Key Insights

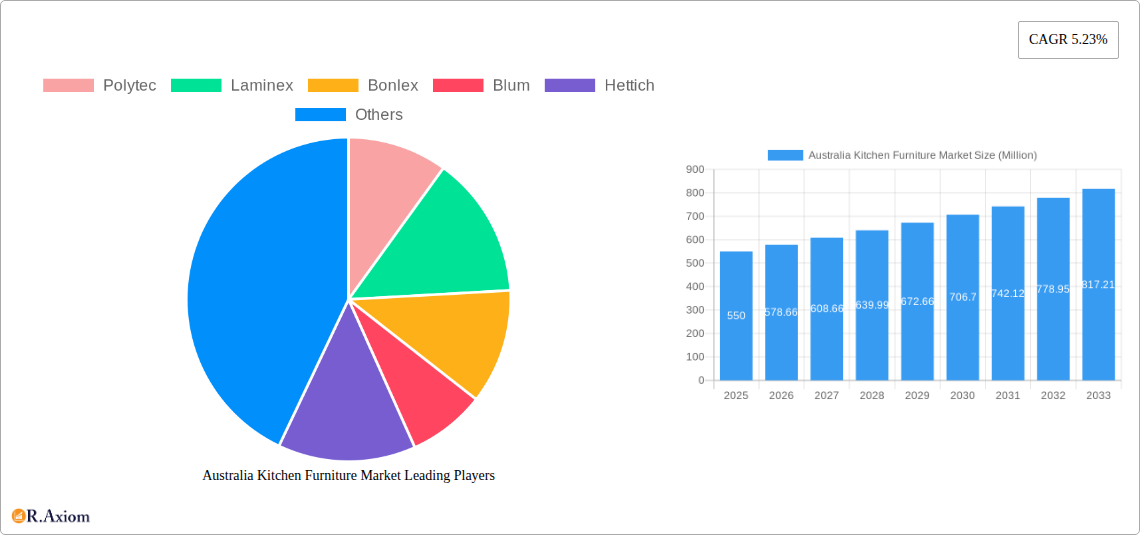

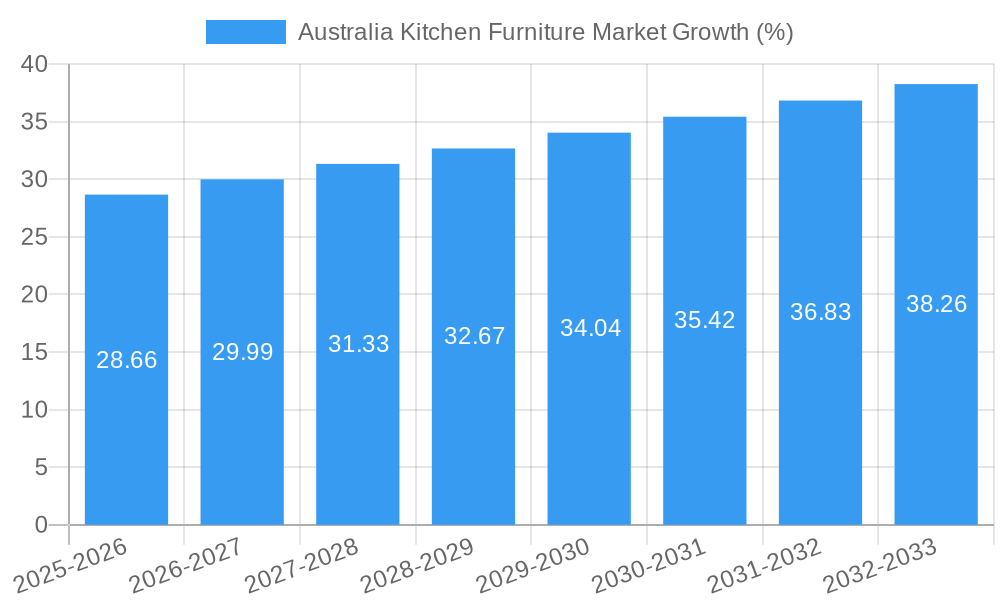

The Australian kitchen furniture market, valued at $0.55 billion in 2025, is projected to experience robust growth, driven by a rising preference for modern kitchen designs, increasing disposable incomes among Australian households, and a surge in home renovations. The market's Compound Annual Growth Rate (CAGR) of 5.23% from 2025 to 2033 indicates a steady expansion, with significant opportunities across various segments. The residential sector constitutes the largest end-user segment, fueled by the growth of the housing market and a preference for aesthetically pleasing and functional kitchens. E-commerce channels are witnessing significant growth, reflecting changing consumer behavior and the convenience of online shopping, while specialty stores remain a crucial distribution channel, offering personalized service and high-quality products. Key players like Ikea and Winning Appliances are leveraging their brand recognition and established supply chains to maintain a strong market presence, while smaller companies focus on niche segments like custom-designed kitchen cabinets. Competition is expected to intensify as both established players and new entrants compete for market share. Factors such as fluctuating material costs and economic downturns may pose challenges to market growth.

The segmentation of the Australian kitchen furniture market offers diverse opportunities. Kitchen cabinets command the largest share within the furniture type segment, while supermarkets and hypermarkets dominate distribution channels in terms of volume, although specialty stores and e-commerce platforms capture higher average order values and profit margins. The commercial segment, encompassing restaurants and cafes, is expected to see moderate growth, particularly as businesses invest in upgrading their facilities and enhancing customer experiences. Further market penetration is anticipated in regional areas, owing to increased urbanization and rising construction activities in outer suburban areas. The increasing focus on sustainable and eco-friendly materials is also reshaping market dynamics, driving demand for products with sustainable sourcing and manufacturing practices. This will require suppliers to invest in innovative materials and manufacturing methods.

Australia Kitchen Furniture Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Australian kitchen furniture market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report leverages rigorous research methodologies to forecast market trends and growth from 2025 to 2033. Market values are expressed in Millions.

Australia Kitchen Furniture Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, regulatory influences, and market dynamics within the Australian kitchen furniture market. The market exhibits a moderately concentrated structure, with key players such as Polytec, Laminex, and Blum holding significant market share. However, the presence of numerous smaller players and the continuous entry of new businesses maintains a level of competition. The market share of the top three players is estimated at xx%.

Innovation Drivers:

- Technological advancements in materials (e.g., sustainable materials, smart kitchen technologies)

- Design innovation focused on ergonomics, aesthetics, and space optimization

- Growing demand for customized and personalized kitchen solutions

Regulatory Framework:

Australian building codes and safety standards significantly influence product design and manufacturing. Changes in these regulations can impact market dynamics.

Product Substitutes:

While there aren't direct substitutes for kitchen furniture, the market faces indirect competition from alternative kitchen solutions, such as modular kitchens and ready-to-assemble (RTA) options.

End-User Trends:

The increasing preference for open-plan living and contemporary kitchen designs fuels demand for stylish and functional kitchen furniture. The rising popularity of smart home technology also presents growth opportunities.

M&A Activities:

The Australian kitchen furniture market has witnessed a moderate level of merger and acquisition activity in recent years, with deal values ranging from xx Million to xx Million. These activities are mainly driven by companies seeking to expand their market reach and product portfolios.

Australia Kitchen Furniture Market Industry Trends & Insights

The Australian kitchen furniture market is experiencing robust growth, driven by several key factors. Rising disposable incomes, increasing urbanization, and a growing preference for home renovations and upgrades are key contributors to market expansion. The market is also witnessing technological disruptions, with the integration of smart appliances and sustainable materials gaining traction. Consumer preferences are shifting towards customized, high-quality, and aesthetically pleasing kitchen furniture. The competitive landscape is characterized by intense rivalry among established players and emerging businesses.

The Compound Annual Growth Rate (CAGR) for the market during the forecast period (2025-2033) is projected at xx%, indicating substantial growth potential. Market penetration of smart kitchen features is currently at xx% and is expected to reach xx% by 2033.

Dominant Markets & Segments in Australia Kitchen Furniture Market

The residential segment dominates the Australian kitchen furniture market, driven by a surge in home construction and renovation activities. Within furniture types, kitchen cabinets represent the largest segment, owing to their essential role in kitchen functionality. Specialty stores remain the primary distribution channel, offering consumers a wide selection and personalized service.

Key Drivers for Dominant Segments:

- Residential Segment: Rising disposable incomes, increased homeownership rates, and a preference for modern kitchens.

- Kitchen Cabinets Segment: Essential component of any kitchen, offering significant customization options.

- Specialty Stores Channel: Strong customer service, product demonstrations, and wider selection.

Dominance Analysis:

The significant market share of the residential segment is attributable to the substantial investment in home renovations and new constructions within Australia. The dominance of kitchen cabinets is due to their inherent necessity in any functional kitchen. Finally, specialty stores are favoured for their ability to provide personalized service and expert advice.

Australia Kitchen Furniture Market Product Developments

Recent product innovations focus on incorporating sustainable materials, ergonomic designs, and smart technology integrations. Manufacturers are emphasizing energy-efficient features and customization options to meet diverse consumer preferences. The market is witnessing a growing trend toward modular kitchen designs that allow for flexibility and adaptability. These developments are enhancing both the functionality and aesthetic appeal of kitchen furniture, thereby strengthening market competitiveness.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the Australian kitchen furniture market across several key parameters:

Furniture Type: Kitchen Cabinets, Kitchen Chairs, Kitchen Tables, Others (Each segment includes detailed market size, growth projections, and competitive landscape analysis).

Distribution Channel: Supermarkets and Hypermarkets, Specialty Stores, e-Commerce, Other Distribution Channels (Each segment includes analysis of sales volume, market share, and future growth potential).

End User: Residential, Commercial (Each segment encompasses analysis of market size, growth drivers, and competitive dynamics).

Key Drivers of Australia Kitchen Furniture Market Growth

Several key factors propel the growth of the Australian kitchen furniture market. These include the rising disposable incomes of Australian households, leading to increased spending on home improvements. Furthermore, the ongoing construction boom and the increasing prevalence of home renovations contribute significantly to market growth. Lastly, advancements in kitchen technology and design, incorporating eco-friendly materials and smart features, continue to fuel demand.

Challenges in the Australia Kitchen Furniture Market Sector

The Australian kitchen furniture market faces challenges such as fluctuating raw material prices, impacting production costs and profitability. Supply chain disruptions and skilled labor shortages also pose significant operational hurdles. Moreover, intense competition among numerous players, including both established brands and smaller businesses, creates pressure on pricing and margins.

Emerging Opportunities in Australia Kitchen Furniture Market

The increasing adoption of sustainable and eco-friendly materials presents significant opportunities for growth. The integration of smart technologies, such as automated storage and smart lighting, also opens new avenues for innovation and market expansion. Finally, a growing focus on customization and personalization offers significant potential for differentiation and competitive advantage.

Leading Players in the Australia Kitchen Furniture Market Market

Key Developments in Australia Kitchen Furniture Market Industry

- 2022 Q4: Laminex launched a new range of sustainable kitchen cabinet materials.

- 2023 Q1: Blum introduced innovative hinge technology enhancing kitchen cabinet functionality.

- 2023 Q2: Polytec partnered with a smart home technology provider to integrate smart features in kitchen cabinets. (Further developments to be added as they occur)

Strategic Outlook for Australia Kitchen Furniture Market Market

The Australian kitchen furniture market is poised for continued growth, driven by several positive factors. These include sustained economic growth, an ongoing focus on home renovations, and the adoption of innovative technologies in kitchen design. The market's increasing focus on sustainability and personalization presents a pathway towards even greater expansion in the future. Companies that prioritize innovation, sustainability, and customer-centric approaches are expected to thrive in this dynamic market.

Australia Kitchen Furniture Market Segmentation

-

1. Furniture Type

- 1.1. Kitchen Cabinets

- 1.2. Kitchen Chairs

- 1.3. Kitchen Tables

- 1.4. Others

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Specialty Stores

- 2.3. e-Commerce

- 2.4. Other Distribution Channels

-

3. End User

- 3.1. Residential

- 3.2. Commercial

Australia Kitchen Furniture Market Segmentation By Geography

- 1. Australia

Australia Kitchen Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Urban Expansion is Fueling Residential Construction

- 3.2.2 Spurring the Need for Furniture and Architectural Hardware; The Growth of Commercial Spaces like Offices and Hotels Bolsters the Demand for Furniture Hardware

- 3.3. Market Restrains

- 3.3.1 The Market's High Sensitivity to Prices is Impacting the Adoption of Premium Hardware Solutions; Ensuring Consistent Quality Across Diverse Products and Suppliers Poses Challenges

- 3.3.2 Impacting Customer Satisfaction and Brand Loyalty

- 3.4. Market Trends

- 3.4.1. Modern Kitchens

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Kitchen Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Furniture Type

- 5.1.1. Kitchen Cabinets

- 5.1.2. Kitchen Chairs

- 5.1.3. Kitchen Tables

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. e-Commerce

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Furniture Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Polytec

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Laminex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bonlex

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Blum

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hettich

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caesarstone

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Corian

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Others

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GOLDENHOMES

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ikea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Winning Appliances

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Polytec

List of Figures

- Figure 1: Australia Kitchen Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Kitchen Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Kitchen Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Kitchen Furniture Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia Kitchen Furniture Market Revenue Million Forecast, by Furniture Type 2019 & 2032

- Table 4: Australia Kitchen Furniture Market Volume K Unit Forecast, by Furniture Type 2019 & 2032

- Table 5: Australia Kitchen Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Australia Kitchen Furniture Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: Australia Kitchen Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Australia Kitchen Furniture Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Australia Kitchen Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Australia Kitchen Furniture Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Australia Kitchen Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Australia Kitchen Furniture Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Australia Kitchen Furniture Market Revenue Million Forecast, by Furniture Type 2019 & 2032

- Table 14: Australia Kitchen Furniture Market Volume K Unit Forecast, by Furniture Type 2019 & 2032

- Table 15: Australia Kitchen Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Australia Kitchen Furniture Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 17: Australia Kitchen Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Australia Kitchen Furniture Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 19: Australia Kitchen Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Australia Kitchen Furniture Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Kitchen Furniture Market?

The projected CAGR is approximately 5.23%.

2. Which companies are prominent players in the Australia Kitchen Furniture Market?

Key companies in the market include Polytec, Laminex, Bonlex, Blum, Hettich, Caesarstone, Corian, Others, GOLDENHOMES, Ikea, Winning Appliances.

3. What are the main segments of the Australia Kitchen Furniture Market?

The market segments include Furniture Type, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Urban Expansion is Fueling Residential Construction. Spurring the Need for Furniture and Architectural Hardware; The Growth of Commercial Spaces like Offices and Hotels Bolsters the Demand for Furniture Hardware.

6. What are the notable trends driving market growth?

Modern Kitchens.

7. Are there any restraints impacting market growth?

The Market's High Sensitivity to Prices is Impacting the Adoption of Premium Hardware Solutions; Ensuring Consistent Quality Across Diverse Products and Suppliers Poses Challenges. Impacting Customer Satisfaction and Brand Loyalty.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Kitchen Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Kitchen Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Kitchen Furniture Market?

To stay informed about further developments, trends, and reports in the Australia Kitchen Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence