Key Insights

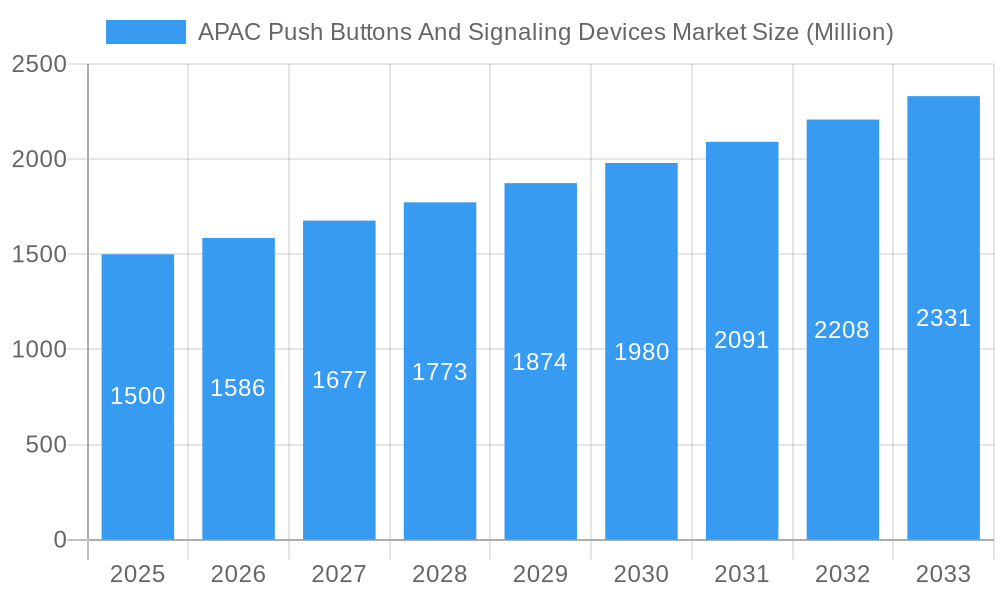

The APAC Push Buttons and Signaling Devices Market is poised for significant expansion, projecting a market size of USD 1.5 Billion in 2025 and a robust Compound Annual Growth Rate (CAGR) of 5.71% through 2033. This growth is primarily fueled by escalating industrial automation initiatives across the region, particularly in manufacturing hubs like China and India. The increasing adoption of smart factory concepts, coupled with the demand for enhanced operational efficiency and safety in sectors like automotive and energy, are key drivers. Advancements in IoT integration and the development of more sophisticated signaling devices, including advanced visual and audible alerts, are further contributing to market momentum. The trend towards miniaturization and enhanced durability in push buttons also caters to evolving industrial needs.

APAC Push Buttons And Signaling Devices Market Market Size (In Billion)

Despite the promising outlook, the market faces certain restraints, including the high initial cost of advanced signaling systems and potential fluctuations in raw material prices for component manufacturing. However, the growing emphasis on predictive maintenance and the need for clear, immediate operator feedback in complex industrial environments are expected to outweigh these challenges. The market is segmented across various product types, including round and square body types, non-lighted push buttons, and other specialized products. Audible, visible, and other types of signaling devices cater to diverse industrial requirements. Key end-user industries driving demand include automotive, energy and power, manufacturing, food and beverage, and transportation, all of which are experiencing substantial investment and growth in the APAC region.

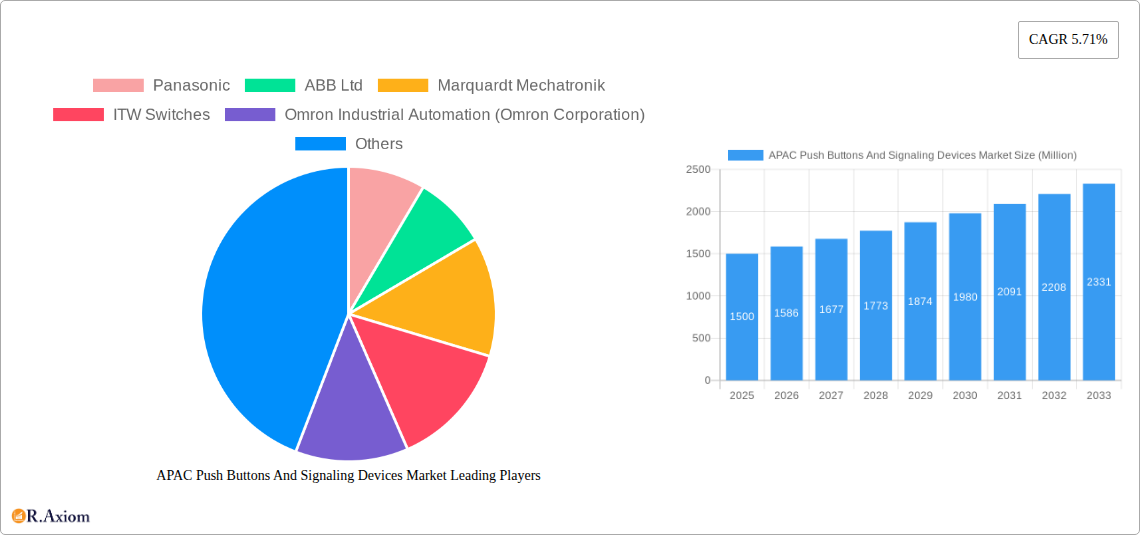

APAC Push Buttons And Signaling Devices Market Company Market Share

This in-depth market research report provides an exhaustive analysis of the Asia-Pacific (APAC) Push Buttons and Signaling Devices Market, encompassing a detailed study period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033. Historical data from 2019 to 2024 is also meticulously examined. The report offers critical insights into market dynamics, segmentation, key drivers, challenges, and emerging opportunities, empowering industry stakeholders to make informed strategic decisions. The estimated market size for APAC Push Buttons and Signaling Devices Market in 2025 is valued at XX Million USD.

APAC Push Buttons And Signaling Devices Market Market Concentration & Innovation

The APAC Push Buttons and Signaling Devices Market exhibits a moderately concentrated landscape, characterized by the presence of both established global giants and agile regional players. Innovation is a key differentiator, driven by increasing demand for advanced functionalities, miniaturization, and enhanced durability in signaling and control systems. Regulatory frameworks, particularly those focused on industrial safety, automation standards, and energy efficiency, are shaping product development and market entry strategies.

- Market Concentration: The top players hold a significant share, but a substantial number of smaller and medium-sized enterprises (SMEs) contribute to market diversity and specialization.

- Innovation Drivers:

- Smart Manufacturing (Industry 4.0): Integration of IoT capabilities and predictive maintenance features.

- Industrial Automation: Demand for robust, reliable, and user-friendly HMI components.

- Miniaturization: Development of compact push buttons and signaling devices for space-constrained applications.

- Connectivity: Incorporation of wireless communication protocols and smart connectivity features.

- Regulatory Frameworks: Compliance with IEC standards, regional safety certifications, and environmental regulations.

- Product Substitutes: While direct substitutes are limited, advancements in touch-screen interfaces and software-based control systems pose indirect competition in certain applications.

- End-User Trends: Increasing adoption of automated systems across manufacturing, automotive, and energy sectors fuels demand for sophisticated signaling devices.

- M&A Activities: Strategic acquisitions and partnerships are observed as companies aim to expand their product portfolios, geographical reach, and technological capabilities. M&A deal values are expected to range from XX Million USD to XX Million USD.

APAC Push Buttons And Signaling Devices Market Industry Trends & Insights

The APAC Push Buttons and Signaling Devices Market is experiencing robust growth, propelled by a confluence of factors including rapid industrialization, escalating adoption of automation technologies, and burgeoning infrastructure development across the region. The increasing penetration of Industry 4.0 principles, which emphasize smart factories and interconnected manufacturing processes, is a significant catalyst. This trend necessitates the deployment of sophisticated and reliable human-machine interface (HMI) components like push buttons and signaling devices for effective control and monitoring. Furthermore, the burgeoning automotive sector, with its focus on advanced driver-assistance systems (ADAS) and electric vehicle (EV) production, is creating substantial demand for specialized signaling solutions. The energy and power sector, driven by investments in renewable energy infrastructure and grid modernization, also presents a lucrative avenue for market expansion.

Technological disruptions are playing a pivotal role in reshaping the market. The integration of IoT capabilities into signaling devices allows for remote monitoring, diagnostics, and predictive maintenance, enhancing operational efficiency and reducing downtime. The development of smart managed switches with advanced surge protection, as evidenced by Hikvision's August 2023 launch, underscores the trend towards more intelligent and robust networking solutions crucial for industrial environments. Consumer preferences are evolving towards devices that offer enhanced user experience, greater customization, and improved safety features. This is pushing manufacturers to innovate in areas such as ergonomic design, illumination technologies, and haptic feedback.

The competitive dynamics of the APAC Push Buttons and Signaling Devices Market are characterized by intense competition, with players vying for market share through product innovation, strategic partnerships, and aggressive pricing. Companies are investing heavily in research and development to introduce next-generation products that meet the evolving demands of end-user industries. The CAGR for the APAC Push Buttons and Signaling Devices Market is projected to be XX% during the forecast period. Market penetration of advanced signaling solutions is steadily increasing, particularly in developed economies within APAC. The growing demand for automation in emerging economies is also expected to drive significant market growth. The continuous advancement in materials science and manufacturing processes is contributing to the development of more durable, compact, and cost-effective signaling devices.

Dominant Markets & Segments in APAC Push Buttons And Signaling Devices Market

The APAC Push Buttons and Signaling Devices Market is a dynamic landscape with distinct regional dominance and segment leadership. China stands out as the largest and most dominant market, driven by its vast manufacturing base, extensive industrial automation initiatives, and significant investments in infrastructure. Countries like Japan, South Korea, and India are also key contributors, each with its unique industrial strengths and technological advancements.

- Dominant Region: Asia-Pacific, with a significant contribution from China, Japan, and South Korea.

- Dominant Countries:

- China: Leading due to its massive manufacturing output and rapid adoption of Industry 4.0.

- Japan: Known for its advanced automation and high-quality industrial equipment.

- South Korea: Strong presence in electronics and automotive manufacturing.

- India: Rapidly growing market driven by government initiatives like "Make in India" and infrastructure development.

Product Segmentation Dominance:

- Round or Square Body Type: This segment holds a significant market share due to its versatility and widespread application across various industries. The demand is fueled by the need for robust and standardized control interfaces.

- Key Drivers: Universal design, ease of integration, high durability, wide availability.

- Non-lighted Push Button: These remain a cornerstone of industrial control systems due to their cost-effectiveness and reliability, especially in environments where illumination is not a primary requirement.

- Key Drivers: Cost-efficiency, simplicity of operation, high reliability in harsh environments.

- Other Products: This encompasses a diverse range of signaling devices, including illuminated push buttons, selector switches, key switches, and pilot lights, which cater to specific operational needs and enhance user feedback.

Type Segmentation Dominance:

- Visible: Audible signaling devices, such as buzzers and horns, are critical for immediate alerts and safety warnings in industrial settings and public spaces.

- Key Drivers: Critical safety alerts, immediate notification requirements, regulatory mandates for audible warnings.

- Audible: Visible signaling devices, including indicator lights, beacons, and strobes, provide visual cues for operational status, alarms, and warnings.

- Key Drivers: Status indication, alarm notification, visual confirmation of system states.

- Other Types: This includes complex signaling solutions and integrated devices that combine audible and visible alerts, offering comprehensive communication capabilities.

End-user Industry Dominance:

- Manufacturing: This is the largest end-user industry, driven by the pervasive need for automation, process control, and safety in factories and production lines.

- Key Drivers: Industrial automation, process control systems, safety regulations, smart manufacturing initiatives.

- Automotive: The automotive industry is a major consumer, demanding high-quality, reliable push buttons and signaling devices for vehicle controls, dashboard indicators, and assembly line automation.

- Key Drivers: Advanced driver-assistance systems (ADAS), electric vehicle (EV) production, autonomous driving technologies, automotive assembly line efficiency.

- Energy and Power: This sector requires robust signaling devices for control panels, substations, renewable energy installations, and power distribution systems.

- Key Drivers: Grid modernization, renewable energy integration, critical infrastructure control, safety monitoring.

- Transportation: With the expansion of high-speed rail networks and urban transit systems, the demand for signaling devices for control and safety is significant. Alstom's recent developments in India highlight this trend.

- Key Drivers: Railway signaling, public transportation systems, airport operations, logistics and supply chain management.

- Food and Beverage: This industry utilizes signaling devices for process control, automation, and hygiene-compliant equipment.

APAC Push Buttons And Signaling Devices Market Product Developments

Product development in the APAC Push Buttons and Signaling Devices Market is increasingly focused on enhancing functionality, reliability, and user experience. Innovations are geared towards smart capabilities, such as IoT integration for remote monitoring and diagnostics, and improved connectivity options. Miniaturization and modular design are key trends, allowing for greater flexibility in equipment design and easier installation. Many new products offer enhanced durability and resistance to harsh environmental conditions, catering to demanding industrial applications. The emphasis is on creating intuitive interfaces that improve operator efficiency and safety.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the APAC Push Buttons and Signaling Devices Market, segmented across key categories to offer granular insights. The segmentation includes:

- Product:

- Round or Square Body Type: These are the most common forms, offering durability and ease of use across various applications.

- Non-lighted Push Button: Fundamental for basic control operations where visual feedback isn't essential.

- Other Products: This category encompasses a wide array of devices including illuminated push buttons, selector switches, and key switches, catering to specific control and indication needs with market sizes projected to grow at XX%.

- Type:

- Audible: Devices like buzzers and horns, crucial for immediate alerts and warnings, with significant growth expected in industrial safety applications.

- Visible: Indicator lights, beacons, and strobes provide visual status updates and alarms, essential for operational monitoring.

- Other Types: This includes combined audible-visible devices and advanced signaling solutions, offering integrated communication with growth driven by smart city initiatives.

- End-user Industry:

- Automotive: Driven by EV adoption and autonomous vehicle development, this segment is expected to see substantial expansion.

- Energy and Power: Investments in renewable energy and grid modernization fuel demand for reliable signaling solutions.

- Manufacturing: The core driver of the market, with continuous adoption of automation and Industry 4.0.

- Food and Beverage: Demand for automated process control and hygienic equipment.

- Transportation: Growth in railway and public transit infrastructure, as highlighted by recent developments.

- Other End-user Industries: Including sectors like healthcare, telecommunications, and building automation.

Key Drivers of APAC Push Buttons And Signaling Devices Market Growth

The APAC Push Buttons and Signaling Devices Market is propelled by several key drivers:

- Industrial Automation & Smart Manufacturing (Industry 4.0): The widespread adoption of automation across industries necessitates advanced control and signaling components for efficient operation and monitoring of interconnected systems.

- Infrastructure Development: Significant investments in transportation networks, energy grids, and smart city projects across APAC are creating substantial demand for signaling devices.

- Automotive Sector Expansion: The burgeoning automotive industry, with its focus on EVs and advanced driver-assistance systems, is a major consumer of high-quality signaling solutions.

- Technological Advancements: The integration of IoT, AI, and wireless communication capabilities in signaling devices enhances their functionality, leading to increased adoption.

- Stringent Safety Regulations: Growing emphasis on industrial safety and worker protection mandates the use of reliable audible and visible signaling devices for hazard warnings.

Challenges in the APAC Push Buttons And Signaling Devices Market Sector

Despite the positive growth trajectory, the APAC Push Buttons and Signaling Devices Market faces several challenges:

- Intense Price Competition: The presence of numerous manufacturers, particularly in lower-cost production regions, leads to aggressive price competition, impacting profit margins.

- Supply Chain Disruptions: Global supply chain vulnerabilities, geopolitical tensions, and raw material price volatility can affect production timelines and costs.

- Rapid Technological Obsolescence: The fast pace of technological innovation requires continuous investment in R&D to stay competitive, posing a challenge for smaller players.

- Counterfeit Products: The proliferation of counterfeit products in some markets can damage brand reputation and compromise safety standards.

- Skilled Labor Shortage: A lack of skilled labor for the design, manufacturing, and integration of advanced signaling systems can hinder market growth in certain regions.

Emerging Opportunities in APAC Push Buttons And Signaling Devices Market

The APAC Push Buttons and Signaling Devices Market is ripe with emerging opportunities:

- Growth in Emerging Economies: Rapid industrialization and infrastructure development in countries like Vietnam, Indonesia, and the Philippines present significant untapped market potential.

- Smart City Initiatives: The increasing global focus on smart cities will drive demand for intelligent signaling solutions for traffic management, public safety, and utility monitoring.

- Renewable Energy Sector Growth: The expansion of solar, wind, and other renewable energy projects requires specialized signaling and control devices for reliable operation.

- IoT and AI Integration: Opportunities exist in developing and marketing smart signaling devices with embedded IoT and AI capabilities for predictive maintenance and remote diagnostics.

- Customization and Specialization: A growing demand for tailored solutions for niche applications in industries like robotics, medical devices, and aerospace offers lucrative specialization opportunities.

Leading Players in the APAC Push Buttons And Signaling Devices Market Market

- Panasonic

- ABB Ltd

- Marquardt Mechatronik

- ITW Switches

- Omron Industrial Automation (Omron Corporation)

- Kaihua Electronic

- Siemens AG

- Nihon Kaiheiki

- NKK Switches

- Schneider Electric

- Wurth Electronics

- Carling Technologies

- Littelfuse

- Eaton Corporation

Key Developments in APAC Push Buttons And Signaling Devices Market Industry

- October 2023: Alstom, the world's largest railway equipment manufacturer, marked the global debut of its modern signaling systems with integrated platform screening doors with the inauguration of the first Regional Rapid Transit System in India.

- August 2023: Hikvision launched a new generation of smart managed switches, allowing installers to remotely deploy and configure security systems with comprehensive operational and maintenance capabilities in conjunction with the HikPartner Pro mobile app. This new generation of smart managed switches includes a robust architecture with 6 KV surge protection for PoE ports. The entire portfolio comprises economical 100 Mbps switches, up to high-power gigabits, explicitly designed for small and medium business projects.

Strategic Outlook for APAC Push Buttons And Signaling Devices Market Market

The strategic outlook for the APAC Push Buttons and Signaling Devices Market is overwhelmingly positive, driven by sustained demand from key end-user industries and the relentless pace of technological innovation. Future growth will be shaped by the increasing integration of smart technologies, such as IoT and AI, into signaling devices, enabling enhanced functionality, remote monitoring, and predictive maintenance. The burgeoning smart manufacturing sector and the ongoing expansion of infrastructure projects across the region will continue to be significant growth catalysts. Companies that focus on developing robust, reliable, and user-friendly solutions, while also embracing customization and specialization, are well-positioned to capitalize on emerging opportunities. Strategic partnerships and mergers and acquisitions are expected to play a crucial role in market consolidation and expansion into new geographical territories and technological domains.

APAC Push Buttons And Signaling Devices Market Segmentation

-

1. Product

- 1.1. Round or Square Body Type

- 1.2. Non-lighted Push Button

- 1.3. Other Products

-

2. Type

- 2.1. Audible

- 2.2. Visible

- 2.3. Other Types

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Energy and Power

- 3.3. Manufacturing

- 3.4. Food and Beverage

- 3.5. Transportation

- 3.6. Other End-user Industries

APAC Push Buttons And Signaling Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

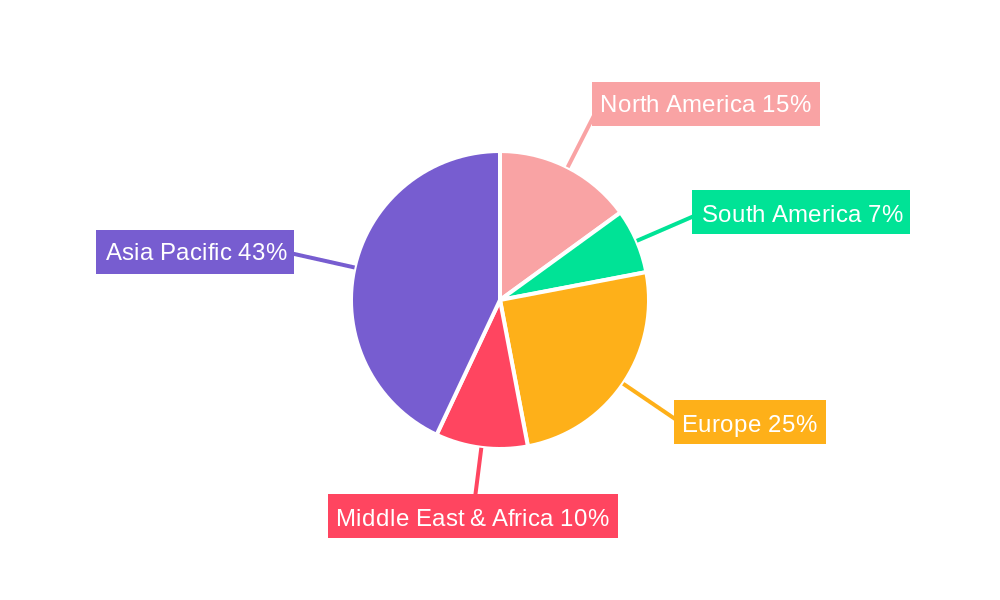

APAC Push Buttons And Signaling Devices Market Regional Market Share

Geographic Coverage of APAC Push Buttons And Signaling Devices Market

APAC Push Buttons And Signaling Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Fire Alarm Management Systems and Safety Systems; Favorable Government Regulations for Industrial Safety

- 3.3. Market Restrains

- 3.3.1. High Initial Investment in Creating Supporting Infrastructure and Automation

- 3.4. Market Trends

- 3.4.1. The Automotive Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Push Buttons And Signaling Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Round or Square Body Type

- 5.1.2. Non-lighted Push Button

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Audible

- 5.2.2. Visible

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Energy and Power

- 5.3.3. Manufacturing

- 5.3.4. Food and Beverage

- 5.3.5. Transportation

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America APAC Push Buttons And Signaling Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Round or Square Body Type

- 6.1.2. Non-lighted Push Button

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Audible

- 6.2.2. Visible

- 6.2.3. Other Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Energy and Power

- 6.3.3. Manufacturing

- 6.3.4. Food and Beverage

- 6.3.5. Transportation

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America APAC Push Buttons And Signaling Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Round or Square Body Type

- 7.1.2. Non-lighted Push Button

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Audible

- 7.2.2. Visible

- 7.2.3. Other Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Energy and Power

- 7.3.3. Manufacturing

- 7.3.4. Food and Beverage

- 7.3.5. Transportation

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe APAC Push Buttons And Signaling Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Round or Square Body Type

- 8.1.2. Non-lighted Push Button

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Audible

- 8.2.2. Visible

- 8.2.3. Other Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Energy and Power

- 8.3.3. Manufacturing

- 8.3.4. Food and Beverage

- 8.3.5. Transportation

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa APAC Push Buttons And Signaling Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Round or Square Body Type

- 9.1.2. Non-lighted Push Button

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Audible

- 9.2.2. Visible

- 9.2.3. Other Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Energy and Power

- 9.3.3. Manufacturing

- 9.3.4. Food and Beverage

- 9.3.5. Transportation

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific APAC Push Buttons And Signaling Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Round or Square Body Type

- 10.1.2. Non-lighted Push Button

- 10.1.3. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Audible

- 10.2.2. Visible

- 10.2.3. Other Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive

- 10.3.2. Energy and Power

- 10.3.3. Manufacturing

- 10.3.4. Food and Beverage

- 10.3.5. Transportation

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Panasonic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Marquardt Mechatronik

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ITW Switches

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Omron Industrial Automation (Omron Corporation)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kaihua Electronic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nihon Kaiheiki

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NKK Switches

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schneider Electric

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Wurth Electronics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Carling Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Littelfuse

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Eaton Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Panasonic

List of Figures

- Figure 1: Global APAC Push Buttons And Signaling Devices Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Push Buttons And Signaling Devices Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America APAC Push Buttons And Signaling Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America APAC Push Buttons And Signaling Devices Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America APAC Push Buttons And Signaling Devices Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America APAC Push Buttons And Signaling Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America APAC Push Buttons And Signaling Devices Market Revenue (Million), by Product 2025 & 2033

- Figure 11: South America APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: South America APAC Push Buttons And Signaling Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 13: South America APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America APAC Push Buttons And Signaling Devices Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America APAC Push Buttons And Signaling Devices Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America APAC Push Buttons And Signaling Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe APAC Push Buttons And Signaling Devices Market Revenue (Million), by Product 2025 & 2033

- Figure 19: Europe APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Europe APAC Push Buttons And Signaling Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Europe APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe APAC Push Buttons And Signaling Devices Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe APAC Push Buttons And Signaling Devices Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe APAC Push Buttons And Signaling Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa APAC Push Buttons And Signaling Devices Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East & Africa APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East & Africa APAC Push Buttons And Signaling Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Middle East & Africa APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East & Africa APAC Push Buttons And Signaling Devices Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa APAC Push Buttons And Signaling Devices Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa APAC Push Buttons And Signaling Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific APAC Push Buttons And Signaling Devices Market Revenue (Million), by Product 2025 & 2033

- Figure 35: Asia Pacific APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: Asia Pacific APAC Push Buttons And Signaling Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Asia Pacific APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific APAC Push Buttons And Signaling Devices Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific APAC Push Buttons And Signaling Devices Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific APAC Push Buttons And Signaling Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific APAC Push Buttons And Signaling Devices Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 33: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 43: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global APAC Push Buttons And Signaling Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific APAC Push Buttons And Signaling Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Push Buttons And Signaling Devices Market?

The projected CAGR is approximately 5.71%.

2. Which companies are prominent players in the APAC Push Buttons And Signaling Devices Market?

Key companies in the market include Panasonic, ABB Ltd, Marquardt Mechatronik, ITW Switches, Omron Industrial Automation (Omron Corporation), Kaihua Electronic, Siemens AG, Nihon Kaiheiki, NKK Switches, Schneider Electric, Wurth Electronics, Carling Technologies, Littelfuse, Eaton Corporation.

3. What are the main segments of the APAC Push Buttons And Signaling Devices Market?

The market segments include Product, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Fire Alarm Management Systems and Safety Systems; Favorable Government Regulations for Industrial Safety.

6. What are the notable trends driving market growth?

The Automotive Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

High Initial Investment in Creating Supporting Infrastructure and Automation.

8. Can you provide examples of recent developments in the market?

October 2023: Alstom, the world's largest railway equipment manufacturer, marked the global debut of its modern signaling systems with integrated platform screening doors with the inauguration of the first Regional Rapid Transit System in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Push Buttons And Signaling Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Push Buttons And Signaling Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Push Buttons And Signaling Devices Market?

To stay informed about further developments, trends, and reports in the APAC Push Buttons And Signaling Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence