Key Insights

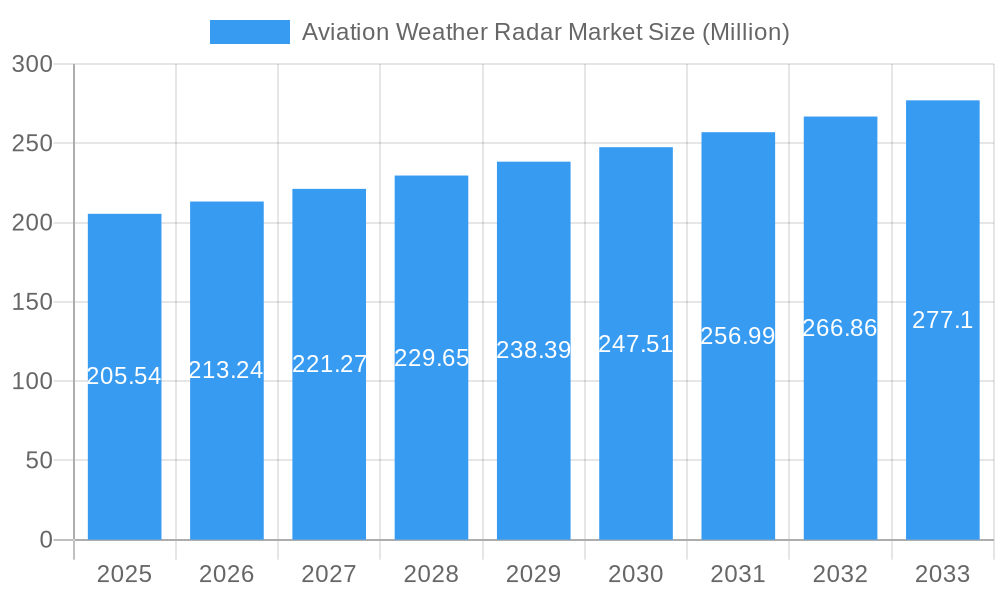

The global Aviation Weather Radar Market is poised for steady expansion, projected to reach a significant valuation of $205.54 million in 2025. With a Compound Annual Growth Rate (CAGR) of 3.75%, the market is expected to witness robust growth throughout the forecast period of 2025-2033. This upward trajectory is primarily propelled by the escalating demand for advanced weather detection and forecasting systems in aviation, aimed at enhancing flight safety and operational efficiency. The inherent volatility of weather patterns poses a constant threat to air travel, making reliable weather radar systems indispensable for commercial airlines, military operations, and general aviation alike. Investments in upgrading existing radar technologies and developing next-generation systems capable of providing more precise and timely weather information are key drivers fueling this market growth. The increasing complexity of air traffic management, coupled with stringent safety regulations, further accentuates the need for sophisticated weather radar solutions.

Aviation Weather Radar Market Market Size (In Million)

The market's growth is further supported by emerging trends such as the integration of artificial intelligence and machine learning into weather radar systems for predictive analysis, as well as the adoption of solid-state radar technology offering improved reliability and reduced maintenance. While the market presents substantial opportunities, certain restraints, including the high initial cost of advanced radar systems and the need for continuous technological upgrades, may temper the pace of adoption for smaller entities. Nevertheless, the overarching imperative for enhanced aviation safety and the continuous modernization of air fleets worldwide are expected to sustain a positive growth trajectory. Key players are actively engaged in research and development to introduce innovative solutions that address evolving aviation needs, solidifying the market's importance in ensuring secure and efficient air travel.

Aviation Weather Radar Market Company Market Share

This comprehensive report, "Aviation Weather Radar Market: Market Size, Share, Trends, Growth, and Forecast 2025–2033," offers an in-depth analysis of the global aviation weather radar sector. This indispensable resource is designed for industry stakeholders, including manufacturers, suppliers, airlines, MRO providers, regulatory bodies, and investors seeking to understand current market dynamics and future growth trajectories. The study encompasses a detailed examination of market concentration, innovation drivers, regulatory landscapes, product substitutes, end-user preferences, and mergers & acquisitions (M&A) activities. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report provides actionable insights and strategic recommendations.

Aviation Weather Radar Market Market Concentration & Innovation

The Aviation Weather Radar Market exhibits a moderate to high level of market concentration, with a few key players dominating global supply. Major companies like L3Harris Technologies Inc, Honeywell International Inc., and Collins Aerospace (RTX Corporation) hold significant market shares, driven by their extensive research and development capabilities and established relationships within the aerospace industry. Innovation is a critical differentiator, propelled by the continuous need for enhanced accuracy, reduced weight, and increased reliability in weather detection systems. Regulatory frameworks, particularly those from the FAA and EASA, play a pivotal role in dictating performance standards and safety requirements, thus influencing innovation pathways. Product substitutes are limited due to the specialized nature of aviation weather radar, with advanced Doppler radar and AI-driven predictive weather modeling representing potential future disruptors. End-user trends, particularly the demand for more precise turbulence detection and integrated weather information systems across commercial, military, and general aviation, are fueling product development. M&A activities, though not excessively frequent, often involve strategic acquisitions aimed at expanding product portfolios or market reach, with deal values typically ranging from tens of millions to hundreds of millions of dollars for significant acquisitions.

Aviation Weather Radar Market Industry Trends & Insights

The Aviation Weather Radar Market is experiencing robust growth, driven by an increasing global air traffic volume and a paramount focus on flight safety. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This expansion is fundamentally fueled by the escalating demand for advanced weather detection systems that can provide real-time, accurate information to pilots, thereby mitigating risks associated with adverse weather phenomena such as thunderstorms, turbulence, and icing conditions. Technological advancements are at the forefront of this trend, with ongoing innovations aimed at enhancing radar resolution, reducing system weight, and improving data processing capabilities. The integration of artificial intelligence (AI) and machine learning (ML) algorithms into weather radar systems is a significant disruptive force, enabling more sophisticated predictive weather analysis and enhanced pilot situational awareness. Consumer preferences are increasingly leaning towards integrated avionics suites where weather radar forms a crucial component, providing seamless data flow and intuitive display for pilots. Competitive dynamics within the market are characterized by intense R&D investment, strategic partnerships, and a focus on providing customized solutions for different aviation segments. The market penetration of advanced weather radar systems is steadily increasing across all aircraft types, from large commercial airliners to smaller general aviation aircraft, as safety mandates and operational efficiency gains become more pronounced. The continuous evolution of radar technology, including the shift towards solid-state systems and advanced signal processing techniques, is further shaping industry trends and driving market penetration.

Dominant Markets & Segments in Aviation Weather Radar Market

North America currently stands as the dominant market region for aviation weather radar, driven by its substantial commercial aviation sector, robust military aviation presence, and a large general aviation fleet. The United States, in particular, accounts for a significant share due to its extensive air traffic network, stringent safety regulations enforced by the FAA, and a high adoption rate of advanced avionics.

Airport Segment: Airports are critical hubs for aviation weather radar deployment, not just for aircraft but also for ground operations and air traffic control. The increasing investment in smart airport technologies and enhanced safety protocols at major international airports supports the demand for advanced weather monitoring systems. Economic policies supporting infrastructure development and air travel growth in regions like Asia Pacific are beginning to challenge North America’s dominance in this segment.

Aircraft Segment:

- Commercial Aviation: This segment represents the largest and fastest-growing market for aviation weather radar. The continuous modernization of commercial fleets, driven by the need for fuel efficiency, safety, and passenger comfort, necessitates the integration of cutting-edge weather radar. Airlines are increasingly opting for advanced systems that offer superior detection capabilities for turbulence and hazardous weather, contributing to enhanced operational reliability and reduced flight delays. The projected growth in global air passenger traffic further solidifies the dominance of this segment.

- Military Aviation: Military aviation represents another significant segment, with a continuous demand for robust and highly accurate weather radar systems capable of operating in diverse and challenging environments. These systems are crucial for mission planning, reconnaissance, and ensuring the safety of aircrews during complex operations. Government defense spending and the modernization of military fleets globally contribute to the sustained demand in this segment.

- General Aviation: While historically a smaller segment, general aviation is witnessing a notable increase in the adoption of advanced weather radar. As general aviation aircraft become more sophisticated and pilots prioritize safety, the demand for compact, reliable, and cost-effective weather radar solutions is rising. The growing popularity of recreational flying and the increasing number of private aircraft owners are key drivers for this segment’s growth.

The dominance of these segments is further influenced by factors such as technological innovation, government funding for aerospace research, and the overall economic health of regions that support aviation activities.

Aviation Weather Radar Market Product Developments

Product developments in the aviation weather radar market are primarily focused on enhancing performance, reducing size and weight, and improving data integration. Key trends include the development of solid-state radar technology offering greater reliability and lower maintenance requirements, as well as advancements in Doppler radar capabilities for more precise turbulence detection and wind shear avoidance. Flat plate antennas, as exemplified by the TSO certification for Collins Aerospace and AVIC LETRI's COMAC C919 Weather Radar Flat Plate Antenna, represent a significant step towards more aerodynamic and efficient designs. Honeywell's IntuVue RDR-7000 weather radar, with its ability to scan from ground to 60,000 feet and out to 320 nm, showcases the drive for extended range and comprehensive scanning. Furthermore, the licensing agreements for older systems, such as Ontic's agreement with Honeywell for RDR4A/B Weather Radar Systems, ensure continued support and availability for existing fleets, highlighting a crucial aspect of the product lifecycle and market sustainability. These developments are crucial for meeting the evolving safety and operational demands across commercial, military, and general aviation.

Aviation Weather Radar Market Report Scope & Segmentation Analysis

This report provides a granular segmentation of the Aviation Weather Radar Market, analyzing its landscape across key end-user categories. The market is segmented into Airport and Aircraft. The Aircraft segment is further broken down into Commercial Aviation, Military Aviation, and General Aviation. Each segment is analyzed for its current market size, projected growth rates, and competitive dynamics. For instance, Commercial Aviation, representing a substantial market share estimated at over $XXX million in 2025, is expected to grow at a CAGR of approximately XX% through 2033, driven by fleet expansion and modernization. Military Aviation, valued at an estimated $XXX million in 2025, will see steady growth influenced by defense spending and technological upgrades. General Aviation, with an estimated market size of $XXX million in 2025, is poised for significant growth due to increasing adoption of advanced avionics.

Key Drivers of Aviation Weather Radar Market Growth

The growth of the Aviation Weather Radar Market is propelled by several key factors, chief among them being the paramount importance of flight safety. Increasing global air traffic necessitates more sophisticated systems to detect and avoid hazardous weather, reducing the risk of accidents and ensuring operational continuity. Technological advancements, including the development of Doppler radar, solid-state electronics, and AI-driven predictive analytics, are continuously enhancing the performance and capabilities of aviation weather radar, making them more accurate, reliable, and cost-effective. Furthermore, stringent regulatory requirements imposed by aviation authorities worldwide mandate the use of advanced weather detection technologies, driving adoption across all aircraft types. The ongoing modernization of both commercial and military aircraft fleets, coupled with a growing general aviation sector, provides a consistent demand for these critical avionics components.

Challenges in the Aviation Weather Radar Market Sector

Despite its growth, the Aviation Weather Radar Market faces several challenges. The high cost of advanced weather radar systems can be a barrier, particularly for smaller operators in the general aviation segment. Stringent and evolving regulatory approval processes can lead to lengthy development cycles and increased costs for manufacturers. Supply chain disruptions, particularly for specialized electronic components, can impact production timelines and availability. Moreover, the long lifespan of many aircraft and the associated avionics can lead to a slower replacement cycle for older radar systems, limiting the immediate adoption of newer technologies. Intense competition among established players also exerts pressure on pricing and profit margins.

Emerging Opportunities in Aviation Weather Radar Market

Emerging opportunities in the Aviation Weather Radar Market are primarily driven by advancements in technology and evolving aviation needs. The increasing integration of weather radar data with other onboard avionics systems, creating comprehensive situational awareness platforms for pilots, presents a significant opportunity. The development of more compact, lighter, and energy-efficient weather radar systems tailored for the growing unmanned aerial vehicle (UAV) market and advanced air mobility (AAM) platforms is another area of significant potential. Furthermore, the application of artificial intelligence and machine learning for predictive weather analysis and enhanced turbulence detection is opening new avenues for product innovation and value creation. Emerging markets with rapidly expanding aviation sectors also offer substantial growth prospects.

Leading Players in the Aviation Weather Radar Market Market

- L3Harris Technologies Inc

- Honeywell International Inc.

- Collins Aerospace (RTX Corporation)

- Telephonics Corporation

- EWR Radar Systems Inc

- Garmin Ltd

- Vaisala Oyj

- Selex ES GmbH

- Leonardo S.p.A

Key Developments in Aviation Weather Radar Market Industry

- November 2022: Collins Aerospace, in collaboration with AVIC Leihua Electronic Technology Research Institute (LETRI), achieved TSO certification from the FAA for COMAC’s C919 Weather Radar Flat Plate Antenna (WFA). This development signifies advancements in antenna design and adherence to stringent aviation safety standards.

- May 2022: ABS Jets, a Honeywell authorized partner, signed an agreement with Honeywell International Inc. to retrofit Embraer Legacy business jets with Honeywell’s IntuVue RDR-7000 weather radar. This agreement highlights the market’s demand for advanced radar systems offering enhanced scanning capabilities and turbulence detection.

- July 2022: Ontic announced an exclusive license agreement with Honeywell for the RDR4A/B Weather Radar Systems. This move ensures continued support and MRO services for existing aircraft, demonstrating a focus on the lifecycle management of aviation products.

Strategic Outlook for Aviation Weather Radar Market Market

The strategic outlook for the Aviation Weather Radar Market remains exceptionally positive, fueled by an unyielding commitment to flight safety and continuous technological innovation. The increasing density of air traffic globally necessitates the widespread adoption of advanced weather detection capabilities, positioning radar systems as indispensable components of modern avionics. The ongoing miniaturization of components and the integration of AI are paving the way for highly sophisticated, yet more accessible, weather radar solutions for a broader range of aircraft, including those in the rapidly expanding general aviation and drone sectors. Strategic partnerships and acquisitions are likely to continue as key players seek to consolidate market presence and expand their technological offerings. The sustained investment in aerospace by governments and private entities, coupled with favorable regulatory environments promoting safety enhancements, will further propel market expansion and reinforce the critical role of aviation weather radar in the future of air travel.

Aviation Weather Radar Market Segmentation

-

1. End User

- 1.1. Airport

-

1.2. Aircraft

- 1.2.1. Commercial Aviation

- 1.2.2. Military Aviation

- 1.2.3. General Aviation

Aviation Weather Radar Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

Aviation Weather Radar Market Regional Market Share

Geographic Coverage of Aviation Weather Radar Market

Aviation Weather Radar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Aviation is Likely to Register High Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Weather Radar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Airport

- 5.1.2. Aircraft

- 5.1.2.1. Commercial Aviation

- 5.1.2.2. Military Aviation

- 5.1.2.3. General Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Aviation Weather Radar Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Airport

- 6.1.2. Aircraft

- 6.1.2.1. Commercial Aviation

- 6.1.2.2. Military Aviation

- 6.1.2.3. General Aviation

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Aviation Weather Radar Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Airport

- 7.1.2. Aircraft

- 7.1.2.1. Commercial Aviation

- 7.1.2.2. Military Aviation

- 7.1.2.3. General Aviation

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Aviation Weather Radar Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Airport

- 8.1.2. Aircraft

- 8.1.2.1. Commercial Aviation

- 8.1.2.2. Military Aviation

- 8.1.2.3. General Aviation

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Aviation Weather Radar Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Airport

- 9.1.2. Aircraft

- 9.1.2.1. Commercial Aviation

- 9.1.2.2. Military Aviation

- 9.1.2.3. General Aviation

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Aviation Weather Radar Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Airport

- 10.1.2. Aircraft

- 10.1.2.1. Commercial Aviation

- 10.1.2.2. Military Aviation

- 10.1.2.3. General Aviation

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Collins Aerospace (RTX Corporation)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Telephonics Corporatio

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EWR Radar Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Garmin Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vaisala Oyj

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Selex ES GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Leonardo S p A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Aviation Weather Radar Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aviation Weather Radar Market Revenue (Million), by End User 2025 & 2033

- Figure 3: North America Aviation Weather Radar Market Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Aviation Weather Radar Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Aviation Weather Radar Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Aviation Weather Radar Market Revenue (Million), by End User 2025 & 2033

- Figure 7: Europe Aviation Weather Radar Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: Europe Aviation Weather Radar Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Aviation Weather Radar Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Aviation Weather Radar Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Asia Pacific Aviation Weather Radar Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Asia Pacific Aviation Weather Radar Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Aviation Weather Radar Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Aviation Weather Radar Market Revenue (Million), by End User 2025 & 2033

- Figure 15: Latin America Aviation Weather Radar Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Latin America Aviation Weather Radar Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Aviation Weather Radar Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Aviation Weather Radar Market Revenue (Million), by End User 2025 & 2033

- Figure 19: Middle East and Africa Aviation Weather Radar Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: Middle East and Africa Aviation Weather Radar Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Aviation Weather Radar Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Weather Radar Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Aviation Weather Radar Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Aviation Weather Radar Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Aviation Weather Radar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Aviation Weather Radar Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Aviation Weather Radar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: France Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Russia Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Aviation Weather Radar Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Aviation Weather Radar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: India Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Aviation Weather Radar Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Aviation Weather Radar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Brazil Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Latin America Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Aviation Weather Radar Market Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Aviation Weather Radar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Saudi Arabia Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Arab Emirates Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Egypt Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Middle East and Africa Aviation Weather Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Weather Radar Market?

The projected CAGR is approximately 3.75%.

2. Which companies are prominent players in the Aviation Weather Radar Market?

Key companies in the market include L3Harris Technologies Inc, Honeywell International Inc, Collins Aerospace (RTX Corporation), Telephonics Corporatio, EWR Radar Systems Inc, Garmin Ltd, Vaisala Oyj, Selex ES GmbH, Leonardo S p A.

3. What are the main segments of the Aviation Weather Radar Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 205.54 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Aviation is Likely to Register High Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Collins Aerospace, together with AVIC LeihuaElectronic Technology Research Institute (LETRI), announced that they had received TSO certification for COMAC’s C919 Weather Radar Flat Plate Antenna (WFA), designed by LETRI from the US Federal Aviation Administration (FAA). A TSO is a minimum performance standard for specified materials, parts, and appliances used on civil aircraft.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Weather Radar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Weather Radar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Weather Radar Market?

To stay informed about further developments, trends, and reports in the Aviation Weather Radar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence