Key Insights

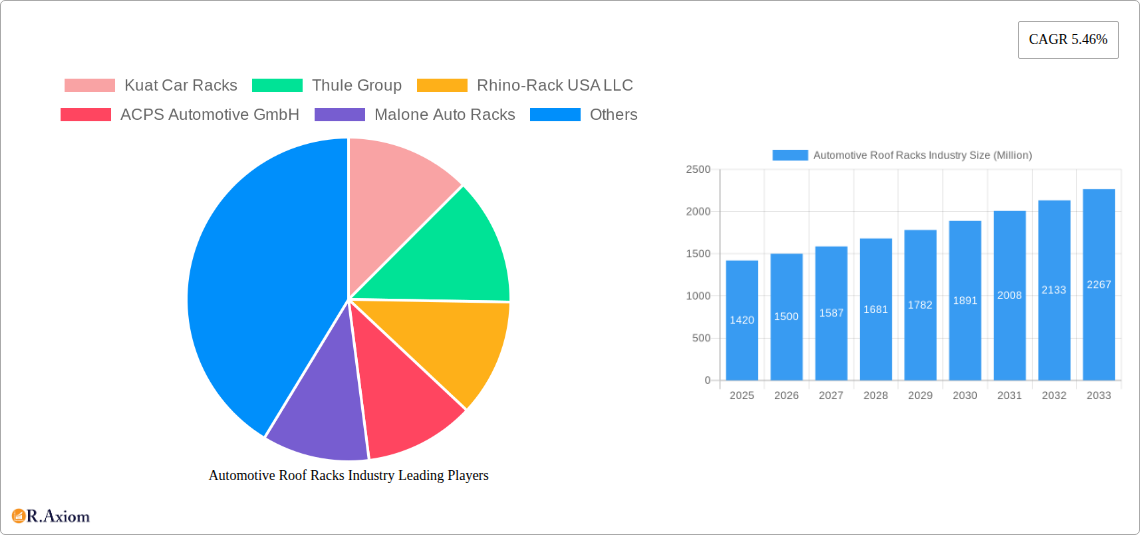

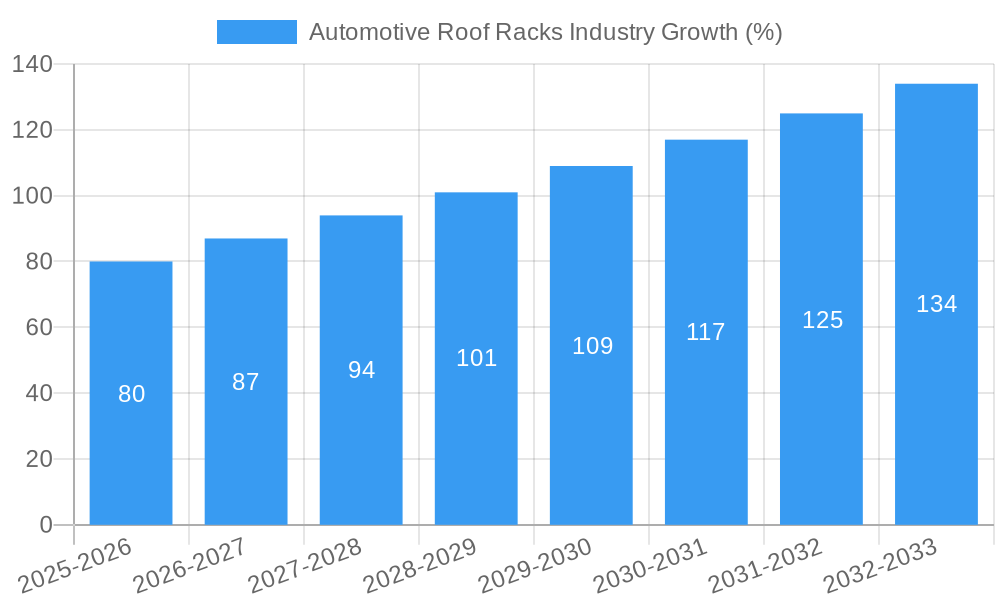

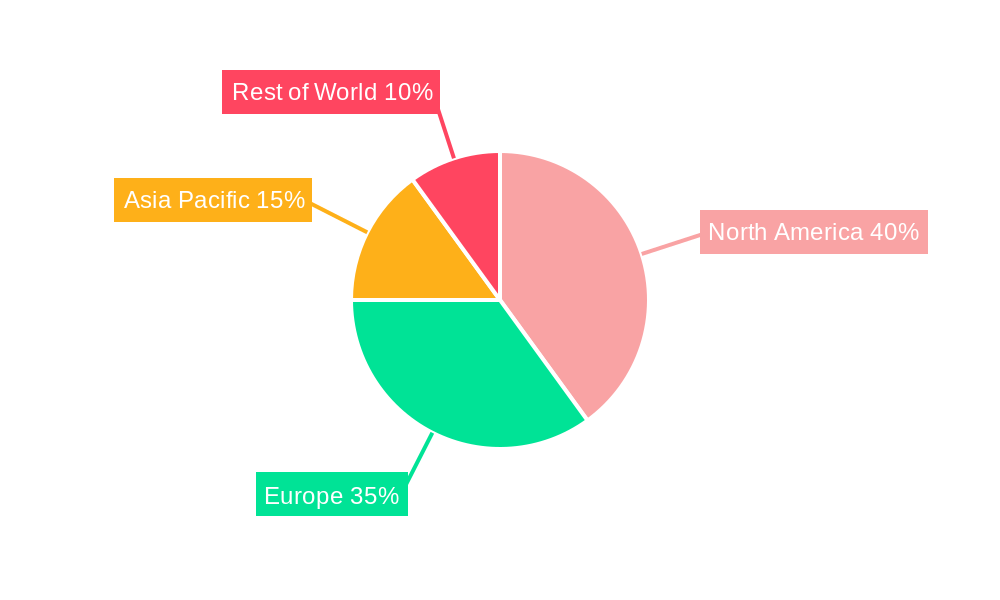

The global automotive roof rack market, valued at $1.42 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.46% from 2025 to 2033. This expansion is fueled by several key factors. The increasing popularity of outdoor recreational activities like skiing, snowboarding, and kayaking is directly boosting demand for roof racks designed to carry specialized equipment. Furthermore, the rising ownership of SUVs and crossovers, vehicles well-suited for roof rack installations, contributes significantly to market growth. Technological advancements, such as the introduction of lightweight yet durable materials and improved aerodynamic designs, enhance product appeal and functionality, attracting a wider consumer base. The market is segmented by application type, encompassing roof racks, roof boxes, bike carriers, ski racks, and watersports carriers, with roof boxes and bike carriers likely holding the largest market share due to their versatile applications. Competitive landscape analysis reveals key players such as Thule, Yakima, and Rhino-Rack, continually innovating to maintain their market presence. Regional variations exist, with North America and Europe anticipated to dominate the market initially due to higher vehicle ownership and established outdoor recreation cultures. However, the Asia-Pacific region is expected to show significant growth potential in the coming years, driven by rising disposable incomes and a burgeoning middle class with increased interest in outdoor activities.

Geographic expansion strategies by established players and the emergence of new regional competitors will further shape the market landscape. Regulatory changes regarding vehicle safety and environmental regulations may influence design and manufacturing processes, potentially impacting market growth. The market’s overall trajectory suggests a positive outlook, with sustained growth expected through 2033, driven by a combination of consumer demand, technological innovation, and expanding market penetration in developing regions. However, potential economic downturns or shifts in consumer preferences towards alternative transportation methods could pose challenges to this positive growth projection. Continued market monitoring and analysis will be necessary to fully understand the evolving dynamics and refine future growth projections.

Automotive Roof Racks Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the global automotive roof racks industry, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period spanning 2025-2033. The report delves into market size, segmentation, competitive landscape, technological advancements, and future growth prospects, enabling informed strategic planning. Market values are presented in Millions.

Automotive Roof Racks Industry Market Concentration & Innovation

The automotive roof rack industry exhibits a moderately concentrated market structure, with several key players holding significant market share. While exact figures for market share are proprietary to this report, Thule Group, Rhino-Rack USA LLC, and Yakima Products Inc. are among the prominent global players, commanding a substantial portion of the market. Smaller, regional players also contribute significantly to the overall market volume.

Market concentration is influenced by factors including brand recognition, product innovation, distribution networks, and economies of scale. The industry is characterized by ongoing innovation, driven by the need to meet evolving consumer demands for enhanced functionality, aesthetics, and safety. This translates to ongoing product development, encompassing features such as aerodynamic designs, improved load-bearing capacities, and integrated locking mechanisms.

Regulatory frameworks, particularly those concerning vehicle safety and environmental regulations (e.g., emissions from manufacturing processes), play a crucial role. Product substitutes, such as in-vehicle storage solutions and alternative transportation methods, pose moderate competitive pressure. However, the convenience and versatility offered by roof racks maintain their strong market position. End-user trends favor multi-functional roof rack systems catering to diverse recreational activities, increasing demand for accessories such as bike racks, ski carriers, and cargo boxes.

Mergers and acquisitions (M&A) activities in the industry have been relatively moderate in recent years, with deal values estimated to be in the xx Million range. This reflects the strategic focus of existing players on organic growth and product development rather than large-scale acquisitions.

Automotive Roof Racks Industry Industry Trends & Insights

The global automotive roof racks market is experiencing robust growth, driven by increasing vehicle ownership, particularly SUVs and crossovers, and a rising interest in outdoor recreational activities. The compound annual growth rate (CAGR) during the historical period (2019-2024) is estimated at xx%, and is projected to reach xx% during the forecast period (2025-2033). Market penetration across various regions is increasing steadily, especially in developing economies experiencing rapid motorization.

Technological disruptions are apparent in the adoption of lightweight materials, such as aluminum and carbon fiber, enhancing fuel efficiency and reducing overall weight. Advanced locking mechanisms and improved aerodynamic designs are further technological advancements enhancing safety and performance. Consumer preferences are shifting towards aesthetically pleasing, easy-to-install, and highly versatile roof racks that seamlessly integrate with vehicles.

Competitive dynamics are characterized by intense competition, particularly among the major players. Companies are focusing on product differentiation, brand building, and strategic partnerships to maintain their market position. The market is witnessing a rise in e-commerce, offering new avenues for direct consumer engagement and sales channels. Growing consumer awareness of eco-friendly materials and sustainable manufacturing practices is also driving innovation in this direction.

Dominant Markets & Segments in Automotive Roof Racks Industry

The North American market currently dominates the automotive roof rack industry, driven by high vehicle ownership rates, a strong culture of outdoor recreation, and robust disposable income. Europe and Asia-Pacific regions follow as significant markets, displaying strong growth potential. Within application segments, roof racks remain the largest segment, followed by cargo boxes and bike racks. The following are key drivers for regional dominance:

- North America: High vehicle ownership, strong outdoor recreation culture, extensive distribution networks.

- Europe: Developed automotive industry, significant recreational vehicle usage, stringent safety regulations.

- Asia-Pacific: Rapidly expanding automotive market, increasing middle class, rising interest in outdoor activities.

Segment Analysis:

- Roof Rack: Largest segment due to its broad applicability and functionality.

- Roof Box: Growing segment driven by the need for secure storage of luggage and cargo.

- Bike Car Rack: High demand from cycling enthusiasts, fueled by growth in cycling as a recreational activity.

- Ski Rack: Significant seasonal demand driven by winter sports enthusiasts.

- Watersport Carrier: Growing segment due to increased participation in watersports activities.

Automotive Roof Racks Industry Product Developments

Recent product innovations have focused on enhancing functionality, safety, and aesthetics. Lightweight materials, improved aerodynamics, and integrated locking systems are key features in new product launches. For instance, the launch of Reconn-Deck truck bed systems by Rhino-Rack US LLC demonstrates a focus on adaptable and robust solutions. Cruzber's introduction of new products like the CRUZ Stema bike rack showcases a commitment to diversified product offerings catering to various needs. These developments reflect an industry-wide trend toward enhanced convenience, increased security, and customization options for consumers.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global automotive roof rack market, segmented by application type:

Roof Rack: This segment covers the basic roof racks designed for carrying cargo. Growth is expected to remain stable due to its fundamental nature. Competitive dynamics are intense, driven by price competition and innovation in mounting systems.

Roof Box: This segment includes enclosed storage boxes that mount on roof racks. Growth is driven by increased demand for secure luggage transportation. Competition is focused on features such as aerodynamics, capacity, and security.

Bike Car Rack: This segment focuses on racks designed to transport bicycles. Growth is closely linked to cycling's popularity as a sport and leisure activity. Competition centers on ease of use, bike compatibility, and carrying capacity.

Ski Rack: This segment addresses racks designed specifically for transporting skis and snowboards. Growth is strongly influenced by seasonal trends and winter sport participation rates. Competition is focused on secure holding mechanisms and easy installation.

Watersport Carrier: This segment covers racks for transporting kayaks, canoes, and paddleboards. Growth mirrors participation trends in watersports. Competition focuses on secure and damage-free transportation.

Key Drivers of Automotive Roof Racks Industry Growth

Several key factors fuel growth within this industry:

- Rising vehicle ownership: The global increase in car ownership, especially SUVs and crossovers, directly impacts demand for roof racks.

- Growing popularity of outdoor recreational activities: The increased participation in activities like camping, cycling, skiing, and watersports drives demand for specialized carriers.

- Technological advancements: Innovations in materials, design, and security features enhance product appeal and performance.

- E-commerce growth: Online retailers provide increased market access for consumers and brands alike.

Challenges in the Automotive Roof Racks Industry Sector

The industry faces certain challenges:

- Fluctuating raw material costs: Increases in the price of aluminum, steel, and other materials impact profitability.

- Supply chain disruptions: Global supply chain instability can lead to production delays and cost increases.

- Intense competition: The presence of numerous players creates a fiercely competitive landscape, putting pressure on margins.

- Stringent safety regulations: Compliance with ever-changing safety standards necessitates continuous investment in product development.

Emerging Opportunities in Automotive Roof Racks Industry

The automotive roof rack market presents several lucrative opportunities:

- Expansion into emerging markets: Untapped demand exists in developing countries with growing vehicle ownership.

- Development of sustainable and eco-friendly products: Consumers are increasingly prioritizing environmentally conscious options.

- Integration of smart technologies: Smart features such as integrated lighting and connectivity offer further growth potential.

- Customization and personalization: Offering tailored solutions that meet individual consumer needs will gain further traction.

Leading Players in the Automotive Roof Racks Industry Market

- Kuat Car Racks

- Thule Group

- Rhino-Rack USA LLC

- ACPS Automotive GmbH

- Malone Auto Racks

- Cruzber SA

- Yakima Products Inc

- Allen Sports

- Saris

- Car Mate Mfg Co Ltd

Key Developments in Automotive Roof Racks Industry Industry

September 2022: Cruzber launched the Cruz Pipe Carrier, expanding its product line into specialized cargo solutions. This reflects a strategy to capture new niches within the market.

September 2022: Cruzber introduced several new products at Automechanika Frankfurt, showcasing its commitment to innovation and expansion. The launch of multiple products simultaneously suggests a robust R&D strategy and a proactive approach to market expansion.

March 2022: Rhino-Rack US LLC launched Reconn-Deck truck bed systems, demonstrating an expansion into new product categories and highlighting adaptability to changing customer needs and industry standards. The emphasis on durability testing showcases a commitment to product quality and safety.

Strategic Outlook for Automotive Roof Racks Industry Market

The automotive roof rack industry is poised for sustained growth, driven by ongoing technological advancements, expanding vehicle ownership, and a rising interest in outdoor activities. The focus on sustainability, product diversification, and smart technologies will shape future market dynamics. Companies prioritizing innovation and adapting to changing consumer preferences are best positioned to capitalize on the considerable growth potential in this dynamic market.

Automotive Roof Racks Industry Segmentation

-

1. Application Type

- 1.1. Roof Rack

- 1.2. Roof Box

- 1.3. Bike Car Rack

- 1.4. Ski Rack

- 1.5. Watersport Carrier

Automotive Roof Racks Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. Other Countries

Automotive Roof Racks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. Recreational Vehicle Rental to Affect The Market Over the Long Term

- 3.4. Market Trends

- 3.4.1. Roof Rack Segment is Expected to Grow at a Faster rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Roof Rack

- 5.1.2. Roof Box

- 5.1.3. Bike Car Rack

- 5.1.4. Ski Rack

- 5.1.5. Watersport Carrier

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Roof Rack

- 6.1.2. Roof Box

- 6.1.3. Bike Car Rack

- 6.1.4. Ski Rack

- 6.1.5. Watersport Carrier

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Europe Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Roof Rack

- 7.1.2. Roof Box

- 7.1.3. Bike Car Rack

- 7.1.4. Ski Rack

- 7.1.5. Watersport Carrier

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Asia Pacific Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Roof Rack

- 8.1.2. Roof Box

- 8.1.3. Bike Car Rack

- 8.1.4. Ski Rack

- 8.1.5. Watersport Carrier

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Rest of the World Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Roof Rack

- 9.1.2. Roof Box

- 9.1.3. Bike Car Rack

- 9.1.4. Ski Rack

- 9.1.5. Watersport Carrier

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. North America Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Rest of Europe

- 12. Asia Pacific Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 Rest of Asia Pacific

- 13. Rest of the World Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 South Africa

- 13.1.3 Other Countries

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Kuat Car Racks

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Thule Group

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Rhino-Rack USA LLC

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 ACPS Automotive GmbH

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Malone Auto Racks

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cruzber SA

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Yakima Products Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Allen Sports

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Saris*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Car Mate Mfg Co Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Kuat Car Racks

List of Figures

- Figure 1: Global Automotive Roof Racks Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 11: North America Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 12: North America Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 15: Europe Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 16: Europe Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 19: Asia Pacific Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 20: Asia Pacific Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 23: Rest of the World Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 24: Rest of the World Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Roof Racks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 3: Global Automotive Roof Racks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Rest of North America Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Africa Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Other Countries Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 24: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United States Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of North America Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 29: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Germany Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: United Kingdom Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 36: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: China Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Japan Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Asia Pacific Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 42: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Brazil Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Other Countries Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Roof Racks Industry?

The projected CAGR is approximately 5.46%.

2. Which companies are prominent players in the Automotive Roof Racks Industry?

Key companies in the market include Kuat Car Racks, Thule Group, Rhino-Rack USA LLC, ACPS Automotive GmbH, Malone Auto Racks, Cruzber SA, Yakima Products Inc, Allen Sports, Saris*List Not Exhaustive, Car Mate Mfg Co Ltd.

3. What are the main segments of the Automotive Roof Racks Industry?

The market segments include Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Roof Rack Segment is Expected to Grow at a Faster rate During the Forecast Period.

7. Are there any restraints impacting market growth?

Recreational Vehicle Rental to Affect The Market Over the Long Term.

8. Can you provide examples of recent developments in the market?

September, 2022: Cruz, the Spanish rack brand of Cruzber, launched Cruz Pipe Carrier. It is an accessory for transporting pipes safely on the roof of a light commercial vehicle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Roof Racks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Roof Racks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Roof Racks Industry?

To stay informed about further developments, trends, and reports in the Automotive Roof Racks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence