Key Insights

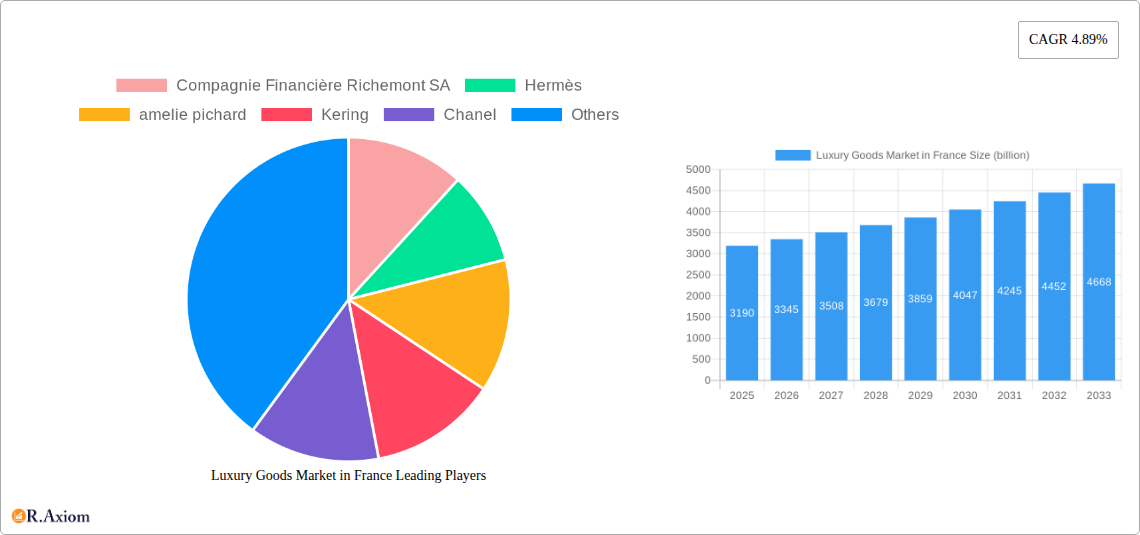

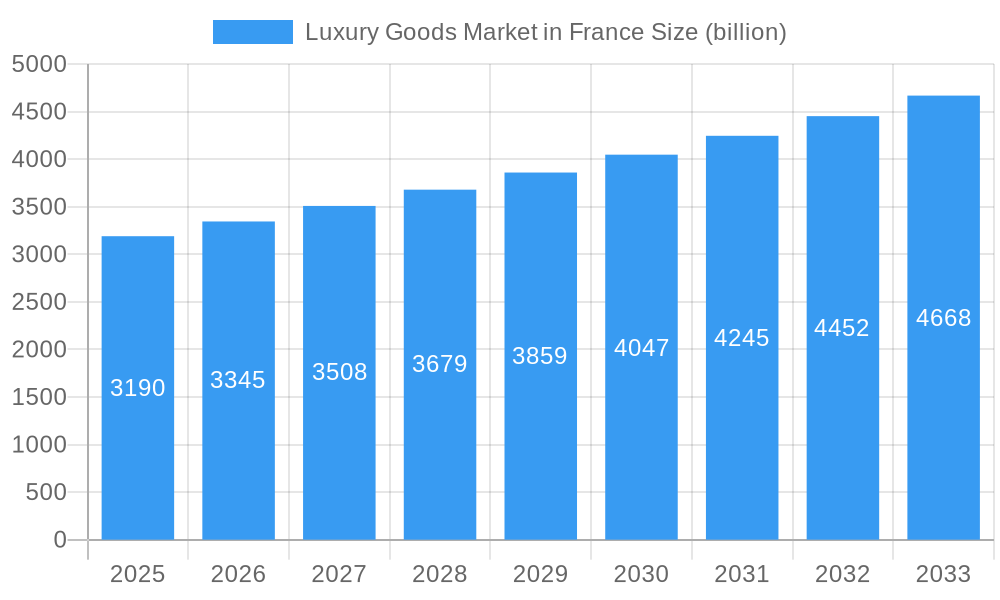

The French luxury goods market is poised for robust expansion, projecting a market size of $3.19 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.89% through 2033. This sustained growth is primarily fueled by a confluence of factors, including the enduring allure of French craftsmanship and heritage, a resurgence in demand for high-end fashion and accessories post-pandemic, and an increasing appetite for experiential luxury purchases. Key drivers include the strong brand recognition of established French houses like Louis Vuitton, Chanel, and Hermès, which continue to innovate and captivate affluent consumers globally. Furthermore, the market benefits from the country's status as a global fashion capital, attracting significant tourist spending, particularly from emerging economies seeking authentic luxury experiences. The rise of digital channels, while disruptive, has also opened new avenues for brands to connect with a wider, digitally-savvy clientele, further bolstering market penetration and sales.

Luxury Goods Market in France Market Size (In Billion)

The luxury goods sector in France is characterized by a diverse range of segments, with clothing and apparel, footwear, and bags leading the charge, followed by jewelry and watches, and other accessories. Distribution channels are evolving, with a notable shift towards online stores and direct-to-consumer models, complementing traditional single-brand and multi-brand retail outlets. Despite its strong performance, the market faces certain restraints, such as heightened global competition, increasing raw material costs, and the need for continuous innovation to maintain exclusivity and desirability. Moreover, evolving consumer preferences towards sustainability and ethical sourcing are presenting both challenges and opportunities for brands to adapt their production and marketing strategies. The strategic presence of major luxury conglomerates like LVMH and Kering, alongside independent powerhouses such as Chanel and Hermès, ensures a dynamic competitive landscape that drives continuous product development and market outreach across key regions like Europe, North America, and the Asia Pacific.

Luxury Goods Market in France Company Market Share

This in-depth report provides a detailed analysis of the Luxury Goods Market in France, a sector characterized by its enduring appeal and significant economic contribution. Spanning the historical period of 2019–2024, the base year of 2025, and a forecast period extending to 2033, this study offers critical insights into market dynamics, growth drivers, and emerging trends. We delve into the intricate landscape of French luxury brands, analyzing their strategies, innovations, and market penetration. The report is structured to provide actionable intelligence for industry stakeholders, including manufacturers, suppliers, distributors, and investors, seeking to capitalize on the French luxury sector. With a focus on high-value segments and key economic indicators, this analysis is an indispensable resource for navigating the complexities of the French luxury market.

Luxury Goods Market in France Market Concentration & Innovation

The Luxury Goods Market in France exhibits a moderately concentrated structure, with several dominant players like LVMH Moët Hennessy Louis Vuitton, Kering, and Compagnie Financière Richemont SA holding significant market share, estimated to be over 80 billion in combined revenue for the base year 2025. Innovation is a paramount driver, fueled by continuous investment in research and development by leading brands such as Chanel and Hermès, focusing on sustainable materials, artisanal craftsmanship, and cutting-edge digital experiences. Regulatory frameworks, while generally supportive of luxury exports, primarily focus on authenticity, intellectual property protection, and ethical sourcing. Product substitutes, while present in lower-tier markets, have minimal impact on the core luxury segment due to the strong brand equity and unique value proposition offered by French luxury goods. End-user trends are increasingly shifting towards experiential luxury, personalized offerings, and a strong demand for traceable and sustainable products. Mergers and acquisitions (M&A) activity, while less frequent in the top-tier segment, often involves strategic acquisitions of niche brands or technology providers to enhance competitive advantage. M&A deal values within the broader French luxury ecosystem have historically ranged from hundreds of millions to several billions, indicating strategic consolidation and brand portfolio expansion.

- Market Concentration: Dominated by a few key conglomerates.

- Innovation Drivers: Sustainable materials, digital integration, personalization, artisanal heritage.

- Regulatory Frameworks: Focus on authenticity, IP protection, ethical sourcing, and sustainability.

- Product Substitutes: Limited impact on core luxury market due to brand loyalty and unique value.

- End-User Trends: Experiential luxury, personalization, sustainability, digital engagement.

- M&A Activities: Strategic acquisitions of niche brands and technology enhancers.

Luxury Goods Market in France Industry Trends & Insights

The Luxury Goods Market in France is poised for substantial growth, driven by a confluence of evolving consumer preferences, technological advancements, and strategic market initiatives. The French luxury market size is projected to reach over 150 billion by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025–2033). A significant trend is the increasing demand for personalized and bespoke luxury items, where consumers seek unique products tailored to their individual tastes and preferences. This is further amplified by the growing influence of digital channels, with online luxury retail in France experiencing exponential growth. Brands are investing heavily in creating seamless omnichannel experiences, integrating e-commerce platforms with physical retail spaces to offer a holistic customer journey. Technological disruptions are playing a crucial role, with the adoption of AI for personalized recommendations, AR/VR for virtual try-ons, and blockchain for supply chain transparency and product authentication. These innovations not only enhance customer engagement but also reinforce the exclusivity and authenticity that define luxury. Consumer preferences are increasingly leaning towards sustainable and ethically produced goods, pushing brands to adopt greener manufacturing processes and transparent sourcing. The concept of "conscious luxury" is gaining traction, with consumers actively seeking brands that align with their values. Competitive dynamics within the French luxury market are intensifying, not just among established heritage brands but also from emerging direct-to-consumer (DTC) labels that leverage digital platforms to build direct relationships with their clientele. The report will delve deeper into how brands are navigating this evolving landscape, from catering to the Gen Z and Millennial luxury consumer, who prioritize experiences and ethical considerations, to maintaining the allure of traditional craftsmanship and heritage. The market penetration of niche luxury segments, such as high-end beauty and personal care, is also expanding, further diversifying the French luxury goods industry. The analysis will also explore the impact of global economic shifts and geopolitical events on consumer spending power and travel retail, a historically significant channel for French luxury brands.

Dominant Markets & Segments in Luxury Goods Market in France

The Luxury Goods Market in France showcases a clear dominance across specific product categories and distribution channels, reflecting the nation's heritage and consumer behavior. Within the Type segmentation, Clothing and Apparel and Bags consistently represent the largest market shares, collectively accounting for an estimated 55 billion in revenue for the base year 2025. This dominance is driven by iconic French fashion houses that have established global benchmarks for style, quality, and craftsmanship. The Jewelry and Watches segments also hold substantial value, driven by timeless designs and the investment appeal of precious materials and intricate mechanisms, with an estimated combined market value of over 30 billion.

Distribution Channel analysis reveals that Single-brand Stores remain the most influential channel, contributing an estimated 60 billion in 2025. This channel offers unparalleled control over brand experience, customer service, and product merchandising, essential for maintaining the exclusivity of luxury goods. Multi-brand Stores also play a significant role, providing curated selections and accessibility to a broader consumer base, contributing an estimated 30 billion. The Online Stores segment is experiencing rapid growth, projected to reach over 40 billion by 2025, as brands and consumers embrace digital platforms for convenience and a wider reach.

Dominant Product Segments:

- Clothing and Apparel: Iconic designs, haute couture, ready-to-wear collections, driving significant revenue. Key drivers include brand heritage, seasonal collections, and celebrity endorsements.

- Bags: A staple of the luxury market, characterized by high demand for iconic models and new season releases. Economic policies supporting export and strong consumer spending power contribute to this segment's strength.

- Jewelry: High-value items, precious metals, and gemstones. Infrastructure for secure high-value transactions and strong global demand for craftsmanship are key.

- Watches: Precision engineering, heritage brands, and investment value. Technological advancements in watchmaking and a robust collector market are significant drivers.

- Footwear: Luxury footwear is a significant contributor, driven by designer collaborations and trend-driven collections.

- Other Accessories: Scarves, eyewear, and small leather goods contribute to overall market value.

Dominant Distribution Channels:

- Single-brand Stores: Crucial for brand control, customer experience, and direct engagement. Government initiatives supporting retail development and intellectual property protection are vital.

- Online Stores: Rapidly growing segment driven by digital infrastructure development, e-commerce logistics, and changing consumer purchasing habits.

- Multi-brand Stores: Offer curated selections and wider accessibility. Strong relationships between luxury brands and department stores are key.

- Other Distribution Channels: Including travel retail and exclusive boutiques, which cater to specific consumer segments and geographies.

Luxury Goods Market in France Product Developments

Product innovation in the Luxury Goods Market in France is a continuous endeavor, focusing on enhancing exclusivity, sustainability, and customer engagement. Brands like Hermès are pushing boundaries with innovative materials and artisanal techniques in their leather goods and silk collections. Chanel consistently reinvents its iconic fragrances and cosmetics with advanced formulations and eco-conscious packaging. The integration of smart technologies into luxury timepieces and accessories is another key development, offering enhanced functionality without compromising on design aesthetics. These advancements not only cater to evolving consumer expectations but also reinforce the competitive advantage of French luxury brands by blending heritage with futuristic vision.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Luxury Goods Market in France, segmented by product type and distribution channel. The Type segmentation includes Clothing and Apparel, Footwear, Bags, Jewelry, Watches, and Other Accessories. The Distribution Channel segmentation covers Single-brand Stores, Multi-brand Stores, Online Stores, and Other Distribution Channels. Each segment is analyzed for its market size, growth projections, and competitive dynamics within the study period of 2019–2033. For instance, the Clothing and Apparel segment, a cornerstone of French luxury, is projected to maintain robust growth, driven by demand for haute couture and prêt-à-porter collections. The Online Stores segment, while smaller historically, is exhibiting the highest growth trajectory, reflecting the increasing digital adoption among luxury consumers.

Key Drivers of Luxury Goods Market in France Growth

The Luxury Goods Market in France is propelled by several key drivers. A primary factor is the sustained global demand for French craftsmanship, heritage, and iconic brands, fostering strong brand loyalty. Economic stability and rising disposable incomes in key international markets contribute significantly to the purchasing power for luxury goods. Technological advancements, particularly in e-commerce and digital marketing, enable brands to reach a wider audience and enhance customer engagement. Furthermore, government support for the luxury sector through initiatives promoting cultural heritage and export competitiveness plays a vital role. The increasing trend of conscious consumption, where consumers prioritize sustainable and ethically produced luxury items, also presents a growth opportunity for brands adopting these practices.

Challenges in the Luxury Goods Market in France Sector

Despite its robust growth, the Luxury Goods Market in France faces several challenges. Increasing global competition from emerging luxury markets and direct-to-consumer brands requires continuous innovation and strategic differentiation. Counterfeiting remains a persistent issue, threatening brand reputation and revenue. Supply chain disruptions, particularly those impacting the availability of rare materials or specialized manufacturing processes, can affect production and delivery timelines. Furthermore, evolving consumer expectations, especially among younger demographics who seek authenticity and social responsibility, necessitate adaptation in marketing and product development strategies. Regulatory changes related to sustainability and ethical sourcing can also pose compliance challenges.

Emerging Opportunities in Luxury Goods Market in France

Emerging opportunities in the Luxury Goods Market in France are abundant, driven by digital transformation and shifting consumer behaviors. The expansion of the online luxury retail sector presents a significant avenue for growth, allowing brands to reach new markets and offer personalized digital experiences. The increasing demand for sustainable and ethically sourced luxury goods creates opportunities for brands that prioritize these values, leading to innovation in materials and production processes. The growing luxury tourism sector, post-pandemic, offers a rebound for high-end retail experiences. Furthermore, the exploration of emerging markets with a burgeoning affluent class and the development of innovative product categories, such as luxury wellness and experiences, represent untapped potential for French luxury brands.

Leading Players in the Luxury Goods Market in France Market

- LVMH Moët Hennessy Louis Vuitton

- Kering

- Compagnie Financière Richemont SA

- Chanel

- Hermès

- Yves Saint Laurent

- L'Oreal Luxe

- Tom Ford SA

- PVH Corp

- amelie pichard

Key Developments in Luxury Goods Market in France Industry

- April 2022: Shiseido launched new skincare products in the French market, aiming to capture a larger share of the high-end beauty segment.

- October 2021: LVMH acquired the French-based fragrance brand Officine Universelle Buly 1803, expanding its portfolio of heritage perfumes for global distribution, including in France.

- October 2021: Roger Vivier launched its latest footwear and accessories collection under its fall '21 line, reinforcing its position in the luxury footwear market.

Strategic Outlook for Luxury Goods Market in France Market

The strategic outlook for the Luxury Goods Market in France is highly positive, driven by a blend of established brand strengths and adaptive strategies. Continued investment in digital transformation, including e-commerce optimization and immersive online experiences, will be critical. Brands that prioritize sustainability and ethical practices will likely see increased consumer loyalty and market advantage. Furthermore, leveraging the enduring appeal of French heritage and craftsmanship, while simultaneously embracing innovation in product development and customer engagement, will be key to maintaining leadership. The report forecasts a sustained growth trajectory, fueled by both domestic demand and international tourism rebound, making France a formidable force in the global luxury landscape.

Luxury Goods Market in France Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distribution Channel

- 2.1. Single-brand Stores

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

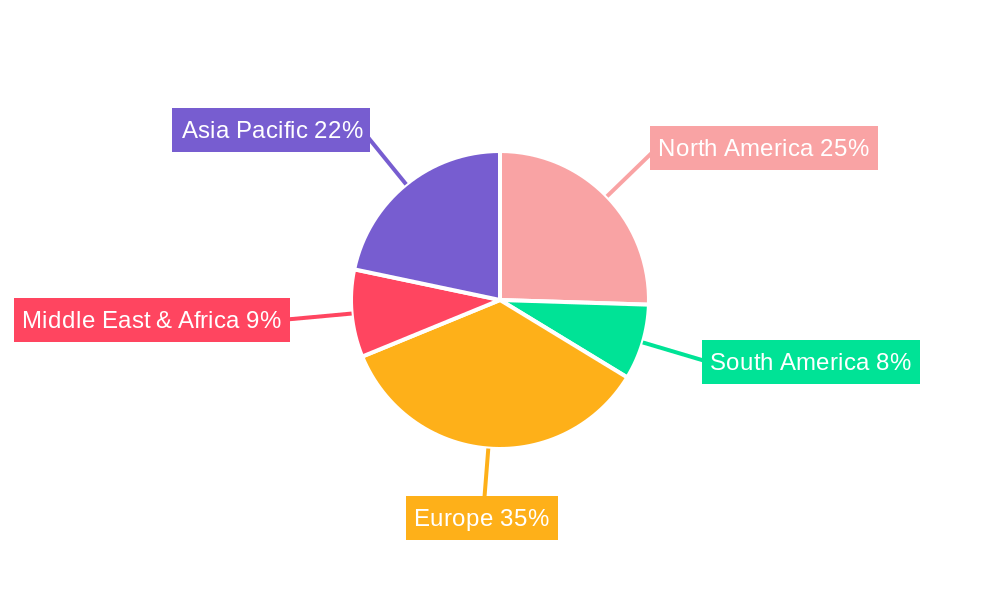

Luxury Goods Market in France Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Goods Market in France Regional Market Share

Geographic Coverage of Luxury Goods Market in France

Luxury Goods Market in France REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Natural and Organic Formulations

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Beauty and Personal Care Products

- 3.4. Market Trends

- 3.4.1. High Affinity for Luxury Perfumes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Goods Market in France Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single-brand Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Luxury Goods Market in France Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewelry

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single-brand Stores

- 6.2.2. Multi-brand Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Luxury Goods Market in France Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewelry

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single-brand Stores

- 7.2.2. Multi-brand Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Luxury Goods Market in France Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewelry

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single-brand Stores

- 8.2.2. Multi-brand Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Luxury Goods Market in France Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewelry

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single-brand Stores

- 9.2.2. Multi-brand Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Luxury Goods Market in France Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewelry

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single-brand Stores

- 10.2.2. Multi-brand Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Compagnie Financière Richemont SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hermès

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 amelie pichard

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kering

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chanel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yves Saint Laurent

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 L'Oreal Luxe

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tom Ford SA*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PVH Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LVMH Moët Hennessy Louis Vuitton

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Compagnie Financière Richemont SA

List of Figures

- Figure 1: Global Luxury Goods Market in France Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Luxury Goods Market in France Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Luxury Goods Market in France Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Luxury Goods Market in France Volume (K Units), by Type 2025 & 2033

- Figure 5: North America Luxury Goods Market in France Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Luxury Goods Market in France Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Luxury Goods Market in France Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America Luxury Goods Market in France Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 9: North America Luxury Goods Market in France Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Luxury Goods Market in France Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Luxury Goods Market in France Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Luxury Goods Market in France Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Luxury Goods Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Luxury Goods Market in France Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Luxury Goods Market in France Revenue (billion), by Type 2025 & 2033

- Figure 16: South America Luxury Goods Market in France Volume (K Units), by Type 2025 & 2033

- Figure 17: South America Luxury Goods Market in France Revenue Share (%), by Type 2025 & 2033

- Figure 18: South America Luxury Goods Market in France Volume Share (%), by Type 2025 & 2033

- Figure 19: South America Luxury Goods Market in France Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 20: South America Luxury Goods Market in France Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 21: South America Luxury Goods Market in France Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America Luxury Goods Market in France Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America Luxury Goods Market in France Revenue (billion), by Country 2025 & 2033

- Figure 24: South America Luxury Goods Market in France Volume (K Units), by Country 2025 & 2033

- Figure 25: South America Luxury Goods Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Luxury Goods Market in France Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Luxury Goods Market in France Revenue (billion), by Type 2025 & 2033

- Figure 28: Europe Luxury Goods Market in France Volume (K Units), by Type 2025 & 2033

- Figure 29: Europe Luxury Goods Market in France Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Luxury Goods Market in France Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Luxury Goods Market in France Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 32: Europe Luxury Goods Market in France Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 33: Europe Luxury Goods Market in France Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe Luxury Goods Market in France Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe Luxury Goods Market in France Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe Luxury Goods Market in France Volume (K Units), by Country 2025 & 2033

- Figure 37: Europe Luxury Goods Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Luxury Goods Market in France Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Luxury Goods Market in France Revenue (billion), by Type 2025 & 2033

- Figure 40: Middle East & Africa Luxury Goods Market in France Volume (K Units), by Type 2025 & 2033

- Figure 41: Middle East & Africa Luxury Goods Market in France Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East & Africa Luxury Goods Market in France Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East & Africa Luxury Goods Market in France Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa Luxury Goods Market in France Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa Luxury Goods Market in France Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa Luxury Goods Market in France Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa Luxury Goods Market in France Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East & Africa Luxury Goods Market in France Volume (K Units), by Country 2025 & 2033

- Figure 49: Middle East & Africa Luxury Goods Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Luxury Goods Market in France Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Luxury Goods Market in France Revenue (billion), by Type 2025 & 2033

- Figure 52: Asia Pacific Luxury Goods Market in France Volume (K Units), by Type 2025 & 2033

- Figure 53: Asia Pacific Luxury Goods Market in France Revenue Share (%), by Type 2025 & 2033

- Figure 54: Asia Pacific Luxury Goods Market in France Volume Share (%), by Type 2025 & 2033

- Figure 55: Asia Pacific Luxury Goods Market in France Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific Luxury Goods Market in France Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific Luxury Goods Market in France Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific Luxury Goods Market in France Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific Luxury Goods Market in France Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific Luxury Goods Market in France Volume (K Units), by Country 2025 & 2033

- Figure 61: Asia Pacific Luxury Goods Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Luxury Goods Market in France Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Goods Market in France Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Luxury Goods Market in France Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Global Luxury Goods Market in France Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Luxury Goods Market in France Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Luxury Goods Market in France Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Luxury Goods Market in France Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Luxury Goods Market in France Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Luxury Goods Market in France Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Global Luxury Goods Market in France Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Luxury Goods Market in France Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Luxury Goods Market in France Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Luxury Goods Market in France Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global Luxury Goods Market in France Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Luxury Goods Market in France Volume K Units Forecast, by Type 2020 & 2033

- Table 21: Global Luxury Goods Market in France Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Luxury Goods Market in France Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Luxury Goods Market in France Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Luxury Goods Market in France Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Brazil Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Brazil Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Argentina Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Global Luxury Goods Market in France Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Global Luxury Goods Market in France Volume K Units Forecast, by Type 2020 & 2033

- Table 33: Global Luxury Goods Market in France Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Luxury Goods Market in France Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Luxury Goods Market in France Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Luxury Goods Market in France Volume K Units Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Germany Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: France Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Italy Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Italy Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Spain Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Spain Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Russia Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Russia Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Benelux Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Benelux Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Nordics Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Nordics Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global Luxury Goods Market in France Revenue billion Forecast, by Type 2020 & 2033

- Table 56: Global Luxury Goods Market in France Volume K Units Forecast, by Type 2020 & 2033

- Table 57: Global Luxury Goods Market in France Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Luxury Goods Market in France Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Luxury Goods Market in France Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Luxury Goods Market in France Volume K Units Forecast, by Country 2020 & 2033

- Table 61: Turkey Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Turkey Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Israel Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Israel Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: GCC Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: GCC Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: North Africa Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: North Africa Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: South Africa Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: South Africa Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: Global Luxury Goods Market in France Revenue billion Forecast, by Type 2020 & 2033

- Table 74: Global Luxury Goods Market in France Volume K Units Forecast, by Type 2020 & 2033

- Table 75: Global Luxury Goods Market in France Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global Luxury Goods Market in France Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global Luxury Goods Market in France Revenue billion Forecast, by Country 2020 & 2033

- Table 78: Global Luxury Goods Market in France Volume K Units Forecast, by Country 2020 & 2033

- Table 79: China Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: China Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 81: India Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: India Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 83: Japan Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Japan Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 85: South Korea Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: South Korea Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Oceania Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Oceania Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Luxury Goods Market in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Luxury Goods Market in France Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Goods Market in France?

The projected CAGR is approximately 4.89%.

2. Which companies are prominent players in the Luxury Goods Market in France?

Key companies in the market include Compagnie Financière Richemont SA, Hermès, amelie pichard, Kering, Chanel, Yves Saint Laurent, L'Oreal Luxe, Tom Ford SA*List Not Exhaustive, PVH Corp, LVMH Moët Hennessy Louis Vuitton.

3. What are the main segments of the Luxury Goods Market in France?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.19 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Natural and Organic Formulations.

6. What are the notable trends driving market growth?

High Affinity for Luxury Perfumes.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Beauty and Personal Care Products.

8. Can you provide examples of recent developments in the market?

In April 2022, well-known skincare brand Shiseido declared the launch of its new skincare products in the french market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Goods Market in France," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Goods Market in France report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Goods Market in France?

To stay informed about further developments, trends, and reports in the Luxury Goods Market in France, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence