Key Insights

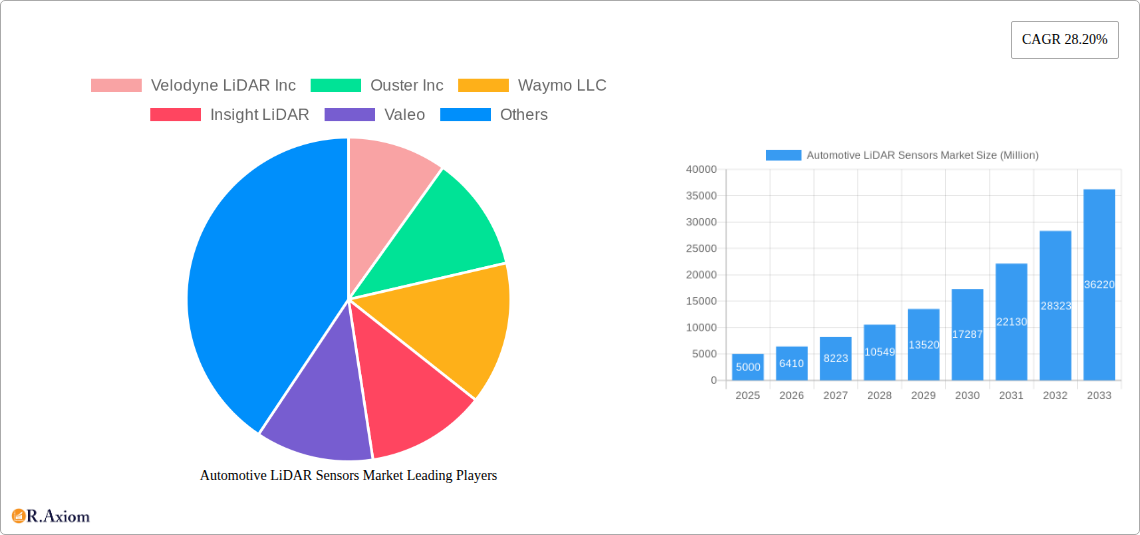

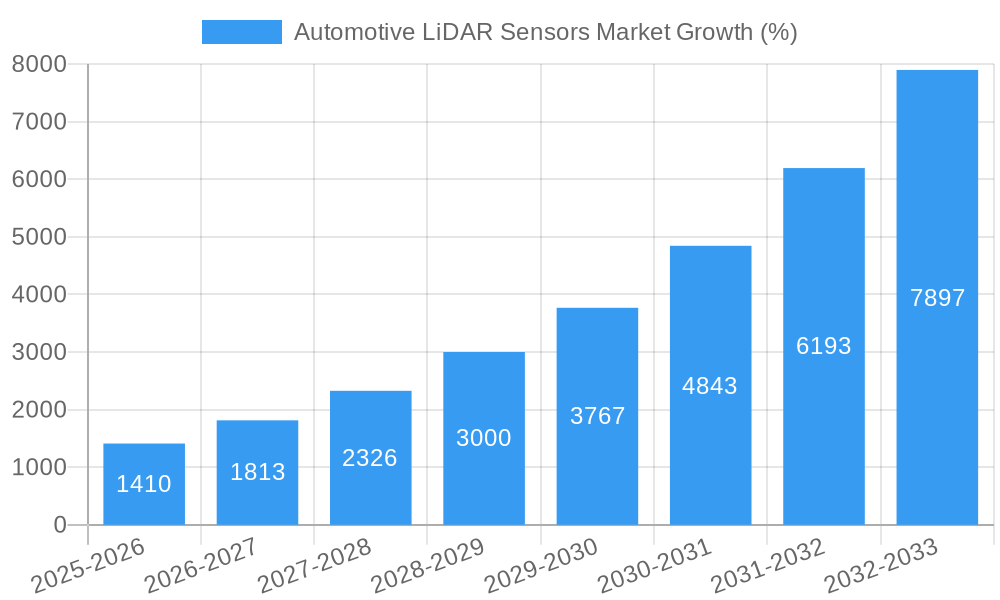

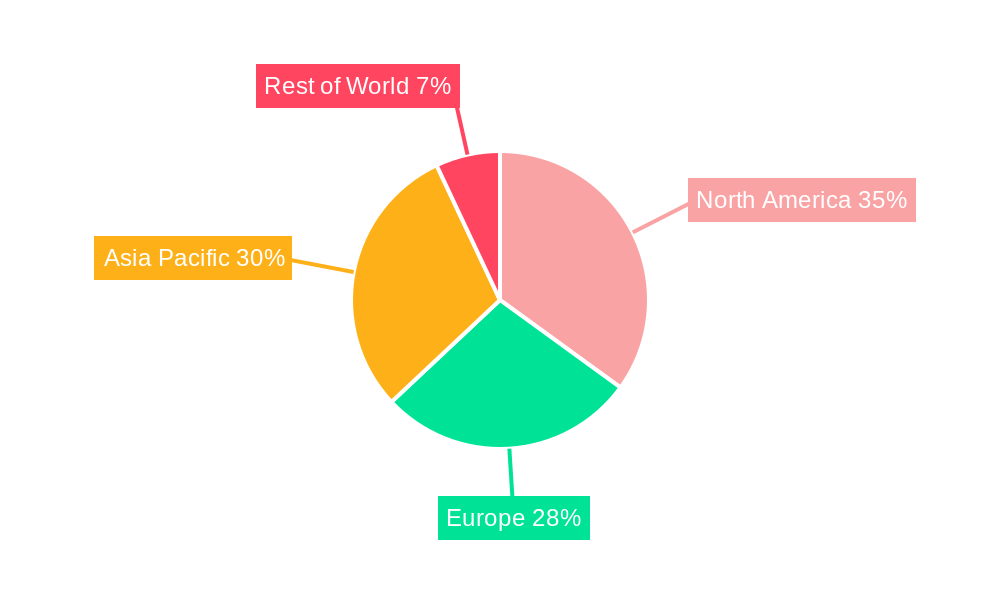

The Automotive LiDAR Sensors market is experiencing robust growth, driven by the increasing adoption of Advanced Driver-Assistance Systems (ADAS) and the burgeoning development of autonomous vehicles (robotic vehicles). The market's Compound Annual Growth Rate (CAGR) of 28.20% from 2019 to 2024 indicates significant expansion, projected to continue throughout the forecast period (2025-2033). This growth is fueled by several key factors, including advancements in LiDAR technology resulting in improved accuracy, range, and affordability, coupled with stringent government regulations promoting road safety and autonomous driving initiatives. The market segmentation reveals strong demand from both the ADAS and robotic vehicle applications, with robotic vehicles expected to be a significant growth driver in the coming years due to their reliance on high-precision sensor data for navigation and obstacle detection. Leading companies like Velodyne LiDAR, Ouster, and Waymo are investing heavily in R&D, fostering innovation and competition within the market. Geographic growth is expected to be distributed across North America, Europe, and Asia Pacific, with the latter region showing particularly strong potential due to the rapid expansion of its automotive industry and supportive government policies.

The competitive landscape is characterized by both established automotive suppliers and specialized LiDAR manufacturers. While established players like Bosch and Valeo leverage their existing automotive supply chain networks, specialized LiDAR companies like Velodyne and Ouster are focusing on technological advancements. The market is also witnessing a trend towards mergers and acquisitions, as larger players seek to consolidate their market share and access key technologies. Despite the positive growth trajectory, challenges such as high initial costs of LiDAR sensors, environmental limitations (e.g., adverse weather conditions affecting performance), and the need for robust data processing infrastructure remain potential restraints. However, ongoing technological innovations and decreasing production costs are expected to mitigate these challenges, ensuring continued market expansion in the long term. Further market analysis should consider the impact of emerging technologies like solid-state LiDAR and the integration of LiDAR with other sensor modalities like radar and cameras for enhanced perception capabilities.

Automotive LiDAR Sensors Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Automotive LiDAR Sensors Market, covering market size, growth drivers, challenges, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period covers 2019-2024. This report is crucial for industry stakeholders, investors, and researchers seeking actionable insights into this rapidly evolving market. The total market size in 2025 is estimated at xx Million and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Automotive LiDAR Sensors Market Market Concentration & Innovation

The Automotive LiDAR Sensors market is characterized by a moderately concentrated landscape with several key players vying for market share. While a few dominant players like Velodyne LiDAR Inc, Ouster Inc, and Waymo LLC hold significant market share, the presence of several other established companies such as Valeo, Robert Bosch GmbH, Leddar Tech, and RoboSens indicates a competitive environment. Market share data for 2025 suggests that Velodyne holds approximately xx%, Ouster holds xx%, and Waymo holds xx%, with the remaining share distributed amongst other competitors.

Innovation is a key driver in this market, with continuous advancements in sensor technology, including solid-state LiDAR, flash LiDAR, and MEMS LiDAR, pushing the boundaries of performance and cost-effectiveness. Regulatory frameworks concerning autonomous vehicle deployment and safety standards significantly impact market growth. The increasing adoption of ADAS (Advanced Driver-Assistance Systems) and the rising demand for autonomous vehicles are major catalysts for market expansion. Product substitutes, such as radar and cameras, pose some competition, but LiDAR's unique capabilities in long-range detection and high-resolution imaging maintain its crucial role. Furthermore, mergers and acquisitions (M&A) activities are frequent, with deal values exceeding xx Million in recent years, as companies strive to expand their product portfolios and market reach. For example, the multi-year agreement between Velodyne LiDAR and NAVYA in March 2020 underscores the strategic partnerships shaping the industry landscape.

Automotive LiDAR Sensors Market Industry Trends & Insights

The Automotive LiDAR Sensors market is experiencing robust growth, driven by several key factors. The increasing adoption of ADAS features in vehicles, such as adaptive cruise control and lane-keeping assist, significantly fuels demand. The burgeoning autonomous vehicle sector represents a substantial growth opportunity, with companies like Waymo actively deploying driverless vehicles. Technological advancements, including the development of more efficient and cost-effective LiDAR systems, further contribute to market expansion. Consumer preferences are shifting towards enhanced safety and convenience features, bolstering demand for LiDAR-equipped vehicles. Competitive dynamics are characterized by intense innovation, strategic partnerships, and M&A activities, as companies strive to enhance their technology and market position. Market penetration of LiDAR sensors is rapidly increasing across various vehicle segments, with xx% penetration in the high-end vehicle segment by 2025. This penetration is expected to rise to xx% by 2033. The market is projected to witness a significant expansion during the forecast period, primarily driven by rising consumer demand for advanced safety features and the expansion of autonomous driving technology. The CAGR for the forecast period is estimated to be xx%.

Dominant Markets & Segments in Automotive LiDAR Sensors Market

The North American region currently dominates the Automotive LiDAR Sensors market, driven by strong demand from the automotive industry, a robust regulatory environment supporting autonomous vehicle development, and significant investments in the sector. Within this region, the United States is the leading country due to its highly developed automotive industry and advanced technological infrastructure.

- Key Drivers for North American Dominance:

- Strong government support for autonomous vehicle development.

- High adoption rate of advanced driver-assistance systems (ADAS).

- Presence of major automotive manufacturers and technology companies.

- Well-developed technological infrastructure and research facilities.

- High consumer spending power and demand for advanced vehicle features.

By application, the ADAS segment currently holds a larger market share compared to the robotic vehicles segment. This is mainly because ADAS features are already being integrated into commercially available vehicles, whereas the widespread adoption of robotic vehicles is still in its nascent stages. However, the robotic vehicles segment exhibits significant growth potential, with its expected contribution to market growth escalating dramatically within the next decade. The increasing demand for autonomous vehicles across various sectors like logistics and transportation presents an immense opportunity for LiDAR technology in the robotic vehicle segment.

Automotive LiDAR Sensors Market Product Developments

Recent product innovations include the development of smaller, lighter, and more energy-efficient LiDAR sensors. These advancements are critical for broader integration into vehicles and improving overall system performance. The market is witnessing a shift towards solid-state LiDAR technology, which offers advantages in terms of reliability, durability, and cost-effectiveness compared to traditional mechanical LiDAR systems. This technological trend is improving the market fit of LiDAR sensors by enabling their adoption in a wider range of vehicles and applications. The competitive advantage hinges on factors such as sensor range, accuracy, resolution, and cost-effectiveness, with companies continuously striving to optimize these parameters.

Report Scope & Segmentation Analysis

This report segments the Automotive LiDAR Sensors market by application:

Robotic Vehicles: This segment encompasses LiDAR sensors used in autonomous vehicles, delivery robots, and other robotic applications. The market size for robotic vehicles is projected to grow at a xx% CAGR from 2025 to 2033, driven by increasing investments in autonomous vehicle technology and rising demand for automated logistics solutions. Competitive dynamics within this segment are characterized by intense innovation and a focus on developing robust and reliable LiDAR systems.

ADAS: This segment includes LiDAR sensors utilized in advanced driver-assistance systems (ADAS). The ADAS segment is expected to witness a steady growth rate, with a projected CAGR of xx% during the forecast period. The growth is primarily driven by increasing consumer demand for safety and convenience features, coupled with governmental regulations promoting the adoption of ADAS technologies. The competitive landscape is relatively consolidated, with major players continuously striving for technological advancements to enhance their market position.

Key Drivers of Automotive LiDAR Sensors Market Growth

Several key factors drive the growth of the Automotive LiDAR Sensors market: The rising demand for enhanced safety features in vehicles, particularly ADAS, fuels market growth. Government regulations and safety standards mandating advanced driver-assistance systems further stimulate market expansion. The surge in investments and technological advancements within the autonomous vehicle industry create significant opportunities for LiDAR sensor adoption. Falling LiDAR sensor costs, along with the improved performance and reliability of newer technologies, make them more accessible to a broader range of vehicle manufacturers and applications.

Challenges in the Automotive LiDAR Sensors Market Sector

Despite the market's growth potential, several challenges persist. High initial costs of LiDAR sensors compared to alternative technologies, such as radar and cameras, remain a barrier to widespread adoption. The complex integration of LiDAR sensors into vehicles necessitates sophisticated software and hardware solutions, resulting in higher development costs. Supply chain disruptions and component shortages can impact production and increase costs. Moreover, the ongoing development and refinement of regulatory frameworks and safety standards for autonomous vehicles present uncertainties. Finally, competitive pressure from established players and new entrants continues to intensify. The inability to meet performance expectations in adverse weather conditions such as fog and heavy rain also poses a major challenge.

Emerging Opportunities in Automotive LiDAR Sensors Market

Emerging opportunities lie in the development of next-generation LiDAR technologies, including solid-state LiDAR, which offer improved performance, cost-effectiveness, and robustness. The expansion of the autonomous vehicle market beyond passenger vehicles into sectors like delivery and logistics creates substantial growth potential. Furthermore, the increasing integration of LiDAR sensors with other sensor technologies, such as radar and cameras, to create multi-sensor fusion systems opens up new possibilities for enhanced perception and decision-making capabilities. Furthermore, the growing demand for improved driver assistance features in emerging markets presents an enormous untapped market for LiDAR sensors.

Leading Players in the Automotive LiDAR Sensors Market Market

- Velodyne LiDAR Inc

- Ouster Inc

- Waymo LLC

- Insight LiDAR

- Valeo

- Robert Bosch GmbH

- Leddar Tech

- RoboSens

Key Developments in Automotive LiDAR Sensors Market Industry

October 2020: Waymo launched a fully driverless ride-hailing service in the Phoenix metro area. This deployment significantly demonstrates the viability of autonomous driving technology and propels the demand for LiDAR sensors.

March 2020: Velodyne Lidar Inc. entered into a multi-year sales agreement with NAVYA for the supply of LiDAR sensors in autonomous shuttles. This strategic partnership underscores the increasing adoption of LiDAR technology in the autonomous vehicle sector.

Strategic Outlook for Automotive LiDAR Sensors Market Market

The future of the Automotive LiDAR Sensors market appears promising, with strong growth projected over the next decade. Continued technological advancements, decreasing costs, and expanding applications across various vehicle segments and industries (robotics, logistics, mapping etc.) are key growth catalysts. The rising demand for autonomous and semi-autonomous vehicles, driven by safety concerns and the pursuit of enhanced driving experiences, further enhances market potential. Strategic partnerships and collaborations among key players will play a crucial role in shaping the competitive landscape and accelerating market growth. The focus will be on the development of more efficient, reliable, and cost-effective LiDAR systems capable of performing effectively under diverse environmental conditions.

Automotive LiDAR Sensors Market Segmentation

-

1. Application

- 1.1. Robotic Vehicles

-

1.2. ADAS

- 1.2.1. ADAS Level 2+ and 2++

- 1.2.2. ADAS Level 3 and Level 4

- 1.2.3. ADAS Level 5

Automotive LiDAR Sensors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of World

Automotive LiDAR Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 28.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Superiority of LiDAR; Increasing Vehicle Safety Regulations and Growing Adoption of Adas Technology By OEM's

- 3.3. Market Restrains

- 3.3.1. Lack of Electric Charging Infrastructure May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. ADAS is Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive LiDAR Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Robotic Vehicles

- 5.1.2. ADAS

- 5.1.2.1. ADAS Level 2+ and 2++

- 5.1.2.2. ADAS Level 3 and Level 4

- 5.1.2.3. ADAS Level 5

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive LiDAR Sensors Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Robotic Vehicles

- 6.1.2. ADAS

- 6.1.2.1. ADAS Level 2+ and 2++

- 6.1.2.2. ADAS Level 3 and Level 4

- 6.1.2.3. ADAS Level 5

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Automotive LiDAR Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Robotic Vehicles

- 7.1.2. ADAS

- 7.1.2.1. ADAS Level 2+ and 2++

- 7.1.2.2. ADAS Level 3 and Level 4

- 7.1.2.3. ADAS Level 5

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Automotive LiDAR Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Robotic Vehicles

- 8.1.2. ADAS

- 8.1.2.1. ADAS Level 2+ and 2++

- 8.1.2.2. ADAS Level 3 and Level 4

- 8.1.2.3. ADAS Level 5

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of World Automotive LiDAR Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Robotic Vehicles

- 9.1.2. ADAS

- 9.1.2.1. ADAS Level 2+ and 2++

- 9.1.2.2. ADAS Level 3 and Level 4

- 9.1.2.3. ADAS Level 5

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. North America Automotive LiDAR Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Automotive LiDAR Sensors Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Automotive LiDAR Sensors Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of World Automotive LiDAR Sensors Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Velodyne LiDAR Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Ouster Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Waymo LLC

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Insight LiDAR

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Valeo

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Robert Bosch GmbH

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Leddar Tech

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 RoboSens

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.1 Velodyne LiDAR Inc

List of Figures

- Figure 1: Global Automotive LiDAR Sensors Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive LiDAR Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive LiDAR Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive LiDAR Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive LiDAR Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive LiDAR Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive LiDAR Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of World Automotive LiDAR Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of World Automotive LiDAR Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive LiDAR Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 11: North America Automotive LiDAR Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 12: North America Automotive LiDAR Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Automotive LiDAR Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive LiDAR Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 15: Europe Automotive LiDAR Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automotive LiDAR Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Automotive LiDAR Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Automotive LiDAR Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Asia Pacific Automotive LiDAR Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Asia Pacific Automotive LiDAR Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Automotive LiDAR Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of World Automotive LiDAR Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Rest of World Automotive LiDAR Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Rest of World Automotive LiDAR Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of World Automotive LiDAR Sensors Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Automotive LiDAR Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Automotive LiDAR Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Automotive LiDAR Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Automotive LiDAR Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Automotive LiDAR Sensors Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive LiDAR Sensors Market?

The projected CAGR is approximately 28.20%.

2. Which companies are prominent players in the Automotive LiDAR Sensors Market?

Key companies in the market include Velodyne LiDAR Inc, Ouster Inc, Waymo LLC, Insight LiDAR, Valeo, Robert Bosch GmbH, Leddar Tech, RoboSens.

3. What are the main segments of the Automotive LiDAR Sensors Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Superiority of LiDAR; Increasing Vehicle Safety Regulations and Growing Adoption of Adas Technology By OEM's.

6. What are the notable trends driving market growth?

ADAS is Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

Lack of Electric Charging Infrastructure May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

October 2020 - Waymo announced that it is launching fully driverless vehicles to the public, announced by the company. It is starting a driverless ride-hailing service for riders in the Phoenix metro area. It will enable passengers to download its app and hail a ride without a driver.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive LiDAR Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive LiDAR Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive LiDAR Sensors Market?

To stay informed about further developments, trends, and reports in the Automotive LiDAR Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence