Key Insights

The European laminates market is poised for significant expansion, projected to reach €10.3 billion by 2025 and sustain a compound annual growth rate (CAGR) of 12.31% through 2033. This robust growth is propelled by escalating adoption in residential spaces, driven by laminates' affordability, durability, and diverse aesthetic options. Concurrently, commercial and industrial sectors are increasingly leveraging laminates for their low maintenance and cost-efficiency in high-traffic environments. The burgeoning online distribution channel further enhances market accessibility and competitive pricing. Leading companies like Classen Group, Tarkett SA, and Mohawk Industries are spearheading innovation through product development and strategic alliances, actively shaping market trajectories.

European Laminates Market Market Size (In Billion)

Market expansion is influenced by factors including raw material price volatility, particularly for wood and resins, which can impact production economics. Environmental considerations related to laminate manufacturing and disposal are also driving a strong industry focus on sustainable practices. Despite these challenges, the market's segmentation by product type (e.g., HDF, MDF), application (residential, commercial, industrial), and distribution channels (online, offline) presents substantial growth avenues. Detailed regional insights for key markets like Germany, France, and the UK will offer a granular understanding of market performance. Future market evolution will be shaped by a commitment to innovative designs, sustainable production, and the exploration of novel application areas.

European Laminates Market Company Market Share

European Laminates Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European laminates market, covering market size, segmentation, growth drivers, challenges, and key players. The report utilizes data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033) to provide a robust forecast for the future. The study period spans from 2019 to 2033, offering a complete overview of market evolution.

European Laminates Market Concentration & Innovation

The European laminates market exhibits a moderately concentrated landscape, with several major players holding significant market share. While precise market share figures for each company are proprietary, key players like Tarkett S.A., Shaw Industries Group Inc., and Mohawk Industries Inc. command substantial portions of the market. The market is characterized by ongoing innovation driven by the demand for durable, aesthetically pleasing, and sustainable flooring solutions.

Several key factors shape market concentration:

- Mergers and Acquisitions (M&A): While specific M&A deal values for the European laminates market during the study period are not publicly available (xx Million), consolidation activity has played a role in shaping the current landscape. Larger players have strategically acquired smaller companies to expand their product portfolios and geographic reach.

- Regulatory Frameworks: Stringent environmental regulations, particularly regarding formaldehyde emissions and sustainable sourcing, influence market dynamics. Companies must invest in compliant production processes, impacting overall market competitiveness.

- Product Substitutes: The market faces competition from other flooring materials such as vinyl, hardwood, and ceramic tiles. The innovation focus is on differentiation through improved aesthetics, durability, and eco-friendly attributes.

- End-User Trends: Growing demand for sustainable and easy-to-maintain flooring options, coupled with shifting preferences towards specific design aesthetics, drives innovation in product development and market segmentation.

European Laminates Market Industry Trends & Insights

The European laminates market is witnessing steady growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, fueled by a number of factors. Market penetration of laminated flooring in residential and commercial spaces continues to grow, particularly in regions with burgeoning construction activities.

- Technological Disruptions: Innovations in surface technologies, including improved wear resistance and realistic wood grain reproductions, are significantly impacting consumer preferences. The development of waterproof and water-resistant laminates is expanding application possibilities.

- Consumer Preferences: Consumers increasingly prioritize aesthetic appeal, durability, and ease of maintenance. The market is responding with a wider array of designs, textures, and finishes, catering to diverse tastes.

- Competitive Dynamics: Established players are investing heavily in R&D and capacity expansion to maintain competitiveness. The introduction of new product lines and innovative marketing strategies are shaping the competitive landscape.

Dominant Markets & Segments in European Laminates Market

The residential segment dominates the European laminates market in terms of application, accounting for approximately xx% of the total market value. Western European countries like Germany, France, and the UK are leading consumers of laminated flooring due to factors including:

- Strong Construction Industry: Sustained growth in residential and commercial construction activity drives demand for flooring materials.

- Favorable Economic Conditions: Higher disposable incomes and improved housing affordability enhance the purchasing power of consumers.

- Government Policies: Government incentives for energy-efficient building materials, if any, can positively influence the market.

Within product types, High-Density Fiberboard (HDF) laminated flooring holds a larger market share than Medium-Density Fiberboard (MDF) due to its superior strength and durability. Offline distribution channels currently maintain a stronger hold in the market than online sales, though the latter is experiencing notable growth.

European Laminates Market Product Developments

Recent product developments emphasize enhanced durability, waterproof capabilities, and realistic wood grain patterns. Innovations in click-locking systems improve installation speed and ease. The market is also witnessing a growing focus on sustainable and environmentally friendly materials, reflecting heightened consumer awareness and regulatory pressure. These developments are enhancing market fit by addressing specific consumer needs and driving adoption of higher value products.

Report Scope & Segmentation Analysis

This report segments the European laminates market based on product type, application, and distribution channel.

By Product Type: High-Density Fiberboard Laminated Flooring and Medium-Density Fiberboard Laminated Flooring. Growth projections for each segment are dependent on factors such as production efficiency and price-performance dynamics.

By Application: Residential, Commercial, and Industrial applications each show varying growth rates and competitive landscapes based on specific needs and purchasing behaviours.

By Distribution Channel: Online and Offline channels represent distinct sales opportunities and require tailored marketing strategies to reach target customers.

Key Drivers of European Laminates Market Growth

The European laminates market's growth is propelled by several key drivers:

- Rising Disposable Incomes: Increased purchasing power leads to higher demand for home improvement and renovation projects.

- Growing Construction Sector: Expansion in residential and commercial construction directly impacts flooring material demand.

- Technological Advancements: Innovations resulting in improved product quality, durability, and aesthetics drive consumer preference.

Challenges in the European Laminates Market Sector

The European laminates market faces several significant challenges:

- Intense Competition: The presence of numerous established players and the entry of new competitors create a highly competitive environment.

- Fluctuating Raw Material Prices: Changes in the cost of raw materials (wood, resins) impact overall production costs and market profitability.

- Environmental Regulations: Adherence to stringent environmental standards requires significant investments in sustainable production practices.

Emerging Opportunities in European Laminates Market

Several emerging opportunities exist for market growth:

- Expansion into New Markets: Untapped market potential exists in less-developed regions within Europe.

- Development of Innovative Products: Introduction of enhanced functionalities (e.g., noise reduction, superior durability) attract new customer segments.

- Sustainable and Eco-Friendly Options: Meeting the growing demand for eco-conscious products can create significant growth opportunities.

Leading Players in the European Laminates Market Market

- Classen Group

- Windmiller GmbH

- Shaw Industries Group Inc. [Shaw Floors]

- Polyflor Ltd [Polyflor]

- Tarkett S.A. [Tarkett]

- Armstrong Flooring Inc. [Armstrong Flooring]

- Mannington Mills Inc. [Mannington]

- Kaindl Flooring GMBH [Kaindl]

- Parador [Parador]

- Swiss Krono Group [Swiss Krono]

- Mohawk Industries Inc. [Mohawk]

- Beaulieu International Group [Beaulieu]

- Fatra a.s.

- Gerflor [Gerflor]

- Forbo Flooring Systems [Forbo]

Key Developments in European Laminates Market Industry

- June 2021: Shaw Industries Group, Inc. partnered with Herndon Properties to develop high-quality residential spaces, enhancing market positioning in the residential sector.

- October 2021: Armstrong Flooring launched Essentials Plus, a new rigid core product targeting the residential market, indicating innovation in product offerings.

- November 2021: Shaw Industries Group, Inc. announced plans to expand its Aiken County operations, signifying investment in increased production capacity and future growth.

Strategic Outlook for European Laminates Market Market

The European laminates market exhibits strong potential for continued growth. Further innovation in product design, sustainability initiatives, and strategic partnerships will be key to success. The market's future trajectory hinges on adapting to evolving consumer preferences, maintaining competitiveness, and navigating regulatory changes effectively. The strategic focus should remain on leveraging technological advancements and catering to the increasing demand for high-quality, sustainable flooring solutions.

European Laminates Market Segmentation

-

1. Product Type

- 1.1. High-Density Fiberboard Laminated Flooring

- 1.2. Medium-Density Fiberboard Laminated Flooring

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

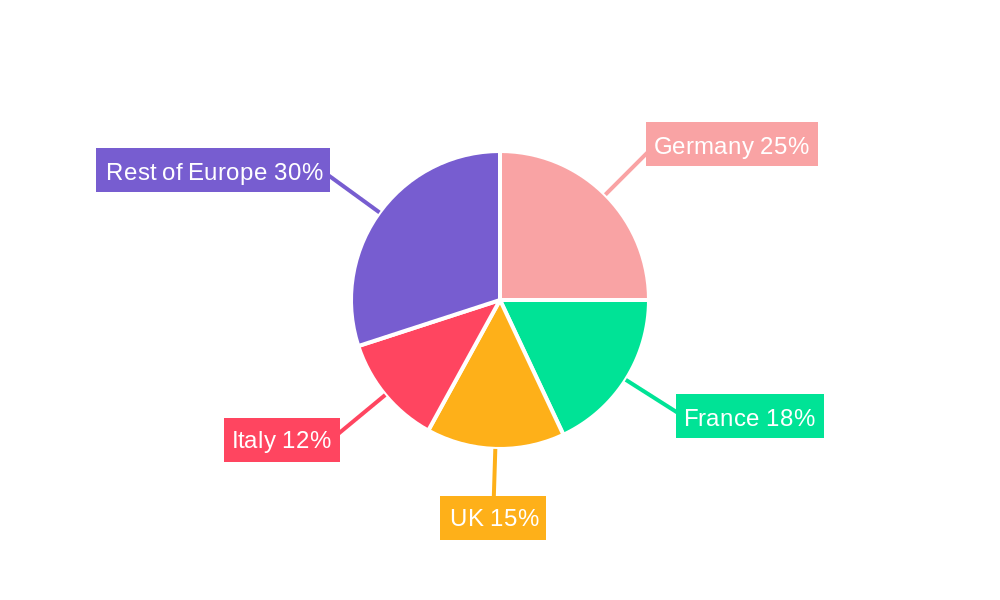

European Laminates Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Russia

- 6. Belgium

- 7. Poland

- 8. Rest of Europe

European Laminates Market Regional Market Share

Geographic Coverage of European Laminates Market

European Laminates Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Infrastructure spending and advancement in smart infrastructure; Increasing value of commercial property construction

- 3.3. Market Restrains

- 3.3.1. Increasing real estate price with inflation restraining demand; Domination by carpet and rug sale affecting laminate flooring

- 3.4. Market Trends

- 3.4.1. Rising Construction Activities is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Laminates Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. High-Density Fiberboard Laminated Flooring

- 5.1.2. Medium-Density Fiberboard Laminated Flooring

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Russia

- 5.4.6. Belgium

- 5.4.7. Poland

- 5.4.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom European Laminates Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. High-Density Fiberboard Laminated Flooring

- 6.1.2. Medium-Density Fiberboard Laminated Flooring

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online

- 6.3.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany European Laminates Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. High-Density Fiberboard Laminated Flooring

- 7.1.2. Medium-Density Fiberboard Laminated Flooring

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online

- 7.3.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France European Laminates Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. High-Density Fiberboard Laminated Flooring

- 8.1.2. Medium-Density Fiberboard Laminated Flooring

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online

- 8.3.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy European Laminates Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. High-Density Fiberboard Laminated Flooring

- 9.1.2. Medium-Density Fiberboard Laminated Flooring

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online

- 9.3.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia European Laminates Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. High-Density Fiberboard Laminated Flooring

- 10.1.2. Medium-Density Fiberboard Laminated Flooring

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online

- 10.3.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Belgium European Laminates Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. High-Density Fiberboard Laminated Flooring

- 11.1.2. Medium-Density Fiberboard Laminated Flooring

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Residential

- 11.2.2. Commercial

- 11.2.3. Industrial

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Online

- 11.3.2. Offline

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Poland European Laminates Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. High-Density Fiberboard Laminated Flooring

- 12.1.2. Medium-Density Fiberboard Laminated Flooring

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Residential

- 12.2.2. Commercial

- 12.2.3. Industrial

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Online

- 12.3.2. Offline

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Rest of Europe European Laminates Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 13.1.1. High-Density Fiberboard Laminated Flooring

- 13.1.2. Medium-Density Fiberboard Laminated Flooring

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Residential

- 13.2.2. Commercial

- 13.2.3. Industrial

- 13.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 13.3.1. Online

- 13.3.2. Offline

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Classen Group

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Windmiller GmbH**List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Shaw Industries Group Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Polyflor Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Tarkett S A

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Armstrong Flooring Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Mannington Mills Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Kaindl Flooring GMBH

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Parador

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Swiss Krono Group

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Mohawk Industries Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Beaulieu International Group

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Fatra a s

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Gerflor

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Forbo Flooring Systems

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.1 Classen Group

List of Figures

- Figure 1: European Laminates Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: European Laminates Market Share (%) by Company 2025

List of Tables

- Table 1: European Laminates Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: European Laminates Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: European Laminates Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: European Laminates Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: European Laminates Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: European Laminates Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: European Laminates Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: European Laminates Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: European Laminates Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: European Laminates Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: European Laminates Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: European Laminates Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: European Laminates Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: European Laminates Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: European Laminates Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: European Laminates Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: European Laminates Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: European Laminates Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: European Laminates Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: European Laminates Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: European Laminates Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: European Laminates Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: European Laminates Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: European Laminates Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: European Laminates Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: European Laminates Market Revenue billion Forecast, by Application 2020 & 2033

- Table 27: European Laminates Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: European Laminates Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: European Laminates Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: European Laminates Market Revenue billion Forecast, by Application 2020 & 2033

- Table 31: European Laminates Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 32: European Laminates Market Revenue billion Forecast, by Country 2020 & 2033

- Table 33: European Laminates Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: European Laminates Market Revenue billion Forecast, by Application 2020 & 2033

- Table 35: European Laminates Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: European Laminates Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Laminates Market?

The projected CAGR is approximately 12.31%.

2. Which companies are prominent players in the European Laminates Market?

Key companies in the market include Classen Group, Windmiller GmbH**List Not Exhaustive, Shaw Industries Group Inc, Polyflor Ltd, Tarkett S A, Armstrong Flooring Inc, Mannington Mills Inc, Kaindl Flooring GMBH, Parador, Swiss Krono Group, Mohawk Industries Inc, Beaulieu International Group, Fatra a s, Gerflor, Forbo Flooring Systems.

3. What are the main segments of the European Laminates Market?

The market segments include Product Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.3 billion as of 2022.

5. What are some drivers contributing to market growth?

High Infrastructure spending and advancement in smart infrastructure; Increasing value of commercial property construction.

6. What are the notable trends driving market growth?

Rising Construction Activities is Driving the Market.

7. Are there any restraints impacting market growth?

Increasing real estate price with inflation restraining demand; Domination by carpet and rug sale affecting laminate flooring.

8. Can you provide examples of recent developments in the market?

On 14th June 2021, Shaw Industries Group, Inc. partnership with local developers Steve and Tammy Herndon of Herndon Properties, delivering an experience on par with what young professionals and prospective associates would expect in larger markets. On 18th October 2021, Armstrong Flooring announced the launch of a new rigid core product, Essentials Plus. Designed for residential spaces, Essentials Plus features the newest, on-trend designs with excellent performance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Laminates Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Laminates Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Laminates Market?

To stay informed about further developments, trends, and reports in the European Laminates Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence