Key Insights

The global automotive airbags market is poised for substantial growth, projected to reach a significant valuation by 2033. This expansion is driven by a confluence of factors, including increasingly stringent government safety regulations worldwide, a rising consumer demand for advanced vehicle safety features, and the continuous innovation in airbag technologies. As vehicle electrification accelerates, the integration of sophisticated airbag systems within these new designs becomes paramount, further fueling market penetration. The inherent complexity and enhanced protective capabilities of modern airbags, such as multi-stage inflation and specialized designs for different vehicle types and seating positions, are key technological advancements contributing to this upward trajectory. Furthermore, the aftermarket segment is experiencing robust growth as older vehicles are retrofitted with improved safety components, enhancing the overall appeal and market reach of automotive airbags.

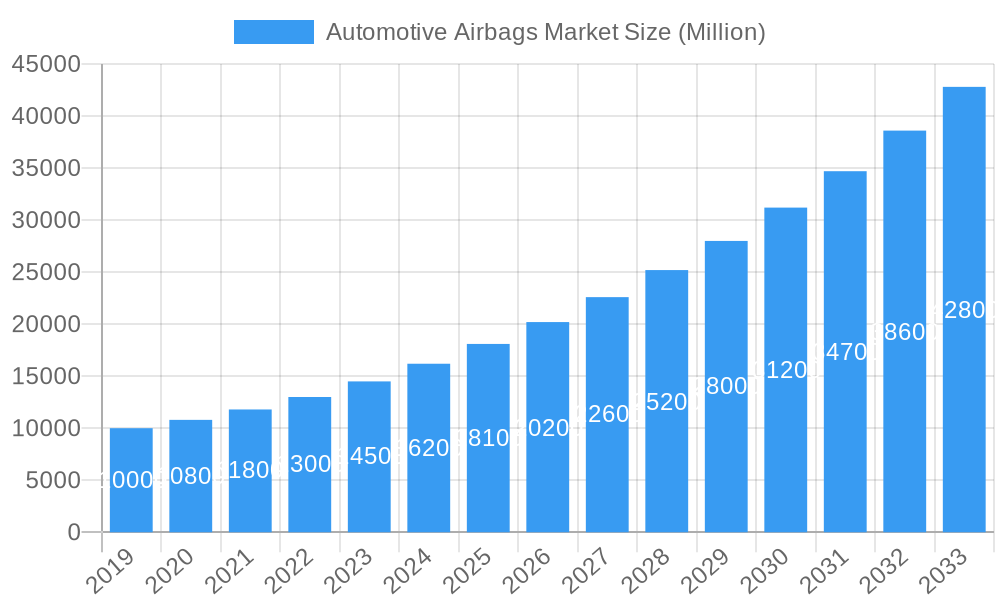

Automotive Airbags Market Market Size (In Billion)

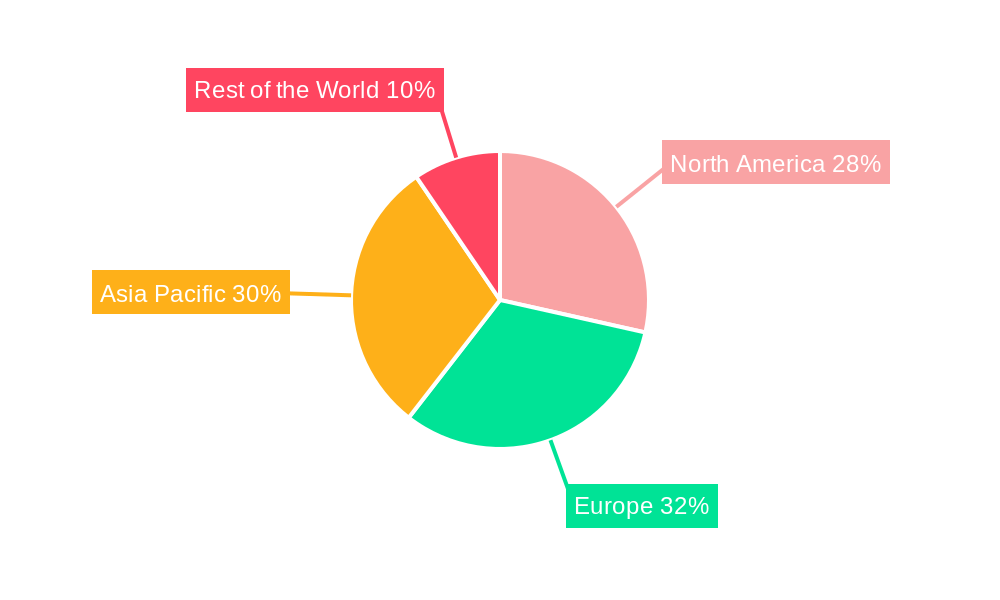

The market's robust Compound Annual Growth Rate (CAGR) of 11.51% underscores its dynamic nature and strong potential. While the adoption of advanced safety features in passenger cars remains a dominant force, the increasing integration of airbags in commercial vehicles, driven by fleet safety mandates and operational efficiency gains from reduced accident-related downtime, presents a significant growth avenue. Key industry players are actively investing in research and development to create lighter, more efficient, and cost-effective airbag solutions, including advanced frontal, side, curtain, and knee airbags, as well as emerging technologies like inflatable seat belts. Geographically, Asia Pacific, led by China and India, is emerging as a critical growth hub due to its burgeoning automotive industry and increasing emphasis on road safety. North America and Europe, with their mature automotive markets and well-established safety standards, continue to represent substantial market share and demand for premium airbag systems.

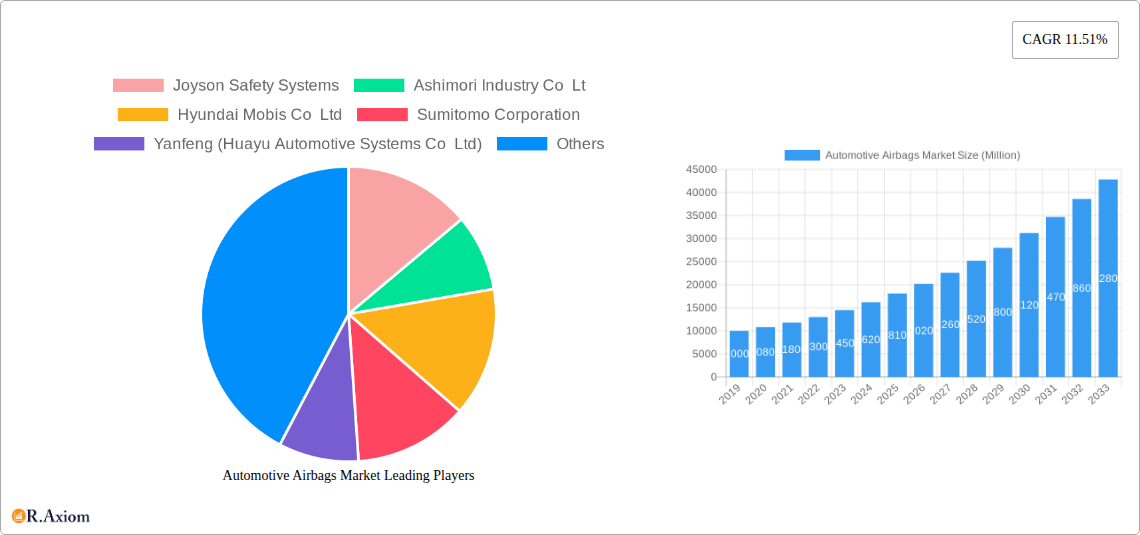

Automotive Airbags Market Company Market Share

Automotive Airbags Market Market Concentration & Innovation

The global automotive airbags market is characterized by a moderate to high level of concentration, with a few dominant players holding significant market share. Innovation remains a key differentiator, driven by increasing demand for advanced safety features and evolving automotive technologies. Regulatory frameworks, such as stringent safety standards enforced by governments worldwide, act as primary innovation drivers, compelling manufacturers to develop more sophisticated airbag systems. For instance, the increasing focus on occupant protection in diverse seating positions and crash scenarios necessitates continuous research and development in areas like curtain airbags, side airbags, and knee airbags. Product substitutes, while limited in direct replacement for life-saving airbags, include advanced driver-assistance systems (ADAS) that aim to prevent accidents altogether. However, regulatory mandates and consumer demand for comprehensive safety ensure the continued growth of the airbag market. End-user trends are leaning towards higher safety specifications across all vehicle types, including passenger cars and commercial vehicles, with a growing preference for integrated safety solutions. Merger and acquisition (M&A) activities are a crucial aspect of market dynamics, allowing companies to expand their product portfolios, geographic reach, and technological capabilities. For example, strategic acquisitions can help consolidate market share and foster innovation through shared R&D resources. The M&A deal value in this sector often reflects the strategic importance of acquiring advanced airbag technologies and market access, contributing to overall market consolidation and efficiency.

Automotive Airbags Market Industry Trends & Insights

The automotive airbags market is witnessing robust growth, propelled by a confluence of technological advancements, evolving consumer preferences, and stringent global safety regulations. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period of 2025-2033, reaching an estimated market size of over $35,000 million by 2033. This sustained growth is primarily attributed to the increasing mandatory safety requirements in major automotive markets worldwide, which mandate the inclusion of a comprehensive suite of airbags, including front, side, curtain, and knee airbags, in new vehicle models. The rising global vehicle production, particularly in emerging economies, further fuels the demand for automotive airbags. Technological disruptions are playing a pivotal role, with continuous innovation in airbag design and deployment systems. Manufacturers are focusing on lighter, more compact, and adaptable airbag solutions that can be seamlessly integrated into modern vehicle interiors without compromising aesthetics or functionality. The development of advanced sensor technologies and intelligent control units enables more precise and timely airbag deployment, enhancing occupant safety in a wider range of collision scenarios. Consumer preferences are increasingly skewed towards vehicles equipped with advanced safety features, with airbags being a fundamental expectation. This trend is amplified by growing consumer awareness of road safety and the potential risks associated with inadequate protection. The competitive dynamics within the automotive airbags market are intense, characterized by strategic collaborations, product development, and a focus on cost-efficiency and quality. Companies are investing heavily in research and development to stay ahead of the curve and meet the ever-increasing safety standards. The penetration of advanced airbag systems, such as inflatable seat belts and specialized knee airbags, is also on the rise, catering to niche safety requirements and enhancing overall vehicle safety. The market penetration of airbags in new vehicles is already very high, approaching 100% in many developed markets, with growth primarily driven by the increasing number of airbags per vehicle and the adoption in commercial vehicle segments.

Dominant Markets & Segments in Automotive Airbags Market

The automotive airbags market exhibits a clear dominance in certain regions and segments, driven by a combination of regulatory mandates, economic strength, and consumer demand.

- Dominant Region: North America and Europe currently lead the automotive airbags market due to their stringent vehicle safety regulations and a high consumer emphasis on safety features. Countries like the United States and Germany are at the forefront, with near-universal adoption of multiple airbag systems in passenger cars. Economic policies that incentivize the adoption of advanced safety technologies and robust aftermarket support further bolster these regions.

- Leading Vehicle Type: Passenger Cars represent the largest segment within the automotive airbags market. This is primarily due to the sheer volume of passenger car production globally and the established regulatory requirements for their safety. The trend towards SUVs and crossovers, which often feature a comprehensive airbag suite, also contributes significantly to this segment's dominance.

- Key Drivers:

- Strict government safety mandates for passenger vehicles.

- High consumer demand for safety features in personal transportation.

- Technological advancements making advanced airbags cost-effective for mass production.

- Growing middle-class populations in emerging economies adopting passenger cars.

- Key Drivers:

- Dominant Airbag Type: Front Airbags (driver and passenger) have historically been the most dominant airbag type due to their foundational role in occupant safety and early regulatory mandates. However, Side Airbags and Curtain Airbags are rapidly gaining market share and importance. Their increasing prevalence is driven by the need to protect occupants in lateral collisions and rollovers, as well as evolving vehicle designs that offer less inherent structural protection in these scenarios.

- Key Drivers:

- Evolving crash test standards (e.g., IIHS, Euro NCAP) that emphasize side-impact protection.

- Increased prevalence of larger vehicles and their impact on side-impact safety.

- Development of advanced sensor technology for precise deployment.

- Consumer demand for comprehensive protection against various collision types.

- Key Drivers:

- Dominant Sales Channel: The Original Equipment Manufacturer (OEM) channel commands the largest share of the automotive airbags market. The majority of airbag units are supplied directly to vehicle manufacturers for integration during the vehicle assembly process. This is a direct consequence of airbag systems being integral safety components designed and validated for specific vehicle platforms.

- Key Drivers:

- Mandatory integration of airbags during vehicle production.

- Long-term supply agreements between airbag manufacturers and OEMs.

- OEMs' control over vehicle safety specifications and component sourcing.

- Economies of scale achieved through large-volume OEM orders.

- Replacement/Aftermarket: While smaller, the replacement/aftermarket segment is crucial for post-accident repairs and older vehicle upgrades. The growing number of vehicles on the road and the increasing awareness of the need to replace deployed airbags contribute to its steady growth.

- Key Drivers:

Automotive Airbags Market Product Developments

Recent product developments in the automotive airbags market are centered on enhancing occupant protection across a wider range of scenarios and improving integration within evolving vehicle architectures. Innovations include the development of more sophisticated and compact airbag modules, such as advanced knee airbags designed for improved leg protection and the continuous refinement of curtain airbags for enhanced head protection in side impacts and rollovers. Companies are also exploring the integration of inflatable seat belts and innovative passenger seat safety solutions, like those from Yanfeng, which incorporate specialized airbags (e.g., hoodie and buttock airbags) for occupants in reclined positions. These developments aim to address emerging safety challenges and meet increasingly stringent regulatory demands, providing competitive advantages through superior safety performance and design integration.

Report Scope & Segmentation Analysis

This comprehensive report delves into the global automotive airbags market, providing in-depth analysis across key segmentation parameters to offer actionable insights. The market is segmented by Vehicle Type, including Passenger Cars and Commercial Vehicles. Further segmentation is provided by Airbag Type, encompassing Front Airbags, Inflatable Seat Belts, Curtain Airbags, Side Airbags, and Knee Airbags. The analysis also covers the Sales Channel, differentiating between Original Equipment Manufacturer (OEM) and Replacement/Aftermarket segments. Growth projections and market size estimates are provided for each segment, detailing competitive dynamics and the unique drivers influencing their respective trajectories. For instance, the Passenger Cars segment is expected to exhibit a strong CAGR of over 8% through 2033, driven by mandatory safety regulations and consumer demand. Conversely, the Commercial Vehicles segment, while smaller, is projected to experience a significant CAGR of approximately 6.5% as safety standards in trucking and logistics evolve.

Key Drivers of Automotive Airbags Market Growth

The automotive airbags market is propelled by several critical growth drivers that shape its trajectory:

- Stringent Global Safety Regulations: Governments worldwide are continuously enhancing vehicle safety standards, mandating a higher number and sophistication of airbags in new vehicles. This includes regulations for side-impact protection, pedestrian safety, and occupant protection in diverse crash scenarios, directly fueling demand for various airbag types.

- Increasing Vehicle Production: The rising global demand for automobiles, particularly in emerging economies, directly translates into a higher volume of airbag installations. As more vehicles are manufactured, the need for essential safety components like airbags escalates.

- Consumer Demand for Advanced Safety Features: Consumers are increasingly prioritizing vehicle safety. The presence of multiple airbags is now a key purchasing criterion, pushing automakers to equip their vehicles with comprehensive airbag systems to meet market expectations.

- Technological Advancements in Airbag Systems: Continuous innovation in airbag materials, deployment mechanisms, and sensor technology allows for lighter, more compact, and more effective airbag solutions. This innovation also enables the development of specialized airbags for specific needs, broadening the market's scope.

Challenges in the Automotive Airbags Market Sector

Despite the robust growth, the automotive airbags market faces several challenges that could impede its progress:

- High Research and Development Costs: Developing advanced airbag technologies requires significant investment in R&D to ensure optimal performance, reliability, and compliance with evolving safety standards.

- Supply Chain Vulnerabilities: The global automotive supply chain is susceptible to disruptions, which can impact the availability and cost of raw materials and components essential for airbag manufacturing. Geopolitical events and natural disasters can exacerbate these vulnerabilities.

- Increasing Complexity of Vehicle Integration: As vehicles become more sophisticated with integrated electronics and advanced driver-assistance systems (ADAS), integrating airbag systems seamlessly without compromising other functionalities or aesthetics presents a significant engineering challenge.

- Stringent and Evolving Regulatory Landscape: While regulations drive growth, the constant evolution and increasing stringency of safety standards necessitate continuous adaptation and re-validation of airbag systems, which can be time-consuming and costly.

Emerging Opportunities in Automotive Airbags Market

The automotive airbags market is ripe with emerging opportunities driven by evolving automotive trends and consumer expectations:

- Expansion in Emerging Economies: As vehicle production and safety consciousness rise in developing nations across Asia, Latin America, and Africa, there is a substantial opportunity for increased airbag adoption in these markets.

- Development of Next-Generation Airbags: Research into novel airbag technologies, such as adaptive airbags that adjust deployment force based on occupant size and position, or airbags designed for autonomous vehicles, presents significant future growth potential.

- Integration with ADAS and Autonomous Driving: The convergence of airbag systems with ADAS and autonomous driving technologies offers opportunities to create more holistic safety solutions, where airbags work in conjunction with other systems to predict and mitigate potential collisions.

- Focus on Lightweight and Sustainable Materials: Developing airbags from lighter and more sustainable materials can appeal to automakers looking to improve fuel efficiency and reduce their environmental footprint, creating a niche market advantage.

Leading Players in the Automotive Airbags Market Market

- Joyson Safety Systems

- Ashimori Industry Co Lt

- Hyundai Mobis Co Ltd

- Sumitomo Corporation

- Yanfeng (Huayu Automotive Systems Co Ltd)

- Continental AG

- Autoliv Inc

- Jinzhou Jinheng Automotive Safety System Co Ltd

- Toyoda Gosei Co Ltd

- ZF Friedrichshafen AG

Key Developments in Automotive Airbags Market Industry

- January 2024: Audi reported that a total of 1,001 units of Q7 and Q8 models would need to be returned to dealerships in the United States because of a driver seat-side airbag fault, which was not properly mounted in the seatback frame. Due to the failure to comply with Federal Motor Vehicle Standards, the company alerted the owners of the impacted vehicles to return their models to dealerships by February 2024. This highlights the critical importance of manufacturing precision and adherence to safety standards.

- November 2023: Toyoda Gosei Co. Ltd commenced operations at its new facility in Guangdong Province, China, to enhance its production capabilities for core safety systems like airbag offerings. The new plant was built as a branch plant of Toyoda Gosei (Foshan) Auto Parts Co. Ltd (TGFP) to meet the increasing needs for airbags and other safety systems that are anticipated with the higher automobile production and stricter safety regulations in China. This strategic expansion underscores the growing demand in the Asian market.

- August 2023: Toyoda Gosei unveiled its 2030 Business Plan, outlining a medium to long-term strategy leading to 2030. The company plans to focus its management resources on key areas such as safety systems, including airbags and seatbelts, as well as interior and exterior components. In response to increasingly stringent safety regulations and other market dynamics, the company anticipates a 50% increase in airbag production by 2030 compared to 2022 figures. This demonstrates a clear commitment to innovation and growth in the safety systems sector.

- July 2023: Yanfeng developed an innovative package of safety solutions that are integrated into the passenger seat, consisting of several innovative components that together provide safety measures intended to reduce injuries from collisions when occupants are seated in a large-angle reclined forward seating position. The company stated that this solution, which includes a hoodie airbag and a buttock airbag, is specifically designed to enhance mobility and safety in China. This showcases the trend towards specialized airbag solutions for evolving seating positions and specific market needs.

Strategic Outlook for Automotive Airbags Market Market

The strategic outlook for the automotive airbags market is exceptionally positive, driven by an unwavering global commitment to vehicle safety and continuous technological innovation. The forecast period of 2025-2033 is expected to witness sustained growth, catalyzed by increasingly stringent governmental regulations that mandate comprehensive airbag protection across all vehicle segments. The expansion of the automotive industry in emerging economies presents a significant untapped market, offering substantial opportunities for both established and new players. Furthermore, the integration of advanced airbag systems with evolving automotive technologies, such as autonomous driving and advanced driver-assistance systems (ADAS), will unlock new avenues for product development and market penetration. The ongoing pursuit of lighter, more efficient, and intelligent airbag solutions will remain a core strategic focus for manufacturers, ensuring they remain competitive in this dynamic and safety-critical industry.

Automotive Airbags Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Type

- 2.1. Front Airbags

- 2.2. Inflatable Seat Belts

- 2.3. Curtain Airbags

- 2.4. Side Airbags

- 2.5. Knee Airbags

-

3. Sales Channel

- 3.1. Original Equipment Manufacturer (OEM)

- 3.2. Replacement/Aftermarket

Automotive Airbags Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Airbags Market Regional Market Share

Geographic Coverage of Automotive Airbags Market

Automotive Airbags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Passenger and Commercial Vehicle Sales to Foster Growth

- 3.3. Market Restrains

- 3.3.1. Airbag Malfunction and Recall Deters Growth

- 3.4. Market Trends

- 3.4.1. Passengers Cars Segment to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Airbags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Front Airbags

- 5.2.2. Inflatable Seat Belts

- 5.2.3. Curtain Airbags

- 5.2.4. Side Airbags

- 5.2.5. Knee Airbags

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Original Equipment Manufacturer (OEM)

- 5.3.2. Replacement/Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive Airbags Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Front Airbags

- 6.2.2. Inflatable Seat Belts

- 6.2.3. Curtain Airbags

- 6.2.4. Side Airbags

- 6.2.5. Knee Airbags

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. Original Equipment Manufacturer (OEM)

- 6.3.2. Replacement/Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive Airbags Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Front Airbags

- 7.2.2. Inflatable Seat Belts

- 7.2.3. Curtain Airbags

- 7.2.4. Side Airbags

- 7.2.5. Knee Airbags

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. Original Equipment Manufacturer (OEM)

- 7.3.2. Replacement/Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive Airbags Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Front Airbags

- 8.2.2. Inflatable Seat Belts

- 8.2.3. Curtain Airbags

- 8.2.4. Side Airbags

- 8.2.5. Knee Airbags

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. Original Equipment Manufacturer (OEM)

- 8.3.2. Replacement/Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive Airbags Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Front Airbags

- 9.2.2. Inflatable Seat Belts

- 9.2.3. Curtain Airbags

- 9.2.4. Side Airbags

- 9.2.5. Knee Airbags

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. Original Equipment Manufacturer (OEM)

- 9.3.2. Replacement/Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Joyson Safety Systems

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ashimori Industry Co Lt

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hyundai Mobis Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sumitomo Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Yanfeng (Huayu Automotive Systems Co Ltd)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Autoliv Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Jinzhou Jinheng Automotive Safety System Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Toyoda Gosei Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ZF Friedrichshafen AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Joyson Safety Systems

List of Figures

- Figure 1: Global Automotive Airbags Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Airbags Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive Airbags Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive Airbags Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Automotive Airbags Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Automotive Airbags Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 7: North America Automotive Airbags Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 8: North America Automotive Airbags Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Airbags Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Airbags Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive Airbags Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive Airbags Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Automotive Airbags Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Automotive Airbags Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 15: Europe Automotive Airbags Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 16: Europe Automotive Airbags Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Airbags Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Airbags Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Airbags Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Airbags Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Airbags Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Airbags Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 23: Asia Pacific Automotive Airbags Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 24: Asia Pacific Automotive Airbags Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Airbags Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Airbags Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Automotive Airbags Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Automotive Airbags Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Rest of the World Automotive Airbags Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Rest of the World Automotive Airbags Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 31: Rest of the World Automotive Airbags Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 32: Rest of the World Automotive Airbags Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Airbags Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Airbags Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive Airbags Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Automotive Airbags Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 4: Global Automotive Airbags Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Airbags Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive Airbags Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Automotive Airbags Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 8: Global Automotive Airbags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Airbags Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Automotive Airbags Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Automotive Airbags Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 15: Global Automotive Airbags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Airbags Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 22: Global Automotive Airbags Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Automotive Airbags Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 24: Global Automotive Airbags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Airbags Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 31: Global Automotive Airbags Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Automotive Airbags Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 33: Global Automotive Airbags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive Airbags Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Airbags Market?

The projected CAGR is approximately 11.51%.

2. Which companies are prominent players in the Automotive Airbags Market?

Key companies in the market include Joyson Safety Systems, Ashimori Industry Co Lt, Hyundai Mobis Co Ltd, Sumitomo Corporation, Yanfeng (Huayu Automotive Systems Co Ltd), Continental AG, Autoliv Inc, Jinzhou Jinheng Automotive Safety System Co Ltd, Toyoda Gosei Co Ltd, ZF Friedrichshafen AG.

3. What are the main segments of the Automotive Airbags Market?

The market segments include Vehicle Type, Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Passenger and Commercial Vehicle Sales to Foster Growth.

6. What are the notable trends driving market growth?

Passengers Cars Segment to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

Airbag Malfunction and Recall Deters Growth.

8. Can you provide examples of recent developments in the market?

January 2024: Audi reported that a total of 1,001 units of Q7 and Q8 models would need to be returned to dealerships in the United States because of a driver seat-side airbag fault, which was not properly mounted in the seatback frame. Due to the failure to comply with Federal Motor Vehicle Standards, the company alerted the owners of the impacted vehicles to return their models to dealerships by February 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Airbags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Airbags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Airbags Market?

To stay informed about further developments, trends, and reports in the Automotive Airbags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence