Key Insights

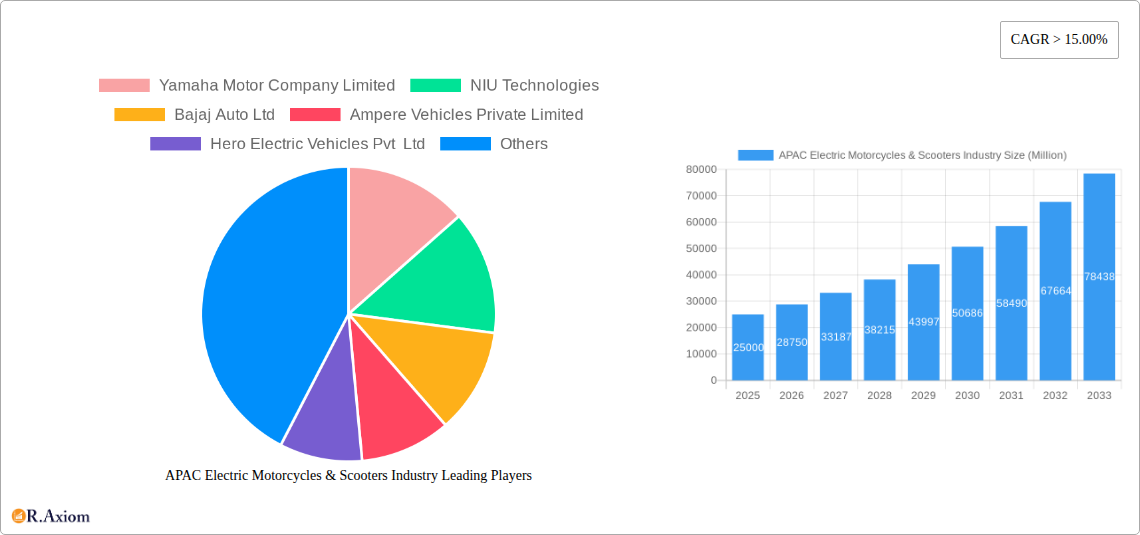

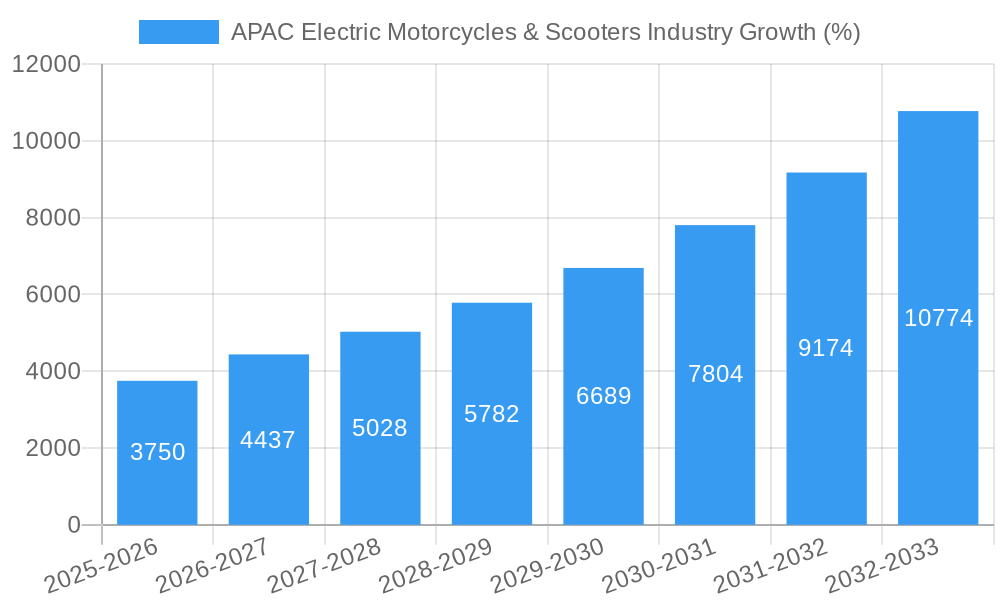

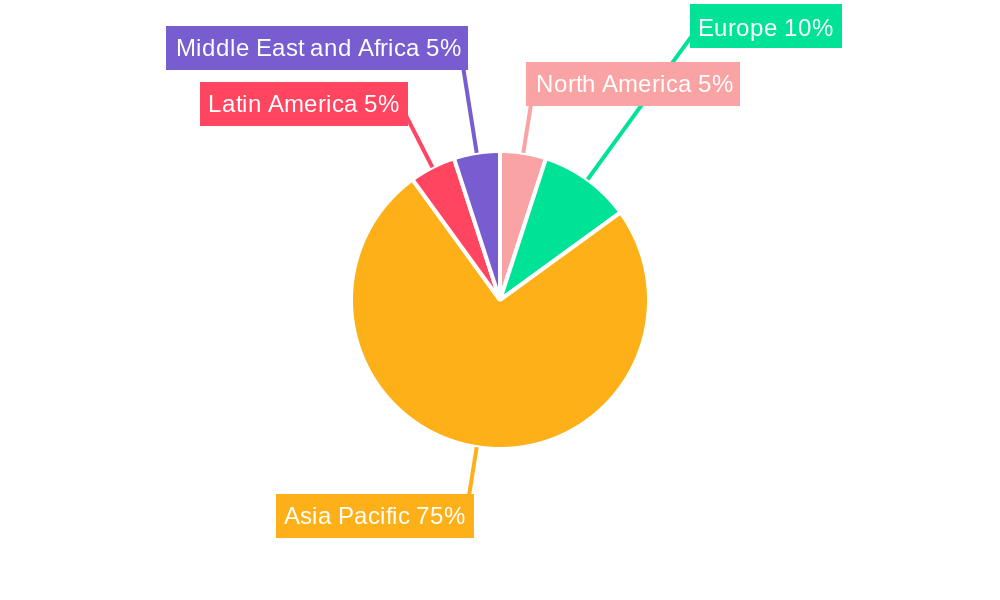

The Asia-Pacific (APAC) electric motorcycle and scooter industry is experiencing explosive growth, driven by increasing environmental concerns, government incentives promoting sustainable transportation, and the falling prices of electric vehicle (EV) batteries. The region's large population and burgeoning middle class, particularly in India and China, are key factors fueling this demand. While precise market sizing for 2025 requires proprietary data, a CAGR exceeding 15% from a known base year suggests substantial expansion. Considering the significant market presence of companies like Yamaha, NIU, Bajaj Auto, and numerous domestic players, we can infer a substantial market value for 2025, potentially in the billions of dollars based on the stated million-unit value scale. This high growth rate is further supported by evolving consumer preferences towards eco-friendly mobility solutions and improvements in battery technology leading to enhanced range and performance. Significant investments in charging infrastructure and supportive government policies are also accelerating market penetration. However, challenges remain, including uneven infrastructure development across regions within APAC, variations in consumer purchasing power, and potential supply chain disruptions. The industry is segmented by propulsion type (hybrid and fully electric) and key countries such as China, India, Japan, and South Korea represent significant markets within the region. Future growth will depend heavily on continued technological advancements, government regulations, and successful strategies from established and emerging players in navigating the complexities of this rapidly evolving market.

The competitive landscape is intensely dynamic, with both established automotive manufacturers and innovative startups vying for market share. The success of companies will rely on their ability to offer competitive pricing, attractive designs, reliable performance, and robust after-sales service networks. While China and India are currently leading the charge, other APAC nations are witnessing increasing adoption rates, indicating a broader regional expansion. Further growth will be impacted by factors such as the availability of financing options, the development of charging infrastructure, and the overall economic environment in various APAC countries. Continuous improvement in battery technology, such as increasing energy density and reducing charging time, will be critical in overcoming range anxiety and promoting wider market acceptance.

This comprehensive report provides a detailed analysis of the Asia-Pacific (APAC) electric motorcycles and scooters industry, covering the period from 2019 to 2033. It offers in-depth insights into market trends, competitive dynamics, technological advancements, and growth opportunities within this rapidly evolving sector. The report is essential for industry stakeholders, investors, and strategic decision-makers seeking to understand and capitalize on the potential of the APAC electric two-wheeler market.

APAC Electric Motorcycles & Scooters Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscapes, product substitutes, end-user trends, and merger & acquisition (M&A) activities within the APAC electric motorcycles and scooters industry. The APAC market exhibits a moderately concentrated structure, with several key players holding significant market share. However, the emergence of numerous startups and smaller players is increasing competition.

Market Share: The top five players (Yamaha, NIU, Bajaj, Yadea, and Hero Electric) collectively hold an estimated 45% of the market share in 2024. This is projected to slightly decrease to 40% by 2033 due to increased competition.

Innovation Drivers: Government incentives, rising environmental concerns, technological advancements in battery technology and charging infrastructure are key drivers of innovation.

Regulatory Frameworks: Varying government regulations across APAC nations significantly influence market growth. China and India's policies, for example, are heavily influencing the adoption of electric two-wheelers.

Product Substitutes: Competition from fuel-efficient internal combustion engine (ICE) scooters and motorcycles remains a factor, particularly in price-sensitive segments. However, technological advancements in electric vehicles are constantly narrowing this gap.

End-User Trends: Growing urban populations, increasing traffic congestion, and a rising middle class are pushing consumer preference towards more convenient and eco-friendly transportation solutions.

M&A Activities: The past five years have witnessed several significant M&A deals, with an estimated total value exceeding xx Million. These activities are likely to continue as larger players seek to expand their market share and technological capabilities.

APAC Electric Motorcycles & Scooters Industry Industry Trends & Insights

The APAC electric motorcycle and scooter market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), with market penetration reaching xx% by 2033. Technological advancements, such as improved battery technology and charging infrastructure, are playing a crucial role in driving market expansion. Consumer preferences are shifting towards electric vehicles due to factors like lower running costs, environmental benefits, and government incentives. However, competitive dynamics remain intense, with established players and new entrants vying for market share. This necessitates continuous innovation and strategic partnerships to maintain competitiveness. The increasing adoption of connected features and smart technologies in electric two-wheelers is also shaping consumer demand. Government regulations and supportive policies continue to be significant catalysts for growth in various APAC markets.

Dominant Markets & Segments in APAC Electric Motorcycles & Scooters Industry

China remains the dominant market for electric motorcycles and scooters in APAC, followed by India.

China:

- Key Drivers: Strong government support for electric vehicle adoption, well-established manufacturing base, and a large consumer market.

- Dominance Analysis: China benefits from significant economies of scale, enabling cost-effective production and competitive pricing. The government's substantial investments in charging infrastructure further solidify its leading position.

India:

- Key Drivers: Growing urban populations, rising concerns about air pollution, and government initiatives promoting electric mobility.

- Dominance Analysis: India's vast market potential, coupled with supportive government policies, is driving substantial growth in the electric two-wheeler segment. However, challenges remain in terms of infrastructure development and affordability.

Japan and South Korea:

While smaller than China and India, Japan and South Korea also exhibit significant growth in the electric two-wheeler market, driven by technological advancements and consumer adoption of electric vehicles. Both countries are likely to continue their growth trajectory, fueled by the increasing adoption of eco-friendly modes of transportation.

Propulsion Type: The electric segment dominates the market with hybrid vehicles accounting for a small portion of sales. This trend is expected to continue.

APAC Electric Motorcycles & Scooters Industry Product Developments

The APAC electric motorcycle and scooter market is witnessing rapid product innovation, focusing on enhanced battery technology, improved range, faster charging times, and advanced features like connectivity and smart functionalities. Manufacturers are also emphasizing safety features and design aesthetics to cater to diverse consumer preferences. These improvements are designed to enhance user experience and address consumer concerns, particularly regarding range anxiety and charging infrastructure limitations. The increasing integration of smart technologies is another key trend, creating a more connected and user-friendly riding experience.

Report Scope & Segmentation Analysis

This report segments the APAC electric motorcycles and scooters market by propulsion type (hybrid and electric) and country (China, India, Japan, South Korea). Each segment's growth projections, market sizes, and competitive dynamics are analyzed individually. The electric segment dominates across all countries, while growth projections vary based on individual country-specific factors like government policies and infrastructure development. Competitive dynamics are shaped by the presence of both global and regional players.

Key Drivers of APAC Electric Motorcycles & Scooters Industry Growth

Several factors are driving growth in the APAC electric motorcycles and scooters industry. These include increasing environmental concerns, government incentives and subsidies promoting electric vehicle adoption, falling battery costs, advancements in battery technology and charging infrastructure, and rising urbanization leading to increased demand for personal transportation solutions. Additionally, the rising middle class in many APAC countries is fueling consumer demand for affordable and eco-friendly vehicles.

Challenges in the APAC Electric Motorcycles & Scooters Industry Sector

The APAC electric two-wheeler market faces challenges, including the high initial cost of electric vehicles compared to petrol-based counterparts, range anxiety, limited charging infrastructure availability in certain regions, and potential supply chain disruptions. Furthermore, the competition from established internal combustion engine (ICE) manufacturers remains a hurdle. The varying regulatory landscapes across different APAC countries also pose complexities for manufacturers operating across multiple markets. These challenges are estimated to impact market growth by approximately xx Million annually.

Emerging Opportunities in APAC Electric Motorcycles & Scooters Industry

Significant opportunities exist within the APAC electric two-wheeler market. The expansion into rural markets presents immense potential, as does the development of innovative battery technologies and charging solutions. The integration of smart features and connectivity provides a path for enhanced user experience and new revenue streams. Furthermore, the increasing demand for last-mile delivery solutions presents opportunities for businesses to invest in fleet solutions.

Leading Players in the APAC Electric Motorcycles & Scooters Industry Market

- Yamaha Motor Company Limited

- NIU Technologies

- Bajaj Auto Ltd

- Ampere Vehicles Private Limited

- Hero Electric Vehicles Pvt Ltd

- Yadea Group Holdings Ltd

- Okinawa Autotech Pvt Ltd

- Zhejiang Luyuan Electric Vehicle Co Ltd

- Dongguan Tailing Electric Vehicle Co Ltd

- Gogoro Limited

- TVS Motor Company Limited

- REVOLT Intellicorp Pvt Ltd

- Ola Electric Mobility Pvt Ltd

- Ather Energy Pvt Ltd

Key Developments in APAC Electric Motorcycles & Scooters Industry Industry

- January 2023: Yadea unveiled new products and technologies at CES, showcasing advancements in electric two-wheeler technology.

- September 2022: Gogoro launched its battery swapping system and smart scooters in Tel Aviv, expanding its international presence.

- August 2022: An unnamed company established a new R&D center, focusing on improving product features and safety.

Strategic Outlook for APAC Electric Motorcycles & Scooters Industry Market

The APAC electric motorcycle and scooter market is poised for continued robust growth, driven by supportive government policies, technological advancements, and evolving consumer preferences. The market's future potential is significant, with opportunities for innovation, expansion into new markets, and the development of sustainable transportation solutions. This positive outlook is expected to result in a xx Million increase in market value by 2033.

APAC Electric Motorcycles & Scooters Industry Segmentation

-

1. Propulsion Type

- 1.1. Hybrid and Electric Vehicles

APAC Electric Motorcycles & Scooters Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Electric Motorcycles & Scooters Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Vehicle Electrification

- 3.3. Market Restrains

- 3.3.1. The Cost of Raw Materials Used in the Manufacturing of Switches is High

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Hybrid and Electric Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North America APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.1.1. Hybrid and Electric Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7. South America APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.1.1. Hybrid and Electric Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8. Europe APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.1.1. Hybrid and Electric Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9. Middle East & Africa APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.1.1. Hybrid and Electric Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10. Asia Pacific APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.1.1. Hybrid and Electric Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11. North America APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Rest of North America

- 12. Europe APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Rest of Europe

- 13. Asia Pacific APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Argentina

- 15. Middle East and Africa APAC Electric Motorcycles & Scooters Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Yamaha Motor Company Limited

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 NIU Technologies

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bajaj Auto Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Ampere Vehicles Private Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hero Electric Vehicles Pvt Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Yadea Group Holdings Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Okinawa Autotech Pvt Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Zhejiang Luyuan Electric Vehicl

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Dongguan Tailing Electric Vehicle Co Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Gogoro Limited

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 TVS Motor Company Limited

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 REVOLT Intellicorp Pvt Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Ola Electric Mobility Pvt Ltd

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Ather Energy Pvt Ltd

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Yamaha Motor Company Limited

List of Figures

- Figure 1: Global APAC Electric Motorcycles & Scooters Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 13: North America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 14: North America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 17: South America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 18: South America APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 21: Europe APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 22: Europe APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East & Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 25: Middle East & Africa APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 26: Middle East & Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 29: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 30: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Rest of North America APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: India APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Mexico APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Brazil APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Arab Emirates APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Saudi Arabia APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 28: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Mexico APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 33: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of South America APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 38: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 39: United Kingdom APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Germany APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: France APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Italy APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Spain APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Russia APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Benelux APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Nordics APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Europe APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 49: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Turkey APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Israel APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: GCC APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: North Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Middle East & Africa APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 57: Global APAC Electric Motorcycles & Scooters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: China APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: India APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Japan APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Korea APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: ASEAN APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Oceania APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of Asia Pacific APAC Electric Motorcycles & Scooters Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Electric Motorcycles & Scooters Industry?

The projected CAGR is approximately > 15.00%.

2. Which companies are prominent players in the APAC Electric Motorcycles & Scooters Industry?

Key companies in the market include Yamaha Motor Company Limited, NIU Technologies, Bajaj Auto Ltd, Ampere Vehicles Private Limited, Hero Electric Vehicles Pvt Ltd, Yadea Group Holdings Ltd, Okinawa Autotech Pvt Ltd, Zhejiang Luyuan Electric Vehicl, Dongguan Tailing Electric Vehicle Co Ltd, Gogoro Limited, TVS Motor Company Limited, REVOLT Intellicorp Pvt Ltd, Ola Electric Mobility Pvt Ltd, Ather Energy Pvt Ltd.

3. What are the main segments of the APAC Electric Motorcycles & Scooters Industry?

The market segments include Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Vehicle Electrification.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

The Cost of Raw Materials Used in the Manufacturing of Switches is High.

8. Can you provide examples of recent developments in the market?

January 2023: Yadea, the world's leading electric two-wheeler brand, made its debut at the Consumer Electronics Show (CES) in Las Vegas, Nevada, unveiling a range of new products and technologies in its 2023 product launch.September 2022: Gogoro Inc. announced the launch of its industry-leading battery swapping system and Smart scooters in the Tel Aviv metropolitan area. In partnership with market leaders Metro Motor and Paz Group, the companies expect to launch in other cities in Israel in the future.August 2022: The company announced the establishment of a new R&D center, which it claims will help introduce new features, and improve quality, safety, and technological innovations for its products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Electric Motorcycles & Scooters Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Electric Motorcycles & Scooters Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Electric Motorcycles & Scooters Industry?

To stay informed about further developments, trends, and reports in the APAC Electric Motorcycles & Scooters Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence