Key Insights

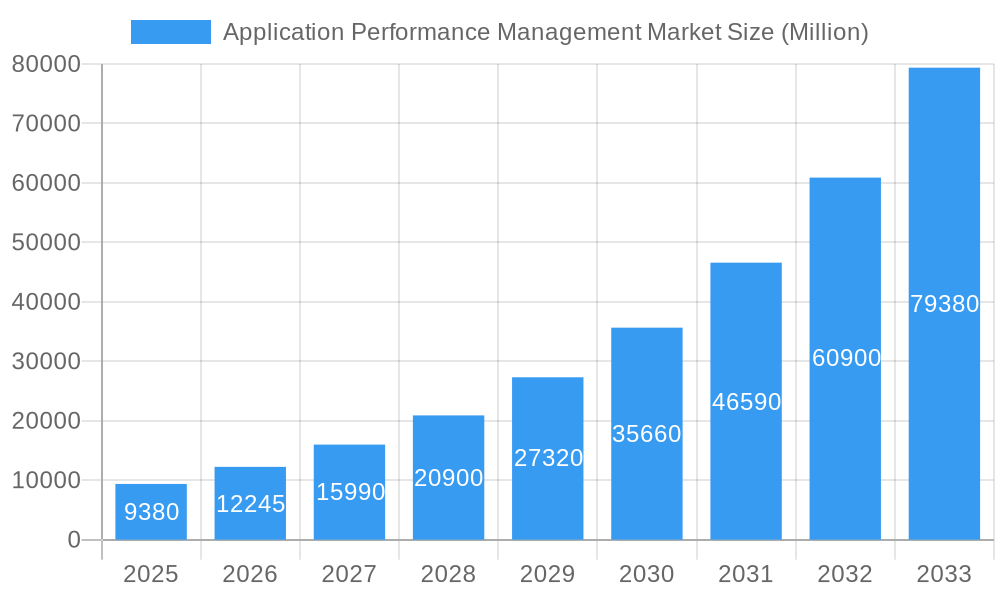

The Application Performance Management (APM) market is experiencing phenomenal growth, projected to reach an impressive 9.38 billion USD by 2025, fueled by an astounding Compound Annual Growth Rate (CAGR) of 30.76%. This rapid expansion is primarily driven by the increasing complexity of modern IT infrastructures, the proliferation of microservices architectures, and the growing demand for seamless digital experiences. Businesses across all sectors are recognizing APM as a critical tool for ensuring application availability, optimizing performance, and proactively identifying and resolving issues before they impact end-users. Key growth drivers include the surge in cloud adoption, the rise of DevOps practices, and the imperative for robust security and compliance. The market is witnessing a significant shift towards cloud-based APM solutions due to their scalability, flexibility, and cost-effectiveness, particularly benefiting Small and Medium Enterprises (SMEs) looking to leverage advanced monitoring capabilities without substantial upfront investments.

Application Performance Management Market Market Size (In Billion)

Looking ahead, the APM market's trajectory from 2025 to 2033 promises continued dominance, with forecasts indicating sustained high growth. The ongoing digital transformation initiatives, coupled with the increasing reliance on data-driven decision-making, will further solidify APM's importance. While the adoption of cloud-based solutions is set to accelerate, on-premise deployments will maintain relevance for organizations with stringent data sovereignty requirements or existing robust on-premise infrastructure. The competitive landscape is robust, featuring established players like Microsoft Corporation, IBM Corp, and Datadog Inc., alongside specialized providers such as New Relic Inc. and Dynatrace LLC. These companies are continuously innovating, integrating AI and machine learning into their offerings to provide deeper insights and automated remediation capabilities. However, challenges such as the initial implementation costs for complex enterprise-wide deployments and the shortage of skilled APM professionals could pose potential restraints to market expansion, though these are being mitigated by advancements in user-friendly interfaces and managed services.

Application Performance Management Market Company Market Share

Here is a detailed, SEO-optimized report description for the Application Performance Management Market, designed for immediate use without modification.

Application Performance Management Market Market Concentration & Innovation

The Application Performance Management (APM) market exhibits a dynamic concentration, driven by significant innovation and strategic mergers and acquisitions. While a few dominant players like Datadog Inc., Microsoft Corporation, and Dynatrace LLC hold substantial market share, the landscape is continuously reshaped by advancements in AI-driven observability and cloud-native solutions. Innovation is primarily fueled by the escalating demand for enhanced user experience, proactive issue resolution, and robust security postures in complex digital environments. Regulatory frameworks, though evolving, are largely supportive of APM adoption, emphasizing data security and privacy. Product substitutes, such as basic monitoring tools, are increasingly being phased out in favor of comprehensive APM solutions. End-user trends are shifting towards integrated platforms that offer end-to-end visibility across hybrid and multi-cloud infrastructures, with a strong emphasis on automation and AIOps. Merger and acquisition activities remain robust, with deal values consistently in the hundreds of millions, as companies seek to expand their portfolios and geographical reach. For instance, SignalFX's acquisition by Splunk Inc. underscores the consolidation trend. The market's innovation trajectory is set to be a critical determinant of its future growth and competitive differentiation.

Application Performance Management Market Industry Trends & Insights

The Application Performance Management (APM) market is experiencing robust growth, projected to reach a valuation of over $30,000 million by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 15.5% during the forecast period of 2025–2033. This expansion is propelled by several key trends and insights. The pervasive digital transformation across industries, coupled with the increasing complexity of modern application architectures, including microservices and containerized environments, necessitates sophisticated APM solutions for optimal performance and reliability. Enterprises are recognizing APM not just as a diagnostic tool but as a critical component of their DevOps, DevSecOps, and Site Reliability Engineering (SRE) strategies. The surge in cloud adoption, particularly hybrid and multi-cloud deployments, has amplified the need for comprehensive observability that spans diverse infrastructures. Technological disruptions, such as the integration of Artificial Intelligence for IT Operations (AIOps) and advanced machine learning algorithms, are revolutionizing how APM platforms identify, predict, and resolve performance bottlenecks and security threats. Consumer preferences are leaning towards seamless, high-performing digital experiences, making APM indispensable for customer satisfaction and retention. The competitive dynamics are characterized by intense innovation, with companies focusing on delivering unified observability platforms that offer enhanced visibility, faster troubleshooting, and automated remediation capabilities. Furthermore, the growing adoption of serverless computing and edge computing presents new frontiers for APM, demanding specialized solutions. The increasing volume and velocity of data generated by applications require APM tools to be scalable and efficient. The focus on security is also intensifying, with APM solutions increasingly incorporating application security capabilities to provide end-to-end visibility from code to production.

Dominant Markets & Segments in Application Performance Management Market

The Application Performance Management (APM) market's dominance is clearly observed in specific segments and regions, driven by distinct economic and technological factors. Cloud deployment stands out as the most dominant segment, accounting for a significant portion of the market share. This is primarily due to the accelerating global shift towards cloud-native architectures, hybrid cloud, and multi-cloud environments. Businesses of all sizes are migrating their applications and infrastructure to the cloud to leverage its scalability, flexibility, and cost-efficiency. The inherent complexity of cloud deployments, with their distributed nature and dynamic resource allocation, necessitates robust APM solutions for continuous monitoring, performance optimization, and fault detection. Major cloud providers' ecosystems and the proliferation of SaaS applications further fuel this trend, creating a fertile ground for cloud-based APM services.

Within enterprise size, large enterprises represent a dominant segment. These organizations typically manage highly complex, mission-critical applications that support extensive business operations. The sheer volume of transactions, the criticality of uptime, and the potential financial impact of performance degradation make APM a non-negotiable investment for them. Large enterprises also possess the budget and the internal expertise to implement and leverage advanced APM capabilities for proactive issue resolution, capacity planning, and security monitoring. The trend towards digital transformation and the need to maintain a competitive edge in their respective industries further underscore the importance of APM for these entities.

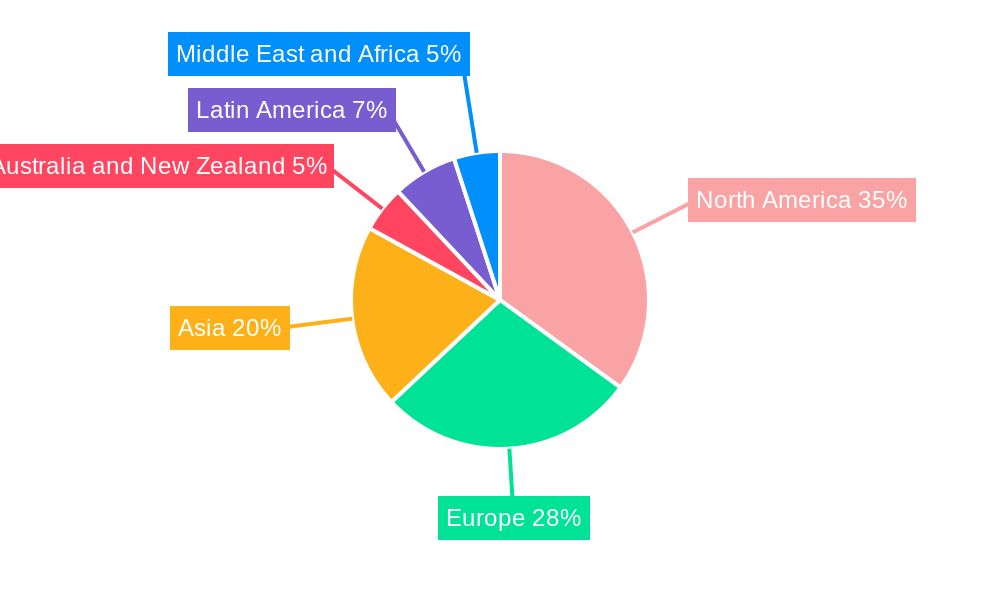

Economically, regions with high digital maturity, significant IT spending, and a strong presence of cloud infrastructure providers, such as North America, continue to lead the APM market. The presence of major technology hubs, a culture of innovation, and a high adoption rate of advanced technologies contribute to its dominance. Supportive government initiatives promoting digital infrastructure and cybersecurity further bolster this leadership.

Key drivers for the dominance of these segments include:

- Cloud-Native Architectures: The rise of microservices, containers, and serverless technologies demands sophisticated monitoring capabilities.

- Digital Transformation Initiatives: Businesses are increasingly reliant on digital platforms, making application performance critical to their success.

- Escalating User Expectations: Consumers demand seamless and fast digital experiences, pushing organizations to prioritize APM.

- Data-Driven Decision Making: APM provides crucial data insights for performance optimization, resource allocation, and strategic planning.

- Security Imperatives: Integrating security into the application lifecycle necessitates continuous monitoring and vulnerability detection.

Application Performance Management Market Product Developments

Product development in the Application Performance Management (APM) market is heavily influenced by the integration of AI and machine learning for enhanced observability. Companies are focusing on delivering unified platforms that consolidate metrics, logs, and traces, providing end-to-end visibility. Innovations are centered around AIOps capabilities for proactive anomaly detection, root cause analysis, and predictive insights. The expansion of features to encompass application security, particularly within DevSecOps workflows, is another key trend. Competitive advantages are being built on seamless integration with CI/CD pipelines, support for a wide array of technologies (including modern cloud-native stacks), and user-friendly interfaces that empower developers and operations teams to troubleshoot issues faster and optimize application performance effectively.

Application Performance Management Market Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Application Performance Management (APM) market, segmented by deployment type and enterprise size. The Deployment segmentation includes On-premise and Cloud solutions. Cloud deployment is projected to witness the highest growth, driven by the widespread adoption of cloud services and the need for scalable monitoring. On-premise solutions, while mature, continue to serve specific industry needs for data control and compliance.

The Enterprise Size segmentation encompasses Small and Medium Enterprises (SMEs) and Large Enterprises. Large enterprises, due to their complex application landscapes and critical business operations, currently represent a larger market share. However, SMEs are increasingly adopting APM solutions to enhance their digital offerings and competitiveness, indicating significant growth potential in this segment. The competitive dynamics within each segment are shaped by vendor capabilities, pricing strategies, and the specific requirements of the target user base.

Key Drivers of Application Performance Management Market Growth

The Application Performance Management (APM) market growth is propelled by several key drivers. Firstly, the ubiquitous nature of digital transformation mandates that businesses ensure their applications deliver optimal performance to meet escalating customer expectations. Secondly, the increasing complexity of application architectures, including microservices and cloud-native environments, creates a critical need for advanced monitoring and troubleshooting capabilities. Thirdly, the proliferation of data and the rise of AIOps are enabling proactive anomaly detection and predictive insights, driving demand for intelligent APM solutions. Finally, growing concerns around cybersecurity and the need for end-to-end visibility across the software development lifecycle, from code to production, are accelerating APM adoption.

Challenges in the Application Performance Management Market Sector

Despite robust growth, the Application Performance Management (APM) market faces several challenges. A significant hurdle is the complexity of integration with existing IT infrastructures, which can be time-consuming and resource-intensive, especially for legacy systems. The high cost of advanced APM solutions can be a barrier for small and medium-sized enterprises, limiting their adoption. Furthermore, the shortage of skilled professionals capable of effectively managing and interpreting APM data presents a talent gap. Data overload and alert fatigue can also overwhelm IT teams, diminishing the effectiveness of APM tools if not properly configured and managed. Finally, keeping pace with the rapid evolution of new technologies and application architectures requires continuous investment and adaptation from APM vendors.

Emerging Opportunities in Application Performance Management Market

Emerging opportunities in the Application Performance Management (APM) market are abundant, driven by technological advancements and evolving business needs. The integration of AI and machine learning into AIOps presents a significant opportunity for predictive and proactive issue resolution, moving beyond reactive monitoring. The growing adoption of serverless computing and edge computing creates demand for specialized APM solutions tailored to these new architectures. Furthermore, the increasing focus on application security offers opportunities to integrate security monitoring and vulnerability detection directly into APM platforms, creating unified observability solutions. The expansion of hybrid and multi-cloud environments necessitates APM tools that provide seamless visibility across diverse infrastructures, opening avenues for vendors to offer comprehensive cross-cloud management.

Leading Players in the Application Performance Management Market Market

- Mic Focus International PLC

- New Relic Inc

- SignalFX (part of Splunk Inc )

- Akamai Technologies Inc

- Datadog Inc

- Broadcom Inc

- Microsoft Corporation

- IBM Corp

- AppDynamics LLC (Cisco Systems Inc )

- Dynatrace LLC

Key Developments in Application Performance Management Market Industry

- May 2023: New Relic Inc. announced the launch of Grok, its AI observability assistant, and plans to employ a big language model to assist engineers in performing numerous common activities using natural language. New Relic uses observability technologies to set up instrumentation, provide reports, and manage accounts for the DevOps and DevSecOps movements. Engineers employ observability tools to gather the information required to run and secure the software they create.

- April 2023: Dynatrace Application Security achieved dual FedRAMP and StateRAMP authorizations, enabling secure cloud transformation for public sector customers. As a result, federal, state, and local government agencies and public educational institutions can use Dynatrace Application Security to identify and prioritize vulnerabilities and protect against attacks continuously, in addition to using the Dynatrace platform for intelligent observability and DevSecOps automation.

Strategic Outlook for Application Performance Management Market Market

The strategic outlook for the Application Performance Management (APM) market is highly positive, driven by the sustained demand for robust digital experiences and operational efficiency. Future growth will be fueled by the continued evolution of AI-driven observability, enabling predictive analytics and automated remediation. The increasing adoption of cloud-native technologies and microservices architectures will necessitate more sophisticated and comprehensive APM solutions. Vendors that can offer unified platforms, integrating performance monitoring, security, and business context, are well-positioned for success. The market will also see continued consolidation through strategic mergers and acquisitions as companies aim to broaden their capabilities and market reach. Ultimately, the APM market is poised for significant expansion as organizations across all sectors prioritize application performance as a critical differentiator.

Application Performance Management Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

-

2. Enterprise Size

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

Application Performance Management Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Application Performance Management Market Regional Market Share

Geographic Coverage of Application Performance Management Market

Application Performance Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing need for End-user satisfaction for successful Digital Business Operations

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About Intellectual Property Outsourcing

- 3.4. Market Trends

- 3.4.1. Adoption in Large Enterprises to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Application Performance Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Application Performance Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.2.1. Small and Medium Enterprises

- 6.2.2. Large Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Application Performance Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.2.1. Small and Medium Enterprises

- 7.2.2. Large Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Application Performance Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.2.1. Small and Medium Enterprises

- 8.2.2. Large Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Australia and New Zealand Application Performance Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.2.1. Small and Medium Enterprises

- 9.2.2. Large Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Latin America Application Performance Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.2.1. Small and Medium Enterprises

- 10.2.2. Large Enterprises

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Middle East and Africa Application Performance Management Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 11.1.1. On-premise

- 11.1.2. Cloud

- 11.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 11.2.1. Small and Medium Enterprises

- 11.2.2. Large Enterprises

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Mic Focus International PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 New Relic Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 SignalFX (part of Splunk Inc )

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Akamai Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Datadog Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Broadcom Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Microsoft Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 IBM Corp

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 AppDynamics LLC (Cisco Systems Inc )

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Dynatrace LLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Mic Focus International PLC

List of Figures

- Figure 1: Global Application Performance Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Application Performance Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Application Performance Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Application Performance Management Market Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 5: North America Application Performance Management Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 6: North America Application Performance Management Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Application Performance Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Application Performance Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 9: Europe Application Performance Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: Europe Application Performance Management Market Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 11: Europe Application Performance Management Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 12: Europe Application Performance Management Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Application Performance Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Application Performance Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 15: Asia Application Performance Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Asia Application Performance Management Market Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 17: Asia Application Performance Management Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 18: Asia Application Performance Management Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Application Performance Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Application Performance Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 21: Australia and New Zealand Application Performance Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Australia and New Zealand Application Performance Management Market Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 23: Australia and New Zealand Application Performance Management Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 24: Australia and New Zealand Application Performance Management Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Application Performance Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Application Performance Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Latin America Application Performance Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Latin America Application Performance Management Market Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 29: Latin America Application Performance Management Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 30: Latin America Application Performance Management Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Application Performance Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Application Performance Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 33: Middle East and Africa Application Performance Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 34: Middle East and Africa Application Performance Management Market Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 35: Middle East and Africa Application Performance Management Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 36: Middle East and Africa Application Performance Management Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Application Performance Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Application Performance Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Application Performance Management Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 3: Global Application Performance Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Application Performance Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 5: Global Application Performance Management Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 6: Global Application Performance Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Application Performance Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global Application Performance Management Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 9: Global Application Performance Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Application Performance Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 11: Global Application Performance Management Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 12: Global Application Performance Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Application Performance Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Application Performance Management Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 15: Global Application Performance Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Application Performance Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 17: Global Application Performance Management Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 18: Global Application Performance Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Application Performance Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 20: Global Application Performance Management Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 21: Global Application Performance Management Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Application Performance Management Market?

The projected CAGR is approximately 30.76%.

2. Which companies are prominent players in the Application Performance Management Market?

Key companies in the market include Mic Focus International PLC, New Relic Inc, SignalFX (part of Splunk Inc ), Akamai Technologies Inc, Datadog Inc, Broadcom Inc, Microsoft Corporation, IBM Corp, AppDynamics LLC (Cisco Systems Inc ), Dynatrace LLC.

3. What are the main segments of the Application Performance Management Market?

The market segments include Deployment, Enterprise Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing need for End-user satisfaction for successful Digital Business Operations.

6. What are the notable trends driving market growth?

Adoption in Large Enterprises to Drive Market Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness About Intellectual Property Outsourcing.

8. Can you provide examples of recent developments in the market?

May 2023: New Relic Inc. announced the launch of Grok, its AI observability assistant, and plans to employ a big language model to assist engineers in performing numerous common activities using natural language. New Relic uses observability technologies to set up instrumentation, provide reports, and manage accounts for the DevOps and DevSecOps movements. Engineers employ observability tools to gather the information required to run and secure the software they create.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Application Performance Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Application Performance Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Application Performance Management Market?

To stay informed about further developments, trends, and reports in the Application Performance Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence