Key Insights

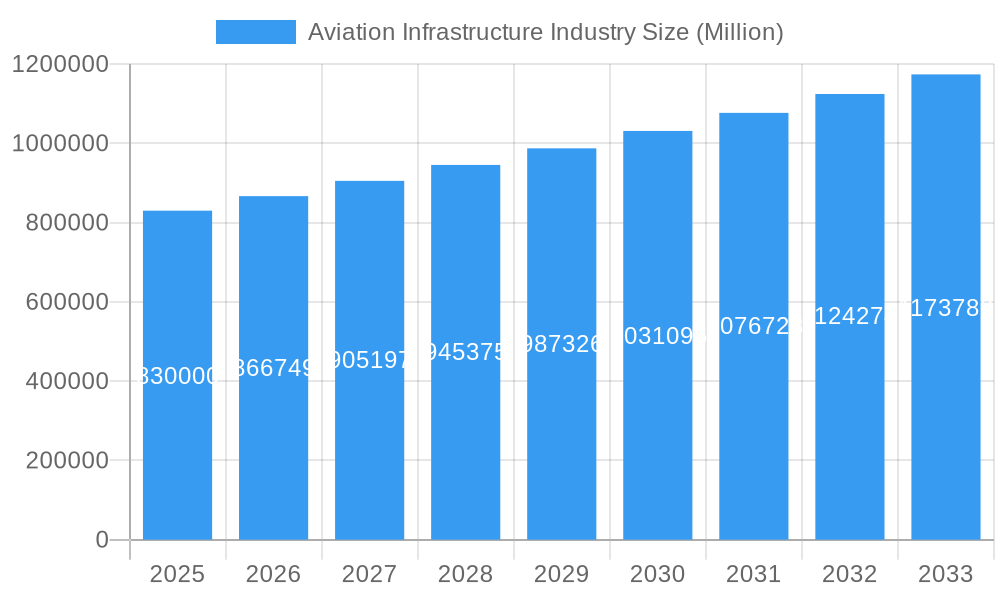

The global Aviation Infrastructure market is poised for substantial growth, projected to reach \$0.83 million by 2025 with a robust Compound Annual Growth Rate (CAGR) of 4.40%. This expansion is fueled by a confluence of factors, including the increasing demand for air travel, driven by economic development and a growing middle class in emerging economies. Governments worldwide are prioritizing the modernization and expansion of airport facilities to accommodate this surge in passenger and cargo traffic. Investments in new terminals, runway upgrades, and advanced air traffic control systems are critical to enhancing airport capacity, efficiency, and passenger experience. Furthermore, the emphasis on sustainable aviation practices and the integration of new technologies, such as smart airport solutions and advanced security systems, are also significant contributors to market growth. The sector's resilience and its integral role in global connectivity underscore its importance.

Aviation Infrastructure Industry Market Size (In Billion)

Key market drivers include the urgent need for capacity expansion at major international hubs, the development of new greenfield airports in rapidly growing regions, and technological advancements aimed at improving operational efficiency and passenger convenience. The market is segmented across various airport types, with commercial airports representing the largest segment due to high passenger volumes, while military and general aviation airports also present opportunities for specialized infrastructure development. Infrastructure types such as terminals, control towers, taxiways, and runways are undergoing continuous upgrades and expansions. Major players in the aviation infrastructure construction and development landscape are actively engaged in large-scale projects across North America, Europe, Asia Pacific, and the Middle East, reflecting the global nature of this industry. Emerging trends like the adoption of sustainable building materials and energy-efficient designs will shape future investments.

Aviation Infrastructure Industry Company Market Share

This comprehensive report provides an in-depth analysis of the global Aviation Infrastructure Industry, covering market dynamics, trends, opportunities, and challenges from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study offers critical insights for stakeholders seeking to understand and capitalize on the evolving aviation landscape. We delve into detailed segmentations across airport types and infrastructure, alongside an examination of key players and recent developments that are shaping the future of air travel.

Aviation Infrastructure Industry Market Concentration & Innovation

The Aviation Infrastructure Industry exhibits a moderate to high market concentration, driven by the capital-intensive nature of projects and the specialized expertise required. Key players like PCL Constructors Inc, Manhattan Construction Group Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hill International Inc, The Sundt Companies Inc, Hensel Phelps, Royal BAM Group NV, Turner Construction Company, J E Dunn Construction Company, Skanska, BIC Contracting LLC, TAV Construction, AECOM, and ALEC Engineering and Contracting hold significant market share, particularly in large-scale commercial airport projects. Innovation is a critical differentiator, fueled by advancements in sustainable construction materials, smart airport technologies, and digitalization of airport operations. Regulatory frameworks, while essential for safety and security, can also present barriers to rapid innovation. Product substitutes are limited due to the unique requirements of aviation infrastructure, but advancements in modular construction and prefabrication offer potential efficiencies. End-user trends are heavily influenced by increasing passenger traffic, cargo demand, and the push for enhanced passenger experience, driving demand for modernized terminals and improved connectivity. Mergers and acquisitions (M&A) activity is expected to remain robust, with estimated deal values in the billions of dollars as companies seek to expand their geographical reach, technological capabilities, and service portfolios.

Aviation Infrastructure Industry Industry Trends & Insights

The global Aviation Infrastructure Industry is poised for significant expansion, driven by a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This robust growth is underpinned by a confluence of factors, including the post-pandemic resurgence in air travel, increasing global trade necessitating efficient cargo handling facilities, and substantial government investments in modernizing aging airport infrastructure. Technological disruptions are at the forefront of this evolution, with the integration of Artificial Intelligence (AI) for predictive maintenance of runways and taxiways, the adoption of Building Information Modeling (BIM) for streamlined project management and design, and the implementation of advanced security screening technologies. Consumer preferences are increasingly dictating airport design, with a growing emphasis on passenger experience, sustainable amenities, and seamless connectivity, driving demand for state-of-the-art terminals and improved passenger flow. Competitive dynamics are characterized by intense bidding for large-scale projects, strategic partnerships, and a focus on specialized expertise in areas like air traffic control systems and sustainable aviation fuel (SAF) infrastructure. Market penetration of smart airport technologies is expected to accelerate, transforming traditional airports into highly efficient, passenger-centric hubs.

Dominant Markets & Segments in Aviation Infrastructure Industry

The Commercial Airport segment is the dominant market within the Aviation Infrastructure Industry, driven by the sheer volume of passenger traffic and cargo operations globally. Within this segment, Terminals represent the largest infrastructure type, accounting for an estimated 40% of market share, as they are the primary touchpoint for passengers and the hub of airport operations.

- Commercial Airports: Experiencing sustained growth due to increasing passenger demand and airline route expansion. Economic policies supporting air travel liberalization and infrastructure development are key drivers.

- Terminals: Dominate due to the need for enhanced passenger capacity, improved amenities, and seamless passenger processing, driven by airlines' focus on passenger experience and operational efficiency.

- Taxiway and Runway: Crucial for air traffic control and airport capacity, these are seeing significant investment for upgrades to accommodate larger aircraft and increase operational efficiency. The need for extended runways to support long-haul flights and advanced lighting systems for all-weather operations are key factors.

- Apron: Essential for aircraft parking, boarding, and servicing. Expansion and modernization are driven by the growing number of aircraft movements and the need for efficient ground handling operations.

- Hangar: Primarily driven by the expansion of airline fleets and the increasing demand for aircraft maintenance, repair, and overhaul (MRO) services. The growth of private aviation also contributes to hangar construction.

- Military Airports: While a smaller segment, they represent stable, long-term demand driven by national security needs and defense spending, often involving specialized infrastructure requirements.

- General Aviation Airports: Experiencing steady growth, fueled by the expansion of private aviation and the increasing demand for smaller, regional air connectivity.

Aviation Infrastructure Industry Product Developments

Product innovations in the Aviation Infrastructure Industry are focused on enhancing efficiency, sustainability, and passenger experience. Advancements include the development of self-healing runway materials for reduced maintenance, smart sensors for real-time monitoring of infrastructure health, and modular construction techniques for faster terminal development. The integration of AI-powered baggage handling systems and advanced air traffic management software offers significant competitive advantages by optimizing operations and reducing delays. The market fit for these innovations is high, driven by the industry's imperative to modernize, reduce operational costs, and adapt to evolving environmental regulations and passenger expectations.

Report Scope & Segmentation Analysis

This report segmentations the Aviation Infrastructure Industry across Airport Type including Commercial Airport, Military Airport, and General Aviation Airport. It also dissects the market by Infrastructure Type, encompassing Terminal, Control Tower, Taxiway and Runway, Apron, Hangar, and Other Infrastructure Types.

- Commercial Airports: Expected to witness substantial growth, with market sizes projected to reach hundreds of billions of dollars by 2033, driven by increasing passenger and cargo volumes.

- Military Airports: Characterized by steady, predictable growth, driven by defense budgets and national security initiatives.

- General Aviation Airports: Poised for moderate growth, with increasing demand from the private jet sector and regional air mobility initiatives.

- Terminals: The largest segment, with continuous investment in expansion and modernization to improve passenger experience and accommodate growing traffic.

- Control Towers: Essential for air traffic management, this segment will see investment in advanced technologies for improved safety and efficiency.

- Taxiway and Runway: Critical for airport capacity and safety, with ongoing upgrades and expansions anticipated.

- Apron: Demand will be driven by the need for increased aircraft parking and efficient ground handling.

- Hangar: Growth is linked to fleet expansion and MRO activities.

- Other Infrastructure Types: This includes a broad range of facilities like fuel farms, maintenance facilities, and cargo handling infrastructure, all integral to airport operations.

Key Drivers of Aviation Infrastructure Industry Growth

The Aviation Infrastructure Industry is propelled by several key growth drivers. Firstly, the continuous increase in global air passenger traffic and cargo volumes necessitates the expansion and upgrading of existing airport facilities. Secondly, government initiatives and smart city development plans are driving significant investments in airport modernization and new airport construction projects worldwide. Thirdly, technological advancements, such as sustainable building materials and digital infrastructure solutions, are enabling more efficient and environmentally friendly construction, further fueling growth. The increasing focus on enhanced passenger experience and the development of airport hubs are also major catalysts.

Challenges in the Aviation Infrastructure Industry Sector

Despite its growth trajectory, the Aviation Infrastructure Industry faces several challenges. Stringent regulatory frameworks and lengthy approval processes can significantly delay project timelines and increase costs. Supply chain disruptions and material cost volatility, exacerbated by global events, pose significant operational hurdles. Furthermore, the high capital investment required for large-scale projects and the need for specialized skilled labor can be restrictive. Environmental concerns and the push for sustainability also present challenges, requiring innovative solutions and significant investment in eco-friendly infrastructure.

Emerging Opportunities in Aviation Infrastructure Industry

Emerging opportunities within the Aviation Infrastructure Industry are ripe for exploitation. The growing demand for sustainable aviation infrastructure, including solar power integration and water management systems, presents a significant market. The rise of airport digitalization and smart airport technologies, such as AI-powered operations and IoT-enabled infrastructure management, offers avenues for enhanced efficiency and passenger experience. Furthermore, the expansion of air cargo facilities to support e-commerce growth and the development of vertiports for urban air mobility (UAM) represent nascent but potentially lucrative new markets.

Leading Players in the Aviation Infrastructure Industry Market

- PCL Constructors Inc

- Manhattan Construction Group Inc

- McCarthy Building Companies Inc

- The Walsh Group

- Austin Industries

- Hill International Inc

- The Sundt Companies Inc

- Hensel Phelps

- Royal BAM Group NV

- Turner Construction Company

- J E Dunn Construction Company

- Skanska

- BIC Contracting LLC

- TAV Construction

- AECOM

- ALEC Engineering and Contracting

Key Developments in Aviation Infrastructure Industry Industry

- 2023: Skanska wins a major contract for the expansion of a commercial airport terminal in Europe, focusing on sustainable design and passenger experience.

- 2023: AECOM announces significant investment in developing smart airport solutions, including AI-driven traffic management systems.

- 2024: Turner Construction Company completes a new state-of-the-art hangar facility for a major airline, enhancing MRO capabilities.

- 2024: Royal BAM Group NV partners with a technology firm to implement advanced modular construction techniques for airport infrastructure projects, aiming to reduce construction time by 30%.

- 2024: The Walsh Group secures a contract for the upgrade of critical taxiway and runway infrastructure at a major international airport, focusing on enhanced safety and capacity.

Strategic Outlook for Aviation Infrastructure Industry Market

The strategic outlook for the Aviation Infrastructure Industry is one of sustained growth and innovation. Key growth catalysts include ongoing global economic recovery, continued expansion of air travel demand, and substantial government stimulus packages aimed at infrastructure development. Companies that strategically invest in sustainable technologies, digital transformation, and passenger-centric solutions will be well-positioned for success. The increasing focus on resilience and efficiency in airport operations will drive demand for advanced infrastructure, creating significant opportunities for market leaders and agile new entrants alike.

Aviation Infrastructure Industry Segmentation

-

1. Airport Type

- 1.1. Commercial Airport

- 1.2. Military Airport

- 1.3. General Aviation Airport

-

2. Infrastructure Type

- 2.1. Terminal

- 2.2. Control Tower

- 2.3. Taxiway and Runway

- 2.4. Apron

- 2.5. Hangar

- 2.6. Other Infrastructure Types

Aviation Infrastructure Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of Aviation Infrastructure Industry

Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Terminal Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 5.1.1. Commercial Airport

- 5.1.2. Military Airport

- 5.1.3. General Aviation Airport

- 5.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.2.1. Terminal

- 5.2.2. Control Tower

- 5.2.3. Taxiway and Runway

- 5.2.4. Apron

- 5.2.5. Hangar

- 5.2.6. Other Infrastructure Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 6. North America Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 6.1.1. Commercial Airport

- 6.1.2. Military Airport

- 6.1.3. General Aviation Airport

- 6.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.2.1. Terminal

- 6.2.2. Control Tower

- 6.2.3. Taxiway and Runway

- 6.2.4. Apron

- 6.2.5. Hangar

- 6.2.6. Other Infrastructure Types

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 7. Europe Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 7.1.1. Commercial Airport

- 7.1.2. Military Airport

- 7.1.3. General Aviation Airport

- 7.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.2.1. Terminal

- 7.2.2. Control Tower

- 7.2.3. Taxiway and Runway

- 7.2.4. Apron

- 7.2.5. Hangar

- 7.2.6. Other Infrastructure Types

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 8. Asia Pacific Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Airport Type

- 8.1.1. Commercial Airport

- 8.1.2. Military Airport

- 8.1.3. General Aviation Airport

- 8.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.2.1. Terminal

- 8.2.2. Control Tower

- 8.2.3. Taxiway and Runway

- 8.2.4. Apron

- 8.2.5. Hangar

- 8.2.6. Other Infrastructure Types

- 8.1. Market Analysis, Insights and Forecast - by Airport Type

- 9. Latin America Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Airport Type

- 9.1.1. Commercial Airport

- 9.1.2. Military Airport

- 9.1.3. General Aviation Airport

- 9.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9.2.1. Terminal

- 9.2.2. Control Tower

- 9.2.3. Taxiway and Runway

- 9.2.4. Apron

- 9.2.5. Hangar

- 9.2.6. Other Infrastructure Types

- 9.1. Market Analysis, Insights and Forecast - by Airport Type

- 10. Middle East and Africa Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Airport Type

- 10.1.1. Commercial Airport

- 10.1.2. Military Airport

- 10.1.3. General Aviation Airport

- 10.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 10.2.1. Terminal

- 10.2.2. Control Tower

- 10.2.3. Taxiway and Runway

- 10.2.4. Apron

- 10.2.5. Hangar

- 10.2.6. Other Infrastructure Types

- 10.1. Market Analysis, Insights and Forecast - by Airport Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PCL Constructors Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Manhattan Construction Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 McCarthy Building Companies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Walsh Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Austin Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hill International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Sundt Companies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hensel Phelps

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Royal BAM Group NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Turner Construction Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 J E Dunn Construction Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Skanska

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BIC Contracting LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TAV Construction

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AECOM

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ALEC Engineering and Contracting

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 PCL Constructors Inc

List of Figures

- Figure 1: Global Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 3: North America Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 4: North America Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 5: North America Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 6: North America Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 9: Europe Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 10: Europe Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 11: Europe Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 12: Europe Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 15: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 16: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 17: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 18: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 21: Latin America Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 22: Latin America Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 23: Latin America Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 24: Latin America Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 27: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 28: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 29: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 30: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 2: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 3: Global Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 5: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 10: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 11: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 17: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 18: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 25: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 26: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 30: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 31: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: United Arab Emirates Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Infrastructure Industry?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the Aviation Infrastructure Industry?

Key companies in the market include PCL Constructors Inc, Manhattan Construction Group Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hill International Inc, The Sundt Companies Inc, Hensel Phelps, Royal BAM Group NV, Turner Construction Company, J E Dunn Construction Company, Skanska, BIC Contracting LLC, TAV Construction, AECOM, ALEC Engineering and Contracting.

3. What are the main segments of the Aviation Infrastructure Industry?

The market segments include Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.83 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Terminal Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence