacific Analytical Instrumentation Market in Food Testing Volume (K Unit), by End-User 2025 & 2033

- Figure 73: Asia Pacific Analytical Instrumentation Market in Food Testing Revenue Share (%), by End-User 2025 & 2033

- Figure 74: Asia Pacific Analytical Instrumentation Market in Food Testing Volume Share (%), by End-User 2025 & 2033

- Figure 75: Asia Pacific Analytical Instrumentation Market in Food Testing Revenue (undefined), by Region 2025 & 2033

- Figure 76: Asia Pacific Analytical Instrumentation Market in Food Testing Volume (K Unit), by Region 2025 & 2033

- Figure 77: Asia Pacific Analytical Instrumentation Market in Food Testing Revenue Share (%), by Region 2025 & 2033

- Figure 78: Asia Pacific Analytical Instrumentation Market in Food Testing Volume Share (%), by Region 2025 & 2033

- Figure 79: Asia Pacific Analytical Instrumentation Market in Food Testing Revenue (undefined), by Country 2025 & 2033

- Figure 80: Asia Pacific Analytical Instrumentation Market in Food Testing Volume (K Unit), by Country 2025 & 2033

- Figure 81: Asia Pacific Analytical Instrumentation Market in Food Testing Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Analytical Instrumentation Market in Food Testing Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Technique 2020 & 2033

- Table 2: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Technique 2020 & 2033

- Table 3: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by End-User 2020 & 2033

- Table 4: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Technique 2020 & 2033

- Table 10: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Technique 2020 & 2033

- Table 11: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by End-User 2020 & 2033

- Table 12: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by End-User 2020 & 2033

- Table 13: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Region 2020 & 2033

- Table 14: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Region 2020 & 2033

- Table 15: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Technique 2020 & 2033

- Table 24: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Technique 2020 & 2033

- Table 25: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by End-User 2020 & 2033

- Table 26: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by End-User 2020 & 2033

- Table 27: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Region 2020 & 2033

- Table 28: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Region 2020 & 2033

- Table 29: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Brazil Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Brazil Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Argentina Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Argentina Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Technique 2020 & 2033

- Table 38: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Technique 2020 & 2033

- Table 39: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by End-User 2020 & 2033

- Table 40: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by End-User 2020 & 2033

- Table 41: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Region 2020 & 2033

- Table 42: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Region 2020 & 2033

- Table 43: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 44: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Germany Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Germany Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: France Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: France Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Italy Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Italy Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Spain Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Spain Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Russia Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Russia Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Benelux Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Benelux Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Nordics Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Nordics Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Technique 2020 & 2033

- Table 64: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Technique 2020 & 2033

- Table 65: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by End-User 2020 & 2033

- Table 66: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by End-User 2020 & 2033

- Table 67: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Region 2020 & 2033

- Table 68: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Region 2020 & 2033

- Table 69: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Turkey Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Turkey Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Israel Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Israel Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: GCC Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: GCC Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: North Africa Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: North Africa Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: South Africa Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: South Africa Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Technique 2020 & 2033

- Table 84: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Technique 2020 & 2033

- Table 85: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by End-User 2020 & 2033

- Table 86: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by End-User 2020 & 2033

- Table 87: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Region 2020 & 2033

- Table 88: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Region 2020 & 2033

- Table 89: Global Analytical Instrumentation Market in Food Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 90: Global Analytical Instrumentation Market in Food Testing Volume K Unit Forecast, by Country 2020 & 2033

- Table 91: China Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: China Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: India Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 94: India Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Japan Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 96: Japan Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 97: South Korea Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 98: South Korea Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Oceania Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 102: Oceania Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Analytical Instrumentation Market in Food Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Analytical Instrumentation Market in Food Testing Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Analytical Instrumentation Market in Food Testing?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Analytical Instrumentation Market in Food Testing?

Key companies in the market include Mettler Toledo International Inc, Bio-Rad Laboratories Inc , Waters Corp, ZEISS International, Agilent Technologies Inc, PerkinElmer Inc, Malvern Panalytical Ltd, Thermo Fisher Scientific, Bruker Corporation, Shimadzu Corporation.

3. What are the main segments of the Analytical Instrumentation Market in Food Testing?

The market segments include Technique, End-User, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

The Imposition of Stringent Regulations is Aiding the Market's Growth; Increasing Technological Advancements; Developing Consumer Interests in Food Quality.

6. What are the notable trends driving market growth?

The Chromatography Segment is Expected to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

JUL 2022 - GenTech Scientific and Conquer Scientific announced a partnership in analytical instrumentation and services. Through this partnership, the companies aim to provide efficient end-to-end solutions for their customers. The companies' complete solutions strategy extends across numerous areas, including cannabis, toxicology, food and beverage, and other high-growth industries. It includes building relationships with partners and leveraging expertise to provide solutions for their customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Analytical Instrumentation Market in Food Testing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Analytical Instrumentation Market in Food Testing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Analytical Instrumentation Market in Food Testing?

To stay informed about further developments, trends, and reports in the Analytical Instrumentation Market in Food Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence