Key Insights

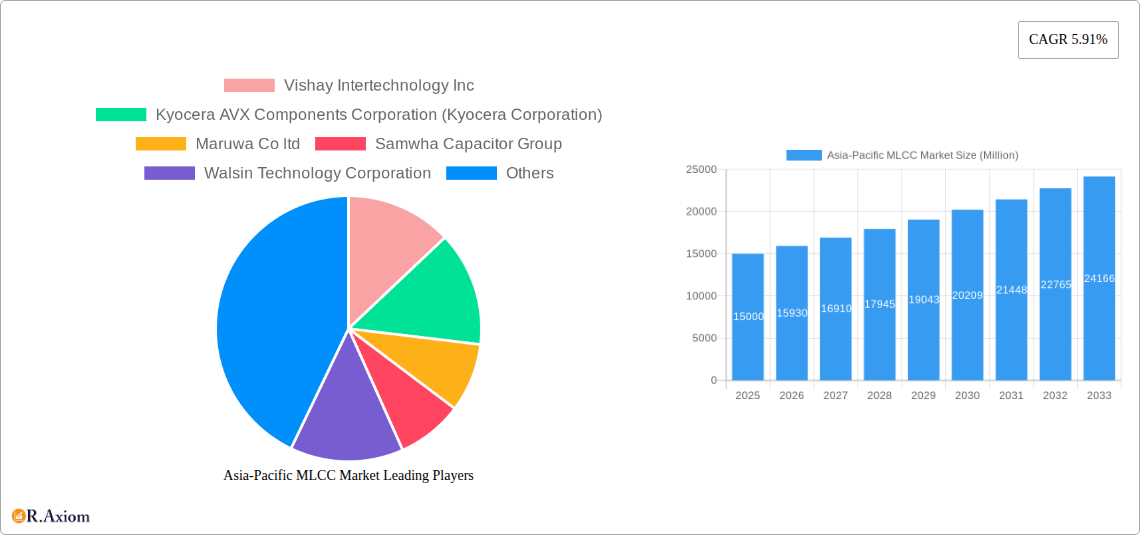

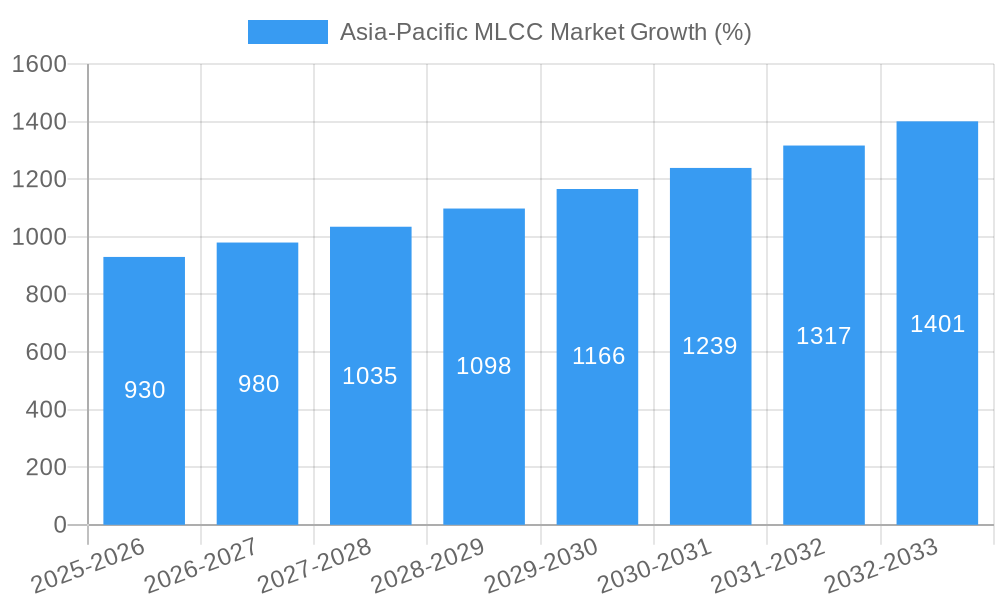

The Asia-Pacific Multilayer Ceramic Capacitor (MLCC) market is experiencing robust growth, driven by the increasing demand for electronic devices across diverse sectors. The region's expanding consumer electronics market, particularly in China, India, and South Korea, is a significant contributor to this growth. Furthermore, the automotive and industrial sectors are witnessing substantial adoption of MLCCs due to the rising integration of advanced electronics in vehicles and industrial automation systems. The market's steady Compound Annual Growth Rate (CAGR) of 5.91% indicates a positive trajectory, with a projected market size exceeding the current XX million value within the forecast period (2025-2033). Key segments contributing to this growth include high-capacitance MLCCs (100µF to 1000µF and above) driven by the need for energy storage in power electronics and automotive applications. Surface mount technology's prevalence facilitates miniaturization and automation, further fueling market expansion. However, challenges such as supply chain disruptions and fluctuations in raw material prices pose potential restraints. The competitive landscape is characterized by a mix of established global players and regional manufacturers, leading to ongoing innovation in MLCC technology and cost optimization strategies.

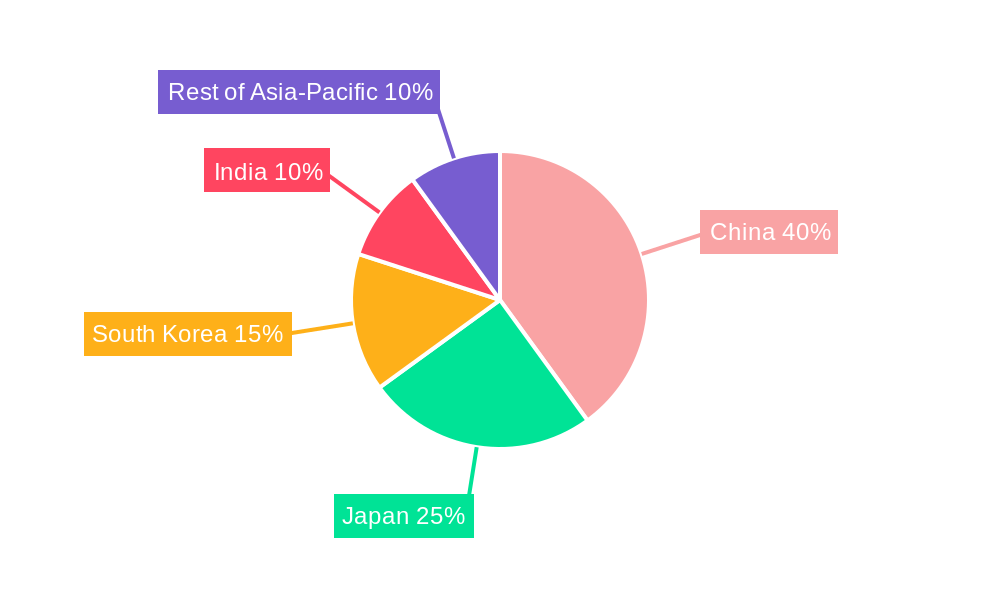

The Asia-Pacific dominance in MLCC manufacturing and consumption is underpinned by its robust electronics manufacturing ecosystem. Japan and South Korea remain key players, leveraging their technological advancements and manufacturing expertise. However, China's rapid industrialization and growing domestic demand are significantly shifting the regional dynamics. The increasing focus on miniaturization, higher capacitance values, and improved performance characteristics is driving continuous product development and upgrades within the MLCC industry. Government initiatives promoting technological advancements and investment in related infrastructure across the Asia-Pacific region further bolster market growth. The future of the Asia-Pacific MLCC market hinges on sustained technological innovation, addressing supply chain challenges, and meeting the increasing demand from diverse end-use sectors. Specific growth within individual countries will vary based on factors like economic development, technological adoption, and government policies.

Asia-Pacific MLCC Market: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Asia-Pacific Multilayer Ceramic Capacitor (MLCC) market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. The report leverages extensive market research to provide accurate data and forecasts, incorporating detailed segmentation by capacitance, mounting type, end-user, country, dielectric type, case size, and voltage.

Asia-Pacific MLCC Market Concentration & Innovation

The Asia-Pacific MLCC market is characterized by a moderately concentrated landscape, with a few key players holding significant market share. Murata Manufacturing Co Ltd, TDK Corporation, and Samsung Electro-Mechanics are among the dominant players, consistently demonstrating innovation in materials science and manufacturing processes to improve capacitor performance. Market share fluctuations are driven by factors such as technological advancements, pricing strategies, and supply chain efficiency. The estimated market share for Murata in 2025 is approximately xx%, TDK at xx%, and Samsung Electro-Mechanics at xx%, with the remaining share distributed among other prominent players like Kyocera AVX, Vishay, and Taiyo Yuden.

Innovation within the industry is heavily influenced by the increasing demand for miniaturization, higher capacitance values, and improved thermal stability across diverse applications. Stringent regulatory frameworks, particularly concerning environmental compliance and product safety, necessitate continuous improvement in materials and manufacturing processes. The emergence of substitute technologies, while limited, presents a competitive challenge that necessitates ongoing research and development.

Mergers and acquisitions (M&A) activities play a crucial role in shaping the market landscape. Recent M&A deals have focused on expanding product portfolios, accessing new markets, and gaining a competitive edge in specific segments. The total value of M&A deals in the Asia-Pacific MLCC market between 2019 and 2024 is estimated at xx Million, with an average deal size of xx Million.

- Key Innovation Drivers: Miniaturization, enhanced capacitance, improved thermal stability, energy efficiency.

- Regulatory Factors: Environmental compliance (RoHS, REACH), safety standards (UL, IEC).

- Substitute Technologies: Film capacitors, other passive components.

- End-User Trends: Growing demand from automotive, consumer electronics, and 5G infrastructure.

Asia-Pacific MLCC Market Industry Trends & Insights

The Asia-Pacific MLCC market is experiencing robust growth, driven by the increasing penetration of electronics across various sectors. The automotive industry's shift towards electric vehicles (EVs) and the proliferation of connected devices are significant catalysts. Technological advancements, particularly in materials science and manufacturing, are continuously improving capacitor performance and enabling the development of smaller, more energy-efficient components. Consumer preferences for compact, high-performance electronics further fuel market expansion.

The market's competitive landscape is dynamic, characterized by intense rivalry among established players and the emergence of new entrants. Strategic alliances, joint ventures, and technological partnerships are common strategies adopted by companies to maintain their market position. The Asia-Pacific MLCC market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration in key segments, such as automotive and 5G infrastructure, is expected to increase significantly.

Dominant Markets & Segments in Asia-Pacific MLCC Market

China remains the dominant market in the Asia-Pacific region, driven by its robust manufacturing sector and large consumer electronics market. Japan and South Korea also hold significant market share due to their established technological prowess and presence of major MLCC manufacturers. The "Less than 100µF" capacitance segment holds the largest market share, owing to its widespread application in various electronic devices. The Surface Mount MLCC mounting type dominates due to its suitability for high-density electronic systems.

- Leading Region: China

- Leading Country: China

- Dominant Capacitance Segment: Less than 100µF

- Dominant Mounting Type: Surface Mount

- Key End-User Segments: Consumer Electronics, Automotive, and Telecommunication.

The automotive industry’s rapid expansion, especially in EVs and hybrid vehicles, is fueling substantial growth in the MLCC market, particularly within high-voltage segments. The demand for high-performance components in power electronics applications is boosting market expansion in regions with significant automotive manufacturing activity. Meanwhile, the consumer electronics sector is a major driver due to the continuous miniaturization and performance enhancement trends in smartphones, laptops, and other portable devices. Expansion into these segments and regions will require efficient logistics and manufacturing strategies to satisfy demand.

Asia-Pacific MLCC Market Product Developments

Recent product innovations focus on enhancing performance parameters such as miniaturization, higher capacitance density, improved temperature stability, and increased voltage ratings. Automotive-grade MLCCs with enhanced reliability and high-voltage capabilities are gaining traction, driven by the electric vehicle revolution. The development of MLCCs tailored to specific applications, such as 5G infrastructure and high-frequency circuits, highlights the trend towards specialized products that cater to niche market requirements. These developments position MLCC manufacturers to benefit from the growing demand for advanced electronic components and systems.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the Asia-Pacific MLCC market across various parameters:

- Capacitance: Less than 100µF, 100µF to 1000µF, More than 1000µF (Growth projections and market sizes will vary significantly based on segment). The less than 100µF segment is expected to dominate due to widespread use in consumer electronics.

- MLCC Mounting Type: Metal Cap, Radial Lead, Surface Mount (Surface Mount is projected to witness the fastest growth due to its suitability for miniaturization).

- End User: Aerospace and Defence, Automotive, Consumer Electronics, Industrial, Medical Devices, Power and Utilities, Telecommunication, Others (Automotive and Consumer Electronics are projected to show high growth).

- Country: China, India, Japan, South Korea, Others (China is expected to be the largest market).

- Dielectric Type: Class I, Class II (Market share will vary based on the application).

- Case Size: 01005, 0201, 0402, 0603, 0805, Others (Smaller case sizes will grow faster due to miniaturization).

- Voltage: Less than 500V, 500V to 1000V, More than 1000V (High-voltage segments will witness increased growth driven by electric vehicles).

Each segment's competitive landscape and dynamics are discussed in detail within the full report.

Key Drivers of Asia-Pacific MLCC Market Growth

The Asia-Pacific MLCC market is propelled by several key factors:

- Technological advancements: Continuous improvements in materials science and manufacturing processes lead to higher capacitance density, improved temperature stability, and miniaturization.

- Growth of electronics sector: The rising demand for electronic devices across various industries, particularly consumer electronics and automotive, fuels market expansion.

- Government initiatives: Policies promoting technological advancements and infrastructure development in the electronics sector further stimulate market growth.

Challenges in the Asia-Pacific MLCC Market Sector

Several challenges hinder the Asia-Pacific MLCC market's growth:

- Supply chain disruptions: Geopolitical instability and global supply chain vulnerabilities can impact raw material availability and manufacturing processes.

- Price fluctuations: Volatile raw material prices and intense competition affect profitability.

- Technological advancements: The emergence of alternative capacitor technologies presents a competitive challenge.

Emerging Opportunities in Asia-Pacific MLCC Market

Significant growth opportunities exist in the Asia-Pacific MLCC market:

- Electric vehicles: The expansion of the electric vehicle market significantly increases demand for high-voltage MLCCs.

- 5G infrastructure: The rollout of 5G networks necessitates high-performance MLCCs in base stations and other infrastructure components.

- Smart devices: The proliferation of smart devices across various sectors creates substantial demand for smaller and more energy-efficient MLCCs.

Leading Players in the Asia-Pacific MLCC Market Market

- Vishay Intertechnology Inc

- Kyocera AVX Components Corporation (Kyocera Corporation)

- Maruwa Co ltd

- Samwha Capacitor Group

- Walsin Technology Corporation

- Samsung Electro-Mechanics

- Würth Elektronik GmbH & Co KG

- Yageo Corporation

- Taiyo Yuden Co Ltd

- TDK Corporation

- Murata Manufacturing Co Ltd

- Nippon Chemi-Con Corporation

Key Developments in Asia-Pacific MLCC Market Industry

- July 2023: KEMET (part of Yageo Corporation) launched the X7R automotive-grade MLCC, designed for high-voltage automotive applications (500V-1kV), expanding the market for high-voltage components.

- June 2023: Introduction of the NTS/NTF series of SMD-type MLCCs, catering to the growing demand within industrial equipment manufacturing, demonstrating adaptation to specific end-user requirements.

- May 2023: Murata introduced the EVA series of MLCCs, tailored to the needs of EV manufacturers, highlighting the focus on the burgeoning electric vehicle market.

Strategic Outlook for Asia-Pacific MLCC Market Market

The Asia-Pacific MLCC market is poised for significant growth, driven by technological advancements, expanding electronics sectors, and government support. The increasing demand for high-performance, miniaturized MLCCs across various applications, notably in the automotive and 5G sectors, presents substantial growth opportunities. Companies focusing on innovation, strategic partnerships, and efficient supply chains are best positioned to capitalize on this market expansion. The continued development of specialized MLCCs, adapted to meet specific application needs, will be crucial for market leadership.

Asia-Pacific MLCC Market Segmentation

-

1. Dielectric Type

- 1.1. Class 1

- 1.2. Class 2

-

2. Case Size

- 2.1. 0 201

- 2.2. 0 402

- 2.3. 0 603

- 2.4. 1 005

- 2.5. 1 210

- 2.6. Others

-

3. Voltage

- 3.1. 500V to 1000V

- 3.2. Less than 500V

- 3.3. More than 1000V

-

4. Capacitance

- 4.1. 100µF to 1000µF

- 4.2. Less than 100µF

- 4.3. More than 1000µF

-

5. Mlcc Mounting Type

- 5.1. Metal Cap

- 5.2. Radial Lead

- 5.3. Surface Mount

-

6. End User

- 6.1. Aerospace and Defence

- 6.2. Automotive

- 6.3. Consumer Electronics

- 6.4. Industrial

- 6.5. Medical Devices

- 6.6. Power and Utilities

- 6.7. Telecommunication

- 6.8. Others

Asia-Pacific MLCC Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific MLCC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology

- 3.3. Market Restrains

- 3.3.1. Rise of Alternative Technologies Such as Thermal Evaporation

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific MLCC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Dielectric Type

- 5.1.1. Class 1

- 5.1.2. Class 2

- 5.2. Market Analysis, Insights and Forecast - by Case Size

- 5.2.1. 0 201

- 5.2.2. 0 402

- 5.2.3. 0 603

- 5.2.4. 1 005

- 5.2.5. 1 210

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Voltage

- 5.3.1. 500V to 1000V

- 5.3.2. Less than 500V

- 5.3.3. More than 1000V

- 5.4. Market Analysis, Insights and Forecast - by Capacitance

- 5.4.1. 100µF to 1000µF

- 5.4.2. Less than 100µF

- 5.4.3. More than 1000µF

- 5.5. Market Analysis, Insights and Forecast - by Mlcc Mounting Type

- 5.5.1. Metal Cap

- 5.5.2. Radial Lead

- 5.5.3. Surface Mount

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. Aerospace and Defence

- 5.6.2. Automotive

- 5.6.3. Consumer Electronics

- 5.6.4. Industrial

- 5.6.5. Medical Devices

- 5.6.6. Power and Utilities

- 5.6.7. Telecommunication

- 5.6.8. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Dielectric Type

- 6. China Asia-Pacific MLCC Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific MLCC Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific MLCC Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific MLCC Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific MLCC Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific MLCC Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific MLCC Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Vishay Intertechnology Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Kyocera AVX Components Corporation (Kyocera Corporation)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Maruwa Co ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Samwha Capacitor Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Walsin Technology Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Samsung Electro-Mechanics

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Würth Elektronik GmbH & Co KG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yageo Corporatio

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Taiyo Yuden Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 TDK Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Murata Manufacturing Co Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Nippon Chemi-Con Corporation

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Asia-Pacific MLCC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific MLCC Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific MLCC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific MLCC Market Revenue Million Forecast, by Dielectric Type 2019 & 2032

- Table 3: Asia-Pacific MLCC Market Revenue Million Forecast, by Case Size 2019 & 2032

- Table 4: Asia-Pacific MLCC Market Revenue Million Forecast, by Voltage 2019 & 2032

- Table 5: Asia-Pacific MLCC Market Revenue Million Forecast, by Capacitance 2019 & 2032

- Table 6: Asia-Pacific MLCC Market Revenue Million Forecast, by Mlcc Mounting Type 2019 & 2032

- Table 7: Asia-Pacific MLCC Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Asia-Pacific MLCC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific MLCC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: India Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South Korea Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Taiwan Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Australia Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia-Pacific Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Asia-Pacific MLCC Market Revenue Million Forecast, by Dielectric Type 2019 & 2032

- Table 18: Asia-Pacific MLCC Market Revenue Million Forecast, by Case Size 2019 & 2032

- Table 19: Asia-Pacific MLCC Market Revenue Million Forecast, by Voltage 2019 & 2032

- Table 20: Asia-Pacific MLCC Market Revenue Million Forecast, by Capacitance 2019 & 2032

- Table 21: Asia-Pacific MLCC Market Revenue Million Forecast, by Mlcc Mounting Type 2019 & 2032

- Table 22: Asia-Pacific MLCC Market Revenue Million Forecast, by End User 2019 & 2032

- Table 23: Asia-Pacific MLCC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: China Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Japan Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Korea Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: India Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: New Zealand Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Indonesia Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Malaysia Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Singapore Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Thailand Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Vietnam Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Philippines Asia-Pacific MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific MLCC Market?

The projected CAGR is approximately 5.91%.

2. Which companies are prominent players in the Asia-Pacific MLCC Market?

Key companies in the market include Vishay Intertechnology Inc, Kyocera AVX Components Corporation (Kyocera Corporation), Maruwa Co ltd, Samwha Capacitor Group, Walsin Technology Corporation, Samsung Electro-Mechanics, Würth Elektronik GmbH & Co KG, Yageo Corporatio, Taiyo Yuden Co Ltd, TDK Corporation, Murata Manufacturing Co Ltd, Nippon Chemi-Con Corporation.

3. What are the main segments of the Asia-Pacific MLCC Market?

The market segments include Dielectric Type, Case Size, Voltage, Capacitance, Mlcc Mounting Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Rise of Alternative Technologies Such as Thermal Evaporation.

8. Can you provide examples of recent developments in the market?

July 2023: KEMET, part of the Yageo Corporation developed the X7R automotive grade MLCC X7R. This MLCC is designed to meet the high voltage requirements of automotive subsystems, ranging from 100pF-0.1uF and with a DC voltage range of 500V-1kV. The range of cases available is EIA 0603-1210, and is suitable for both automotive under hoods and in-cabin applications. These MLCCs demonstrate the essential and reliable nature of capacitors, which are essential for the mission and safety of automotive subsystems.June 2023: The growing demand for industrial equipments has driven the company to introduce NTS/NTF NTS/NTF Series of SMD type MLCC. These capacitors are rated with 25 to 500 Vdc with a capacitance ranging from 0.010 to 47µF. These MLCCs are used in on-board power supplies,voltage regulators for computers,smoothing circuit of DC-DC converters,etc.May 2023: Murata has introduced the EVA series of MLCC, which are beneficial to EV manufacturers due to their versatility. These MLCC's can be used in a variety of applications, including OBC (On-Board Charger), inverter and DC/DC Converter, BMS (Battery Management System), and WPT (Wireless Power Transfer) implementations. As a result, they are ideal to the increased isolation that the 800V powertrain migration will require, while also meeting the miniaturization requirements of modern automotive systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific MLCC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific MLCC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific MLCC Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific MLCC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence