Key Insights

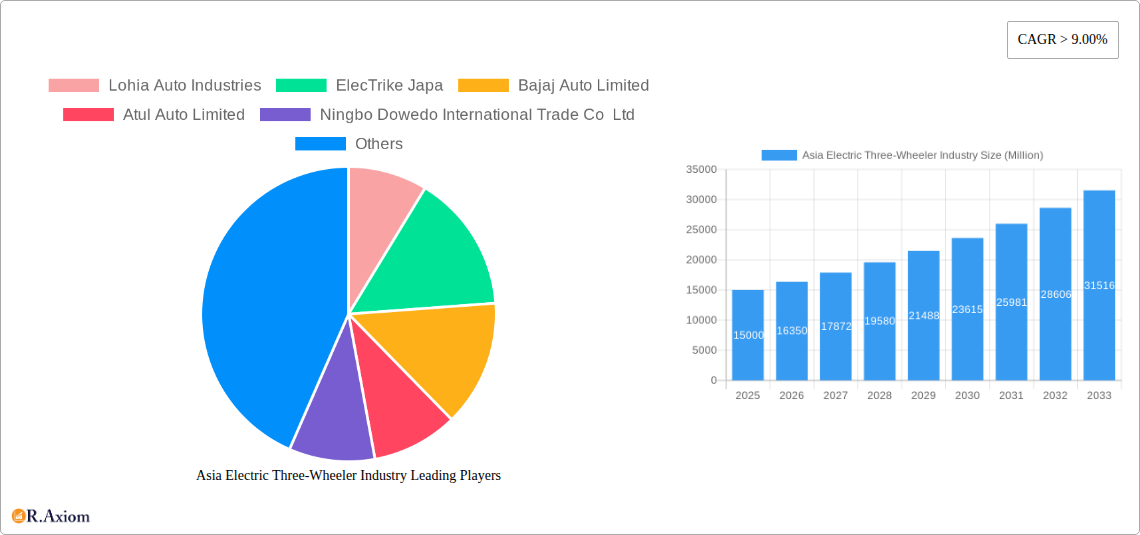

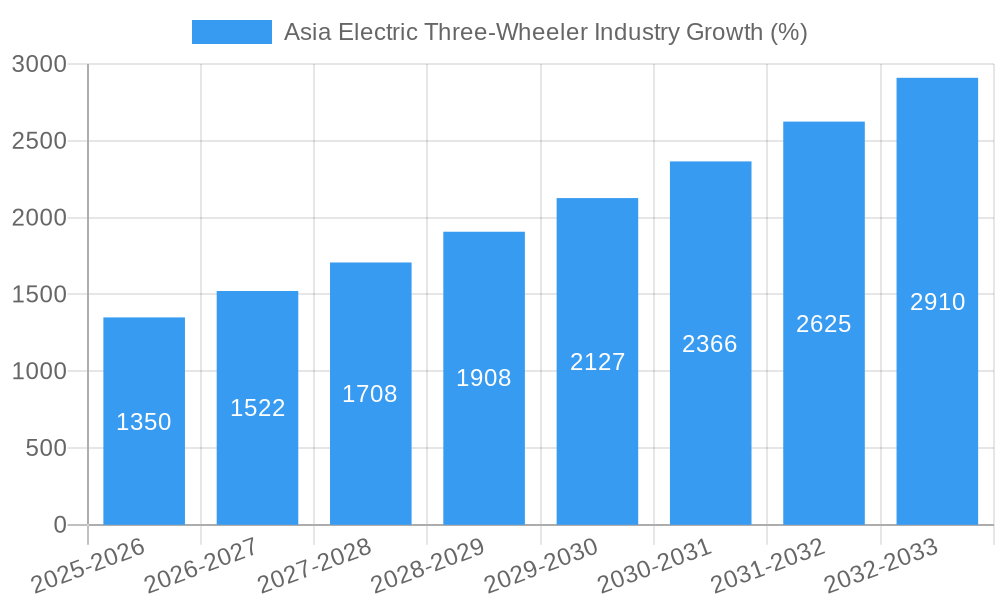

The Asia electric three-wheeler market, currently experiencing robust growth with a CAGR exceeding 9%, presents a significant opportunity for investors and manufacturers. Driven by increasing urbanization, rising fuel prices, stringent emission norms, and government initiatives promoting electric mobility, the market is poised for substantial expansion over the forecast period (2025-2033). The market is segmented by vehicle type (passenger and goods carriers) and fuel type (petrol, CNG/LPG, diesel, and electric), with electric three-wheelers rapidly gaining traction. Key players like Lohia Auto Industries, Bajaj Auto Limited, and Mahindra & Mahindra are actively investing in research and development, expanding their product portfolios, and strengthening their distribution networks to capitalize on this burgeoning market. The Asia-Pacific region, particularly India, China, and South Korea, dominates the market due to high population density, favorable government policies, and a large addressable market for last-mile connectivity solutions. However, challenges remain, including high initial investment costs for electric vehicles, limited charging infrastructure in certain regions, and consumer concerns about range anxiety. Despite these hurdles, the long-term outlook for the Asia electric three-wheeler market remains positive, driven by technological advancements, improving battery technology, and a growing preference for eco-friendly transportation solutions. The market's evolution will likely witness increased competition, product diversification, and a focus on providing affordable and reliable electric three-wheelers to cater to a wider consumer base. The focus on developing robust charging infrastructure and addressing range anxiety will be crucial for sustained growth and market penetration.

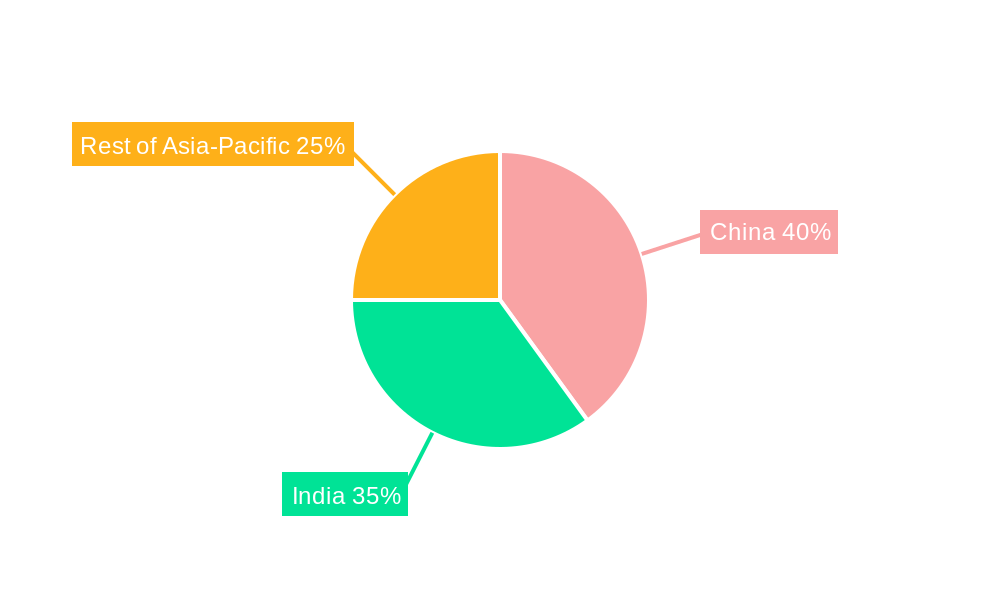

The dominance of the Asia-Pacific region is expected to continue, with China and India leading the charge. The success of established players will depend on their ability to innovate, adapt to changing consumer preferences, and strategically navigate the evolving regulatory landscape. Furthermore, the entry of new players and technological disruptions could reshape the competitive landscape. The market segmentation by vehicle type and fuel type reveals the dynamic nature of the industry, with the electric segment showing the strongest growth trajectory. Companies are focusing on developing advanced battery technologies, enhancing vehicle performance, and integrating smart features to attract environmentally conscious consumers and meet evolving transportation needs. The forecast period will see significant investments in research and development, resulting in improvements in battery life, charging times, and overall vehicle performance.

Asia Electric Three-Wheeler Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia electric three-wheeler industry, offering valuable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The study leverages extensive data analysis to provide actionable intelligence, enabling informed decision-making.

Asia Electric Three-Wheeler Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Asian electric three-wheeler market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of established players and emerging entrants, leading to a moderately concentrated market structure. While exact market share data for each player fluctuates, Bajaj Auto Limited and Mahindra & Mahindra Ltd. hold significant shares, with other players like Lohia Auto Industries and Atul Auto Limited vying for market dominance.

Key aspects covered include:

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated to be around xx in 2025, indicating a moderately concentrated market.

- Innovation Drivers: Growing demand for last-mile delivery solutions, increasing environmental concerns, and supportive government policies are driving innovation in battery technology, charging infrastructure, and vehicle design.

- Regulatory Frameworks: Government regulations promoting electric vehicle adoption, including subsidies and emission standards, are significantly shaping the market trajectory.

- Product Substitutes: Competition exists from other last-mile delivery solutions such as motorcycles and small delivery trucks; however, the unique advantages of three-wheelers—maneuverability and load capacity—maintain their relevance.

- End-User Trends: The increasing preference for electric vehicles due to cost savings and environmental benefits is a major market driver.

- M&A Activities: The report details significant mergers and acquisitions in the industry over the historical period (2019-2024), with total deal values estimated at xx Million. Future M&A activity is anticipated, driven by the consolidation of the market and the pursuit of technological advancement.

Asia Electric Three-Wheeler Industry Industry Trends & Insights

This section delves into the key trends shaping the Asia electric three-wheeler market, focusing on growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market is experiencing substantial growth, driven by factors such as increasing urbanization, rising e-commerce penetration, and government support for electric mobility.

- Market Growth Drivers: Rapid urbanization, increasing demand for last-mile delivery, rising fuel prices, and favorable government policies are key growth catalysts.

- Technological Disruptions: Advancements in battery technology, charging infrastructure, and vehicle connectivity are transforming the industry, leading to enhanced vehicle performance, longer ranges, and improved user experience.

- Consumer Preferences: Consumers are increasingly prioritizing electric three-wheelers due to lower running costs, reduced emissions, and improved convenience.

- Competitive Dynamics: Intense competition exists among established and new players, leading to continuous innovation in product design, features, and pricing strategies.

- CAGR: The Asia electric three-wheeler market is expected to witness a CAGR of xx% during the forecast period (2025-2033).

- Market Penetration: Electric three-wheelers are gradually gaining market share, with penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Asia Electric Three-Wheeler Industry

This section identifies the dominant markets and segments within the Asia electric three-wheeler industry. India and China are expected to remain the largest markets, driven by strong domestic demand and favorable government policies.

- Leading Regions/Countries: India and China are the dominant markets, accounting for xx Million units of sales in 2025.

- Dominant Vehicle Types: Passenger carriers and goods carriers are the two primary vehicle types, with the passenger carrier segment projected to grow at a faster rate due to growing urban mobility needs.

- Dominant Fuel Types: Electric three-wheelers are experiencing significant growth and are expected to gain a larger share of the market compared to petrol, CNG/LPG, and diesel-powered vehicles.

Key Drivers of Market Dominance (using bullet points as examples):

- India: Strong government incentives, large population, and expanding e-commerce sector.

- China: Extensive manufacturing base, robust domestic demand, and focus on electric vehicle adoption.

- Passenger Carriers: Rising urbanization and increasing demand for personal transportation.

- Electric Fuel Type: Government support for EV adoption, reduced running costs, and environmental benefits.

Asia Electric Three-Wheeler Industry Product Developments

Recent product innovations focus on improving battery technology for longer range and faster charging, enhancing safety features, and incorporating smart technologies for connectivity and remote diagnostics. This enhances efficiency and user experience, while addressing key market needs for increased reliability and durability.

Report Scope & Segmentation Analysis

The report comprehensively segments the Asia electric three-wheeler market by vehicle type (passenger carrier and goods carrier) and fuel type (petrol, CNG/LPG, diesel, and electric). Each segment is analyzed based on its market size, growth rate, competitive dynamics, and future outlook.

- Vehicle Type: Passenger Carrier: xx Million units, Goods Carrier: xx Million units

- Fuel Type: Electric: xx Million units, Petrol: xx Million units, CNG/LPG: xx Million units, Diesel: xx Million units

Key Drivers of Asia Electric Three-Wheeler Industry Growth

The industry’s growth is fueled by a confluence of factors: Government initiatives promoting electric vehicle adoption, the rise of e-commerce necessitating efficient last-mile delivery solutions, increasing urbanization driving demand for personal transportation, and advancements in battery technology lowering costs and improving performance.

Challenges in the Asia Electric Three-Wheeler Industry Sector

Significant challenges include the high initial cost of electric three-wheelers, limitations in charging infrastructure, range anxiety among consumers, and the need for robust battery recycling infrastructure. These issues, if not effectively addressed, can hinder market expansion.

Emerging Opportunities in Asia Electric Three-Wheeler Industry

Emerging opportunities lie in developing advanced battery technologies, expanding charging infrastructure, integrating smart technologies for fleet management, penetrating new markets in rural areas, and catering to niche segments like food delivery and tourism.

Leading Players in the Asia Electric Three-Wheeler Industry Market

- Lohia Auto Industries

- ElecTrike Japa

- Bajaj Auto Limited

- Atul Auto Limited

- Ningbo Dowedo International Trade Co Ltd

- Mahindra and Mahindra Ltd

- TVS Motor Company

- Piaggio & C SpA

- ChongQing Zongshen Tricycle Manufacturing Co Ltd

- Scooters India Ltd

Key Developments in Asia Electric Three-Wheeler Industry Industry

- 2022-Q4: Bajaj Auto launches new electric three-wheeler model with improved battery technology.

- 2023-Q1: Indian government announces new subsidies for electric three-wheeler purchases.

- 2023-Q3: Mahindra & Mahindra partners with a battery manufacturer to secure long-term supply.

- 2024-Q2: Significant investment in charging infrastructure announced by a major energy company in India.

Strategic Outlook for Asia Electric Three-Wheeler Industry Market

The Asia electric three-wheeler market holds immense potential for growth, driven by continuous technological advancements, supportive government policies, and the rising demand for sustainable and efficient transportation solutions. The market is expected to witness a significant expansion in the coming years, presenting lucrative opportunities for established players and new entrants alike.

Asia Electric Three-Wheeler Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Carrier

- 1.2. Goods Carrier

-

2. Fuel Type

- 2.1. Petrol

- 2.2. CNG/LPG

- 2.3. Diesel

- 2.4. Electric

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Indonesia

- 3.4. Bangladesh

- 3.5. Sri Lanka

- 3.6. Rest of Asia

Asia Electric Three-Wheeler Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Indonesia

- 4. Bangladesh

- 5. Sri Lanka

- 6. Rest of Asia

Asia Electric Three-Wheeler Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Electric School Buses

- 3.3. Market Restrains

- 3.3.1. Uncertainty of The Global Pandemic

- 3.4. Market Trends

- 3.4.1. Industry’s Shift Toward the Adoption of Electric Three Wheelers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Carrier

- 5.1.2. Goods Carrier

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. CNG/LPG

- 5.2.3. Diesel

- 5.2.4. Electric

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Indonesia

- 5.3.4. Bangladesh

- 5.3.5. Sri Lanka

- 5.3.6. Rest of Asia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Indonesia

- 5.4.4. Bangladesh

- 5.4.5. Sri Lanka

- 5.4.6. Rest of Asia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Carrier

- 6.1.2. Goods Carrier

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Petrol

- 6.2.2. CNG/LPG

- 6.2.3. Diesel

- 6.2.4. Electric

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Indonesia

- 6.3.4. Bangladesh

- 6.3.5. Sri Lanka

- 6.3.6. Rest of Asia

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. India Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Carrier

- 7.1.2. Goods Carrier

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Petrol

- 7.2.2. CNG/LPG

- 7.2.3. Diesel

- 7.2.4. Electric

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Indonesia

- 7.3.4. Bangladesh

- 7.3.5. Sri Lanka

- 7.3.6. Rest of Asia

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Indonesia Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Carrier

- 8.1.2. Goods Carrier

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Petrol

- 8.2.2. CNG/LPG

- 8.2.3. Diesel

- 8.2.4. Electric

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Indonesia

- 8.3.4. Bangladesh

- 8.3.5. Sri Lanka

- 8.3.6. Rest of Asia

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Bangladesh Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Carrier

- 9.1.2. Goods Carrier

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Petrol

- 9.2.2. CNG/LPG

- 9.2.3. Diesel

- 9.2.4. Electric

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Indonesia

- 9.3.4. Bangladesh

- 9.3.5. Sri Lanka

- 9.3.6. Rest of Asia

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Sri Lanka Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Passenger Carrier

- 10.1.2. Goods Carrier

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Petrol

- 10.2.2. CNG/LPG

- 10.2.3. Diesel

- 10.2.4. Electric

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Indonesia

- 10.3.4. Bangladesh

- 10.3.5. Sri Lanka

- 10.3.6. Rest of Asia

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Rest of Asia Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.1.1. Passenger Carrier

- 11.1.2. Goods Carrier

- 11.2. Market Analysis, Insights and Forecast - by Fuel Type

- 11.2.1. Petrol

- 11.2.2. CNG/LPG

- 11.2.3. Diesel

- 11.2.4. Electric

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Indonesia

- 11.3.4. Bangladesh

- 11.3.5. Sri Lanka

- 11.3.6. Rest of Asia

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12. China Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 13. Japan Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 14. India Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 15. South Korea Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 16. Taiwan Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 17. Australia Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Asia-Pacific Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Lohia Auto Industries

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 ElecTrike Japa

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Bajaj Auto Limited

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Atul Auto Limited

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Ningbo Dowedo International Trade Co Ltd

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Mahindra and Mahindra Ltd

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 TVS Motor Company

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Piaggio & C SpA

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 ChongQing Zongshen Tricycle Manufacturing Co Ltd

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Scooters India Ltd

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Lohia Auto Industries

List of Figures

- Figure 1: Asia Electric Three-Wheeler Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Electric Three-Wheeler Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 19: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 20: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 23: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 24: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 28: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 31: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 32: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 35: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 36: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Electric Three-Wheeler Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Asia Electric Three-Wheeler Industry?

Key companies in the market include Lohia Auto Industries, ElecTrike Japa, Bajaj Auto Limited, Atul Auto Limited, Ningbo Dowedo International Trade Co Ltd, Mahindra and Mahindra Ltd, TVS Motor Company, Piaggio & C SpA, ChongQing Zongshen Tricycle Manufacturing Co Ltd, Scooters India Ltd.

3. What are the main segments of the Asia Electric Three-Wheeler Industry?

The market segments include Vehicle Type, Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Electric School Buses.

6. What are the notable trends driving market growth?

Industry’s Shift Toward the Adoption of Electric Three Wheelers.

7. Are there any restraints impacting market growth?

Uncertainty of The Global Pandemic.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Electric Three-Wheeler Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Electric Three-Wheeler Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Electric Three-Wheeler Industry?

To stay informed about further developments, trends, and reports in the Asia Electric Three-Wheeler Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence