Key Insights

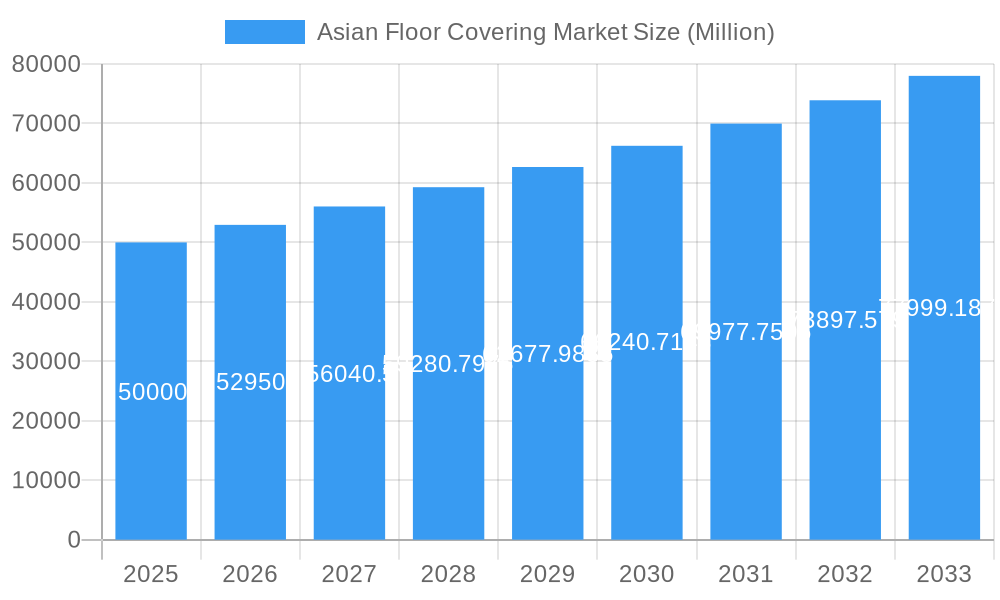

The Asian Floor Covering Market is projected for robust expansion, with an estimated market size of approximately USD 50,000 million in 2025, growing at a Compound Annual Growth Rate (CAGR) of 5.90% through 2033. This growth is propelled by a confluence of factors, including increasing urbanization, rising disposable incomes, and a burgeoning construction sector across the region. The demand for aesthetically pleasing and durable flooring solutions is on the rise in both residential and commercial spaces. Key drivers include significant infrastructure development, a growing emphasis on interior design and home renovation, and the increasing adoption of advanced manufacturing techniques that enhance product quality and variety. The market is witnessing a shift towards sustainable and eco-friendly flooring options, aligning with global environmental consciousness.

Asian Floor Covering Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape. In terms of materials, while traditional options like Ceramic Floor and Wall Tile and Vinyl sheet and Floor Tile hold significant shares, there's a notable surge in demand for Wood Flooring and Carpet and Area Rugs, reflecting evolving consumer preferences for comfort and aesthetics. The Commercial segment is a significant revenue generator, driven by the expansion of retail spaces, hospitality, and corporate offices. However, the Residential Replacement sector is expected to witness considerable growth as homeowners invest in upgrading their living spaces. Distribution channels are diverse, with Contractors and Specialty Stores playing crucial roles in reaching end-users, complemented by the growing influence of Home Centers and online platforms. Major players like TOLI Corporation, DAIKEN Corporation, and Welspun Flooring are actively expanding their presence and product portfolios to capture this growing market.

Asian Floor Covering Market Company Market Share

This in-depth report provides a comprehensive analysis of the Asian Floor Covering Market, offering critical insights into market dynamics, growth trajectories, and competitive landscapes. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for industry stakeholders seeking to understand and capitalize on the evolving opportunities within this dynamic sector. We delve into market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities, alongside industry trends, dominant markets, and product developments. With detailed segmentation across materials, distribution channels, and end-users, this report equips you with actionable intelligence for strategic decision-making.

Asian Floor Covering Market Market Concentration & Innovation

The Asian Floor Covering Market exhibits a moderate level of market concentration, with a few key players holding significant market shares, particularly in the ceramic and vinyl segments. For instance, Asia-Pacific Ceramic is estimated to hold a market share of approximately 18% in the ceramic floor and wall tile segment. Innovation is a key differentiator, driven by advancements in material science, sustainable manufacturing processes, and smart flooring technologies. The development of eco-friendly materials like recycled vinyl and bamboo flooring is gaining traction, responding to growing environmental consciousness. Regulatory frameworks, while varying across countries, are increasingly focused on safety standards, fire retardancy, and emissions, influencing product development and market entry strategies. Product substitutes, such as the increasing adoption of resilient flooring options over traditional materials, are also reshaping market dynamics. End-user trends are shifting towards personalized aesthetics, durability, and ease of maintenance, with significant demand from the growing middle-class population. Mergers and acquisitions (M&A) activities, though not as prevalent as in more mature markets, are occurring as larger players seek to expand their product portfolios and geographical reach. For example, a recent M&A deal in the wood flooring sector was valued at approximately $75 Million, indicating strategic consolidation efforts.

Asian Floor Covering Market Industry Trends & Insights

The Asian Floor Covering Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. This expansion is primarily fueled by rapid urbanization, increasing disposable incomes, and a burgeoning construction industry across key economies like China, India, and Southeast Asian nations. Technological disruptions are playing a pivotal role, with innovations in manufacturing enabling the production of more durable, aesthetically pleasing, and cost-effective flooring solutions. For example, advancements in digital printing technology for ceramic tiles allow for an unprecedented variety of designs, mimicking natural materials like wood and stone with remarkable realism. The market penetration of luxury vinyl tile (LVT) and laminate flooring is steadily increasing, offering a compelling blend of affordability and performance. Consumer preferences are increasingly leaning towards sustainable and eco-friendly options, driving demand for products made from recycled materials or renewable resources. Furthermore, the demand for enhanced functionality, such as scratch resistance, water resistance, and antimicrobial properties, is growing, particularly in high-traffic commercial and residential spaces. Competitive dynamics are intensifying, with both domestic and international players vying for market share. Strategies like product differentiation, aggressive marketing campaigns, and expansion of distribution networks are common. The growing influence of e-commerce platforms is also transforming how consumers discover and purchase flooring, creating new avenues for sales and marketing. The increasing adoption of smart home technologies is also influencing product development, with some manufacturers exploring integrated solutions for climate control or air purification within flooring systems. The overall market penetration for floor coverings in Asia, while growing, still has significant room for expansion, especially in developing economies.

Dominant Markets & Segments in Asian Floor Covering Market

The Non Resilient Flooring segment, particularly Ceramic Floor and Wall Tile, currently dominates the Asian Floor Covering Market, driven by its widespread adoption in residential and commercial construction due to its durability, aesthetic versatility, and relatively low cost. China stands out as the leading country, accounting for an estimated 45% of the total market revenue, fueled by its massive domestic construction industry and significant export volumes.

Key Drivers for Dominance:

- Economic Policies and Infrastructure Development: Government investments in infrastructure projects, affordable housing initiatives, and favorable industrial policies in countries like China and India have significantly boosted the construction sector, directly impacting flooring demand.

- Cost-Effectiveness and Durability: Ceramic tiles offer a superior balance of cost, durability, and design flexibility, making them a preferred choice for a wide range of applications.

- Consumer Preferences: The aesthetic appeal and low maintenance of ceramic and porcelain tiles align with the preferences of a large segment of the Asian population.

- Technological Advancements: Continuous innovation in ceramic tile manufacturing, including digital printing and advanced glazing techniques, allows for a vast array of designs and textures, catering to diverse design trends.

Within the Material segmentation:

- Ceramic Floor and Wall Tile: Expected to maintain its leading position, driven by ongoing residential renovations and new commercial projects.

- Wood Flooring: Gaining traction, particularly engineered wood, due to its premium appeal and increasing affordability for mid-range housing.

- Laminate Flooring: Continues to be a popular choice for budget-conscious consumers seeking wood-like aesthetics.

- Vinyl sheet and Floor Tile: Witnessing substantial growth due to its water resistance, durability, and ease of installation, making it ideal for kitchens, bathrooms, and high-traffic commercial areas.

In terms of Distribution Channel:

- Contractors are the dominant channel, serving as the primary interface for large-scale residential and commercial projects.

- Specialty Stores cater to a discerning clientele seeking premium and bespoke flooring solutions.

- Home Centers are increasingly important for DIY consumers and smaller renovation projects.

For End-User:

- Residential Replacement and Builder segments collectively represent the largest share, driven by new housing construction and renovation activities.

- Commercial applications, including offices, retail spaces, hospitality, and healthcare facilities, are also significant growth areas, demanding performance-oriented flooring solutions.

Asian Floor Covering Market Product Developments

Product innovations in the Asian Floor Covering Market are increasingly focused on sustainability, enhanced performance, and aesthetic versatility. Manufacturers are developing eco-friendly flooring options, such as carpets made from recycled plastics and wood flooring sourced from sustainably managed forests. Advancements in vinyl flooring technology have led to the introduction of highly durable, waterproof, and scratch-resistant LVT and SPC (Stone Plastic Composite) products that mimic the look and feel of natural materials. Smart flooring solutions are also emerging, with some products incorporating antimicrobial properties or enhanced thermal insulation. These developments are driven by a growing consumer demand for healthier, more durable, and aesthetically pleasing living and working environments, offering competitive advantages through superior functionality and design appeal.

Report Scope & Segmentation Analysis

This report meticulously segments the Asian Floor Covering Market across key dimensions. The Material segmentation includes Carpet and Area Rugs, Non Resilient Flooring (encompassing Wood Flooring, Ceramic Floor and Wall Tile, Laminate Flooring, and Stone Flooring), Vinyl sheet and Floor Tile, and Other Resilient Flooring. Growth projections within these material segments are influenced by their respective performance characteristics, price points, and consumer trends. The Distribution Channel segmentation analyzes Contractors, Specialty Stores, Home Centers, and Others, with Contractors expected to maintain a significant share due to project-based sales. The End-User segmentation focuses on Residential Replacement, Commercial, and Builder segments, with each exhibiting unique demand drivers and growth trajectories. The Commercial segment, for instance, is anticipated to witness strong growth owing to increased infrastructure development and demand for specialized flooring solutions.

Key Drivers of Asian Floor Covering Market Growth

The Asian Floor Covering Market's growth is propelled by several key factors. Rapid urbanization and a growing middle class across Asia are fueling demand for new residential and commercial construction. Significant government investments in infrastructure development, including housing projects and public facilities, further boost the sector. Technological advancements in manufacturing processes are leading to the production of more durable, aesthetically diverse, and cost-effective flooring solutions. The increasing awareness and preference for sustainable and eco-friendly building materials are also driving the adoption of environmentally conscious flooring options. Furthermore, rising disposable incomes are enabling consumers to invest more in home improvements and renovations, contributing to market expansion.

Challenges in the Asian Floor Covering Market Sector

Despite the positive growth trajectory, the Asian Floor Covering Market faces several challenges. Fluctuations in raw material prices, particularly for wood, ceramic, and petroleum-based products, can impact manufacturing costs and profitability. Intense competition from both domestic and international players can lead to price wars and pressure on profit margins. Varying regulatory standards and complex import/export procedures across different Asian countries can create trade barriers and logistical hurdles. Supply chain disruptions, exacerbated by geopolitical factors and transportation challenges, can affect the availability and timely delivery of materials. Moreover, counterfeit products and quality control issues in some regions can damage brand reputation and consumer trust.

Emerging Opportunities in Asian Floor Covering Market

Emerging opportunities in the Asian Floor Covering Market lie in the growing demand for sustainable and luxury flooring solutions. The increasing popularity of LVT, SPC, and engineered wood flooring presents significant growth avenues. The expansion of e-commerce platforms offers new channels for reaching a wider customer base and driving sales, especially for niche and specialty products. The development of smart flooring technologies, integrating features like underfloor heating or antimicrobial coatings, caters to evolving consumer needs for comfort and hygiene. Furthermore, untapped markets in developing Asian economies, coupled with government initiatives promoting affordable housing and urban development, present substantial expansion opportunities for market players.

Leading Players in the Asian Floor Covering Market Market

- Asia-Pacific Ceramic

- TOLI Corporation

- CERA Sanitaryware Limited

- Welspun Flooring

- Flooring India Company

- Fujian Floors China Co Ltd

- DAIKEN Corporation

- Pergo

- Inovar Resources Sdn Bhd

- Hanhent International China Co Ltd

Key Developments in Asian Floor Covering Market Industry

- 2024 Q1: Fujian Floors China Co Ltd announced the launch of a new range of eco-friendly laminate flooring, incorporating recycled materials.

- 2023 Q4: TOLI Corporation expanded its production capacity for high-performance vinyl flooring in Southeast Asia to meet growing regional demand.

- 2023 Q3: Welspun Flooring invested in advanced digital printing technology to enhance the customization options for its carpet and area rug offerings.

- 2022 Q2: CERA Sanitaryware Limited acquired a smaller competitor specializing in ceramic tile manufacturing to broaden its product portfolio.

- 2021 Q1: DAIKEN Corporation focused on research and development for advanced wood flooring treatments, enhancing durability and water resistance.

Strategic Outlook for Asian Floor Covering Market Market

The strategic outlook for the Asian Floor Covering Market is characterized by sustained growth and innovation. Key growth catalysts include the continued expansion of the construction industry, driven by urbanization and government initiatives. Manufacturers focusing on sustainable product development, advanced material technologies, and catering to evolving consumer preferences for aesthetics and functionality will likely gain a competitive edge. Expanding distribution networks, particularly through online channels and partnerships, will be crucial for market penetration. Strategic collaborations and potential acquisitions will further shape the competitive landscape, enabling companies to broaden their product offerings and geographic reach, capitalizing on the vast untapped potential within this dynamic market.

Asian Floor Covering Market Segmentation

-

1. Material

- 1.1. Carpet and Area Rugs

-

1.2. Non Resilient Flooring

- 1.2.1. Wood Flooring

- 1.2.2. Ceramic Floor and Wall Tile

- 1.2.3. Laminate Flooring

- 1.2.4. Stone Flooring

- 1.3. Vinyl sheet and Floor Tile

- 1.4. Other Resilient Flooring

-

2. Distribution Channel

- 2.1. Contractors

- 2.2. Specialty Stores

- 2.3. Home Centers

- 2.4. Others

-

3. End-User

- 3.1. Residential Replacement

- 3.2. Commercial

- 3.3. Builder

Asian Floor Covering Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asian Floor Covering Market Regional Market Share

Geographic Coverage of Asian Floor Covering Market

Asian Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government-led housing initiatives and infrastructure development projects across Asia are boosting demand for floor coverings. Affordable housing schemes and smart city projects are particularly influential.

- 3.3. Market Restrains

- 3.3.1 In many Asian markets

- 3.3.2 consumers are highly price-sensitive

- 3.3.3 which can limit the adoption of premium or high-end floor coverings. Economic fluctuations and inflation can also affect purchasing decisions

- 3.4. Market Trends

- 3.4.1 There is a growing demand for sustainable and eco-friendly flooring options in Asia. Consumers are increasingly seeking products made from recycled materials

- 3.4.2 sustainably sourced wood

- 3.4.3 and low-VOC (volatile organic compounds) products. Bamboo and cork flooring are examples of sustainable choices gaining popularity.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asian Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Carpet and Area Rugs

- 5.1.2. Non Resilient Flooring

- 5.1.2.1. Wood Flooring

- 5.1.2.2. Ceramic Floor and Wall Tile

- 5.1.2.3. Laminate Flooring

- 5.1.2.4. Stone Flooring

- 5.1.3. Vinyl sheet and Floor Tile

- 5.1.4. Other Resilient Flooring

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Contractors

- 5.2.2. Specialty Stores

- 5.2.3. Home Centers

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential Replacement

- 5.3.2. Commercial

- 5.3.3. Builder

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Asia-Pacific Ceramic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TOLI Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CERA Sanitaryware Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 6 COMPANY PROFILES

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Welspun Flooring

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flooring India Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fujian Floors China Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DAIKEN Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pergo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Inovar Resources Sdn Bhd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hanhent International China Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Asia-Pacific Ceramic

List of Figures

- Figure 1: Asian Floor Covering Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asian Floor Covering Market Share (%) by Company 2025

List of Tables

- Table 1: Asian Floor Covering Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Asian Floor Covering Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asian Floor Covering Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 4: Asian Floor Covering Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asian Floor Covering Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 6: Asian Floor Covering Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asian Floor Covering Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 8: Asian Floor Covering Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Japan Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Bangladesh Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Pakistan Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Floor Covering Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Asian Floor Covering Market?

Key companies in the market include Asia-Pacific Ceramic, TOLI Corporation, CERA Sanitaryware Limited, 6 COMPANY PROFILES, Welspun Flooring, Flooring India Company, Fujian Floors China Co Ltd, DAIKEN Corporation, Pergo, Inovar Resources Sdn Bhd, Hanhent International China Co Ltd.

3. What are the main segments of the Asian Floor Covering Market?

The market segments include Material, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Government-led housing initiatives and infrastructure development projects across Asia are boosting demand for floor coverings. Affordable housing schemes and smart city projects are particularly influential..

6. What are the notable trends driving market growth?

There is a growing demand for sustainable and eco-friendly flooring options in Asia. Consumers are increasingly seeking products made from recycled materials. sustainably sourced wood. and low-VOC (volatile organic compounds) products. Bamboo and cork flooring are examples of sustainable choices gaining popularity..

7. Are there any restraints impacting market growth?

In many Asian markets. consumers are highly price-sensitive. which can limit the adoption of premium or high-end floor coverings. Economic fluctuations and inflation can also affect purchasing decisions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Floor Covering Market?

To stay informed about further developments, trends, and reports in the Asian Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence