Key Insights

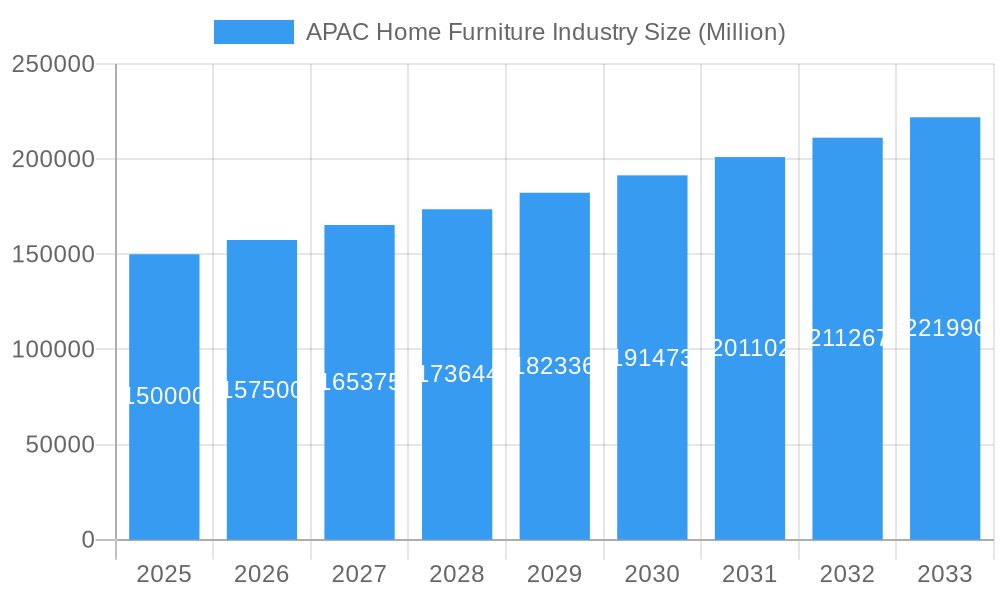

The Asia-Pacific (APAC) home furniture market is poised for significant expansion, driven by increasing disposable incomes, a growing middle class, and rapid urbanization. E-commerce penetration further fuels this growth by enhancing consumer access and convenience. Key market segments include living room, bedroom, and kitchen furniture, with the latter showing increased interest due to modern design and smart home technology adoption. Despite supply chain and raw material price volatilities, the market demonstrates a strong Compound Annual Growth Rate (CAGR) of 10.2%. The market size is projected to reach 206141.7 million by 2033, with 2024 as the base year.

APAC Home Furniture Industry Market Size (In Billion)

Long-term prospects for the APAC home furniture market remain robust, supported by a continuously expanding middle class and ongoing urbanization in key economies like India and China. Emerging trends include innovative designs, sustainable materials, and customization, alongside a growing preference for multi-functional and space-saving furniture solutions in urban environments. Companies are prioritizing enhanced online presence and supply chain optimization. The competitive landscape features both international and local players, with value-added services like interior design consultations becoming crucial for customer acquisition and retention.

APAC Home Furniture Industry Company Market Share

This report offers a comprehensive analysis of the APAC home furniture industry from 2019 to 2033. It delves into market dynamics, key players, growth drivers, and challenges, providing critical insights for stakeholders and potential investors in this dynamic sector. The analysis utilizes 2024 as the base year and forecasts market trends through 2033, with an estimated market size of 206141.7 million in the base year.

APAC Home Furniture Industry Market Concentration & Innovation

The APAC home furniture market exhibits a moderately concentrated structure, with several large players commanding significant market share. Beijing Qumei Furniture Group Corp Ltd, Ashley Furniture Industries Inc, and Herman Miller represent some of the leading multinational corporations. However, numerous smaller regional players and local manufacturers also contribute significantly to the overall market volume. Market share data for 2024 indicates Beijing Qumei holds approximately xx% market share, Ashley Furniture holds approximately xx%, and Herman Miller holds approximately xx%. The remaining market share is dispersed among other players, including several prominent companies within the 7 company profiles included in this report.

Several factors drive innovation in this sector. These include:

- Evolving consumer preferences: Growing demand for sustainable, customizable, and technologically integrated furniture.

- Technological advancements: Increased use of 3D printing, automation in manufacturing, and the integration of smart home technology into furniture.

- Stringent regulatory frameworks: Regulations related to material sourcing, manufacturing processes, and product safety drive innovation towards environmentally friendly and safer products.

- Product substitutes: The emergence of alternative materials and designs necessitates continuous product improvement to maintain competitiveness.

Mergers and acquisitions (M&A) activity is relatively moderate, with deal values in the range of xx Million in recent years, primarily driven by strategies to expand geographic reach and product portfolios. Notable recent deals included (specific details on recent M&A activities are not available, therefore the value and details are not included).

APAC Home Furniture Industry Industry Trends & Insights

The APAC home furniture market is experiencing robust growth, fueled by several key factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Rising disposable incomes, rapid urbanization, and a shift towards improved living standards are major drivers of market expansion. Technological disruptions, such as the rise of e-commerce and the integration of smart home technology, are significantly impacting consumer preferences and shaping the competitive landscape.

Consumer preferences are evolving towards more stylish and functional furniture, emphasizing sustainability and customization options. The market is witnessing a growing demand for eco-friendly materials and furniture with reduced environmental impact. The increasing popularity of online shopping is also a key factor, with online sales channels exhibiting significant growth and market penetration (xx% in 2024, projected to reach xx% by 2033). This digital transformation is forcing companies to adapt their distribution strategies and customer engagement models. Competitive dynamics are characterized by increasing competition among established players and the emergence of new entrants offering innovative products and services.

Dominant Markets & Segments in APAC Home Furniture Industry

Dominant Regions/Countries:

China and India represent the largest markets in APAC, driven by their vast populations, rising middle classes, and robust economic growth. Japan also holds a significant position, known for its sophisticated design preferences and high-quality furniture market. Other countries are growing at a faster pace, though still lagging behind the three major countries.

- Key Drivers in China: Strong economic growth, rising disposable incomes, urbanization, and government initiatives supporting domestic manufacturing.

- Key Drivers in India: Rapid urbanization, growing middle class, increasing disposable incomes, and a young population with evolving lifestyle preferences.

- Key Drivers in Japan: High disposable incomes, sophisticated design preferences, and a strong emphasis on quality and durability.

Dominant Product Segments:

- Living-Room and Dining-Room Furniture: This segment holds the largest market share, driven by strong demand for stylish and functional furniture for the primary living areas.

- Bedroom Furniture: This segment also holds a significant market share, reflecting the importance of comfortable and aesthetically pleasing bedroom furniture.

- Kitchen Furniture: The kitchen furniture segment displays moderate growth, driven by evolving kitchen designs and a preference for modern and functional kitchen spaces.

- Lamps and Lighting Furniture: This niche segment exhibits a steady growth rate, driven by increasing preference for stylish and energy-efficient lighting solutions.

- Plastic and Other Furniture: This category is experiencing growth due to affordability and versatility.

Dominant Distribution Channels:

- Specialty Stores: Traditional specialty stores remain the dominant distribution channel, offering a wide selection and expert advice.

- Online: E-commerce is rapidly growing, leveraging convenience and accessibility to attract a wider customer base.

- Supermarkets/Hypermarkets: This channel contributes a moderate share, offering a convenient purchase option for readily available furniture items.

APAC Home Furniture Industry Product Developments

Recent product innovations focus on incorporating sustainable materials, smart technology, and personalized designs. The integration of smart home technology into furniture is becoming increasingly prevalent, adding features such as adjustable lighting, temperature control, and integrated audio systems. Manufacturers are also focusing on modular furniture designs that can be adapted to changing needs and lifestyles, contributing to enhanced customer satisfaction and sustainability through reduced waste. This focus aligns well with current market trends, emphasizing both functionality and environmental responsibility.

Report Scope & Segmentation Analysis

This report segments the APAC home furniture market across various dimensions:

- By Product: Living-room and dining-room furniture, bedroom furniture, kitchen furniture, lamps and lighting furniture, plastic and other furniture. Growth projections vary by segment, with living room and bedroom furniture leading.

- By Distribution Channel: Supermarkets/hypermarkets, specialty stores, online, and other channels. Online channels are expected to show the fastest growth.

- By Country: Japan, India, China, and other APAC countries. China and India represent the largest markets. Competitive dynamics are complex, with varying levels of market concentration and competition.

Key Drivers of APAC Home Furniture Industry Growth

The APAC home furniture industry's growth is propelled by several key factors:

- Rising Disposable Incomes: A growing middle class in many APAC countries translates to increased spending on home furnishings.

- Rapid Urbanization: Urbanization drives demand for new housing and consequently, increased furniture purchases.

- Technological Advancements: Innovations in design, materials, and manufacturing processes are enhancing product offerings and increasing market appeal.

- Government Initiatives: Policies and initiatives in certain countries promote domestic manufacturing and boost overall market growth.

Challenges in the APAC Home Furniture Industry Sector

The industry faces challenges including:

- Supply Chain Disruptions: Global supply chain disruptions can impact raw material availability and manufacturing costs.

- Intense Competition: The market is highly competitive, with both established players and emerging companies vying for market share.

- Fluctuating Raw Material Prices: Price volatility can impact profitability and necessitates strategic pricing adjustments.

- Environmental Regulations: Adherence to stringent environmental regulations increases production costs and demands innovative solutions.

Emerging Opportunities in APAC Home Furniture Industry

The APAC home furniture market presents exciting opportunities, including:

- Growing E-commerce: The expansion of e-commerce presents significant opportunities for online sales and market expansion.

- Demand for Sustainable Furniture: Consumers' growing preference for environmentally friendly products creates opportunities for manufacturers to offer sustainable solutions.

- Smart Home Integration: Integrating smart technology into furniture unlocks new growth avenues and enhances product appeal.

- Customization and Personalization: Offering bespoke furniture design and customization caters to increasing consumer demand for unique and personalized products.

Leading Players in the APAC Home Furniture Industry Market

- Beijing Qumei Furniture Group Corp Ltd

- Ashley Furniture Industries Inc

- Cassina IXC Ltd

- 7 COMPANY PROFILES

- Herman Miller

- Bals Corporation

- Dalian Huafeng Furniture Group Co Ltd

- Zuari Furniture

- Durian Furniture

- Markor International Furniture Co Ltd

- Godrej Interio

Key Developments in APAC Home Furniture Industry Industry

- February 2023: IKEA launched three new home and furniture collections for spring 2023. This expansion boosted consumer choice and enhanced market competition.

- March 2023: Kave Home, partnering with Nook & Cranny, expanded into Southeast Asia, increasing market competition and consumer access to a broader range of furniture styles.

- March 2023: Wriver launched new furniture collections designed in collaboration with leading studios. This launch elevated the luxury segment and showcases the industry's focus on design innovation.

Strategic Outlook for APAP Home Furniture Industry Market

The APAP home furniture market presents a promising outlook. Continued economic growth across the region, coupled with rising disposable incomes and evolving consumer preferences, will drive robust market expansion. Opportunities abound for companies focusing on sustainable practices, technological integration, and personalized products. Those companies that successfully navigate the challenges of supply chain management and intense competition are poised for significant growth and market share gains in the coming years.

APAC Home Furniture Industry Segmentation

-

1. Product

- 1.1. Living-Room and Dining-Room Furniture

- 1.2. Bedroom Furniture

- 1.3. Kitchen Furniture

- 1.4. Lamps and Lighting Furniture

- 1.5. Plastic and Other Furniture

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

APAC Home Furniture Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Home Furniture Industry Regional Market Share

Geographic Coverage of APAC Home Furniture Industry

APAC Home Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Shifts in lifestyle and home preferences

- 3.2.2 such as the desire for multifunctional and space-saving furniture

- 3.2.3 are driving demand. Modern consumers are looking for furniture that combines style with practicality and efficiency.

- 3.3. Market Restrains

- 3.3.1 The cost of high-quality materials

- 3.3.2 such as solid wood and premium fabrics

- 3.3.3 can be high. This can impact the pricing of furniture products and limit affordability for some consumers.

- 3.4. Market Trends

- 3.4.1 There is a growing demand for sustainable and eco-friendly home furniture in APAC. Consumers are increasingly seeking products made from recycled materials

- 3.4.2 responsibly sourced wood

- 3.4.3 and environmentally friendly finishes.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Home Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Living-Room and Dining-Room Furniture

- 5.1.2. Bedroom Furniture

- 5.1.3. Kitchen Furniture

- 5.1.4. Lamps and Lighting Furniture

- 5.1.5. Plastic and Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America APAC Home Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Living-Room and Dining-Room Furniture

- 6.1.2. Bedroom Furniture

- 6.1.3. Kitchen Furniture

- 6.1.4. Lamps and Lighting Furniture

- 6.1.5. Plastic and Other Furniture

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America APAC Home Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Living-Room and Dining-Room Furniture

- 7.1.2. Bedroom Furniture

- 7.1.3. Kitchen Furniture

- 7.1.4. Lamps and Lighting Furniture

- 7.1.5. Plastic and Other Furniture

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe APAC Home Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Living-Room and Dining-Room Furniture

- 8.1.2. Bedroom Furniture

- 8.1.3. Kitchen Furniture

- 8.1.4. Lamps and Lighting Furniture

- 8.1.5. Plastic and Other Furniture

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa APAC Home Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Living-Room and Dining-Room Furniture

- 9.1.2. Bedroom Furniture

- 9.1.3. Kitchen Furniture

- 9.1.4. Lamps and Lighting Furniture

- 9.1.5. Plastic and Other Furniture

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific APAC Home Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Living-Room and Dining-Room Furniture

- 10.1.2. Bedroom Furniture

- 10.1.3. Kitchen Furniture

- 10.1.4. Lamps and Lighting Furniture

- 10.1.5. Plastic and Other Furniture

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Beijing Qumei Furniture Group Corp Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ashley Furniture Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cassina IXC Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 7 COMPANY PROFILES

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Herman Miller

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bals Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dalian Huafeng Furniture Group Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zuari Furniture

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Durian Furniture

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Markor International Furniture Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Godrej Interio

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Beijing Qumei Furniture Group Corp Ltd

List of Figures

- Figure 1: Global APAC Home Furniture Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America APAC Home Furniture Industry Revenue (million), by Product 2025 & 2033

- Figure 3: North America APAC Home Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America APAC Home Furniture Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 5: North America APAC Home Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America APAC Home Furniture Industry Revenue (million), by Country 2025 & 2033

- Figure 7: North America APAC Home Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America APAC Home Furniture Industry Revenue (million), by Product 2025 & 2033

- Figure 9: South America APAC Home Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America APAC Home Furniture Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 11: South America APAC Home Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America APAC Home Furniture Industry Revenue (million), by Country 2025 & 2033

- Figure 13: South America APAC Home Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe APAC Home Furniture Industry Revenue (million), by Product 2025 & 2033

- Figure 15: Europe APAC Home Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe APAC Home Furniture Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 17: Europe APAC Home Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe APAC Home Furniture Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Europe APAC Home Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa APAC Home Furniture Industry Revenue (million), by Product 2025 & 2033

- Figure 21: Middle East & Africa APAC Home Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa APAC Home Furniture Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa APAC Home Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa APAC Home Furniture Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa APAC Home Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific APAC Home Furniture Industry Revenue (million), by Product 2025 & 2033

- Figure 27: Asia Pacific APAC Home Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific APAC Home Furniture Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific APAC Home Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific APAC Home Furniture Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific APAC Home Furniture Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Home Furniture Industry Revenue million Forecast, by Product 2020 & 2033

- Table 2: Global APAC Home Furniture Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global APAC Home Furniture Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Home Furniture Industry Revenue million Forecast, by Product 2020 & 2033

- Table 5: Global APAC Home Furniture Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global APAC Home Furniture Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global APAC Home Furniture Industry Revenue million Forecast, by Product 2020 & 2033

- Table 11: Global APAC Home Furniture Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global APAC Home Furniture Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Home Furniture Industry Revenue million Forecast, by Product 2020 & 2033

- Table 17: Global APAC Home Furniture Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global APAC Home Furniture Industry Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global APAC Home Furniture Industry Revenue million Forecast, by Product 2020 & 2033

- Table 29: Global APAC Home Furniture Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global APAC Home Furniture Industry Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global APAC Home Furniture Industry Revenue million Forecast, by Product 2020 & 2033

- Table 38: Global APAC Home Furniture Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global APAC Home Furniture Industry Revenue million Forecast, by Country 2020 & 2033

- Table 40: China APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific APAC Home Furniture Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Home Furniture Industry?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the APAC Home Furniture Industry?

Key companies in the market include Beijing Qumei Furniture Group Corp Ltd, Ashley Furniture Industries Inc, Cassina IXC Ltd, 7 COMPANY PROFILES, Herman Miller, Bals Corporation, Dalian Huafeng Furniture Group Co Ltd, Zuari Furniture, Durian Furniture, Markor International Furniture Co Ltd, Godrej Interio.

3. What are the main segments of the APAC Home Furniture Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 206141.7 million as of 2022.

5. What are some drivers contributing to market growth?

Shifts in lifestyle and home preferences. such as the desire for multifunctional and space-saving furniture. are driving demand. Modern consumers are looking for furniture that combines style with practicality and efficiency..

6. What are the notable trends driving market growth?

There is a growing demand for sustainable and eco-friendly home furniture in APAC. Consumers are increasingly seeking products made from recycled materials. responsibly sourced wood. and environmentally friendly finishes..

7. Are there any restraints impacting market growth?

The cost of high-quality materials. such as solid wood and premium fabrics. can be high. This can impact the pricing of furniture products and limit affordability for some consumers..

8. Can you provide examples of recent developments in the market?

March 2023: Celebrated luxury furniture brand, Wriver, has announced the launch of a range of new furniture pieces designed in collaboration with the eminent award-winning design studios Morph Lab, MuseLAB, Studio Sumeet Nagi, and Wriver Design Studio, exclusively at India Design 2023. With the aim of syncing rare craftsmanship and material innovation and furthering their vision of 'energizing modern living', the collections are grounded in international sensibilities and crafted to empower interior designs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Home Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Home Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Home Furniture Industry?

To stay informed about further developments, trends, and reports in the APAC Home Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence