Key Insights

Angola's Oil and Gas Upstream Sector is projected for significant expansion. The market is valued at $85.8 billion in the base year 2024, with an estimated Compound Annual Growth Rate (CAGR) of 2.8% through 2033. Growth is propelled by substantial investments in exploration and production, especially in deepwater and ultra-deepwater blocks harboring vast hydrocarbon reserves. Government initiatives, including policy reforms, tax incentives, and local content promotion, are enhancing investor confidence. Key global operators are actively developing existing fields and exploring new frontiers. Driven by global energy demand and Angola's strategic position, upstream activities will remain robust, supported by technological advancements in exploration and extraction.

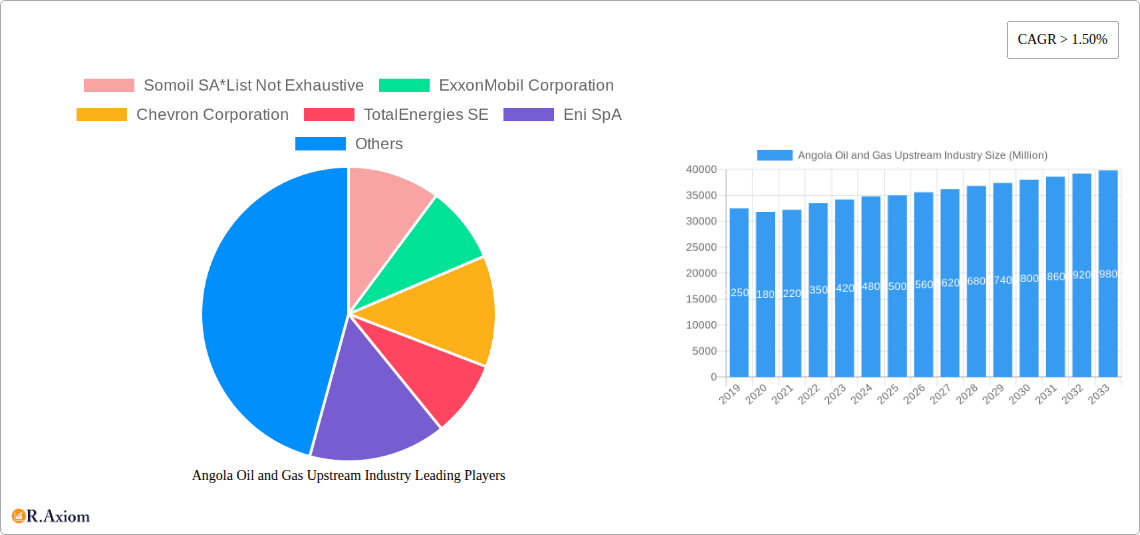

Angola Oil and Gas Upstream Industry Market Size (In Billion)

The industry's trajectory is shaped by key drivers such as new reserve discoveries, global energy security imperatives, and technological innovation. Restraints include high capital expenditure, volatile oil prices, and environmental considerations, necessitating investment in sustainable practices. The market is segmented into onshore and offshore operations, with offshore dominance attributed to Angola's extensive coastline and proven reserves. This report focuses on Angola as the primary growth region, featuring substantial development projects. The competitive landscape includes established international oil companies and national entities like Sonangol P&P.

Angola Oil and Gas Upstream Industry Company Market Share

Angola Oil & Gas Upstream Market: 2024-2033 Analysis

This report offers a comprehensive analysis of Angola's oil and gas upstream industry, providing critical insights into market dynamics and future potential. Covering the historical period up to the base year 2024, and a forecast period extending to 2033, this study is vital for stakeholders seeking to capitalize on opportunities within Angola's energy sector.

Angola Oil and Gas Upstream Industry Market Concentration & Innovation

The Angola oil and gas upstream industry exhibits a moderately concentrated market structure, dominated by a few supermajors alongside significant national and independent players. Key companies influencing market dynamics include ExxonMobil Corporation, Chevron Corporation, TotalEnergies SE, Eni SpA, BP PLC, Sonangol P&P, and Somoil SA, among others. Innovation is primarily driven by advancements in exploration technologies, enhanced oil recovery (EOR) techniques, and digitalization for operational efficiency. Regulatory frameworks, particularly the evolving policies of the Angolan government aimed at attracting foreign investment and promoting local content, play a crucial role. Product substitutes are limited in the upstream sector, with the primary focus remaining on crude oil and natural gas extraction. End-user trends are characterized by increasing demand for cleaner energy sources and a greater emphasis on sustainable upstream operations. Mergers and acquisitions (M&A) activity, though potentially influenced by fluctuating oil prices and regulatory shifts, offers strategic growth avenues. The total value of M&A deals in the upstream sector is estimated to reach xx Million in the forecast period. Market share is projected to see shifts based on exploration success and production optimization, with offshore segments expected to retain a substantial portion of the overall market share.

Angola Oil and Gas Upstream Industry Industry Trends & Insights

The Angola oil and gas upstream industry is poised for significant growth, propelled by a confluence of robust market expansion drivers, transformative technological disruptions, evolving consumer preferences, and dynamic competitive landscapes. The industry's Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025 to 2033. Market penetration is anticipated to deepen as new exploration blocks are awarded and existing fields undergo enhanced recovery processes. Key growth drivers include Angola's vast, largely untapped deepwater and ultra-deepwater reserves, estimated to hold billions of barrels of oil equivalent. Government initiatives, such as tax incentives and streamlined licensing procedures, are actively fostering a more attractive investment climate. Technological disruptions are revolutionizing upstream operations. The adoption of artificial intelligence (AI) and machine learning (ML) for seismic data interpretation and reservoir modeling is enhancing exploration success rates and reducing discovery costs. Advanced drilling techniques and subsea technologies are enabling access to more challenging reservoirs. Furthermore, the increasing focus on digitalization and the Industrial Internet of Things (IIoT) is improving operational efficiency, predictive maintenance, and safety standards across the value chain. Consumer preferences, globally, are steering energy demand towards lower-carbon alternatives. While crude oil remains a primary commodity, there is a growing industry imperative to reduce the carbon intensity of production. This translates into a push for more efficient extraction methods, methane emission reduction strategies, and the potential integration of carbon capture, utilization, and storage (CCUS) technologies in future upstream projects. The competitive dynamics within Angola's upstream sector are characterized by intense competition among international oil companies (IOCs), national oil companies (NOCs), and independent producers. Strategic partnerships and joint ventures are common, allowing companies to share risks and leverage diverse expertise. The ongoing efforts to increase local content and foster domestic participation in the oil and gas value chain are also shaping the competitive landscape, creating opportunities for local service providers and contributing to economic development. The industry is also witnessing a greater emphasis on environmental, social, and governance (ESG) performance, with companies facing increasing pressure from investors and regulators to demonstrate responsible operations. This trend is likely to influence investment decisions and operational strategies, driving innovation in sustainable upstream practices.

Dominant Markets & Segments in Angola Oil and Gas Upstream Industry

The Offshore segment unequivocally dominates the Angola oil and gas upstream industry, representing the lion's share of current production and future exploration potential. This dominance is underpinned by several critical factors, including the sheer scale and richness of Angola's offshore hydrocarbon basins, particularly the deepwater and ultra-deepwater provinces. These areas are known to host prolific oil and gas fields, attracting substantial foreign direct investment due to their high-yield potential.

Key drivers contributing to the offshore segment's supremacy include:

- Vast Untapped Reserves: Angola possesses some of the world's most promising deepwater hydrocarbon reserves, with exploration continuously revealing significant discoveries. These reserves are estimated to contain billions of barrels of oil and trillions of cubic feet of natural gas, making them a cornerstone of national energy production.

- Technological Advancements: The success of offshore exploration and production is heavily reliant on cutting-edge technologies. Innovations in seismic imaging, subsea production systems, floating production storage and offloading (FPSO) units, and advanced drilling techniques have made accessing and extracting resources from challenging deepwater environments economically viable. Companies are continually investing in these technologies to optimize extraction and minimize operational risks.

- Government Policies and Investment Climate: The Angolan government has historically prioritized the offshore sector, offering attractive fiscal terms, production-sharing agreements, and licensing rounds specifically designed to incentivize international oil companies to invest heavily in deepwater exploration. Policies aimed at attracting foreign investment and fostering collaboration with national oil companies have been instrumental in driving offshore development.

- Infrastructure Development: Significant investment has been channeled into developing the necessary offshore infrastructure, including subsea pipelines, offshore processing facilities, and logistics support systems. The presence of established infrastructure reduces the barrier to entry and enhances the efficiency of operations.

- Economies of Scale: Large-scale offshore projects, by their nature, often benefit from economies of scale. The ability to deploy massive platforms and processing facilities for extensive fields leads to more cost-effective production per barrel compared to smaller, onshore operations.

While the onshore sector plays a role, particularly in mature fields and with potential for enhanced recovery, its contribution to overall production and future growth is considerably smaller than that of the offshore segment. The focus on deepwater exploration and production remains the primary engine of Angola's upstream oil and gas industry, driving investment, innovation, and economic output. The market size of the offshore segment is projected to be xx Million by 2025.

Angola Oil and Gas Upstream Industry Product Developments

Product developments in Angola's oil and gas upstream industry are largely centered on optimizing the extraction and processing of existing hydrocarbon resources. Innovations focus on enhanced oil recovery (EOR) techniques, such as the injection of polymers or gases, to maximize output from mature fields. Advanced drilling and completion technologies are crucial for accessing deeper and more complex reservoirs, both onshore and offshore. The industry is also witnessing a gradual integration of digital technologies, including AI-powered reservoir analysis and predictive maintenance for equipment, leading to improved operational efficiency and reduced downtime. These developments aim to enhance the economic viability of existing assets and attract investment for new exploration ventures, offering a competitive advantage through cost reduction and increased production yields.

Report Scope & Segmentation Analysis

This report segments the Angola oil and gas upstream industry into two primary categories: Onshore and Offshore. The Onshore segment, while contributing to national production, is characterized by mature fields and a focus on enhanced recovery techniques. Growth projections for this segment are moderate, with an estimated market size of xx Million by 2025. Competitive dynamics are influenced by the operational efficiency of existing infrastructure and the successful implementation of EOR strategies. The Offshore segment, encompassing shallow, deepwater, and ultra-deepwater exploration and production, is the dominant force within the industry. With significant untapped reserves and ongoing exploration activities, this segment is projected to experience substantial growth, with an estimated market size of xx Million by 2025. Competitive dynamics are driven by technological advancements in subsea systems, FPSOs, and the ability to attract substantial capital investment for high-risk, high-reward exploration endeavors.

Key Drivers of Angola Oil and Gas Upstream Industry Growth

The growth of Angola's oil and gas upstream industry is propelled by several pivotal factors. Economically, Angola possesses vast proven reserves and considerable unexplored potential, particularly in its deepwater offshore basins, attracting significant foreign direct investment. Technologically, continuous advancements in exploration and production technologies, such as seismic imaging, subsea systems, and enhanced oil recovery methods, are unlocking previously inaccessible resources and improving extraction efficiency. Regulatory advancements by the Angolan government, including favorable fiscal terms and streamlined licensing processes, create a more conducive investment environment for international oil companies. Furthermore, global energy demand, while diversifying, continues to rely heavily on oil and gas for the medium term, providing a sustained market for Angola's production. The estimated value of new discoveries in the forecast period is xx Million.

Challenges in the Angola Oil and Gas Upstream Industry Sector

Despite promising prospects, the Angola oil and gas upstream industry faces significant challenges. Regulatory hurdles, including potential policy changes and bureaucratic complexities, can impact investment timelines and project feasibility. Supply chain issues, such as the availability of specialized equipment and skilled labor, can lead to project delays and cost overruns. Intense global competition for capital investment and the fluctuating nature of international oil prices exert constant pressure on profitability. Environmental concerns and increasing stakeholder expectations for sustainable practices necessitate significant investment in emission reduction technologies and responsible operational management. The estimated cost of compliance with new environmental regulations is xx Million.

Emerging Opportunities in Angola Oil and Gas Upstream Industry

Emerging opportunities in Angola's oil and gas upstream industry lie in the development of ultra-deepwater fields, where significant untapped reserves are believed to exist. Advancements in subsea processing technologies and floating production systems are making these challenging environments more economically viable. Furthermore, there is a growing opportunity in the gas sector, with the potential for increased domestic utilization and exports, particularly through liquefied natural gas (LNG) projects. The drive towards decarbonization presents opportunities for companies investing in carbon capture, utilization, and storage (CCUS) technologies and the exploration of associated gas recovery. The Angolan government's focus on local content development also offers opportunities for domestic companies to participate more actively in the value chain.

Leading Players in the Angola Oil and Gas Upstream Industry Market

- ExxonMobil Corporation

- Chevron Corporation

- TotalEnergies SE

- Eni SpA

- BP PLC

- Sonangol P&P

- Somoil SA

Key Developments in Angola Oil and Gas Upstream Industry Industry

- 2024: Announcement of new deepwater exploration license awards, signaling continued investment in offshore potential.

- 2023/2024: Implementation of enhanced oil recovery (EOR) projects in mature onshore fields, aiming to boost production by an estimated xx%.

- 2022: Significant discoveries reported in ultra-deepwater blocks, reinforcing Angola's status as a prime exploration frontier.

- 2021: Government initiative to streamline regulatory processes for upstream project approvals.

- 2020: Increased focus on digitalization and AI integration for seismic data analysis and reservoir management.

- 2019: Major offshore field commenced production, contributing significantly to national output.

Strategic Outlook for Angola Oil and Gas Upstream Industry Market

The strategic outlook for Angola's oil and gas upstream industry is characterized by a sustained focus on unlocking its vast deepwater potential. Continued investment in exploration and production technologies will be crucial for maximizing resource recovery and maintaining competitive cost structures. The government's commitment to creating an attractive investment climate through stable fiscal policies and efficient regulatory frameworks will be a key growth catalyst. Opportunities in the natural gas sector present a significant avenue for diversification and economic development. Furthermore, the increasing emphasis on environmental sustainability will drive innovation in cleaner production methods and the adoption of emerging technologies like CCUS, shaping the long-term viability and attractiveness of the Angolan upstream market. The estimated investment in new technologies by 2033 is xx Million.

Angola Oil and Gas Upstream Industry Segmentation

- 1. Onshore

- 2. Offshore

Angola Oil and Gas Upstream Industry Segmentation By Geography

- 1. Angola

Angola Oil and Gas Upstream Industry Regional Market Share

Geographic Coverage of Angola Oil and Gas Upstream Industry

Angola Oil and Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Angola Oil and Gas Upstream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Angola

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Somoil SA*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chevron Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TotalEnergies SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eni SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BP PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sonangol P&P

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Somoil SA*List Not Exhaustive

List of Figures

- Figure 1: Angola Oil and Gas Upstream Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Angola Oil and Gas Upstream Industry Share (%) by Company 2025

List of Tables

- Table 1: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Onshore 2020 & 2033

- Table 2: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Offshore 2020 & 2033

- Table 3: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Onshore 2020 & 2033

- Table 5: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Offshore 2020 & 2033

- Table 6: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Angola Oil and Gas Upstream Industry?

The projected CAGR is approximately 2.8%.

2. Which companies are prominent players in the Angola Oil and Gas Upstream Industry?

Key companies in the market include Somoil SA*List Not Exhaustive, ExxonMobil Corporation, Chevron Corporation, TotalEnergies SE, Eni SpA, BP PLC, Sonangol P&P.

3. What are the main segments of the Angola Oil and Gas Upstream Industry?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Offshore Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Angola Oil and Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Angola Oil and Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Angola Oil and Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Angola Oil and Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence