Key Insights

The Asia-Pacific offshore energy market is projected to experience significant expansion, reaching an estimated market size of $34.07 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 13.1% through 2033. This growth is driven by increasing government commitments to renewable energy targets, a strategic shift away from fossil fuels, and technological advancements in offshore wind power that enhance efficiency and reduce costs. Growing awareness of climate change and the demand for sustainable energy solutions are further accelerating the adoption of offshore energy. The region's extensive coastlines and favorable offshore wind resources position it as a key player in the global energy transition.

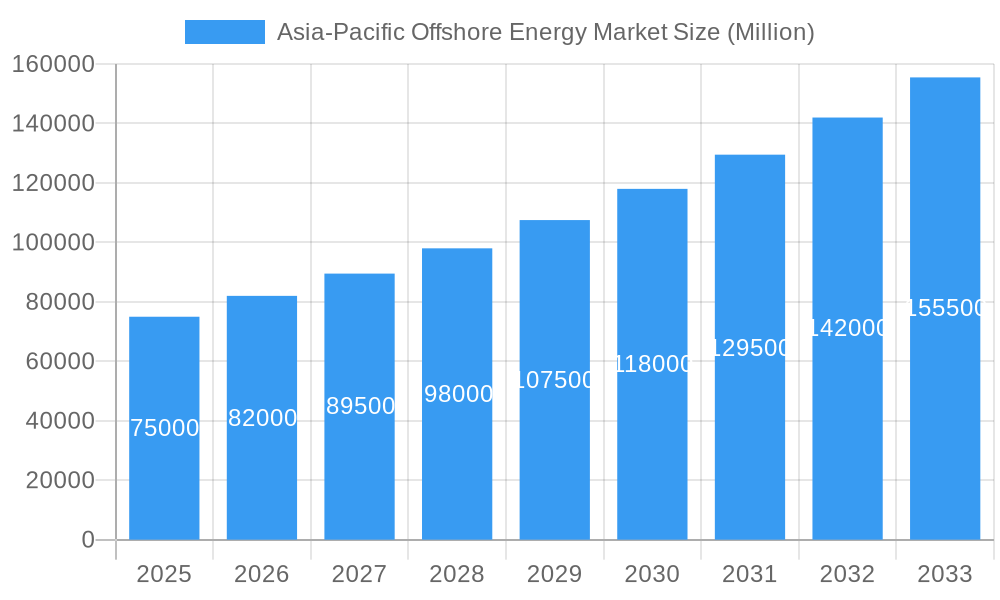

Asia-Pacific Offshore Energy Market Market Size (In Billion)

Key trends include rapid growth in offshore wind farm development across China, Taiwan, and South Korea. While wave and tidal stream energy technologies are still maturing, they are attracting increased investment and pilot projects. Ocean Thermal Energy Conversion (OTEC) is also emerging in tropical areas. Challenges include high initial capital investment, complex regulatory environments, and the need for robust grid infrastructure. However, the strong commitment to decarbonization, energy security, technological innovation, and supportive government policies ensure a dynamic growth trajectory for the Asia-Pacific offshore energy sector.

Asia-Pacific Offshore Energy Market Company Market Share

Asia-Pacific Offshore Energy Market: Comprehensive Growth & Opportunity Analysis (2019-2033)

Report Description:

This in-depth report provides a definitive analysis of the Asia-Pacific Offshore Energy Market, encompassing historical performance (2019-2024), base year insights (2025), and robust future projections through 2033. We delve into the dynamic landscape of offshore wind energy, wave energy, tidal stream, Ocean Thermal Energy Conversion (OTEC), and other emerging technologies across key geographies including China, Taiwan, South Korea, Japan, Vietnam, and the Rest of Asia-Pacific. With a focus on market concentration, innovation drivers, regulatory frameworks, product development, industry trends, and emerging opportunities, this report equips industry stakeholders with actionable intelligence for strategic decision-making. Key players such as GE Renewable Energy, Xinjiang Goldwind Science & Technology Co Ltd, Siemens Gamesa Renewable Energy SA, Ming Yang Smart Energy Group Ltd, Envision Group, Suzlon Energy Ltd, Vestas Wind Systems AS, Hann-Ocean Energy, Nordex SE, and Mitsubishi Heavy Industries Ltd are thoroughly analyzed. This report is designed for immediate use without further modification.

Asia-Pacific Offshore Energy Market Market Concentration & Innovation

The Asia-Pacific offshore energy market exhibits a moderate to high level of concentration, particularly within the offshore wind segment, which dominates the overall market. Leading companies like Siemens Gamesa Renewable Energy SA and Ming Yang Smart Energy Group Ltd hold significant market share, driven by substantial investments in R&D and large-scale project deployments. Innovation is a key differentiator, with a strong emphasis on developing more efficient wind turbine technologies, advanced foundation designs, and sophisticated grid integration solutions. Regulatory frameworks across the region are increasingly supportive, with governments introducing favorable policies, subsidies, and streamlined permitting processes to encourage offshore energy development. For instance, the declaration of Australia's first offshore wind zone signifies a proactive regulatory push. Product substitutes, while nascent for wave and tidal energy, are primarily traditional fossil fuels, but the cost-competitiveness and environmental benefits of offshore renewables are rapidly diminishing their appeal. End-user trends indicate a strong preference for clean energy solutions, driven by climate change concerns and energy security objectives. Mergers and acquisitions (M&A) activities are expected to increase as companies seek to consolidate market positions, acquire new technologies, and expand their geographical reach. Deal values are projected to rise as larger projects and technological advancements demand significant capital investment.

Asia-Pacific Offshore Energy Market Industry Trends & Insights

The Asia-Pacific offshore energy market is experiencing a period of accelerated growth, fueled by a confluence of favorable industry trends and critical insights. The primary growth driver remains the escalating demand for clean and sustainable energy sources, exacerbated by the region's rapidly expanding economies and increasing energy consumption. Government policies and ambitious renewable energy targets set by nations such as China, Japan, and South Korea are instrumental in this expansion, providing significant incentives and regulatory support for offshore projects. Technological disruptions are at the forefront, with continuous advancements in offshore wind turbine technology leading to larger, more efficient turbines capable of harnessing stronger winds at greater depths. Innovations in floating offshore wind platforms are unlocking vast potential in deeper waters previously inaccessible. The market penetration of offshore wind is projected to surge, with an estimated Compound Annual Growth Rate (CAGR) of over 15% during the forecast period. Consumer preferences are shifting decisively towards greener energy portfolios, with a growing awareness of environmental impact and a willingness to support sustainable initiatives. The competitive dynamics are intensifying, with established global players vying for market share against emerging regional champions, leading to innovation and price optimization. The development of robust supply chains, including specialized vessel manufacturing and skilled labor, is becoming increasingly crucial for successful project execution. Furthermore, the integration of smart grid technologies and energy storage solutions is enhancing the reliability and efficiency of offshore energy, making it a more attractive proposition for grid operators and end-users alike. The trend towards larger, multi-gigawatt projects is also notable, promising economies of scale and accelerated deployment.

Dominant Markets & Segments in Asia-Pacific Offshore Energy Market

The offshore wind energy segment is undeniably the dominant force within the Asia-Pacific offshore energy market, driven by significant investments, established technological maturity, and strong governmental support.

Dominant Technology: Wind Energy

- Key Drivers: Supportive government policies and targets for renewable energy deployment, substantial investments from utilities and independent power producers, technological advancements in turbine size and efficiency, and the availability of suitable offshore locations.

- Dominance Analysis: China stands as the undisputed leader in installed offshore wind capacity, with ambitious expansion plans that continue to shape the global market. Japan and South Korea are rapidly emerging as significant players, actively developing their offshore wind resources with substantial project pipelines. Taiwan has also made notable strides, establishing itself as a key market for offshore wind development. The technological advancements in fixed-bottom and floating offshore wind turbines have significantly reduced costs and expanded the deployable areas, making wind energy the most viable and scalable offshore energy technology in the region.

Dominant Geography: China

- Key Drivers: Enormous domestic energy demand, strong government commitment to decarbonization and energy independence, extensive coastline with favorable wind resources, and a well-developed industrial base capable of manufacturing key components.

- Dominance Analysis: China's sheer scale of deployment and its rapid pace of development have positioned it as the leading market. The country has consistently led in annual installations and cumulative capacity, often surpassing the rest of the world combined. Favorable economic policies, including feed-in tariffs and auction mechanisms, coupled with substantial investments in port infrastructure and grid connections, have created an unparalleled environment for offshore wind growth.

Emerging and Niche Segments:

- Wave Energy: While still in its nascent stages, wave energy holds significant potential, particularly in countries with extensive coastlines and strong wave resources. Early-stage research and development are ongoing, with pilot projects exploring its viability.

- Tidal Stream: Countries like South Korea and Japan, with strong tidal currents, are exploring tidal stream energy. The predictable nature of tidal power makes it an attractive option, though technological challenges and high installation costs remain hurdles.

- Ocean Thermal Energy Conversion (OTEC): OTEC technology has potential in tropical and subtropical regions of the Asia-Pacific, such as Southeast Asian nations. However, its widespread adoption is hindered by high capital costs and the need for specific geographical conditions.

- Rest of Asia-Pacific: This segment encompasses countries like Vietnam, the Philippines, and Thailand, which possess considerable untapped offshore wind potential. While currently less developed than the leading nations, these markets are poised for significant future growth as policies mature and investments increase. Vietnam, in particular, is attracting substantial interest for its offshore wind capabilities.

Asia-Pacific Offshore Energy Market Product Developments

Product developments in the Asia-Pacific offshore energy market are primarily concentrated within the wind energy sector, focusing on enhancing turbine efficiency and reliability. Innovations include the development of larger rotor diameters, advanced blade designs for optimized aerodynamics, and more robust foundation structures for deeper waters and harsher marine environments. The emergence of floating offshore wind platforms is a significant technological leap, enabling deployment in areas previously unsuitable for fixed-bottom turbines. These platforms offer competitive advantages by expanding the accessible resource potential and reducing reliance on specific seabed conditions. Furthermore, advancements in predictive maintenance technologies, utilizing artificial intelligence and IoT sensors, are improving operational uptime and reducing maintenance costs, thereby enhancing the overall market fit and economic viability of offshore energy projects.

Report Scope & Segmentation Analysis

The "Asia-Pacific Offshore Energy Market" report encompasses a comprehensive analysis of the market's landscape, segmented by technology and geography. The technological segmentation includes Wind Energy, Wave Energy, Tidal Stream, Ocean Thermal Energy Conversion (OTEC), and Other Technologies. Wind energy is expected to dominate the market throughout the forecast period due to its maturity and significant investment. Wave and tidal stream energy, while representing smaller market shares, are projected to witness steady growth as technologies mature and costs decrease. OTEC is a niche segment with potential in specific geographical zones. The geographical segmentation covers China, Taiwan, South Korea, Japan, Vietnam, and the Rest of Asia-Pacific. China is anticipated to lead in terms of market size and growth due to its aggressive renewable energy targets. Japan and South Korea are expected to show substantial growth, driven by strong government support and technological innovation. Vietnam and other developing economies in the Rest of Asia-Pacific represent high-growth potential markets as their offshore energy sectors mature.

Key Drivers of Asia-Pacific Offshore Energy Market Growth

The Asia-Pacific offshore energy market is propelled by several interconnected drivers. Foremost is the urgent global and regional imperative to transition towards cleaner energy sources, driven by climate change mitigation goals and the need for energy security. Supportive government policies, including ambitious renewable energy targets, subsidies, and favorable regulatory frameworks, are critical in de-risking investments and stimulating project development. Technological advancements, particularly in offshore wind turbine technology and floating platforms, are continuously improving efficiency and reducing costs, making offshore energy increasingly competitive. Economic factors, such as the declining cost of renewable energy technologies and the potential for job creation and local economic development, further bolster growth. The increasing demand for electricity in rapidly industrializing nations within the region also necessitates the expansion of power generation capacity, with offshore energy offering a sustainable solution.

Challenges in the Asia-Pacific Offshore Energy Market Sector

Despite its promising trajectory, the Asia-Pacific offshore energy market faces several significant challenges. High upfront capital investment remains a substantial barrier, requiring substantial financial commitments for project development. The complex and often lengthy permitting processes and regulatory hurdles in some countries can lead to project delays and increased costs. Supply chain constraints, including the availability of specialized vessels, skilled labor, and manufacturing capacity for key components, can hinder rapid deployment. Grid integration challenges, particularly for large-scale offshore projects connecting to the onshore grid, require significant infrastructure upgrades. Environmental concerns and stakeholder engagement, such as managing potential impacts on marine ecosystems and engaging with fishing communities, need careful consideration and proactive management to ensure social license to operate. Furthermore, the intermittency of renewable energy sources necessitates robust energy storage solutions and grid management strategies.

Emerging Opportunities in Asia-Pacific Offshore Energy Market

The Asia-Pacific offshore energy market is ripe with emerging opportunities. The expansion of floating offshore wind technology opens up vast untapped wind resources in deeper waters, significantly increasing the deployable capacity. The development of integrated energy systems, combining offshore wind with green hydrogen production, offers a pathway to decarbonize heavy industries and transportation sectors. The growing demand for energy storage solutions, such as battery storage and pumped hydro, to complement intermittent renewable generation presents another significant opportunity. Furthermore, the increasing focus on offshore wind decommissioning and recycling technologies creates a new market for specialized services and innovative solutions. Emerging markets within the "Rest of Asia-Pacific" region, such as Vietnam and the Philippines, represent substantial untapped potential as their policy frameworks mature and investments begin to flow.

Leading Players in the Asia-Pacific Offshore Energy Market Market

- GE Renewable Energy

- Xinjiang Goldwind Science & Technology Co Ltd

- Siemens Gamesa Renewable Energy SA

- Ming Yang Smart Energy Group Ltd

- Envision Group

- Suzlon Energy Ltd

- Vestas Wind Systems AS

- Hann-Ocean Energy

- Nordex SE

- Mitsubishi Heavy Industries Ltd

Key Developments in Asia-Pacific Offshore Energy Market Industry

- August 2022: Australia's federal government declared its first offshore wind zone, providing a green light for developers to commence planning and consultations for wind farms. The initial zone is slated for establishment off the coast of Gippsland, Victoria, with other areas like Hunter Valley, Illawarra, Portland (Victoria), Northern Tasmania, Perth, and Bunbury (Western Australia) to follow.

- June 2022: The Union Minister for Power and New & Renewable Energy announced comprehensive transmission plans for offshore wind energy projects in India. These plans encompass essential transmission and evacuation infrastructure for 10 GW of offshore wind capacity off Gujarat and Tamil Nadu. A decision was made to bid out offshore wind energy blocks equivalent to 4.0 GW per year for three years starting FY 22-23 for development off the coasts of Tamil Nadu and Gujarat, with power sales through open access, captive, bi-lateral third-party, and merchant sales. Subsequently, 5 GW capacity projects will be awarded annually until FY 29-30. Projects bid out in the first two years (8 GW total) will also benefit from carbon credits.

Strategic Outlook for Asia-Pacific Offshore Energy Market Market

The strategic outlook for the Asia-Pacific offshore energy market remains exceptionally positive, driven by a powerful combination of policy support, technological advancements, and growing market demand. The continued decline in the levelized cost of energy (LCOE) for offshore wind, coupled with the expansion of floating wind capabilities, is set to unlock unprecedented growth potential across the region. Governments are expected to further refine regulatory frameworks and streamline permitting processes, reducing project development timelines and attracting greater investment. The burgeoning market for offshore renewable energy is anticipated to foster innovation in areas such as advanced materials, digital solutions for asset management, and integration with emerging energy carriers like green hydrogen. Strategic collaborations and partnerships between international and regional players will be crucial for navigating market complexities and scaling up deployment. The Asia-Pacific region is poised to solidify its position as a global leader in offshore energy development, contributing significantly to the world's clean energy transition and sustainable economic growth.

Asia-Pacific Offshore Energy Market Segmentation

-

1. Technology

- 1.1. Wind Energy

- 1.2. Wave Energy

- 1.3. Tidal Stream

- 1.4. Ocean Thermal Energy Conversion (OTEC)

- 1.5. Other Technologies

-

2. Geography

- 2.1. China

- 2.2. Taiwan

- 2.3. South Korea

- 2.4. Japan

- 2.5. Vietnam

- 2.6. Rest of Asia-Pacific

Asia-Pacific Offshore Energy Market Segmentation By Geography

- 1. China

- 2. Taiwan

- 3. South Korea

- 4. Japan

- 5. Vietnam

- 6. Rest of Asia Pacific

Asia-Pacific Offshore Energy Market Regional Market Share

Geographic Coverage of Asia-Pacific Offshore Energy Market

Asia-Pacific Offshore Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Wind Energy Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Wind Energy

- 5.1.2. Wave Energy

- 5.1.3. Tidal Stream

- 5.1.4. Ocean Thermal Energy Conversion (OTEC)

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Taiwan

- 5.2.3. South Korea

- 5.2.4. Japan

- 5.2.5. Vietnam

- 5.2.6. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Taiwan

- 5.3.3. South Korea

- 5.3.4. Japan

- 5.3.5. Vietnam

- 5.3.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. China Asia-Pacific Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Wind Energy

- 6.1.2. Wave Energy

- 6.1.3. Tidal Stream

- 6.1.4. Ocean Thermal Energy Conversion (OTEC)

- 6.1.5. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Taiwan

- 6.2.3. South Korea

- 6.2.4. Japan

- 6.2.5. Vietnam

- 6.2.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Taiwan Asia-Pacific Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Wind Energy

- 7.1.2. Wave Energy

- 7.1.3. Tidal Stream

- 7.1.4. Ocean Thermal Energy Conversion (OTEC)

- 7.1.5. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Taiwan

- 7.2.3. South Korea

- 7.2.4. Japan

- 7.2.5. Vietnam

- 7.2.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. South Korea Asia-Pacific Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Wind Energy

- 8.1.2. Wave Energy

- 8.1.3. Tidal Stream

- 8.1.4. Ocean Thermal Energy Conversion (OTEC)

- 8.1.5. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Taiwan

- 8.2.3. South Korea

- 8.2.4. Japan

- 8.2.5. Vietnam

- 8.2.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Japan Asia-Pacific Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Wind Energy

- 9.1.2. Wave Energy

- 9.1.3. Tidal Stream

- 9.1.4. Ocean Thermal Energy Conversion (OTEC)

- 9.1.5. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Taiwan

- 9.2.3. South Korea

- 9.2.4. Japan

- 9.2.5. Vietnam

- 9.2.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Vietnam Asia-Pacific Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Wind Energy

- 10.1.2. Wave Energy

- 10.1.3. Tidal Stream

- 10.1.4. Ocean Thermal Energy Conversion (OTEC)

- 10.1.5. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. Taiwan

- 10.2.3. South Korea

- 10.2.4. Japan

- 10.2.5. Vietnam

- 10.2.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Rest of Asia Pacific Asia-Pacific Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Wind Energy

- 11.1.2. Wave Energy

- 11.1.3. Tidal Stream

- 11.1.4. Ocean Thermal Energy Conversion (OTEC)

- 11.1.5. Other Technologies

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. Taiwan

- 11.2.3. South Korea

- 11.2.4. Japan

- 11.2.5. Vietnam

- 11.2.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 GE Renewable Energy*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Xinjiang Goldwind Science & Technology Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Siemens Gamesa Renewable Energy SA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ming Yang Smart Energy Group Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Envision Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Suzlon Energy Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Vestas Wind Systems AS

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Hann-Ocean Energy

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nordex SE

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Mitsubishi Heavy Industries Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 GE Renewable Energy*List Not Exhaustive

List of Figures

- Figure 1: Asia-Pacific Offshore Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Offshore Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Technology 2020 & 2033

- Table 3: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Technology 2020 & 2033

- Table 9: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 11: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Technology 2020 & 2033

- Table 15: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 17: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 20: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Technology 2020 & 2033

- Table 21: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 26: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Technology 2020 & 2033

- Table 27: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 29: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 32: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Technology 2020 & 2033

- Table 33: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 34: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 35: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

- Table 37: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 38: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Technology 2020 & 2033

- Table 39: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 40: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 41: Asia-Pacific Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Asia-Pacific Offshore Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Offshore Energy Market?

The projected CAGR is approximately 13.1%.

2. Which companies are prominent players in the Asia-Pacific Offshore Energy Market?

Key companies in the market include GE Renewable Energy*List Not Exhaustive, Xinjiang Goldwind Science & Technology Co Ltd, Siemens Gamesa Renewable Energy SA, Ming Yang Smart Energy Group Ltd, Envision Group, Suzlon Energy Ltd, Vestas Wind Systems AS, Hann-Ocean Energy, Nordex SE, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Asia-Pacific Offshore Energy Market?

The market segments include Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.07 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Wind Energy Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

August 2022: It has been announced that the first offshore wind zone in Australia has been declared by the federal government, giving developers the green light to increase planning and consultation for wind farms. The first offshore wind zone is expected to be established off the coast of Gippsland, in Victoria's southeast, with Hunter Valley and Illawarra, Portland in Victoria, Northern Tasmania, Perth in Western Australia, Bunbury in Western Australia, and other areas to follow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Offshore Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Offshore Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Offshore Energy Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Offshore Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence