Key Insights

The Australian skincare products market is projected for substantial growth, expected to reach $1.8 billion by 2033. Fueled by a Compound Annual Growth Rate (CAGR) of 4.4%, expansion is driven by increasing consumer demand for advanced, personalized, and effective skincare solutions. Key growth factors include heightened awareness of skin health benefits, the adoption of consistent skincare routines, and rising disposable incomes enabling investment in premium products. Social media influence and beauty trends are also popularizing innovative ingredients and formulations. A significant trend towards natural, organic, and ethically sourced ingredients, coupled with a demand for sustainable and health-conscious products, is also shaping the market. This surge in demand for eco-friendly and transparently sourced products is prompting manufacturers to prioritize sustainable practices.

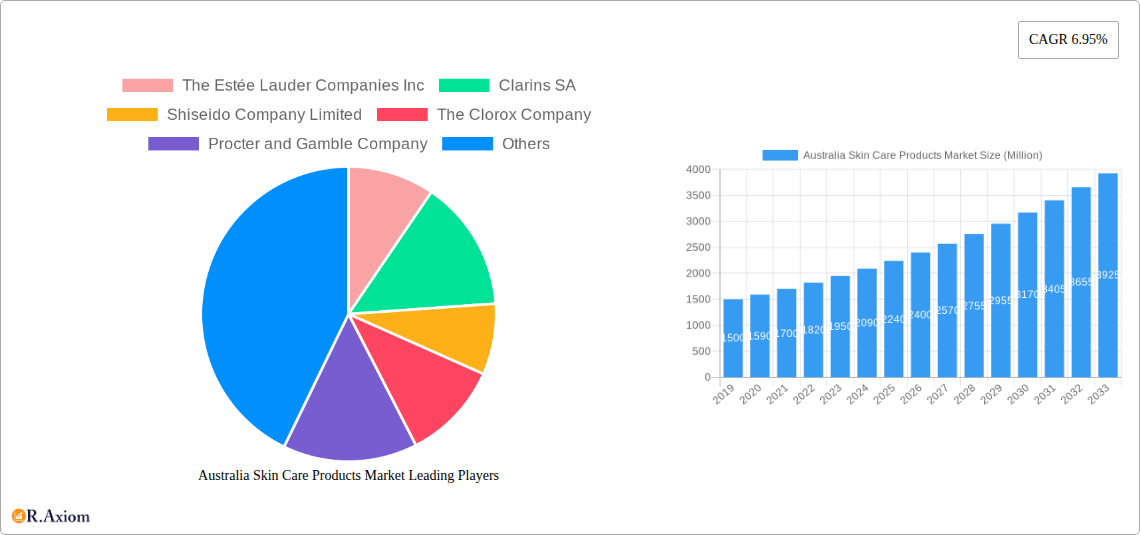

Australia Skin Care Products Market Market Size (In Billion)

The competitive landscape features prominent global players such as L'Oréal SA, Procter & Gamble, and Unilever PLC, who are actively innovating to meet diverse consumer needs. The market is primarily segmented by product type, with facial care dominating due to its daily application and targeted benefits, followed by body care. Specialized treatments and sun care also represent growing segments. Distribution channels are diversifying, with online retail rapidly gaining traction due to convenience and wider selection, while supermarkets and specialist stores continue to serve mass-market and premium segments respectively. Potential challenges include intense price competition and evolving regulatory requirements for product claims and ingredients. Despite these factors, the Australian skincare market demonstrates a positive outlook for sustained revenue generation and innovation throughout the forecast period.

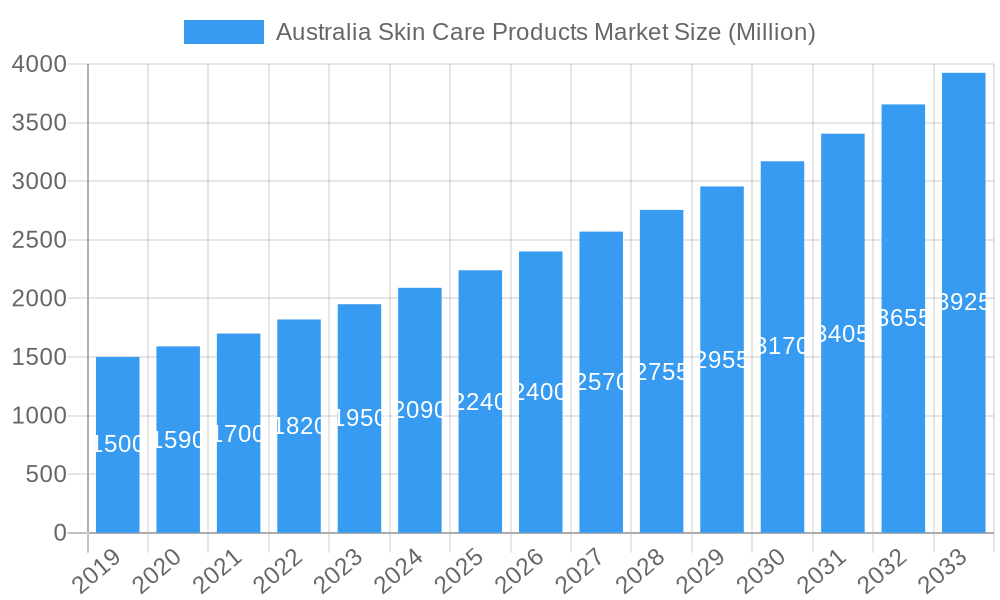

Australia Skin Care Products Market Company Market Share

Australia Skincare Market Analysis: Size, CAGR & Forecast (Base Year: 2025)

This comprehensive report offers in-depth analysis of the Australian skincare products market, providing critical insights for manufacturers, suppliers, distributors, and investors. Covering the period 2019-2033, with robust data for the Base Year 2025 and the Forecast Period 2025–2033, alongside historical data from 2019–2024. The report examines key market dynamics, segment performance, innovation trends, and competitive strategies, emphasizing high-traffic keywords within the Australian beauty and wellness sector. The estimated market size for 2025 is $1.8 billion, with a projected CAGR of 4.4%.

Australia Skin Care Products Market Market Concentration & Innovation

The Australian skin care products market exhibits a moderate to high level of concentration, driven by the presence of established global giants and a growing cohort of innovative local brands. Key players like The Estée Lauder Companies Inc., L'Oréal SA, and Procter & Gamble Company hold significant market share. Innovation is a critical driver, fueled by a growing consumer demand for scientifically advanced formulations, natural and organic ingredients, and sustainable packaging solutions. Regulatory frameworks, overseen by bodies like the Therapeutic Goods Administration (TGA), ensure product safety and efficacy, influencing product development and marketing strategies. Product substitutes, ranging from cosmetic procedures to DIY remedies, present a constant challenge, necessitating continuous product differentiation. End-user trends lean towards personalized skin care routines, targeted solutions for specific concerns (e.g., anti-aging, acne), and a preference for brands with strong ethical and environmental commitments. Mergers and acquisitions (M&A) activities are expected to remain active as larger companies seek to acquire innovative startups and expand their portfolios, with an estimated M&A deal value of $300 Million in the forecast period.

- Market Share: Leading companies command an aggregate market share of approximately 65%.

- Innovation Focus: Emphasis on clean beauty, ingredient transparency, and personalized solutions.

- Regulatory Impact: Strict adherence to TGA guidelines for product claims and ingredient sourcing.

- M&A Activity: Strategic acquisitions to gain access to niche markets and innovative technologies.

Australia Skin Care Products Market Industry Trends & Insights

The Australian skin care products market is experiencing robust growth, propelled by an increasing consumer awareness of skin health, rising disposable incomes, and a pervasive digital influence on purchasing decisions. The market penetration of advanced skin care solutions is steadily climbing, with consumers actively seeking products that offer tangible results. Key growth drivers include the burgeoning demand for anti-aging products, driven by an aging population and a desire to maintain youthful skin, and the increasing popularity of natural and organic ingredients, aligning with broader wellness trends. Technological disruptions, such as AI-powered skin analysis tools and personalized product recommendations via mobile apps, are transforming the consumer experience. Furthermore, the growing emphasis on men's grooming has opened up new avenues for product development and market expansion. E-commerce platforms continue to gain prominence, offering convenience and a wider selection of products, further intensifying competitive dynamics. The market is characterized by a dynamic interplay between established multinational corporations and agile local brands, each vying for consumer attention through innovative product launches, strategic marketing campaigns, and a deep understanding of local consumer preferences. The estimated market size for 2025 is $5,200 Million, with an expected CAGR of 7.8% for the forecast period.

- Growth Drivers: Rising disposable incomes, increasing skin health awareness, and demand for anti-aging solutions.

- Technological Integration: AI-driven personalization, online consultations, and smart beauty devices.

- Consumer Preferences: Shift towards natural, organic, and cruelty-free products; interest in ingredient transparency.

- Competitive Landscape: Intense competition from global brands, local innovators, and direct-to-consumer (DTC) players.

Dominant Markets & Segments in Australia Skin Care Products Market

The Australian skin care products market is characterized by a dominant segment in Facial Care, which accounts for approximately 70% of the total market value. This dominance is attributed to a universal need for facial cleansing, moisturizing, anti-aging treatments, and targeted solutions for various skin concerns like acne and hyperpigmentation. Within distribution channels, Online Retail Stores are rapidly emerging as a powerhouse, projected to capture over 35% of the market share by 2025, driven by convenience, wider product availability, and competitive pricing. Specialist Retail Stores, including department stores and dedicated beauty boutiques, maintain a significant presence, offering expert advice and a curated selection of premium brands. Supermarkets and Hypermarkets cater to the mass market, providing accessible and everyday skin care essentials.

- Facial Care Dominance:

- Key Drivers: High consumer awareness of facial skin health, prevalence of specific skin concerns (e.g., acne, aging), and a wide array of specialized products.

- Market Size Projection (2025): $3,640 Million.

- Consumer Behavior: Demand for anti-aging serums, moisturizers, cleansers, and sunscreens.

- Online Retail Stores' Ascendancy:

- Key Drivers: Convenience, extensive product selection, competitive pricing, personalized recommendations, and ease of access.

- Market Penetration Growth: Expected to reach 35% by 2025.

- Impact: Driving increased accessibility and competition across all price points.

- Specialist Retail Stores' Continued Relevance:

- Key Drivers: In-store expert advice, brand experience, premium product offerings, and personalized consultations.

- Market Segment Contribution: Significant, particularly for luxury and clinical skincare brands.

- Supermarkets/Hypermarkets' Accessibility:

- Key Drivers: Wide reach, everyday product availability, and affordability for mass-market consumers.

- Role: Serving as a primary channel for basic skin care necessities.

Australia Skin Care Products Market Product Developments

Product development in the Australian skin care market is heavily influenced by the demand for clean, effective, and sustainable solutions. Innovations are centered on advanced formulations utilizing potent active ingredients such as peptides, ceramides, and bio-retinols, catering to concerns like premature aging and skin barrier repair. The integration of microbiome-friendly ingredients and probiotic extracts is gaining traction, promoting a healthier skin ecosystem. Furthermore, the development of multi-functional products that simplify routines while delivering comprehensive benefits, such as SPF moisturizers with added antioxidants, is a key trend. The competitive advantage for brands lies in their ability to offer transparent ingredient lists, eco-friendly packaging, and clinically proven efficacy, resonating with the environmentally conscious and health-aware Australian consumer.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Australian skin care products market, segmented by Type and Distribution Channel. The Type segmentation includes Facial Care, Body Care, and Other Types, with Facial Care expected to maintain its leading position due to high consumer demand for targeted treatments and anti-aging solutions. Body Care is projected to experience steady growth, driven by an increasing focus on overall skin wellness and the demand for specialized products like firming lotions and exfoliants. Other Types encompass niche categories like hand care, foot care, and specific treatment products. The Distribution Channel segmentation covers Supermarkets/Hypermarkets, Convenience Stores, Specialist Retail Stores, Online Retail Stores, and Other Distribution Channels. Online Retail Stores are anticipated to witness the fastest growth, reflecting evolving consumer shopping habits and the ease of access to a broad spectrum of products.

- Facial Care Segment: Projected market size of $3,640 Million in 2025, driven by anti-aging and treatment-focused products.

- Body Care Segment: Expected to grow steadily, with an estimated market size of $1,300 Million in 2025, focusing on hydration and rejuvenation.

- Other Types Segment: Encompassing niche products with a projected market size of $260 Million in 2025.

- Online Retail Stores Channel: Forecasted to be the fastest-growing distribution channel, capturing significant market share due to convenience and accessibility.

Key Drivers of Australia Skin Care Products Market Growth

The Australian skin care products market is propelled by several key drivers. Firstly, increasing consumer awareness regarding skin health and the benefits of regular skin care routines fuels demand. Secondly, the aging population in Australia creates a significant market for anti-aging and restorative skin care products. Technological advancements in formulation and delivery systems allow for more effective and targeted solutions, further stimulating growth. The rise of e-commerce and digital marketing has broadened accessibility and influenced consumer purchasing decisions. Growing consumer preference for natural, organic, and ethically sourced ingredients aligns with a global trend and presents a substantial opportunity.

- Consumer Health Consciousness: Increased focus on maintaining healthy skin.

- Aging Demographics: Driving demand for anti-aging and regenerative products.

- Technological Advancements: Innovative formulations and delivery systems.

- E-commerce Expansion: Enhanced accessibility and wider product reach.

- Natural & Organic Trend: Consumer preference for clean and sustainable ingredients.

Challenges in the Australia Skin Care Products Market Sector

Despite its growth, the Australian skin care products market faces several challenges. Intense competition from a multitude of local and international brands can lead to price wars and necessitate significant marketing investments. Stringent regulatory frameworks, while ensuring product safety, can also increase the cost and time associated with product development and launch. Supply chain disruptions, as evidenced by recent global events, can impact product availability and increase operational costs. Furthermore, the evolving nature of consumer preferences requires continuous product innovation and adaptation, which can be resource-intensive. Counterfeit products and the proliferation of unsubstantiated online claims pose a threat to brand reputation and consumer trust.

- Intense Competition: High number of brands leading to price pressures.

- Regulatory Hurdles: Compliance with TGA guidelines and evolving standards.

- Supply Chain Vulnerabilities: Potential disruptions impacting product availability.

- Rapidly Changing Consumer Preferences: Need for continuous innovation and adaptation.

- Counterfeit Products: Threat to brand integrity and consumer safety.

Emerging Opportunities in Australia Skin Care Products Market

The Australian skin care products market presents numerous emerging opportunities. The growing men's grooming segment offers substantial untapped potential for tailored product lines. The increasing demand for personalized skin care solutions, driven by advancements in AI and genetic testing, is creating a niche market for customized formulations. Sustainability and eco-friendly packaging are no longer niche concerns but a mainstream expectation, presenting opportunities for brands that prioritize environmental responsibility. The rise of "skinimalism" – a trend towards simplified routines with multi-functional products – is an area for product innovation. Furthermore, the integration of wellness and skin health, with a focus on holistic approaches, opens doors for brands to offer products that address both internal and external well-being.

- Men's Grooming Expansion: Tailored product lines for male consumers.

- Personalized Skin Care: Customized formulations based on individual needs.

- Sustainable & Eco-Friendly Products: High demand for environmentally conscious options.

- Skinimalism Trend: Development of multi-functional and simplified routines.

- Holistic Wellness Integration: Connecting skin health with overall well-being.

Leading Players in the Australia Skin Care Products Market Market

The following companies are significant players in the Australia Skin Care Products Market:

- The Estée Lauder Companies Inc.

- Clarins SA

- Shiseido Company Limited

- The Clorox Company

- Procter and Gamble Company

- Unilever PLC

- Miranda Kerr Pty Ltd (Kora Organics)

- LOccitane Group

- L'Oreal SA

- Johnson & Johnson Inc

- Beiersdorf AG

Key Developments in Australia Skin Care Products Market Industry

- March 2023: Shiseido's skincare brand Drunk Elephant launched its latest moisturizer, the Protini Polypeptide Cream, in Australia. This innovative product is enriched with Pygmy waterlily extract, essential amino acids, and a unique blend of signal peptides to provide deep hydration and restore your skin's natural vitality.

- February 2023: The Australian skincare brand STUFF unveiled a line of eight supercharged skincare products designed specifically for men. Among these offerings, the SPF 50+ Face Lotion stands out as a remarkable all-in-one solution, boasting paraben-free ingredients and eco-friendly, recyclable packaging.

- July 2022: The clinical skincare brand Tula Skincare, known for its products featuring probiotic extracts and superfoods, made its entry into the Australian and New Zealand markets through a strategic partnership with the esteemed beauty retailer Mecca.

Strategic Outlook for Australia Skin Care Products Market Market

The strategic outlook for the Australian skin care products market is highly positive, driven by sustained consumer demand for efficacy, natural ingredients, and personalized experiences. Key growth catalysts include further innovation in clean beauty formulations, the expansion of the men's grooming sector, and the increasing adoption of sustainable packaging. Brands that can effectively leverage digital channels for direct-to-consumer engagement and personalized marketing will be well-positioned for success. Strategic partnerships, whether with retailers or technology providers, will be crucial for expanding reach and enhancing product offerings. The market's future potential lies in its ability to adapt to evolving consumer values, embrace technological advancements, and deliver demonstrable results, ensuring continued growth and market leadership.

Australia Skin Care Products Market Segmentation

-

1. Type

- 1.1. Facial Care

- 1.2. Body Care

- 1.3. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Conveniences Stores

- 2.3. Specialist Retail Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Australia Skin Care Products Market Segmentation By Geography

- 1. Australia

Australia Skin Care Products Market Regional Market Share

Geographic Coverage of Australia Skin Care Products Market

Australia Skin Care Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit Skin Care Products

- 3.4. Market Trends

- 3.4.1. Growing Influence of Social Media and Impact of Digital Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Skin Care Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Facial Care

- 5.1.2. Body Care

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Conveniences Stores

- 5.2.3. Specialist Retail Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Estée Lauder Companies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clarins SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shiseido Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Clorox Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Procter and Gamble Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Unilever PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Miranda Kerr Pty Ltd (Kora Organics)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LOccitane Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 L'Oreal SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Johnson & Johnson Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Beiersdorf AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 The Estée Lauder Companies Inc

List of Figures

- Figure 1: Australia Skin Care Products Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Skin Care Products Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Skin Care Products Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Australia Skin Care Products Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Australia Skin Care Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Australia Skin Care Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Australia Skin Care Products Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Australia Skin Care Products Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Australia Skin Care Products Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Australia Skin Care Products Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Australia Skin Care Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Australia Skin Care Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Australia Skin Care Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Australia Skin Care Products Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Skin Care Products Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Australia Skin Care Products Market?

Key companies in the market include The Estée Lauder Companies Inc, Clarins SA, Shiseido Company Limited, The Clorox Company, Procter and Gamble Company, Unilever PLC, Miranda Kerr Pty Ltd (Kora Organics)*List Not Exhaustive, LOccitane Group, L'Oreal SA, Johnson & Johnson Inc, Beiersdorf AG.

3. What are the main segments of the Australia Skin Care Products Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products.

6. What are the notable trends driving market growth?

Growing Influence of Social Media and Impact of Digital Technology.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit Skin Care Products.

8. Can you provide examples of recent developments in the market?

March 2023: Shiseido's skincare brand Drunk Elephant launched its latest moisturizer, the Protini Polypeptide Cream, in Australia. This innovative product is enriched with Pygmy waterlily extract, essential amino acids, and a unique blend of signal peptides to provide deep hydration and restore your skin's natural vitality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Skin Care Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Skin Care Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Skin Care Products Market?

To stay informed about further developments, trends, and reports in the Australia Skin Care Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence